PDF Attached

Reuters:

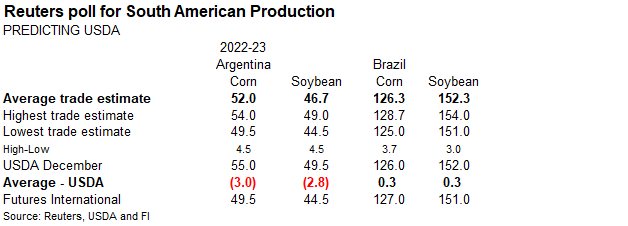

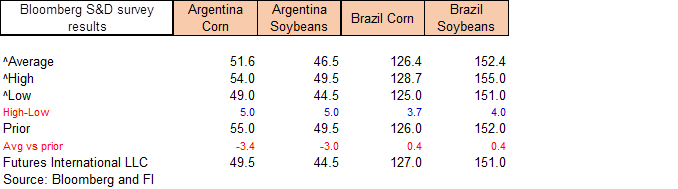

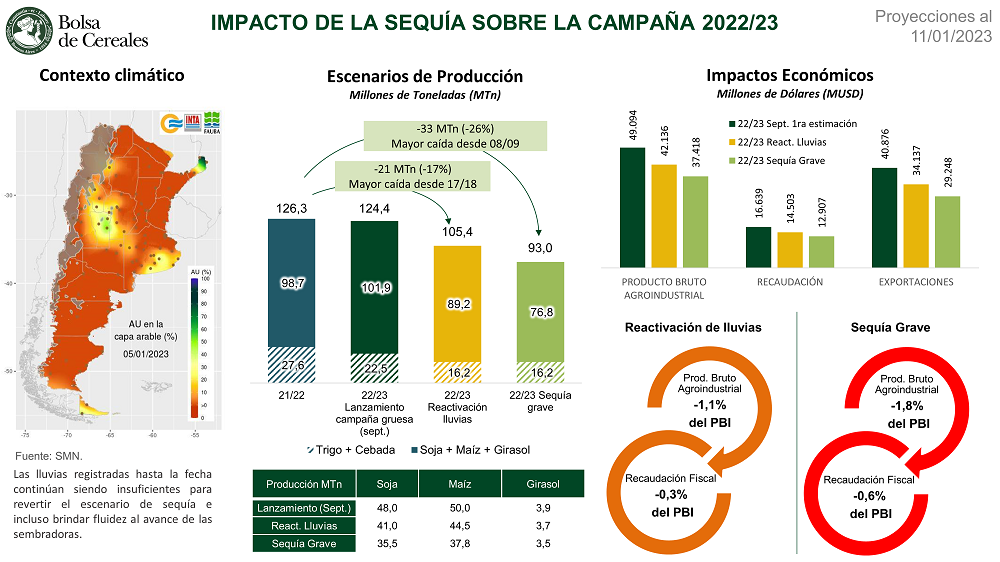

ARGENTINE 2022/23 SOYBEAN HARVEST SEEN AT 37 MLN TONNES VS 49 MLN TONNES PREVIOUSLY ESTIMATED -ROSARIO EXCHANGE

ARGENTINE 2022/23 CORN HARVEST SEEN AT 45 MLN TONNES VS 55 MLN TONNES PREVIOUSLY ESTIMATED -ROSARIO EXCHANGE

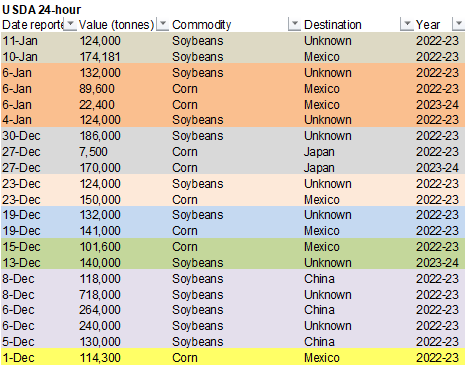

Private exporters reported sales of 124,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year.

Argentina crop tours should propel soybeans higher. Buy after the 11 am CT number.

Argentina’s weather outlook turned negative this morning. Light rains favor Cordoba and Buenos Aires today and Thursday before dry weather sets in Friday through Sunday, and through next week. Brazil is in good shape and the far southern areas have an opportunity for rain later this week. The US Midwest will see precipitation across the southern and eastern winter growing areas today and Thursday. Most of the US winter wheat areas of the Great Plains will remain dry with exception of a wintry mix for southwest NE, northern CO, and KS today.

MOST IMPORTANT WEATHER FOR THE COMING WEEK

- U.S. and European forecast models were wetter today for hard red winter wheat areas of the central U.S. Plains, although the models had differing solutions in both timing and precipitation distribution

- Some moisture is to be expected, but the model differences speak volumes about low confidence in the advertised distribution

- Some precipitation is expected, but no drought busting rain or snow will fall

- California storminess will continue through the weekend and into early next week, and then a break is expected to emerge

- A North America trend change is expected later next week and into the latter part of this month resulting in a northwesterly flow pattern aloft that will bring cooler temperatures and less precipitation to the middle and eastern parts of the nation over time

- California and most of the western states will be drier and cooler for a little while than trend warmer as this week 2 and week 3 change takes place

- West Texas may get a few showers in the next ten days, but a general soaking precipitation event is highly unlikely

- South Texas rainfall is not likely be significant in the next couple of weeks and moisture will need to support early planting in late February and March, but there is plenty of time for that

- Eastern U.S. Midwest will experience some timely rain events that will help ease dryness

- Soil moisture is rated favorably, but precipitation amounts in recent months have been lighter than usual leaving river and stream flows lower than usual

- Northern U.S. Plains and Canada Prairies precipitation will be restricted for a while

- Northern Argentina will get rain late this week that will improve topsoil moisture for cotton and minor corn and soybeans areas from northern Santiago del Estero to Formosa, Chaco and far northern Santa Fe

- The moisture will be welcome, but much more will be needed

- Central and southern Argentina dryness will be an ongoing concern with little relief expected, despite a few showers

- Rain developed overnight in Cordoba, southern Santa Fe, western Buenos Aires and La Pampa, Argentina with most amounts less than 0.50 inch

- A few areas of greater rain were noted in southwestern Buenos Aires

- Rio Grande do Sul, Brazil is expecting some needed rain in the coming week to ten days

- The moisture will be helpful in easing dryness that has been prevailing recently

- Other areas in Brazil are still plenty moist

- Some of the marketplace and a few producers in Brazil suggest the wetter bias has become too much and drier weather is needed especially with the harvest of early season soybeans approaching quickly

- The lighter precipitation will be most noted next week and should prove helpful for maturing crops and supporting early season harvesting as well as some Safrinha planting

- North Africa still has a big need for rain, but the situation is not a crisis yet because of winter crop semi-dormancy across the region

- A boost in soil moisture will be needed in February and March to stimulate new crop development and to support the best possible yield potentials

- A few bouts of very light rainfall is expected, but most of the precipitation will still leave a big need for more moisture

- Eastern Spain and the lower Danube River Basin in Europe are still carrying moisture deficits from last year, but with winter crops dormant today there is not much urgency in fixing the deficits

- Relief has already occurred in the lower Danube Basin and more rain is advertised

- Europe is expecting a stormier weather pattern this weekend and next week in particular with larger precipitation events and bouts of strong wind possible

- Soil moisture is adequate to abundant across much of the central and north and further increases in moisture are expected

- Russia’s New Lands experienced another bitter cold morning today with lows in the -40s and -30s in the eastern New Lands and -20s and negative teens in eastern winter wheat country; however, snow cover was present to ensure adequate wheat protection against the cold

- Warming is likely in western Russia and Ukraine the remainder of this week with slowly increasing wind and precipitation expected over time

- Eastern winter crop areas in Russia and Ukraine will not see much precipitation this week, although it will not be completely dry

- Warming is expected and precipitation will develop more significantly in time from northwestern Ukraine, Belarus and the Baltic States to northwestern Russia

- The greatest precipitation is expected this weekend and next week

- China rain and snow that develop late this week and into the weekend in east-central and southeastern crop areas will prove to be timely and beneficial

- Winter crops are still dormant, but wheat and rapeseed will benefit from the moisture

- Australia summer crop areas in southern Queensland and parts of New South Wales would benefit from greater rain

- Dryland western production areas in Queensland need rain more than any other area today and not much is expected for a while

- Rain will be increasing in central through northern Queensland crop areas during the next week to ten days benefiting sorghum and minor cotton areas as well as sugarcane

- South Africa will receive very little rain during the next few days and then some showers will begin late this weekend into early next week in south-central and southeastern parts of the nation

- The precipitation may be a little erratic and light for a while raising the need for greater rainfall later this month and into February

- India’s weather will be wettest in the far north from Uttarakhand northward to Jammu and Kashmir during the next week to ten days

- The moisture will be good for wheat and other winter crops, but many other areas in India will likely stay dry or mostly dry raising the need for significant rain

- Southeast Asia (Indonesia and Malaysia in particular) rainfall has diminished because of the suppressed phase of Madden Julian Oscillation and that will continue for a little while longer

- Soil moisture will decrease for a while until rainfall increases again which may not occur until late this month

- Totally dry weather is unlikely and the showers expected will help slow drying rates and key crop conditions very good

- Western Turkey is receiving some rain and snow and more is needed rain and mountain snow the remainder of this week while central and eastern parts of the nation are relatively dry

- Most of the wheat and other winter crops are rated favorably due to good autumn precipitation, but there is need for greater precipitation in all of the nation

- Middle East rainfall is expected to be favorably mixed over the next ten days although the resulting precipitation should be mostly light to locally moderate

- Some rain will return to central and eastern Turkey next week ending a ten day period of dry weather

- Iraq and Syria will not get much precipitation for a while and the same may occur in Jordan and few neighboring areas

- East-central Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

- Coffee and cocoa conditions should remain favorable in all production areas, despite the anomalies

- West-central Africa dryness will continue through the next ten days to two weeks

- Dry conditions are normal at this time of year

- No excessive heat is expected in this coming week, although warmer than usual conditions are beginning to evolve and may continue into the latter part of this month

- Samar Island, Philippines received some additional heavy rain Tuesday with amounts of 3.00 to nearly 10.00 inches noted Monday and some areas reported another 5.00 inches Tuesday

- Southern and eastern portions of the Philippines may see additional heavy rain in the coming week

- Vietnam central and lower coastal areas may receive bouts of rain in the coming week with some of it possibly reaching into the Central Highlands

- Light showers were noted in these same areas Tuesday and early today

- Today’s Southern Oscillation Index was +21.45 and it will likely begin weakening over the next few days and could fall more significantly for a while later this month

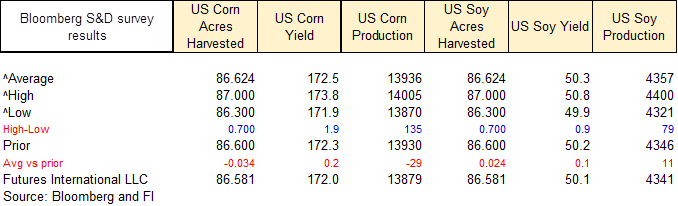

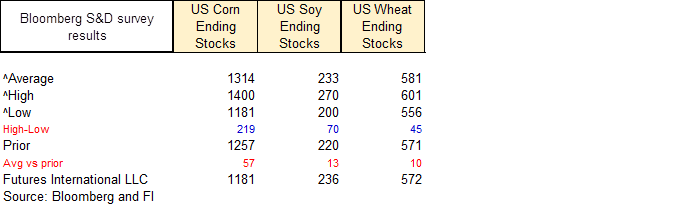

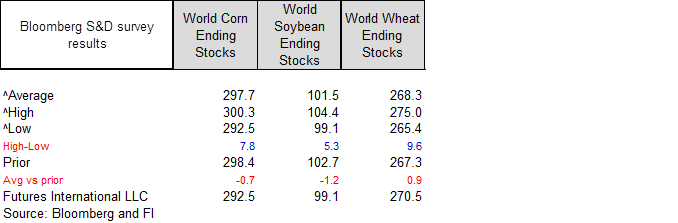

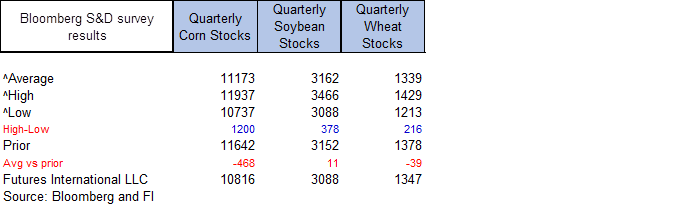

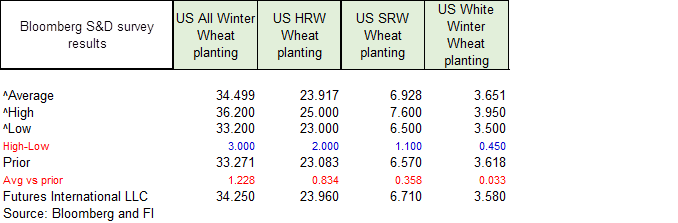

Source: Bloomberg and FI

Macros

US DoE Crude Oil Inventories (W/W) 06-Jan: +18.961M (est -2.000M; prev +1.694M)

– Distillate: -1.069M (est -1.350M; prev -1.427M)

– Cushing: +2.511M (prev +244K)

– Gasoline: +4.114M (est +750K; prev -346K)

– Refinery Utilization: +4.5% (est +4.5%; prev -12.4%)

US MBA Mortgage Applications Jan-6: 1.2% (prev -10.3%)

– MBA 30-Year Mortgage Rate Jan-6: 6.42% (prev 6.58%)

Mexican Industrial Production NSA (Y/Y) Nov: 3.2% (exp 2.8%; prev 3.1%)

– Industrial Production SA (M/M) Nov: 0.0% (exp -0.3%; prev 0.4%)

– Manufacturing Production NSA (Y/Y) Nov: 4.6% (exp 4.8%; prev 5.3%)

Brazilian Retail Sales (Y/Y) Nov: 1.5% (exp 1.9%; prev 2.7%)

– Retail Sales (M/M) Nov: -0.6% (exp -0.3%; prev 0.4%)

· BA Grains Exchange is bullish per Argentina grain production.

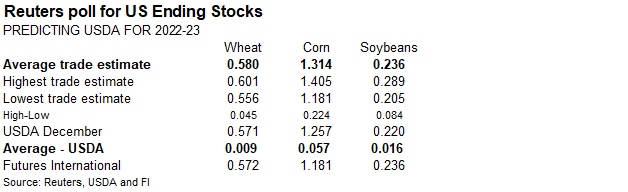

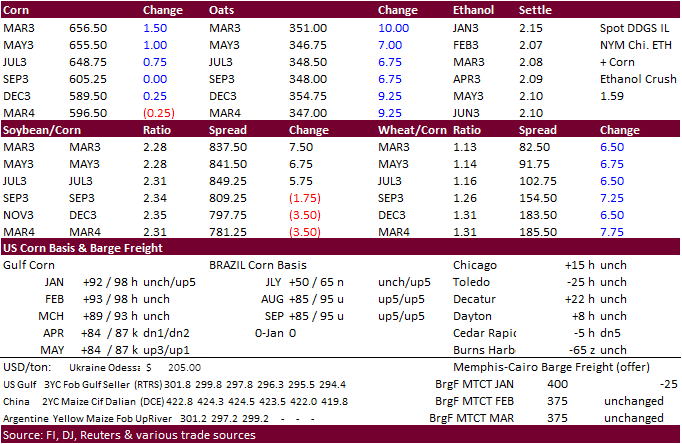

· CBOT corn futures were higher on technical buying and an increase in world import interest. March CBOT corn failed to close below $6.50 over the past week. Higher soybeans lent support.

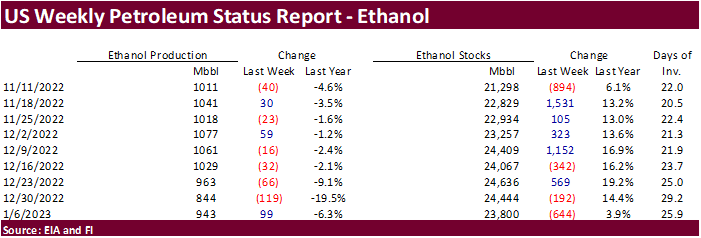

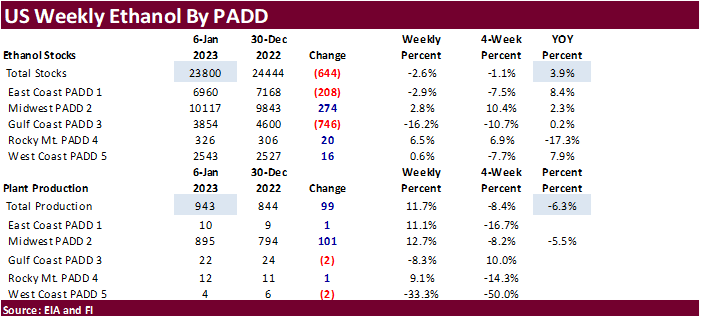

· US weekly ethanol production fell below expectations.

US DoE Crude Oil Inventories (W/W) 06-Jan: +18.961M (est -2.000M; prev +1.694M)

– Distillate: -1.069M (est -1.350M; prev -1.427M)

– Cushing: +2.511M (prev +244K)

– Gasoline: +4.114M (est +750K; prev -346K)

– Refinery Utilization: +4.5% (est +4.5%; prev -12.4%)

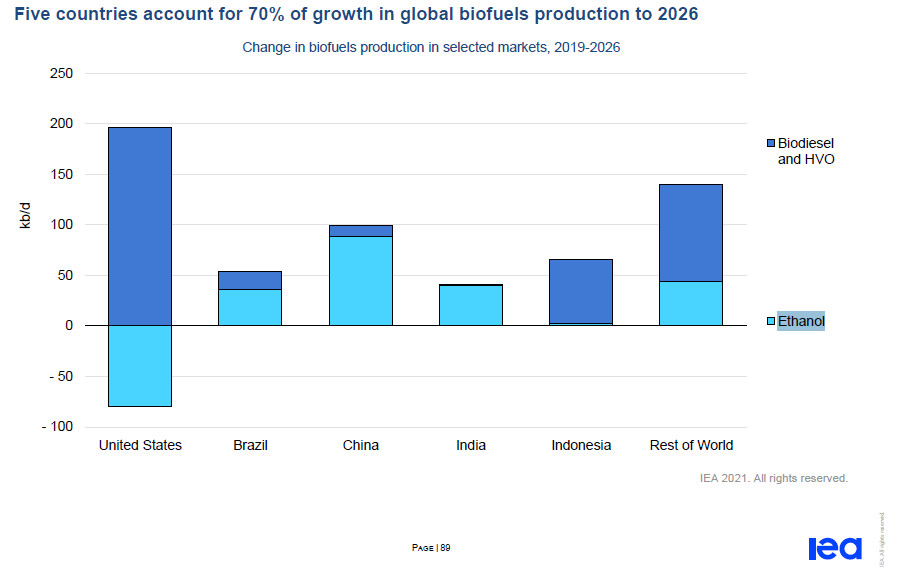

· China extended anti-dumping and anti-subsidy tariffs on US DDGS from the United States for another five years. The anti-dumping tariffs are between 42.2% and 53.7% while anti-subsidy tariffs range from 11.2% to 12% (up to 66% total). China looks to boost ethanol production through 2026.

Export developments.

· Taiwan’s MFIG bought about 65,000 tons of corn from the US at an estimated premium of 219.66 cents a bushel c&f over the Chicago July contract for shipment between March 20 and April 8, later if from the PNW. Argentina corn was offered at 227.50 cents over the July.

· Yesterday SK’s MFG bought SA corn at $339.79/ton.

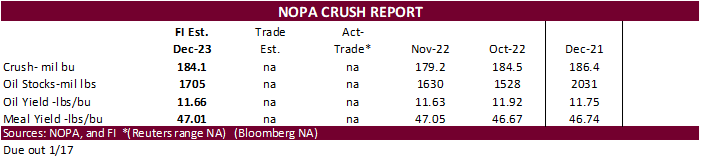

Updated 01/03/23

March corn $6.35-$7.10 range. May $6.25-$7.25

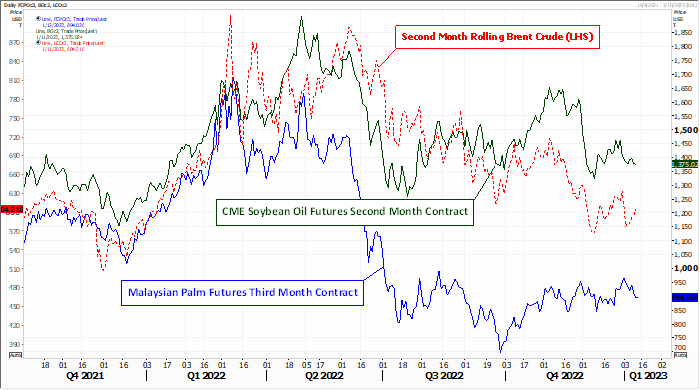

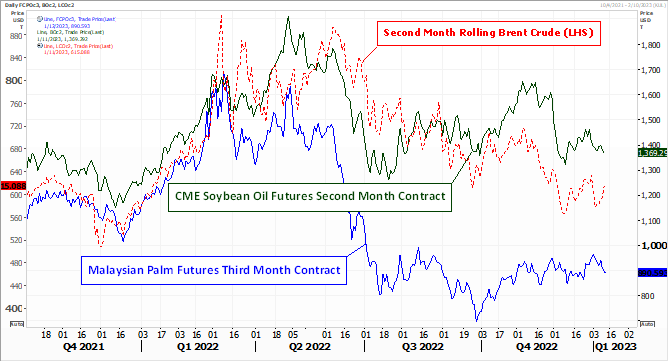

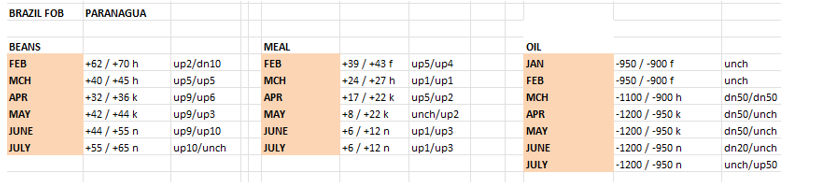

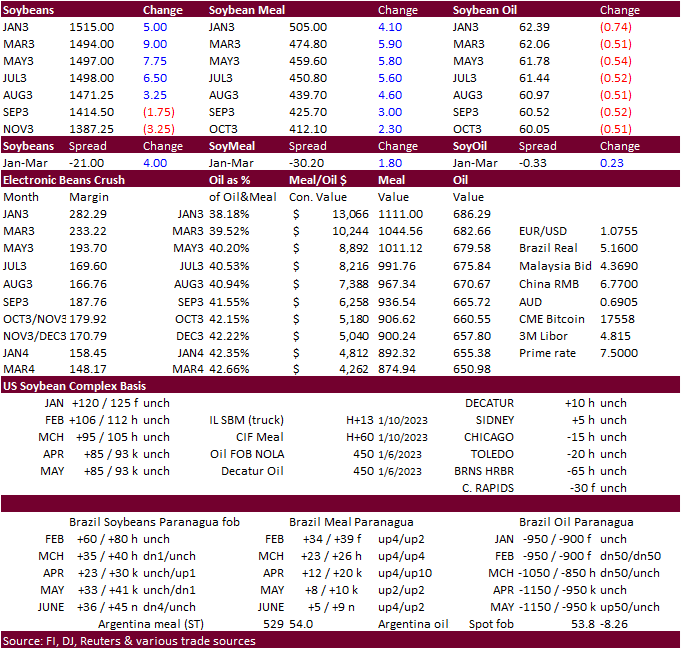

· CBOT soybeans and soybean meal were higher from Argentina end users looking around for soybeans to fulfill crush obligations, driving up SA cash premiums. Soybean meal traded higher despite lower soybean oil. Product spreading was noted even though Argentina is known to export both products. Palm oil could benefit from deep discounts.

· Brazil soybean premiums are firm.

· Argentina may have bought at least a couple cargoes of soybeans from Brazil recently. This is a nonevent as Argentina tends to import soybeans every year around the end of their crop cycle. With other surrounding countries also experiencing poor new-crop crop conditions and delays to new-crop harvesting progress (Paraguay) it come as no surprise the largest soybean meal producer would turn to another neighboring country.

· Malaysian palm oil traded near a three week low.

· SGS reported 1-10 January Malaysian palm oil export at 262,201 tons, a 45 percent decrease from the same period a month earlier, similar to the declines posted by ITS and AmSpec on Tuesday.

· Indonesia set its crude palm oil reference price at $920.57 per ton for Jan. 16-31, up from $858.96 per ton FH Jan. Indonesia’s palm oil export tax will be $74 per ton and levy at $95 per ton.

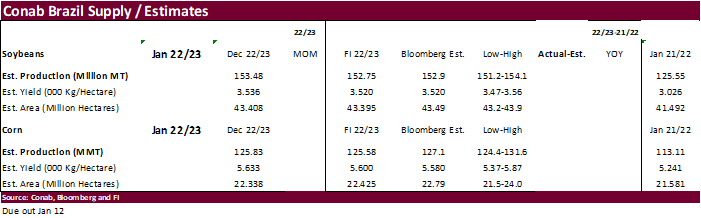

Argentina’s Bolsa de Cereales suggested “serious consequences” 35.5 MMT for soybeans noted below.

· Under the 24-hour announcement system, private exporters reported sales of 124,000 tons of soybeans for delivery to unknown destinations during the 2022-23 marketing year.

· South Korea’s Agro-Fisheries & Food Trade Corp. seeks 19,000 tons of food-non-GMO soybeans, optional origin, on January 19 for arrival in February to April 2024.

· Turkey seeks about 24,000 tons of sunflower oil on January 13 for February 15 to March 20 delivery.

Updated 01/07/23

Soybeans – March $14.60-$15.50

Soybean meal – March $465-$525

Soybean oil – March 59.00-70.00

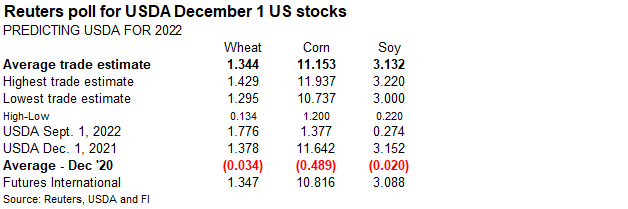

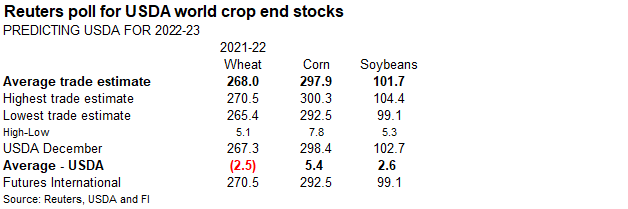

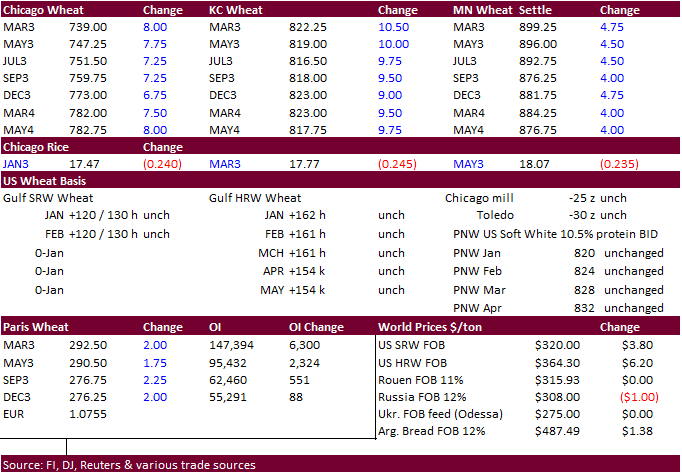

· US wheat futures were higher on positioning ahead of the USDA reports. We didn’t see any bullish news.

· Traders saw Egypt book 120,000 tom of wheat in their latest import tender.

· Today China was to auction off 140,000 tons of wheat from reserves.

· Paris March wheat was surprisingly up 2.00 euros earlier at 293.000 per ton.

· South Korea’s FLC bought up to 65,000 tons of feed wheat from the US or Australia and $346 per ton C&F for shipment between May 10 and June 10.

· A group of South Korean flour mills seeks 50,000 tons of milling wheat from the United States on Thursday for shipment between March 16 and April 15.

· Turkey seeks 565,000 tons of milling, including red, wheat on January 12 for February through March shipment.

· Taiwan is in for 45,200 tons of US wheat on January 13 for March shipment. Wheat types sought include dark northern spring, hard red winter and white wheat.

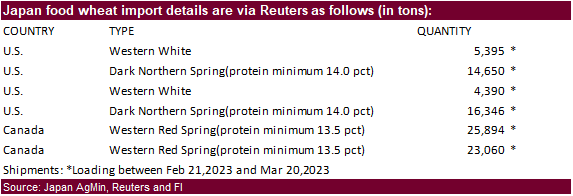

· Japan seeks 89,735 tons of food wheat later this week.

Rice/Other

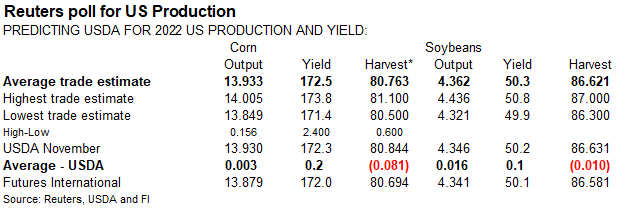

· (Bloomberg) — US 2022-23 production seen slightly lower than USDA’s previous estimate, according to the avg in a Bloomberg survey of eight analysts.

-Production seen down 96,000 bales, while exports seen down 131,000 bales

-Ending stocks seen mostly unchanged at 3.5m bales

-World production seen down by 151,000 bales

Updated 01/11/23

Chicago – March $7.00 to $8.25

KC – March 7.80-$9.30

MN – March $8.50 to $9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.