PDF attached

Attached

is our 2021 US winter wheat by class supply estimates (w/ graphs).

CME

RAISES WHEAT FUTURES MAINTENANCE MARGINS BY 9.1% TO $1,800 PER CONTRACT FROM $1,650 FOR MARCH 2021

CME

RAISES CORN FUTURES MAINTENANCE MARGINS BY 18.2% TO $1,300 PER CONTRACT FROM $1,100 FOR MARCH 2021 (Reuters)

![]()

Under

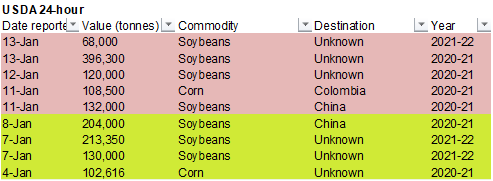

the 24-hour announcement system, private exporters sold 464,300 tons of soybeans to unknown. Of that, 396,300 tons were for 2020-21 delivery and 68,000 tons for 2021-22.

US

producer selling and profit taking pressured soybeans, meal, and Chicago wheat. Nearby corn ended higher. Soybean oil traded two-sided, ending lower. KC and MN traded higher on Russian wheat export duty chatter.

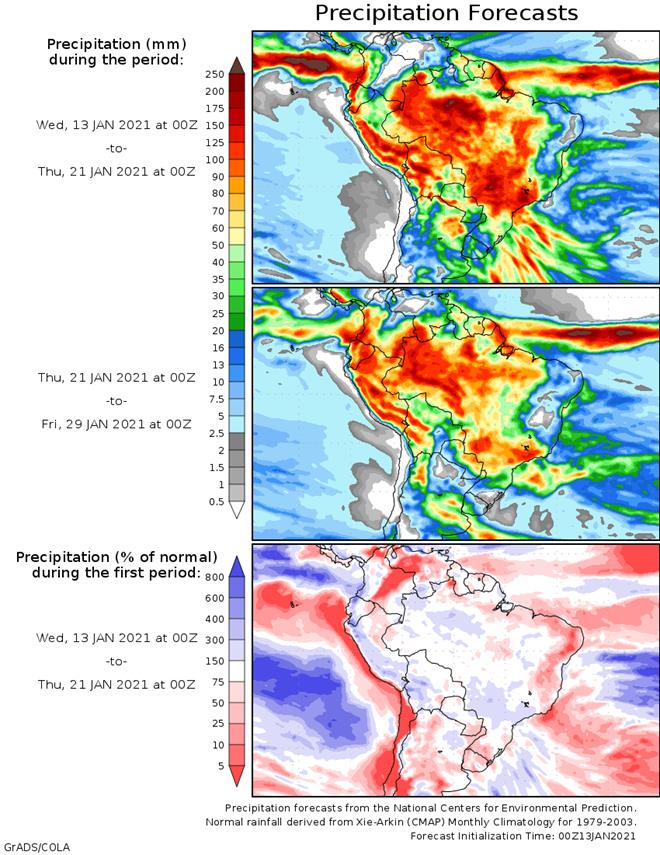

Weather

NOT

MUCH CHANGE OVERNIGHT

- South

America’s weather outlook has not changed - Argentina

weather trended drier Tuesday with a few showers in the north - Temperatures

the past couple of days have trended milder with highs in the 70s and 80s Fahrenheit that has helped conserve soil moisture through slower evaporation and is giving crops an opportunity to better utilize the moisture from this week’s rain - Argentina

is still expecting rain again Thursday in the far southwest and then then Friday into Saturday in the central and northeast - Sufficient

amounts of moisture will occur in Santa Fe, Entre Rios, Corrientes, Chaco, Formosa and a few neighboring areas to help improve soil moisture that is still a little light after the first rain event passed through the region Sunday night and Monday - Rainfall

is not expected to be very great in parts of the south with a trace to 0.50 inch in parts of Buenos Aires and 0.20 to 0.75 inch in La Pampa, San Luis and southern Cordoba - Rainfall

farther to the north will vary from 0.60 to 2.00 inches and locally more - Net

drying is still advertised from Sunday through Jan. 23 - GFS

model suggests rain chances will improve again Jan. 24-28, but the model may be exaggerating some of the expected rain - Argentina’s

bottom line still looks good for this first week of the outlook due to recent rain and that which is still coming. However, the drier and hotter weather expected for a while next week will accelerate drying and deplete soil moisture raising crop stress. That

will put much pressure on the Jan. 24-28 rainfall events that (at this moment) are of low confidence. Crop stress could become more of an issue later in the reproductive season during February, but there is plenty of time for weather patterns to cooperate

with greater rainfall. Confidence in the GFS advertised rain events are low, but some rain is expected. - All

of Brazil’s most important grain, oilseed, cotton, citrus and sugarcane areas will receive rain at one time or another during the next ten days - The

moisture will be sufficient to sustain normal crop development for many areas and improve crop conditions in some areas - Sao

Paulo and extreme eastern Mato Grosso do Sul have the greatest near term need for rain as well as parts of central and southwestern Mato Grosso after being missed by some of the greater amounts recently - These

areas should get rain later this week to bring adequate relief - Eastern

Minas Gerais through eastern Bahia and Espirito Santo to Pernambuco will receive limited rainfall and experience some net drying - These

areas are not important grain, oilseed or cotton production areas, but do produce some coffee, cocoa and sugarcane - Temperatures

in Brazil will be seasonable with a slight warmer bias in the north during the drier days - Brazil’s

greatest rainfall is probably a week away for some areas and a close watch on the distribution of daily rainfall is needed until that time - Winterkill

is not much of a threat in wheat areas for the next ten days - Snow

cover is present in most of Russia and is increasing in parts of Europe - Temperatures

will not be low enough to induce damage in any snow-free wheat area worldwide for at least a week and probably ten days - Snow

free areas in the world that will be closely monitored for a threat to wheat include; northwestern U.S. Plains, southwestern Canada’s Prairies, U.S. hard red winter wheat areas and China - However,

none of these areas has any immediate risk of damaging cold - Russia’s

Southern Region, Middle Volga River Basin and northwestern Kazakhstan will receive periods of snow over the next ten days - The

moisture will be welcomed to crops in the spring after some of these areas were extremely dry during the summer, autumn and early winter - Cooling

is expected in Russia later this week into next week with some of the cold expected to be notable, but mostly in the north where there is plenty of snow on the ground to protect winter crops - Ukraine

and northern parts of Russia’s Southern Region will experience low temperatures in the positive and negative single digits this weekend into next week, but snow will cover the ground by that time protecting most crops from the cold - Europe

temperatures are colder biased, but not cold enough to raise any potential threat to winter crops - A

boost in home and business heating fuel consumption rates has occurred, but the demand is not excessively great except in some Mediterranean Sea countries where temperatures are most below average - Europe

temperatures will continue a little below average for much of the coming week, although France and the U.K. will experience a more seasonable range of temperatures - Europe

precipitation will be frequent across much of the continent during the coming week to ten days maintaining moisture abundance and putting some additional snow on the ground - A

boost in snow cover is needed to protect winter crops from any bitter cold that evolves later this month - U.S.

precipitation outlook next two weeks - Snow

and rain will evolve in the northern Plains late today and change to snow Thursday before racing through the Midwest late this week and into the weekend - Cooling

will accompany the event with some windy conditions and briefly falling temperatures after some very warm weather today into Thursday - Blizzard

or near blizzard conditions are now expected from the easternmost Dakotas into northern Iowa, Minnesota and Wisconsin Thursday night into Friday

- Snow

accumulations of 2 to 6 inches will be common with local totals possibly reaching over 8 inches - The

Delta and southeastern states will not be impacted by much precipitation through the early part of next week - A

storm system is expected in both regions during the middle to latter part of next week - Another

precipitation event may evolve across the north-central states and Great Lakes region Jan. 22-25 - Cooling

will follow this event - There

is potential for another storm to evolve in the lower Midwest or Delta in the last week of January that might develop into a nor’easter

- Snowfall

may increase in the western United States late next week into the following weekend as colder air pushes into that region - Excessive

wind will occur today from Saskatchewan and eastern Alberta, Canada into Montana and western North Dakota - The

wind will shift to the northern and central Plains Thursday and early Friday

- Sustained

wind speeds of 30-40 mph with gusts to 50 mph will occur the Plains and Canada’s Prairies while gusts in Montana, Wyoming and some neighboring areas could vary from 50-90 mph

- The

greatest wind speeds will occur near the canyons of central Montana as the wind gets funnel out of the mountains into the Plains - Some

power outages and personal property damage is expected - South

Africa will continue to be impacted by periodic showers and thunderstorms over the next ten days supporting most of its crops in a favorable manner - Temperatures

will be seasonable - A

few pockets of dryness might evolve over time, but there will be no threat to production - Jan.

21-27 will be drier biased relative to this week and net drying could be increased across the nation during that period of time - India

weather over the next couple of weeks will include some periodic rainfall in the far south, but the bulk of the nation’s winter crops will not be impacted by significant moisture - Last

week’s rain in northern India improved winter crops from eastern Rajasthan and northern Uttar Pradesh into Punjab - Recent

rain in far southern India was less welcome and may have continued to disrupt harvesting of sugarcane, late cotton and groundnuts - Australia

summer grain and cotton areas will be mostly dry through Saturday - Rain

will develop in southeastern Queensland and northeastern New South Wales Sunday into next week offering some short term reprieve from this week’s drying - Precipitation

may be more limited for a while again next week - Temperatures

will be hotter in the central and western parts of the nation this week while more seasonable readings prevail in the east - China

weather this week will be seasonably dry except for some light snow in the northeast and a few rain showers in the southwest - Temperatures

will be near normal this week and then slightly warmer biased during the weekend and next week - Rain

in Northern Africa recently was good for wheat and barley - Additional

rain is needed in southwestern Morocco and northwestern Algeria where recent rain was good, but not enough to seriously bolster soil moisture for long term benefits to winter crops - Showers

will be mostly confined to coastal areas of northeastern Algeria and northern Tunisia during the next ten days leaving some of the drier areas in need of more rain for a while - Waves

of rain will impact the Philippines, Indonesia and Malaysia over the next week to ten days - Excessive

moisture is possible at times, but most of the greater rainfall that has been seen recently has abated for the next several days and then will return again - Flooding

has been an issue for the nation at times in recent months - Mainland

areas of Southeast Asia will be dry over the next ten days except coastal areas of Vietnam where waves of rain are expected - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days - Some

rain fell in Ivory Coast and Ghana coffee and cocoa areas Monday, but resulting amounts were light - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +19.50 today and the index will remain very strong for a while longer - Mexico

and Central America weather will continue to generate erratic rainfall - Far

southern Mexico and portions of Central America will be most impacted by periodic moisture which is greater than usual at this time of year - Canada

Prairies will remain unseasonably warm today and then trend colder late this week into next week

- The

region will continue warmer than usual, but not nearly as warm as that of today and Wednesday - Precipitation

will increase briefly in the central and east today and early Thursday as colder air arrives - Blizzard

conditions are possible for a little while today and tonight in Saskatchewan - Southeast

Canada will receive only light amounts of precipitation this workweek and temperatures will be warmer than usual - Rain

and snow are expected this weekend - Cooling

is likely next week, and precipitation may briefly increase

Source:

World Weather Inc. and FI

Wednesday,

Jan. 13:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Vietnam

customs data on coffee, rice and rubber exports in December - FranceAgriMer

monthly crop report - ANZ

Commodity Price - Malaysia

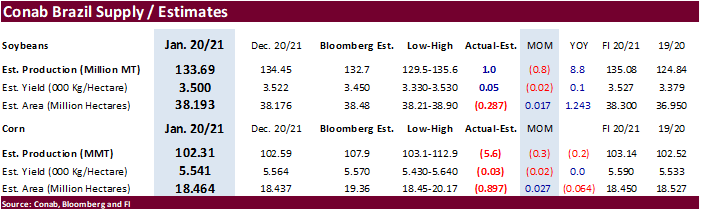

Cocoa Board 4Q cocoa grind data - Conab’s

data on yield, area and output of corn and soybeans in Brazil

Thursday,

Jan. 14:

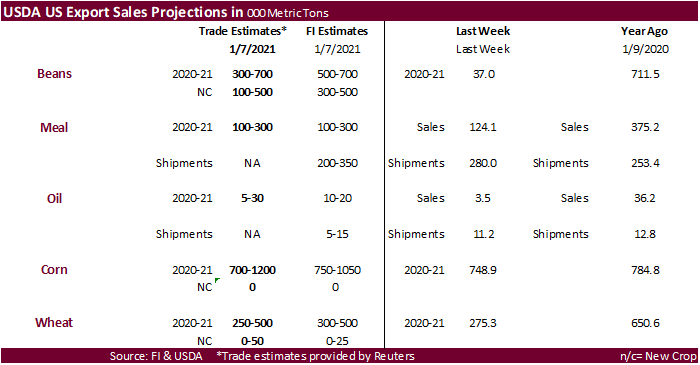

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

customs to publish 2020 trade data, including imports of soy, edible oils, meat and rubber - AB

Foods trading update - International

Grains Council monthly report - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana

Friday,

Jan. 15:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 4Q 2020 cocoa grind data - Malaysia’s

Jan. 1-15 palm oil export data - New

Zealand Food Prices

Source:

Bloomberg and FI

US

CPI (M/M) Dec: 0.4% (est 0.4%, prev 0.2%)

US

CPI (Y/Y) Dec: 1.4% (est 1.3%, prev 1.2%)

US

CPI Ex Food & Energy (M/M) Dec: 0.1% (est 0.1%, prev 0.2%)

US

CPI Ex Food & Energy (Y/Y) Dec: 1.6% (est 1.6%, prev 1.6%)

US

Real Avg Hourly Earnings (Y/Y): 3.7% (prev 3.2%)

US

Real Weekly Earnings (Y/Y): 4.9% (prev 4.7%)

US

DoE Crude Oil Inventories (W/W) 08-Jan: -3248K (est -3000K; prev -8010K)

–

Distillate Inventories: 4786K (est 2000K; prev 6390K)

–

Cushing OK Crude: -1975K (prev 792K)

–

Gasoline Inventories: 4395K (est 2500K; prev 4519K)

–

Refinery Utilization: 1.30% (est 0.15%; prev 1.30%)

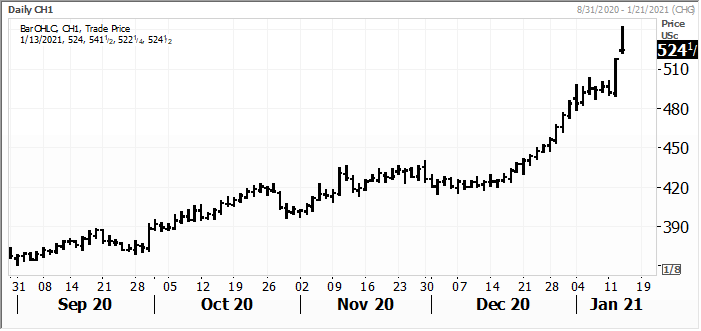

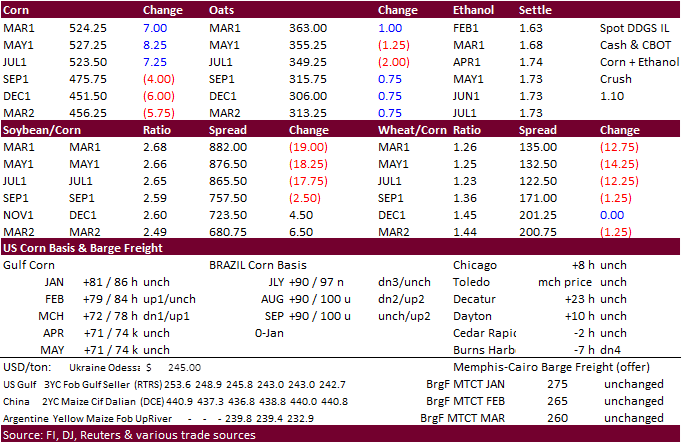

Corn.

-

Corn

traded the day session sharply higher on follow through bullish sentiment from the USDA report, potential slowdown in Black Sea shipments, and a lower than expected Brazil Conab production estimate. Prices quickly came well of their highs on heavy producer

selling and long liquidation. March ended 8.75 cents higher at $3.2775. We remain bullish corn but there might be additional correction to fill a short term gap. CBOT March corn gapped higher from 517.25 (yesterday high) and 522.25 (overnight low). Prices

remain firm headed into the day session. We see March climbing to $5.50. CBOT corn is at a 7-1/2 year high.

-

Funds

on Wednesday bought an estimated net 20,000 corn after picking up 58,000 on Tuesday.

-

Conab

reported the Brazil corn crop at 102.3 million tons, 5.6 million below a Bloomberg trade guess and 0.3 million below the previous month.

-

Argentina

lifted its 30,000 per day ton limit on corn exports, in part to producer backlash. Farm groups and export companies agreed to monitor domestic prices.

-

Meanwhile

Russia is considering a barley and corn export tax of 10 euros ($12) per ton and 25 euros per ton, respectively, between Feb. 1 and March 31, 2021.

-

In

Ukraine, the livestock and poultry producers’ associations asked the government to limit corn exports throughout 2020-21 to 22 million tons to avoid shortages of animal feed. Ukraine has exported 9.7 million tons of corn so far this season. Ukraine Black

Sea shipments are currently restricted because of weather conditions. -

Today

was day 4 of the “Goldman Roll.”

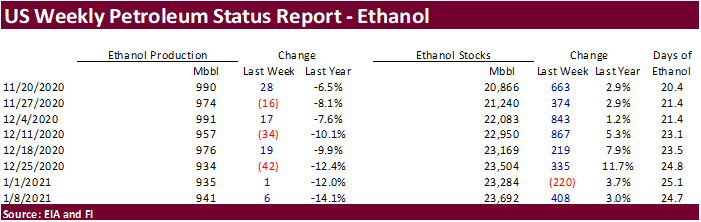

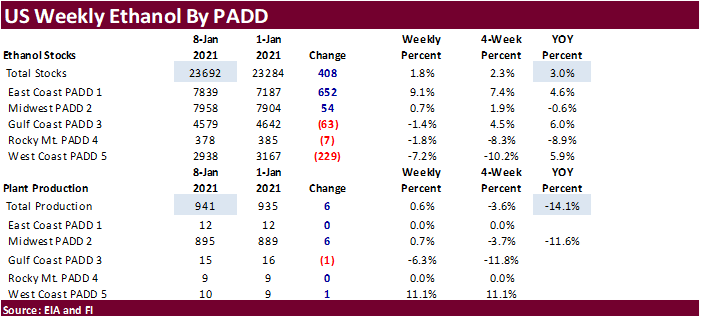

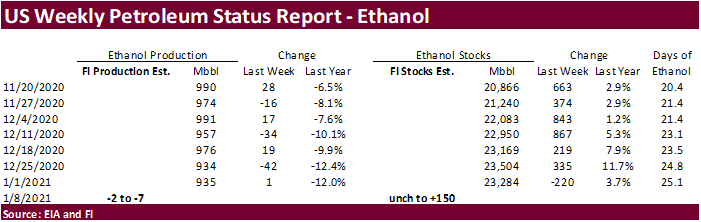

US

weekly ethanol production increased 6,000 barrels per day to 941,000 barrels, highest level in a month, and stocks were up 408,000 barrels to 23.692 million barrels, highest level since May 8, 2020.

A

Bloomberg poll looked for weekly US ethanol production to be unchanged and stocks up 244,000 barrels. September to Jan 8 ethanol production is running 7.5% below the same period a year ago. US gasoline demand decreased 91,000 barrels to 7.532 million, but

down 12 percent from this time last year.

CBOT

March corn

Source:

Reuters and FI

Corn

Export Developments

- South

Korea’s FLC bought 66,000 tons of corn at around $295.50/ton c&f for February shipment.

-

Results

awaited: Qatar seeks 100,000 tons of bulk barley on January 12.

- Results

awaited: Qatar seeks 640,000 cartons of corn oil on January 12.

Updated

1/12/21

March

corn is seen trading in a $4.75 and $5.50 range

-

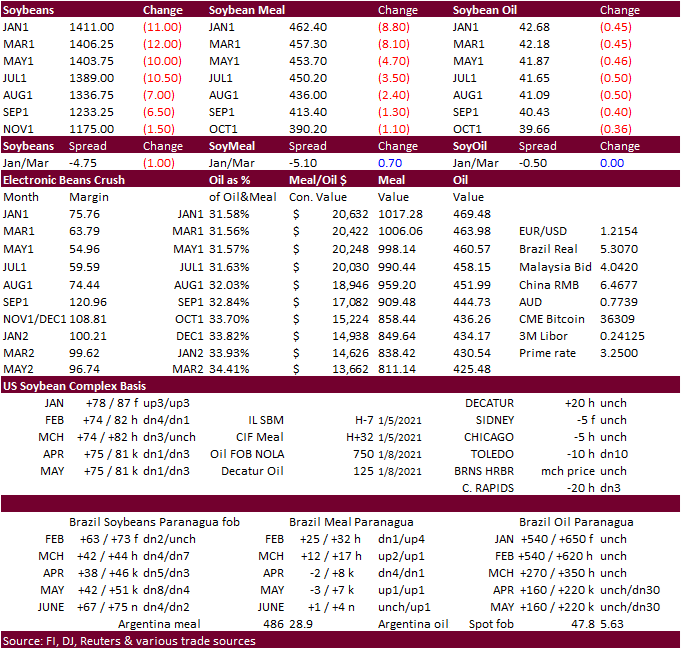

Early

in the trade, soybean contracts reached a fresh high but selected weaker soybean meal contracts are limiting gains. Then producer selling increased which pressured futures through much of the day session. Soybean oil started higher on product spreading but

fell on weakness in soybeans. -

Funds

on Wednesday

sold

an estimated net 8,000 soybeans, sold

6,000 soybean meal and sold

3,000 soybean oil. -

The

EPA at any moment approve 2019 small refinery biofuel waivers. All 33 applicants could see approval amounting to roughly 1.1 billion gallons, which could be mostly ethanol.

-

Conab

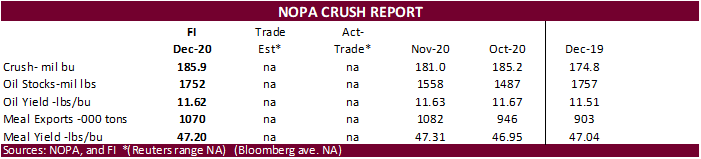

reported the Brazilian soybean crop at 133.7 million tons, 1 million tons above a Bloomberg trade guess and 0.8 million tons below their December estimate. Today we may see ongoing overnight corn/soybean spreading. Note NOPA is due out Friday (our trade

estimates below). -

Brazilian

truck drivers are planning a strike starting February 1st, which is not good timing as harvest will be running hard during that month. Some believe this strike might be the largest truck strike Brazil has ever seen. The last big strike crippled soybean movement

in 2018. That’s strike was over fuel costs. -

Argentina’s

producer strike ended after the government dropped their corn export registration restrictions.

-

China

cash crush margins improved on our calculation to 172 cents (143 previous), compared to 98 year ago. China announced they will import more Indonesian products and increase investments. This could include CPO.

-

China

bought one PNW November soybean cargo yesterday, and one Argentina May shipment. They also were thought to have bought a February cargo (unknown origin).

-

Indonesia

plans to import 2.6 million tons of soybeans this year (AgMin). -

Malaysian

palm oil traded at a two week low on slowing palm exports. Malaysia will leave its export duty for crude palm oil at the maximum 8% for February after calculating a reference price of 3,657.67 ringgit per ton.

- Under

the 24-hour announcement system, private exporters sold 464,300 tons of soybeans to unknown. Of that, 396,300 tons were for 2020-21 delivery and 68,000 tons for 2021-22.

- Algeria

seeks 35,000 tons of soybean meal on Thursday for Feb 15-Feb 28 shipment, optional origin. - The

USDA seeks 7,430 tons of vegetable oil under the PL480 program on January 14 for shipment during Feb 16 to Mar 15 (Mar 1-31 for plants at ports).

- USDA

seeks 6,390 tons of vegetable oil on January 20 under the PL480 program for March 1-31 shipment (Mar 16-Apr 15 for plants at ports).

Updated

1/12/21

March

soybeans are seen in a $13.25 and $15.00 range

March

soymeal is seen in a $430 and $500 range

March

soybean oil is seen in a 42.00 and 45.50 cent range

- Chicago

wheat hit a 2014 high overnight but set back on light fund long liquidation, producer selling, and lower soybeans. Paris wheat futures hit a new contract high on additional talk over Russia’s plan to increase their upcoming wheat export tax.

- We

heard there were wheat contracts being registered for delivery, maybe upwards to 800,000 bushels.

- Funds

on Wednesday

sold an

estimated net 5,000 Chicago wheat contracts. - EU

March milling wheat was up 2.25 at 226.75 euros, or 1 percent higher. - On

January 15, Russian officials will meet to discuss the export taxes on grains and oilseeds. Russian may expand their export tax beyond oilseed and wheat exports. Russia is considering a barley and corn export tax of 10 euros ($12) per ton and 25 euros per

ton, respectively, between Feb. 1 and March 31, 2021. The latest for wheat we heard was 70 euros / ton from March. Timing on the export duties should be clearer when the official meet on Friday.

- FranceAgriMer

estimated French soft wheat exports outside the European Union’s 27 at 7.27 million tons, down from 13.57 million tons last season. French 2020-21 soft wheat stocks were unchanged from the 2.5 million tons estimated in December.

-

We

picked up Bangladesh bought 50,000 tons of wheat at around $339.39/ton for shipment within 40 days of contract signing. It may have been Russian origin.

- Jordan

seeks 120,000 tons of wheat on January 13 for July-August shipment. They saw three participants.

-

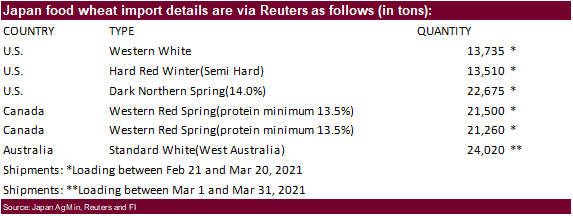

Japan

in a SBS auction seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival in Japan by March 18 on January 19.

-

Jordan

seeks 120,000 tons of feed barley on Jan 19. -

Japan

seeks 116,700 tons of food wheat this week.

-

Syria

seeks 200,000 tons of wheat on Jan 18 for shipment within 60 days after contract signing.

-

Turkey

seeks 400,000 tons of milling wheat on Jan 19 for Jan through Feb 25 shipment.

- Results

awaited: Syria seeks 25,000 tons of Black Sea wheat on January 11. - Bangladesh

seeks 50,000 tons of wheat in January 18 for shipment within 40 days of contract signing.

- Bangladesh

seeks 50,000 tons of wheat in January 25 for shipment within 40 days of contract signing.

-

(new

1/13) Bangladesh seeks 50,000 tons of rice on January 26. -

Bangladesh

seeks 10,000 tons of rice on January 18.

·

Bangladesh seeks 60,000 tons of rice on January 20.

·

Bangladesh seeks 50,000 tons of rice on Jan. 24.

·

South Korea seeks 113,555 tons of US, Thailand, and China rice on Jan 21 for April 30 through July 31 arrival.

·

Syria seeks 25,000 tons of rice on February 9.

Updated

1/12/21

March Chicago wheat is seen in a $6.35‐$7.15

range

March KC wheat is seen in a

$6.00‐$6.50 range

March MN wheat is seen in a $6.00‐$6.55 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.