The

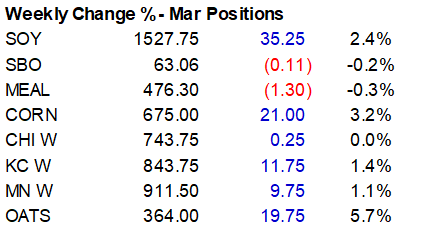

soybean complex ended mixed, with soybeans higher and products lower. Corn finished higher on follow through buying and wheat closed mixed. CBOT agriculture products open at 7:00 PM CT Monday.

https://www.cmegroup.com/trading-hours.html#foi=F&tradeDate=2023-01-16&pageNumber=1&sortBy=name&subGroups=5

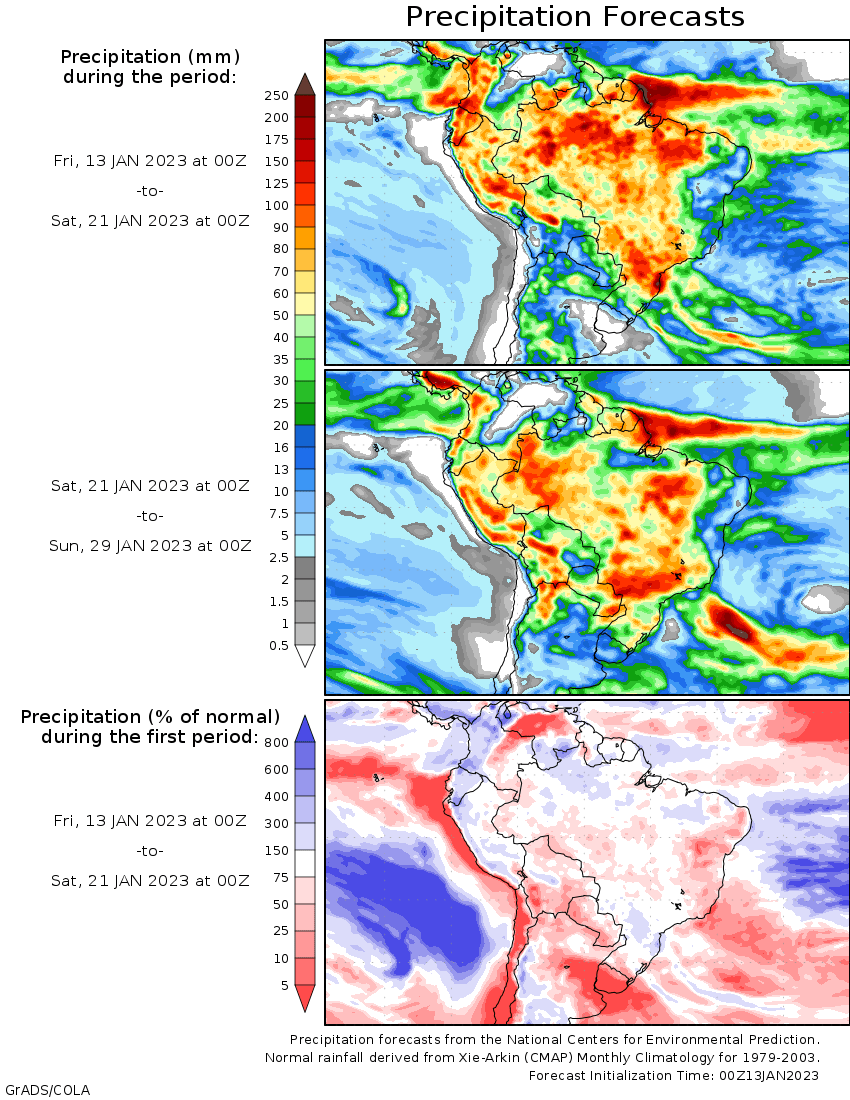

Largely

unchanged SA and US weather forecast updated Friday. Argentina will see some light rain across Cordoba and Santa Fe through early today before dry weather sets in through Tuesday. Argentina may see rain late next week. Brazil will see rain favoring Mato Grosso,

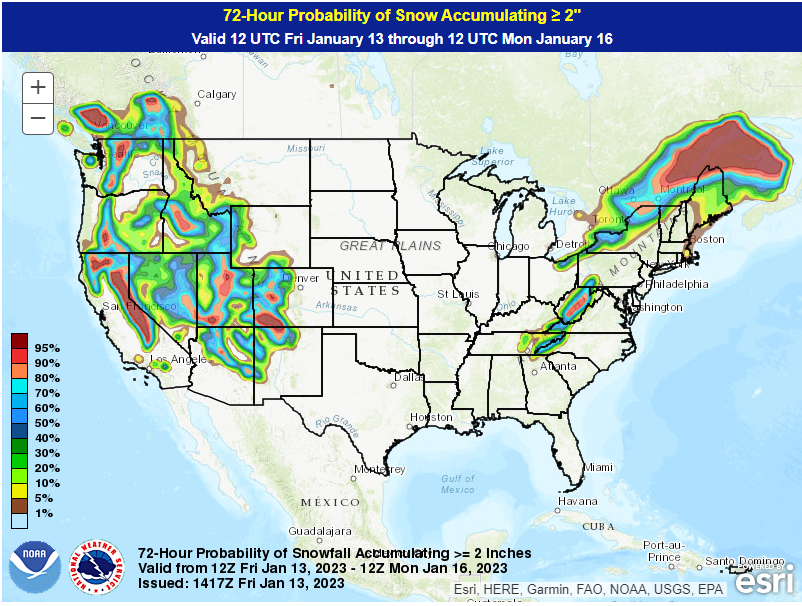

Goias, Mato Grosso do Sul, Sao Paulo, Parana, Santa Catarina, and the dry southern state of Rio Grande do Sul. Brazil’s west central and southern areas will generally see good rain through early next week. The US Midwest will see snow across the northwest

Monday and rains for the centra and southern areas. The ECB will see additional rain next week. The US Great Plains will see light rain for northern NE on Monday while other areas will remain dry. Later next week the GP may see precipitation.

World

Weather, INC.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

U.S.

hard red winter wheat production areas will encounter precipitation events during mid-week next week and in the following weekend -

The

precipitation is expected to be light and welcome, but not enough to break down drought -

Colder

air developing in the region during the second week of the forecast will shut down the precipitation chances and allow drying to occur again for a while -

No

serious change to drought is likely in West or South Texas during the next couple of weeks -

Rain

and snow will impact a part of the U.S. Midwest and central through the northeastern Plains next week and the moisture will be welcome, but could leave behind a little strip of significant snow -

U.S.

Delta, Tennessee River Basin, southeastern states and eastern Midwest will encounter periods of rain during the next two weeks improving soil moisture for some areas and maintaining moisture abundance in other areas -

California’s

stormy weather pattern will prevail for another week, but a turn toward colder and drier air will evolve late next week and into the following weekend -

Watch

for possible freezes in southern California late next week that might threaten some fruit and vegetable crops -

Northwestern

U.S. Plains and Canada’s Prairies precipitation will be limited for a while in this coming week to ten days -

North

America temperatures will be warmer than usual for another week except in the western U.S. where readings will be near to below average -

Colder

weather is expected in central and eastern parts of North America during the final days of January and early February -

This

change should also induce below average precipitation in the western and central parts of the nation

-

Northern

Argentina received some significant rain Thursday and early today -

Areas

from Tucuman, southern Salta and northern Cordoba to Chaco and Corrientes were impacted -

Rainfall

of 0.30 to 1.30 inches occurred most often with more than 4.60 inches occurring near the Tucuman/Santiago del Estero border -

A

few other showers occurred in southern Santa Fe and neighboring areas with rainfall of 0.30 inch or less while most of central and southern Argentina was dry -

Argentina’s

hot weather abated Thursday except in the far north where a few extremes of upper 90s to 106 Fahrenheit occurred one last day -

Some

afternoon temperatures in Cordoba were limited to the upper 60s and lower 70s -

Northern

Argentina rain will end today with dry weather likely in most other areas through the middle of next week -

Argentina’s

next best opportunity for rain comes late next week and into the following weekend at which time 65% of the nation will get rain with most amounts of 0.15 to 0.85 inch and a few greater totals – wettest in the west and south part of the nation

-

Some

additional showers are possible Jan. 23-26 -

Argentina’s

bottom line is one of relief for far northern parts of the nation because of rain overnight and that which lingers today. However, most of the central and southern parts of the nation will continue too dry through most of next week to seriously change crop

or field conditions. Crop moisture stress will continue until the rain event of late next week and early in the following weekend evolves. That event will provide “some” relief to dryness, but no general soaking that will break the drought. Follow up precipitation

Jan. 23-26 will be welcome, but it may not be sufficient to seriously change the bottom line either. Temperatures will trend warmer than usual once again later this weekend into next week until the next rain event develops. In the meantime, reproducing early

season corn and sunseed continues to low production potential. -

Brazil

will see a good mix of rain and sunshine over the next two weeks to support most of its summer grain, oilseed, cotton, rice, citrus, sugarcane and coffee production areas -

There

will be an ongoing need for greater rain in far southern parts of the nation where some “partial” relief to dryness is expected during the weekend and next week -

Rio

Grande do Sul will remain a region of concern until a general soaking of rain evolves which is not likely occur for a while -

Enough

rain will occur periodically to slow the deteriorating crop situation and for parts of the state enough rain will fall to induce some short-term bouts of improvement -

Brazil’s

soybean harvest and Safrinha crop planting prospects are good with most of the excessive rainfall of late expected to slowly wind down while the wetter bias briefly drifts more to the west -

India

needs improved rainfall for its winter crops, but not much moisture is expected outside of the far north and extreme south for at least another week

-

Most

of the nation’s greatest rain will continue from Uttarakhand northward into Jammu and Kashmir during the next two weeks

-

Some

light showers will occur briefly from northern Uttar Pradesh to Punjab with two week rain totals no more than 0.50 inch and many areas getting less than 0.25 inch -

Any

rain will be welcome, but more is needed -

India’s

second week forecast is a little wetter today for central and eastern parts of the nation, though confidence in the change is still a little low -

Some

showers are likely, but how significant the resulting rain will be is still debatable with much of it expected to be light -

Any

moisture would be welcome as winter crops approach reproduction -

Western

and central Europe will be stormy in this coming week followed by a drier week of weather -

Temperatures

will be warmer than usual into next week, but will trend cooler with some temperatures in the west slipping below average late next week

-

Soil

moisture continues to improve in many areas, although moisture deficits remain in eastern Spain and the lower Danube River Basin -

Eastern

China will receive light rain and snow through Saturday before trending drier again next week.

-

The

moisture will be great for winter wheat and rapeseed, though crops will remain dormant or semi-dormant for a while -

The

moisture should be available in the spring to support early season crop development -

Follow

up precipitation will be needed -

East-central

Philippines received additional heavy rain again Thursday -

Some

flooding has occurred recently because of frequent bouts of excessive moisture -

A

strong monsoonal flow pattern will promote additional bouts of rainy weather throughout the central and eastern parts of the nation during the next two weeks -

Additional

flooding is possible periodically -

Another

1.00 to 3.00 inches of rain fell from southeastern Luzon Island into Samar Island with local totals reaching 5.83 inches Thursday -

North

Africa rain potentials are expected to improve next week as direr and cooler air pushes southward across Europe -

The

moisture is needed to improve conditions for spring crop development -

Far

western Russia, Belarus and the Baltic States will experience waves of snow and rain during the next ten days resulting in a boost in both snow cover and spring runoff potential -

Limited

precipitation is expected in other winter crop areas in the western CIS -

Australia

summer crop areas in southern Queensland and parts of New South Wales would benefit from greater rain -

Dryland

western production areas in Queensland need rain more than any other area today and not much is expected for another week -

Rain

has increased recently in central Queensland benefitting some corn, soybean, cotton and other crops along with some sugarcane -

Key

summer crop areas in southern Queensland and northern New South Wales may start seeing rainfall a little more often late next week and into the following weekend -

South

Africa will receive very little rain during the next few days and then some showers will begin next week in south-central and southeastern parts of the nation

-

The

precipitation may be a little erratic and light initially raising the need for greater rainfall later this month and into February -

Southeastern

areas should be wettest while precipitation to the northwest in summer crop areas is lightest -

The

second week outlook is wetter today than that of Wednesday -

Southeast

Asia (Indonesia and Malaysia in particular) rainfall has diminished because of the suppressed phase of Madden Julian Oscillation and that will continue for a little while longer

-

Soil

moisture will decrease for a while until rainfall increases again which may not occur until late this month -

Totally

dry weather is unlikely and the showers expected will help slow drying rates and key crop conditions very good -

Wetter

conditions are expected to return to the Maritime Province during the second week of the forecast -

Western

Turkey received some welcome rain earlier this week, but more is needed especially in central and eastern parts of the nation where dry weather prevailed -

Restricted

precipitation is expected again for the coming week -

Middle

East rainfall is expected to trend drier although the resulting precipitation should be mostly light to locally moderate -

Some

rain will return to central and eastern Turkey next week ending a ten day period of dry weather -

Iraq

and Syria will not get much precipitation for a while and the same may occur in Jordan and few neighboring areas

-

East-central

Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

-

Coffee

and cocoa conditions should remain favorable in all production areas, despite the anomalies -

West-central

Africa dryness will continue through the next ten days to two weeks -

Dry

conditions are normal at this time of year -

No

excessive heat is expected in this coming week, although warmer than usual conditions are beginning to evolve and may continue into the latter part of this month -

Vietnam

central and lower coastal areas may receive bouts of rain in the coming week with some of it possibly reaching into the Central Highlands -

Light

showers were noted in these same areas earlier this week -

Today’s

Southern Oscillation Index was +21.44 and the index is expected to begin a steady fall over the next week to ten days

Source:

Bloomberg and FI

Bloomberg

Ag calendar

Monday,

Jan. 16:

- Malaysia’s

Jan. 1-15 palm oil exports - Malaysia

CPO export tax for February (tentative) - HOLIDAY:

US

Tuesday,

Jan. 17:

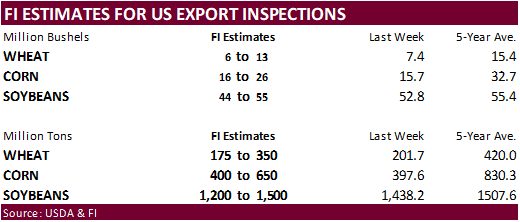

- USDA

export inspections – corn, soybeans, wheat, 11 am (10 am CT) - NOPA

12 pm (11 am CT) - China

4Q pork output and inventory levels - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data

Wednesday,

Jan. 18:

- Global

Forum for Food and Agriculture, Berlin, Jan. 18-21 - Asia

4Q 2022 cocoa grinding data

Thursday,

Jan. 19:

- European

cocoa grindings - North

America cocoa grindings - EIA

weekly US ethanol inventories, production - Port

of Rouen data on French grain exports - New

Zealand Food Prices - USDA

red meat production, 3pm

Friday,

Jan. 20:

- Malaysia’s

Jan. 1-20 palm oil exports - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - US

net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - US

cotton ginnings - US

cattle on feed

Macros

103

Counterparties Take $2.180 Tln At Fed Reverse Repo Op (prev $2.203 Tln, 101 Bids)

US

Univ. Of Michigan Sentiment Jan P: 64.6 (est 60.7; prev 59.7)

–

Current Conditions: 68.6 (est 60.0; prev 59.4)

–

Expectations: 62.0 (est 59.0; prev 59.9)

–

1-Year Inflation: 4.0% (est 4.3%; prev 4.4%)

–

5-10 Year Inflation: 3.0% (est 2.9%; prev 2.9%)

US

Import Price Index (M/M) Dec: 0.4% (exp -0.9%; prev -0.6%)

–

Import Price Index Ex-Petroleum (M/M) Dec: 0.8% (exp -0.3%; prev -0.3%)

–

Import Price Index (Y/Y) Dec: 3.5% (exp 2.2%; prev 2.7%)

–

Export Price Index (M/M) Dec: -2.6% (exp -0.7%; prev -0.3%)

–

Export Price Index (Y/Y) Dec: 5.0% (exp 7.3%; prev 6.3%)

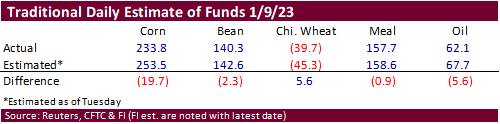

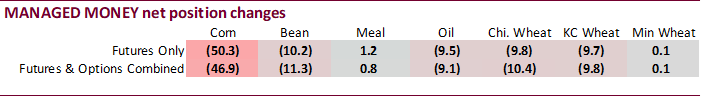

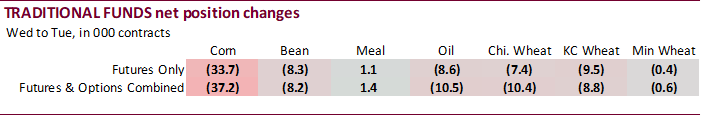

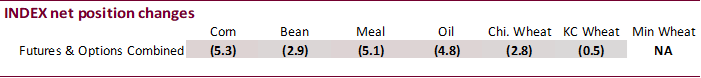

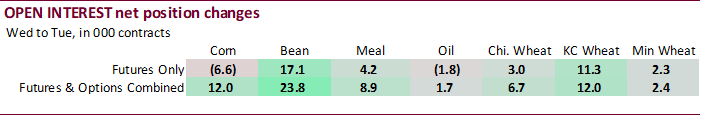

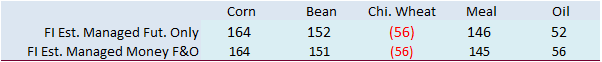

No

major surprises in the CFTC COT report. The corn position was less long than expected. Money managers were heavy sellers of corn for the week ending January 10. They unloaded 46,900 corn futures and options contracts. They also reduced net long positions for

soybeans and soybean oil.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

77,454 -36,354 355,818 -5,252 -378,783 46,136

Soybeans

96,363 -3,829 121,780 -2,932 -178,269 5,976

Soyoil

28,241 -7,798 95,562 -4,779 -133,651 13,368

CBOT

wheat -73,459 -10,660 98,234 -2,792 -22,747 11,399

KCBT

wheat -23,951 -7,807 46,519 -458 -22,046 6,853

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

149,605 -46,852 218,958 -4,568 -372,866 46,347

Soybeans

131,704 -11,290 67,821 61 -166,462 7,385

Soymeal

142,711 833 72,065 -5,097 -250,120 462

Soyoil

54,614 -9,147 88,727 1,476 -156,604 9,793

CBOT

wheat -63,134 -10,420 65,072 -1,566 -19,196 9,896

KCBT

wheat -8,023 -9,780 36,345 1,174 -23,553 6,238

MGEX

wheat -2,704 127 1,574 162 794 1,288

———- ———- ———- ———- ———- ———-

Total

wheat -73,861 -20,073 102,991 -230 -41,955 17,422

Live

cattle 91,489 8,727 48,008 -3,796 -137,100 -4,320

Feeder

cattle 42 -302 2,531 5 3,004 -336

Lean

hogs 22,735 -27,624 47,085 269 -61,408 18,175

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

58,792 9,603 -54,489 -4,530 1,481,932 11,999

Soybeans

6,810 3,060 -39,874 784 727,769 23,773

Soymeal

12,549 576 22,796 3,224 454,472 8,859

Soyoil

3,415 -1,331 9,848 -791 408,665 1,711

CBOT

wheat 19,287 37 -2,028 2,051 394,847 6,675

KCBT

wheat -4,247 956 -522 1,412 176,931 11,977

MGEX

wheat 1,747 -733 -1,411 -844 57,437 2,366

———- ———- ———- ———- ———- ———-

Total

wheat 16,787 260 -3,961 2,619 629,215 21,018

Live

cattle 9,584 -796 -11,982 186 385,715 -13,678

Feeder

cattle -1,026 1,010 -4,551 -379 56,237 1,852

Lean

hogs -2,708 1,663 -5,704 7,518 255,641 7,767

·

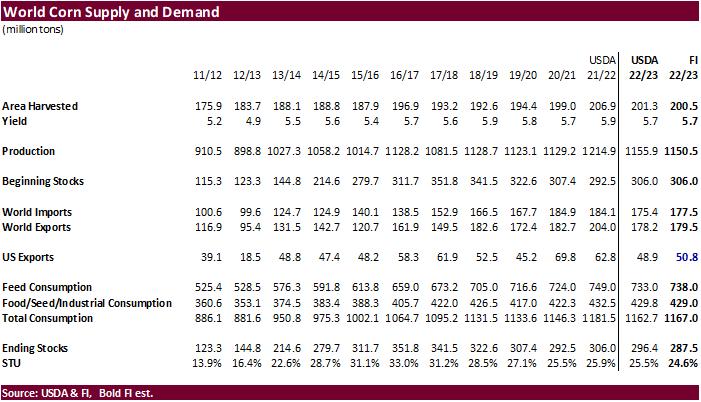

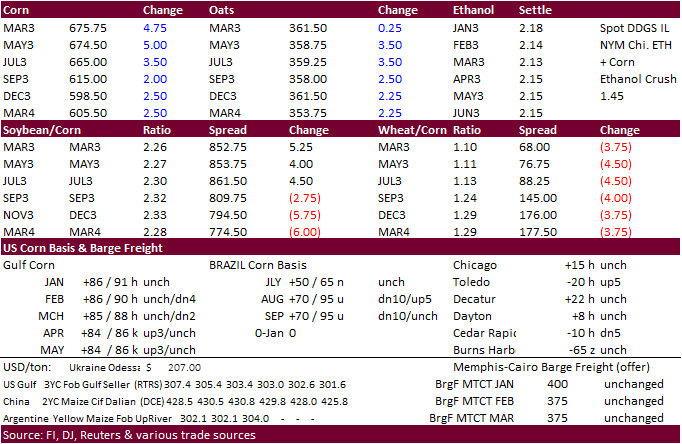

CBOT corn

traded higher on follow through buying after

USDA reported a cut in 2022 US corn production and lower than expected December 1 corn stocks. News was light. The US will have a long holiday weekend and markets will reopen Monday evening.

·

March corn was up 4 cents and December up 2.50 cents.

·

Ukraine’s grain harvest reached 94% complete or 51 million tons. It includes 23.5 million tons of corn. We look for total Ukraine corn production to end up near 26.1 million tons, below USDA’s 27.0 million ton estimate.

·

Reuters research department in a note mentioned US Corn Belt ethanol margins reached a 9-year high as of Thursday when the average margin hit $0.43/gallon. They look for US ethanol production to increase over the next few weeks.

We agree, but that would be in large part to plants catching up to their average pace prior to the late December cold snap. Inventories remain high.

·

China approved imports of eight genetically modified (GMO) crops, including GMO alfalfa and a canola variety.

Export

developments.

·

Late Thursday MFG bought 68,000 tons of corn from the US or SA at $338.79/ton c&f for shipment between February 24 to March 15. Earlier in the week they bought corn from South America.

Updated

01/12/23

March

corn $6.30-$7.00 range. May

$6.25-$7.20

·

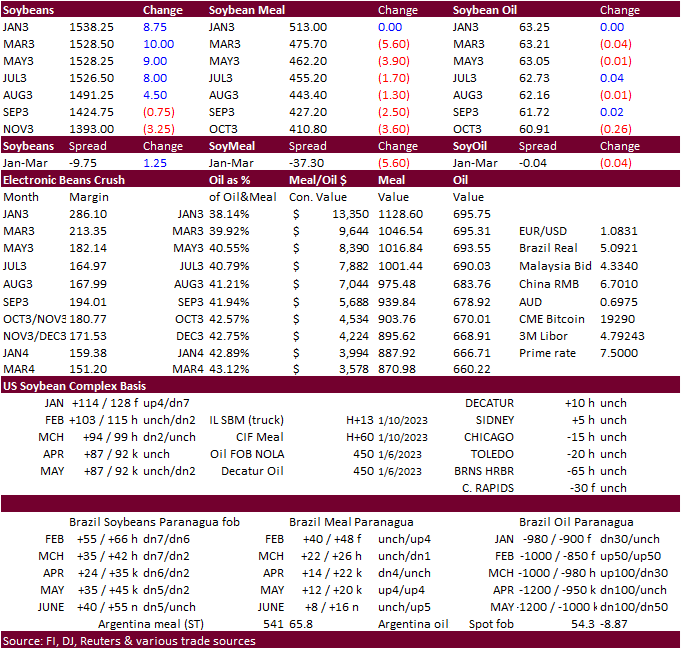

CBOT soybeans,

meal and soybean oil traded two-sided. March soybean finished 9.25 cents higher, and September was down 0.25 cent. Positioning was noted. Soybean meal ended lower led by the nearby contracts. Soybean oil traded sharply lower early but recovered to finish 13-19

points lower. Palm oil was lower overnight. For the week Malaysian palm oil fell 5.2 percent.

·

A good amount of new-crop crush traded.

·

Rain is expected in southwest Argentina next week, but the rest of the crop areas will see ongoing stressful conditions.

·

China customs reported China soybean imports during December at 10.56 million tons, up 19 percent from a year ago, and is also highest since June 2021. Annual 2022 China soybean imports reached 91.08 million tons, down 5.6% from

2021. Some analysts don’t see much of an improvement in China soybean imports during 2023 due to low slower livestock production growth and reduced used for soybean meal in feed formulas.

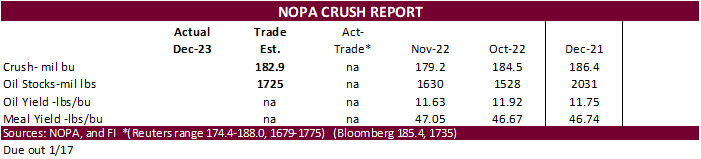

·

NOPA is due out Tuesday and the average trade guess is 182.9 million bushels, below 186.4 million year earlier. Some have noted the crush could end up well below that level after the cold spell hit the US around Christmas time.

·

South Korea bought 12,000 tons of soybean meal from China at $602/ton c&f for arrival by April 30.

·

Turkey bought 24,000 tons of sunflower oil for February 15 to March 20 delivery at $1,218.80 to $1,228.80/ton.

Updated

01/12/23

Soybeans

– March $14.75-$15.75, May $14.75-$16.00

Soybean

meal – March $460-$525, May $425-$550

Soybean

oil – March

60.00-68.00, May 59-70

·

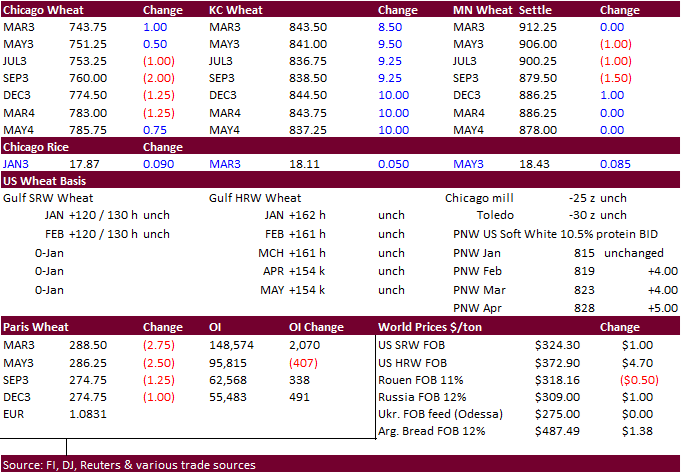

US wheat futures were mixed. Chicago ended higher in the nearby position and lower in the back months. KC rallied from a US weather outlook calling for restricted precipitation across a majority of the US Great Plains. MN ended

mixed with back months higher, supported by new-crop crop concerns for the US despite higher than expected US winter wheat seedings survey by USDA.

·

CBOT markets reopen Monday night as the US observes the MLK holiday.

·

Paris March wheat was down 2.75 euros earlier at 288.75 per ton.

·

Russia will lower their wheat export tax rate for the January 18-24 period to 4,719.4 rubles per ton from 4,766.3 current.

Export

Developments.

·

Taiwan Flour Millers’ Association bought 45,200 tons of milling wheat from the United States for shipment from the PNW between March 8 and March 22.

-27,600

tons of dark northern spring wheat of a minimum 14.5% protein content at $395.75 a ton FOB

-11,650

tons of hard red winter wheat of a minimum 12.5% protein content at $380.75 a ton FO

-5,950

tons of soft white wheat of a minimum 8.5% to maximum 10% protein at $321.75 a ton FOB.

·

South Korea’s MFG bought about 130,000 tons of feed wheat in two private deals this week. One 65,000 ton consignment was from the US or Australia was purchased at an estimated $343.00 a ton c&f for shipment between April 15 and

May 15. Another 65,000 tons was from the US, Australia or Canada at $344.40 a ton c&f for between April 26 and May 15.

Rice/Other

·

None reported

Updated

01/12/23

Chicago

– March $7.00 to $8.25, May $7.00-$8.50

KC

– March $7.75-$9.25, $7.50-$9.50

MN

– March $8.75 to $10.00,

$8.00-$10.00

Terry Reilly

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 3126041366

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading

of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo