PDF Attached

Attached

is our US acreage table and graphs, along with SST(3.4) versus selected country yields.

Busy

week ahead with USDA reports Thursday. Also, on that day the US CPI will be released, giving the trade a glimpse of how much the Fed may increase interest rates in February. Export inspections were ok. Lower trade in soybeans, meal, corn and Chicago & KC wheat.

Soybean oil and MN ended higher.

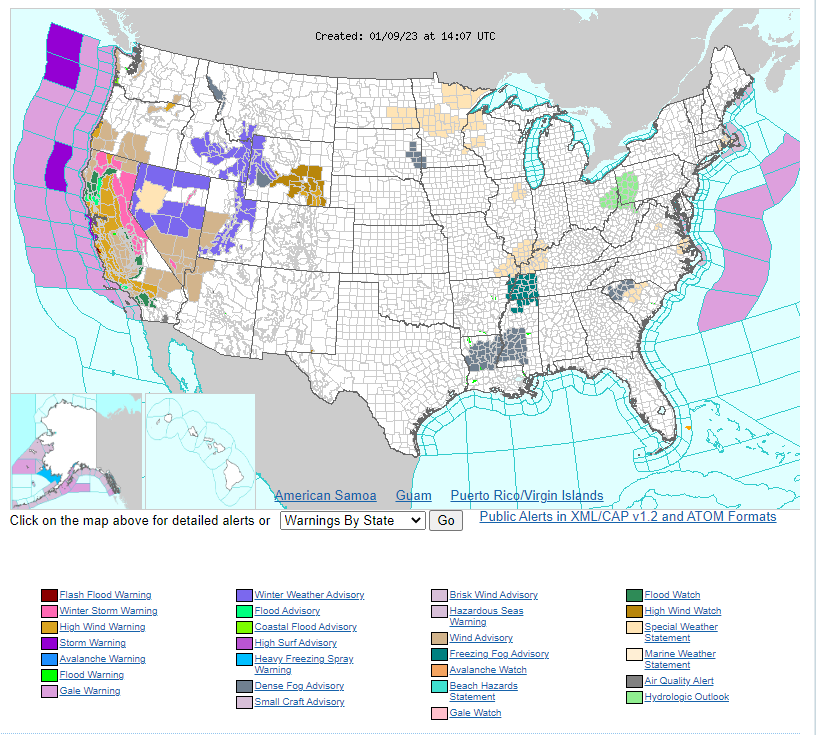

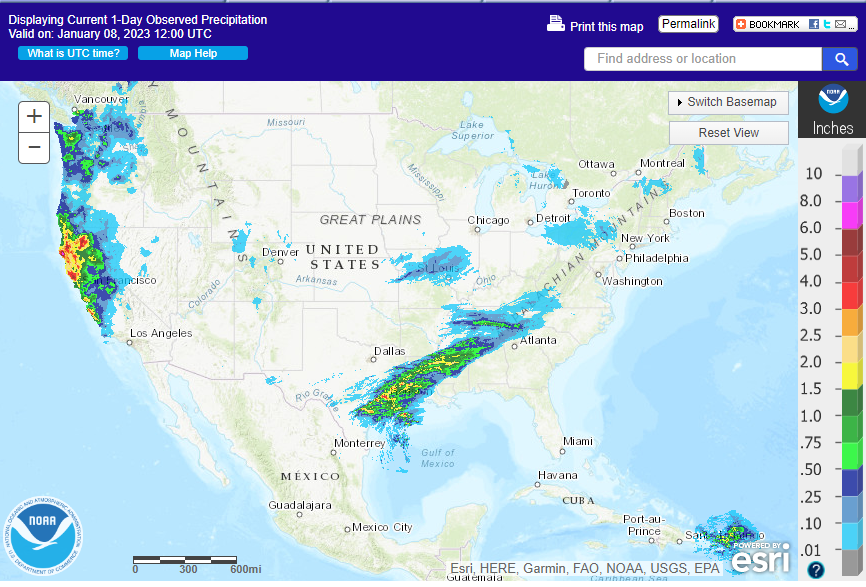

Californians

are facing another round of flooding and power outages tonight into Tuesday.

https://origin.wpc.ncep.noaa.gov/discussions/hpcdiscussions.php?disc=pmdspd

Argentina

will see light rain across La Pampa, Cordoba, BA and northern Santa Fe Tuesday through Thursday, before drying down Friday. The far southern areas will see restricted rain while the central areas should improve. Rain will fall across Mato Grosso, Goias, MGDS,

Sao Paulo and lesser extent Parana, Santa Catarina, and Rio Grande do Sul. The far western Great Plains will see a wintery mix mid this week while other areas of the GP will remain dry. Rains were as expected over the weekend for southeastern TX, northeastern

KS and west central IL. Light precipitation will fall across south central and east central of the Midwest Wednesday through Thursday, and southeastern areas later this week. This should be beneficial for winter crops. US Midwest temperatures will be mild

through Thursday. Well above average temperatures will build into the southern Plains. Rain should favor many central and eastern European countries this week.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

NOT

MUCH CHANGE OVERNIGHT -

Argentina

continued dry during the weekend with temperatures very warm to hot -

Highest

afternoon temperatures were in the upper 90s to 106 degrees Fahrenheit -

Soil

moisture depletion was accelerated and crop stress increased once again -

Argentina

will remain hot and dry through Tuesday -

A

frontal system will move from southwest to northeast across Argentina during the middle and latter part of this week bringing temperatures down to a more seasonable range -

Some

rain will accompany the frontal system, but resulting rainfall will not be nearly enough to offer a sustainable period of drought relief -

Rainfall

will vary from 0.05 to 0.60 inch with a few greater amounts, but that will not be enough to counter more than a day or two of evaporation and much more rain will still be needed -

Northern

Argentina will experience frequent rainfall Thursday into the weekend with 0.50 to 1.50 inches resulting with a few amounts over 2.00 inches possible -

Cotton

areas will benefit most from the rain -

Most

Argentina grain and oilseed production areas are unlikely to get much moisture through the next ten days -

A

few random showers are possible in the west and north leaving the heart of production country dry -

Argentina

temperatures will cool to a seasonable range this week, but may warm up again for a while next week.

-

The

GFS model run continues to suggest rain in the late in the second week of the outlook, but that has not been verifying recently -

Argentina’s

bottom line is still one of concern over production potential. No serious relief from dryness is expected this week, although a few showers and some cooler temperatures are likely. Rain that is advertised for the second week of the outlook (mostly after Jan.

18) may not be enough for a serious improvement to crops. Production cuts are inevitable with early season corn and sunseed to suffer significant losses. Late season crops could yield better, but the recovery may be limited depending on when drought conditions

finally abate. -

Brazil

weather during the Friday through Sunday period was dry from western Mato Grosso through most of Mato Grosso do Sul, Paraguay and Parana to Rio Grande do Sul.

-

Rain

did fall from northern Sao Paulo to eastern Mato Grosso, Tocantins, southwestern Bahia, Minas Gerais and Espirito Santo where amounts varied from 0.45 inch to 2.20 inches with Franca, Sao Paulo reporting 5.20 inches -

High

temperatures were in the 70s and 80s in central and east-central parts of the nation and in the 80s and lower 90s Fahrenheit elsewhere -

Brazil

weather early this week will continue dry in the far west and extreme south, but showers and thunderstorms will slowly begin to evolve as mid-week approaches -

Well

timed rainfall is expected to evolve in most of the southern and western parts of Brazil during the second half of this week into next week with sufficient amounts of moisture to improve topsoil moisture and crop conditions -

Additional

rain will still be needed for western and southern Brazil, but enough will occur for temporary relief

-

Brazil’s

bottom line is still mostly good especially if significant rain occurs as advertised later this week into next week. World Weather, Inc. is a little concerned that the advertised rain in southern Brazil may be lighter than expected and relief to dryness may

also be more limited than suggested. However, it will still be timely rainfall that should go a long way in helping to improve crop development for a short period of time. Timely rainfall will have to continue periodically to ensure sufficient soil moisture

in a timely manner to support the best yield potentials. Other areas in the nation should get sufficient amounts of rain to maintain abundant soil moisture and mostly good crop conditions. There is need for some drier weather to get early soybeans harvested

and Safrinha crops planted as quickly as possible. -

Far

northern India will some light rainfall this week that may help improve wheat and other crops as they approach reproduction -

Most

of the significant rain will be from Uttaranchal into Jammu and Kashmir where moderate to locally heavy is possible.

-

Areas

southward into northern Uttar Pradesh and Punjab will vary from a trace to 0.50 inch -

All

other areas will be dry or mostly dry -

The

remainder of India will stay free of significant rain keeping the need for precipitation running high as reproduction approaches -

India

weather during the weekend was dry and mild to warn -

South

Africa will be dry through most of this workweek which may prove beneficial for routine fieldwork -

Rain

should begin again during the weekend and increase next week -

If

the precipitation resumes as advertised the precipitation will be well timed and should help maintain very good production potentials

-

South

Africa weekend precipitation was scattered lightly in the eastern half of the nation -

Many

areas experienced net drying conditions -

Southern

Natal, north-central Mpumalanga and central Limpopo were wettest -

China

was mostly dry during the weekend, although a few showers did occur in Liaoning where moisture totals varied up to 0.25 inch -

Temperatures

were warmer than usual -

China

weather will continue relatively dry early this week with temperatures warmer than usual, but changes in the second half of this week will bring cooling and wetter conditions -

Rain

and rain changing to snow will occur in east-central and southeastern China during the Thursday through Sunday period

-

Moisture

totals will range from 0.20 to 0.75 inch in the north and 0.75 to 2.50 inches with a few totals over 3.00 inches in the Yangtze River Basin and areas southward to the South China Sea Coast -

Snowfall

of 3 to 10 inches will be possible with the higher elevated areas in the Yangtze River Basin most impacted -

Next

week’s precipitation will begin in the southern coastal provinces as rain, but it will lift to the north and change to a wintry mix of precipitation types with some new accumulating snowfall likely -

China’s

moisture in the next two weeks will be ideal in preparing fields for spring planting and crop development even though no new crop development is likely for well over a month.

-

Australia

rainfall is expected to be erratic and light through the next two weeks with temperatures warmer than usual across the south -

Totally

dry weather is unlikely, but resulting rainfall is not expected to be great enough to counter evaporation in most areas -

There

will be a few exceptions with rainfall to be a little more significant in southeastern Queensland periodically and possibly in a few other areas of northeastern New South Wales -

The

bottom line, though, will be one of a growing need for greater rain in Queensland and possibly in a few New South Wales locations as well. Unirrigated summer crop conditions may deteriorate especially in Queensland as time moves along -

Australia

was dry during the Friday through Sunday period in key crop areas -

Temperatures

were warmer than usual in the south and near normal elsewhere. -

Europe

weekend weather was greatest in western and northern parts of the continent.

-

Central

and western Spain, Portugal, France, the United Kingdom, Germany areas north to Scandinavia were wettest -

Moisture

totals varied from 0.40 to 1.61 inches in general with local totals of more than 2.00 inches -

One

location in northern Portugal received 4.45 inches -

Lighter

precipitation fell from Poland into northwestern Ukraine and some immediate neighboring areas of Czech Republic and Slovakia where up[ to 0.20 inch was common

-

Drier

biased conditions occurred in southeastern Europe and central and southern Italy as well as extreme eastern Spain -

Europe

will be warmer than usual through the next two weeks with precipitation likely in most areas

-

Eastern

Spain may be one of the driest areas along with Ukraine -

Eastern

France, Western German, the U.K. and Scandinavia will be wettest along with some of the eastern Adriatic Sea countries where multiple inches of rain are likely with local flooding possible.

-

Some

significant snow will fall in the Alps -

Western

CIS weather was bitterly cold during the weekend with restricted precipitation, although snow fell Thursday and Friday ahead of the coldest conditions -

Snow

cover should have been present in most winter wheat and rye production areas that experienced temperatures near and below zero Fahrenheit.

-

There

may have been a few exceptions, but very little crop damage was suspected -

Much

colder temperatures occurred farther north, but snow depths were more than sufficient to protect winter crops from the cold -

Eastern

winter crop areas in Russia and Ukraine will not see much precipitation this week, although it will not be completely dry -

Warming

is expected and precipitation will develop more significantly in time from northwestern Ukraine, Belarus and the Baltic States to northwestern Russia -

The

greatest precipitation is expected this weekend and next week -

California

and some western portions of Washington and Oregon will experience frequent rain and mountain snowfall during the next ten days -

Substantial

precipitation is still expected in California’s central and north resulting in some rising flood potentials near the coast and in much of the Sacramento Valley -

Heavy

mountain snowfall will raise the snowpack further above normal raising the spring and summer runoff potential -

The

state will need this wet biased pattern to last into spring to make a huge difference in long term drought -

Other

U.S. Great Basin, Pacific Northwest and northern Rocky Mountain areas will also experience above normal precipitation in the coming ten days raising mountain snowpack for better runoff in the spring -

Drought

remains, but should be eased -

U.S.

Midwest is not likely to see high volumes of precipitation through mid-week, but precipitation will begin increasing late this week through all of next week

-

Temperatures

will be above normal through the next two weeks -

U.S.

Delta and Tennessee River Basin will be plenty moist for a while with waves of precipitation expected through the next ten days to two weeks -

Temperatures

will be warmer than usual -

U.S.

hard red winter wheat areas in the central and southwestern Plains are unlikely to see much precipitation over the next ten days to two weeks -

Some

moisture will impact parts of the region, but resulting amounts should be light and sporadic having no impact on drought status -

West

Texas crop areas will not likely see much precipitation over the next ten days to two weeks -

Texas

Blacklands and Coastal Bend will get some rainfall periodically in the next ten days to two weeks, though most of it will hold off until late this week and into next week

-

South

Texas precipitation will be quite limited for a while -

Northern

U.S. Plains, Canada’s Prairies precipitation potentials will be low for the next ten days and then there may be some increase after mid-month -

Some

precipitation is expected briefly during mid-week this week, but resulting amounts will not have much impact on the region overall -

Very

warm temperatures will continue in North America over the next week to ten days -

Some

cooling is expected in late January and February -

North

Africa weather remains drier than usual with little prospect for significant rain through the next ten days -

Showers

that occur briefly this week will not likely have a big impact on crop conditions, but any moisture will be welcome

-

Much

of North Africa still has need for significant rain -

Improved

rain potentials may evolve beyond mid-month -

Western

Turkey will receive some needed rain and mountain snow this week while central and eastern parts of the nation are relatively dry -

Most

of the wheat and other winter crops are rated favorably due to good autumn precipitation, but there is need for greater precipitation in all of the nation -

Middle

East rainfall is expected to be favorably mixed over the next ten days although the resulting precipitation should be mostly light to locally moderate -

Some

rain will return to western Turkey next week ending a ten day period of dry weather -

East-central

Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

-

Coffee

and cocoa conditions should remain favorable in all production areas, despite the anomalies -

West-central

Africa dryness will continue through the next ten days to two weeks -

Dry

conditions are normal at this time of year -

No

excessive heat is expected in this coming week, although warmer than usual conditions may begin to evolve a week from now and continue into January 18.

-

Indonesia,

Malaysia and the Philippines rainfall has been and will continue to be erratic with lighter than usual rainfall expected most often over the coming week

-

Eastern

Philippines receive sporadic rainfall during the weekend with locally great amounts in southeastern Luzon and northeastern Mindanao

-

Vietnam

central and lower coastal areas may receive bouts of rain in the coming week with some of it possibly reaching into the Central Highlands -

Weekend

precipitation occurred similarly with rain in coastal areas and a few showers and thunderstorms reaching into the Central Highlands.

-

Today’s

Southern Oscillation Index was +20.82 and it will likely begin weakening this week and could fall more significantly for a while later this month

Source:

World Weather INC

Bloomberg

Ag Calendar

- USDA

Export Inspections - HOLIDAY:

Japan

Tuesday,

Jan. 10:

- Malaysian

Palm Oil Board’s Dec. data on stockpiles, production and exports - Malaysia’s

Jan. 1-10 palm oil exports - EU

weekly grain, oilseed import and export data

Wednesday,

Jan. 11:

- EIA

weekly US ethanol inventories, production - New

Zealand Commodity Price

Thursday,

Jan. 12:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - International

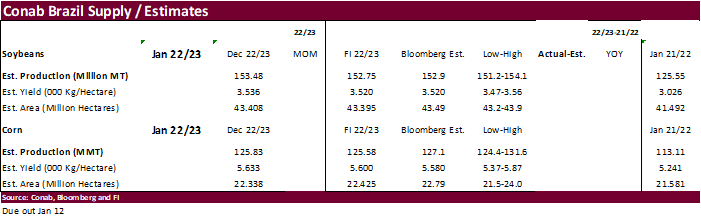

Grains Council report - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - Net-export

sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Jan. 13:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options

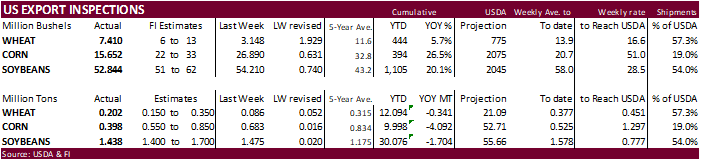

USDA

inspections versus Reuters trade range

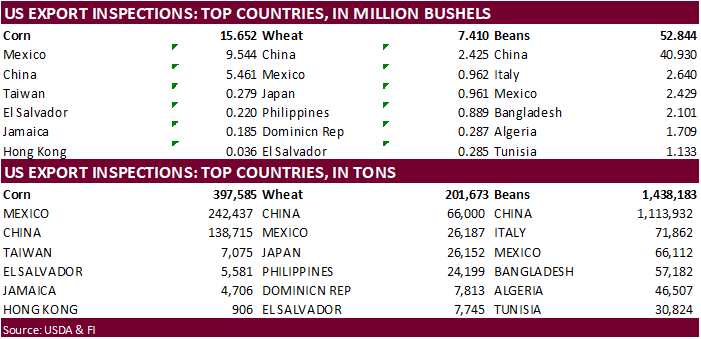

Wheat

201,673 versus 75000-350000 range

Corn

397,585 versus 325000-900000 range

Soybeans

1,438,183 versus 1000000-1850000 range

China

ended up the bulk of soybeans and they took 138,715 tons of US corn.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JAN 05, 2023

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 01/05/2023 12/29/2022 01/06/2022 TO DATE TO DATE

BARLEY

0 0 0 1,855 10,010

CORN

397,585 683,042 1,023,656 9,997,874 14,090,143

FLAXSEED

0 0 0 200 224

MIXED

0 0 0 0 0

OATS

0 0 0 6,486 300

RYE

0 0 0 0 0

SORGHUM

11,332 2,754 201,482 418,224 1,930,821

SOYBEANS

1,438,183 1,475,344 985,821 30,076,241 31,780,111

SUNFLOWER

0 0 0 2,160 432

WHEAT

201,673 85,672 234,356 12,094,151 12,434,776

Total

2,048,773 2,246,812 2,445,315 52,597,191 60,246,817

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

103

Counterparties Take $2.199 Tln At Fed Reverse Repo Op (prev $2.208 Tln, 100 Bids)

US

Employment Trends Index Dec: 116.31 (prev R 117.14)

President

Biden visiting Mexico – GMO corn issue will likely come up in talks.

Kevin

McCarthy was elected House Speaker

US

CPI will be out Thursday.

Mexican

CPI (M/M) Dec: 0.38% (exp 0.39%; prev 0.58%)

–

CPI Core (M/M) Dec: 0.65% (exp 0.65%; prev 0.45%)

–

CPI (Y/Y) Dec: 7.82% (exp 7.84%; prev 7.80%)

–

CPI Core (Y/Y) Dec: 8.35% (exp 8.35%; prev 8.51%)

China

To Cut Value-Added Tax Among Small Businesses Until December

Canadian

Building Permits (M/M) Nov: 14.1% (R prev -5.3%). The total value of building permits in Canada jumped 14.1% in November to $11.0 billion, rebounding after two consecutive monthly losses. On a constant dollar basis (2012=100), the total value of building

permits went up 12.3% to $6.5 billion.

·

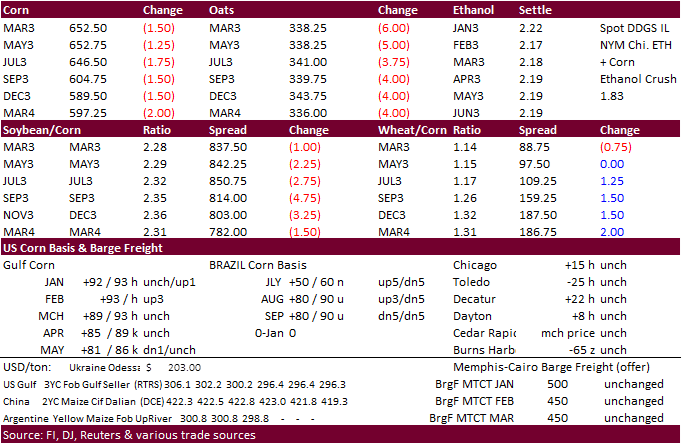

CBOT corn futures

were

mixed early this morning, ending lower on weakness in soybeans and wheat. Lower soybean meal also weighed on prices. US energy market were higher. WTI crude oil was up around $0.90 per barrel as of 2:05 pm CT and February natural gas higher, but well off

session lows. Some traders noted the corn spread between Brazil and US is narrowing, giving some optimism US exports could soon increase.

·

Matif corn trade near a 3-month low.

·

Fund rebalance started today.

·

USDA US corn export inspections as of January 05, 2023 were 397,585 tons, within a range of trade expectations, below 683,042 tons previous week and compares to 1,023,656 tons year ago. Major countries included Mexico for 242,437

tons, China for 138,715 tons, and Taiwan for 7,075 tons.

·

A Brazilian corn cargo (68,000 tons) arrived in southern China over the weekend, first bulk shipment. Many more cargoes will soon arrive after Brazil’s AgMin reported late last week that 1.2 million tons of corn was shipped from

Brazil to China.

·

Look for positioning to pick up ahead of the USDA reports due out January 12.

·

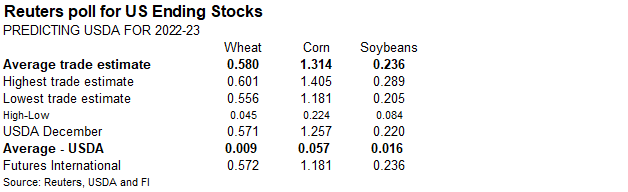

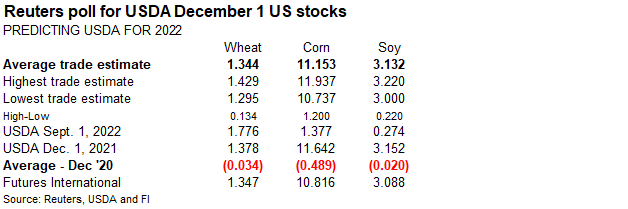

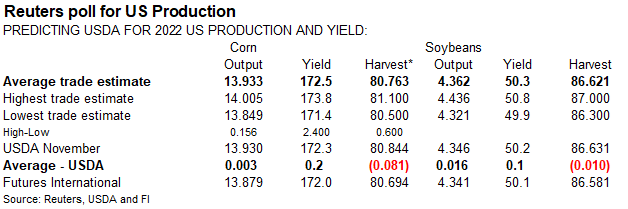

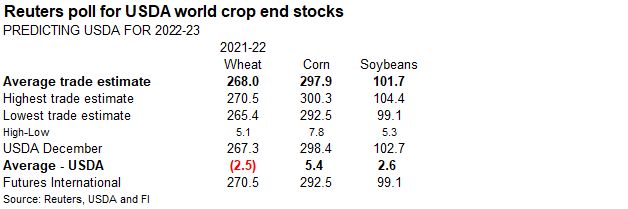

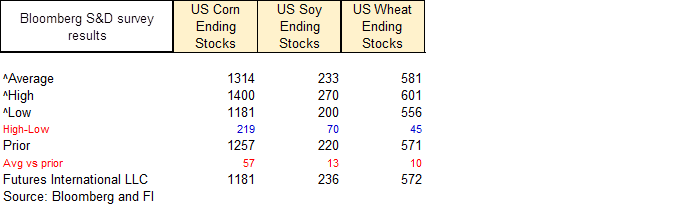

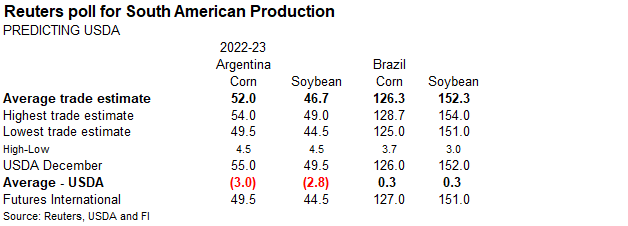

Many traders are looking for USDA to lower corn exports on Thursday. We agree but look for a small decline as we are thinking Argentina corn production could be lowered up to 5.5 million tons. A Reuters trade guess calls for a

3 million ton reduction.

·

A 65,000 ton corn cargo ran aground in the Sez Cannel earlier today. The Ukraine corn was bound for China.

·

Ukraine Black Sea corn exports fell 35% last for the week ending January 8 to 610,996 tons, including 250,000 tons of corn to China. 939,948 tons were export previous week.

U

of I: Cattle Finishing Net Returns Prospects for 2023

Langemeier,

M. “Cattle Finishing Net Returns Prospects for 2023.” farmdoc

daily

(13):3, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 6, 2023.

https://farmdocdaily.illinois.edu/2023/01/cattle-finishing-net-returns-prospects-for-2023.html

Export

developments.

·

Taiwan’s MFIG seeks 65,000 tons of corn from the US, Brazil, Argentina, or South Africa, on Wednesday, January 11, for March 20 and April 8 shipment. If sourced from the US PNW or South Africa, shipment is sought between April

4 and April 23.

Updated

01/03/23

March

corn $6.35-$7.10 range. May

$6.25-$7.25

·

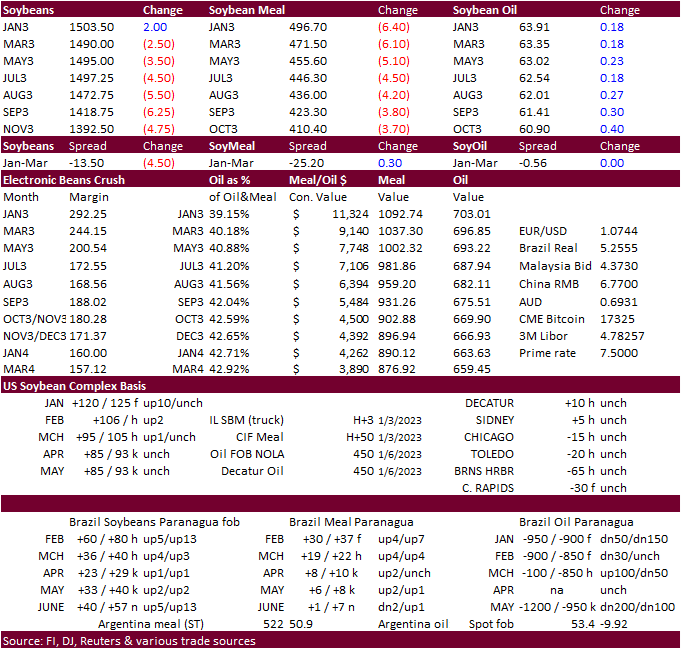

CBOT soybeans and meal were lower while soybean oil finished higher in part to strength in US energy prices. The March soybean meal contract on Friday closed at its highest level since March. CFTC Commitment of Traders showed

a record net long position by money managers for soybean meal. US interior and Gulf soybean meal basis was sharply higher last week.

·

Today soybean meal basis in Frankfort, Indiana, increased $20/short ton to 30 over the March. Mankato, MN, as up $6 to 24 under and KC, Missouri, declined $6 to 9 over.

·

USDA US soybean export inspections as of January 05, 2023 were 1,438,183 tons, within a range of trade expectations, below 1,475,344 tons previous week and compares to 985,821 tons year ago. Major countries included China for

1,113,932 tons, Italy for 71,862 tons, and Mexico for 66,112 tons.

·

Some of the fundamentals behind soybeans remain unchanged. Overnight newswires noted dry weather across Argentina & southern Brazil, and China demand prospects increasing after travel opened. Tens of thousands of travelers began

to fly in and out of China on Sunday.

·

US crush margins remain very high and promote product production.

·

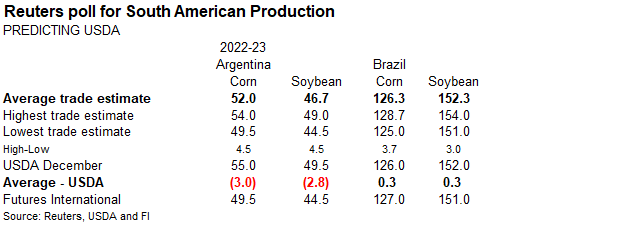

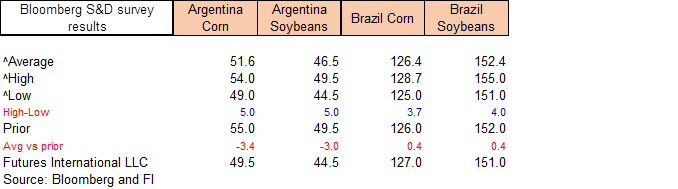

Three million hectares (7.4 million acres) of Argentina’s growing areas were last rated in poor condition. Traders expect a 2.8 million ton decrease in Argentina soybean production and 3.0 million ton lower corn output by USDA

on January 12, or down 5.6% and 5.5%, respectively. Despite worsening crop conditions in southern Brazil, traders are looking for a modest increase in soybean and corn production for that country.

·

Brazil’s soybean harvest progress is off to a slow start, according to AgRural. Only 0.4 percent of the soybean crop had been collected as of late last week, compared to 0.2 percent previous year. 2.3 percent of the center-south

crop had been collected, below 3.1% this time year ago.

·

Brazil 2022-23 producer sales reached 28.5 percent of the expected 153.3 million ton estimate, Safras reported, or 43.6 million tons. This is down from 36.5 percent for the same period year ago. The sales are slow in part to

uncertainty over the Brazil government elections, volatile cash prices and inflation concerns. Producers tend to hold onto their crops as a hedge. Old crop soybean sales were 96% near its average of 97%.

·

EU rapeseed prices were lowered earlier by 3.75 euros to 574.00 for the nearby position.

·

Indonesia and Malaysia agreed to work together to promote palm oil consumption, including use for biofuel. Palm oil production has been targeted by several countries over several issues, including deforestation. Indonesia is set

to increase use of palm oil to B35 starting February 1.

·

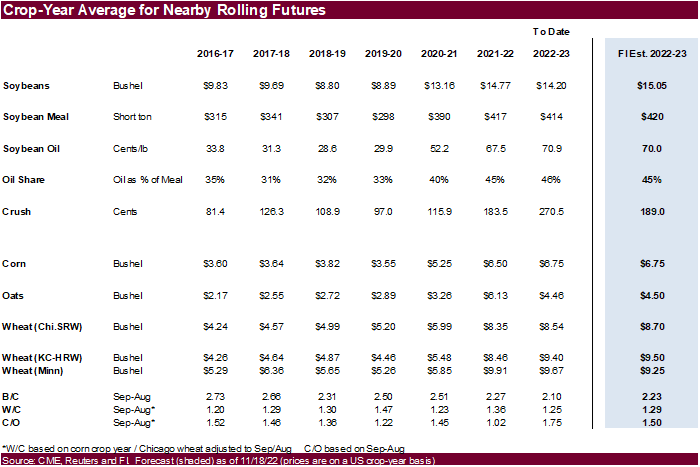

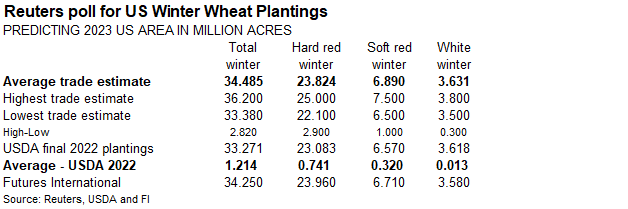

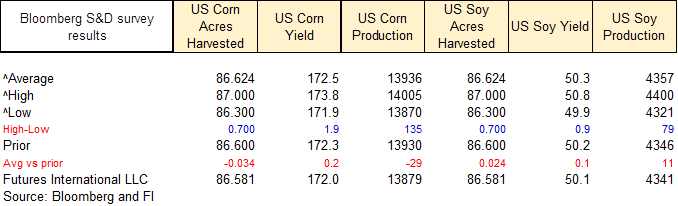

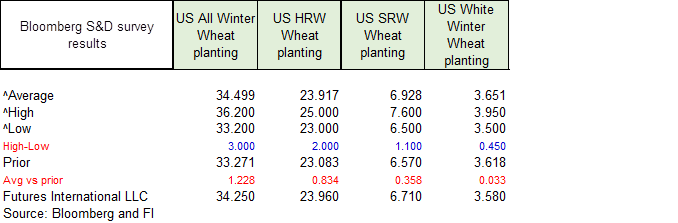

The nearby soybean/corn ratio is starting to tick higher. We look for the US 2023 soybean planted area to increase to 89.100 million acres from 87.455 million for 2022 (March 2022 was 90.550) and 97.195 million for 2021. US 2023

corn acres are estimated at 91.300 million, up from 88.608 million for 2022 and compares to 93.252 million for 2021.

·

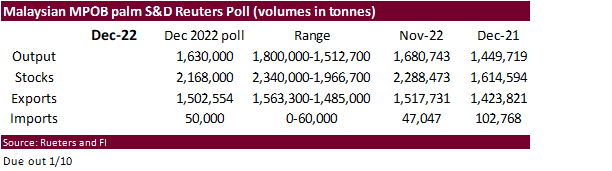

MPOB S&D data will be out later tonight. In our opinion, we think the S&D will be supportive for palm oil futures as stocks are estimated to be lowest since August. Palm oil futures sold off during their “third” session (CBOT

morning day session hours).

·

Turkey seeks about 24,000 tons of sunflower oil on January 13 for February 15 to March 20 delivery.

Malaysian

palm oil inventories

at the end of December are seen at their lowest level since August.

Updated

01/07/23

Soybeans

– March $14.60-$15.50

Soybean

meal – March $465-$525

Soybean

oil – March

59.00-70.00

·

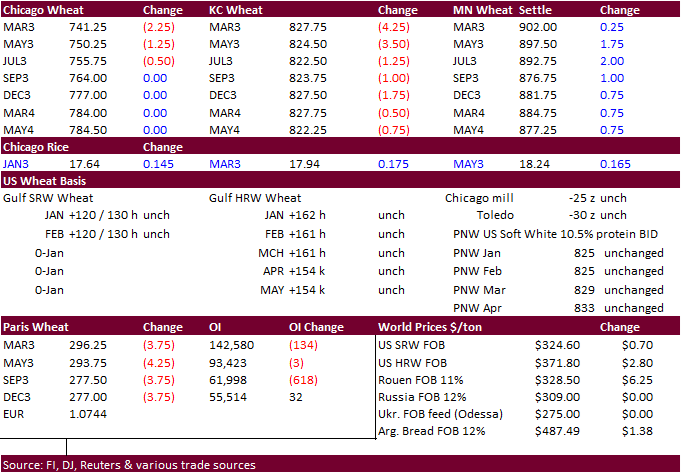

Chicago and KC wheat futures ended lower and MN higher. March Chicago wheat saw its largest weekly loss since August, last week. Egypt, Turkey and Taiwan are in for wheat. The USD declined a large 83 points by 2:05 pm CT and this

may have limited losses.

·

USDA US all-wheat export inspections as of January 05, 2023 were 201,673 tons, within a range of trade expectations, above 85,672 tons previous week and compares to 234,356 tons year ago. Major countries included China for 66,000

tons, Mexico for 26,187 tons, and Japan for 26,152 tons.

·

Paris March wheat was 3.75 euros lower at 296.50 euros a ton.

·

Pakistan reported a surge in inflation. Over a one-week period, it was up 1.09 percent, led by a rise in meat (chicken), rice and flour prices. We may see Pakistan floating an import tender for wheat soon. Food inflation over

a month period was up 32-38 percent across cities and the countryside.

·

China will auction off 140,000 tons of wheat from reserves on January 11. The sale includes 100,000 tons bought in 2015, 2016 and 2017 under its minimum purchase price policy, and another 40,000 tons of 2014 and 2015 wheat from

its temporary reserve. (Reuters)

·

Turkey seeks 565,000 tons of milling, including red, wheat on January 12 for February through March shipment.

·

Taiwan is in for 45,200 tons of US wheat on January 13 for March shipment. Wheat types sought include dark northern spring, hard red winter and white wheat.

Rice/Other

·

Vietnam’s rice exports in December fell 26.1% from the previous month to 434,611 tons. Rice shipments from Vietnam in 2022 rose 13.8% year on year.

·

Vietnam’s coffee exports in December were up 53.5% from the month before at 197,077 tons. For 2022, Vietnam exported 1.78 million tons of coffee, up 13.8% from a year earlier.

·

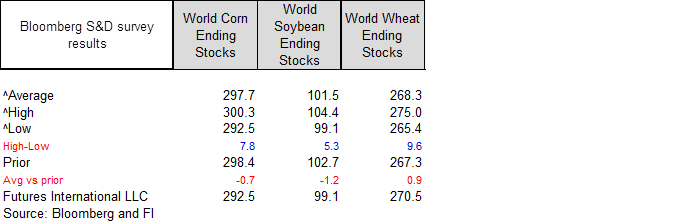

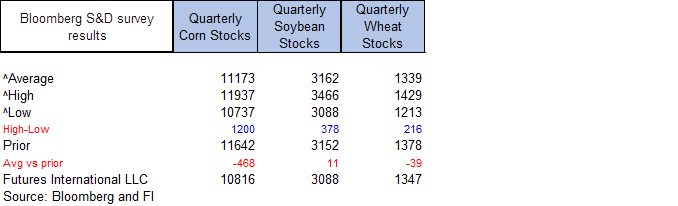

(Bloomberg) — US 2022-23 production seen slightly lower than USDA’s previous estimate, according to the avg in a Bloomberg survey of eight analysts.

-Production

seen down 96,000 bales, while exports seen down 131,000 bales

-Ending

stocks seen mostly unchanged at 3.5m bales

-World

production seen down by 151,000 bales

Updated

01/04/23

Chicago

– March $7.00 to $8.25

KC

– March 8.00-$9.40

MN

– March $8.50 to $9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.