PDF Attached

The

US will be on holiday Monday. CBOT agriculture markets will open Monday night.

South

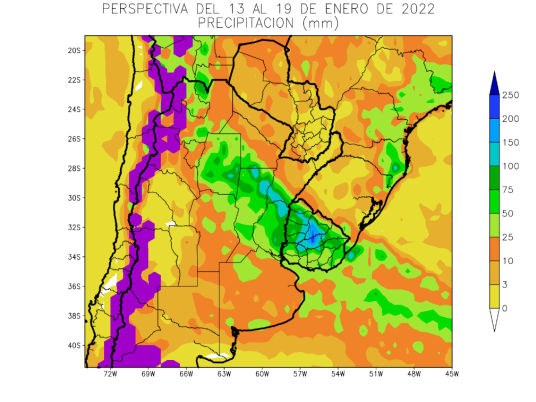

American weather and positioning ahead of the US holiday weekend dominated market action. The midday weather models turned little drier for Argentina and wetter Brazil for the 11-15 period. 1-5 and 6-10 were largely unchanged.

Weather

World

Weather (Friday) midday weather highlights:

South

America (Week 1-Discussion of significant model changes)

- The

GFS model was wetter from southeastern Cordoba to the southern fringe of Entre Rios Wednesday into next Friday

This increase is likely overdone

- The

GFS model reduced rain in parts of southern Parana and Santa Catarina Wednesday into next Friday

Some of this reduction was likely needed

South

America (Week 2-Discussion of significant model changes)

- The

GFS model reduced rain in northern Argentina Jan. 21-23

The latest run may be too dry

- The

GFS model reduced rain from Mato Grosso to Goias to southern Minas Gerais Jan. 21-23

Some of this reduction was likely needed, but the latest run may be too dry

- The

GFS model was wetter from southern Mato Grosso do Sul to central and western Mato Grosso do Sul and southern Paraguay Jan. 24-26

This increase is likely overdone

- The

GFS model increased rain from northeastern La Pampa to Buenos Aires Jan. 24-26

This increase is likely overdone

- The

GFS model was wetter in central and northern Argentina Jan. 26-28 with most of the rain light and most of the significant rain confined to far northern areas

The latest run is likely too wet

- The

GFS model reduced rain from a large part of Mato Grosso do Sul to Parana to Santa Catarina Jan. 26-28

Some of this reduction was likely needed

Source:

BA Grains Exchange

WORLD

WEATHER HIGHLIGHTS FOR JANUARY 14, 2022

- Crop

stress and damage continues in Argentina. - No

soil moisture is present, no rain fell or will fall for two more days and temperatures have been and will continue in the range of 100 to 110 Fahrenheit (38-43) with a few extremes today and Saturday in the 110 to 116 degree range (43-45C).

- Dramatic

cooling is expected Sunday through Wednesday and thunderstorms will produce 1.00 to 3.00 inches of rain, but mostly in the northeast half of Argentina.

- The

southwest will not get nearly as much and will have to wait for a second storm system at the end of next week to get some additional relief.

- The

bottom line remains one of relief for Argentina after Saturday, but the greatest improvement will occur in the northeast half of the nation. Additional rainfall may occur later this month, but another ridge of high pressure is possible in February.

- In

Brazil, weather conditions are drying down beneficially - Greatly

improved early season soybean and corn maturation and harvest weather is expected for a while.

- Established

and late planted crops will have good subsoil moisture to continue developing with.

- Timely

rainfall will return for early season Safrinha crops later this month and next.

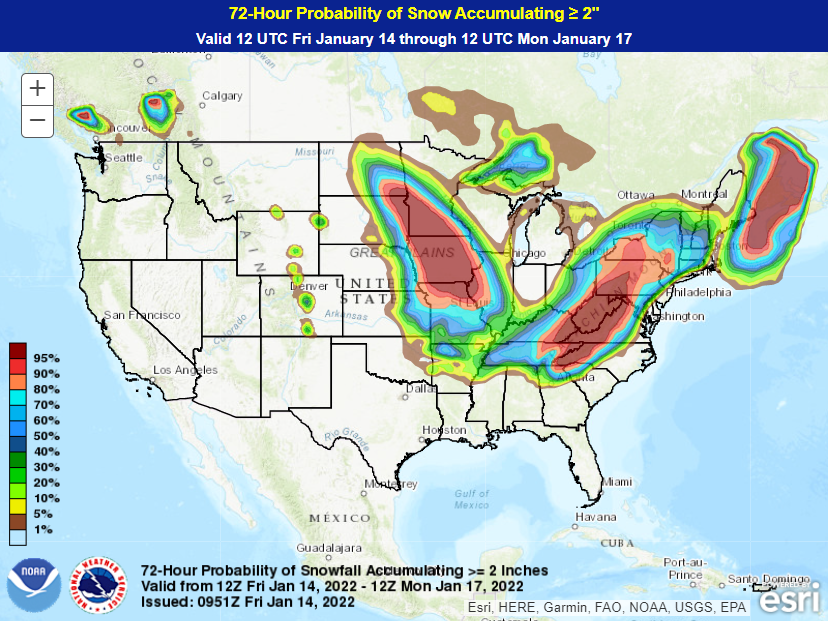

- In

the U.S., a snowstorm from North Dakota to Iowa and Missouri will occur today and tonight with 3-10 inches of accumulation - The

storm will become a raging nor’easter for the eastern United Sunday and Monday producing 6-12 inches and many 12-20 inch amounts in the northeastern parts of the nation and neighboring southeastern Canada.

- Outside

of this weekend’s storm, U.S. weather will be tranquil for a while, but a big surge of cold is expected in the central part of the nation late next week.

- Northwest

Africa remains quite dry - Western

Europe is drying out - India’s

weather is great after recent rain - China’s

weather is stable and mostly good. - Bitter

cold in Russia that had been advertised for the second week of the forecast has been reduced, but plenty of snow is on the ground to protect crops anyway.

- Additional

snow will fall in western Russia and parts of Ukraine and Eastern Europe over the next ten days.

- New

South Wales, Australia will get abundant rainfall in the next week to ten days while lighter and more sporadic showers occur in Queensland, Australia.

- South

Africa may get a little too much rain in the coming week to ten days resulting in at least some flooding.

- Southeast

Asia weather will continue wet from Indonesia and Malaysia into the Philippines with local flooding in eastern Malaysia and southern Philippines in the next week to ten days

Source:

World Weather, inc.

Friday,

Jan. 14:

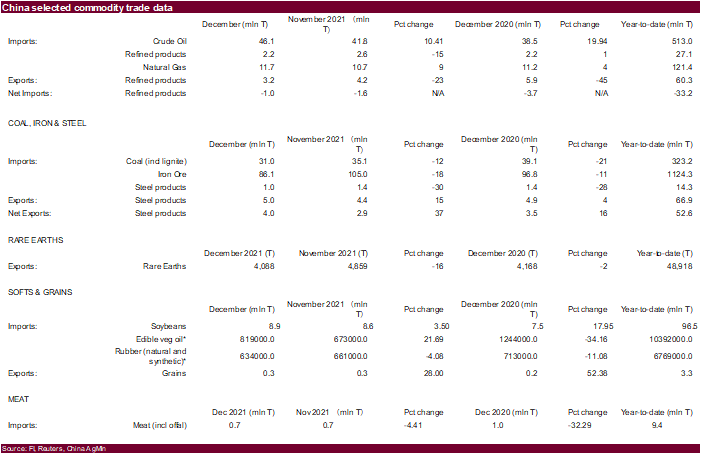

- China’s

December trade data - ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Monday,

Jan. 17:

- China

4Q pork output and inventory levels - Ivory

Coast cocoa arrivals - HOLIDAY:

U.S.

Tuesday,

Jan. 18:

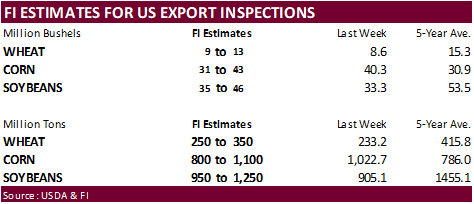

- USDA

export inspections – corn, soybeans, wheat, 11am

- China’s

second batch of December trade data - EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

Malaysia

Wednesday,

Jan. 19:

- European

quarterly cocoa grindings report (tentative)

Thursday,

Jan. 20:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - China’s

third batch of country-wise December trade data - Port

of Rouen data on French grain exports - Malaysia’s

Jan. 1-20 palm oil exports - New

Zealand food prices - USDA

red meat production, 3pm

Friday,

Jan. 21:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

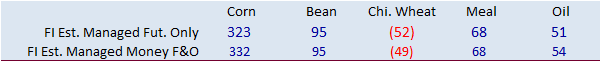

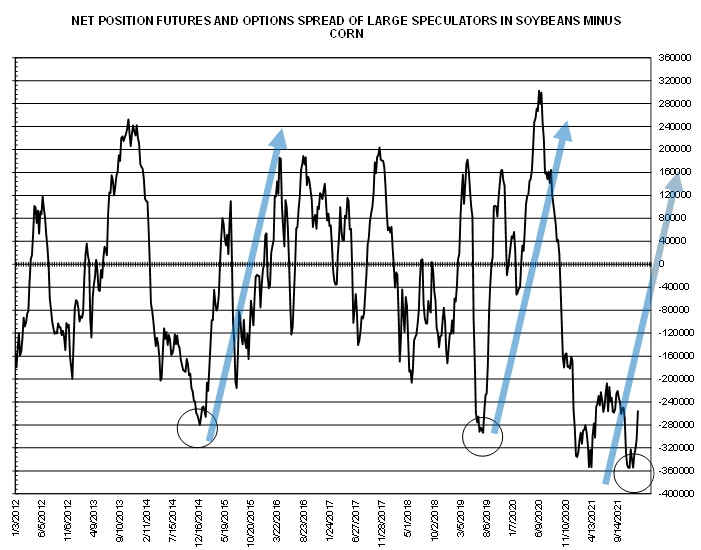

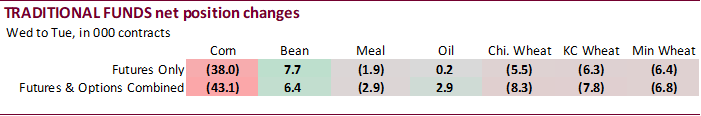

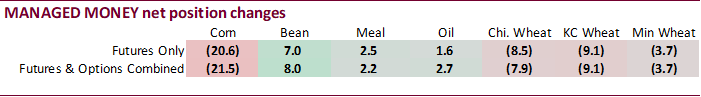

CFTC

Commitment of Traders report

Soybeans

going to rally over corn? Fund cycle suggest that…

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

240,207 -28,784 445,573 6,746 -657,116 1,120

Soybeans

85,287 -562 193,613 12,704 -243,874 -16,208

Soyoil

10,442 1,425 119,246 -1,724 -139,671 -2,593

CBOT

wheat -45,177 -9,108 133,288 8,659 -78,392 720

KCBT

wheat 17,171 -4,314 53,223 -6,348 -74,185 10,322

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

344,379 -21,526 286,103 24,936 -651,582 -2,728

Soybeans

106,879 7,961 149,123 9,067 -252,226 -19,490

Soymeal

72,920 2,152 94,070 7,003 -216,516 -5,530

Soyoil

55,907 2,719 88,570 -2,654 -145,139 -3,182

CBOT

wheat -27,764 -7,920 87,148 9,751 -63,636 -1,198

KCBT

wheat 42,674 -9,138 21,770 -3,022 -61,753 10,460

MGEX

wheat 5,734 -3,747 2,334 691 -14,648 6,019

———- ———- ———- ———- ———- ———-

Total

wheat 20,644 -20,805 111,252 7,420 -140,037 15,281

Live

cattle 61,941 -10,405 80,445 168 -150,042 5,764

Feeder

cattle 6,470 -856 4,036 244 -2,433 -437

Lean

hogs 48,804 -6,870 59,402 2,577 -100,831 3,710

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

49,764 -21,600 -28,664 20,918 1,861,529 -4,162

Soybeans

31,250 -1,605 -35,026 4,066 833,968 44,628

Soymeal

20,862 -5,026 28,663 1,400 454,258 17,979

Soyoil

-9,322 226 9,984 2,891 430,663 7,966

CBOT

wheat 13,972 -362 -9,720 -271 455,595 16,109

KCBT

wheat -6,483 1,360 3,792 341 242,770 -4,294

MGEX

wheat 3,813 -3,048 2,768 84 71,192 -5,969

———- ———- ———- ———- ———- ———-

Total

wheat 11,302 -2,050 -3,160 154 769,557 5,846

Live

cattle 17,341 -1,591 -9,686 6,065 372,991 -8,788

Feeder

cattle 628 269 -8,701 780 51,666 2,348

Lean

hogs 8,956 860 -16,330 -277 267,471 2,646

=================================================================================

Macros

80

Counterparties Take $1.599 Tln At Fed Reverse Repo Op. (prev $1.637 Tln, 79 Bids)

US

Retail Sales (M/M) Dec: -1.9% (est -0.1%; prev 0.3%)

–

US Retail Sales Ex. Auto (M/M) Dec: -2.3% (est 0.1%; prev 0.3%)

–

US Retail Sales Ex. Auto & Gas (M/M) Dec: -2.5% (est -0.2%; prev 0.2%)

–

US Retail Sales Control Group (M/M) Dec: -3.1% (est 0.0%; prev -0.1%)

US

Import Price Index (M/M) Dec: -0.2% (est 0.2%; prev 0.7%)

–

Import Price Index Ex-Petroleum (M/M) Dec: 0.3% (est 0.6%; prev 0.7%)

–

Import Price Index (Y/Y) Dec: 10.4% (est 10.8%; prev 11.7%)

US

Export Price Index (M/M) Dec: -1.8% (est 0.3%; prev 1.0%)

–

Export Price Index (Y/Y) Dec: 14.7% (est 16.0%; prev 18.2%)

US

Retail Sales (M/M) Prior Revised: 0.2%

–

US Retail Sales Ex. Auto (M/M) Prior Revised: 0.1%

–

US Retail Sales Ex. Auto & Gas (M/M) Prior Revised: -0.1%

–

US Retail Sales Control Group (M/M) Prior Revised: -0.5

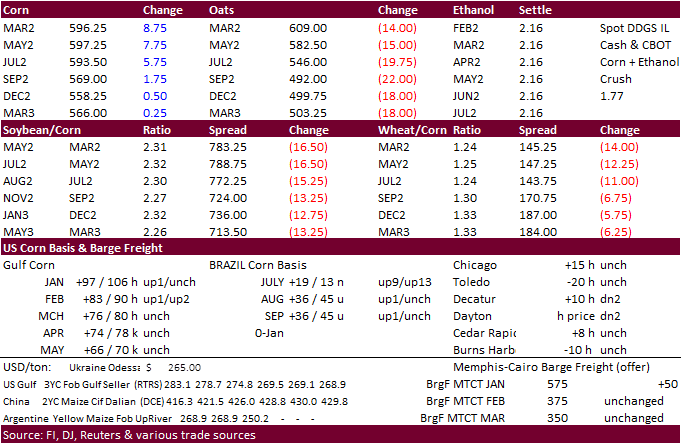

Corn

·

CBOT corn was higher led by the nearby months from technical buying and high soybean prices relative to alternative corn for fee demand. Slowing US ethanol production has weighed on corn but increases in global demand, notably

South Korea, has slowed bearish sentiment.

·

USD was 34 higher and WTI crude up 217 cents.

·

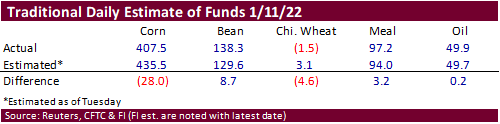

The funds on Friday bought an estimated net 7,000 corn contracts.

·

Safras & Mercado estimated the Brazil corn crop at 115.64 million tons versus 116.08 million previous. USDA at 115 million tons.

·

For reference it was reported on Thursday:

o

Argentina’s Rosario Grains Exchange lowered their Argentina corn crop by 8 million tons to only 48 million. USDA is at 54 million tons for Argentina corn.

o

Argentina’s Buenos Aires grains exchange has yet to cut their estimate but it’s coming. They trimmed the soybean planting area by 100,000 hectares to a total 16.4 million hectares due to dry weather.

o

Agroconsult estimated the Brazil corn crop at 119.4 million tons (24.5MMT first crop), down from a late November projection of 124 million tons. Conab is at 112.9 million and USDA at 115 million tons.

·

Yesterday Agroconsult estimated a 32-million-ton year over year in Brazil corn production. We wonder how much of that will get exported in 2022, a hard category to forecast. USDA has 43 MMT Brazil corn exports for the Oct-Sep

period versus 19.5 MMT for 2020-21. Brazil corn exports were slow last fall and have picked up over the winter. South Korea has been buying Brazil corn lately and interest is there from Japan.

·

China 2021 meat imports of 9.38 million tons were 5.4% below the 9.91 million tons in 2020. December’s meat imports of 654,000 tons were down 32% from a year ago.

India

Grain and Feed Update

Export

developments.

·

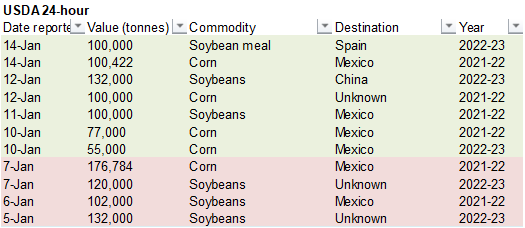

USDA reported 100,422 tons of corn sold to Mexico for 2021-22 delivery under the 24-hour announcement system.

·

South Korea’s FLC bought about 65,000 tons of animal feed corn, optional origin, at an estimated $328.10 a ton c&f for arrival in South Korea around April 30.

·

South Korea’s MFG bought 198,000 tons of corn in three consignments late April and early May arrival. One consignment of 68,000 tons to be sourced from worldwide origins was said to have been sold at $328.20 a ton for arrival

in South Korea around April 30. A second consignment of 65,000 tons also to be sourced from worldwide origins was said to have been sold at $328.00 a ton c& for arrival in South Korea around May 3.A third consignment of 65,000 tons expected to be sourced from

South America or South Africa was said to have been sold at $327.69 a ton c&f for arrival in South Korea around May 8.

Updated

1/10/22

March

corn is seen in a $5.70 to $6.20 range

·

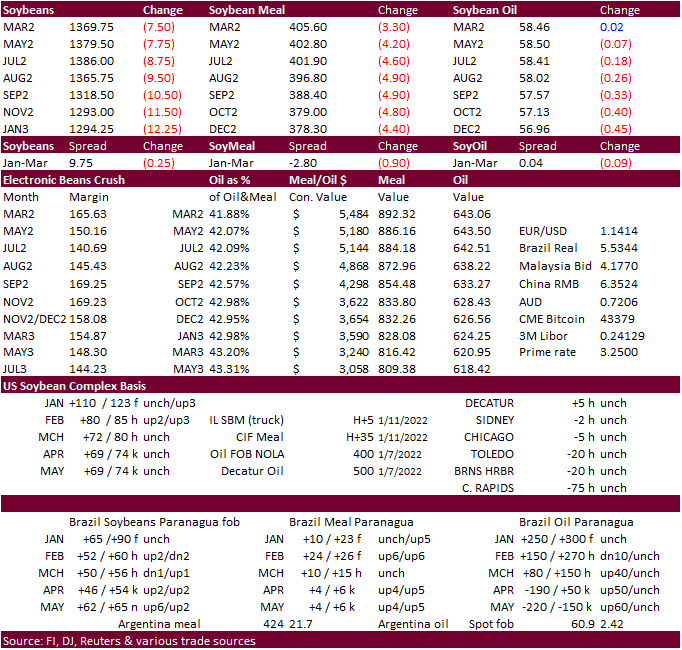

US soybeans ended lower in a two sided trade as longs have been exiting positions ahead of the rain event slated for Brazil and Argentina. Not all of Argentina will see rains and we warn Tuesday’s market action could be very volatile.

Safras was the latest private group to downgrade the Brazilian soybean crop.

·

The funds sold an estimated net 4,000 soybeans, sold 2,000 soybean meal and were net even for soybean oil.

·

Morning weather models turned a little more favorable for Argentina and Brazil but the 11-15 day midday models removed some of the rain for Argentina and was wetter for Brazil.

·

Safras & Mercado estimated the Brazil soybean crop at 132.3 million tons versus 144.71 million previous. USDA at 139 million tons. For reference it was reported on Thursday:

o

Agroconsult estimated the Brazil soybean crop at 134.2 million tons, down from a late November projection of 144.3 million tons. Agroconsult noted the average yield could reach a 6-year low.

o

Conab is at 140.5 million tons for Brazil.

o

Argentina’s Rosario Grains Exchange lowered their Argentina soybean crop from 45 to 40 million tons, above USDA’s 46.5 MMT estimate. They also warned producers could see a $2.9 billion hit from drought conditions.

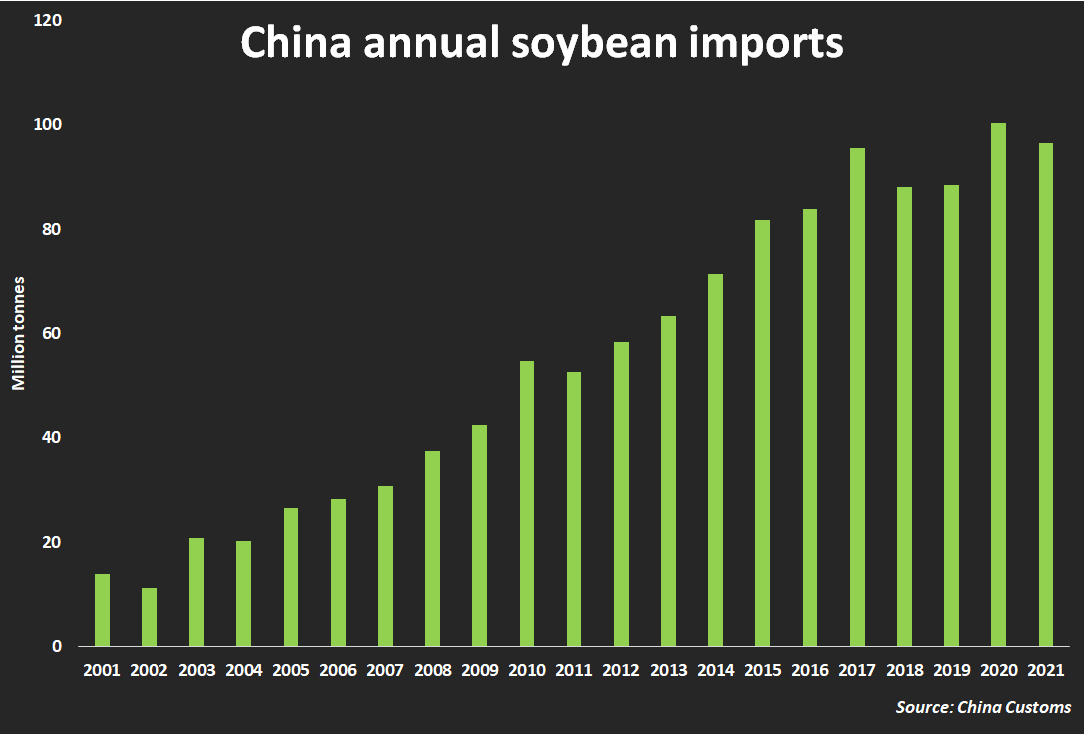

·

China imported 8.87 millio0n tons of soybeans during the month of December (up 18% from year earlier) and for all of 2021 they amounted to 96.52 million tons, down from 100.33 MMT year earlier.

Source:

Reuters

·

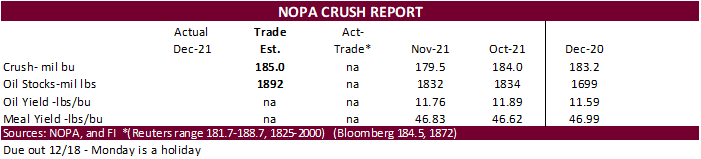

NOPA’s December crush report will be released on Tuesday due to the Federal US holiday. The average trade guess is 185 million bushels, which could be a record for the month of December. Trade estimates below.

·

Cargo surveyor AmSpec reported Malaysian Jan 1-15 palm exports at 492,883 million tons, compared to a large 725,600 tons a month ago. Cargo surveyor ITS reported Malaysian palm exports at 426,111 tons, 45 percent below 772,137

tons from the same period a month ago.

·

Malaysia will keep their February crude palm oil export tax unchanged at 8 percent.

·

Malaysian palm futures traded lower by 38 ringgit to 5,123.

·

China soybean cash crush values on our analysis were running at 195 cents/bushel (196 previous) versus 183 at the end of last week and 198 year ago.

·

Offshore values this morning were leading CBOT soybean oil 51 points higher (61 higher for the week to date) and meal $2.40 higher ($5.80 higher for the week).

Export

Developments

·

USDA reported 100,000 tons of soybean meal sold to Spain for 2022-23 delivery under the 24-hour announcement system.

·

The USDA seeks 7,540 tons of vegetable oil in 4-liter cans for Feb 16-Mar 15 shipment on January 19.

Updated

1/10/22

Soybeans

– March $13.00-$14.25

Soybean

meal – March $370-$435

Soybean

oil – March 54.50-61.00

·

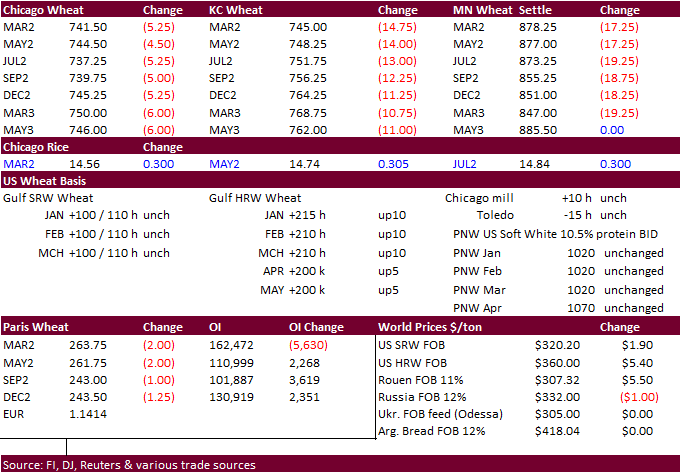

US wheat futures extended losses from improving US weather conditions, slow US export demand and higher USD.

·

Funds sold an estimated an estimated net 4,000 soft red winter wheat contracts.

·

Global import demand improved this week with Algeria the latest tender announcement with purchasing about 600,000 tons of wheat.

·

A welcome snow event (for crops) across parts of the central and upper winter wheat country will occur through Saturday.

·

March wheat settled down 2.25 euros, or 0.8%, at 263.50 euros ($300.50) a ton, after earlier dropping to 259.75 euros, its lowest since Oct. 6.

·

Russian wheat exports during the Jan-Nov period decreased to 30.0 million tons in the first eleven months of 2001 from 33.7 million tons a year ago.

·

Ukraine’s AgMin does not plan to limit grain exports this crop year.

·

South Korea’s MFG bought 50,000 tons of feed wheat at $334/ton for shipment around March 20 and April.

·

Taiwan seeks 49,395 tons of US wheat on Jan 20 for LH March shipment.

·

Jordan seeks 120,000 tons of wheat on January 18. Possible shipment combinations are in 2022 between July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Turkey seeks 335,000 tons of milling wheat on January 18.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on January 16.

Updated

1/10/22

Chicago

March $7.20 to $8.40 range

KC

March $7.55 to $8.75 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.