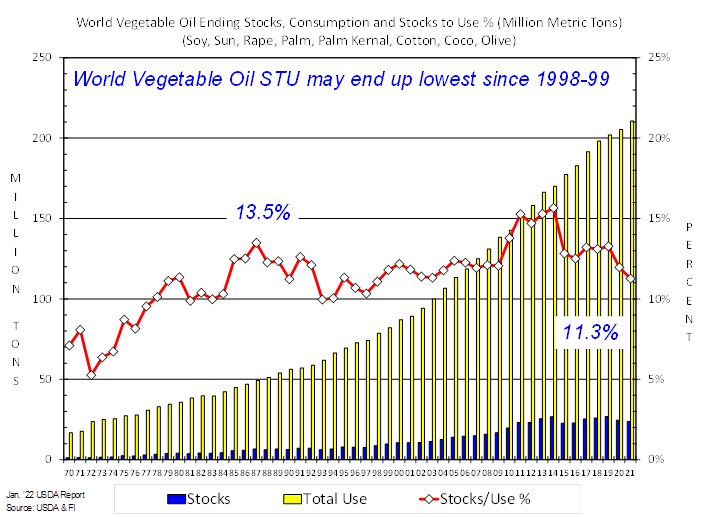

PDF attached includes world STU graphs, CFTC COT and Cattle on Feed snapshot.

USDA

reported private exporters reported the following activity:

-

132,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year -

247,800

metric tons of corn received in the reporting period for delivery to unknown destinations during the 2021/2022 marketing year

This

week the agriculture markets saw an extremely volatile trade. Today nearby corn hit buy stops after breaking above $6.1475. Soybean oil ended higher (following record palm oil prices), meal down sharply, and soybeans lower. Chicago wheat fell on follow through

selling. Index funds, combined for the CBOT ags, posted a record net long position as of last Tuesday. The Cattle on Feed report showed more cattle on feed and placements well above expectations. SA weather developments and outside commodity influence should

be on deck next week.

WEATHER

EVENTS AND FEATURES TO WATCH

- Another

cold morning occurred today in the U.S. Midwest - Lowest

temperatures in Missouri and Illinois slipped to the negative and positive single digits Fahrenheit with little to no snow on the ground in some wheat production areas raising some concern over crop damage4 - Not

much, winterkill was suspected, although temperatures were near and below the damage threshold.

- Many

winter crops in the region should have been sufficiently hardened against the cold to minimize permanent damage, but some impact cannot be ruled out - Cool

temperatures also occurred in the central U.S. Plains this morning with single digit lows common southward through the heart of Oklahoma and eastern parts of the Texas Panhandle

- Most

of this wheat was not seriously impacted by the cold, but the combination of drought and this week’s does raise some concern over crop conditions - A

large part of Nebraska reported low temperatures Thursday morning below zero and that was a concern for wheat as well as some of the Oklahoma temperatures this morning

- World

Weather, Inc. does not believe much, if any, serious damage occurred from this week’s cold weather - Another

bout of bitter cold is expected in the northern half of the Plains and Midwest during mid-week next week with temperatures likely to be similar to those of this morning.

- After

that there is likely to be a warmer bias developing in some of these areas as January ends - Heavy

rain fell overnight in Argentina from northwest through central Buenos Aires with amounts varying from 1.50 to 5.87 inches (38-149mm) - Local

flooding was suspected - Another

band of significant rain occurred in the interior southwest of Buenos Aires where amounts varied from 0.50 to nearly 2.00 inches - Showers

surrounded these two areas of greatest rainfall producing light amounts of moisture.

- The

northeast half of Argentina was dry Thursday and temperatures continued hot in the far northeast with extremes to 110 Fahrenheit in Formosa - Argentina’s

forecast has not changed today relative to that of Thursday - Additional

rain is expected through Saturday from Buenos Aires to Cordoba and neighboring areas of southern Santiago del Estero and southern Santa Fe - Some

of this rain will be heavy varying from 1.00 to more than 4.00 inches resulting in an expansion in area subjected to at least flash flooding - Local

totals may get up over 4.00 inches and flooding might become more serious in a few locations - Rain

next week is expected to occur as scattered showers and thunderstorms intermixing with periods of sunshine - Drier

weather will evolve late next week into the early days of February - Northeastern

Argentina has the greatest need for rain and may see it evolve late next week into the following weekend - Hot

and dry conditions continued Thursday from northern Argentina through Paraguay and immediate neighboring areas of southern Brazil.

- Extreme

highs of 100 to 108 Fahrenheit (38-42C) occurred from northwestern Rio Grande do Sul through all of Paraguay to northeastern Argentina with Formosa reaching 110

- Stress

to livestock and crops continued at an extreme - Production

cuts are continuing - Paraguay,

northern Argentina and neighboring areas of Mato Grosso do Sul, Parana and Rio Grande do Sul will continue hot and dry through Tuesday of next week - A

breakdown of high pressure aloft over South America is still expected during mid- to late-week next week resulting in a rising potential for rain in the drought stricken areas of Paraguay and all neighboring areas of southern Brazil and northern Argentina - Rainfall

will begin erratically, but most crop areas should get rain at one time or another by February 1 - Yield

losses will not be reversed, but the change will stop the decline in crop conditions and production - There

is potential for another ridge of high pressure to evolve over Argentina during February, but its impact on agriculture should be less than that of earlier this month - Brazil

crop areas away from the southwest and Rio Grande do Sul will be favorably mixed during the next two weeks supporting good early season soybean maturation and harvest progress while supporting ongoing crop development - Sufficient

rainfall is expected in Safrinha crop areas to support planting, germination and emergence on into February - U.S.

hard red winter wheat production areas are unlikely to see much precipitation of significance over the next ten days to two weeks

- Waves

of cold will continue to move through the U.S. north-central and Midwestern states through mid-week next week and then some warming is anticipated - Temperatures

will be colder than usual in this first week of the outlook from the northern Plains to the Atlantic Coast while warmer biased in the far western states - U.S.

Delta, Tennessee River Basin and southeastern states will see enough precipitation during the next ten days to maintain adequate to abundant soil moisture

- Recent

rainfall in the lower Delta has helped to east low soil moisture and more rain is possible in the region over this coming week - Florida

is also a little dry as are a few areas in neighboring border areas southern Georgia and southeastern South Carolina, but these areas will see at least some rain in the next ten days - Florida

citrus areas will be closely monitored for cool weather, but as of today there is no threat of damaging cold in the production region - Cold

air advertised for Feb. 1-2 in today’s 06z GFS model run was overdone and unlikely to verify - Snow

is expected to accumulate in North Carolina tonight and some areas of freezing rain and sleet will also occur especially in northeastern South Carolina - Travel

issues are likely - Snow

accumulations will range from 3 to 8 inches with eastern North Carolina getting some of the greater amounts - California

and the far western states will continue missing precipitation events over the next ten days and temperatures will be warmer than usual - Mountain

snowpack is still favorable for this time of year, but relative to the April 1 peak of the snowfall season the region is reporting 56-60% of that normal - There

is plenty of time for improving weather, but none is expected for a while - Canada’s

southwestern Prairies continue to miss significant precipitation and snow events - Drought

remains very serious from this region and southward into Montana and the western most Dakotas - Some

precipitation is expected in these areas during the coming ten days, but it will be light and probably will not impact the long term outlook - Interior

parts of Washington and Oregon will continue to get limited precipitation - Mountain

snowpack is abundant in the Cascade Mountains and the northern Rocky Mountains - Snow

will continue to fall often in these areas protecting runoff potentials for irrigated crops in the spring - Cold

air in the eastern U.S. during the coming week will bring waves of precipitation to the southeastern states preventing those areas from drying out

- West

Texas will be dry for the next ten days - Western

Europe precipitation is expected to be restricted during the next ten days while eastern parts of the continent get precipitation periodically - There

will be no threat of crop damaging cold in any part of the continent - Eastern

Europe will see a boost in snow cover during the next week to ten days - Spain

and Portugal need moisture - Western

parts of Russia, Ukraine and neighboring areas will see waves of snow and some rain during the next ten days keeping winter crops adequately protected from any threatening cold – if such a risk evolves - No

damaging cold is expected in snow free areas - Northwestern

Africa will continue dry biased and a little warmer than usual during the next ten days and perhaps longer - Southwestern

Morocco is driest along in the northeast Morocco/northwestern Algeria border area - Rain

is needed in these areas, but winter crops are semi-dormant and do not need much moisture until the second half of February and March - Northern

India will get some light rain late this weekend into early next week - The

moisture will further support high yielding winter crops this year, although reproduction will occur mostly in February - Recent

rain events and that coming up should have crops in better than usual conditions ahead of reproduction - South

Africa’s forecast provides and erratic rainfall pattern for a while - The

coming week of weather will allow for some welcome drying to take place - Sufficient

soil moisture and timely showers will maintain a very good outlook for 2022 production, despite some pockets of excessive rain and hail damage this summer - Australia’s

weather is expected to be favorably mixed over the next two weeks, but a larger volume of rain will be needed in some dryland crop areas in Queensland

- The

expected precipitation in this next ten days should be sufficient to help crops develop well, especially in New South Wales - Crop

stress may continue to be an issue in the drier areas of Queensland - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- Western

portions of Luzon Islands, Philippines will need a boost in rainfall soon - A

tropical disturbance may threaten the Philippines this weekend and into next week, but it should have a low impact - Wind

damage is not likely - Rainfall

should be light to moderate impacting the eastern islands more than anywhere else - Northern

Laos and northern Vietnam received rain in the first half of this week bolstering topsoil moisture - Additional

light rain may come and go over the next week to ten days - Coffee

flowering is possible, although temperatures may be cool enough to restrict that potential - Any

flowering will be limited to the northern parts of Vietnam near the Red River - Most

other areas in mainland crop areas of Southeast Asia have been seasonably and are unlikely to see much precipitation which is normal for this time of year - Coastal

areas of Vietnam will get some rain periodically - China’s

weather will be wettest in the Yangtze River Basin and interior southern parts of the nation through the next two weeks - Winter

crops are dormant or semi-dormant and expected to remain in good condition for the next ten days - Some

snow and freezing rain may occur periodically as well - Northern

China precipitation will be restricted for the next two weeks which is normal for this time of year - West-central

Africa precipitation will remain confined to coastal areas for a while - Coffee

and cocoa maturation and harvest progress is advancing well - There

is very little risk of a notable Harmattan wind that would threat crops - Ethiopia

will be dry-biased again in the coming week while Tanzania, Uganda and southwestern Kenya get periodic rainfall all of which is normal for this time of year - Today’s

Southern Oscillation Index is +4.20 - The

index may move erratically for a while - New

Zealand rainfall will continue lighter than usual over the next ten days - The

nation has been drying out in recent weeks - Temperatures

have been seasonable - Mexico

will experience waves of rain in the east and in a few southern locations during the next ten days - No

general soaking of rain is expected, although precipitation will be greater than usual in the east - Any

precipitation would be welcome, but greater amounts are desired especially in northern parts of the nation where winter crops could be negatively impacted in unirrigated areas by ongoing dryness in the next few weeks

- Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Colombia

will be much wetter than Venezuela - Many

areas in Venezuela may experience net drying

Source:

World Weather, inc.

Thursday,

Jan. 20:

- EIA

weekly U.S. ethanol inventories, production - China’s

third batch of country-wise December trade data - Port

of Rouen data on French grain exports - Malaysia’s

Jan. 1-20 palm oil exports - New

Zealand food prices - USDA

red meat production, 3pm

Friday,

Jan. 21:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

Monday,

Jan. 24:

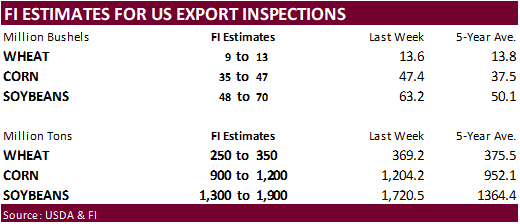

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals - Brazil’s

Unica to release cane crush, sugar output data during the week (tentative) - U.S.

cold storage data for pork, beef and poultry; poultry slaughter, 3pm - USDA

total milk production, 3pm

Tuesday,

Jan. 25:

- EU

weekly grain, oilseed import and export data - Malaysia’s

Jan. 1-25 palm oil exports - Moscow

Agros Expo conference, Jan. 25-27

Wednesday,

Jan. 26:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

Australia, India

Thursday,

Jan. 27:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Paris

Grain Day conference, Jan. 27-28 - Port

of Rouen data on French grain exports

Friday,

Jan. 28:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

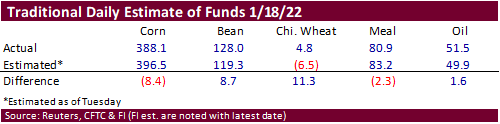

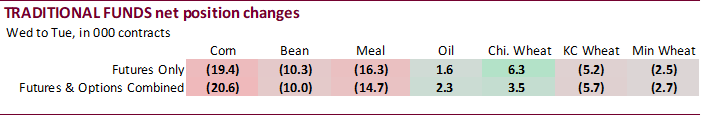

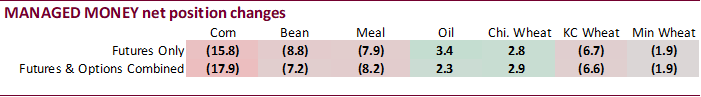

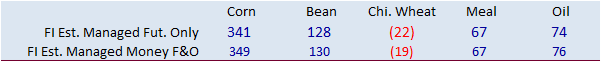

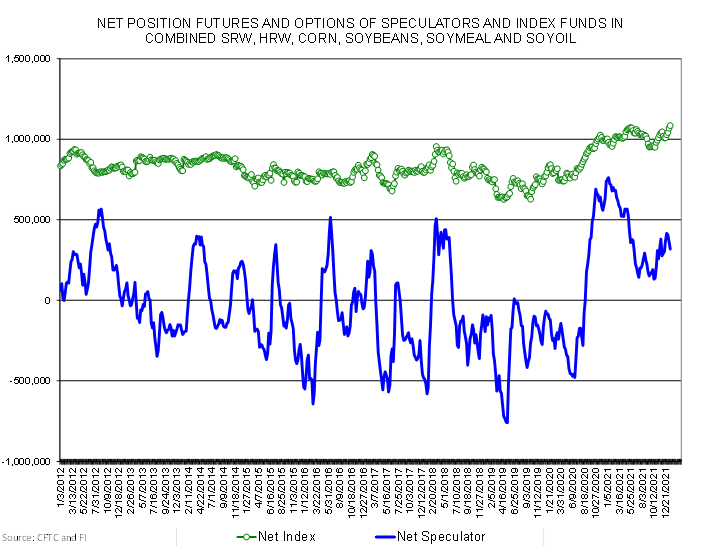

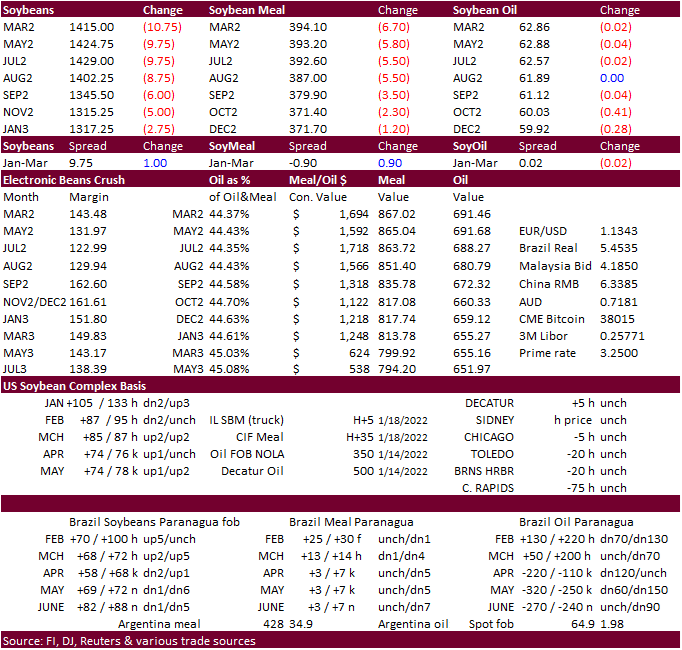

CFTC

Commitment of Traders report

A

record net long position was recorded for the index funds combined SRW, HRW, Corn, Soybeans, Soybean Meal, and Soybean Oil net long position.

No

major surprises were noted other than the net position for traditional funds Chicago wheat were more long than expected.

As

of Friday – estimated

Reuters

table below

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

224,828 -15,379 442,156 -3,418 -632,545 24,572

Soybeans

71,317 -13,970 205,264 11,650 -237,855 6,019

Soyoil

11,956 1,515 119,003 -242 -140,432 -761

CBOT

wheat -42,144 3,032 137,820 4,533 -86,509 -8,118

KCBT

wheat 11,824 -5,347 54,949 1,726 -69,835 4,350

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

326,523 -17,855 291,693 5,590 -630,775 20,808

Soybeans

99,639 -7,241 160,062 10,938 -249,506 2,721

Soymeal

64,743 -8,177 100,120 6,049 -209,131 7,385

Soyoil

58,208 2,302 88,934 363 -147,295 -2,156

CBOT

wheat -24,901 2,863 92,388 5,240 -72,881 -9,245

KCBT

wheat 36,119 -6,555 26,159 4,390 -59,756 1,998

MGEX

wheat 3,857 -1,878 1,977 -357 -11,400 3,249

———- ———- ———- ———- ———- ———-

Total

wheat 15,075 -5,570 120,524 9,273 -144,037 -3,998

Live

cattle 62,177 235 82,279 1,834 -152,722 -2,680

Feeder

cattle 5,465 -1,004 4,531 495 -2,073 360

Lean

hogs 48,795 -10 60,290 889 -99,995 837

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

46,997 -2,767 -34,440 -5,777 1,828,316 -33,213

Soybeans

28,530 -2,720 -38,726 -3,699 841,473 7,505

Soymeal

14,295 -6,566 29,973 1,308 458,623 4,365

Soyoil

-9,320 2 9,473 -511 434,799 4,136

CBOT

wheat 14,560 589 -9,167 553 468,778 13,184

KCBT

wheat -5,584 899 3,062 -731 239,872 -2,898

MGEX

wheat 3,040 -772 2,526 -241 71,926 734

———- ———- ———- ———- ———- ———-

Total

wheat 12,016 716 -3,579 -419 780,576 11,020

Live

cattle 18,666 1,326 -10,401 -716 377,575 4,584

Feeder

cattle 787 158 -8,709 -8 53,133 1,467

Lean

hogs 7,166 -1,789 -16,256 73 276,468 8,997

81

Counterparties Take $1.706 Tln At Fed Reverse Repo Op. (prev $1.679 Tln, 82 Bids)

Canadian

Retail Sales (M/M) Nov: 0.7% (est 1.2%; prev 1.6%; prevR 1.5%)

–

Retail Sales Ex-Autos (M/M) Nov: 1.1% (est 1.3%; prev 1.3%)

·

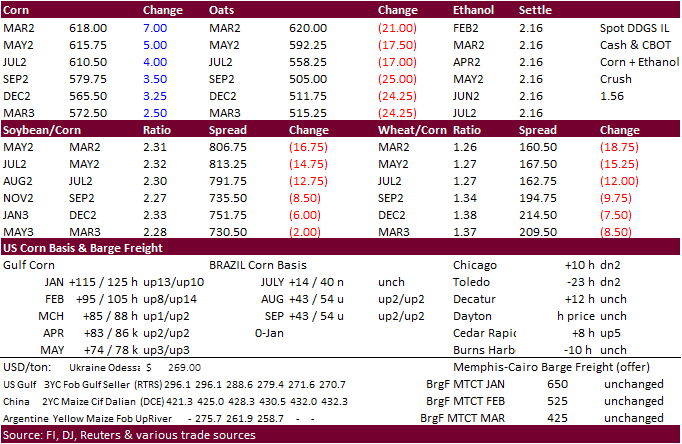

Funds were net buyers of an estimated 7,000 contracts.

·

March corn gained over May in part to US Gulf corn competitive against other major suppliers, good spot demand, and logistical problems.

·

USDA corn export sales were good at 1.091 million tons with Japan and Mexico largest buyers. US sorghum sales were a marketing year high and included 264,000 tons to unknown and 183,500 tons for China. USDA also announced 247,800

tons of corn was sold to unknown (received).

·

Spot Ukraine corn is roughly $10 cheaper into SE Asia than US Gulf corn, and close enough spread to attract US business. PNW corn into SE is about $10-15/ton premium over Black Sea corn.

·

Fertilizer prices are still high across the Midwest. One of our smaller corn producer contacts located in Indiana is paying roughly $600/acre for fertilizer production versus about $266/acre year ago.

·

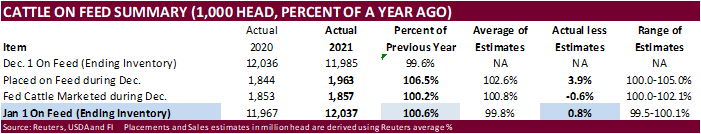

USDA Cattle on Feed showed January 1 on feed up 0.6% from a year ago, 0.8 percentage point above trade expectations. Placements were reported well above expectations and marketed slightly lower. The higher than expected on feed

and placements is supportive corn.

IFES

2021: 2022 Market Outlook for Corn and Soybeans: Part II, Acreage

Irwin,

S. and J. Janzen. “IFES 2021: 2022 Market Outlook for Corn and Soybeans: Part II, Acreage.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 20, 2022.

Export

developments.

·

Under the 24-hour announcement system, private exporters sold

247,800

metric tons of corn received in the reporting period for delivery to unknown destinations during the 2021/2022 marketing year.

Updated

1/21/22

March

corn is seen in a $5.90 to $6.35 range (up 10, up 15)

·

CBOT soybean prices ended lower on profit taking, sharply lower meal, and export sales coming in near the lower end of trade expectations. Soybean oil extended its rally on strength in palm oil, despite a lower trade in WTI crude

oil. SA rains this weekending will again be important, but some are questioning if the arrival of them will be too late for Brazil.

·

Funds sold an estimated net 6,000 soybeans, sold 4,000 SBM and bought 1,000 SBO.

·

Yesterday Brent crude oil this week hit its strongest level in over seven years.

·

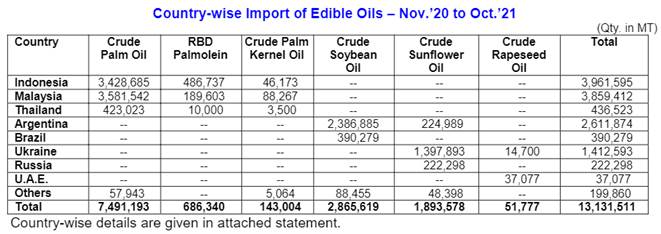

Malaysian palm futures traded higher by 71 ringgit to 5,326, a record high. One reason for the record prices is Malaysia saw unfavorable weather during December and workers shortages slowed production.

·

There is concern combined Indonesia and Malaysian palm oil exports will erode this year. Earlier this week Indonesia’s Trade Ministry draft a plan to limit palm oil exports amid efforts to control domestic cooking oil prices.

Then a Trade Ministry official denied there was such plan. If such a plan is put in place, India may shift some import demand to Malaysia and other vegetable oils, including US soybean oil. But we think this might be a long term issue rather a short term

problem. Combined Indonesia and Malaysia palm oil production is flattening out, ,and domestic consumption is on the rise. Indonesia will eventually go to B40 and Malaysia targets B20. Exports will eventually erode. At least India no longer competes heavily

with the EU for palm oil imports.

·

China soybean cash crush values on our analysis were running at 184 cents/bushel versus 195 at the end of last week and 190 year ago.

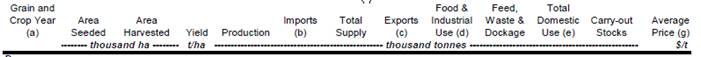

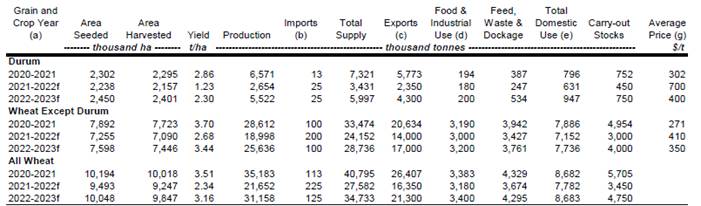

Canada

AAFC

Export

Developments

·

Under the 24-hour announcement system, private exporters sold

132,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

·

Turkey’s state grain board TMO seeks about 6,000 tons of crude sunflower oil on Jan. 28 for shipment between Feb. 8 and Feb. 25.

Updated

1/20/22

Soybeans

– March $13.25-$14.75

Soybean

meal – March $370-$435

Soybean

oil – March 59.00-64.50

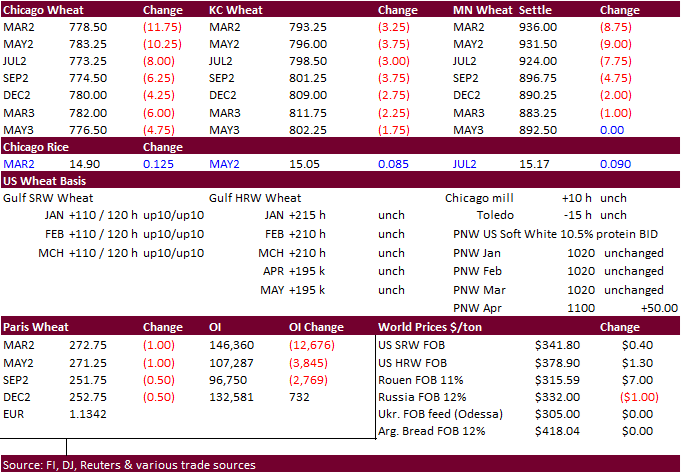

·

Funds sold an estimated net 6,000 Chicago wheat contracts.

·

EU wheat basis the March settled down1.25 euros, or 0.5%, at 272.50 euros ($309.12) a ton.

·

Russia’s wheat export customs duty will fall to $95.80/ton next week, from $97.50.

Canada

AAFC

·

The Philippines seeks 36,000 tons of Australian wheat on January 25 for April 1-30 shipment.

·

South Korea flour mills bought 82,000 tons of milling from the United States for shipment in March in two consignments.

·

Iran’s GTC started buying a more than expected (60k sought) milling wheat for February – March shipment. About 195,000 tons may have been purchased in three consignments of about 65,000 tons.

·

Jordan seeks 120,000 tons of feed barley on January 26 for July – August shipment.

·

Jordan retendered on wheat seeking 120,000 tons on February 1 for July – August shipment.

Rice/Other

·

South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.