PDF Attached

CME Incentive Program for Commercials Using Blocks

Starting Feb 1, a fee incentive program for commercial participants will go live. The program will make block outright fees equal to Globex member fees until July 31st. Clients will have to fill out a form and send it back. The brokers will turn this into the CME. Any questions or in need of this form, please contact your broker.

Wide two-sided trade today for the CBOT agriculture markets. After a mostly higher overnight trade, soybean meal kicked off the selling early, dragging soybeans lower followed by corn, then wheat, and eventually soybean oil. Traders noted a wetter weather forecast for Argentina next week. Sloppy outside related commodity markets added to the negative undertone. WTI crude oil was trading lower during the CBOT ag close and USD near unchanged.

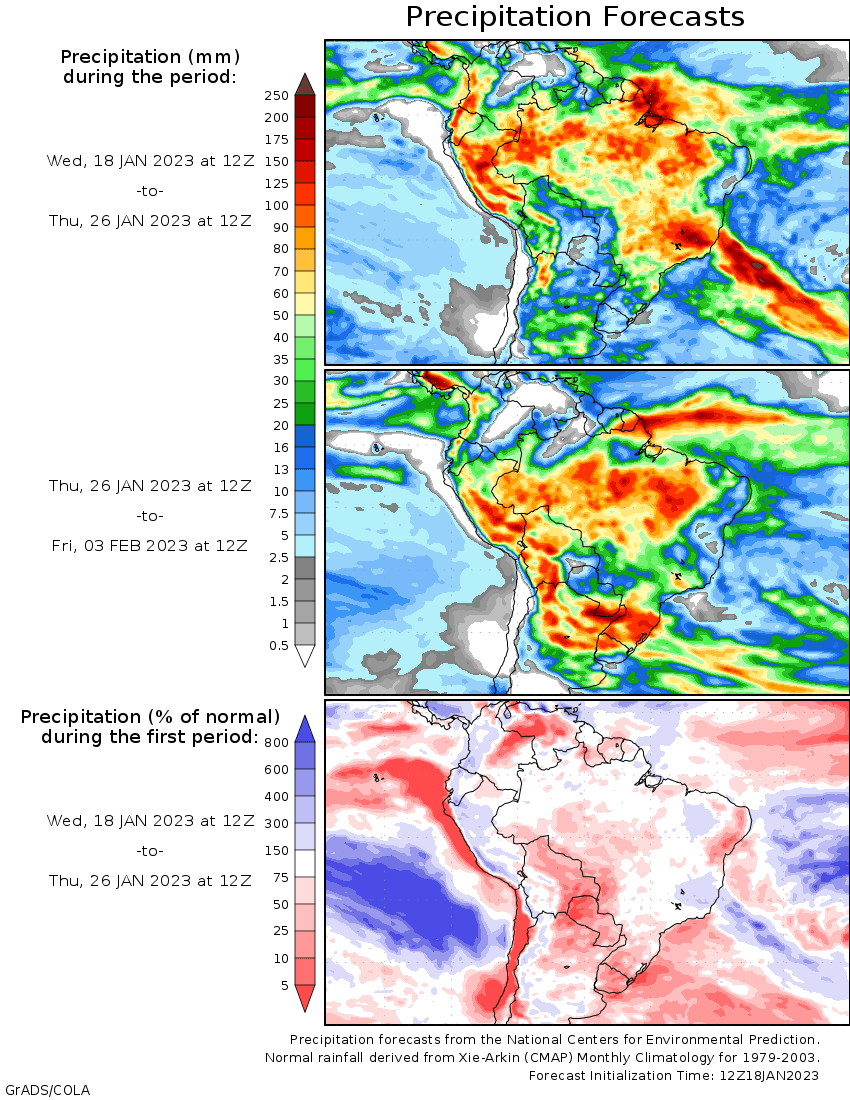

MOST IMPORTANT WEATHER FOR THE COMING WEEK

- Argentina is advertised wetter today relative to that of earlier this week

- Today’s ECMWF forecast model has increased precipitation across Argentina for next week and the GFS is also producing rain for most of the nation, but not quite as aggressively

- If the models are correct there will be at least some rain for all crops in Argentina at one time or another in the next ten days

- Drought busting rain may not occur, but sufficient amounts are likely to improve crops at least for a little while

- Frequent follow up rain will be very important

- Argentina’s outlook through the weekend has not changed much and that suggests an erratic rainfall pattern with Friday and Saturday wettest

- Some rain has occurred overnight in southeastern Santiago del Estero, northwestern Santa Fe and from Cordoba into western Buenos Aires

- Rain totals through dawn today varied up to 0.50 inch most often, but 1.00 to 2.79 inches occurred in northwestern Santa Fe and extreme southeastern Santiago del Estero

- Most other areas were dry

- Temperatures in Argentina Tuesday were very warm to hot again with highs in the upper 90s to 105 degrees Fahrenheit in many central and northern crop areas

- One location in northwestern Santiago del Estero reported 108 degrees Fahrenheit

- Some cooling did occur in southwestern parts of the nation where highs were limited to the 80s and lower 90s

- Brazil’s weather briefly improved Tuesday with less frequent and less significant rain for much of the nation’s summer crop areas

- The net drying that resulted was helpful in firming the soil in many areas, though more drying is needed

- Brazil’s weather outlook is to be favorably mixed over the next two weeks with alternating periods of rain and sunshine likely

- Heavy rainfall should mostly occur in southern Minas Gerais and Sao Paulo

- Crop maturation and harvest conditions should improve along with the planting of Safrinha crops

- Rio Grande do Sul is the only Brazilian State that continues in need of greater rain

- Recent rainfall in the northern soybean areas in the state was welcome, but net drying is likely across most of the state for a while

- Central and southern corn and rice areas are driest and need rain most significantly

- Some of Argentina’s rain should eventually (next week) move into southern Brazil offering some additional relief from dryness in Rio Grande do Sul.

- Central U.S. winter storm to produce significant snow from Nebraska to upper Michigan next two days

- Snowfall will range from 8 to 12 inches with local totals to 14 inches in Nebraska and 3 to 9 inches in Iowa with a few totals over 10 inches in the west and 2 to 8 inches from southern South Dakota to northern Michigan; including most of Wisconsin except the far southeast

- Moisture continent will vary from 0.15 to 0.85 inch with a few totals near 1.00 inch in Nebraska

- Travel delays and livestock stress are expected from northeastern Colorado northern Michigan

- U.S. hard red winter wheat areas will get another chance for precipitation Friday into Saturday, although that event will be a more limited event with the boost in precipitation only providing temporary relief from drought

- Southwestern U.S. Plains, including West Texas, will be dry biased over the next two weeks

- California’s active weather pattern is winding down with just one additional wave of light precipitation expected this week

- The break in the precipitation will help reduce flood potentials and give recent moisture a chance to soak into the ground, but more rain and snow will be needed to seriously raise water supply over that of recent past years and to curb this multi-year drought

- U.S. Midwest, Delta and southeastern states will experience a frequent occurrence of rain and some snow (mostly in the Midwest) during the next couple of weeks maintaining and in some cases improving topsoil moisture for use in the spring

- U.S. Northern Plains and Canada’s Prairies will experience light amounts of precipitation during the next ten days to two weeks

- Snow cover remains significant in central and eastern North Dakota, Minnesota and in random locations across central and especially far eastern South Dakota

- Snow-free conditions are present in portions of the southwestern Canada Prairies and in portions of both Montana and western South Dakota

- Snow cover in Canada is greatest near the U.S. border in Manitoba and across the northern most portions of crop country

- Concern will rise over some of the drier areas in southwestern Canada where drought has lasted six years in some areas

- U.S. temperatures will turn colder next week while this week’s readings are near to below normal in the western states and above normal in the central and east

- Temperatures in the last week of this month will be cooler than usual in the central and western states with emphasis on the north-central states and south-central Canada

- India rain potentials are improving for a few north-central and many eastern winter crop areas next week

- The moisture will favor wheat, winter rice and some pulse production areas, but may not impact rapeseed production areas

- Rainfall will be light and the need for follow up rain will be high except from parts of Uttarakhand into Jammu and Kashmir where frequent precipitation of significance is expected

- Eastern Australia summer crop areas will begin experiencing periodic showers and thunderstorms during the weekend and especially next week

- The rain will help improve dryland sorghum, cotton and other crops

- Eastern China’s precipitation will resume in the Yangtze River Basin this weekend and especially next week

- The moisture will help maintain a very good outlook for future rapeseed and minor wheat production areas

- Some rain and snow will also impact the rest of the nation, but resulting moisture will not be great enough for serious changes to soil moisture

- North Africa will begin receiving routine bouts of rain in northern Algeria and coastal Tunisia the remainder of this week and next week

- The moisture boost will be ideal for improving wheat and barley establishment and raising the potential for better crop performance in the spring

- Some rain will also fall in northern Morocco, but southwestern Morocco and interior parts of Tunisia are expected to miss most of the significant rain resulting in ongoing dryness

- Europe precipitation will be greatest from southern Italy into Hungary and Romania during the next week

- Some flooding is expected in southern Italy and in the eastern Adriatic Sea region due to rainfall varying from 3.00 to more than 7.00 inches by this time next week

- Precipitation elsewhere across Europe is expected to be relatively brief and light

- Temperatures will be cool in the west and warm in the east through the weekend and then near to above normal next week

- Far western Russia, Belarus, western Ukraine and the Baltic States are expecting frequent snow and rain events into Saturday followed by drier weather for at least a week thereafter

- Most other areas in Russia and Ukraine will be dry

- South Africa will be mostly dry in the northeast (mostly Limpopo) through the coming week while showers and thunderstorms slowly increase in other areas

- Heavy rain is expected in parts of Eastern Cape and Natal during the coming week causing some local flooding and disrupting some farm activity

- Southeastern parts of the nation will continue wettest next week

- Southeast Asia (Indonesia and Malaysia in particular) will experience slowly increasing rain frequency and intensity in the next week to ten days

- Recent precipitation was erratic and sometimes very light

- Philippines rainfall has been heavy at times in eastern production areas of the nation this winter due to a strong northeast monsoon flow

- Rain Tuesday was lighter and less threatening, but flooding has occurred recently from northeastern Mindanao through Samar to southeastern Luzon Island

- The unsettled weather will continue this week

- Some forecast models suggest a tropical cyclone may evolve and threaten Mindanao late this weekend into early next week, but confidence is low

- Lower coastal areas of Vietnam may receive some rain periodically during the next ten days, but no heavy rain is expected

- Western Turkey will continue to receive frequent rain over the next ten days with some mountain snow

- Central and eastern Turkey will be drier biased for the next ten days

- Middle East rainfall is expected to be erratic over the next couple of weeks with only pockets of significant moisture

- East-central Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

- Coffee and cocoa conditions should remain favorable in all production areas, despite the anomalies

- West-central Africa dryness will continue through the next ten days to two weeks except near the coast where periodic precipitation is likely

- Dry conditions are normal at this time of year

- No excessive heat is expected in this coming week, although warmer than usual conditions are expected into the first days of February

- Today’s Southern Oscillation Index has peaked and it has begun a period of more significant decline. The index today was still at +18.25 after peaking at +21.45 last Wednesday

Source: World Weather and FI

Bloomberg Ag calendar

Thursday, Jan. 19:

- Global Forum for Food and Agriculture, Berlin, Jan. 18-21

- European cocoa grindings

- North America cocoa grindings

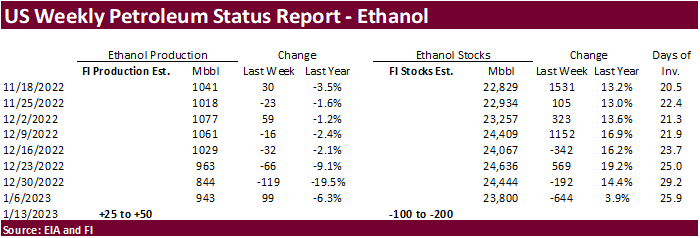

- EIA weekly US ethanol inventories, production

- Port of Rouen data on French grain exports

- New Zealand Food Prices

- USDA red meat production, 3pm

Friday, Jan. 20:

- Global Forum for Food and Agriculture, Berlin, Jan. 18-21

- Malaysia’s Jan. 1-20 palm oil exports

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options

- US net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- US cotton ginnings

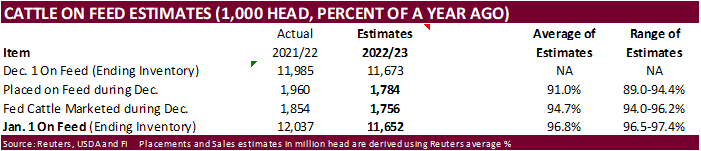

- US cattle on feed

Source: Bloomberg and FI

CME is introducing new crop weekly options

https://www.cmegroup.com/articles/2023/new-crop-vs-old-crop-risk-of-the-past-year.html

Macros

US MBA Mortgage Applications Jan 13: 27.9% (prev 1.2%)

US 30-Yr MBA Mortgage Rate Jan 13: 6.23% (prev 6.42%)

US Retail Sales Advance (M/M) Dec: -1.1% (est -0.9%; prevR -1.0%)

US Retail Sales Ex Auto Dec: -1.1% (est -0.5%; prevR -0.6%)

US Retail Sales Ex Auto And Gas Dec: -0.7% (est 0.0%; prevR -0.5%)

US Retail Sales Control Group (M/M) Dec: -0.7% (est -0.3%; prev -0.2%)

US PPI Final Demand (M/M) Dec: -0.5% (est -0.1%; prev 0.3%)

US PPI Ex Food And Energy (M/M) Dec: 0.1% (est 0.1%; prev 0.4%)

US PPI Final Demand (Y/Y) Dec: 6.2% (est 6.8%; prev 7.4%)

US PPI Ex Food And Energy (Y/Y) Dec: 5.5% (est 5.6%; prev 6.2%)

Canadian Industrial Product Price (M/M) Dec: -1.1% (prev -0.4%)

Canadian Raw Materials Price Index (M/M) Dec: -3.1% (prev -0.8%)

US Industrial Production (M/M) Dec: -0.7% (est -0.1%; prev R -0.6%)

– Capacity Utilisation (M/M): 78.8% (est 79.5%; prev R 79.4%)

– Manufacturing (SIC) Production (M/M): -1.3% (est -0.2%; prev R -1.1%)

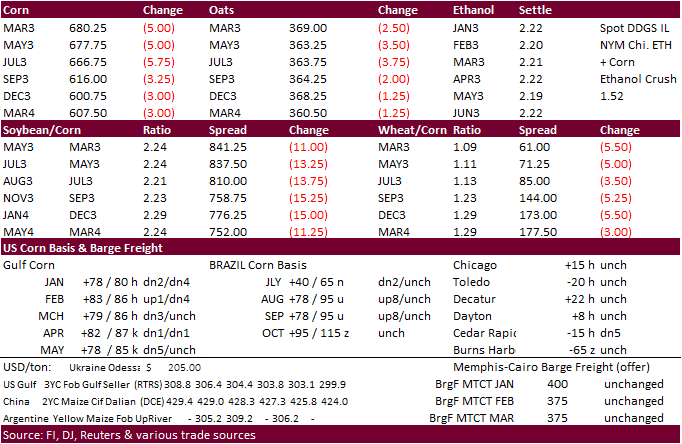

· CBOT corn turned and ended lower following weakness in soybean meal prices and an improvement in the 6-10 day precipitation outlook for Argentina. There were no USDA 24-hour sales despite chatter earlier this week China could be interested in US corn.

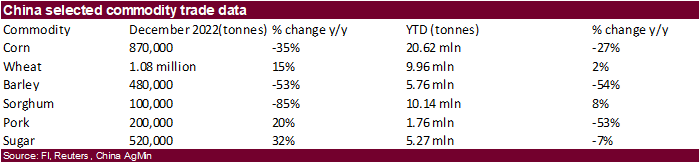

· China December corn imports increased 35 percent from a year earlier to 870,000 tons and brings total 2022 corn imports to 20.6 million tons, down from 28.4 million during 2021. This is higher than we expected from this time a year earlier and expect imports to further slow during 2023 due to a large 2022 harvest.

· China’s state planner said they are confident of their grain supply. China’s AgMin announced they are making headway on trial projects for GMO corn and soybeans and looking to organize pork purchases for state reserves. They reported that the China’s sow herd at the end of 2022 was slightly higher than a reasonable level. China is asking producers to reduce sow herds. 2022 pork production rose to its highest level in eight years. China’s sow herd by the end of 2022 nearly reached 44 million.

· There is some concern the Brazil summer grain crop could be over capacity, by a slightly amount. Brazil was thought to have 187.9 million tons of capacity.

· Cattle on Feed is due out Friday.

EIA forecasts lower wholesale U.S. natural gas prices in 2023 and 2024

https://www.eia.gov/todayinenergy/detail.php?id=55219&src=email

Export developments.

· Egypt seeks corn on January 19 for Feb 10-25 shipment. Egypt tends to buy South American corn followed by Ukraine origin.

Updated 01/12/23

March corn $6.30-$7.00 range. May $6.25-$7.20

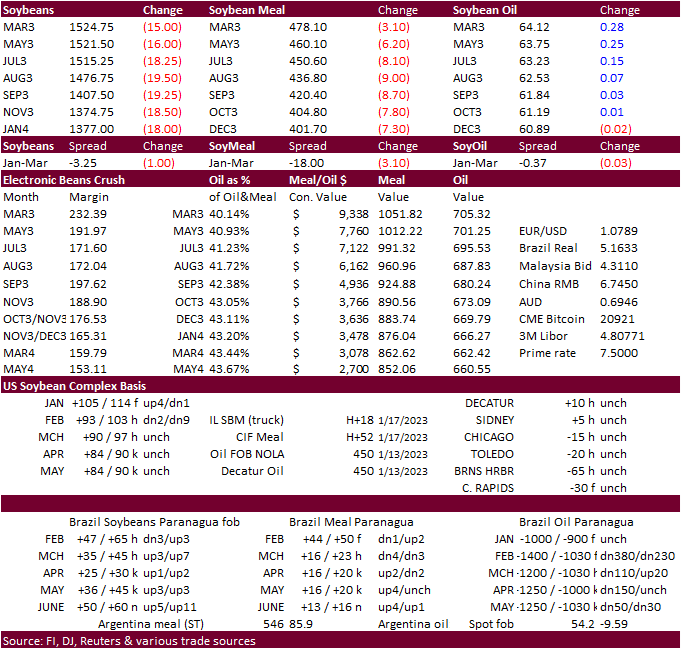

· CBOT soybean complex traded two-sided, ending lower for soybeans and soybean meal. Soybean oil finished higher bias the nearby contracts. After a higher overnight session, soybean meal turned lower early which dragged soybeans down. A reversal in WTI soybean oil to the downside pressured soybean oil. Profit taking was seen for soybeans after prices climbed to a 7-month high this week. Argentina crop concerns eased a touch as the weather forecast improved for next week. The forecast for rain this week was unchanged but wetter for early next week. It appears now all crop areas across Argentina have a chance for rain one time or another over the next ten days.

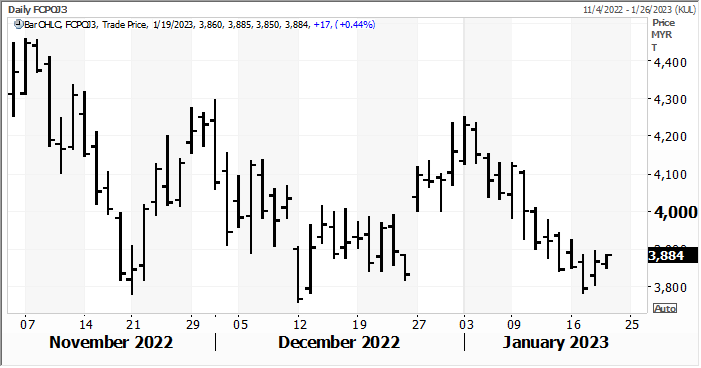

· Palm oil closed higher on strength in mineral oil although chatter of India possibly raising their CPO import tariff may have limited grains.

· US soybean meal basis fell $5/short ton for Chicago, Decatur, IL and Fostoria, OH.

· Brazil’s AgMin said the country can increase grain planting by 5 percent each crop year for several years without deforestation. They are working on plans to work on degraded pastures. They estimate about 150 million hectares (370.66 million acres) of pastures with low productivity and want to convert around 40 million hectares, “in regions suitable for agriculture.”

April palm oil futures

Source: Reuters and FI

· The Philippines seeks up to 45,000 tons of soybean meal on January 19. The soybean meal was sought for April 18 and May 25 shipment.

· The USDA seeks 50,160 tons of soybean meal on January 19 for March 1-10 shipment, for the Food for Progress program.

Updated 01/12/23

Soybeans – March $14.75-$15.75, May $14.75-$16.00

Soybean meal – March $460-$525, May $425-$550

Soybean oil – March 60.00-68.00, May 59-70

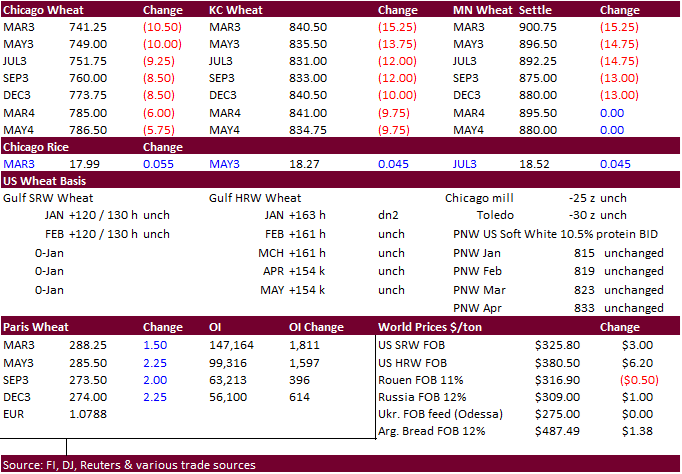

· US wheat futures traded two-sided, ending lower following weakness in corn and soybeans, along with light outside commodity selling. The rebound in the USD by 12:30 pm CT likely added to the negative undertone. It was near unchanged at the close for the CBOT agriculture markets.

· Paris March wheat was up 1.50 euros earlier at 288.75 per ton, in part to technical buying and good demand for EU soft wheat exports.

· FranceAgriMer increased its forecast of French soft wheat exports outside the European Union to 10.6 million tons from10.3 million tons in December, led by demand from Algeria and Morocco. This is about 21% above last crop-year. Stocks as of this June 30 were reduced to 2.33 million tons from 2.55 million estimated in December.

· China auctioned off 142,709 tons of wheat from state reserves that includes 2014-2017 crop years.

· China plans to auction off 140,000 tons of wheat on February 1, that includes stocks from the 2014-2017 crop years.

· China December wheat imports increased 15 percent from a year ago and up 7 percent from November, bringing total 2022 wheat imports to 9.96 million tons, slightly above 2021 and a fresh record.

· Saudi Arabia’s state grains buyer SAGO will become the General Food Security Authority (GFSA). The new agency will expand their responsibilities, including strategic storage, developing an warning system, and partner with countries and international organizations.

Export Developments.

· Tunisia seeks 125,000 tons of durum wheat on January 19, optional origin, for shipment between February 15 and April 5.

· Thailand bought 117,000 tons of feed wheat at $325-$327 and $340/ton, for July and March shipment, respectively. Black Sea, Brazil and/or Australia was thought to be origin.

· Algeria wheat purchase is now estimated between 570,000 and 600,000 tons. The 11.5% protein milling wheat is for March shipment. $334.50 c&f was thought to have been paid.

· Japan seeks 70,000 tons of feed wheat and 40,000 tons of barley on January 25 for arrival in Japan by March 16.

· The Philippines seek up to 165,000 tons of feed wheat and up to 45,000 tons of soybean meal on January 19. The wheat was sought for April 16 and June 25 shipment.

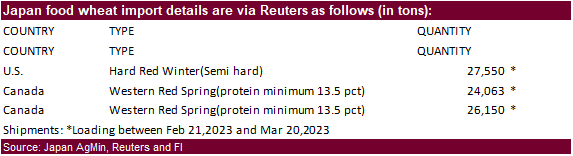

· Japan seeks 77,763 tons of food wheat later this week for Feb 21-Mar 20 shipment.

Rice/Other

· Thailand lowered its rice export target for this year to 7.5 million tons from a previous target of 8 million tons.

Updated 01/12/23

Chicago – March $7.00 to $8.25, May $7.00-$8.50

KC – March $7.75-$9.25, $7.50-$9.50

MN – March $8.75 to $10.00, $8.00-$10.00

Terry Reilly

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 3126041366

DISCLAIMER:

The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

#non-promo