PDF Attached

Private

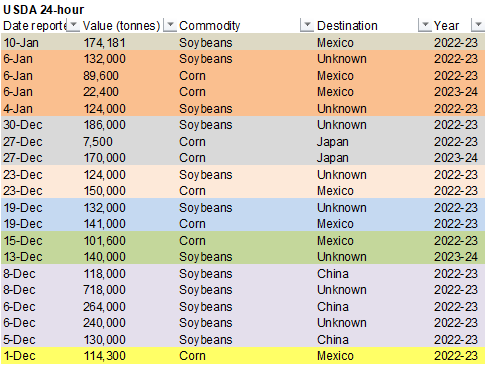

exporters reported sales of 174,181 metric tons of soybeans for delivery to Mexico during the 2022/2023 marketing year.

Mixed

to lower trade in CBOT agriculture markets. Expiring January soybeans and meal ended higher. Rest of the complex was lower. Corn was mixed on bull spreading. US wheat futures sold off from Black Sea competition. March palm oil futures in Malaysian fell more

than 3.5 percent overnight on poor exports for the start of 2023 and lower than expected December exports. MPOB S&D data did show end of December palm oil stocks smallest since August to 2.19 million tons, but December exports fell more than expected, off

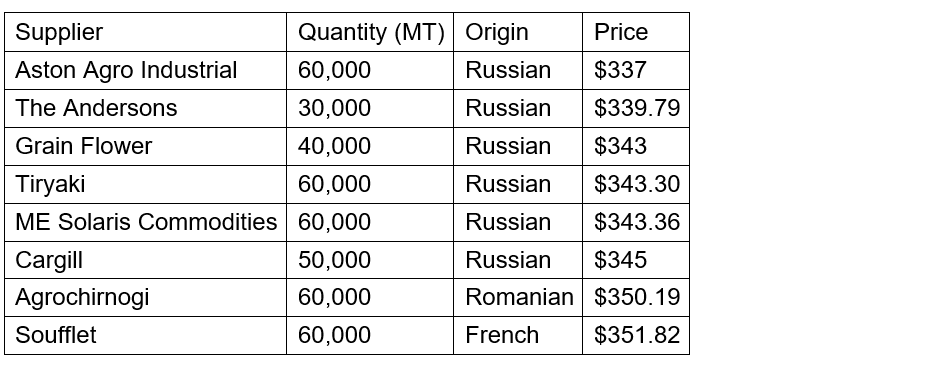

3.5% from November to 1.47 million tons. Egypt booked 60,000 tons of wheat. 120,000 was expected to be finalized.

![]()

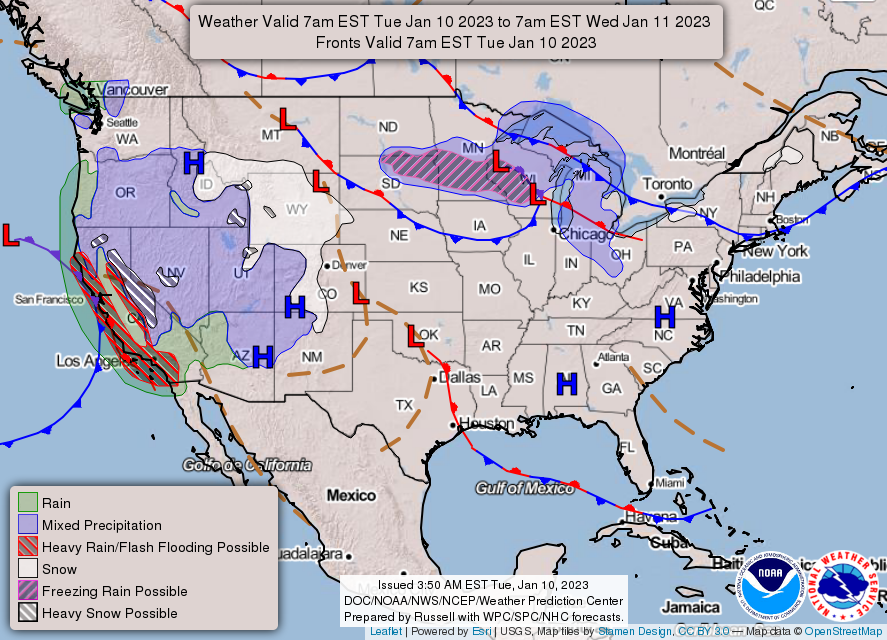

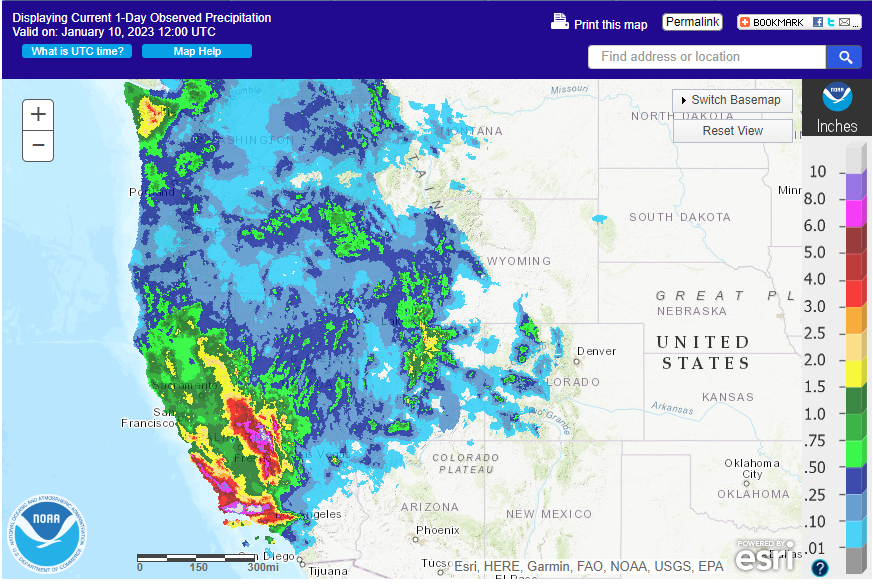

Californians

are facing another round of flooding and power outages today.

https://origin.wpc.ncep.noaa.gov/discussions/hpcdiscussions.php?disc=pmdspd

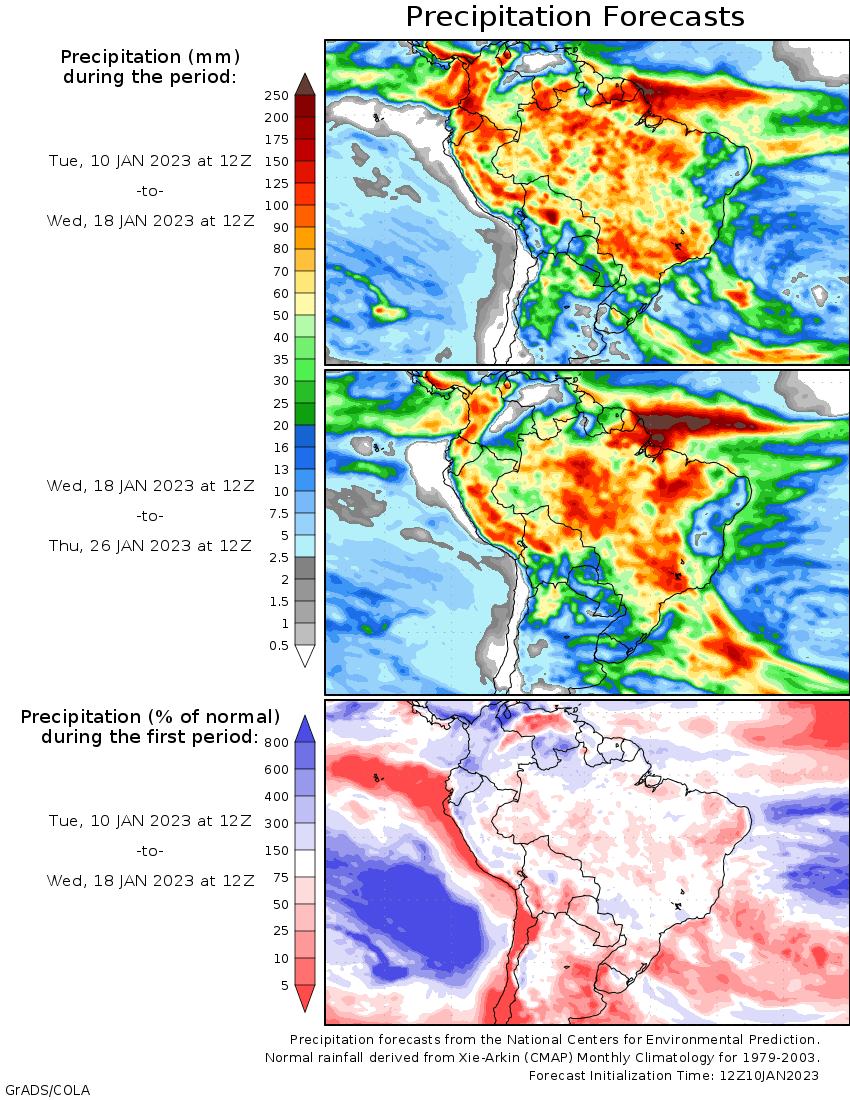

The

morning weather outlook for Argentina was slightly less favorable than that of yesterday while the US Midwest improved. Argentina will see light rain across La Pampa, Cordoba, BA and northern Santa Fe today through Thursday, before drying down Friday. The

far southern areas will see restricted rain while the central areas should improve. Rain will fall across Mato Grosso, Goias, MGDS, Sao Paulo and lesser extent Parana, Santa Catarina, and Rio Grande do Sul. The far western Great Plains will see a wintery mix

mid this week while other areas of the GP will remain dry. Light precipitation will fall across south central and east central of the Midwest Wednesday through Thursday, and southeastern areas later this week. This should be beneficial for winter crops. US

Midwest temperatures will be mild through Thursday. Well above average temperatures will build into the southern Plains. Rain should favor many central and eastern European countries this week.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

North

Africa still has a big need for rain, but the situation is not a crisis yet because of winter crop semi-dormancy across the region -

A

boost in soil moisture will be needed in February and March to stimulate new crop development and to support the best possible yield potentials -

Eastern

Spain and the lower Danube River Basin in Europe are still carrying moisture deficits from last year, but with winter crops dormant today there is not much urgency in fixing the deficits -

Europe

is expecting a stormier weather pattern this weekend and next week in particular with larger precipitation events and bouts of strong wind possible -

Soil

moisture is adequate to abundant across much of the central and north and further increases in moisture are expected -

Russia’s

New Lands experienced another bitter cold morning today with lows in the -40s and -30s with a few -20s in wheat country; however, snow cover was present to ensure adequate wheat protection against the cold -

Warming

is likely in western Russia and Ukraine the remainder of this week with slowly increasing wind and precipitation expected over time -

Eastern

winter crop areas in Russia and Ukraine will not see much precipitation this week, although it will not be completely dry -

Warming

is expected and precipitation will develop more significantly in time from northwestern Ukraine, Belarus and the Baltic States to northwestern Russia -

The

greatest precipitation is expected this weekend and next week -

Argentina

is not expecting drought busting rain for a while, but some welcome rain will fall in the north benefiting cotton and minor grain and oilseed crops late Wednesday and especially Thursday

-

Additional

rain will be needed in the north, but temporary improvements are likely -

Central

and southern Argentina are not likely to get much meaningful rain for at least a week -

Some

increase in shower activity is expected during the second half of next week with 0.20 to 0.75 inch of moisture possible -

Buenos

Aires will be driest -

Most

of Brazil will experience waves of rain during the next week to ten days and the moisture that results will be good for most crops -

There

has been some discussion in the marketplace about too much moisture in a part of center west and center south Brazil

-

Some

of that concern is real, but with less rain intensity and frequency possible next week the concern may be put down for a while -

Early

harvesting has begun for soybeans and the process will slowly ramp up over the next few weeks -

Some

Safrinha planting of corn and cotton has also begun and it will continue for a while during the next few weeks -

A

boost in rainfall for far southern Brazil will be good for some of the drier areas of Rio Grande do Sul, Paraguay and Parana -

China

rain and snow that develop later this week and into the weekend in east-central and southeastern crop areas will prove to be timely and beneficial -

Winter

crops are still dormant, but wheat and rapeseed will benefit from the moisture -

Australia

summer crop areas in southern Queensland and parts of New South Wales would benefit from greater rain -

Dryland

western production areas in Queensland need rain more than any other area today and not much is expected for a while -

Rain

will be increasing in central through northern Queensland crop areas during the next week to ten days benefiting sorghum and minor cotton areas as well as sugarcane -

South

Africa will receive very little rain during the next few days and then some showers will begin late this weekend into early next week in south-central and southeastern parts of the nation

-

The

precipitation may be a little erratic and light for a while raising the need for greater rainfall later this month and into February -

India’s

weather will be wettest in the far north from Uttarakhand northward to Jammu and Kashmir during the next week to ten days -

The

moisture will be good for wheat and other winter crops, but many other areas in India will likely stay dry or mostly dry raising the need for significant rain

-

Southeast

Asia (Indonesia and Malaysia in particular) rainfall has diminished greatly because of the suppressed phase of Madden Julian Oscillation and that will continue for a little while longer

-

Soil

moisture will decrease for a while until rainfall increases again which may not occur until late this month -

Totally

dry weather is unlikely, and the showers expected will help slow drying rates and key crop conditions very good -

California

and some western portions of Washington and Oregon will experience frequent rain and mountain snowfall during the next week -

Substantial

precipitation is still expected in California’s central and north resulting in some rising flood potentials near the coast and in much of the Sacramento Valley -

Heavy

mountain snowfall will raise the snowpack further above normal raising the spring and summer runoff potential -

The

state will need this wet biased pattern to last into spring to make a huge difference in long term drought -

Other

U.S. Great Basin, Pacific Northwest and northern Rocky Mountain areas will also experience above normal precipitation in the coming ten days raising mountain snowpack for better runoff in the spring -

Drought

remains, but should be eased -

U.S.

Midwest precipitation will begin increasing late this week through all of next week

-

Central

and eastern areas will be wettest -

Temperatures

will be above normal through the next two weeks -

U.S.

Delta and Tennessee River Basin will be plenty moist for a while with waves of precipitation expected through the next ten days to two weeks -

Temperatures

will be warmer than usual -

U.S.

hard red winter wheat areas in the central and southwestern Plains are unlikely to see much precipitation over the next ten days to two weeks -

Some

moisture will impact parts of the region, but resulting amounts should be light and sporadic having no impact on drought status -

West

Texas crop areas will not likely see much precipitation over the next ten days to two weeks -

Texas

Blacklands and Coastal Bend will get a few showers in the next two weeks, but no general soaking is expected -

South

Texas precipitation will be quite limited for a while -

Northern

U.S. Plains, Canada’s Prairies precipitation potentials will be low for the next ten days and then there may be some increase later this month -

Some

precipitation is expected briefly during mid-week this week, but resulting amounts will not have much impact on the region overall -

Very

warm temperatures will continue in North America over the next week to ten days -

Some

cooling is expected in late January and February -

Western

Turkey will receive some needed rain and mountain snow the remainder of this week while central and eastern parts of the nation are relatively dry -

Most

of the wheat and other winter crops are rated favorably due to good autumn precipitation, but there is need for greater precipitation in all of the nation -

Middle

East rainfall is expected to be favorably mixed over the next ten days although the resulting precipitation should be mostly light to locally moderate -

Some

rain will return to central and eastern Turkey next week ending a ten day period of dry weather -

Iraq

and Syria will not get much precipitation for a while and the same may occur in Jordan and few neighboring areas

-

East-central

Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

-

Coffee

and cocoa conditions should remain favorable in all production areas, despite the anomalies -

West-central

Africa dryness will continue through the next ten days to two weeks -

Dry

conditions are normal at this time of year -

No

excessive heat is expected in this coming week, although warmer than usual conditions may begin to evolve a week from now and continue into January 18.

-

Eastern

Philippines received some locally heavy rain Monday with amounts of 3.00 to nearly 10.00 inches over Samar Island -

Some

additional heavy rain is possible in the region today and Thursday -

Vietnam

central and lower coastal areas may receive bouts of rain in the coming week with some of it possibly reaching into the Central Highlands -

Light

showers were noted in these same areas Monday and early today -

Today’s

Southern Oscillation Index was +20.982 and it will likely begin weakening this week and could fall more significantly for a while later this month

Source:

World Weather INC

Bloomberg

Ag Calendar

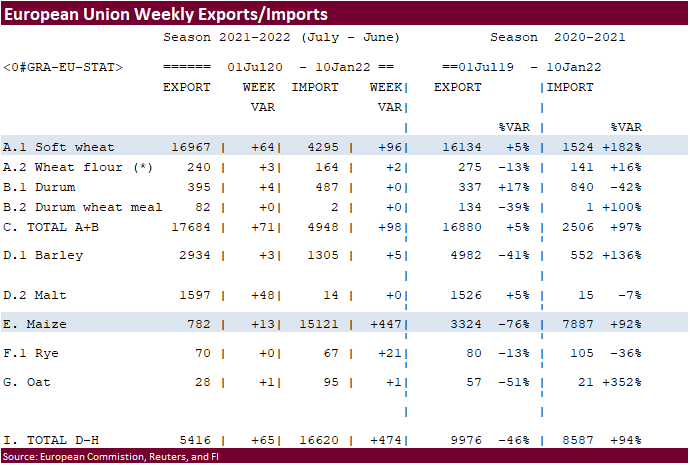

- Malaysian

Palm Oil Board’s Dec. data on stockpiles, production and exports - Malaysia’s

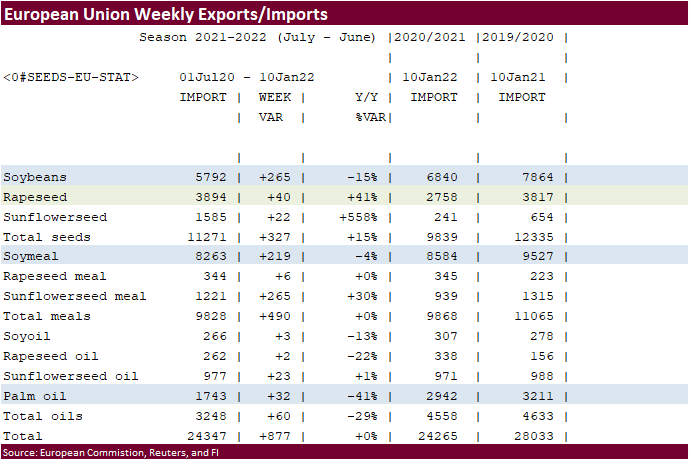

Jan. 1-10 palm oil exports - EU

weekly grain, oilseed import and export data

Wednesday,

Jan. 11:

- EIA

weekly US ethanol inventories, production - New

Zealand Commodity Price

Thursday,

Jan. 12:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - International

Grains Council report - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - Net-export

sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Jan. 13:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options

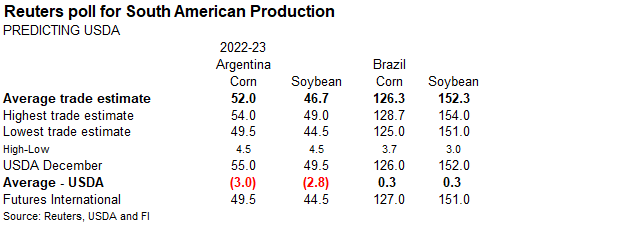

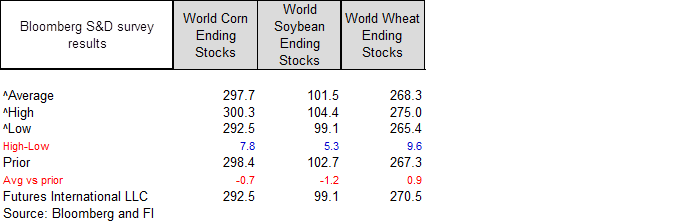

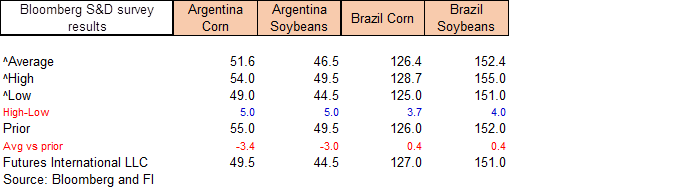

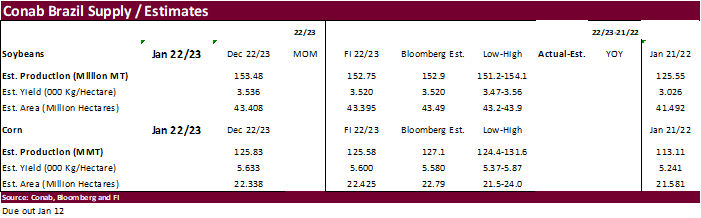

Soybean

and Corn Advisory

2022/23

Argentina Soybean Estimate Lowered 2.0 mt to 41.0 Million

2022/23

Brazil Soybean Estimate Unchanged at 151.0 Million Tons

2022/23

Argentina Corn Estimate Lowered 1.0 mt to 45.0 Million

2022/23

Brazil Corn Estimate Unchanged at 125.0 Million Tons

CBOT

December 2022 Agricultural Options Review

Macros

102

Counterparties Take $2.193 Tln At Fed Reverse Repo Op (prev $2.199 Tln, 103 Bids)

US

Wholesale Inventories (M/M) Nov F: 1.0% (est 1.0%; prev 1.0%)

–

Wholesale Trade Sales (M/M) Nov: -0.6% (est 0.2%; prev R 0.4%)

EIA

STEO Current Yr Crude F’cast (Bpd) Jan: 12.41 (prev 11.87)

–

Forward Yr Crude F’cast (Bpd): 12.81 (prev 12.34)

–

Current Yr Dry NatGas F’cast (Bcf/d): 100.34 (prev 98.13)

–

Forward Yr Dry NatGas F’cast (Bcf/d): 102.29 (prev 100.38)

·

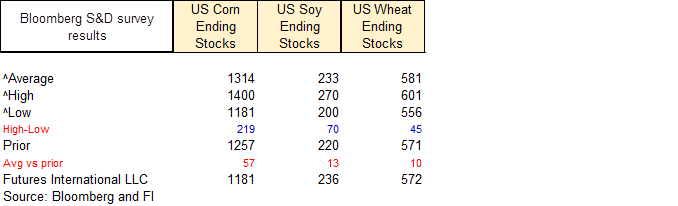

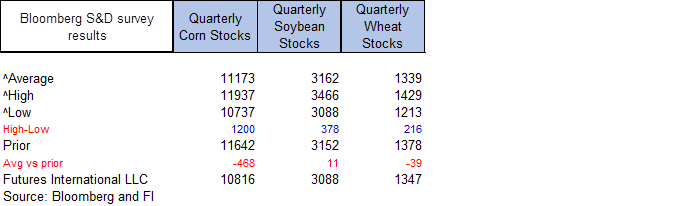

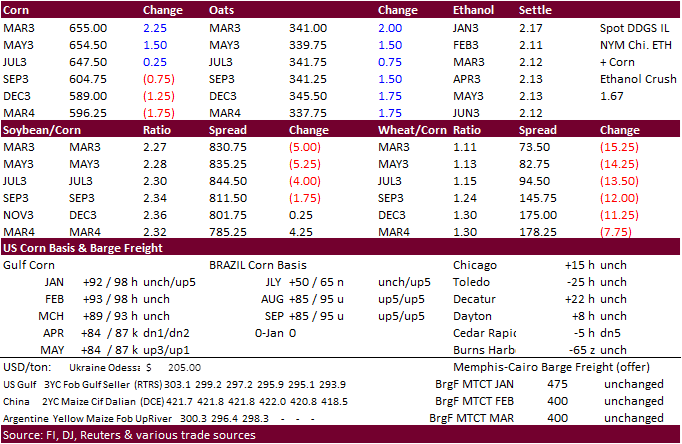

CBOT corn futures

started

lower but turned higher on corn/wheat spreading and bottom picking after the nearby contract hit a three week low (technical buying). The front three months ended higher and back months lower. Some noted the poor state of corn conditions north of BA in Argentina,

where a good amount of the corn is in the silking stage.

·

There was talk the spread between spot South America and US corn is narrowing, so traders are becoming more optimistic US corn exports will increase over the medium term with Brazil starting to run out of exportable supplies ahead

of their new crop, second crop, harvested around June.

·

Look for positioning Wednesday ahead of the USDA reports.

·

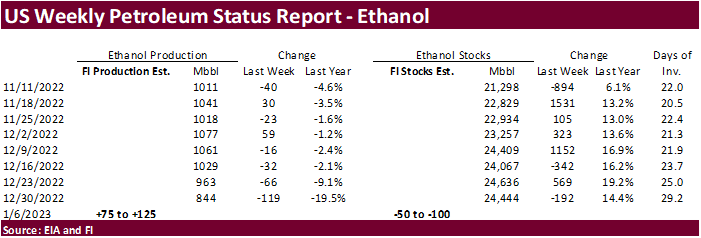

The trade is looking for US exports to be revised lower by 25 to 50 million bushels, and its possible USDA may lower corn for ethanol by 25 million bushels. We are unsure if USDA will decrease their export projection.

·

Anec: Brazil January corn exports seen reaching 5.024 million tons vs. 4.326 million tons week ago.

·

A Bloomberg poll looks for weekly US ethanol production to be up 115,000 thousand barrels to 959k (944-995 range) from the previous week and stocks down 130,000 barrels to 24.313 million.

Export

developments.

·

Taiwan’s MFIG bought about 65,000 tons of corn from South America for February 10 and March 1 shipment at an estimated $339.79/ton c&f.

Updated

01/03/23

March

corn $6.35-$7.10 range. May

$6.25-$7.25

·

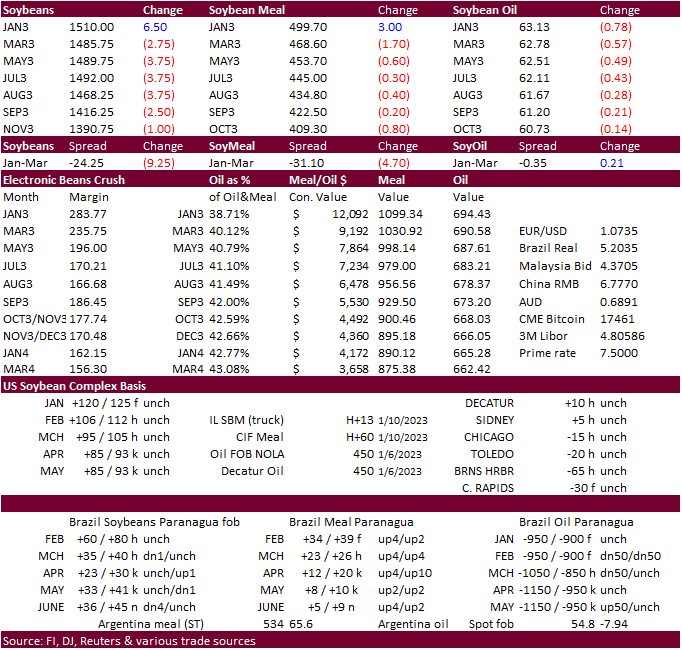

CBOT soybeans,

meal and soybean oil traded lower as longs lifted positions ahead of the USDA report. Expiring January soybeans and soybean meal ended higher. March soybean oil finished down 78 points. Argentina and southern Brazil are set to see some rain this week, but

some crops in Argentina are past the stage to see a significant improvement in yields.

Soybeans saw pressure from lower SBO, rising Covid concerns with outbreaks across China renewing demand concerns, and slowing USDA soybean export inspections.

·

US domestic soybean meal was unchanged to mixed on Tuesday from Monday.

·

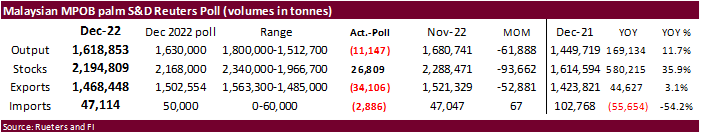

March palm oil futures in Malaysian on Tuesday fell more than 3.5 percent overnight on poor palm exports for the start of 2023 and lower than expected December exports.

·

MPOB S&D data did show end of December palm oil stocks smallest since August to 2.19 million tons, but December exports fell more than expected, off 3.5% from November to 1.47 million tons.

·

Anec: Brazil January soybean meal exports seen reaching 1.403 million tons vs. 1.337 million tons week ago.

USDA

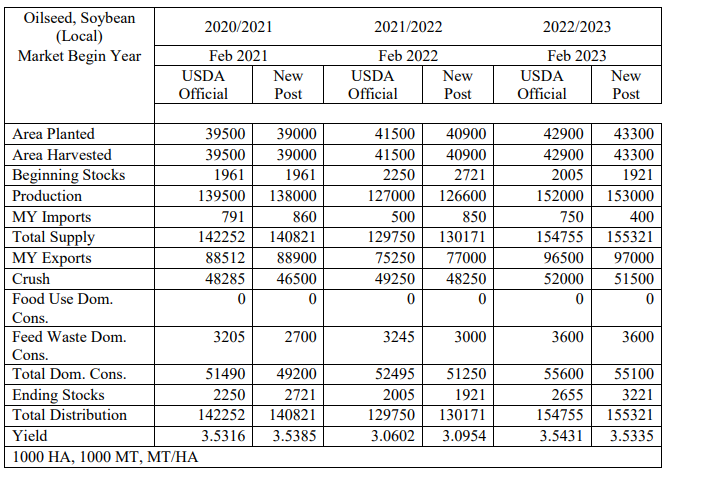

Attaché on Brazil soybeans: 153MMT production (1 MMT above USDA) and 51.5MMT crush.

Note:

·

Only 0.4 percent of the soybean crop had been collected as of late last week, compared to 0.2 percent previous year. 2.3 percent of the center-south crop had been collected, below 3.1% this time year ago.

·

Some trade estimates are near 151 million tons for production.

·

Turkey seeks about 24,000 tons of sunflower oil on January 13 for February 15 to March 20 delivery.

·

USDA reported private exporters reported sales of 174,181 tons of soybeans for delivery to Mexico during the 2022-23 marketing year.

Updated

01/07/23

Soybeans

– March $14.60-$15.50

Soybean

meal – March $465-$525

Soybean

oil – March

59.00-70.00

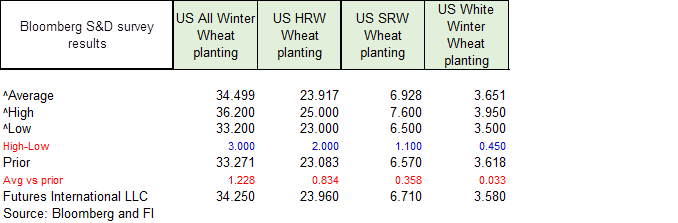

·

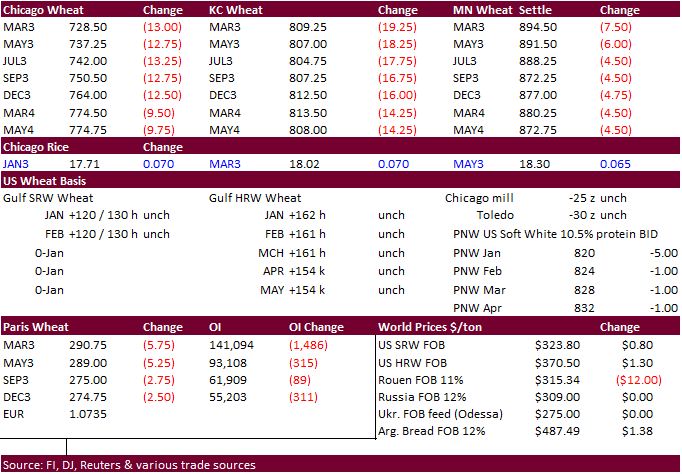

US wheat futures traded lower in part to uncompetitive US export prices. Chicago wheat hit a 15-month low and Paris wheat hit a 10-month low on Tuesday. Egypt received offers for wheat and Black Sea was cheapest. India may see

a record wheat crop, adding to the list of large supplies by Australia and Russia.

·

The Indian Institute of Wheat and Barley Research told Reuters that the 2023 India wheat production could reach a record 112 million tons versus 106.84 million tons a year ago and 109.59 million for 2021. Higher yield variety

seeds and favorable weather have favored early crop establishment.

·

Interfax Russia reported five ships left Ukraine over the past three days carrying 158,550 tons of foodstuff as part of the Grain initiative. 17 million tons have been exported since the beginning of August under the initiative.

·

IKAR reported wheat prices for Russian 12.5% protein from Black Sea ports were around $306 per ton for FOB delivery in the first half of February, near unchanged from late December.

·

China gave local companies the green light to pursue trade with Australia as political relationships improved. They already resumed coal import and are looking for Australia to drop complaints at the World Trade Organization on

Chinese tariffs on wine and barley.

·

Pakistan received a shipment of Russian wheat. It arrived in Karachi city of the southeastern Sindh province. Pakistan aims to import 750,000 tons of Russian wheat by March 30.

·

China will auction off 140,000 tons of wheat from reserves on January 11. The sale includes 100,000 tons bought in 2015, 2016 and 2017 under its minimum purchase price policy, and another 40,000 tons of 2014 and 2015 wheat from

its temporary reserve. (Reuters)

·

Anec: Brazil January wheat exports seen reaching 446,105 tons vs. 280,715 tons week ago.

·

Turkey seeks 565,000 tons of milling, including red, wheat on January 12 for February through March shipment.

·

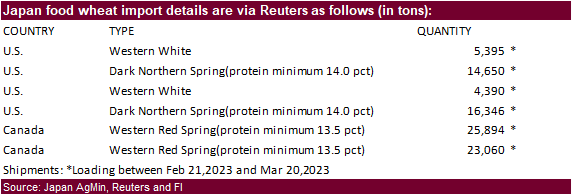

Taiwan is in for 45,200 tons of US wheat on January 13 for March shipment. Wheat types sought include dark northern spring, hard red winter and white wheat.

·

Japan seeks 89,735 tons of food wheat later this week.

Rice/Other

·

Russia extended their ban on rice exports through June 30. It applies to exports outside of the Eurasian Economic Union (EAEU). There are no restrictions on exporting these products to other EAEU countries.

·

Vietnam’s coffee exports in December were up 53.5% from the month before at 197,077 tons. For 2022, Vietnam exported 1.78 million tons of coffee, up 13.8% from a year earlier.

·

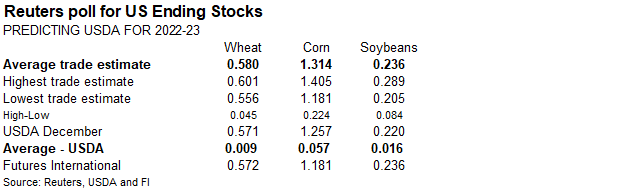

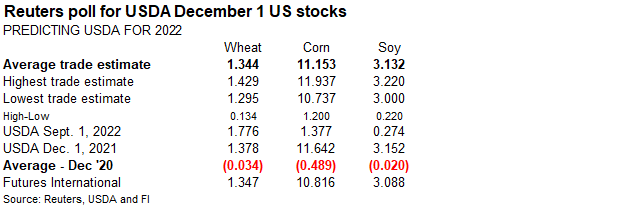

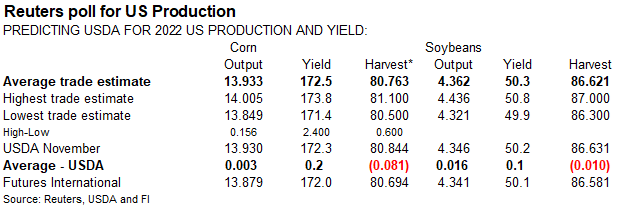

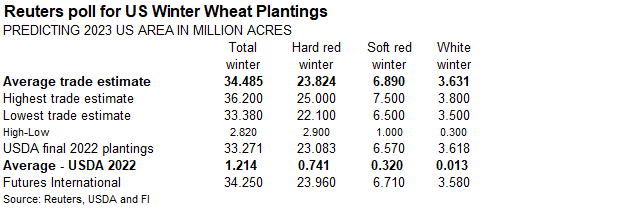

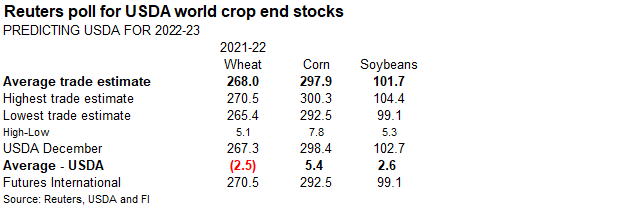

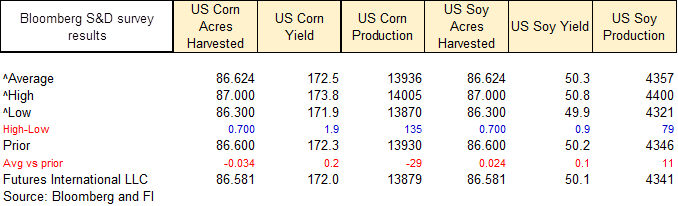

(Bloomberg) — US 2022-23 production seen slightly lower than USDA’s previous estimate, according to the avg in a Bloomberg survey of eight analysts.

-Production

seen down 96,000 bales, while exports seen down 131,000 bales

-Ending

stocks seen mostly unchanged at 3.5m bales

-World

production seen down by 151,000 bales

Updated

01/04/23

Chicago

– March $7.00 to $8.25

KC

– March 8.00-$9.40

MN

– March $8.50 to $9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.