PDF Attached

USDA:

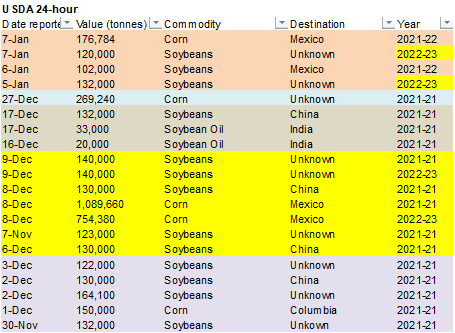

Private exporters reported the following activity:

-176,784

metric tons of corn for delivery to Mexico during the 2021/2022 marketing year

-120,000

metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

CBOT

agriculture prices traded in a wide, choppy trade. Many markets were two-sided. A sharply lower USD provided support. Meal was the leader to the upside on Friday. Several block trades were done this week for the back 2022 contracts. Several reports are due

out next week, including USDA on Wednesday. On Friday this was the GFS midday model discussion via World Weather Inc.

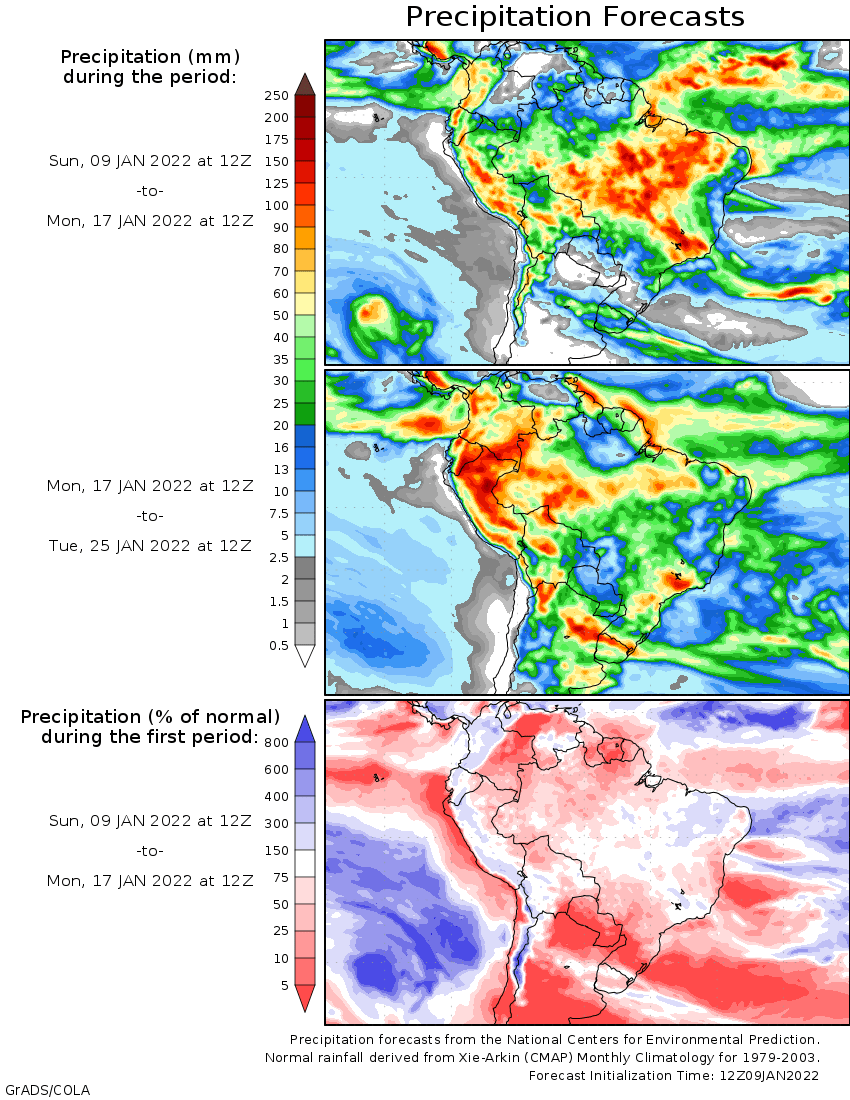

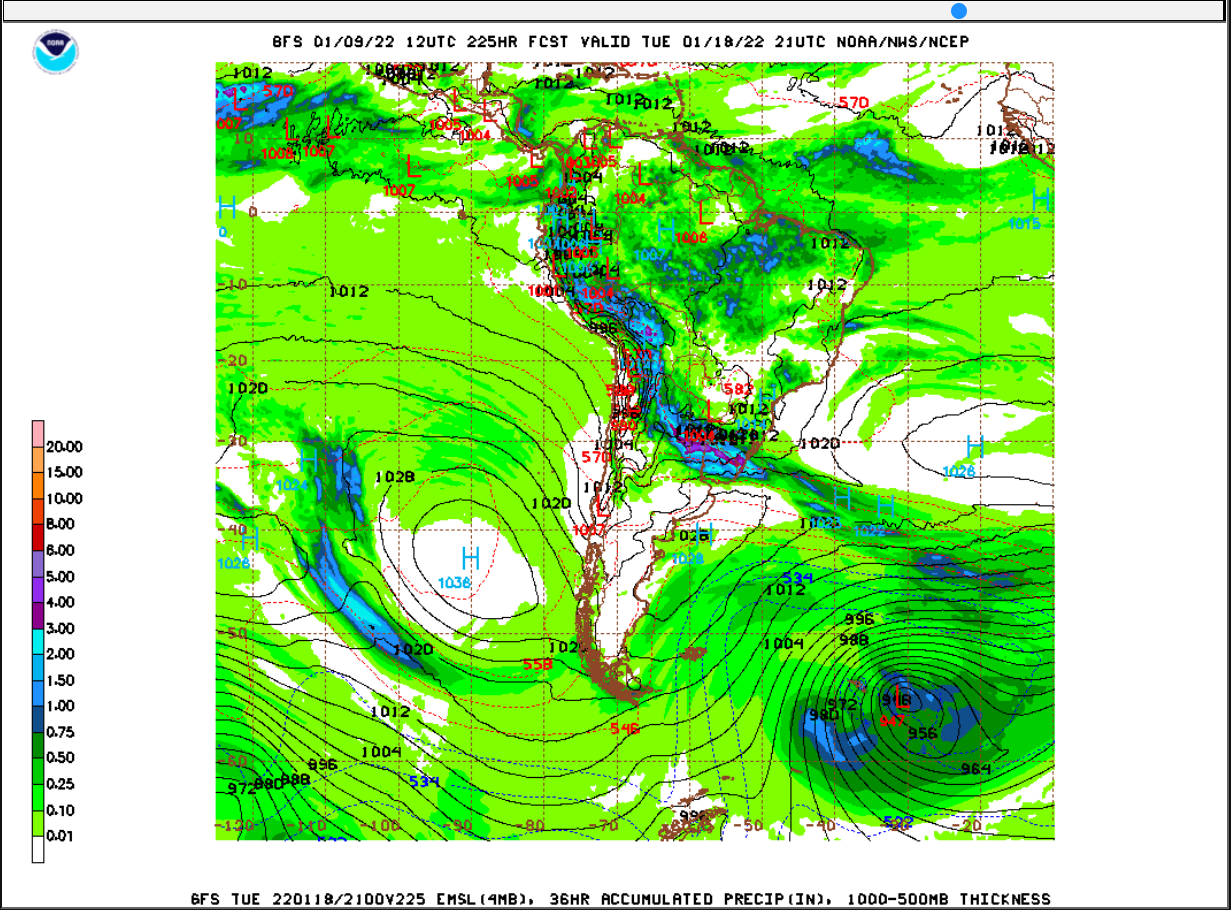

South

America (Week 2-Discussion of significant model changes)

·

The GFS model was wetter in much of Argentina Jan. 15-18 with mostly light rain and some dry areas from central La Pampa to central and southern Buenos Aires

·

The GFS model reduced rain from Mato Grosso into Goias with reductions in light rain extending into Minas Gerais Jan. 14-16

·

The GFS model reduced rain from Paraguay to Santa Catarina, Parana, Sao Paulo, and southern Minas Gerais Jan. 17-19

·

The GFS model reduced rain in central and northern Argentina Jan. 20-21

·

The GFS model reduced rain from southern Paraguay to central and northern Rio Grande do Sul, Santa Catarina, and southern Parana Jan. 19-21

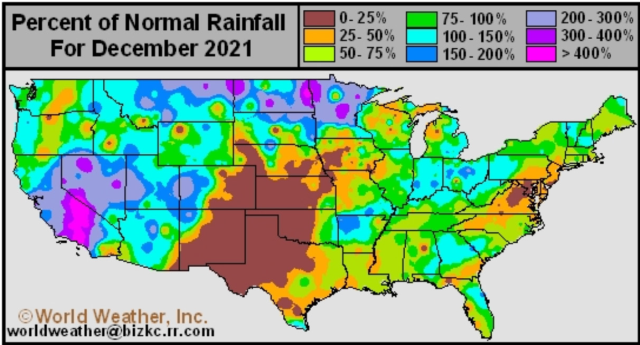

Weather

Eastern

US soil moisture levels are very good, but US winter wheat crop areas out west could use additional precipitation.

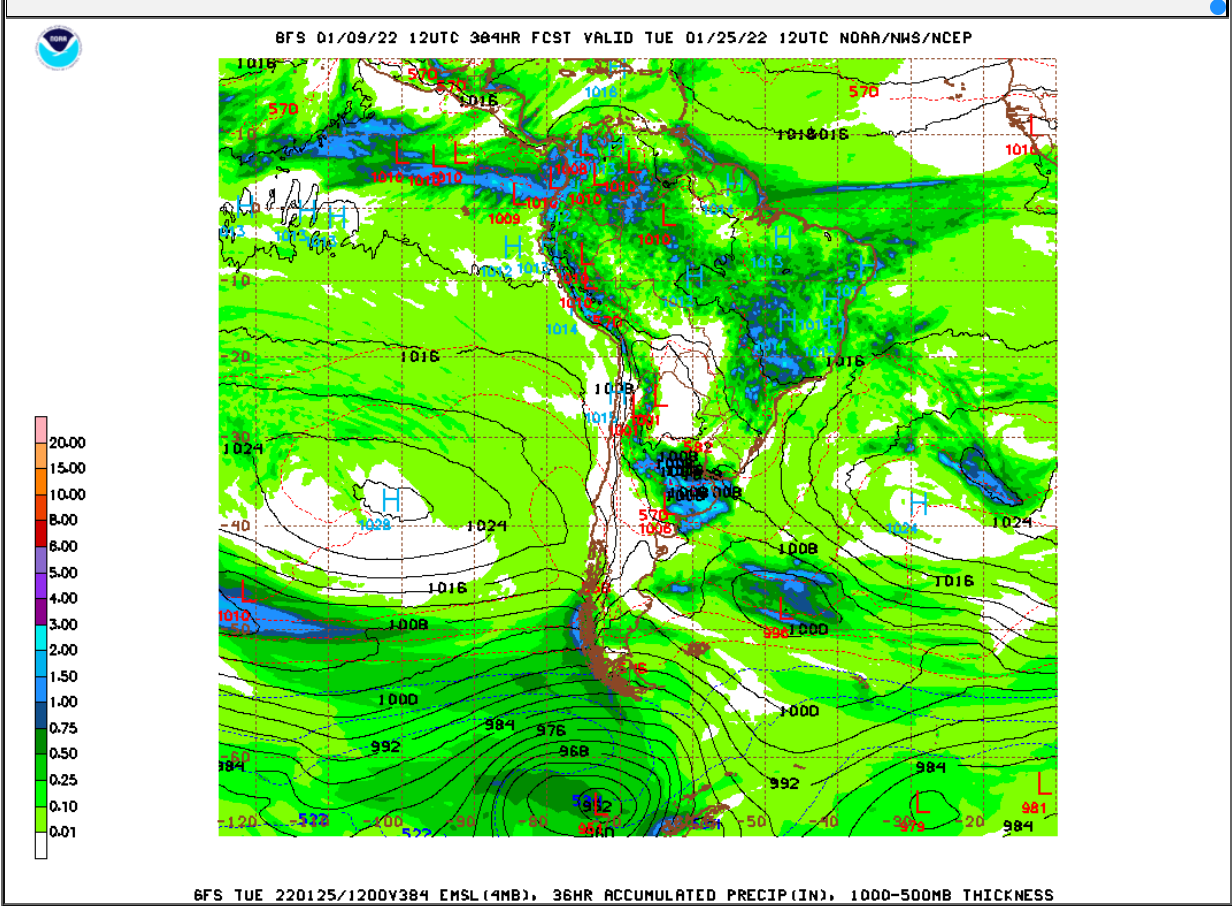

Sunday

Maps for SA:

Good

rain for southern Brazil and parts of Argentina are slated for the 17-19th period and Jan 23-25th.

WEATHER

EVENTS AND FEATURES TO WATCH

-

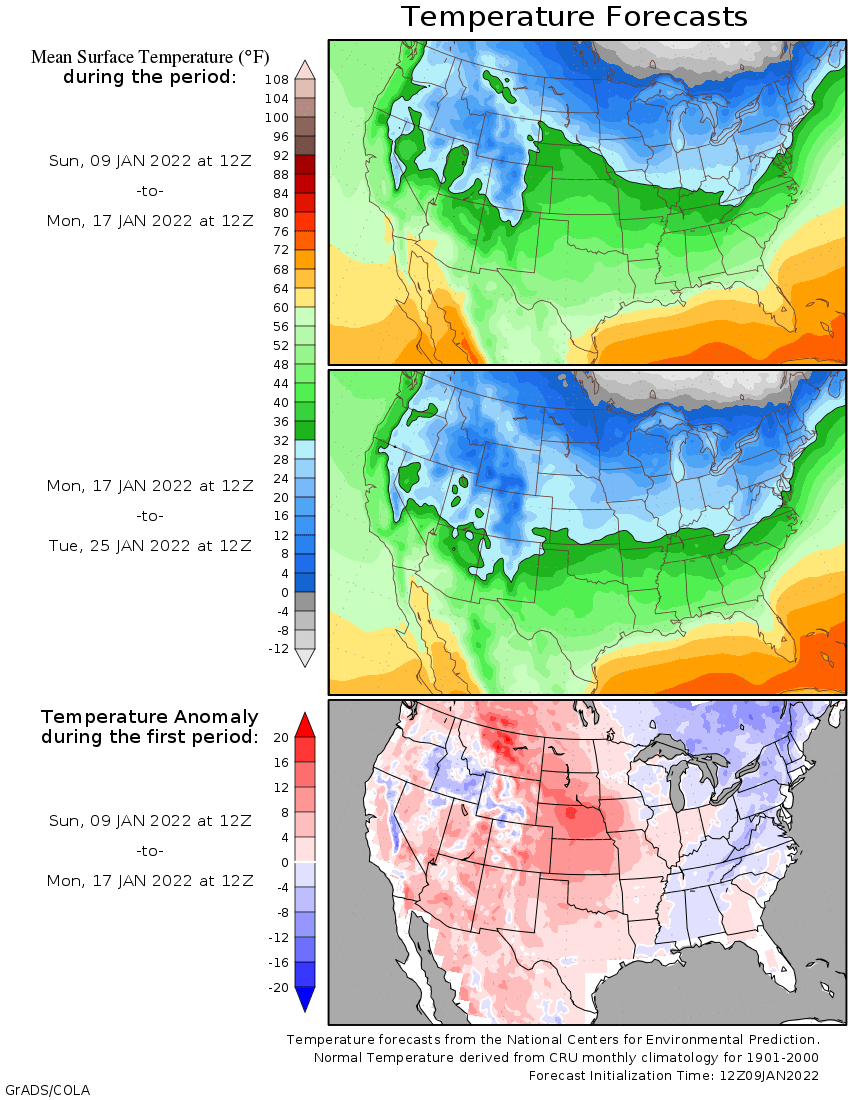

Cold

conditions in the U.S. this morning are grabbing a little attention -

Areas

from the central U.S. Plains into the lower Midwest were in the positive single digits Fahrenheit most often, but numerous pockets of negative single digit readings were also noted -

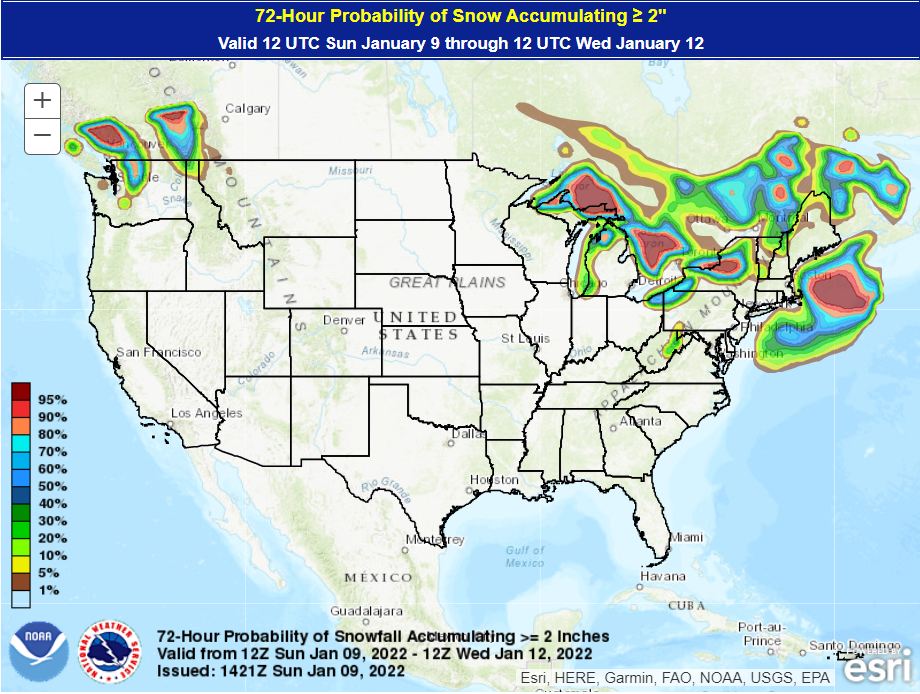

Snow

free conditions occurred from central Missouri to central Indiana and west-central Ohio where most of the coldest conditions occurred -

A

pocket northeast of St. Louis, Mo in Illinois reported more significantly cold temperatures dropping to -9 and lower, but the area impacted was extremely small -

Most

of the region from the central Plains to Ohio should not have experienced any serious wheat damage

-

Single

digit low temperatures also occurred southward into the northwest half of Oklahoma with Armour (located northwest of Oklahoma City) slipping to +2 Fahrenheit -

No

snow was on the ground in Oklahoma, the Texas Panhandle or far southern Kansas

-

The

temperatures were most likely above the damage threshold -

Central

Minnesota morning temperatures today dropped to the range of upper -20s through to -39 Fahrenheit – the region is snow covered and there are no winter crops in the region -

Positive

and negative single digit low temperatures also occurred in western Kentucky and Tennessee this morning, but those areas were buried in snow -

Snow

fell significantly Thursday from Kentucky and the northern and central parts of Tennessee through Pennsylvania, West Virginia and northwestern Virginia to the southern New England coast and areas southward into Delaware -

Accumulations

varied from 4 to 10 inches with local totals getting up to 12 inches in Connecticut and eastern Massachusetts as well as in West Virginia.

-

Totals

snowfall to 8 inches occurred in parts of Kentucky and Tennessee -

Thursday’s

snow event will continue today along the upper Atlantic Coast with more heavy snow expected along the New England coast -

U.S.

weather during the next ten days will include restricted precipitation in hard red winter wheat areas, but a little precipitation may occur infrequently

-

West

Texas may get some light precipitation during the middle part of next week, but resulting moisture totals will be no more than 0.50 inch with many areas getting less than 0.30 inch -

South

Texas may get some precipitation infrequently over the next couple of weeks, but the moisture will be limited in significance and brief in duration

-

Central

and southern California and the southwestern desert region will be dry for the next couple of weeks -

Precipitation

will continue periodically in the Pacific Northwest with the Cascade mountains and coastal areas of Washington and Oregon wettest

-

British

Columbia coastal areas will experience some of the greatest precipitation and strongest wind periodically -

Northwestern

U.S. Plains and southwestern Canada’s Prairies will continue to experience restricted precipitation -

Midwest,

Delta and Tennessee River Basin areas will be wettest during the next ten days with frequent periods of rain and some snow -

Southeastern

states will experience some periodic precipitation -

Crop

conditions in Argentina are deteriorating a little every day that goes by without rain -

Topsoil

moisture is rated very short in much of the nation with those areas getting rain most recently having “short” topsoil moisture -

Temperatures

Thursday were more seasonable, but the weather was dry -

Temperatures

late this weekend through all of next week will be in the range of 95 to 110 degrees Fahrenheit with a few hotter readings in the drier areas of the north -

Subsoil

moisture is also becoming depleted in many crop areas in the central and north making the situation critically dry already and the longest stretch of hot, dry, weather has not begun yet -

Subsoil

moisture in southern Cordoba, northeastern La Pampa, southeastern San Luis and areas southeast to central Buenos Aires has been good in recent weeks supporting crops while rainfall has been restricted, but the subsoil moisture in this region is now marginally

adequate to short and another ten days of dry and warm to hot weather will deplete that inducing more serious stress in this more important summer crop region -

Some

crop loss is expected -

The

most recently planted crops will run the highest risk of failure without rain and with temperatures excessively hot -

Early

planted corn and sunseed are reproducing and are losing yield potential and the trend will last for ten days -

Week

two weather in Argentina, Jan. 15-19, will offer some scattered showers and thunderstorms, but it is unclear how significant that rain may or may not be -

Temperatures

may also trend a little less hot during that period of time -

Brazil

weather Thursday and early today included rain from the northeastern and central parts of Sao Paulo through Minas Gerais to Goias with lighter showers and thunderstorms in Mato Grosso, Tocantins, western Bahia and northern Mato Grosso do Sul.

-

Rainfall

was greatest from southern and eastern Goias into Sao Paulo and much of Minas Gerais where 0.50 to 2.50 inches resulted -

Rainfall

elsewhere was not much more than 0.50 inch -

Temperatures

were near to below average -

Southern

Brazil weather is advertised a little drier today than yesterday suggesting less relief from dryness in western Parana and southern Mato Grosso do Sul as well as Paraguay

-

Rio

Grande do Sul gets little to no rain during the next ten days suggesting it will experience the greatest potential decline in crop development if the forecast is correct -

Less

rain in southwestern Brazil relative to previous days should raise a flag of caution since the region could become drier biased again threatening late season crops after recent relief from dryness -

Northern

Brazil rainfall should continue frequent and abundant from Minas Gerais into Tocantins and eastern Mato Grosso during the next week, but less rain will evolve in the following week -

The

wet bias will maintain concern over crop quality, although daily rain amounts are not likely to be great enough to cause any “epic-like” flood event, but concern about local flooding should continue -

Less

frequent and less significant rain should evolve in northern crop areas late next week into the following weekend, although showers and thunderstorms will continue periodically with a little more sunshine intermixing -

Paraguay

is unlikely to get nearly as much rain as neighboring areas of Brazil may get over the next ten days and crop stress in the nation will remain serious – like that of Argentina -

Canada’s

Prairies will receive waves of snow during the next two weeks with northern and eastern areas getting the greatest amounts -

East-central

and southern Alberta and west-central and southwestern Saskatchewan are still in a serious drought and the snowfall in those areas will be light and provide very little relief when it melts -

Temperatures

will trend much warmer next week -

Northern,

central and eastern India have been and will continue to receive rain over the coming week that will moisten the topsoil and help support crop development ahead of reproduction -

Wheat,

millet, rapeseed and some pulse crops will be among the beneficiaries of the precipitation

-

Some

rain has already impacted northern India over the past couple of days -

Southern

India will be relatively dry, although significant rain fell along the lower east coast during the weekend -

Europe

weather has been and should continue to be good for dormant winter crops -

Concern

about dryness in Spain may continue for a while, but soil moisture and snow cover should be sufficient for crops elsewhere over the next ten days -

North

Africa precipitation will be limited to Tunisia and northeastern Algeria through the weekend -

Most

other areas will be dry or mostly dry for 8-9 days -

Some

rain will reach Morocco and Algeria in the week of Jan. 16 -

Southwestern

Morocco continues to be in a notable multi-year drought and dryness is also a concern in northwestern Algeria -

Crops

elsewhere are doing relatively well -

Warmer

temperatures in parts of Ukraine and Russia’s Southern Region recently induced a little rain while snow fell frequently to the north -

Snow

cover has been receding from eastern Europe, Ukraine and Russia’s Southern Region, but there is no threatening cold coming anytime soon -

Cooling

next week and into the following weekend will reverse the trend putting back some of the snow lost -

No

threatening cold weather is expected anytime soon in Europe or the western CIS -

Snow

cover will remain widespread across much of Russia and the northernmost part of Ukraine as well as some areas in eastern Europe -

Winter

crops are in good conditions no change is expected -

China’s

weather will continue mostly uneventful for a while, although periods of rain and a little snow will impact the Yangtze River Basin and areas southward during the next couple of weeks.

-

The

moisture will preserve the integrity of the 2022 rapeseed and southern wheat crops -

Snow

will fall periodically in the far northeast while the Yellow River Basin and southern coastal provinces receive little to no precipitation -

Temperatures

will be near to slightly warmer than usual -

Southeast

Asia oil palm, citrus, sugarcane, coffee, cocoa, rice and other crop areas of Indonesia, Malaysia and Philippines will receive frequent bouts of rain over the next two weeks -

Some

heavy rain is possible, but no serious widespread flood problem is expected -

Local

flooding will be possible, though -

Mainland

areas of Southeast Asia will be mostly dry during the next ten days except Vietnam coastal areas where some moderate to heavy rain will be possible late this week and into the weekend -

Australia

weather outlook has not changed much -

Rain

fell significantly to the immediate west of the Great Dividing Range in New South Wales Thursday -

More

than 2.00 inches resulted in some areas -

Thunderstorms

are expected to continue in central and eastern parts of New South Wales and a few interior southeastern Queensland locations into Monday with other showers occurring periodically over the next ten days -

Rainfall

will be greatest along the western slopes of the Great Dividing Range in New South Wales today and then diminish after that -

The

precipitation may continue next week as isolated to scattered showers and thunderstorms that will benefit summer crops in both Queensland and New South Wales, although the rain in Queensland will be most restricted -

Temperatures

will be near to above normal -

Late

season winter crop harvesting in southern Australia should not be seriously impacted by rain since most of the crop has been harvested -

South

Africa will experience a good mix of rain and sunshine during the next two weeks -

The

long term summer outlook remains favorable -

Western

summer crop areas have the greatest need for rain and they should get at least some periodically -

Temperatures

will be seasonable -

West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual -

East-central

Africa will be erratic, but it is expected daily through the next ten days supporting coffee, cocoa, rice sugarcane and other crops -

Middle

East precipitation is increasing with improved soil moisture likely over the next ten days -

Some

beneficial moisture has already occurred in Pakistan, Afghanistan, Iraq and Iran -

Winter

crops will benefit from whatever rain falls, but it is not expected to be evenly distributed for a while -

Mexico

weather will trend wetter in far southern and some extreme eastern crop areas during the coming week -

Some

showers may evolve in north-central areas Jan. 11-14 -

Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica during the next ten days -

A

few showers will occur in Guatemala periodically as well, although rainfall will be light -

Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected -

Today’s

Southern Oscillation Index was +10.53 and it was expected to drift lower for a while this week -

New

Zealand rainfall is expected to continue getting less than usual precipitation this week with temperatures near to above normal

Source:

World Weather, inc.

Monday,

Jan. 10:

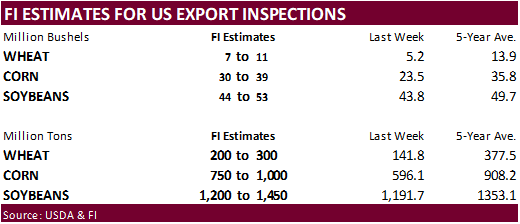

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysian

Palm Oil Board’s data for December output, exports and stockpiles - Malaysia’s

Jan. 1-10 palm oil exports - Ivory

Coast cocoa arrivals - HOLIDAY:

Japan

Tuesday,

Jan. 11:

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases data on area, yield and output of corn and soybeans

Wednesday,

Jan. 12:

- China

farm ministry’s CASDE outlook report - USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - USDA’s

NASS 2021 summary of crop acreages and yields, noon - USDA’s

quarterly stockpiles data for commodities, including wheat, barley, corn, soybeans and sorghum, noon - EIA

weekly U.S. ethanol inventories, production - USDA’s

Farm Service Agency issues 2021 crop size data gathered from producers, 1pm - New

Zealand Commodity Price

Thursday,

Jan. 13:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Suedzucker

quarterly earnings - Agrana

nine- month earnings - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

Jan. 14:

- China’s

December trade data - ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source:

Bloomberg and FI

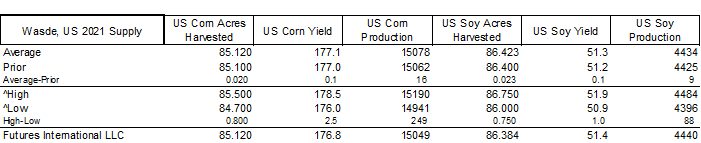

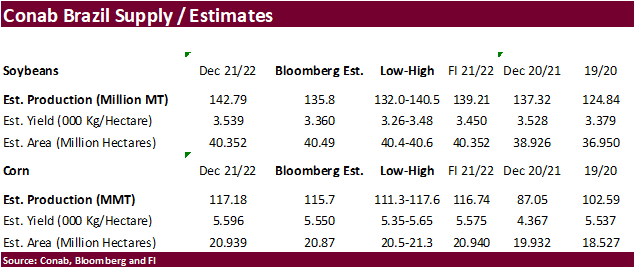

Bloomberg

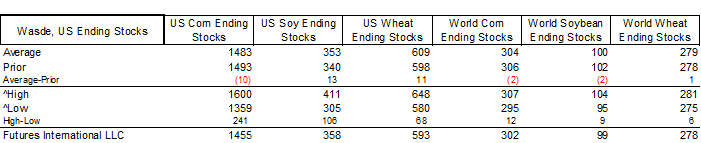

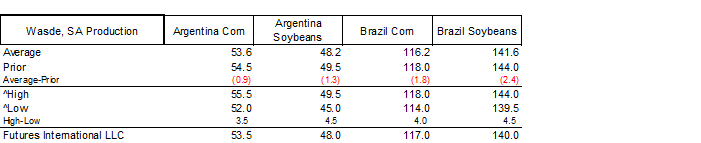

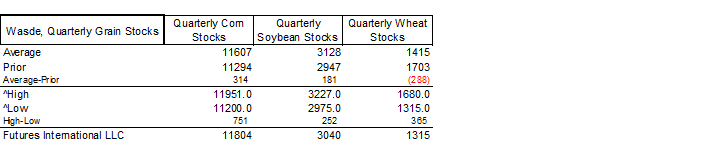

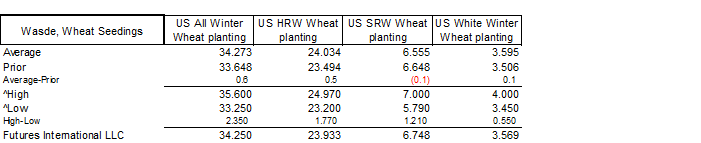

Trade Estimates for the January USDA crop/stocks reports.

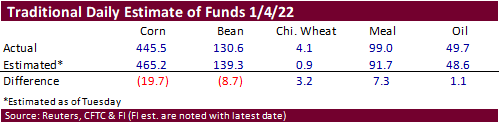

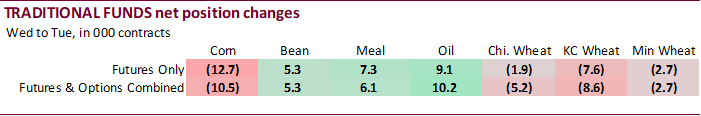

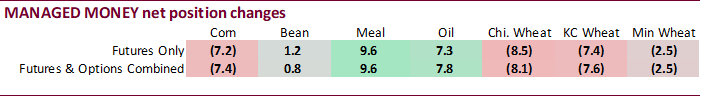

Largest

discrepancy in the Commitment of Traders reports was that the funds net long position was not as long as expected, by 19,700 contracts. The funds were also not as long as expected for soybeans, by 8,700. Both position results may have little impact on prices.

The net long traditional fund position for corn was down a small amount as of last Tuesday and for soybeans the net long position is highest since July 13, 2021. Chicago wheat is headed to near a flat position for funds futures only if prices continue to

decline.

CFTC

via Reuters

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

268,991 -13,799 438,828 4,594 -658,237 25,076

Soybeans

85,850 5,140 180,909 3,798 -227,666 -2,812

Soyoil

9,016 7,427 120,970 2,698 -137,078 -12,350

CBOT

wheat -36,068 -5,570 124,628 3,214 -79,112 5,111

KCBT

wheat 21,486 -8,166 59,571 -2,142 -84,508 8,229

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

365,905 -7,440 261,167 921 -648,855 25,468

Soybeans

98,919 839 140,056 5,299 -232,737 -4,504

Soymeal

70,768 9,606 87,067 51 -210,986 -7,660

Soyoil

53,188 7,794 91,223 -2,896 -141,957 -9,523

CBOT

wheat -19,845 -8,071 77,397 3,892 -62,438 4,019

KCBT

wheat 51,813 -7,593 24,792 -805 -72,213 7,369

MGEX

wheat 9,481 -2,549 1,643 516 -20,667 3,505

———- ———- ———- ———- ———- ———-

Total

wheat 41,449 -18,213 103,832 3,603 -155,318 14,893

Live

cattle 72,346 2,743 80,277 -766 -155,806 -443

Feeder

cattle 7,326 5,646 3,792 240 -1,997 -2,761

Lean

hogs 55,674 -2,044 56,825 -394 -104,542 530

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

71,365 -3,077 -49,582 -15,872 1,865,691 22,589

Soybeans

32,855 4,491 -39,093 -6,126 789,340 21,901

Soymeal

25,888 -3,472 27,263 1,475 436,279 5,975

Soyoil

-9,547 2,400 7,094 2,224 422,697 2,853

CBOT

wheat 14,334 2,916 -9,448 -2,756 439,485 5,758

KCBT

wheat -7,843 -1,049 3,451 2,078 247,064 2,544

MGEX

wheat 6,860 -180 2,683 -1,292 77,161 -436

———- ———- ———- ———- ———- ———-

Total

wheat 13,351 1,687 -3,314 -1,970 763,710 7,866

Live

cattle 18,932 1,484 -15,750 -3,018 381,779 20,465

Feeder

cattle 360 -76 -9,481 -3,050 49,318 3,076

Lean

hogs 8,095 1,287 -16,053 621 264,825 1,877

Macros

75

Counterparties Take $1.530 Tln At Fed Reverse Repo Op. (prev $1.511 Tln, 74 Bids)

US

Change In Nonfarm Payrolls Dec: 199K (est 450K; prev 210K; prevR 249K)

–

Unemployment Rate Dec: 3.9% (est 4.1%; prev 4.2%)

–

Avg. Hourly Earnings (M/M) Dec: 0.6% (est 0.4%; prev 0.3%; prevR 0.4%)

–

Avg. Hourly Earnings (Y/Y) Dec: 4.7% (est 4.2%; prev 4.8%; 5.1%)

US

Private Payrolls Dec: 211K (est 365K; prev 235K; prevR 270K)

–

Manufacturing Payrolls Dec: 26K (est 35K; prev 31K; prevR 35K)

–

Government Payrolls Dec: K (prev -25K)

Canadian

Net Change In Employment Dec: 54.7K (est 25K; prev 153.7K)

–

Unemployment Rate Dec: 5.9% (est 6.0%; prev 6.0%)

–

Full Time Employment Change Dec: 122.5K (est 5.3K; prev 79.9K)

–

Part Time Employment Change Dec: -67.7K (est 10K; prev 73.8K)

New

Covid variant called ‘Deltacron’ detected in Cyprus; 25 cases so far

·

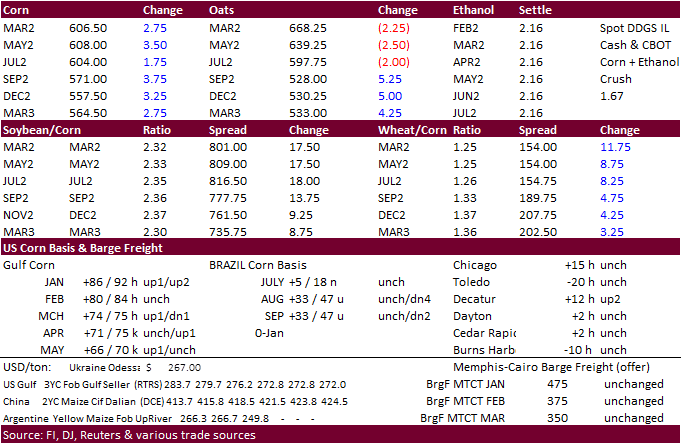

CBOT corn traded higher today after soybeans and wheat staged a rebound, and soybean meal futures surged higher. The USD was sharply lower. USDA announced corn sold to Mexico.

·

Funds bought an estimated net 4,000 contracts on Friday.

·

March corn was up 2.3% for the week.

·

US employment increased less than expected in December.

·

Other news is light.

·

Yesterday the Buenos Aires Grain Exchange reported the Argentine corn crop rated 40% good & excellent compared to 58% week earlier.

Export

developments.

·

USDA this morning reported private exporters sold 176,784 tons of 2021-22 corn to Mexico.

Wholesale

electricity prices trended higher in 2021 due to increasing natural gas prices

https://www.eia.gov/todayinenergy/detail.php?id=50798&src=email

Updated

1/3/22

March

corn is seen in a $5.60 to $6.20 range

·

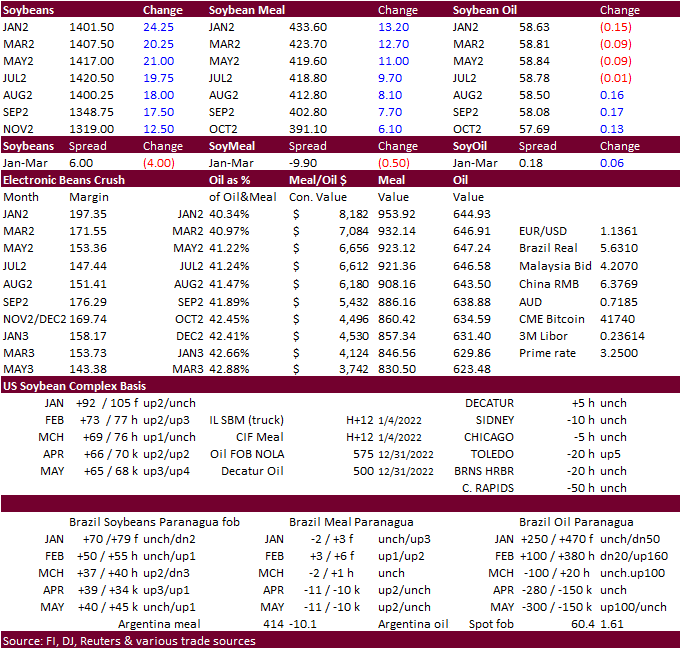

CBOT soybeans settled 19.25-24.25 cents higher on dry SA weather over the next week and sharply higher soybean meal that rallied $9.20 to $14.00 short ton. Soybean oil finished lower in the front four months. March soybean meal

hit a all-time contract high today of $431.80. It settled at $425. US rail soybean meal basis across the interior eased $3-4 for a few locations. Truck basis was mostly unchanged ($5 lower Mankato).

·

Some factors that supported soybean meal:

- Index

rebalancing. Rumor funds need to buy 35,000 soybean meal contracts. - Lack

of meal offers out of Argentina on top of Argentina producers reserve sellers of soybeans.

- European

buyers are having a hard time sourcing soybean meal from South America. Some business could be shifted to the US.

- Rally

in EU rapeseed futures might price out rapeseed meal, allowing more to turn to other oilmeals.

- USD

was down sharply

·

Funds bought an estimated net 13,000 soybeans, bought 7,000 soybean meal and sold 2,000 soybean oil.

·

We are hearing the recent surge in soybean meal prices led Brazil crush margins for March 2022 to appreciate to over $50/ton, a very high level. There might be some debate if crushers will prevail over exporters for the upcoming

soybean crop, but with production around the 137-140 million ton range, Brazil will have enough soybeans for both demand outlets through at least fall 2022.

·

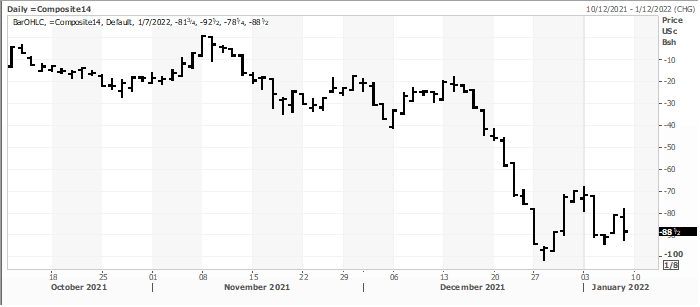

The recent slide in soybean prices may have attracted some new-crop export pricing. We are hearing China may have bought 3 USG cargos for October shipment at around +114 over the November and 5-6 PNW cargoes also of October at

+190 over the November. The CBOT soybean March contract earlier this week traded around 90 cents premium over the November 2022 before narrowing to around 88.50 cents. Earlier this morning the spread was around 80 cents.

·

Malaysian palm futures traded higher by 8 ringgit to 4,993. The March position is up three consecutive weeks and for this week gained 6.5%.

Export

Developments

·

We are hearing China is pricing new-crop US soybeans.

·

Under the 24-hour announcement system, private exporters sold 120,000 tons of new-crop (2022-23) soybeans to unknown.

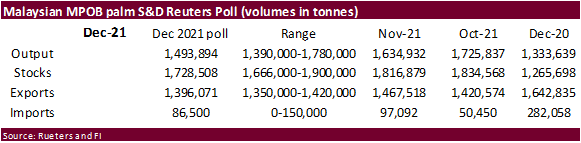

MPOB

is

due out Monday, first of many reports released next week. A Reuters poll looks for Malaysia’s palm oil inventories at end-December to sink 4.9% from the previous month to 1.73 million tons, lowest in five months.

Updated

1/5/22

Soybeans

– March $13.00-$14.25

Soybean

meal – March $370-$435

Soybean

oil – March 53.00-61.00

·

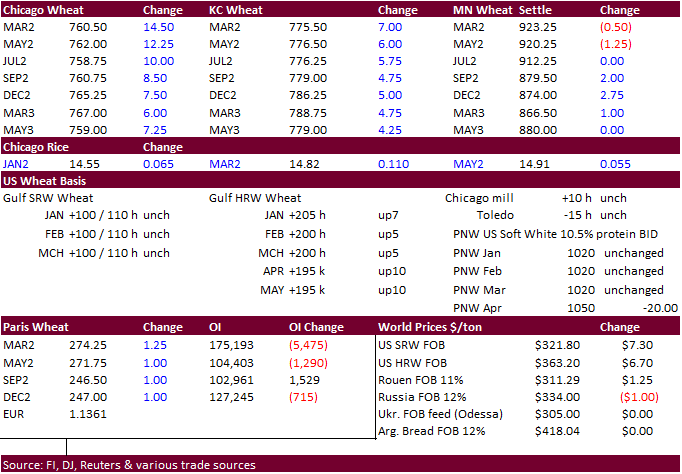

US SRW wheat ended higher led by the front months after fund selling dried. Sharply higher soybeans lent support. KC followed Chicago while MN ended mixed with March and May lower.

·

Technical selling and lack of US export developments was noted earlier.

·

Funds on the day bought 6,000 SRW (Chicago) wheat contracts.

·

There was an unconfirmed rumor China was in for US soft red winter. Export prices don’t suggest this but the spreads did erupt today.

·

Reuters – Brazil was able to clear two wheat shipments at its key Santos port after a few days of delay caused by a protest by agricultural tax collectors as part of their campaign for higher wages, industry association Abitrigo

said.

·

EU wheat basis the March position was 1.25 higher at 274.50 euros a ton.

·

Russia was on holiday.

·

Yesterday IKAR reported Russian wheat with 12.5% protein content loading from Black Sea ports for supply in January stood at $330 a ton free on board (FOB), unchanged from late 2021.

·

Jordan seeks 120,000 tons of wheat on January 18. Possible shipment combinations are in 2022 between July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

China plans to sell 500,000 tons of wheat from state reserves on January 12 to flour millers.

·

Results awaited: Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

Rice/Other

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen as 3.46m bales, slightly above USDA’s previous est., according to the avg in a Bloomberg survey of seven analysts. Estimates range from 3.0m to 3.85m bales. Global ending

stocks seen 125,000 bales lower at 85.61m bales.

·

Bangladesh seeks 50,000 tons of rice on January 16.

Updated 12/9/21

Chicago March $7.40 to $8.60 range

KC March $7.55 to $9.00 range

MN March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.