The

rally today in the US agriculture markets were sparked by an initial weaker USD, ongoing SA weather concerns, followed by indications Argentina’s trade problems have a long way to go for resolution. Articles circulated that hinted selected trade groups may

resume or start strikes atter the government stopped corn registrations through February.

IMPORTANT

WEATHER ISSUES OF THE DAY

- Rainfall

in Argentina overnight was a little better organized and locally greater than expected from western Buenos Aires through the heart of Cordoba - Most

amounts ranged from 0.15 to 0.75 inch with local totals of 1.00 to 2.00 inches - One

location in southwestern Buenos Aires reported 2.16 inches of rain - The

greatest precipitation occurred in three pockets; 1) in southwestern Buenos Aires, 2) near the Buenos Aires/Santa Fe/Cordoba common border and 3) near and northwest of Cordoba City, Cordoba.

- Southeastern

Paraguay received another good dose of rain overnight and some of that extended south into northern Rio Grande do Sul, Brazil where amounts varied greatly from 0.12 to 0.75 inch most often - However,

1.00 to 3.00 inches occurred in southeastern Paraguay and up to 1.57 inches occurred locally in northwestern Rio Grande do Sul - Some

rain also scattered across a part of interior western Parana and across portions of Mato Grosso do Sul.

- Today’s

Argentina forecast still favors scattered shower and thunderstorm activity next week, but until then some areas will experience net drying especially in central and eastern parts of the nation - Rain

is expected to concentrate on portions of Buenos Aires today and Wednesday with 0.30 to 1.00 inch and a few local totals of 1.00 to 2.00 inches

- Precipitation

elsewhere will not be very great - Not

much other precipitation of significance will occur through Saturday, although a few showers may occur in the perimeter of Argentina’s crop country - Isolated

to scattered showers and thunderstorms will then begin Sunday and continue next week - The

European model is not nearly as wet as the GFS model for next week in east-central crop areas and World Weather, Inc. favors the European solution - East-central

Argentina may not receive more than 0.50 inch of rain next week while other areas receive 0.40 to 1.25 inches with local totals possibly getting up near and over 2.00 inches - The

greatest rainfall will occur in far northern and western parts of the nation - Additional

rainfall will scatter across parts of Argentina periodically late next week and into the following weekend before a new round of net drying occurs - World

Weather, Inc. urges a little caution about the Argentina outlook next week. The GFS model has been too excited about rainfall. La Nina is still deeply in control of South America weather and the odds are good that the European model has the best solution suggesting

east-central parts of Argentina may not do very well with rainfall next week. Our comments in Monday’s special weather report on Argentina are still valid that even if the rain event next week is not as good as advertised there will be some short term benefit

to crops and enough rain will fall to keep a large part of the nation’s crop viable and still poised to perform adequately if timely rain continues. Recent rainfall and that expected over the next two weeks will be highly erratic and variable from one location

to another resulting in pockets of serious crop stress not far from areas that will experience more favorable development potential.

- Brazil’s

weather outlook today has not changed much, although there is more rain advertised in both Rio Grande do Sul and in a part of northeastern Brazil - If

the forecast changes verify most of Brazil will benefit greatly from weather in this coming ten days - Sufficient

rain will fall to support crops in nearly all areas allowing the improving trend for pod setting and filling in soybean production areas to continue - Coffee,

citrus, rice, cotton corn, cocoa and other crops will all benefit from a good distribution of rain - Morocco

will receive waves of rain over the coming week bolstering soil moisture for improved wheat and barley establishment

- This

is the beginning of the third year of drought in southwestern Morocco making the coming week of rain extremely important and welcome - Northwestern

Algeria has also been drier biased this season and some rain will fall there as well

- Most

of the Mediterranean Sea region of southern Europe will receive frequent rainfall resulting in greater soil moisture, but also inducing some potential for flooding - Rainfall

will be greatest in eastern Spain, Italy, the eastern Adriatic Sea nations and from parts of Greece and Bulgaria to Russia’s Southern Region - Waves

of rain and snow will impact Russia’s Southern Region through the next ten days resulting in a welcome boost to soil moisture in areas that have no frost in the ground - Snow

will pile up on top of the ground in areas where temperatures are coldest, but the snow will melt during the warmer days and weeks ahead in late winter and early spring to improve soil conditions for better winter crop establishment - Additional

rain fell in northern India Monday resulting in further improvement in topsoil moisture - Additional

moisture totals varied up to 0.75 inch, although most areas received lighter totals

- Recent

precipitation from eastern Rajasthan and northern Uttar Pradesh into Jammu and Kashmir has bolstered soil moisture for improved winter crop conditions - Moisture

totals over the past several days have ranged from 0.30 to 1.00 inch with local totals to 1.58 inches

- Today

will be the last day for precipitation in the region for a while - Some

rain will fall in central India Thursday and Friday of this week with amounts to 0.50 inch

- China

will experience some very cold temperatures Wednesday possibly resulting in some potential for winterkill due to the lack of snow cover - Wednesday

and Thursday will be coldest this week with extreme lows in the positive and negative single digits Fahrenheit near and north of the Yellow River with little to no snow on the ground - Winterkill

is not very likely, but the situation will be closely monitored because of temperatures near the damage threshold

- Sufficient

wheat hardening has occurred over the past week and through the first part of this week to help limit the potential for permanent crop damage - Waves

of rain will impact the Philippines starting late this week and lasting a full week - Excessive

moisture is expected resulting in new flooding for parts of the nation especially in eastern most islands - Flooding

has already been an issue for the nation at times in recent months and additional damage to crops and property will be possible - Frequent

rain in Indonesia and Malaysia will eventually result in some new flooding - Recent

flooding in Peninsular Malaysia caused damage to crops and personal property, although that situation will improve before new excessive rain and flooding impacts a part of the region in the coming week to ten days - Other

areas in Indonesia and Malaysia are likely to become too wet over time with Java and northern Borneo as well as peninsular Malaysia impacted from time to time.

- Mainland

areas of Southeast Asia will be dry over the next ten days except coastal areas of Vietnam where waves of rain are expected - Eastern

Australia received additional rain Monday in New South Wales and parts of Queensland - Amounts

varied from 0.10 to 0.88 inch with a few totals to 1.81 inches - Northeastern

New South Wales has been wettest, but southeastern Queensland will become the wetter area over the balance of this week - Eastern

Australia will receive additional showers and thunderstorms into Friday and then net drying is expected for a while in key grain and cotton production areas - Another

0.50 to 2.50 inches of rain and locally more will occur by Saturday morning in southeastern Queensland - Not

much other precipitation is expected there or in New South Wales for a full week - Cape

York Peninsula and the upper Queensland, Australia coast will experience frequent waves of rain through the next ten days resulting in more flooding

- The

area near Townsville, Queensland has received excessive rainfall in the past week and will be getting much more resulting in damage for sugarcane and some other agriculture - South

Africa received scattered showers and thunderstorms in the western and southern parts of the nation Monday with highly varying amounts of rain - Most

areas reported less than 0.60 inch of moisture with local totals over 1.00 inch - Temperatures

trended cooler in the wetter biased areas with highs in the upper 60s and 70s Fahrenheit which is down form 80s and 90s during the weekend - South

Africa will receive frequent showers and thunderstorms over the next ten days bringing rain to most summer crop areas and ensuring aggressive crop development - Western

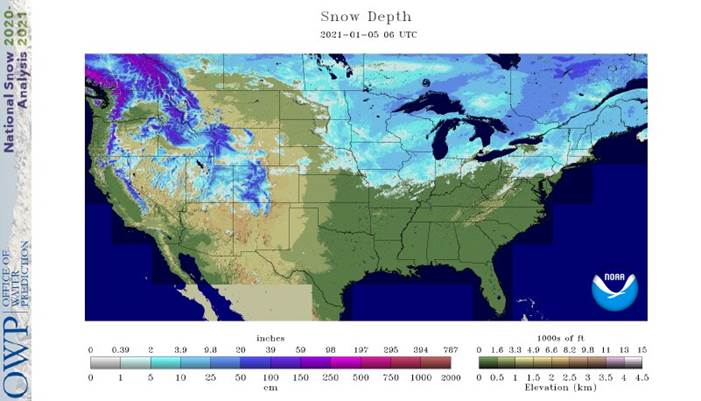

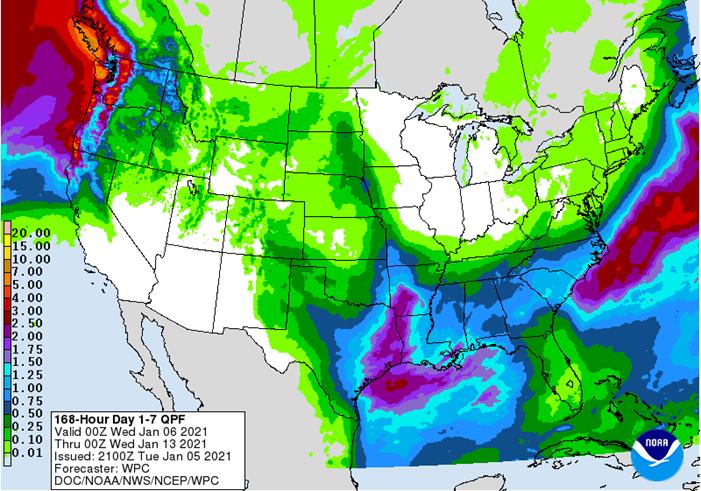

areas may be wettest for a while - U.S.

weather Monday was dry except for a little lingering snow in the northeast and widespread rain and mountain snow in the Pacific Northwest - Temperatures

were a little warmer than usual in many areas across the nation - U.S.

weather changes were minor overnight - Rain,

snow and a little freezing rain will occur tonight and Wednesday from the eastern Dakotas and western Minnesota into Missouri and eastern Kansas

- Moisture

totals will vary from 0.05 to 0.35 inch and locally more - Snowfall

of 1 to 4 inches is most likely, but several counties in southeastern North Dakota and northeastern South Dakota will receive 4 to 8 inches

- Locally

heavy snow like that will also occur in a narrow band across interior western Iowa - The

storm system responsible for rain and snow in the western Corn Belt through Wednesday will produce widespread rainfall across the Delta and into the southeastern states late Wednesday into early Friday - Hard

red winter wheat areas will receive their greatest precipitation during the weekend as snow and rain fall from Colorado to northern Texas and parts of Oklahoma

- Moisture

totals will vary from 0.10 to 0.35 inch with local totals of 0.35 to 0.75 inch and possibly more with northern Texas and southern Oklahoma wettest - Rain

will fall across eastern Texas, the lower Delta and southeastern states during the late weekend and early part of next week with 0.40 to 1.50 inches resulting - Waves

of rain and mountain snow will impact the Pacific Northwest throughout the coming two weeks maintaining wet conditions in some of those areas - Colder

air moving into North America near mid-month may drop a cold front through the north-central and eastern U.S. with a little snow and rain accompanying it - Additional

waves of cool air and brief bouts of snow will move from northwest to southeast across the central and eastern United States in the third week of this month and progressive cooling is expected - Some

of the bitter cold impacting China this week will reach North America near mid-month and will prevail into the end of January with Canada Prairies, the U.S. northern Plains and Midwest all experiencing notably colder weather over time. - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +18.25 today which is the highest this index has been in the current La Nina episode - Mexico

and Central America weather will continue to generate erratic rainfall - Far

southern Mexico and portions of Central America will be most impacted by periodic moisture - Canada

Prairies will remain unseasonably warm this week and warmer than usual through day ten before cooling occurs during the weekend and next week - Southeast

Canada will receive less than usual precipitation this week and temperatures will continue a little warmer than usual

Source:

World Weather Inc. and FI

Tuesday,

Jan. 5:

- New

Zealand global dairy trade auction - Purdue

Agriculture Sentiment, 9:30am - Malaysia’s

Jan. 1-5 palm oil export data - Virtual

palm oil trade fair and seminar 2021, Jan. 5-7 - HOLIDAY:

Russia

Wednesday,

Jan. 6:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

CNGOIC to publish soy and corn reports - HOLIDAY:

Russia, Poland

Thursday,

Jan. 7:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Russia, Ghana, Egypt

Friday,

Jan. 8:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Trading

of China’s hog futures to begin on Dalian Commodity Exchange - HOLIDAY:

Russia

Source:

Bloomberg and FI

Macros

US

ISM Manufacturing Dec: 60.7 (est 56.8; prev 57.5)

–

Prices Paid: 77.6 (est 65.0; prev 65.4)

–

New Orders: 67.9 (prev 65.1)

–

Employment: 51.5 (prev 48.4)

OPEC

Delegates: Saudis Plan To Make Voluntary Output Cut In February

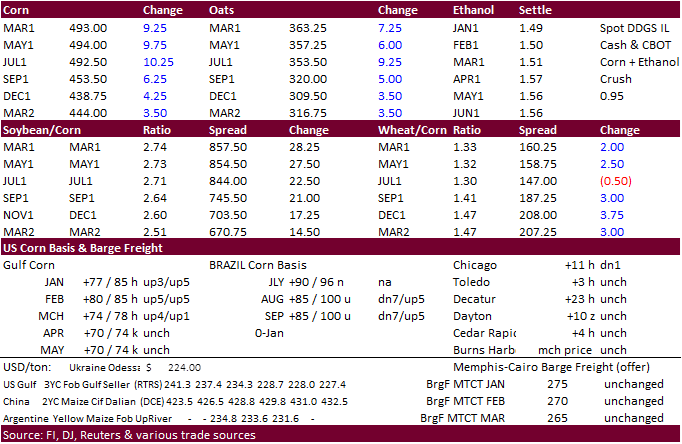

Corn.

-

CBOT

corn futures

bias the nearby position nearly reached an absolute contract high. Argentina stopped registrations through the end of February, which may make the US the only game in town. But Argentina corn registrations shot up since December 31 for shipments date during

March onward. Registrations

for Argentina maybe up for two reasons. One is that they are dedicated for new-crop, in which supply will be more abundant, and second new-crop prices may provide a better replacement for old-crop commitments.

-

On

Tuesday, funds bought an estimated net 25,000 contracts. -

Last

night there were 3900 CH 450c exercised leaving over $1.1m of time value on the table. This was viewed as unwarranted as many traders could have converted them to futures. If you need help with options, please drop us a line.

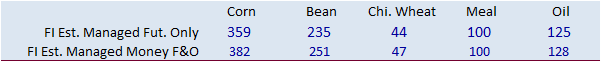

-

Managed

money and traditional funds added many contracts for the week ending a week ago Tuesday. Funds were less long than expected in soybeans, which may prompt soybean/corn spreading.

-

Mexico

will phase out importing genetically modified corn over the next three years and phase out imports as they aim to become self-sufficient.

-

2020/21

Brazil Corn Estimate Unchanged at 102.0 Million Tons -

2020/21

Argentina Corn Estimate Lowered 1.0 mt to 45.0 Million

-

StoneX

Brazil survey-based production lowered their soybean estimate to 132.64 million soybeans from 133.9 million previously. Corn was unchanged at 109.34 million tons. -

The

CME lowered hog futures margins by 22.8% to $2,200 per contract from $2,850.

-

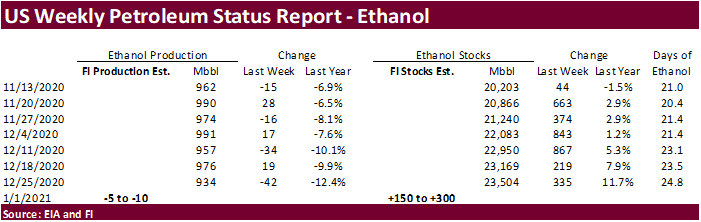

A

Bloomberg poll looks for weekly US ethanol production to be down 7,000 at 927,000 barrels (913-940 range) from the previous week and stocks up to 241,000 barrels to 23.745 million.

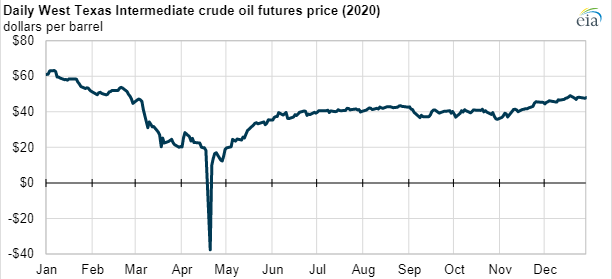

EIA:

Crude oil prices briefly traded below $0 in spring 2020 but have since been mostly flat

https://www.eia.gov/todayinenergy/detail.php?id=46336&src=email

Corn

Export Developments

-

Qatar

seeks 100,000 tons of bulk barley on January 12.

- Qatar

seeks 640,000 cartons of corn oil on January 12.

Updated

1/5/20

March

corn is seen

trading in a $4.50 and $5.25 range

-

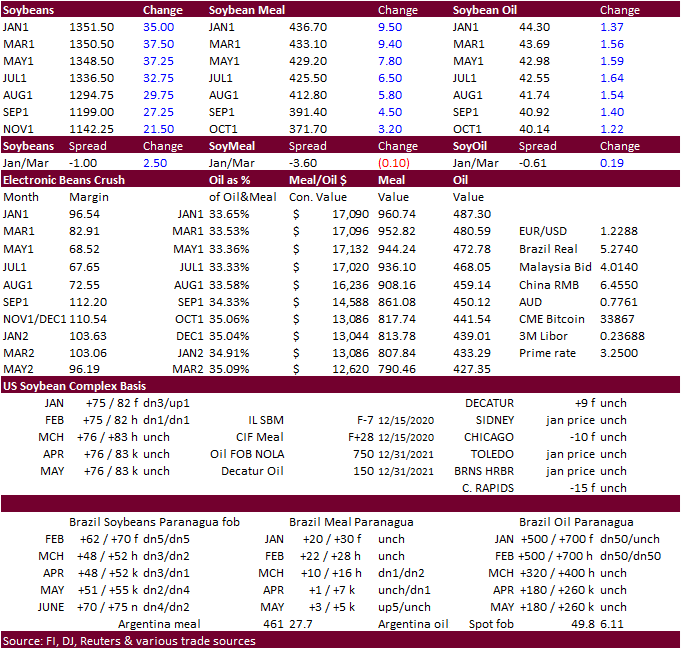

Newcomers

to the agriculture industry might be in for a history lesson as soybeans continue to awe traders on the volatile moves presented over the recent month. Today March soybeans climbed to a new contract high of $13.7325. We think it can easily hit $14 soon.

Unfavorable SA weather and indications for La Nina may stick around for a little while longer sent speculator longs back into the market, day after producer selling disrupted a New Year business day rally. Back to volatility, the trade saw a

15

cent trading range at the 1:10 minute, with roughly 5,200 contracts trading. This is one example traders must learn to endure. Soybean oil was up sharply in part on expectations for global palm oil inventories will continue to shrink, and Argentina political

problems sending soybean oil business elsewhere, such as the US. Soybean meal was also up sharply but the soybean products were unable to keep up with the speculative buying in soybeans, resulting in another violent trading range session for the CBOT crush,

under pressure, thus leading analysts to predict rationing will commence during the last half of the current Oct-Sep marketing year. We think we will eventually see a draw in US daily crush rates during or after late April, based on current commercial coverage.

-

On

Tuesday, funds bought an estimated 30,000 soybean contracts, 9,000 soybean meal and 12,000 soybean oil lots.

-

Argentina

grain handlers are still on strike action at some facilities bias southern export areas. One source mentioned exporters can load at one terminal but not another. Meanwhile Argentina corn registrations surged to over 1.2 million tons during the first week

of new year for shipments beyond the February period. High prices are beneficial for exporters.

-

China

bought at least one Brazilian soybean cargoes yesterday for March shipment, and two to three US PNW soybean cargoes for Sep-Oct shipment.

-

Soybean

and Corn Advisory: -

2020/21

Brazil Soybean Estimate Lowered 2.0 mt to 128.0 Million -

2020/21

Argentina Soybean Estimate Lowered 1.0 mt to 46.0 Million -

Argentina

weather this week will include scattered showers and thunderstorms. Brazil saw scattered showers over the long holiday weekend. Brazil will see rain on and off over the next two weeks. Some areas will not receive adequate rainfall including the southern

and eastern Mato Grosso, Bahia, eastern Piaui, Pernambuco and northeastern Minas Gerais.

- Today

the USDA/CCC seeks 2,000 tons of vegetable oil, packaged in 4 liter cans, for export to Kenya for February 1-28 shipment (Feb 16 to Mar 15 for plants located at ports).

MPOB

Jan. 11 Malaysian palm estimates:

Range Median

Production

1,296,000-1,386,000 1,326,283

Exports

1,272,000-1,650,000 1,500,000

Imports

60,000-150,000 100,000

Closing

stocks 1,107,000-1,477,200 1,218,535

Updated

1/05/20

March

$12.50 and $14.50 range

March

$415 and $480 range

March

is expected to trade in a 42.50 and 46.00 cent range

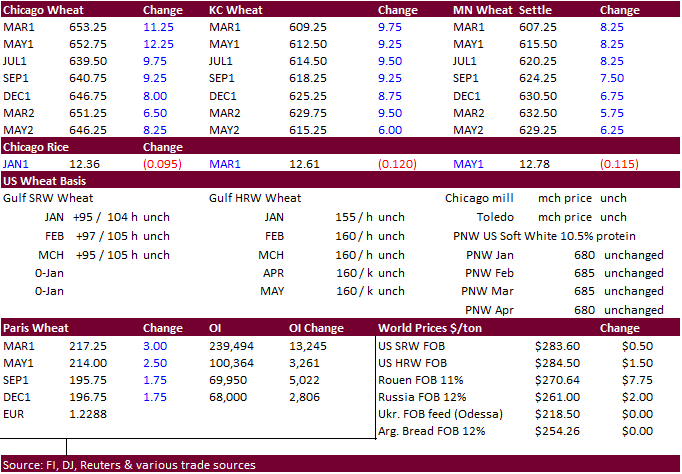

- US

wheat out of most of the major commodities probably saw the least amount of market direction news but managed to rally on the heels of corn and soybeans, and perhaps an overlooked market when comparing price advances by soybeans over the past month. We don’t

expect USDA to report any surprises to December 1 US wheat stocks next week, nor make major changes to the US and/or global carryout.

- On

Tuesday funds bought an estimated net 12,000 Chicago SRW wheat contracts.

- Ukraine

winter grain crops remain in good conditions. - UkrAgroConsult

estimated Ukraine 2021 wheat production at 26.5 million tons, up 1 million from last season.

- EU

March milling wheat was up 2.50 at 217.25 euros, a two-year high.

- Ethiopia

canceled an import tender for 600,000 tons of wheat that was set to close back on November.

- Jordan

bought 60,000 tons of animal feed barley (120k sought). Possible shipment combinations are in 2021 for June 1-15, June 16-30, July 1-15 and July 16-31.

- Bangladesh

seeks 50,000 tons of wheat in January 13 for shipment within 40 days of contract signing.

·

None reported

Updated

1/4/20

March

Chicago wheat is seen in a $5.90‐$6.65 range

March

KC wheat is seen in a $5.70‐$6.20 range

March

MN wheat is seen in a $5.75‐$6.15 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.