PDF Attached

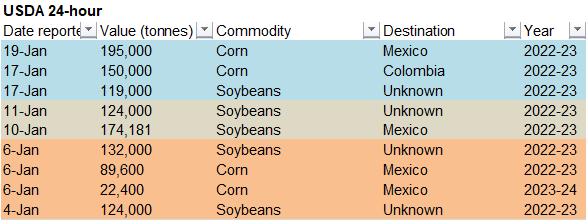

USDA

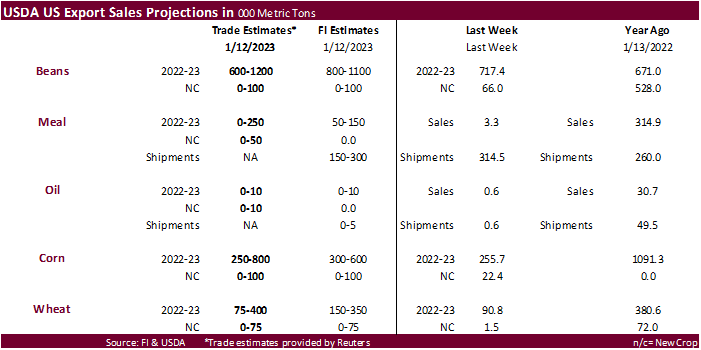

announced private exporters reported sales of 195,000 tons of corn for delivery to Mexico during the 2022/2023 marketing year. The soybean complex ended lower on rain prospects for Argentina (despite a downgrade in crop conditions by

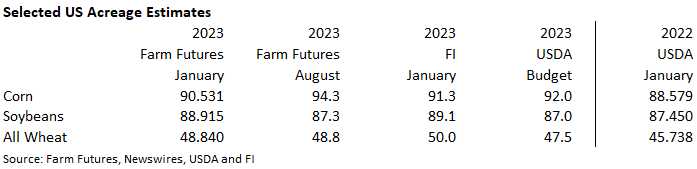

the BA Grains Exchange), along with corn. Wheat traded mostly lower on improving US weather prospects, lower EU wheat futures, and Black Sea competition. A Farm Futures survey calls for US 2023 soybean plantings to end up near 88.915 million acres, corn at

90.531 million acres, and all-wheat at 48.840 million acres. Spring wheat (including durum) was seen at 13.948 million acres and winter wheat at 34.892 million.

![]()

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Relief

is still expected in Argentina during the next ten days to two weeks -

Precipitation

Wednesday and early today was not very great, but rain will impact most crop areas during the coming ten days and enough will occur to stop the decline in crop conditions and actually improve some of the crops -

Friday

and Saturday will bring the first round of significant rain to southern and some eastern most parts of the nation -

Showers

and thunderstorms are likely in the north later in the weekend -

The

middle to latter part of next week will likely be the next wetter period with central and northern areas getting the greatest rain -

Improvements

in late season corn, peanuts, sorghum and soybeans as well as cotton is expected -

Some

citrus and sugarcane improvement is also expected -

So

far this year peanuts and sugarcane have experienced the best weather while sunseed and early season corn have lost the most production potential -

Far

southern Brazil (Rio Grande do Sul mostly) will not see a good distribution of rain for a while, though some showers and thunderstorms will pop up infrequently and lightly -

The

state will continue to have low soil moisture in parts of the region and greater rain will soon be needed -

World

Weather, Inc. anticipates greater rainfall for far southern Brazil, Uruguay and Paraguay during the last week in January.

-

Most

of Brazil will experience a routine occurrence of rain and thunderstorm activity over the next two weeks, though the intensity and frequency of rain will be a little less than that of recent weeks -

Some

of the wettest areas in the nation will continue wet – mostly in southern Minas Gerais and northern Sao Paulo; other areas will see enough sunshine and lighter rain to improve crop maturation and harvest conditions -

Much

of Brazil reported limited rainfall Wednesday -

Impressive

snowfall occurred in central Nebraska Wednesday with nearly two feet of accumulation in a small region -

Most

of the snowfall ranged from 6-14 inches with only the southeast reporting limited accumulations

-

Northwestern

Kansas reported up to 5 inches of snow accumulation while northeastern Colorado had 4 to 12 inches -

Moisture

totals in Nebraska varied from 0.20 to 0.85 inch with a few areas getting close to 1.00 inch of moisture -

Western

Kansas moisture totals varied from 0.20 to 0.50 inch with similar totals in northeastern Colorado.

-

Significant

moisture also occurred in the U.S. Midwest Wednesday and early today from the same storm system that produced heavy snow in the central Plains -

Moisture

totals of 1.00 to 3.00 inches from southeastern Missouri to southwestern Indiana while 0.25 to 1.25 inches occurred in many other areas -

The

lower Ohio river Basin, Tennessee River Basin and northern Delta were wettest

-

Additional

storminess is likely in the central U.S. Plains late Friday into the weekend

-

Some

heavy snowfall is expected in western Kansas where moisture totals will vary from 0.20 to 0.65 inch

-

Snow

accumulations may range from 5 to 12 inches -

rain

and snow will impact eastern Kansas while mostly light rain occurs in northern and eastern Oklahoma -

Southwestern

U.S. Plains; including most of West Texas will not get much precipitation over the next two weeks -

South

Texas will receive “some” rain over the next two weeks, but most amounts will be less than 0.50 inch for the entire period leaving need for more rain prior to planting in late February and early March -

California’s

active weather pattern is winding down with some lingering rain and mountain snow today

-

Ten

days of drier weather may occur, although complete dryness is not expected in the north -

The

break in the precipitation will help end flooding concerns and give recent moisture a chance to soak into the ground, but more rain and snow will be needed to seriously raise water supply over that of recent past years and to curb this multi-year drought -

U.S.

Midwest, Delta and southeastern states will experience a frequent occurrence of rain and some snow (mostly in the Midwest) during the next couple of weeks maintaining and, in some cases, improving topsoil moisture for use in the spring -

U.S.

Northern Plains and Canada’s Prairies will experience light amounts of precipitation during the next ten days to two weeks -

Snow

cover remains significant in central and eastern North Dakota, Minnesota and in random locations across central and especially far eastern South Dakota

-

Snow-free

conditions are present in portions of the southwestern Canada Prairies and in portions of both Montana and western South Dakota -

Snow

cover in Canada is greatest near the U.S. border in Manitoba and across the northern most portions of crop country -

Concern

will rise over some of the drier areas in southwestern Canada where drought has lasted six years in some areas -

A

band of significant snow will occur from northern Saskatchewan into Manitoba this weekend and early next week

-

U.S.

temperatures will turn colder next week while this week’s readings are near to below normal in the western states and above normal in the central and east

-

Temperatures

in the last week of this month will be cooler than usual in the central and western states with emphasis on the north-central states and south-central Canada -

Bitter

cold weather may hold off until sometime in the first half of February -

India

rain potentials are improving for a few north-central and many eastern winter crop areas next week

-

The

moisture will favor wheat, winter rice and some pulse production areas, but may not impact rapeseed production areas -

Rainfall

will be light and the need for follow up rain will be high except from parts of Uttarakhand into Jammu and Kashmir where frequent precipitation of significance is expected -

Eastern

Australia summer crop areas will begin experiencing periodic showers and thunderstorms during the weekend and especially next week -

The

rain will help improve dryland sorghum, cotton and other crops -

Eastern

China’s precipitation will resume in the Yangtze River Basin this weekend and especially next week -

The

moisture will help maintain a very good outlook for future rapeseed and minor wheat production areas

-

Some

rain and snow will also impact the rest of the nation, but resulting moisture will not be great enough for serious changes to soil moisture -

North

Africa will begin receiving routine bouts of rain in northern Algeria and coastal Tunisia the remainder of this week and next week

-

The

moisture boost will be ideal for improving wheat and barley establishment and raising the potential for better crop performance in the spring -

Some

rain will also fall in northern Morocco, but southwestern Morocco and interior parts of Tunisia are expected to miss most of the significant rain resulting in ongoing dryness -

Europe

precipitation will be greatest from southern Italy into Hungary and Romania during the next week -

Some

flooding is expected in southern Italy and in the eastern Adriatic Sea region due to rainfall varying from 2.00 to 6.00 inches by this time next week

-

Precipitation

elsewhere across Europe is expected to be relatively brief and light -

Temperatures

will be cool in the west and warm in the east through the weekend and then near to above normal next week

-

Far

western Russia, Belarus, western Ukraine and the Baltic States are expecting frequent snow and rain events over the next ten days to two weeks -

Most

other areas in Russia and Ukraine will only receive a light amount of moisture -

South

Africa will be mostly dry in the northeast (mostly Limpopo) through the coming week while showers and thunderstorms slowly increase in other areas -

Heavy

rain is expected in parts of Eastern Cape and Natal during the coming week causing some local flooding and disrupting some farm activity -

Southeastern

parts of the nation will continue wettest next week -

Southeast

Asia (Indonesia and Malaysia in particular) will experience slowly increasing rain frequency and intensity in the next week to ten days

-

Recent

precipitation was erratic and sometimes very light -

Philippines

rainfall has been heavy at times in eastern production areas of the nation this winter due to a strong northeast monsoon flow -

Rain

Tuesday and Wednesday was lighter and less threatening, but flooding has occurred recently from northeastern Mindanao through Samar to southeastern Luzon Island -

The

unsettled weather will resume over the next two weeks with more frequent rain and eventually some additional heavy rainfall and flooding are expected in the east again -

Some

forecast models suggest a tropical cyclone may evolve and threaten Mindanao late this weekend into early next week, but confidence is low -

Lower

coastal areas of Vietnam may receive some rain periodically during the next ten days, but no heavy rain is expected -

Western

Turkey will continue to receive frequent rain over the next ten days with some mountain snow -

Central

and eastern Turkey will be drier biased for the next ten days -

Middle

East rainfall is expected to be erratic over the next couple of weeks with only pockets of significant moisture -

East-central

Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and lighter.

-

Coffee

and cocoa conditions should remain favorable in all production areas, despite the anomalies -

West-central

Africa dryness will continue through the next ten days to two weeks except near the coast where periodic precipitation is likely

-

Dry

conditions are normal at this time of year -

No

excessive heat is expected in this coming week, although warmer than usual conditions are expected into the first days of February

-

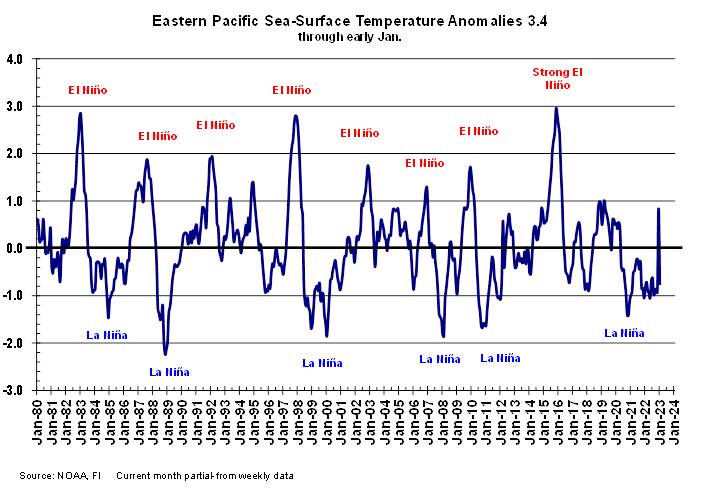

Today’s

Southern Oscillation Index was +18.19 today and it is likely to drift lower as time moves along

Source:

World Weather and FI

Bloomberg

Ag calendar

Thursday,

Jan. 19:

- Global

Forum for Food and Agriculture, Berlin, Jan. 18-21

- European

cocoa grindings - North

America cocoa grindings - EIA

weekly US ethanol inventories, production - Port

of Rouen data on French grain exports - New

Zealand Food Prices - USDA

red meat production, 3pm

Friday,

Jan. 20:

- Global

Forum for Food and Agriculture, Berlin, Jan. 18-21

- Malaysia’s

Jan. 1-20 palm oil exports - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - US

net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - US

cotton ginnings - US

cattle on feed

Monday,

Jan. 23:

- MARS

monthly report on EU crop conditions - Brazil’s

Unica to release sugar output, cane crush data during the week (tentative) - HOLIDAY:

China, Hong Kong, Malaysia, Indonesia, Korea, New Zealand, Singapore, Vietnam

Tuesday,

Jan. 24:

- EU

weekly grain, oilseed import and export data - HOLIDAY:

China, Singapore, Hong Kong, Malaysia, Korea, Vietnam

Wednesday,

Jan. 25:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

Jan. 1-25 palm oil exports - US

cold storage data for pork, beef and poultry, 3pm - National

Coffee Association’s webinar on 2023 US coffee outlook - USDA

total milk production, 3pm - US

poultry slaughter, 3pm - HOLIDAY:

China, Hong Kong, Vietnam

Thursday,

Jan. 26:

- Paris

Grain Conference, day 1 - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

to release its outlook for world orange and orange-juice production - Port

of Rouen data on French grain exports - HOLIDAY:

China, India, Australia, Vietnam

Friday,

Jan. 27:

- Paris

Grain Conference, day 2 - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - US

cattle inventory, 3pm - HOLIDAY:

China

Source:

Bloomberg and FI

Macros

US

Initial Jobless Claims Jan 14: 190K (est 214K; prev 205K)

US

Continuing Claims Jan 7: 1647K (est 1655K; prev 1634K)

US

Housing Starts Dec: 1382K (est 1358K; prev 1427K)

US

Building Permits Dec: 1330K (est 1365K; prevR 1351K)

US

Housing Starts (M/M) Dec: -1.4K (est -4.8%; prev -0.5%)

US

Building Permits (M/M) Dec: -1.6K (est 1.0%; prevR -10.6%)

US

Philadelphia Fed Business Outlook Jan: -8.9 (est -11.0; prevR -13.7)

US

Philadelphia Fed Business Conditions January -8.9 (Consensus -11.0) Vs December -13.7

Philadelphia

Fed Prices Paid Index January 24.5 Vs December 36.3

Philadelphia

Fed New Orders Index January -10.9 Vs December -22.3

Philadelphia

Fed Employment Index January 10.9 Vs December -0.9

Philadelphia

Fed Six-Month Business Conditions January 4.9 Vs December -0.9

Philadelphia

Fed Six-Month Capital Expenditures Outlook January 10.5 Vs December 16.2

US

EIA NatGas Storage Change (BCF) 13-Jan: -82 (est -76; prev +11)

–

Salt Dome Cavern NatGas Stocks (BCF): +12 (prev +25)

US

DoE Crude Oil Inventories (W/W) 13-Jan: +8.408M (est -3.000M; prev +18.961M)

–

Distillate: -1.939M (est -200K; prev -1.069M)

–

Cushing: +3.646M (prev +2.511M)

–

Gasoline: +3.483M (est +2.400M; prev +4.114M)

–

Refinery Utilization: +1.2% (est +3.5%; prev +4.5%)

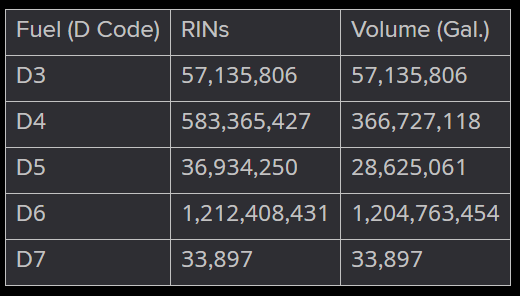

2022

U.S.

GENERATED 583 MLN BIODIESEL (D4) BLENDING CREDITS IN DECEMBER, VS 582 MLN IN NOVEMBER

U.S.

GENERATED 1.21 BLN ETHANOL (D6) BLENDING CREDITS IN DECEMBER, VS 1.27 BLN IN NOVEMBER

2021

U.S.

GENERATED 576 MLN BIODIESEL (D4) BLENDING CREDITS IN DECEMBER, VS 464 MLN IN NOVEMBER

U.S.

GENERATED 1.30 BLN ETHANOL (D6) BLENDING CREDITS IN DECEMBER, VS 1.26 BLN IN NOVEMBER

·

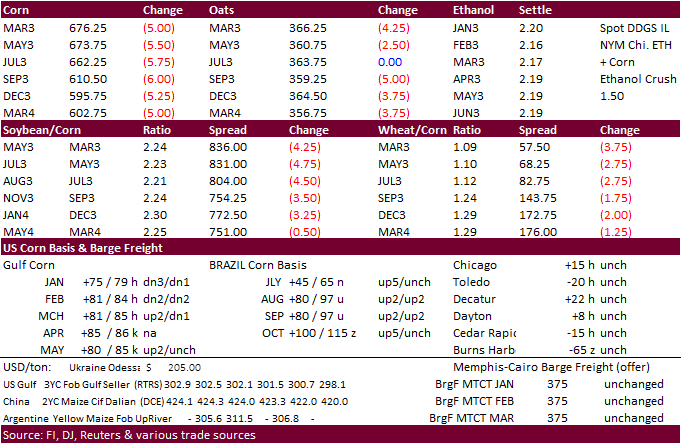

CBOT corn

ended

lower from Black Sea export competition and forecasts for rain to fall across Argentina over the next week. US offers for Egypt’s corn import tender fell short but were close to the lowest offer presented. They ended up picking up Romanian wheat, but some

noted the terms of the import tender blocked out much of the competition. USDA announced 195,000 tons of corn was sold to Mexico, and that may have limited losses.

·

Funds sold an estimated net 4,000 corn contracts.

·

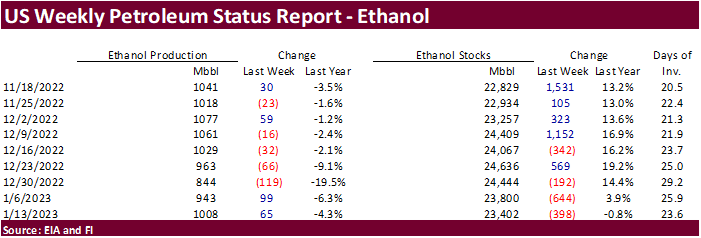

US weekly ethanol production was better than expected and ethanol stocks dropped for the third consecutive week.

·

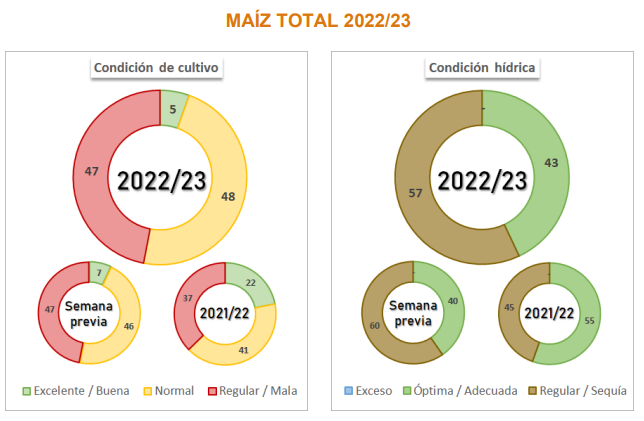

The Buenos Aires grains exchange cut its estimate for Argentina’s 2022-23 corn harvest to 44.5 million tons, down from 50 million tons previously and 52 million tons last year. Corn plantings are running 89 percent.

·

Argentina’s BA Grains Exchange reported the combined good and excellent corn rating at 5 percent and poor condition at 48 percent. Last week they were 7 and 47 percent, respectively. Rosario last week lowered their corn estimate

to 45 million tons.

·

African swine fever is spreading throughout the Thailand island of Penang and far west-central Thailand, a sign the disease has not gone away in Southeast Asia.

·

USDA reported US eggs set in the US down slightly from a year ago and chicks placed up 1 percent. Cumulative placements were up 2 percent from the same period a year earlier.

·

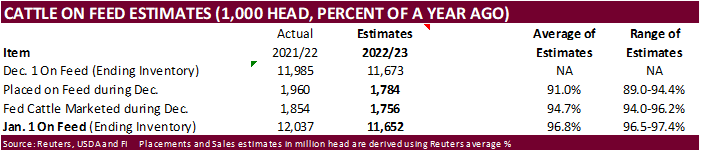

Cattle on Feed is due out Friday.

·

CME hog futures fell on Wednesday as wholesale pork price declined to near a 2-year low. Demand from China has slowed as they saw a surge in pork production late last year.

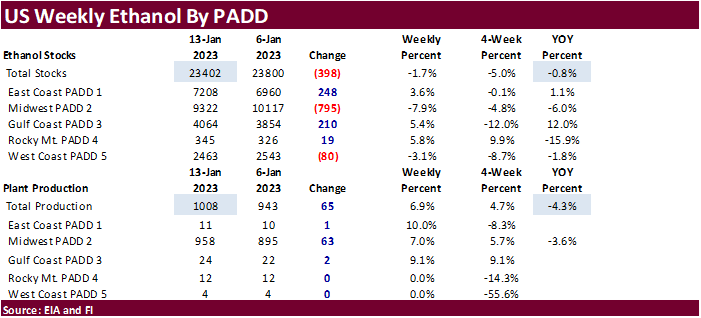

US

ethanol production

for the week ending January 13 increased a more than expected 65,000 barrels to 1.008 million and stocks decreased 398,000 barrels to 23.402 million. A Bloomberg poll looked for weekly US ethanol production to be up 41,000 thousand barrels stocks up 107,000

barrels. The recovery in US ethanol production was aided by above normal temperatures since late December and very good ethanol margins since the start of the year. The average production change over the past four weeks is down 5,000 barrels while stocks are

off 166,000. Early September 2022 through January 13 ethanol production is still running well below, by 5.2%, from the comparable period year ago and 4.2 percent below pre pandemic levels. US gasoline stocks increased by 3.5 million barrels to 230.3 million

barrels, and implied gasoline demand increased 496,000 barrels to 8.054 million. US gasoline demand is down about 2 percent from the same week a year ago and off nearly 6 percent from mid-January 2020. Refinery and blender net input of oxygenates fuel was

834,000 barrels, up 66,000 from the previous week. Net production of combined finished reformulated and conventional motor gasoline with ethanol was 8.223 million barrels, up 649,000 barrels from the previous week and represents 91.1 percent of total finished

motor gasoline, same percentage blending rate as the previous week. We remain 25 million bushels below USDA for US 2022-23 corn for ethanol use.

US

DoE Crude Oil Inventories (W/W) 13-Jan: +8.408M (est -3.000M; prev +18.961M)

–

Distillate: -1.939M (est -200K; prev -1.069M)

–

Cushing: +3.646M (prev +2.511M)

–

Gasoline: +3.483M (est +2.400M; prev +4.114M)

–

Refinery Utilization: +1.2% (est +3.5%; prev +4.5%)

Export

developments.

·

Egypt bought 50,000 tons of Romanian corn at $339 per ton c&f for shipment Feb. 10-25 and payment at sight. Some noted the specifications of the tender excluded many offers. Lowest offer earlier was $336/ton of Ukrainian origin.

Lowest US offer was $337.93/ton. Egypt tends to buy South American corn followed by Ukraine origin.

·

USDA: Private exporters reported sales of 195,000 metric tons of corn for delivery to Mexico during the 2022/2023 marketing year.

Updated

01/19/23

March

corn $6.50-$7.25 range. May

$6.25-$7.20

·

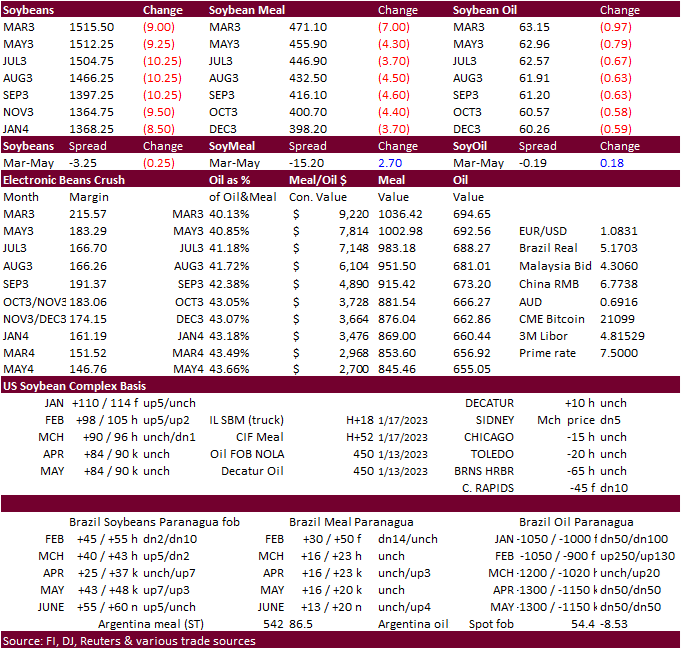

CBOT soybean

complex traded lower as traders digest improving Argentina weather. It’s uncertain at this point is soybean production will improve from the 39 trade estimate, what we think is worked in. But not a 100 percent has been planted yet, and La Nina is abating.

We are using 40.5 million tons for the Argentina crop. Soybean meal and soybean oil traded lower. Meal saw a good amount of bear spreading from a slight erosion in SA meal premiums.

·

Funds sold an estimated net 4,000 soybeans, 3,000 soybean meal and 3,000 soybean oil.

·

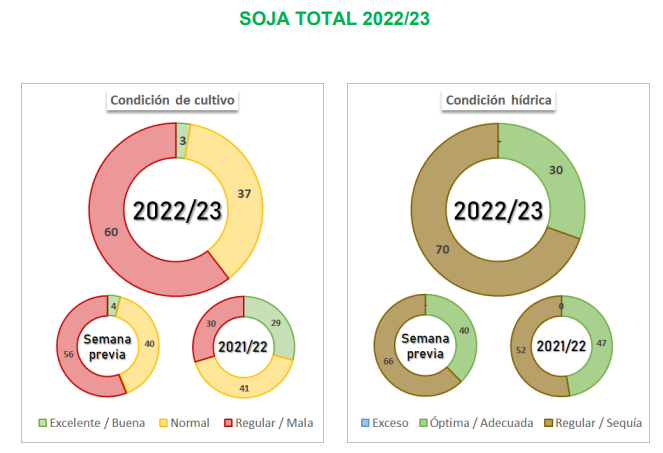

Argentina soybean and corn conditions worsened from the previous week.

·

Argentina’s BA Grains Exchange reported the combined good and excellent soybean rating at 3 percent and poor condition at 60 percent. Last week they were 4 and 56 percent, respectively. Soybean plantings are running at 96 percent.

·

Malaysian palm futures ended higher.

·

A Reuters poll calls for 2023 will average 3,800 ringgit a ton in 2023, down 23% from last year’s record average of 4,910 ringgit.

·

Two Brazilian soybean cargoes destined for Argentina showed on shipping lineup reports earlier this week, one expected to sail February 5 and another February 8.

·

Russia proposed increasing its export tariffs on soybeans by 20 percent to 50 percent to increase domestic processing.

·

China is looking to increase its domestic soybean area by 6 percent or 667,000 hectares for the 2023 crop to reduce its dependency on imports. 2022 China soybean plantings were up 22 percent and production was up nearly 24 percent

to 20.3 million tons.

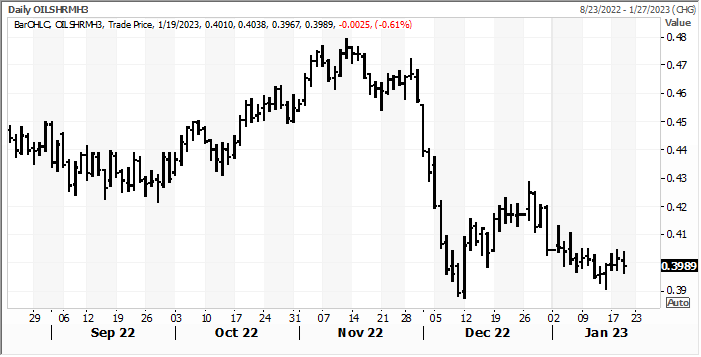

March

soybean oil share

Source:

Reuters and FI

·

The trade is waiting for results on the Philippines seeking up to 45,000 tons of soybean meal. The soybean meal was sought for April 18 and May 25 shipment.

·

Today the USDA seeks 50,160 tons of soybean meal for March 1-10 shipment, for the Food for Progress program.

Updated

01/19/23

Soybeans

– March $14.75-$15.75, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

60.00-68.00, May 58-70

·

US wheat futures traded two-sided and ended lower for Chicago and KC and higher for front month MN. The bearish undertone for Chicago and KC was tied with large Russia grain export prospects and good winter grain conditions for

Russia. EU wheat fell to near a 10-month low. US winter grain growing area soil moisture levels are improving as precipitation falls across the Great Plains. NE saw a good anow event over the past day. US SRW wheat growing areas are good shape.

·

Funds sold an estimated net 4,000 Chicago wheat contracts.

·

March Paris milling wheat officially closed down 3.75 euros, or 1.3%, at 294.75 euros a ton ($308.38/ton).

·

Some western countries pledged to supply Ukraine weapons, a signal the Russia/Ukraine situation has no near term end in sight. The Ukraine/Russia conflict turns one year old next month.

·

After Russia’s President announced earlier this week the country needs to become more focused on grain reserves to ensure supply by controlling exports, the Russian AgMin estimated grain exports this season are expected to end

up between 55 and 60 million tons through June 2023. This compares to IKAR’s 55.5 million ton estimate.

·

Russia’s AgMin reported about 94 percent of the winter crops were rated in satisfactory condition, 3 points below this time year ago.

·

India domestic wheat prices hit a record high this week and now the government is considering some type of policy to cool prices. They already curbed exports during the FH of 2022.

Export

Developments.

·

Tunisia’s state grains agency bought 125,000 tons of optional origin durum wheat in five consignments of 25,000 tons an estimated $489.49, $492.68, $492.29, $494.49, and $493.09/ton C&F for shipment between Feb. 15 and April 5.

·

The Philippines bought around 110,000 tons of Australian feed wheat. No prices were provided. The wheat was sought for April 16 and June 25 shipment.

·

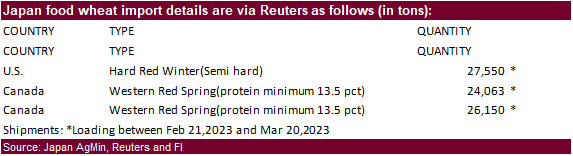

Japan bought 77,763 tons of food wheat for Feb 21-Mar 20 shipment. Original details as follows:

·

Japan seeks 70,000 tons of feed wheat and 40,000 tons of barley on January 25 for arrival in Japan by March 16.

Rice/Other

·

(Bloomberg) — China Dec. Cotton Imports +24.9% Y/y. China’s exports of rare-earth products fell 2% from a year ago in Dec., according to figures released by the Beijing-based Customs General Administration.

·

(Bloomberg) — The Philippines is planning to import 450,000 tons of sugar to boost domestic supplies and temper prices, an official from the Sugar Regulatory Administration said.

·

(Bloomberg) — Florida’s Orange Crop Is Smallest In Decades, Hit by Weather, Disease. Florida orange growers are harvesting their smallest crop in nearly 90 years, the result of an ill-timed freeze, two hurricanes and citrus

disease that is laying waste to its groves.

·

(Reuters) – India is not looking at allowing more sugar exports, government and industry officials said on Thursday, dampening speculation that the world’s biggest producer of the sweetener would permit a second tranche of overseas

shipments.

Updated

01/19/23

Chicago

– March $7.00 to $8.00, May $7.00-$8.25

KC

– March $7.75-$9.00, $7.50-$9.25

MN

– March $8.75 to $10.00,

$8.00-$10.00

Terry Reilly

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 3126041366

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo