PDF Attached

CFTC Commitment of Traders will be sent in a separate email.

USDA

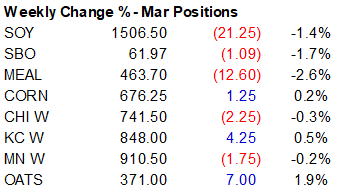

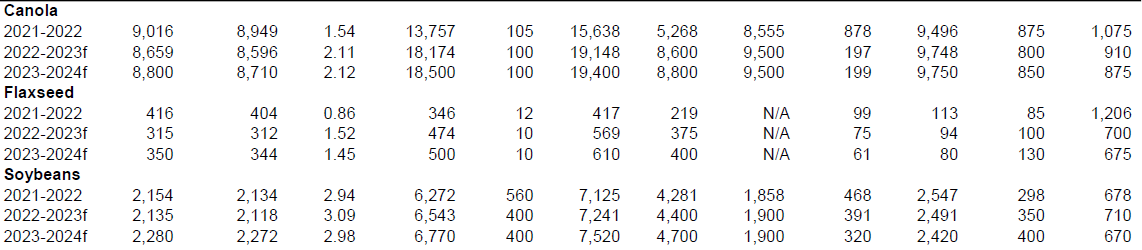

24-hour: Private exporters reported sales of 220,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year. The soybean complex trended lower led by selling in the products. Corn finished moderately lower, and wheat

rallied from bottom picking. News was light. USDA export sales were good overall, exception soybean oil.

There were no major export developments other than the USDA 24-hour soybean sale. For the week the soybean complex was lower, and grain near unchanged.

As

expected, rains fell across Argentina’s northern Santa Fe and central La Pampa Thursday into Friday. Argentina’s weather forecast was unchanged with rains favoring south Cordoba, La Pampa, Buenos Aires today; and Santa Fe, Entre Rios, eastern Buenos Aires

over the weekend. The southwest areas will benefit the most. Week 2 of Argentina’s weather forecast calls for additional rain bias central areas. Brazil will see rain across most of the growing areas through early next week. RGDS will remain on the drier side.

Some disruptions to harvest progress is expected. The US weather forecast is unchanged. The central and southern Great Plains will see a wintery mix through Saturday and again Tuesday.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Southwestern

Argentina began receiving significant rain overnight -

La

Pampa, western Buenos Aires and southern Cordoba reported 0.60 to 2.25 inches of rain with local totals approaching 3.00 inches -

The

rain will shift to the east across Buenos Aires today and then diminish tonight while shifting northeast into east-central parts of nation where only light rainfall is expected -

Other

areas in Argentina will not be getting much significant rain for a while -

The

next round of most significant rain will evolve late next week and continue through the following weekend

-

The

entire nation will have received significant rain by the end of the month and the moisture will improve field and crop conditions nationwide by that time -

However,

the improvement outside of the south today and early Saturday will likely be limited until late next week and into the following weekend -

Far

southern Brazil, Uruguay and Paraguay are not likely to see large amounts of rain for a while and moisture stress will continue for some crop areas -

The

greatest potential for generalized rain in these areas will come near the end of this month and the moisture will be good for improved crop conditions at that time -

Until

then sufficient shower activity is expected to slow declining crop conditions in central and southern Rio Grande do Sul while northern crops will stay in fair to good shape while needing greater rain -

Center

south Brazil crop areas continue wet, although lighter rain in the past three days has improved the excessive moisture situation; however, the rain frequency and intensity is expected to increase once again -

Harvest

and crop maturation delays are likely in Minas Gerais, northeastern Sao Paulo, Goias and a few neighboring areas because of frequent rain and wet field conditions -

Mato

Grosso, however, is expected to see the least significant and lowest frequency of rain supporting early soybean maturation and harvest progress -

Safrinha

corn and cotton planting progress should improve in Mato Grosso as well -

Most

crop areas outside of Minas Gerais, northeastern Sao Paulo and a few Goias locations will experience a mostly good environment for crop development -

U.S.

crop weather expectations have not changed greatly today relative to that of Thursday -

Snow

will fall in western Kansas and eastern Colorado tonight and Saturday with sufficient accumulations to slow travel and stress livestock briefly, but the moisture will be good for improving topsoil moisture when the snow melts -

Rain

and snow will also impact neighboring areas -

Another

opportunity for snow and rain will develop in the central Plains early to mid-week next week before turning into a larger storm system of significance across the Midwest -

Heavy

snow will fall from Missouri to the Great Lakes region during the middle part of next week while significant rain falls to the south -

Rain

will fall abundantly in the Delta, Tennessee River Basin and areas northeast to the middle and upper Atlantic Coast -

Some

amounts will range from 1.00 to 3.00 inches and that follows lighter rain that occurs in the southeastern states this weekend -

U.S.

week-two weather will bring colder air to the north-central states and producing some additional snow and rain in the eastern states

-

Some

upslope conditions will occur as the cold air pushes into the central and eastern states resulting in light snow along the front range of the Rocky Mountains -

U.S.

Temperatures will be trending much colder late next week and into the following weekend -

Until

then the cold will build up in Canada’s Prairies and may impact a part of the northern U.S. Plains in time -

Despite

talk about the polar vortex becoming displaced, the coldest air will not likely evolve into the United States until early February and any cold that occurs prior to then is expected to be brief and not very intense -

Southwestern

U.S. Plains; including most of West Texas will not get much precipitation over the next two weeks -

South

Texas will receive “some” rain over the next two weeks, but most amounts will be less than 0.50 inch for the entire period leaving need for more rain prior to planting in late February and early March -

California’s

active weather pattern has ended for a while -

Ten

days of drier weather may occur, although complete dryness is not expected in the north -

The

break in the precipitation will help end flooding concerns and give recent moisture a chance to soak into the ground, but more rain and snow will be needed to seriously raise water supply over that of recent past years and to curb this multi-year drought -

U.S.

Northern Plains and Canada’s Prairies will experience light amounts of precipitation during the next ten days to two weeks -

Snow

cover remains significant in central and eastern North Dakota, Minnesota and in random locations across central and especially far eastern South Dakota

-

Snow-free

conditions are present in portions of the southwestern Canada Prairies and in portions of both Montana and western South Dakota -

Snow

cover in Canada is greatest near the U.S. border in Manitoba and across the northern most portions of crop country -

Concern

will rise over some of the drier areas in southwestern Canada where drought has lasted six years in some areas -

A

band of significant snow will occur from northern Saskatchewan into Manitoba this weekend and early next week

-

India

rain potentials are improving for a few north-central and many eastern winter crop areas next week

-

The

moisture will favor wheat, winter rice and some pulse production areas, but may not impact rapeseed production areas -

Rainfall

will be light and the need for follow up rain will be high except from parts of Uttarakhand into Jammu and Kashmir where frequent precipitation of significance is expected -

Eastern

Australia summer crop areas will begin experiencing periodic showers and thunderstorms during the weekend and especially next week -

The

rain will help improve dryland sorghum, cotton and other crops -

Eastern

China’s precipitation will resume in the Yangtze River Basin this weekend and especially next week -

The

moisture will help maintain a very good outlook for future rapeseed and minor wheat production areas

-

Some

rain and snow will also impact the rest of the nation, but resulting moisture will not be great enough for serious changes to soil moisture -

North

Africa will begin receiving routine bouts of rain in northern Algeria and coastal Tunisia the remainder of this week and next week

-

The

moisture boost will be ideal for improving wheat and barley establishment and raising the potential for better crop performance in the spring -

Some

rain will also fall in northern Morocco, but southwestern Morocco and interior parts of Tunisia are expected to miss most of the significant rain resulting in ongoing dryness -

Europe

precipitation will be greatest from southern Italy into Hungary and Romania during the next week -

Some

flooding is expected in southern Italy and in the eastern Adriatic Sea region due to rainfall varying from 2.00 to 6.00 inches by this time next week

-

Precipitation

elsewhere across Europe is expected to be relatively brief and light -

Temperatures

will be cool in the west and warm in the east through the weekend and then near to above normal next week

-

Far

western Russia, Belarus, western Ukraine and the Baltic States are expecting frequent snow and rain events over the next ten days to two weeks -

Most

other areas in Russia and Ukraine will only receive a light amount of moisture -

South

Africa will be mostly dry in the northeast (mostly Limpopo) through the coming week while showers and thunderstorms slowly increase in other areas -

Heavy

rain is expected in parts of Eastern Cape and Natal during the coming week causing some local flooding and disrupting some farm activity -

Southeastern

parts of the nation will continue wettest next week -

Southeast

Asia (Indonesia and Malaysia in particular) will experience slowly increasing rain frequency and intensity in the next week to ten days

-

Recent

precipitation was erratic and sometimes very light -

Philippines

rainfall has been heavy at times in eastern production areas of the nation this winter due to a strong northeast monsoon flow -

Rain

this week has been lighter and less threatening, but flooding has occurred recently from northeastern Mindanao through Samar to southeastern Luzon Island -

The

unsettled weather will resume over the next two weeks with more frequent rain and eventually some additional heavy rainfall and flooding are expected in the east again -

Some

forecast models suggest a tropical cyclone may evolve and threaten Mindanao late this weekend into early next week, but confidence is low -

Lower

coastal areas of Vietnam may receive some rain periodically during the next ten days, but no heavy rain is expected -

Western

Turkey will continue to receive frequent rain over the next ten days with some mountain snow -

Central

and eastern Turkey will be drier biased for the next ten days -

Middle

East rainfall is expected to be erratic over the next couple of weeks with only pockets of significant moisture -

East-central

Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

-

Coffee

and cocoa conditions should remain favorable in all production areas, despite the anomalies -

West-central

Africa dryness will continue through the next ten days to two weeks except near the coast where periodic precipitation is likely

-

Dry

conditions are normal at this time of year -

No

excessive heat is expected in this coming week, although warmer than usual conditions are expected into the first days of February

-

Today’s

Southern Oscillation Index was +17.62 today and it is likely to drift lower as time moves along

Bloomberg

Ag calendar

Friday,

Jan. 20:

- Global

Forum for Food and Agriculture, Berlin, Jan. 18-21

- Malaysia’s

Jan. 1-20 palm oil exports - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - US

net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - US

cotton ginnings - US

cattle on feed

Monday,

Jan. 23:

- MARS

monthly report on EU crop conditions - Brazil’s

Unica to release sugar output, cane crush data during the week (tentative) - HOLIDAY:

China, Hong Kong, Malaysia, Indonesia, Korea, New Zealand, Singapore, Vietnam

Tuesday,

Jan. 24:

- EU

weekly grain, oilseed import and export data - HOLIDAY:

China, Singapore, Hong Kong, Malaysia, Korea, Vietnam

Wednesday,

Jan. 25:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

Jan. 1-25 palm oil exports - US

cold storage data for pork, beef and poultry, 3pm - National

Coffee Association’s webinar on 2023 US coffee outlook - USDA

total milk production, 3pm - US

poultry slaughter, 3pm - HOLIDAY:

China, Hong Kong, Vietnam

Thursday,

Jan. 26:

- Paris

Grain Conference, day 1 - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

to release its outlook for world orange and orange-juice production - Port

of Rouen data on French grain exports - HOLIDAY:

China, India, Australia, Vietnam

Friday,

Jan. 27:

- Paris

Grain Conference, day 2 - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - US

cattle inventory, 3pm - HOLIDAY:

China

Source:

Bloomberg and FI

USDA

Export Sales

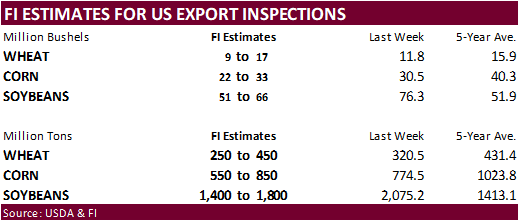

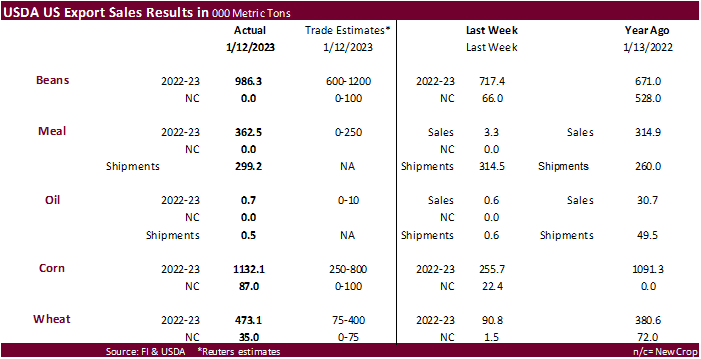

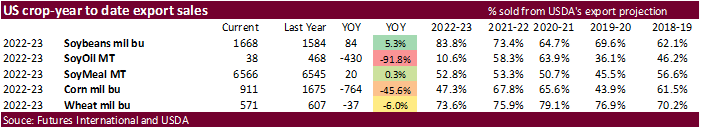

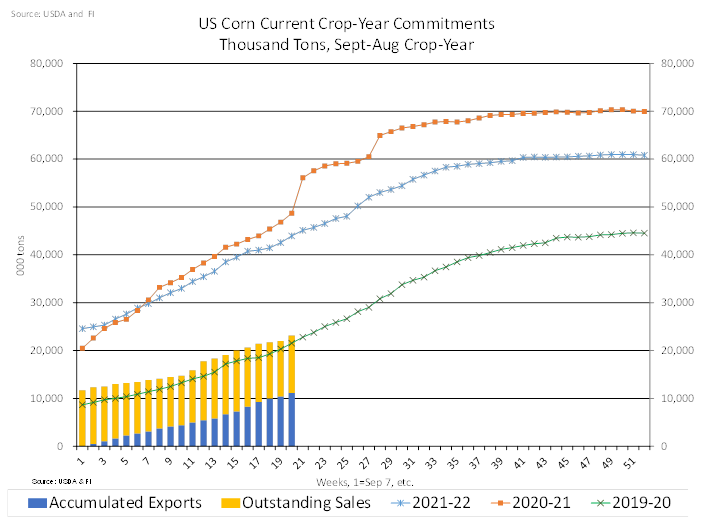

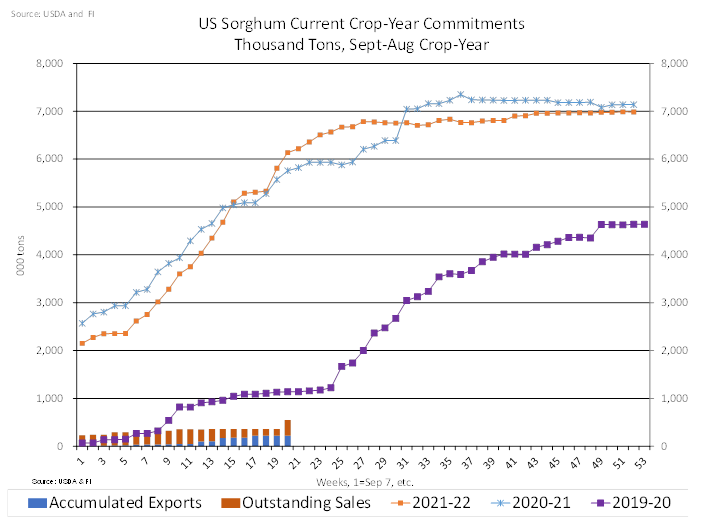

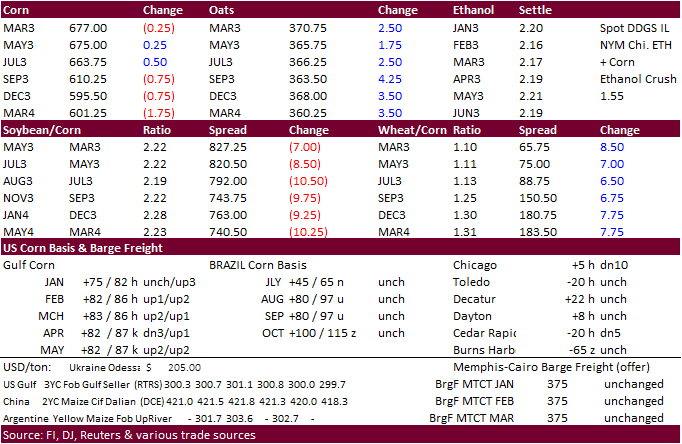

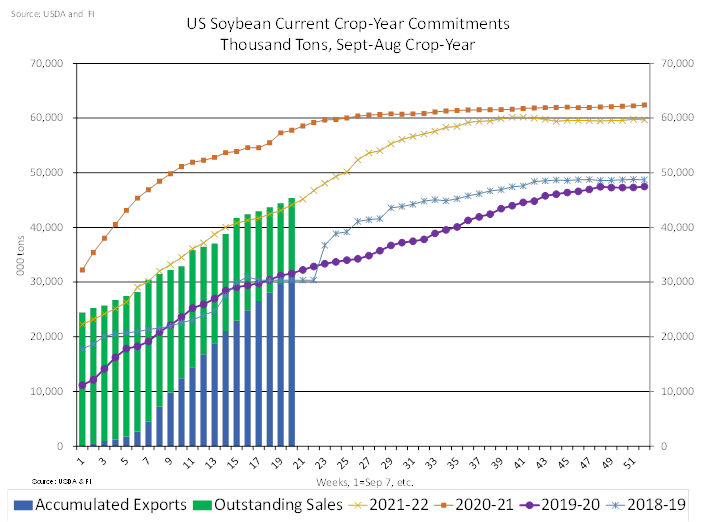

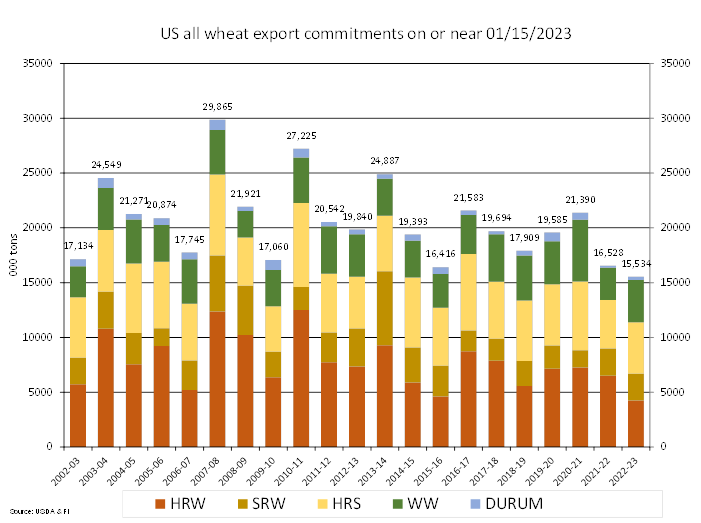

Good

sales were posted for corn, sorghum, soybean meal and all-wheat. Soybean and soybean oil sales were within expectations.

Diving

into the soybean export sales, it appears were there several switches. Of the 986,200 tons for 2022-23, it included China (507,000 MT, including 313,000 MT switched from unknown destinations and decreases of 80,000 MT), Mexico (262,300 MT, including decreases

of 3,100 MT), Spain (244,300 MT, including 249,800 MT switched from unknown destinations and decreases of 12,000 MT), Vietnam (67,200 MT, including 55,000 MT switched from unknown destinations and decreases of 200 MT), and Pakistan (66,000 MT), were offset

by reductions for unknown destinations (382,300 MT). Soybean meal sales included the Philippines, Spain, Ireland, and Chile. Soybean exports were 299,200 tons. Soybean oil sales were again poor at 700 tons and shipments at 500 tons.

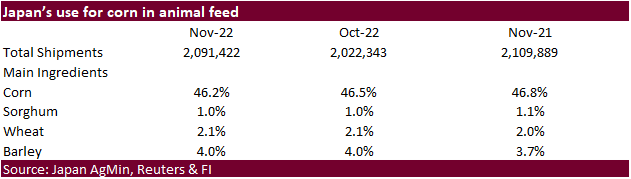

Corn

export sales of 1.132 million tons were up from 255,700 tons previous week and included Japan, Mexico and South Korea as primary buyers. China was in there for 71,400 tons but 68,000 tons were switched from unknown. Sorghum sales were a strong 189,000 tons,

a marketing year high, and appears all for China. All wheat sales of 473,100 tons were up from 90,800 tons previous week and included Mexico and various Asian countries.

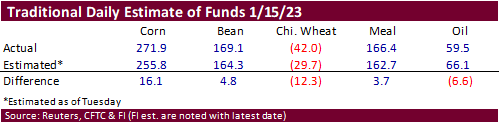

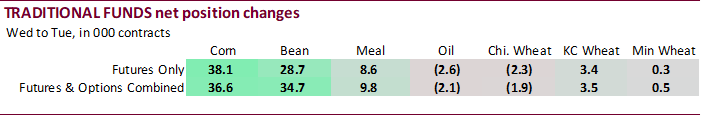

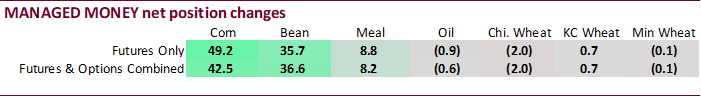

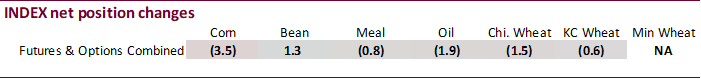

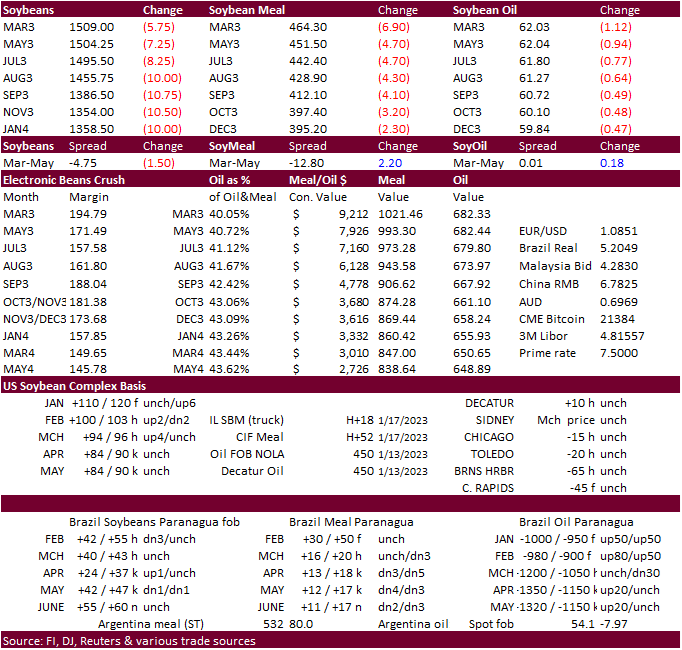

CFTC

Commitment of Traders

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

113,865 36,410 352,318 -3,500 -408,523 -29,741

Soybeans

130,766 34,403 123,044 1,264 -212,212 -33,943

Soyoil

27,564 -677 93,667 -1,895 -133,398 253

CBOT

wheat -74,270 -811 96,721 -1,512 -20,691 2,056

KCBT

wheat -20,394 3,557 45,880 -639 -22,944 -898

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

192,137 42,533 213,633 -5,325 -400,976 -28,109

Soybeans

168,298 36,594 67,204 -617 -198,857 -32,395

Soymeal

150,939 8,229 70,008 -2,057 -254,868 -4,749

Soyoil

54,008 -607 89,356 630 -157,440 -836

CBOT

wheat -65,089 -1,955 65,017 -54 -17,544 1,654

KCBT

wheat -7,291 732 35,021 -1,324 -23,665 -112

MGEX

wheat -2,776 -72 1,574 0 -199 -993

———- ———- ———- ———- ———- ———-

Total

wheat -75,156 -1,295 101,612 -1,378 -41,408 549

Live

cattle 84,672 -6,818 46,285 -1,724 -128,278 8,822

Feeder

cattle -5,951 -5,992 3,392 861 5,963 2,958

Lean

hogs 10,663 -12,072 47,610 526 -51,504 9,904

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

52,864 -5,928 -57,659 -3,170 1,552,011 70,078

Soybeans

4,952 -1,858 -41,597 -1,723 771,901 44,133

Soymeal

14,074 1,527 19,847 -2,949 463,876 9,405

Soyoil

1,909 -1,506 12,167 2,319 412,731 4,066

CBOT

wheat 19,377 89 -1,762 267 405,665 10,818

KCBT

wheat -1,524 2,723 -2,541 -2,019 184,108 7,177

MGEX

wheat 2,283 536 -882 530 58,230 792

———- ———- ———- ———- ———- ———-

Total

wheat 20,136 3,348 -5,185 -1,222 648,003 18,787

Live

cattle 8,397 -1,187 -11,076 906 377,719 -7,996

Feeder

cattle -1,620 -596 -1,784 2,767 62,196 5,959

Lean

hogs -3,447 -741 -3,321 2,384 269,776 14,135

Macros

US

Crude Oil Futures Settle At $81.31/Bbl, Up $0.98 Or 1.22%

Brent

Crude Futures Settle At $87.63/Bbl, Up $1.47 Or 1.71%

98

Counterparties Take $2.091 Tln At Fed Reverse Repo Op (prev $2.110 Tln, 100 Bids)

Canadian

Retail Sales (M/M) Nov: -0.1% (est -0.5%; prevR 1.3%)

Canadian

Retail Sales Ex Auto (M/M) Nov: -0.6% (est -0.6%; prevR 1.6%)

US

Existing Home Sales Change Dec: 4.02M (est 3.95M; prev R 4.08M)

–

Existing Home Sales (M/M): -1.5% (est -3.4%; prev R -7.9%)

–

Median Home Price (Y/Y) (USD): 366.9K or +2.3% (prev 370.7K or +3.5%)

·

CBOT corn

trimmed

some losses post USDA export sales report (good for corn and sorghum). During the day session prices saw a two-sided trade, ending moderately lower for most contracts. Lower soybeans and higher wheat left corn futures in limbo. A rally in WTI crude oil (as

of 1:15 pm CT) limited losses for the corn market.

·

News was light as traders will be watching the rain events for Argentina this weekend. The USD was near unchanged at the time CBOT ags closed.

·

There were no major export developments announced overnight.

·

Yesterday The Buenos Aires Grains Exchange cut its estimate for Argentina’s 2022-23 corn harvest to 44.5 million tons, down from 50 million tons previously and 52 million tons last year. Corn plantings are running 89 percent.

·

Some US farm groups are asking the Federal Trade Commission (FTC) to examine the high eggs prices for price manipulation, especially after one egg company posted 4th quarter profits well above the comparable quarter

year ago. But that company noted demand was high across the US and their farms had no cases of bird flu disease.

·

The US is not the only country seeing a shortage of egg supplies. Malaysia is seeing an egg shortage from a decline in production due to higher feed prices are driving India to export a record 50 million eggs per month.

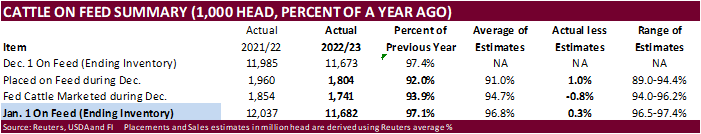

·

The US Cattle on Feed report showed a slightly less than expected contraction for the January 1 cattle on feed at 97.1%. Marketing were a touch below trade expectations at 1.741 million head, 93.9 percent of a year ago. Placements

were 1.804 million, 1 percent above expectations at 92.0%.

Export

developments.

·

None reported.

Updated

01/19/23

March

corn $6.50-$7.25 range. May

$6.25-$7.20

·

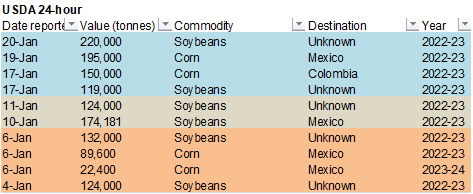

CBOT’s soybean complex traded two-sided and were lower (near contract lows) headed into the close. Bull spreading was a feature for soybeans while bear spreading was seen for soybean meal and soybean oil. There were 42 soybean

registrations cancelled Thursday evening (1,140 open). March CBOT crush was down 21.50 cents and May off 12.75 cents.

·

The weather outlook improved again for Argentina and the US outlook looks good for a boost in soil moisture for the dry areas of the western Corn Belt over the next week. Traders will be closely monitoring the rains for Argentina

over the next two weeks.

·

USDA reported 220,000 tons of soybeans sold to unknown.

·

Oil World lowered their estimate for Argentina soybean production to 34 million tons from 42.5 million last year (their estimate). USDA is at 45.5MMT for the Argentina 2022-23 crop. Yesterday

Argentina’s

BA Grains Exchange reported the combined good and excellent soybean rating at 3 percent and poor condition at 60 percent. Last week they were 4 and 56 percent, respectively. Soybean plantings are running at 96 percent.

·

2022 China soybean imports were 91.08 million tons. Of that, 54.4 million tons were from Brazil, 29 million tons from the US, 3.65 from Argentina and 1.79 million tons from Uruguay.

·

Cargo survey SGS reported Malaysian 1-20 January palm oil shipments at 654,888 tons, 29.1 percent below the 923,642 tons shipped during the December 1-20 period. ITS reported a 41 percent decrease to 589,308 tons and AmSpec a

38.5 percent decline to 566,561 tons.

·

Palm oil closed little higher on Friday, ending the week up 1.6%.

·

This morning offshore values were leading SBO higher by about 73 points this morning (55 lower for the week to date) and meal $1.40 short ton

higher

($6.40 lower for the week).

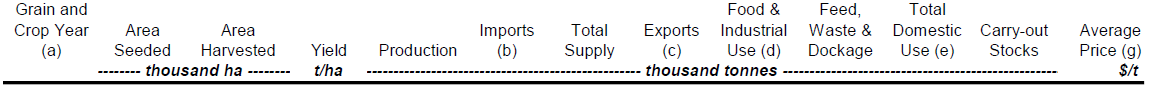

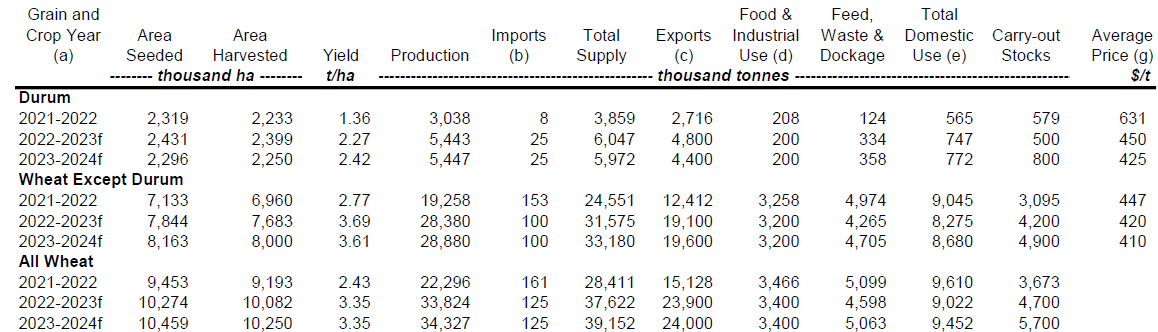

Agriculture

and Agri-Food Canada (AAFC) – Canada: Outlook for Principal Field Crops

·

USDA reported private exporters reported sales of 220,000 tons of soybeans for delivery to unknown destinations during the 2022-23 marketing year.

·

Results are awaited for the Philippines seeking up to 45,000 tons of soybean meal. The soybean meal was sought for April 18 and May 25 shipment.

Updated

01/19/23

Soybeans

– March $14.75-$15.75, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

60.00-68.00, May 58-70

·

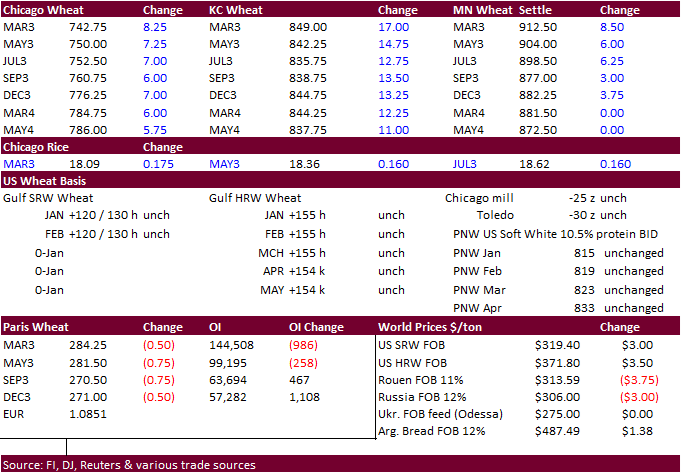

US wheat futures stated lower on follow through selling but rallied during the morning day session on bottom picking. USDA export sales were good for wheat.

·

Chicago wheat had been under pressure since Wednesday prior to today on Black Sea export competition and expectations for Russia to not curb exports during the remainder of the current crop season, a reversal from what the trade

read into earlier this week after President Putin said the country must control grain sales to ensure reserves. Pricing in US wheat was led by the KC contracts on Friday.

·

There were no wheat export developments.

·

Paris March wheat was down 0.50 euros at 284.75 per ton, or 0.2% ($308.78/ton).

Agriculture

and Agri-Food Canada (AAFC) – Canada: Outlook for Principal Field Crops

Export

Developments.

·

Japan seeks 70,000 tons of feed wheat and 40,000 tons of barley on January 25 for arrival in Japan by March 16.

Rice/Other

·

None reported

Updated

01/19/23

Chicago

– March $7.00 to $8.00, May $7.00-$8.25

KC

– March $7.75-$9.00, $7.50-$9.25

MN

– March $8.75 to $10.00,

$8.00-$10.00

USDA Export Sales

U.S. EXPORT SALES FOR WEEK ENDING 1/12/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

106.8 |

984.6 |

2,016.8 |

75.9 |

3,270.4 |

4,483.9 |

21.0 |

90.3 |

|

SRW |

34.0 |

643.7 |

702.2 |

17.0 |

1,780.7 |

1,786.6 |

0.0 |

41.6 |

|

HRS |

181.0 |

1,389.7 |

1,273.1 |

86.9 |

3,314.3 |

3,154.5 |

0.0 |

49.8 |

|

WHITE |

152.9 |

1,231.5 |

783.2 |

129.0 |

2,630.7 |

2,160.7 |

14.0 |

14.3 |

|

DURUM |

-1.5 |

119.7 |

54.6 |

0.0 |

168.4 |

112.7 |

0.0 |

1.5 |

|

TOTAL |

473.1 |

4,369.2 |

4,829.8 |

308.9 |

11,164.6 |

11,698.3 |

35.0 |

197.5 |

|

BARLEY |

0.0 |

4.9 |

18.0 |

0.0 |

6.7 |

12.5 |

0.0 |

0.0 |

|

CORN |

1,132.1 |

12,028.6 |

25,583.6 |

715.7 |

11,099.7 |

16,962.2 |

87.0 |

1,248.4 |

|

SORGHUM |

189.0 |

328.9 |

3,917.4 |

1.1 |

221.1 |

1,888.9 |

0.0 |

0.0 |

|

SOYBEANS |

986.2 |

13,661.4 |

9,670.1 |

2,066.2 |

31,728.3 |

33,438.3 |

0.0 |

397.0 |

|

SOY MEAL |

362.5 |

3,254.4 |

2,935.4 |

299.2 |

3,311.2 |

3,609.9 |

0.0 |

18.3 |

|

SOY OIL |

0.7 |

18.3 |

213.9 |

0.5 |

20.0 |

254.6 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

2.0 |

123.3 |

178.1 |

5.8 |

197.8 |

600.6 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

13.4 |

10.4 |

0.0 |

13.5 |

3.3 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

8.1 |

5.6 |

0.1 |

7.9 |

27.6 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

36.1 |

67.6 |

0.7 |

7.8 |

16.8 |

0.0 |

0.0 |

|

L G MLD |

0.6 |

141.3 |

78.8 |

8.2 |

306.1 |

407.3 |

0.0 |

0.0 |

|

M S MLD |

-8.4 |

124.8 |

102.4 |

15.0 |

116.6 |

184.1 |

0.0 |

0.0 |

|

TOTAL |

-5.6 |

446.9 |

442.8 |

29.8 |

649.8 |

1,239.7 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

209.4 |

4,867.3 |

7,864.2 |

183.1 |

4,201.1 |

3,403.1 |

26.9 |

1,230.1 |

|

PIMA |

2.5 |

58.4 |

221.5 |

6.3 |

67.3 |

161.5 |

0.0 |

1.1 |

Export Sales Highlights

This

summary is based on reports from exporters for the period January 6-12, 2023.

Wheat:

Net sales of 473,100 metric tons (MT) for 2022/2023 were up noticeably from the previous week and up 99 percent from the prior 4-week average. Increases primarily for Mexico (124,100 MT, including decreases of 11,100 MT), South Korea (112,000 MT), the Philippines

(70,200 MT, including decreases of 900 MT), Japan (47,500 MT), and Honduras (40,000 MT), were offset by reductions for Panama (1,500 MT) and Guatemala (1,200 MT). Net sales of 35,000 MT for 2023/2024 were reported for Mexico (21,000 MT) and Japan (14,000 MT).

Exports of 308,900 MT were up 60 percent from the previous week and 46 percent from the prior 4-week average. The destinations were primarily to the Philippines (81,700 MT), China (68,100 MT), Japan (35,400 MT), Taiwan (33,400 MT), and Nigeria (29,200 MT).

Corn:

Net sales of 1,132,100 MT for 2022/2023 were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for Japan (340,000 MT, including 56,800 MT switched from unknown destinations and decreases of 1,300 MT), Mexico (271,000

MT, including decreases of 1,000 MT), South Korea (134,500 MT), China (71,400 MT, including 68,000 MT switched from unknown destinations and decreases of 2,300 MT), and Taiwan (70,200 MT, including decreases of 100 MT). Total net sales of 87,000 MT for 2023/2024

were for Japan. Exports of 715,700 MT were up 85 percent from the previous week, but down 8 percent from the prior 4-week average. The destinations were primarily to Mexico (290,500 MT), China (275,400 MT), Japan (55,500 MT), Costa Rica (32,300 MT), and Canada

(24,300 MT).

Barley:

No net sales or exports were reported for the week.

Sorghum:

Total net sales of 189,000 MT for 2022/2023–a marketing-year high–were unchanged from the previous week, but up noticeably from the prior 4-week average. The destination was China. Exports of 1,100 MT were up noticeably from the previous week, but down 91

percent from the prior 4-week average. The destination was to Mexico.

Rice:

Net sales reductions of 5,600 MT for 2022/2023–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Increases primarily for El Salvador (1,500 MT), Canada (1,200 MT, including decreases of 200 MT), Guatemala

(500 MT), Mexico (200 MT), and Belgium (200 MT), were more than offset by reductions primarily for Jordan (9,400 MT). Exports of 29,800 MT were up 46 percent from the previous week, but down 21 percent from the prior 4-week average. The destinations were primarily

to Japan (13,000 MT), Haiti (6,100 MT), Guatemala (5,700 MT), Canada (3,200 MT), and Taiwan (700 MT).

Soybeans:

Net sales of 986,200 MT for 2022/2023 were up 38 percent from the previous week and 48 percent from the prior 4-week average. Increases primarily for China (507,000 MT, including 313,000 MT switched from unknown destinations and decreases of 80,000 MT), Mexico

(262,300 MT, including decreases of 3,100 MT), Spain (244,300 MT, including 249,800 MT switched from unknown destinations and decreases of 12,000 MT), Vietnam (67,200 MT, including 55,000 MT switched from unknown destinations and decreases of 200 MT), and

Pakistan (66,000 MT), were offset by reductions for unknown destinations (382,300 MT). Exports of 2,066,200 MT were up 28 percent from the previous week and 23 percent from the prior 4-week average. The destinations were primarily to China (1,366,900 MT),

Spain (244,300 MT), Mexico (161,500 MT), Vietnam (68,200 MT), and the Netherlands (58,600 MT).

Optional

Origin Sales:

For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export

for Own Account: For

2022/2023, the current exports for own account outstanding balance is 1,500 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 362,500 MT for 2022/2023 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for the Philippines (54,400 MT, including decreases of 1,700 MT), Spain (50,000 MT), Ireland (48,900 MT, including 24,000

MT switched from the Philippines), Chile (45,000 MT), and Colombia (35,700 MT), were offset by reductions primarily for Israel (6,000 MT). Exports of 299,200 MT were down 5 percent from the previous week, but up 11 percent from the prior 4-week average. The

destinations were primarily to the Philippines (95,900 MT), Ecuador (38,400 MT), Mexico (35,300 MT), Ireland (26,400 MT), and Japan (25,900 MT).

Soybean

Oil:

Net sales of 700 MT for 2022/2023 were up 8 percent from the previous week, but down 63 percent from the prior 4-week average. Increases were reported for Canada (500 MT) and Mexico (200 MT). Exports of 500 MT were down 8 percent from the previous week and

70 percent from the prior 4-week average. The destinations were to Canada (400 MT) and Mexico (100 MT).

Cotton:

Net sales of 209,400 RB for 2022/2023 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for China (55,100 RB), Pakistan (43,600 RB, including decreases of 200 RB), Vietnam (42,500 RB, including 100 RB switched

from China), Turkey (25,600 RB, including decreases of 17,200 RB), and South Korea (18,700 RB), were offset by reductions for Mexico (2,500 RB). Net sales of 26,900 RB for 2023/2024 were primarily for Turkey (21,600 RB). Exports of 183,100 RB were up 22 percent

from the previous week and 48 percent from the prior 4-week average. The destinations were primarily to China (60,200 RB), Pakistan (46,100 RB), Mexico (13,500 RB), Vietnam (12,600 RB), and Indonesia (7,000 RB). Net sales of Pima totaling 2,500 RB for 2022/2023

were down 24 percent from the previous week, but up 6 percent from the prior 4-week average. Increases were primarily for Vietnam (1,300 RB), Taiwan (400 RB), South Korea (300 RB), Bangladesh (200 RB), and Bahrain (100 RB). Exports of 6,300 RB were unchanged

from the previous week, but up 14 percent from the prior 4-week average. The destinations were primarily to India (4,100 RB), Vietnam (900 RB), Turkey (400 RB), Japan (300 RB), and Peru (200 RB).

Optional

Origin Sales: For

2022/2023, the current outstanding balance of 9,300 RB, all Malaysia.

Export

for Own Account: For

2022/2023, new exports for own account totaling 1,900 RB were to China. The current exports for own account outstanding balance of 122,300 RB are for China (92,000 RB), Vietnam (21,900 RB), Pakistan (6,500 RB), India (1,500 RB), and Indonesia (400 RB).

Hides

and Skins:

Net sales of 564,200 pieces for 2023 were primarily for China (355,200 whole cattle hides, including decreases of 15,200 pieces), South Korea (65,700 whole cattle hides, including decreases of 1,700 pieces), Mexico (60,100 whole cattle hides, including decreases

of 5,000 pieces), Thailand (35,300 whole cattle hides, including decreases of 1,200 pieces), and Brazil (13,300 whole cattle hides, including decreases of 1,000 pieces). In addition, total net sales of 14,300 calf skins were for Italy. Exports of 439,500 whole

cattle hides exports were primarily to China (306,200 pieces), Mexico (48,200 pieces), South Korea (35,900 pieces), Thailand (20,200 pieces), and Brazil (16,300 pieces).

Net

sales of 63,400 wet blues for 2023 were primarily for Italy (28,900 unsplit, including decreases of 300 unsplit), Thailand (18,200 unsplit, including decreases of 100 unsplit), China (6,700 unsplit), Mexico (5,400 unsplit), and Brazil (2,500 unsplit). Exports

of 119,300 wet blues were primarily to Italy (48,200 unsplit and 1,600 grain splits), China (24,000 unsplit), Vietnam (16,000 unsplit), Thailand (12,100 unsplit), and Taiwan (4,400 unsplit). Net sales reductions of 11,200 splits for 2023 were reported for

Hong Kong (9,300 pounds) and Vietnam (1,900 pounds). Exports of 43,600 splits were to China.

Beef:

Net sales of 17,300 MT for 2023 were primarily for China (4,800 MT, including decreases of 100 MT), South Korea (4,100 MT, including decreases of 400 MT), Japan (3,900 MT, including decreases of 500 MT), Mexico (1,700 MT, including decreases of 100 MT), and

Taiwan (1,200 MT, including decreases of 100 MT). Exports of 15,700 MT were primarily to Japan (5,200 MT), South Korea (3,400 MT), China (1,700 MT), Taiwan (1,600 MT), and Mexico (1,500 MT).

Pork:

Net sales of 34,100 MT for 2023 were primarily for Mexico (11,800 MT, including decreases of 200 MT), Canada (4,800 MT, including decreases of 300 MT), China (4,100 MT, including decreases of 600 MT), South Korea (3,700 MT, including decreases of 500 MT),

and Japan (3,500 MT, including decreases of 300 MT). Exports of 31,100 MT were primarily to Mexico (14,800 MT), China (4,100 MT), Japan (3,600 MT), South Korea (2,600 MT), and Canada (2,400 MT).

Terry Reilly

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 3126041366

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo