PDF Attached

The

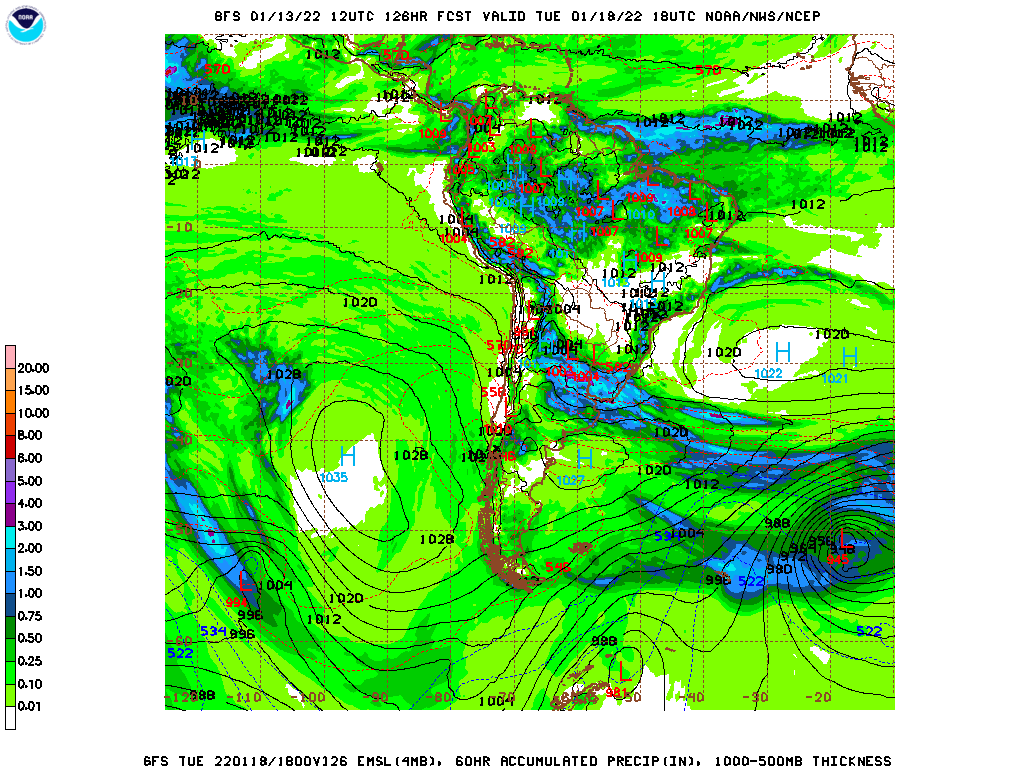

US will be on holiday Monday. The CBOT ag markets traded lower from selling ahead of the upcoming weekend rain event(s) for Argentina and southern Brazil. Additional downgrades to the Argentine and Brazilian crops did little to slow selling. News was light.

Morning weather models indicated improving conditions for Brazil (wetter south and less frequent rain central and northern areas). Argentina rains are still on deck for Sunday into early next week.

Weather

Maps

verified rain 16-18th for Argentina

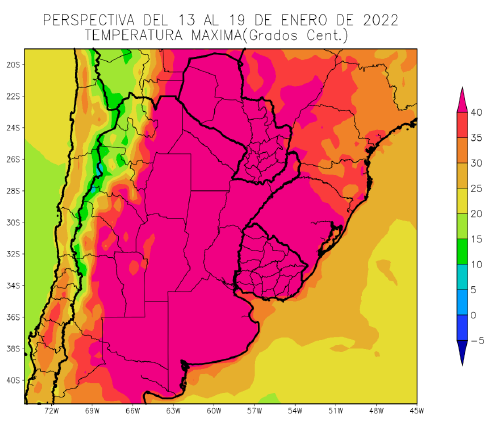

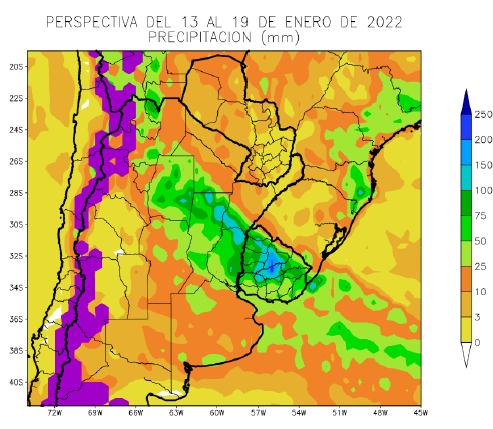

BA

Grains Exchange

BA

Grains Exchange

U.S.

WEATHER FORECASTER CPC: LA NIÑA LIKELY TO CONTINUE INTO THE SPRING (67% CHANCE DURING MARCH-MAY 2022) AND THEN TRANSITION TO ENSO-NEUTRAL (51% CHANCE DURING APRIL-JUNE 2022) – Reuters News

WEATHER

EVENTS AND FEATURES TO WATCH

- Argentina

temperatures Wednesday afternoon reached 100-110 degrees Fahrenheit (38-41C) similar to those of Tuesday, although readings to 106 were more common - High

temperatures in Buenos Aires were in the 90s with some upper 70s and 80s along the lower east coast - No

rain fell and soil moisture remains depleted from the topsoil and short to very short in the subsoil - Crop

and livestock stress was serious in most of the nation - Potential

yields in many crops are falling - Milk

production was declining because of the heat - Livestock

weight gains will decline, but the heat wave will only last into Saturday - Less

intensive Argentina rainfall was noted in today’s forecast model runs for early next week in northern Buenos Aires to San Luis relative to that of the mid-day and evening model runs of Wednesday - Dry

and hot conditions will prevail through Saturday morning - Daily

high temperatures of 100 to110 will occur daily with extremes of 110 to 116 Fahrenheit

- A

couple of hotter readings cannot be ruled out - Most

of the nation will receive rain from late Saturday of this week into Sunday, January 23, although rain does not fall in all areas every days - The

most significant rain will occur Monday into Wednesday with east-central and northeastern areas wettest - A

follow up rain event will occur late next week into the following weekend favoring central and southern areas - Rain

totals by Jan. 23 in some northeastern crop areas will vary from 2.00 to 4.00 inches and locally to 6.00 inches

- Central

and Southwestern Argentina rainfall will vary from 0.75 to 2.00 inches with some potential for locally more

- Weak

ridge building suggested by GFS model for Jan. 23-24 does not last long and breaks down Jan. 25-27 - European

and GFS Ensemble forecast models suggest zonal flow pattern aloft across Argentina Jan. 25-28, but higher heights than usual

- Showers

and thunderstorms should occur erratically during this period of time - World

Weather, Inc. does not see weather in Argentina as harsh as this week again for an extended period of time, although a ridge of high pressure is expected again in either late January or early February - Argentina’s

bottom line will remain extremely stressful through Saturday for all crops and livestock. Some recently planted grain and oilseed crops may have to be replanted or will be lost because of too much dryness and recent heat. Other crops with favorable root systems

have a good chance of recovering from this week’s stress if rain falls as significantly and generally as advertised during the late weekend and next week. Cooler temperatures Sunday through the end of next week will be a huge boon to the nation’s crops reducing

stress for all areas – even those that have to wait longer for significant rain to fall. Follow up rain will be critically important and a close watch on the situation is warranted. Some late season planting and replanting will occur immediately after rain

falls next week. - Brazil

weather already improved in the North Tuesday and Wednesday with lighter rainfall, greater sunshine and some warmer temperatures in the water-logged areas

- Brazil

weather is expected to be much improved for Mato Grosso, Tocantins, Bahia, Minas Gerais and Goias over the next two weeks with net drying for many areas initially and then a good mix of showers and sunshine in the second week of the forecast - Southern

Brazil rainfall will continue lighter than usual over the next ten days and possibly for two weeks, but there will be some periodic shower activity - Crop

conditions should stay mostly good, but there will be some concern about less than usual precipitation as time moves along - Southern

and some western Rio Grande do Sul crop areas will get rain briefly next week that will improve topsoil moisture for rice and corn

- Northern

Rio Grande do Sul and areas north and west into Parana, Paraguay and Mato Grosso do Sul will likely see a more erratic and light rainfall pattern that might eventually return the need for greater rain - Brazil

temperatures are expected to be near to slight above normal this weekend through all of next week - Much

of Paraguay is unlikely to see “significant” relief to its dry bias, although some showers will occur

- The

bottom line for Brazil is mostly good for its crops, although there will be some watchful eyes on interior southern parts of the nation where the ground may dry out more significantly during the coming ten days in response to some ridge building limiting rainfall

and keeping temperatures a little warm biased. Similar conditions farther north in Brazil will translate into a much improved early soybean and corn maturation and harvest environment. Safrinha corn and cotton planting should occur quickly as soybean harvesting

advances. Rainfall should resume in center west, center south and northeastern Brazil after Jan. 20, but it will not be nearly as great as it has been. - U.S.

weather is expected to continue dry biased in the Great Plains and much of the western states during the next ten days with less rain in the interior Pacific Northwest as well - California

weather will include some showers to the far north periodically, but most of the precipitation will be lighter than usual - A

succession of cool air masses will impact the central and eastern parts of North America beginning this weekend and continuing through the following weekend keeping temperatures in a seasonable range

- Western

North America (including Canada) will experience warmer than usual weather

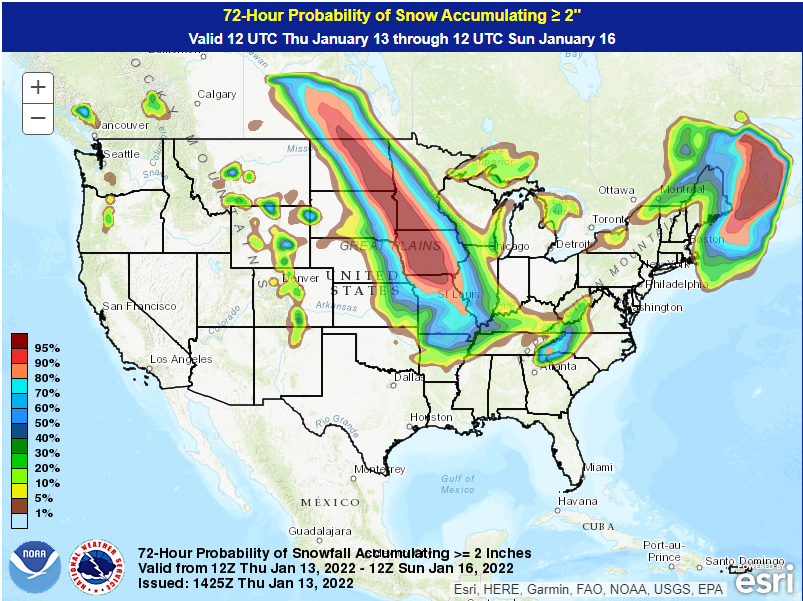

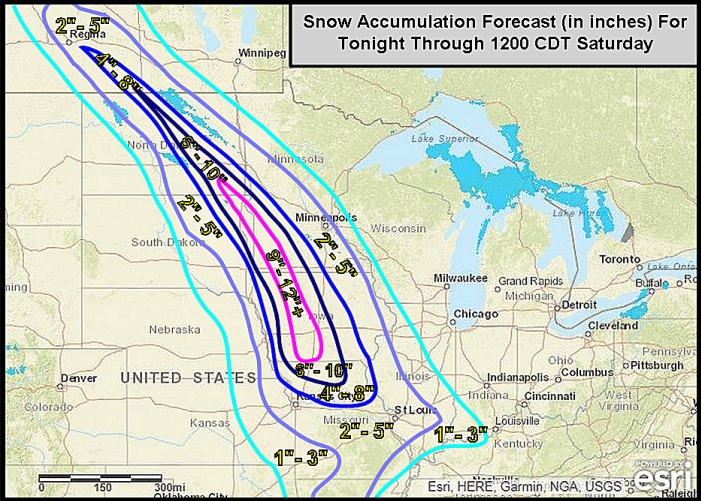

- A

snow event expected from North Dakota to Missouri and parts of Illinois, Kentucky and Indiana tonight into Saturday will leave behind a swath of significant snowfall - Accumulations

of 2 to 8 inches and local totals of 8-12 will be possible - A

nor’easter of sorts is expected to impact the Atlantic Coast states this Sunday and Monday - Significant

rain will fall along the coast while interior areas of the northeastern states will experience heavy snowfall

- Some

areas in the lower and eastern Midwest into New York, New England and southeastern Quebec, Canada may get 6 to 14 inches of snow - New

South Wales, Australia will receive periodic showers and thunderstorms over the next ten days supporting cotton, sorghum and other summer crops - This

weekend through Jan. 23 will be wettest - Rainfall

of 0.35 to 1.00 and a few 1.00 to 3.00-inch amounts are expected by mid-week next week with similar amounts in the following seven days - Queensland,

Australia will get showers and thunderstorms next week and then see greater rainfall possibly Jan. 21-27 - Rain

totals in this first week of the outlook will vary from 0.30 to 1.00 inch with a few 1.00 to 2.00-inch amounts - Greater

rain is needed for dryland crop production areas and most livestock areas - Queensland

rainfall may begin to increase in the middle to latter part of next week while rain continues in New South Wales - The

moisture boost will be a boon to summer crops - Australia

temperatures will be warmer than usual in western Queensland, western New South Wales and neighboring areas where rainfall may not be as great as needed to protect livestock grazing areas from further deterioration through the weekend - Rain

is needed on these areas - Australia’s

bottom line is one of needed rain in Queensland’s unirrigated grain, oilseed and cotton areas as well as all of eastern Australia’s livestock country, but especially in the west. No serious changes to dryness in western parts of Queensland or New South Wales

will occur in the coming week, but some relief is expected in the January 20-26 period.

- South

Africa rainfall will be well distributed during the next two weeks with all crop areas impacted at one time or another - Limpopo

may be driest in this first week of the outlook - Yield

potentials remain high and “some” of the worry over wet weather diseases has been reduced with less rainfall recently - India

weather the remainder of this week will support more rain in southeastern parts of the nation expanding the area benefiting from recent significant moisture - The

precipitation will be greatest in Chhattisgarh, Odisha and northeastern Andhra Pradesh where rainfall will range from 0.50 inch to 1.50 inches with local totals over 2.00 inches

- Net

drying is expected elsewhere, but especially in the western half of the nation - Canada’s

Prairies will be warmer than usual over the coming week and then a little colder especially in the east

- Canada’s

southwestern Prairies are still drier than usual with moisture totals less than 0.25 inch over the next two weeks

- Snow

cover is still limited in east-central and southern Alberta and central, west-central and southwestern parts of Canada’s Prairies - This

is the most seriously drought stricken part of the Prairies and not much relief is likely prior to spring - Europe

precipitation during the next two weeks will be restricted especially in the western half to two-thirds of the continent in this first week of the outlook - Spain

and perhaps a part of Romania are the only areas that would benefit greatly from more significant precipitation, but restricted amounts are expected for a while - Soil

moisture is likely to be favorable across the continent during the next two weeks, despite limited precipitation - There

will be no threatening cold weather - Western

Russia, Belarus, Ukraine and Baltic States will get light and sporadic precipitation through the weekend with a boost in snow and a little rain next week - There

will be no threatening cold temperatures in the first week of the outlook, but cooling is expected Jan. 21-27 that would threaten crops if there was no snow, but snow cover will be widespread in the coldest areas and it will be sufficient protection for the

coldest areas to protect wheat - North

Africa precipitation will be limited during the next ten days with only a few showers likely in northeastern Algeria and Tunisia

- Southwestern

Morocco continues to be in a notable multi-year drought while dryness is also a concern in northwestern Algeria - Crops

elsewhere are doing relatively well - China’s

weather will continue mostly uneventful for a while, although periods of rain and a little snow will impact the Yangtze River Basin and interior southeastern provinces during the next couple of weeks.

- The

moisture will preserve the integrity of the 2022 rapeseed and southern wheat crops - Snow

will fall periodically in the far northeast while the Yellow River Basin and southern coastal provinces receive little to no precipitation - The

southern coastal provinces will eventually become too dry and this may lead to some concern about early rice planting in March, but there is plenty of time for change - Temperatures

will be near to slightly warmer than usual - Southeast

Asia oil palm, citrus, sugarcane, coffee, cocoa, rice and other crop areas of Indonesia, Malaysia and Philippines will receive frequent bouts of rain over the next two weeks - Some

heavy rain is possible, but no serious widespread flood problem is expected - Local

flooding will be possible, though - Eastern

Malaysia and southern Philippines will be wettest in the next ten days - Mainland

areas of Southeast Asia will be mostly dry during the next ten days except Vietnam coastal areas where some moderate rain will be possible late this week and into the weekend - Northernmost

Laos and northern Vietnam coffee, rice and other crop areas will get some rain late this week and especially Saturday through Monday, Jan. 17. - Another

round of rain will impact the same region Jan. 19-23 - West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual - East-central

Africa rainfall will be erratic, but it is expected daily through the next ten days supporting coffee, cocoa, rice sugarcane and other crops - Greater

rain is expected in Uganda and southwestern Kenya over the next ten days and the change will be welcome - Middle

East precipitation has been increasing with improved soil moisture likely over the next ten days - Some

beneficial moisture has already occurred in Pakistan, Afghanistan, Iraq and Iran - Winter

crops will benefit from whatever rain falls, but it is not expected to be evenly distributed for a while - Mexico

weather will trend wetter in southern parts of the nation for a little while this week

- Most

other areas will be dry for the next week - Northern

Mexico “may” get some rain after January 19. - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica during the next ten days - A

few showers will occur in Guatemala periodically as well, although rainfall will be light - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Interior

Colombia and many areas in Venezuela have received less than usual precipitation in the past 30 days, but the greatest dryness may be outside of key crop areas - Today’s

Southern Oscillation Index was +5.64 and it was expected to slowly level off over the next few days, although some additional decline is probable.

- New

Zealand rainfall is expected to continue getting less than usual precipitation this week with temperatures near to above normal

- Some

forecast models have suggested remnants of Tropical Cyclone Cody may come close enough to eastern parts of North Island to produce some heavy rainfall this weekend, but confidence is low.

Source:

World Weather, inc.

Thursday,

Jan. 13:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Suedzucker

quarterly earnings - Agrana

nine- month earnings - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

Jan. 14:

- China’s

December trade data - ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

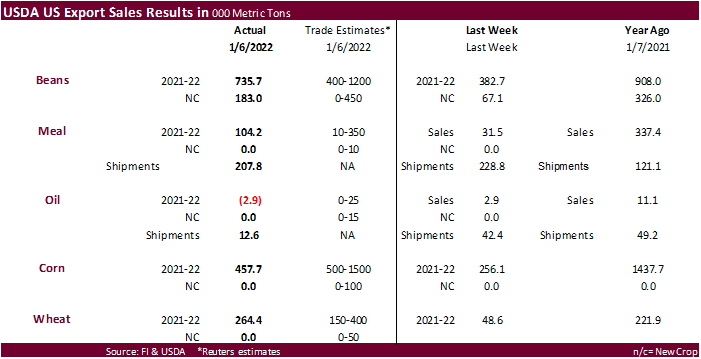

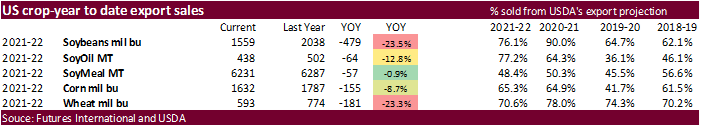

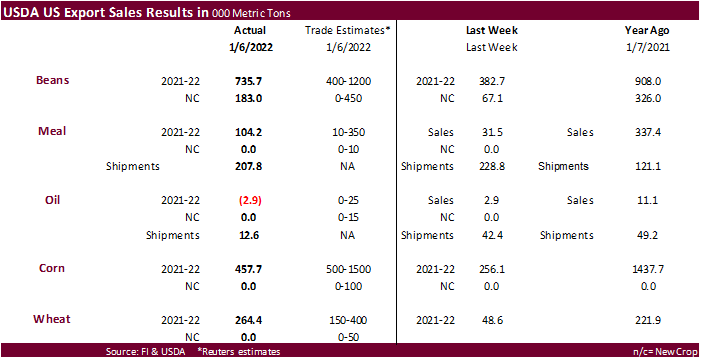

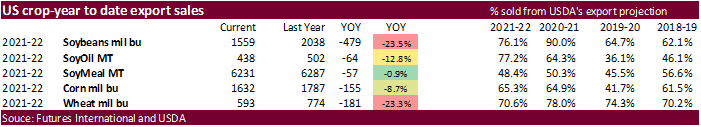

USDA

Export Sales

China

showed up for soybeans, sorghum, and cotton. USDA soybean export sales were ok for soybeans at 735,700 tons, but below average for this time of year. New crop sales of 183,000 tons were as expected. Meal and soybean oil sales were poor. Corn export sales

fell short of a range of expectations, below 500,000 tons, and wheat was only 264,400 tons with nothing posted for new-crop. Overall bearish, IMO.

Macros

US

PPI Final Demand (M/M) Dec: 0.2% (est 0.4%; prev 0.8%)

–

PPI Final Demand (Y/Y) Dec: 9.7% (est 9.8%; prev 9.6%)

–

PPI Ex-Food, Energy (M/M) Dec: 0.5% (est 0.5%; prev 0.7%)

–

PPI Ex-Food, Energy (Y/Y) Dec: 8.3% (est 8.0%; prev 7.7%)

US

Initial Jobless Claims Jan 8: 230K (est 200K; prev 207K)

–

Continuing Claims Jan 1: 1559K (est 1733K; prev 1754K; prevR 1753K)

US

PPI Final Demand For December 2021 – Official Report

The

Producer Price Index for final demand increased 0.2 percent in December, seasonally

adjusted,

the U.S. Bureau of Labor Statistics reported today. This rise followed advances of 1.0

percent

in November and 0.6 percent in October. (See table A.) On an unadjusted basis, final

demand

prices moved up 9.7 percent in 2021, the largest calendar-year increase since data were

first

calculated in 2010.

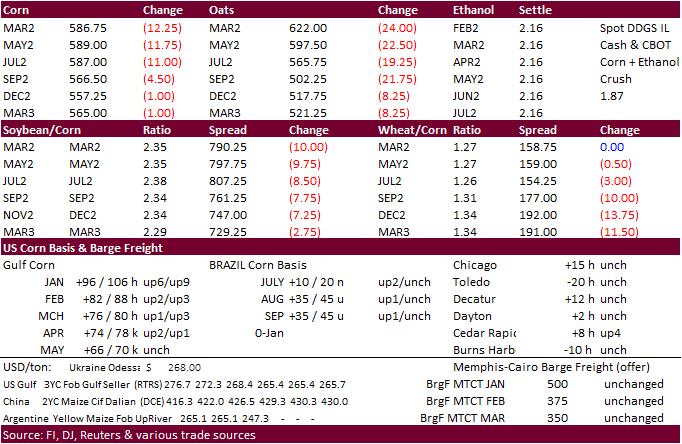

Corn

·

CBOT corn traded lower, following wheat and soybeans, despite additional downgrades to Argentina and Brazil corn production. Longs were liquidating ahead of the long US holiday weekend.

·

March corn trade at its lowest level since January 3, through its 50-day MA, where some buying showed up.

·

USD was 12 points lower as of 1:05 pm CT and WTI crude down 19 cents (back months were higher).

·

Argentina’s Rosario Grains Exchange lowered their Argentina corn crop by 8 million tons to only 48 million. USDA is at 54 million tons for Argentina corn.

·

Argentina’s Buenos Aires grains exchange has yet to cut their estimate but it’s coming. Today they trimmed the soybean planting area by 100,000 hectares to a total 16.4 million hectares due to dry weather.

·

Agroconsult estimated the Brazil corn crop at 119.4 million tons (24.5MMT first crop), down from a late November projection of 124 million tons. Conab is at 112.9 million and USDA at 115 million tons.

·

The Baltic Dry Index was down 7.6% to 1,873 points.

Comparing

Brazilian (1st and 2nd Crops), American, and Argentine Corn Yields

EIA

expects gasoline and diesel prices to fall in 2022 and 2023 as demand growth slows

https://www.eia.gov/todayinenergy/detail.php?id=50878&src=email

Export

developments.

South

Korea’s MFG group seeks 140,000 tons of corn on January 14 for arrival around April 23.

Updated

1/10/22

March

corn is seen in a $5.70 to $6.20 range

·

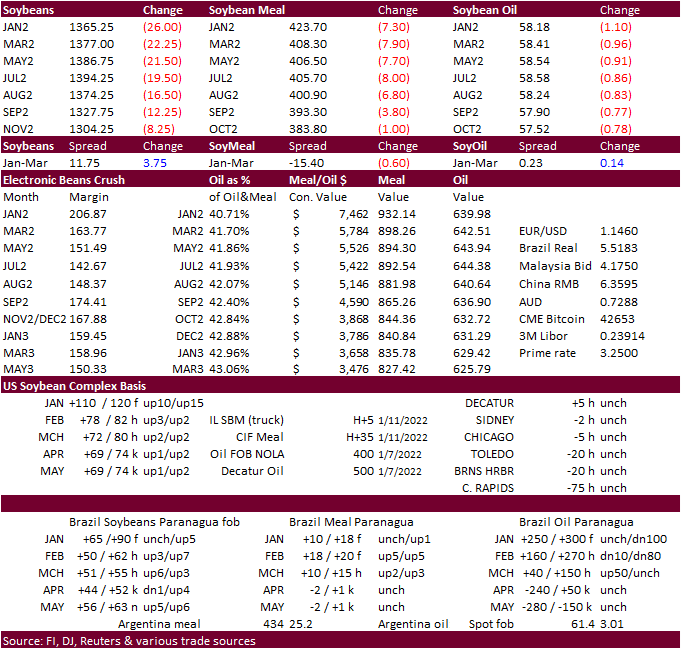

CBOT soybean complex traded sharply lower from a general commodity selloff and expectations for rain across the dry areas of South America over the weekend into early next week. Additional downgrades to Brazil and Argentina soybean

production did little to support prices. March soybeans gave up yesterday’s gains and grind further lower. We see March support near the 13.51 area, around its 20-day MA. Soybean meal and soybean oil both traded lower, with soybean oil slightly gaining on

soybean meal.

·

Agroconsult estimated the Brazil soybean crop at 134.2 million tons, down from a late November projection of 144.3 million tons. Conab is at 140.5 million and USDA at 139.0 million tons. They noted the average yield could reach

a 6-year low.

·

Argentina’s Rosario Grains Exchange lowered their Argentina soybean crop from 45 to 40 million tons, above USDA’s 46.5 MMT estimate. They also warned producers could see a $2.9 billion hit from drought conditions.

·

Temperatures will remain hot in Argentina but will ease by Sunday.

·

The morning weather models indicated improving conditions for Brazil (wetter south and less frequent rain central and northern areas).

·

US soybean meal rail basis was down $3/short ton at Chicago, Decatur (IL) and Morristown (IN) locations.

·

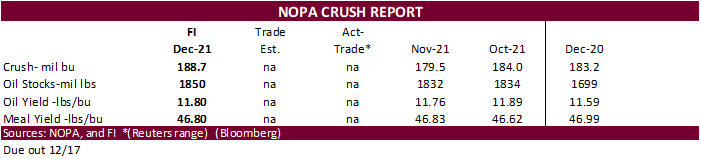

Malaysian palm futures traded higher by 121 ringgit to 5,040, at a 10-week high.

·

NOPA’s December crush report will be released on Tuesday due to the Federal US holiday.

Export

Developments

·

The USDA seeks 7,540 tons of vegetable oil in 4-liter cans for Feb 16-Mar 15 shipment on January 19.

Updated

1/10/22

Soybeans

– March $13.00-$14.25

Soybean

meal – March $370-$435

Soybean

oil – March 54.50-61.00

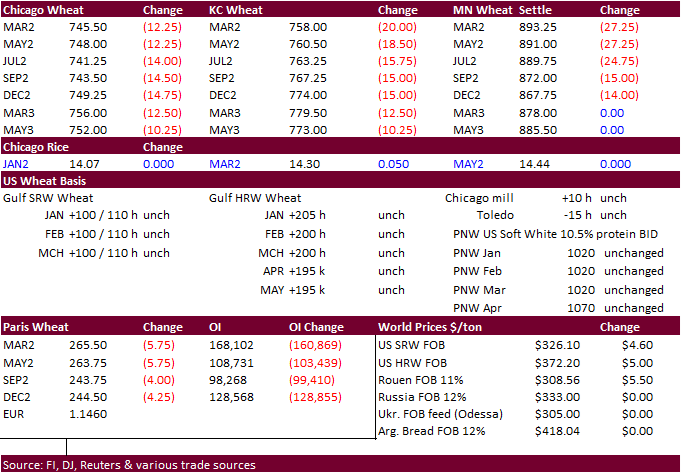

·

US wheat traded

sharply lower led by the Minneapolis contract, in part to a weather forecast calling for precipitation across the US. Not all wheat areas will see precipitation. The west-central and southern Great Plains badly needs rain. Some traders noted some of the weakness

in today’s trade was Iraq choosing Australian wheat over the US for their import tender. USDA export sales were poor.

·

Results awaited on a few import tenders for the balance of the week.

·

The USD was down again today but that did little to limit losses.

·

EU wheat basis the March position was 5.75 lower at 265.75 eros a ton.

·

Strategie Grains lowered their European Union soft wheat exports for 2021-22 to 31.2 MMT from 31.5 MMT due to strong competition from Argentina and Black Sea countries in Africa.

·

(Reuters) – The International Grains Council (IGC) on Thursday raised its forecast for 2021/22 global wheat production, partly driven by an improved outlook for the crop in Australia. In its monthly update, the inter-governmental

body increased its 2021/22 world wheat crop outlook by four million tons to 781 million tons. The IGC also cut its forecast for global corn (maize) production in the 2021/22 season by 5 million tons to 1.207 billion tons with projections for Argentina and

Brazil downwardly revised.

·

A welcome snow event for parts of the central and upper winter wheat country will occur Thursday through Saturday.

Source:

World Weather Inc.

·

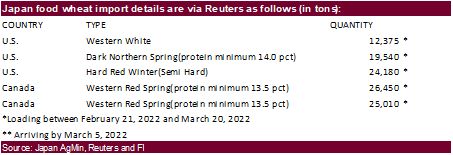

Iran’s GTC bought 240,000 tons of milling wheat (60k sought) for Feb-Mar shipment.

·

Postponed until Friday: Algeria seeks milling wheat for FH March shipment.

·

Japan bought 107,555 tons of milling wheat. Original tender details as follows:

·

Results awaited: Japan in a SBS imported tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on January 13 for arrival in Japan by March 17.

·

Results awaited: China plans to sell 500,000 tons of wheat from state reserves on January 12 to flour millers.

·

Jordan seeks 120,000 tons of wheat on January 18. Possible shipment combinations are in 2022 between July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Turkey seeks 335,000 tons of milling wheat on January 18.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on January 16.

Updated

1/10/22

Chicago

March $7.20 to $8.40 range

KC

March $7.55 to $8.75 range

MN

March $8.75‐$10.00

China showed up for soybeans, sorghum and cotton. USDA soybean export sales were ok for soybeans at 735,700 tons, but below average for this time of year. New crop sales of 183,000 tons were as expected.

Meal and soybean oil sales were poor. Corn export sales fell short of a range of expectations, below 500,000 tons, and wheat was only 264,400 tons with nothing posted for new-crop. Overall bearish, IMO.

U.S. EXPORT SALES FOR WEEK ENDING 1/6/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

38.4 |

2,041.2 |

1,446.4 |

92.5 |

4,318.3 |

5,770.9 |

0.0 |

14.0 |

|

SRW |

65.9 |

679.9 |

499.2 |

75.8 |

1,698.0 |

1,087.8 |

0.0 |

37.0 |

|

HRS |

96.2 |

1,259.6 |

1,816.4 |

57.6 |

3,076.6 |

4,294.9 |

0.0 |

0.0 |

|

WHITE |

30.9 |

805.6 |

2,456.5 |

32.5 |

2,101.3 |

3,098.5 |

0.0 |

0.0 |

|

DURUM |

33.0 |

54.2 |

100.8 |

0.0 |

112.7 |

488.9 |

0.0 |

33.0 |

|

TOTAL |

264.4 |

4,840.5 |

6,319.3 |

258.4 |

11,307.0 |

14,741.0 |

0.0 |

84.0 |

|

BARLEY |

0.0 |

19.0 |

13.7 |

0.0 |

11.5 |

16.9 |

0.0 |

0.0 |

|

CORN |

457.7 |

25,790.0 |

28,661.5 |

1,011.8 |

15,664.6 |

16,720.6 |

0.0 |

1,512.0 |

|

SORGHUM |

20.9 |

3,576.3 |

3,219.2 |

139.6 |

1,752.6 |

2,059.5 |

0.0 |

0.0 |

|

SOYBEANS |

735.6 |

10,803.7 |

14,561.1 |

1,020.1 |

31,633.7 |

40,911.7 |

183.0 |

466.1 |

|

SOY MEAL |

104.2 |

2,880.4 |

2,822.8 |

207.8 |

3,350.2 |

3,464.7 |

-0.7 |

35.5 |

|

SOY OIL |

-2.9 |

232.6 |

247.9 |

12.6 |

205.1 |

254.3 |

-0.1 |

0.3 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

0.0 |

175.4 |

202.9 |

1.7 |

584.0 |

787.0 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

10.5 |

15.6 |

0.3 |

3.2 |

13.3 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

3.7 |

10.5 |

0.2 |

27.3 |

22.7 |

0.0 |

0.0 |

|

M&S BR |

0.5 |

67.7 |

45.3 |

1.1 |

16.5 |

50.7 |

0.0 |

0.0 |

|

L G MLD |

18.4 |

64.7 |

72.2 |

11.7 |

404.6 |

298.0 |

0.0 |

0.0 |

|

M S MLD |

2.4 |

100.7 |

171.5 |

2.4 |

181.6 |

211.0 |

0.0 |

0.0 |

|

TOTAL |

21.3 |

422.7 |

518.1 |

17.3 |

1,217.1 |

1,382.7 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

401.0 |

7,789.8 |

6,066.2 |

167.6 |

3,204.4 |

5,798.0 |

38.3 |

1,152.5 |

|

PIMA |

2.4 |

225.2 |

243.1 |

9.3 |

154.0 |

352.7 |

0.0 |

5.3 |

This

summary is based on reports from exporters for the period December 31, 2021 – January 6, 2022.

Wheat: Net

sales of 264,400 metric tons (MT) for 2021/2022 were up noticeably from the previous week, but down 20 percent from the prior 4-week average. Increases primarily for the Philippines (50,000 MT), Mexico (42,300 MT, including decreases of 18,500 MT), Algeria

(33,000 MT), Japan (26,800 MT), and Jamaica (22,000 MT), were offset by reductions primarily for the French West Indies (11,500 MT). Exports of 258,400 MT were up 23 percent from the previous week and 2 percent from the prior 4-week average. The destinations

were primarily to Japan (60,300 MT), Indonesia (60,300 MT), Mexico (56,100 MT), Nicaragua (33,000 MT), and Taiwan (28,500 MT).

Corn:

Net sales of 457,700 MT for 2021/2022 were up 79 percent from the previous week, but down 59 percent from the prior 4-week average. Increases primarily for Mexico (278,800 MT, including decreases of 20,600 MT), Japan (233,000 MT, including 101,500 MT switched

from unknown destinations), China (70,200 MT, including 68,000 MT switched from unknown destinations), Canada (27,000 MT, including decreases of 1,100 MT), and Nicaragua (16,900 MT), were offset by reductions primarily for unknown destinations (216,300 MT).

Exports of 1,011,800 MT were up 3 percent from the previous week, but down 1 percent from the prior 4-week average. The destinations were primarily to Mexico (347,800 MT), China (274,700 MT), Japan (131,700 MT), Saudi Arabia (73,300 MT), and Costa Rica (49,300

MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 381,000 MT is for unknown destinations (309,000 MT), Italy (63,000 MT), and Saudi Arabia (9,000 MT).

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales of 20,900 MT for 2021/2022 resulting in increases for China (143,900 MT, including 68,000 MT switched from unknown destinations and decreases of 500 MT), were offset by reductions for unknown destinations (123,000 MT). Exports of 139,600 MT were

up 88 percent from the previous week, but down 18 percent from the prior 4-week average. The destinations were to China (139,300 MT) and Mexico (300 MT).

Rice:

Net sales of 21,300 MT for 2021/2022 were down 23 percent from the previous week and 63 percent from the prior 4-week average. Increases were primarily for Haiti (16,200 MT), Canada (2,300 MT), Mexico (1,100 MT, including decreases of 200 MT), Belgium (500

MT), and New Zealand (300 MT). Exports of 17,300 MT were down 68 percent from the previous week and 63 percent from the prior 4-week average. The destinations were primarily to Haiti (7,200 MT), Mexico (5,500 MT), Canada (2,500 MT), Taiwan (1,100 MT), and

Belgium (500 MT).

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 735,600 MT for 2021/2022 were up 92 percent from the previous week, but down 1 percent from the prior 4-week average. Increases primarily for China (301,800 MT, including 264,000 MT switched from unknown destinations and decreases of 1,200 MT),

Mexico (187,900 MT, including decreases of 1,400 MT), Egypt (175,800 MT, including 57,500 MT switched from China and decreases of 3,700 MT), Bangladesh (57,500 MT, including 55,000 MT switched from unknown destinations), and Indonesia (33,900 MT, including

decreases of 200 MT), were offset by reductions primarily for unknown destinations (109,000 MT). Net sales of 183,000 MT for 2022/2023 were for unknown destinations (120,000 MT) and China (63,000 MT). Exports of 1,020,100 MT were down 42 percent from the

previous week and 43 percent from the prior 4-week average. The destinations were primarily to China (489,000 MT, including 69,500 MT – late), Mexico (107,700 MT), Egypt (106,800 MT), Pakistan (68,800 MT), and Spain (59,900 MT).

Export

for Own Account:

For 2021/2022, exports for own account totaling 59,900 MT to Canada were applied to new or outstanding sales. Decreases of 100 MT were reported for Canada. The current exports for own account outstanding balance is 3,000 MT, all Canada.

Late

Reporting:

For 2021/2022, exports totaling 69,500 MT of soybeans were reported late to China.

Soybean

Cake and Meal:

Net sales of 104,200 MT for 2021/2022 were up noticeably from the previous week, but down 16 percent from the prior 4-week average. Increases primarily for Mexico (26,200 MT, including decreases 1,000 MT), Morocco (24,000 MT), Colombia (22,300 MT, including

15,000 MT switched from unknown destinations and decreases of 23,000 MT), Canada (18,200 MT, including decreases of 1,400 MT), and the Dominican Republic (11,500 MT), were offset by reductions primarily for unknown destinations (13,000 MT). Net sales reductions

of 700 MT for 2022/2023 resulting in increases for Canada (1,900 MT), were more than offset by reductions for the Netherlands (2,000 MT) and Japan (700 MT). Exports of 207,800 MT were down 9 percent from the previous week and 16 percent from the prior 4-week

average. The destinations were primarily to Colombia (77,900 MT), the Philippines (48,300 MT), Mexico (32,600 MT), Canada (29,200 MT), and Guatemala (9,500 MT).

Optional

Origin Sales: For 2021/2022, the current outstanding balance of 50,000 MT is for Venezuela.

Soybean

Oil:

Net sales reductions of 2,900 MT for 2021/2022–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Increases reported for South Korea (300 MT) and the Dominican Republic (200 MT), were more than offset by

reductions for Canada (3,000 MT) and India (400 MT).

Total net sales reductions of 100 MT for 2022/2023 were for Canada. Exports of 12,600 MT were down 70 percent from the previous week and 28 percent from the prior 4-week average. The destinations were to the Dominican Republic (9,200 MT), Mexico (1,600 MT),

Colombia (1,500 MT), and Canada (300 MT).

Cotton:

Net sales of 401,000 RB for 2021/2022 were up noticeably from the previous week and up 85 percent from the prior 4-week average. Increases were primarily for China (139,500 RB), India (74,700 RB), Turkey (53,200 RB), Pakistan (38,400 RB), and Vietnam (36,600

RB, including 300 RB switched from China). Net sales of 38,300 RB for 2022/2023 were primarily for Pakistan (36,500 RB). Exports of 167,600 RB were up 60 percent from the previous week and 27 percent from the prior 4-week average. The destinations were

primarily to China (59,000 RB), Vietnam (26,900 RB), Turkey (19,400 RB), Mexico (18,000 RB), and Pakistan (13,700 RB). Net sales of Pima totaling 2,400 RB were down 46 percent from the previous week and 49 percent from the prior 4-week average. Increases

were primarily for China (1,700 RB), Pakistan (300 RB), and Brazil (300 RB). Exports of 9,300 RB were up 29 percent from the previous week and 37 percent from the prior 4-week average. The destinations were primarily to Peru (4,800 RB), Indonesia (1,700

RB), India (1,600 RB), China (500 RB), and Vietnam (400 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the

current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales for the 2022 marketing year, which began January 1, totaled 188,800 pieces, primarily for China (124,500 whole cattle hides, including decreases of 13,500 pieces), Mexico (17,000 whole cattle hides, including decreases of 400 pieces), South Korea

(16,800 whole cattle hides, including decreases of 1,000 pieces), Taiwan (16,400 whole cattle hides), and Indonesia (10,300 whole cattle hides, including decreases of 100 pieces), were offset by reductions for Thailand (8,400 pieces). Net sales reductions

of 400 pieces were carried over from the 2021 marketing year, which ended December 31. Exports for the period ending December 31 of 195,200 pieces brought accumulated exports to 20,003,400 pieces, down 6 percent from the prior year’s total of 21,233,400 pieces.

The destinations were primarily to China (132,800 pieces), South Korea (18,100 pieces), Thailand (18,000 pieces), Mexico (13,800 pieces), and Brazil (5,700 pieces).

Net

sales for 2022 marketing year, which began January 1, totaled 31,300 wet blues primarily for China (8,800 unsplit, including decreases of 1,000 pieces), Vietnam (8,800 unsplit), Thailand (5,600 unsplit), Taiwan (5,100 unsplit), and Mexico (1,700 unsplit),

were offset by reductions for Italy (100 unsplit). In addition, net sales of 200 grain splits were reported for Italy. There were no net sales carried over from the 2021 marketing year which ended on December

31.

Exports for the period ending December 31 of 32,800 wet blues brought accumulated exports to 6,929,900 wet blues, up 15 percent prior year total of 6,040,100 wet blues. The primary destinations were China (16,800 unsplit), Italy (8,000 unsplit), and Vietnam

(8,000 unsplit). Net sales of splits totaling 296,000 pounds for 2022 marketing year were for China. Accumulated exports of splits in 2021 totaled 19,559,400 pounds, up 17 percent from the prior year’s total of 16,779,200 pounds. Exports of 41,000 pounds

were to China.

Beef:

Net sales for 2022 marketing year, which began January 1, totaled 9,700 MT primarily for Japan (2,600 MT, including decreases of 300 MT), Mexico (1,400 MT), South Korea (1,400 MT, including decreases of 500 MT), China (1,100 MT, including decreases of 400

MT), and Egypt (500 MT), were offset by reductions for the United Arab Emirates (100 MT). Net sales of 900 MT were carried over from the 2021 marketing year, which ended December 31. Exports for the period ending December 31 of 8,600 MT brought accumulated

exports to 925,100 MT, up 9 percent from the prior year total of 851,800 MT. The primary destinations were to South Korea (3,100 MT), Japan (1,900 MT), China (1,700 MT), Taiwan (500 MT), and Mexico (500 MT).

Pork:

Net sales for 2022, which began January 1, totaled 19,800 MT primarily for Mexico (10,100 MT, including decreases of 300 MT), Japan (3,100 MT, including decreases of 500 MT), South Korea (2,100 MT, including decreases of 600 MT), China (1,400 MT, including

decreases of 400 MT), and Canada (1,300 MT, including decreases of 500 MT), were offset by reductions for Peru (200 MT) and the Philippines (100 MT). Net sales reductions of 3,100 MT was carried over from the 2021 marketing year, which ended December 31.

Exports for the period ending December 31 of 20,500 MT brought accumulated exports to 1,791,700 MT, were down 8 percent from the prior year total of 1,938,000 MT. The primary destinations were to Mexico (10,700 MT), China (2,800 MT), Japan (2,800 MT), South

Korea (1,500 MT), and Canada (900 MT).

January

13, 2022 1 FOREIGN AGRICULTURAL SERVICE/USDA

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.