PDF Attached

Lower

trade in soybeans and corn on improving South American weather and widespread market selling. Chicago and KC wheat ended higher in part to short covering. Look for positioning ahead of the USDA reports due out on Wednesday.

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

- Argentina

was dry Friday through Sunday afternoon and temperatures were slightly warmer than usual - Highest

temperatures were in the upper 80s and lower 90s in the south and in the 90s to 106 in the north…..Sunday was hottest - Argentina

will be progressively heating up through Saturday with very little rainfall

- Highest

temperatures in the middle 90s to 113 degrees are expected with a few hotter readings late this week - Argentina

will experience some showers late Saturday into next Sunday and they will increase through mid-week next week - Rainfall

will be great enough to reduce temperatures back to a more seasonably warm range - Rain

amounts will vary from 0.50 to 1.50 inches with a few totals of 2.00 to 4.00 inches - Greatest

rainfall in the north - Some

weak ridge building will occur during mid- to late week next week in the north forcing rainfall to southern parts of the nation late in the week and during the following weekend - Rainfall

in the south will vary from 0.30 to 1.00 inch with a few 1.00 to 2.00-inch amounts

- Showers

and thunderstorms will shift northward in the second weekend of the two-week outlook with seasonable temperatures returning - Argentina’s

bottom line is quite stressful for crops and livestock this week through Saturday due to hot temperatures, no rain and no soil moisture with deteriorating grazing and crop conditions. Some relief is expected next week and into the following weekend due to

periodic showers and thunderstorms and less oppressive heat. Follow up rain will be very important. Some of the early planted corn and sunseed have already lost yield potential and there is some concern that recently planted crops may have withered and died

or about to do the same. Crops from southeastern San Luis and southern Cordoba through northeastern La Pampa to central Buenos Aires have suffered the least damage, but are being stressed more significantly this week making next week’s rainfall extremely important.

- Brazil

rainfall during the weekend continued frequent and significant from eastern Mato Grosso and Tocantins to Minas Gerais and parts of western Bahia, including portions of Goias

- Rainfall

varied from 1.25 to more than 4.00 inches - A

few locations in east-central Minas Gerais received 4.00 to 6.22 inches of rain resulting in some flooding - Rain

also fell in southern and central Mato Grosso do Sul, western Parana and portions of southern Paraguay with amounts of 0.30 to 1.50 inches and local totals to 2.28 inches

- Temperatures

were cooler than usual in the heavier rainfall areas and near normal in most other areas - Brazil

rainfall will be decreasing this week and limited, although not absent, this weekend and next week - Rainfall

for the week will vary from nothing in parts of Rio Grande do Sul, western Santa Catarina and Paraguay to between 2.00 and 5.00 inches from northeastern Sao Paulo and southern Minas Gerais into eastern Mato Grosso and parts of Tocantins - The

first half of this week will be wettest - Rainfall

in Parana and Mato Grosso do Sul will vary from 0.30 to 1.50 inches - Eastern

Bahia and parts of northern Espirito Santo will also experience less than 1.00 inch of moisture - Temperatures

will continue near to below normal early this week and more seasonable late this week and in the weekend - Brazil

weather will include more sporadic rainfall during the weekend and next week, but daily showers and thunderstorms will impact 30-50% of the nation each day - Rainfall

will vary from 0.20 to 0.75 inch with a few amounts to 1.50 inches each day - Temperatures

will gradually become near to slightly warmer than usual as the precipitation becomes lighter and more sporadic

- Brazil’s

bottom line is one of improvement for the nation’s crops, but especially those that have been too wet recently. Less frequent and less significant rain in early maturing corn and soybean production areas will be ideal in promoting better drying conditions

late this week into next week. Harvest progress is expected to become more aggressive during this period of time which should lead to some aggressive Safrinha crop planting as well. Recent rain in the interior south has brought on improved crop development

conditions after being too dry early this growing season. Rio Grande do Sul is the only exception where the state is expected to experience a steadily decreasing soil moisture profile and rising crop stress. The same is true for Paraguay. Rio Grande do Sul

may get some rain and a break from drying in the middle to latter part of next week.

- New

South Wales, Australia will receive periodic showers and thunderstorms this week supporting cotton, sorghum and other summer crops - Rainfall

of 0.25 to 1.00 and a few 1.00 to 3.00-inch amounts are expected - Queensland,

Australia is unlikely to get much “meaningful” moisture this week, although a few showers will evolve - Greater

rain is needed for dryland production areas - Queensland

may continue to experience erratic rainfall as will New South Wales during the weekend and next week - Eastern

Australia could experience a boost in precipitation during the latter part of next week and if that evolves it would be a boon to the nation’s unirrigated summer crops and would bolster soil moisture and water supply for future irrigation - Australia

temperatures will be warmer than usual in western Queensland, western New South Wales and neighboring areas where rainfall may not be as great as needed to protect livestock grazing areas from further deterioration. - Rain

is needed on these areas - Australia’s

bottom line is one of needed rain in Queensland’s unirrigated grain, oilseed and cotton areas as well as all of eastern Australia’s livestock country, but especially in the west. No serious changes to dryness in western parts of Queensland or New South Wales

during the next ten days. - South

Africa rainfall was erratic during the weekend as it will be through the next two weeks, but all areas will be impacted at one time or another and sufficient rain will occur to support crop needs - Yield

potentials remain high and “some” of the worry over wet weather diseases has been reduced with less rainfall recently - India

rainfall was widespread during the weekend from northern Madhya Pradesh through Rajasthan and northern and central Uttar Pradesh to northern Pakistan and northern Uttarakhand - Some

rainfall varied from 1.00 to 3.00 inches from Haryana and northwestern Uttar Pradesh to Jammu and Kashmir and far northern Pakistan - Rainfall

in northern India and Pakistan since January 1 has been widespread and significant enough to help improve production potentials for 2022 - Follow

up rain will be needed in February while crops are reproducing and beginning to fill, but the crop is poised to perform very well - India

weather this week will support more rain in east-central and southeastern parts of the nation expanding the area benefiting from significant moisture - The

precipitation will be greatest from southeastern Madhya Pradesh through Chhattisgarh into Odisha and northeastern Andhra Pradesh where rainfall will range from 0.75 inch to 2.00 inches with local totals over 3.00 inches

- Net

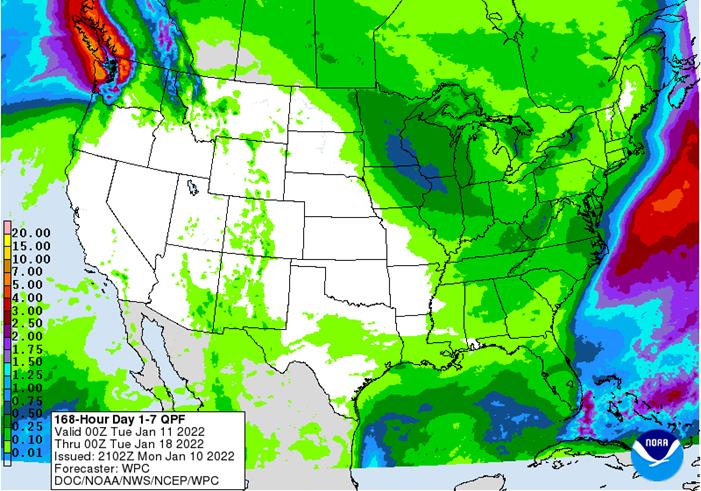

drying is expected elsewhere, but especially in the western half of the nation - U.S.

weekend weather included widespread precipitation from the western and northern Delta through the lower eastern Midwest - Moisture

totals varied from 0.50 to over 2.00 inches with the northern Delta to Kentucky wettest

- Flooding

continues in areas from northeastern Arkansas into southwestern Indiana and portions of Kentucky and these areas and many in neighboring parts of the Tennessee River Basin and the middle Ohio River Basin need to dry down - Rain

and mountain snow fell in the Pacific Northwest, but the central valleys of Washington, Oregon and Idaho failed to receive much moisture - Dry

weather occurred in most other areas - Temperatures

were quite cold early in the weekend with low temperatures in the single digits and teens across the lower Midwest and central Plains while in the negative teens and negative single digits in the northern Plains and upper Midwest - Warming

did occur in the second half of the weekend - Canada’s

Prairies turned a little warmer during the weekend with additional snow falling in many areas - Canada’s

southwestern Prairies are still drier than usual with moisture totals less than 0.25 inch over the next two weeks

- Snow

cover is still limited in east-central and southern Alberta and central, west-central and southwestern parts of Canada’s Prairies - This

is the most seriously drought stricken part of the Prairies and not much relief is likely prior to spring - Europe

weather during the weekend was wettest in France and a part of the United Kingdom and western Germany while scattered showers of light intensity occurred in southeastern parts of the continent - Rainfall

ranged from 1.00 to 2.25 inches in southwestern France while varying up to 0.80 inch elsewhere in France - Precipitation

in the forms of rain and snow fell in Germany, the U.K. and from the Italian Peninsula through the Balkan Countries to Ukraine and southern Belarus where moisture totals varied up to 0.60 inch - Most

other areas were dry biased - Temperatures

were mild to cool, but non-threatening to dormant winter crops - Europe

precipitation during the next two weeks will be restricted especially in the western half to two-thirds of the continent

- Spain

is the only nation that would benefit greatly from more significant precipitation, but little to none is expected for a while - Soil

moisture is expected to be favorable across the continent during the next two weeks, despite limited precipitation - There

will be no threatening cold weather - Western

Russia, Belarus, Ukraine and Baltic States will get light and sporadic precipitation during the coming week with a boost in snow and a little rain next week - There

will be no threatening cold temperatures, but cooling is expected next week and the snow will be sufficient protection for the coldest areas to protect wheat - North

Africa precipitation was limited to Tunisia and northeastern Algeria during the weekend - Rainfall

was heavy near the northeastern Algeria and northwestern Tunisia border where 1.00 to 4.50 inches resulted - Lighter

rain surrounded this region with amounts to 0.60 inch - Most

other areas in North Africa were dry and will continue dry during much of the next ten days - Southwestern

Morocco continues to be in a notable multi-year drought while dryness is also a concern in northwestern Algeria - Crops

elsewhere are doing relatively well - China’s

weather will continue mostly uneventful for a while, although periods of rain and a little snow will impact the Yangtze River Basin and areas southward during the next couple of weeks.

- The

moisture will preserve the integrity of the 2022 rapeseed and southern wheat crops - Snow

will fall periodically in the far northeast while the Yellow River Basin and southern coastal provinces receive little to no precipitation - The

southern coastal provinces will eventually become too dry and this may lead to some concern about early rice planting in March, but there is plenty of time for change - Temperatures

will be near to slightly warmer than usual - Southeast

Asia oil palm, citrus, sugarcane, coffee, cocoa, rice and other crop areas of Indonesia, Malaysia and Philippines will receive frequent bouts of rain over the next two weeks - Some

heavy rain is possible, but no serious widespread flood problem is expected - Local

flooding will be possible, though - Mainland

areas of Southeast Asia will be mostly dry during the next ten days except Vietnam coastal areas where some moderate rain will be possible late this week and into the weekend - Northernmost

Laos and northern Vietnam coffee, rice and other crop areas will get some rain late this week and especially Saturday through Monday, Jan. 17. - West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual - East-central

Africa will be erratic, but it is expected daily through the next ten days supporting coffee, cocoa, rice sugarcane and other crops - Middle

East precipitation is increasing with improved soil moisture likely over the next ten days - Some

beneficial moisture has already occurred in Pakistan, Afghanistan, Iraq and Iran - Winter

crops will benefit from whatever rain falls, but it is not expected to be evenly distributed for a while - Mexico

weather will trend wetter along the east coast for a little while this week

- Most

other areas will be dry for the next ten days - Rain

was removed from the forecast in northern Mexico overnight - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica during the next ten days - A

few showers will occur in Guatemala periodically as well, although rainfall will be light - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Interior

Colombia and many areas in Venezuela have received less than usual precipitation in the past 30 days, but the greatest dryness may be outside of key crop areas - Today’s

Southern Oscillation Index was +7.04 and it was expected to continue falling for a while this week. The index peaked at +13.07 December 31.

New

Zealand rainfall is expected to continue getting less than usual precipitation this week with temperatures near to above normal.

Source:

World Weather, inc.

Monday,

Jan. 10:

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysian

Palm Oil Board’s data for December output, exports and stockpiles - Malaysia’s

Jan. 1-10 palm oil exports - Ivory

Coast cocoa arrivals - HOLIDAY:

Japan

Tuesday,

Jan. 11:

- EU

weekly grain, oilseed import and export data - Brazil’s

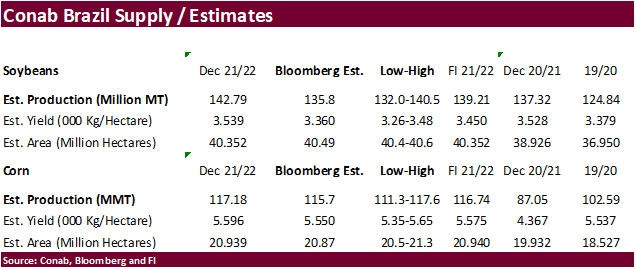

Conab releases data on area, yield and output of corn and soybeans

Wednesday,

Jan. 12:

- China

farm ministry’s CASDE outlook report - USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - USDA’s

NASS 2021 summary of crop acreages and yields, noon - USDA’s

quarterly stockpiles data for commodities, including wheat, barley, corn, soybeans and sorghum, noon - EIA

weekly U.S. ethanol inventories, production - USDA’s

Farm Service Agency issues 2021 crop size data gathered from producers, 1pm - New

Zealand Commodity Price

Thursday,

Jan. 13:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Suedzucker

quarterly earnings - Agrana

nine- month earnings - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

Jan. 14:

- China’s

December trade data - ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source:

Bloomberg and FI

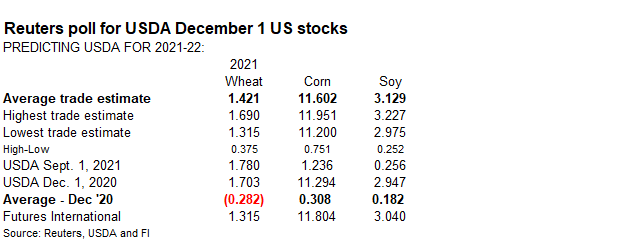

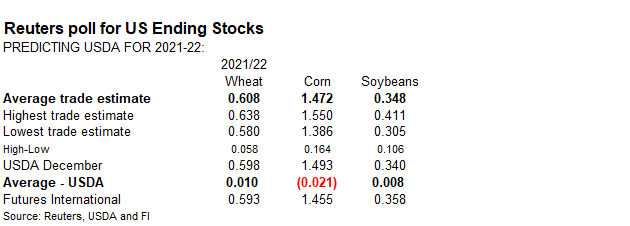

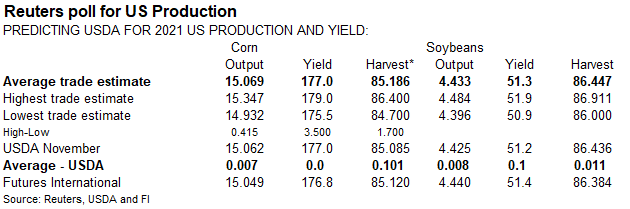

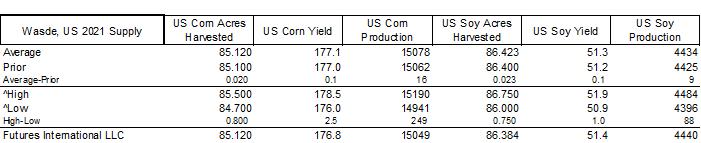

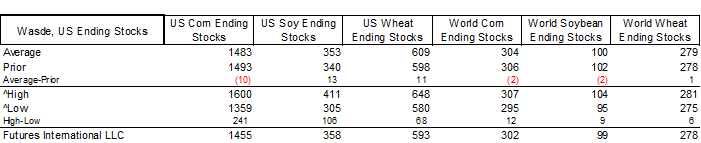

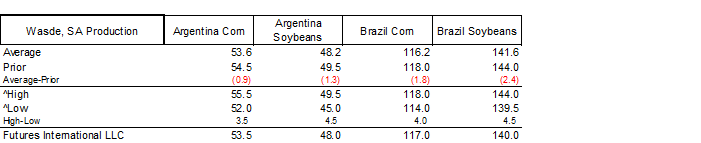

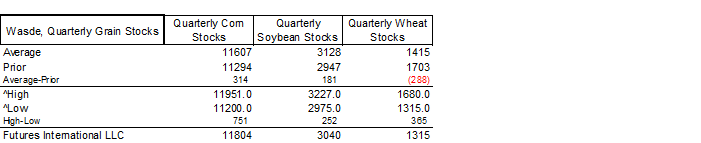

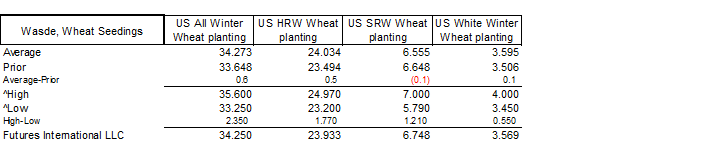

Bloomberg

trade estimates for the January USDA crop/stocks reports.

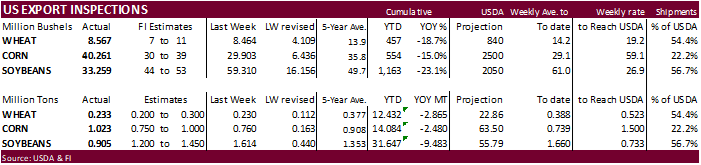

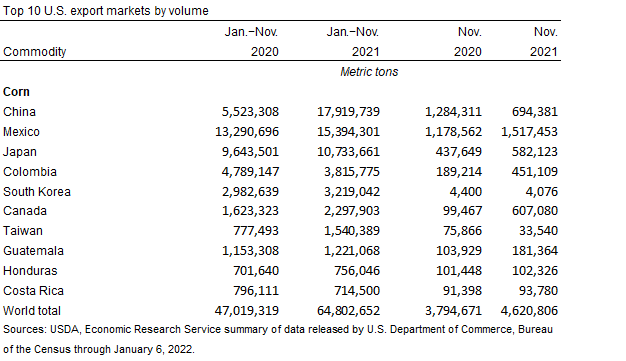

USDA

inspections versus Reuters trade range

Wheat

233,159 versus 175000-400000 range

Corn

1,022,677 versus 600000-1250000 range

Soybeans

905,149 versus 950000-1500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JAN 06, 2022

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 01/06/2022 12/30/2021 01/07/2021 TO DATE TO DATE

BARLEY

0 0 0 10,010 20,944

CORN

1,022,677 759,563 1,345,367 14,084,268 16,564,135

FLAXSEED

0 0 0 224 461

MIXED

0 0 0 0 0

OATS

0 0 0 300 2,593

RYE

0 0 0 0 0

SORGHUM

201,482 1,951 133,461 1,930,821 2,481,721

SOYBEANS

905,149 1,614,158 1,909,217 31,646,567 41,129,711

SUNFLOWER

0 0 0 432 0

WHEAT

233,159 230,361 281,356 12,431,651 15,296,793

Total

2,362,467 2,606,033 3,669,401 60,104,273 75,496,358

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

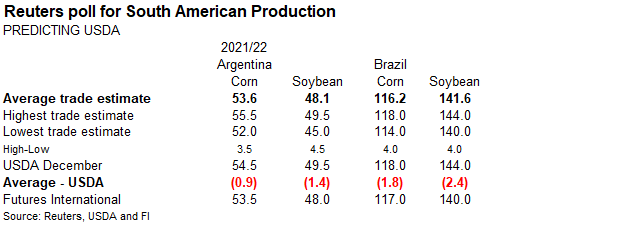

Soybean

and Corn Advisory

2021/22

Brazil Soybean Estimate Lowered 3.0 mt to 135.0 Million

2021/22

Argentina Soybean Estimate Lowered 2.0 mt to 43.0 Million

2021/22

Paraguay Soybean Estimate Unchanged, Could Move Lower

2021/22

Brazil Corn Estimate Lowered 1.0 mt to 112.0 Million

2021/22

Argentina Corn Estimate Lowered 1.0 mt to 51.0 Million

Macros

76

Counterparties Take $1.560 Tln At Fed Reverse Repo Op. (prev $1.530 Tln, 75 Bids)

US

Wholesale Inventories (M/M) Nov F: 1.4% (est 1.2%; prev 1.2%)

US

Wholesale Trade Sales (M/M) Nov: 1.3% (prev R 2.5%) ***

New

Covid variant called ‘Deltacron’ detected in Cyprus; 25 cases so far

·

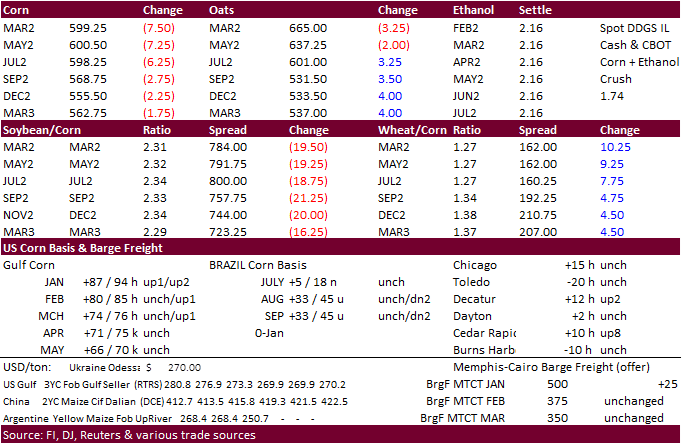

CBOT corn traded and ended lower from weakness in soybeans but a reversal in wheat limited losses. Improving South American weather was the driver to the downside, with bear spreading a feature. Rain will develop across southern

Brazil and Argentina later this week into next week. Over the weekend it was hot and dry.

·

WTI crude oil and equities were lower by the time CBOT ags closed but some stocks minimized losses by the end of the day.

·

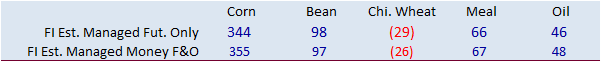

Funds sold an estimated net 11,000 corn contracts.

·

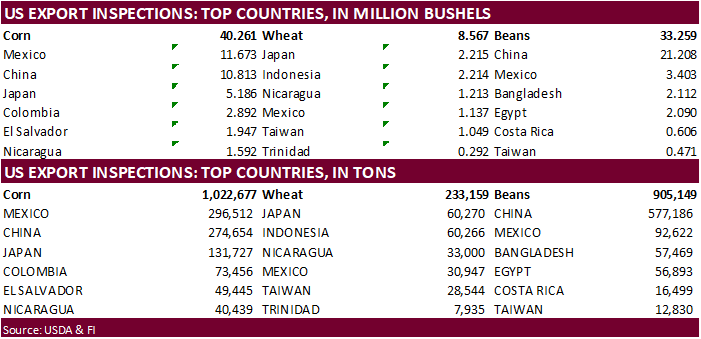

USDA US corn export inspections as of January 06, 2022 were 1,022,677 tons, within a range of trade expectations, above 759,563 tons previous week and compares to 1,345,367 tons year ago. Major countries included Mexico for 296,512

tons, China for 274,654 tons, and Japan for 131,727 tons.

Export

developments.

·

The Korea Feed Association (KFA) bought around 130,000 tons of optional origin corn in two consignments each of about 65,000 tons, both at an estimated $334.17 a ton c&f. The first consignment was sought for arrival around March

30 and second consignment was sought for arrival around April 20.

·

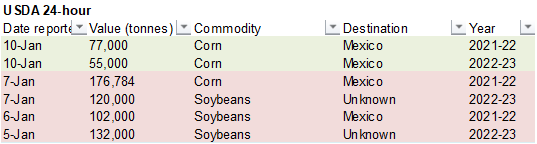

Under the 24-hur announcement system, private exporters sold 132,000 tons of corn to Mexico, 77,000 for the current crop year and 55,000 tons new-crop.

Solar

power will account for nearly half of new U.S. electric generating capacity in 2022

https://www.eia.gov/todayinenergy/detail.php?id=50818&src=email

Updated

1/10/22

March

corn is seen in a $5.70 to $6.20 range (up 10 cents, unchanged back end)

·

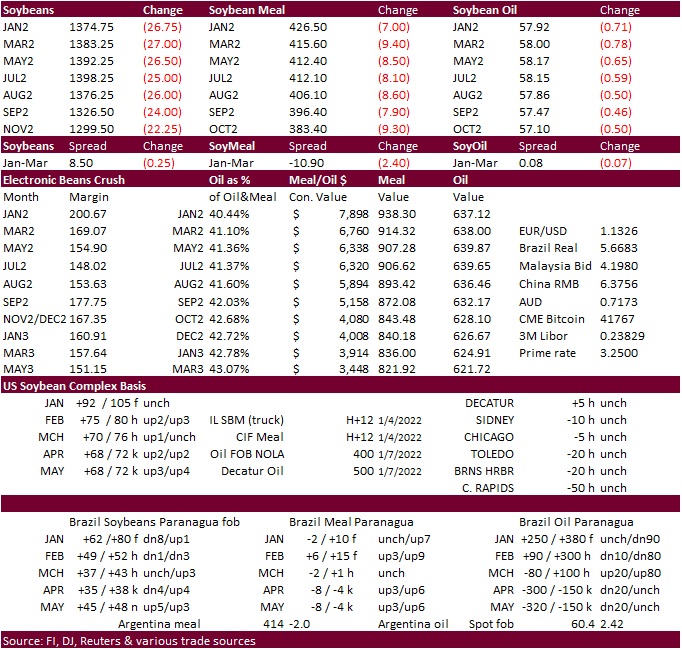

CBOT soybeans ended lower on improving South American weather, poor USDA export inspections, and technical selling. Note March soybeans rallied and closed above $14/bu on Friday. March settled $13.8475, down 25.50 cents. USD was

23 points higher mid-afternoon. Funds are still holding a large net long position and long liquidation may continue on Tuesday as traders position ahead of the USDA reports due out Wednesday.

·

Funds sold an estimated net 14,000 soybeans, 5,000 soybean meal and 4,000 soybean oil.

·

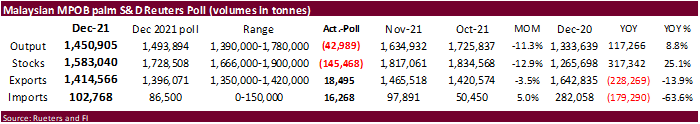

Soybean oil traded two-sided in part to bullish Malaysian palm oil stocks data but was lower for the majority of the day session on weakness in WTI crude oil and lower soybeans. Soybean meal struggled to trade higher but ended

the day sharply lower. US soybean meal basis increased $5/short ton to 45 over the March for Claypool, IN and rose $5/short ton to 10 under for Mankato, MN.

·

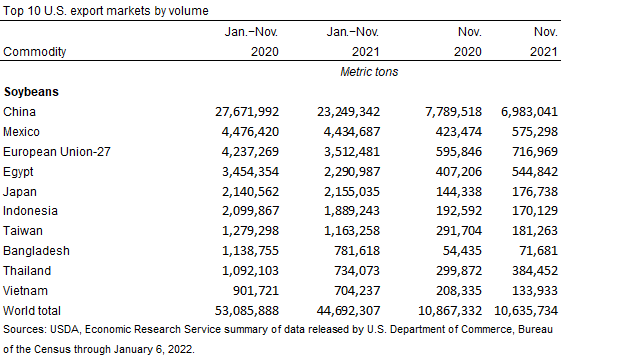

USDA US soybean export inspections as of January 06, 2022 were 905,149 tons, below a range of trade expectations, below 1,614,158 tons previous week and compares to 1,909,217 tons year ago. Major countries included China for 577,186

tons, Mexico for 92,622 tons, and Bangladesh for 57,469 tons.

·

Brazil started harvesting in Parana and Mato Grosso. Yields in Parana are coming in at very low levels.

·

Russia’s export duty on sunflower oil exports from February 1 will be $251.4 per ton, compared to $280.8 per ton in January 2022. The duty was calculated on the basis of the indicative price of $1,359.2 per ton.

·

Heavy rains and thunderstorms fell today over parts of Indonesia’s Sumatra and Kalimantan.

·

Cargo surveyor AmSpec reported Malaysian Jan 1-10 palm exports at 318,928 million tons, 41.4% below the same period a month ago of 544,059. Cargo surveyor ITS reported Malaysian palm exports at 334,750 tons, 41.5 percent below

572,689 tons from the same period a month ago.

·

Malaysian palm futures traded higher by 36 ringgit to 5,029. Overnight the contract hit an absolute record high of 5,123.

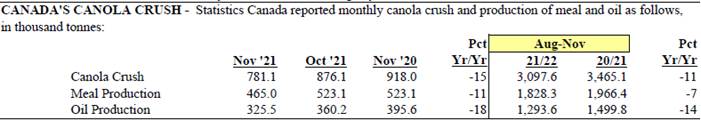

August

– November Canadian canola oil production

is running 14 percent below the same period year earlier.

Source:

TNS, StatsCan, and FI

Export

Developments

·

The USDA bought 12,000 tons of bulk crude degummed soybean oil for export, under the Food for Progress export program, to the Dominican Republic. Price paid was reported at $1,388 per ton, with delivery Feb 5-15. (TNS)

·

The USDA seeks 7,540 tons of vegetable oil in 4 liter cans for Feb 16-Mar 15 shipment on January 19.

Updated

1/10/22

Soybeans

– March $13.00-$14.25

Soybean

meal – March $370-$435

Soybean

oil – March 54.50-61.00

(up 150, unchanged back end)

·

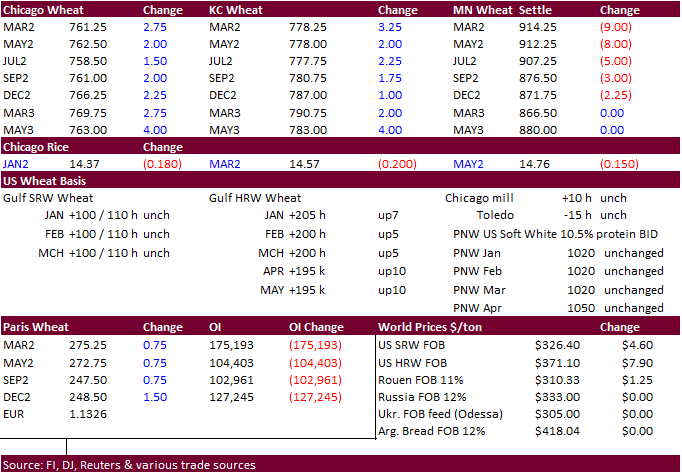

Unlike soybean and corn, funds are net short Chicago wheat and today we saw short covering in Chicago that spilled over into KC type wheat. KC was also supported on weather forecasts calling for dry conditions across the central

and southern Great Plains. MN wheat finished lower on advancing Australian harvesting progress and little issues with the US upper Great Plains and Canadian weather forecasts. Positioning ahead of the USDA reports due out on Wednesday may keep wheat in a two-sided

range over the next day.

·

Funds bought an estimated net 2,000 SRW wheat contracts.

·

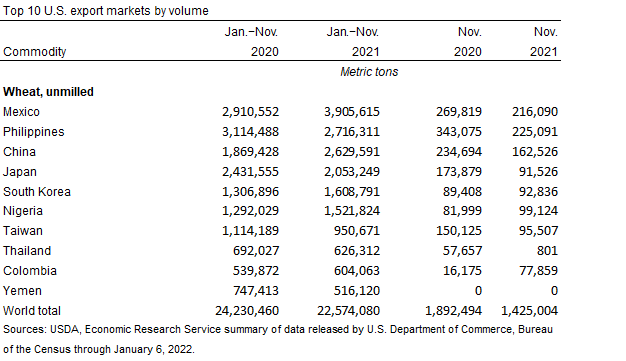

USDA US all-wheat export inspections as of January 06, 2022 were 233,159 tons, within a range of trade expectations, above 230,361 tons previous week and compares to 281,356 tons year ago. Major countries included Japan for 60,270

tons, Indonesia for 60,266 tons, and Nicaragua for 33,000 tons.

·

EU wheat basis the March position was 0.75 higher at 275.50 euros a ton.

·

Euronext will launch durum wheat futures on Tuesday.

·

Ukraine exported 33.5 million tons of grain so far in the 2021-22 July-June season, up 23.2% from the same stage a season earlier. That included 16.1 million tons of wheat, 5.3 million tons of barley and 11.8 million tons of corn.

Ukraine took in a record 84 million tons of grain in clean weight in 2021, up from 65 million tons in 2020.

·

China sold 100% or 506,568 tons of 2014-2020 crop-year wheat on January 5, to local millers at an average price of 2,707 yuan ($424.73) per ton. China sold 891,938 tons of wheat at an auction from state reserves in October.

·

China plans to sell 500,000 tons of wheat from state reserves on January 12 to flour millers.

·

Jordan seeks 120,000 tons of wheat on January 18. Possible shipment combinations are in 2022 between July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

Rice/Other

·

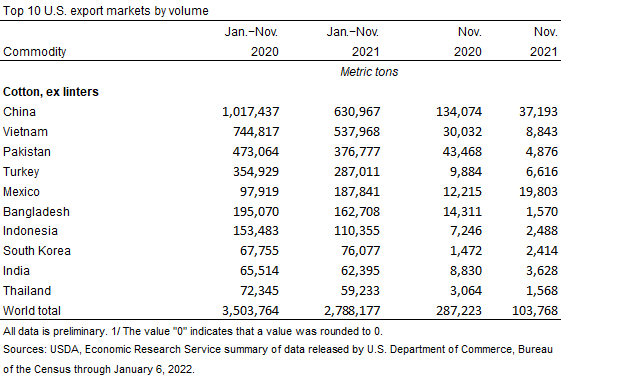

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen as 3.46m bales, slightly above USDA’s previous est., according to the avg in a Bloomberg survey of seven analysts. Estimates range from 3.0m to 3.85m bales. Global ending

stocks seen 125,000 bales lower at 85.61m bales.

·

Bangladesh seeks 50,000 tons of rice on January 16.

Updated

1/10/22

Chicago

March $7.20 to $8.40 range (down 20, down 20)

KC

March $7.55 to $8.75 range (unchanged, down 25)

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.