PDF Attached

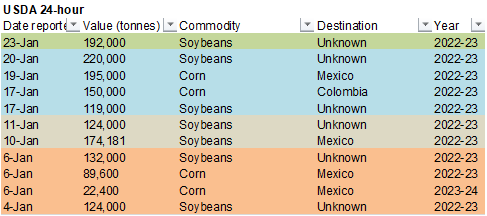

USDA

under its 24-hour reporting system announced 192,000 tons of soybeans were sold for delivery to unknown destinations. January 1-23 USDA 24-hour sales for the combined old and new-crop soybean crop years are running at 1.085 million tons, down from 1.866 million

tons during the December 1-23 period.

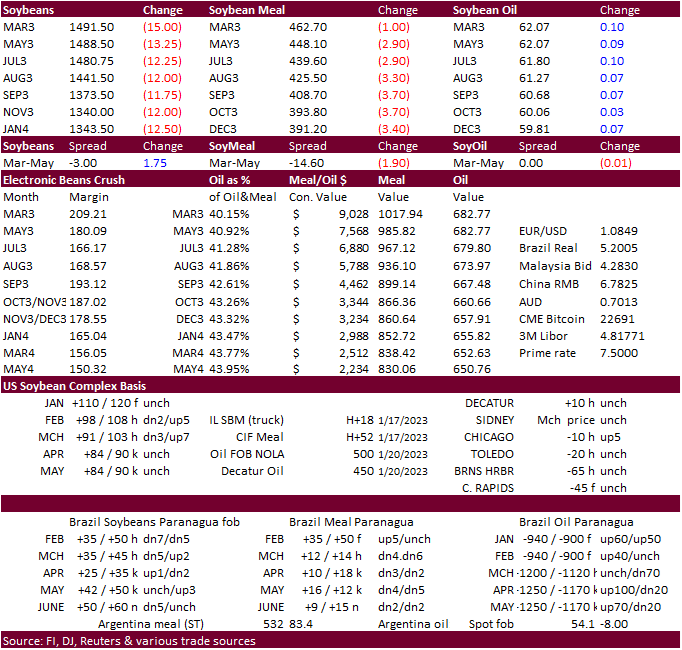

Very

choppy day of trading after Argentina received beneficial rain over the weekend. Prices closed lower for soybeans, corn, and wheat. Soybean products, after opening lower, pared losses, with meal closing lower and soybean oil remarkably higher, despite a large

selloff in crude oil. March crush was weaker early but rebounded hard to close higher.

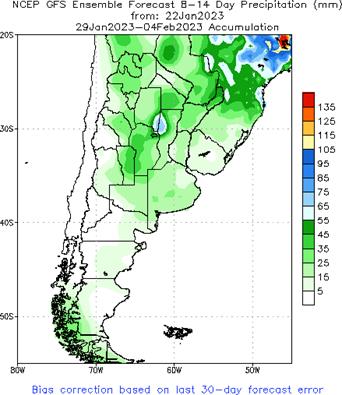

The

morning forecast showed improvements for Argentina and the US. Argentina received good rains over the weekend that will benefit crops. Amounts ranged from 0.60 to 1.50 inches, locally up to 2.00 inches. Additional rain will occur across Argentina later this

week and early February. We think the decline in crop conditions should stall. Southern Brazil saw some rain over the weekend, including the southern dry state of RGDS. Rest of Brazil saw beneficial rains but harvesting progress for soybeans likely slowed.

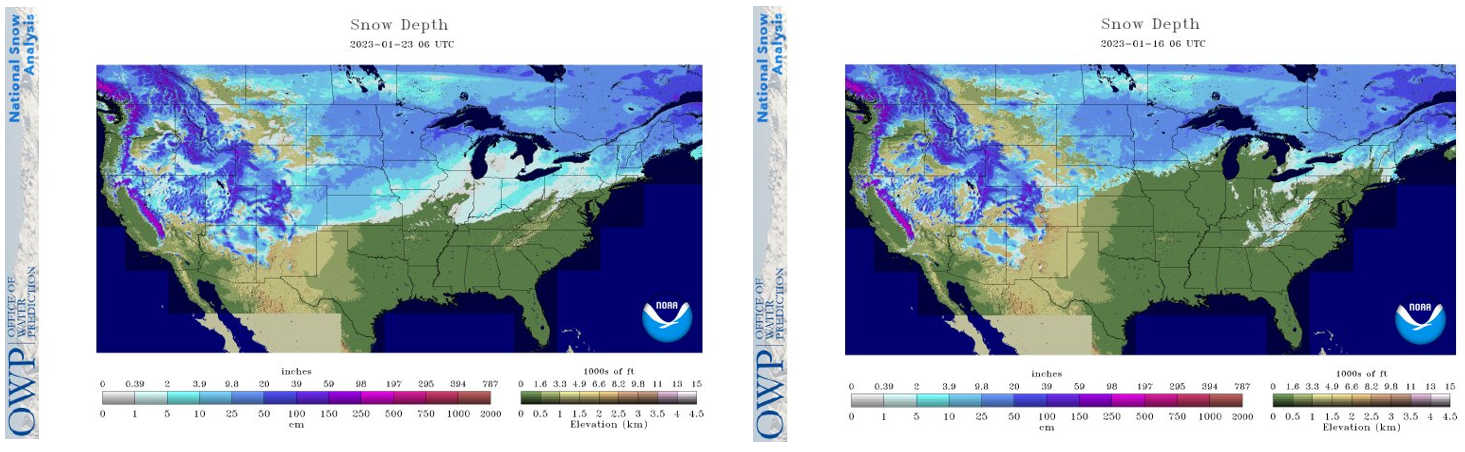

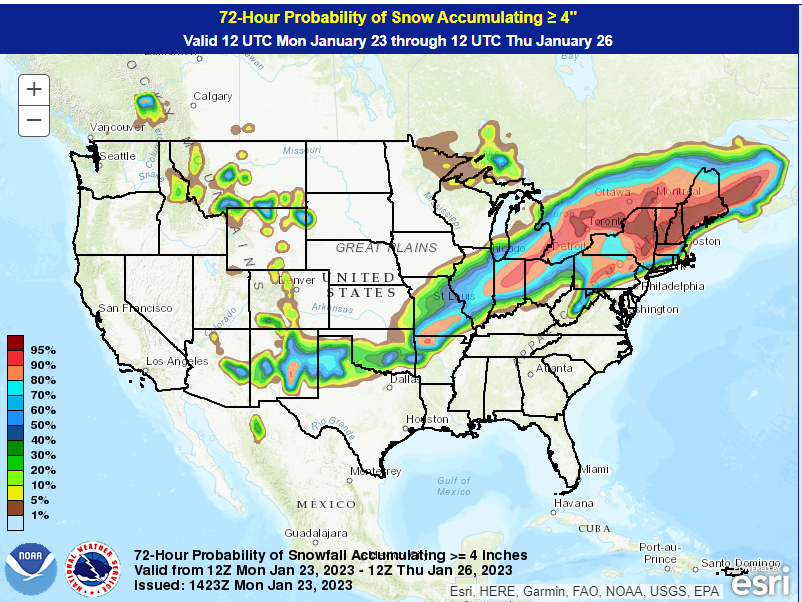

The US Great Plains will see snow favoring KS, OK, and northern Texas Tuesday.

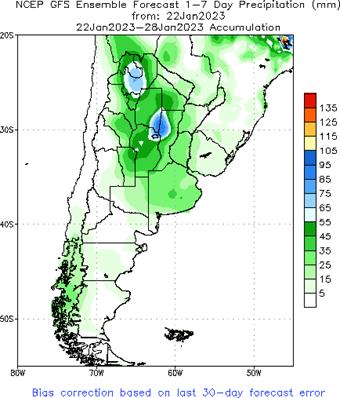

Argentina

1-7 and 8-14 day

World

Weather Inc.

World

Weather Inc.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Argentina

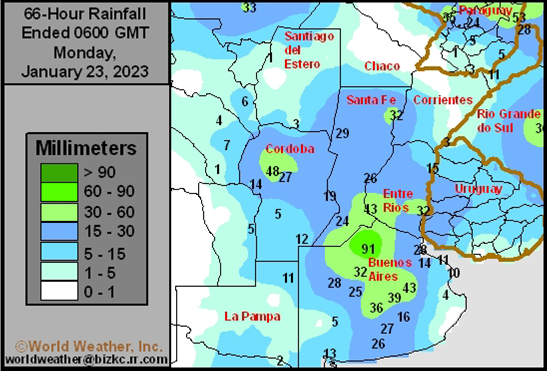

rain advanced to the east and north during the weekend after beginning in the southwest Friday -

Sufficient

rain fell to improve topsoil moisture and crop conditions in many areas from Santa Fe, Entre Rios and northern Cordoba to central and northeastern Buenos Aires -

Rainfall

varied from 0.60 to 1.58 inches was officially reported most often with local totals in northern Buenos Aires reaching 3.58 inches and Cordoba City, Cordoba reported 1.77 inches -

Satellite

estimated rain totals were also locally great in southeastern Santa Fe and in western Entre Rios -

Mostly

dry weather occurred during the weekend in southeastern Buenos Aires, Santiago del Estero, Chaco, Formosa and Corrientes -

Dry

weather resumed in La Pampa, western Buenos Aires and southern Cordoba after rain fell significantly Thursday night and Friday morning -

Overall,

rain in Argentina occurred mostly as expected Friday into Saturday with many areas getting 0.60 to 1.50 inches and local totals over 2.00 inches. Pockets of greater than expected rain were suspected in north-central Buenos Aires and from southeastern Santa

Fe into western Entre Rios. The moisture was ideal in easing long term stress, though low subsoil moisture continued in many areas suggesting follow up moisture is necessary to seriously ease long term dryness. Additional rain is forthcoming over the next

two weeks and sufficient rain will fall to further improve crops, although rainfall in the east may be more limited than that in the west.

-

Argentina

rainfall in the coming ten days will be greatest in western Argentina and in particular the northwest -

Rain

totals of 2.00 to more than 5.00 inches will fall in Salta and 1.00 to 3.00 inches in surrounding areas in the northwest -

Rainfall

elsewhere during the coming ten days will vary from 0.30 to 1.25 inches in eastern and southern portions of the nation with local totals of 1.25 to more than 2.00 inches -

Tuesday

into Saturday will be wettest this week -

Dry

bean areas in northwestern Argentina along with sugarcane and citrus crops will receive most of the greatest rain in this next ten days, but cotton and some grain and oilseed areas will also benefit. The improving environment for crops in Argentina will continue

during this period, though there will be need for more rain in portions of the east.

-

Temperatures

were hot in northern Argentina early in the weekend with highest temperatures of 100 to 113 degrees Fahrenheit from northern Cordoba, central and northern Santa Fe as well as Entre Rios northward to Formosa -

Highest

temperatures to the south were in the 80s and lower 90s -

Argentina

temperatures will be warmer than usual early this week especially in the north -

Cooling

is likely later this week with near to below normal temperatures likely during the weekend and next week

-

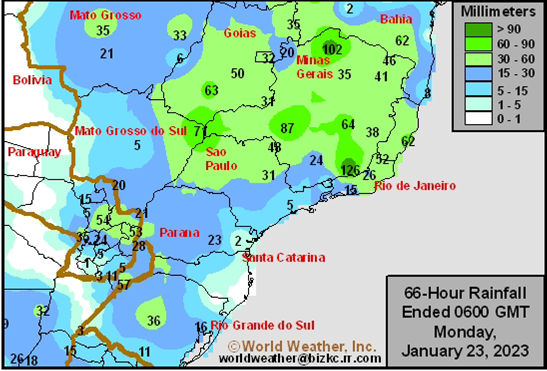

Brazil

weather during the weekend occurred as expected and not many changes were suggested in this week’s forecast -

Rainfall

Friday through Sunday morning was greatest from northern Sao Paulo and eastern most Mato Grosso do Sul to southern Bahia and Goias where 1.00 to 1.77 inches was common -

Local

rain totals reached over 3.00 inches in south-central Minas Gerais and to 4.00 inches in northern Minas Gerais

-

Rainfall

was more erratic and a little light in southern and western Brazil with local totals through Sunday morning of 0.50 to 1.42 inches, though the greatest rainfall was limited, and some drying was noted -

Some

of the driest weather occurred in Parana, Rio Grande do Sul and Mato Grosso do Sul -

Soil

moisture was still rated favorably in many areas Friday reducing concern over crop conditions after weekend rainfall was limited -

Central

and southern Rio Grande do Sul continues to have the greatest issue with dryness, despite a few areas getting some significant rain -

Santa

Maria, Rio Grande do Sul reported 1.42 inches of rain, but that was an exception -

Mato

Grosso did better with rain Sunday into this morning than earlier in the weekend -

Brazil

weekend temperatures were near to below normal except in the far south where readings were just slightly warmer than usual -

Brazil

weather will change very little over the next ten days to two weeks -

Rain

is expected to fall in most of the nation, although Rio Grande do Sul will continue to receive the least frequent and least significant rain for at least the next five days leaving areas of dryness to prevail -

Other

areas in Brazil will remain plenty wet and that may result in some slow early season crop maturation and harvest progress -

Minas

Gerais, Espirito Santo, Rio de Janeiro and immediate neighboring areas will be wettest -

Temperatures

will continue to a near and slightly below normal except in the far south where precipitation will be restricted allowing temperatures to be a little warmer than usual -

Brazil’s

bottom line remains good for developing crops, although there is need for at least a little more rain in Rio Grande do Sul. There is also need for less frequent and less significant rain from Mato Grosso to Sao Paulo and Minas Gerais so that early season soybeans

and corn can mature quickly and be harvested. Safrinha corn and cotton planting would also advance swiftly if rain frequency and intensity is reduced for a little while. The drier weather noted late last week and into the weekend in portions of western and

interior southern Brazil should have proven beneficial in reducing surplus soil moisture and improving the harvest and planting environment, but the trend needs to prevail for a while to allow aggressive fieldwork.

-

Kansas,

Colorado and immediate neighboring areas in southeastern Nebraska reported snow and some rain during the weekend -

Snow

accumulations of 2 to 8 inches were common and local totals to 11 inches occurred in the western half of the state and eastern Colorado

-

1

to 6 inches was common in eastern winter wheat areas in Kansas and southeastern Nebraska -

No

snow fell in southern Kansas -

Moisture

totals varied from 0.05 to 0.70 inch with local totals in southeastern Colorado reaching 0.88 inch -

Northern

Oklahoma received up to 0.35 inch of moisture -

Texas

winter wheat areas were not impacted and moisture totals in southern Oklahoma were minimal -

U.S.

Central Plains low temperatures today were in the single digits Fahrenheit across many of the snow covered areas of Kansas, Colorado and Nebraska which induced no damage to crops because of the snow.

-

U.S.

southern hard red winter wheat areas will get snow and some rain tonight and Tuesday -

Moisture

totals in the Texas Panhandle will vary from 0.10 to 0.50 inch while amounts in Oklahoma vary from 0.20 to 0.75 inch and a few areas will get as much as 1.25 inches

-

Snow

accumulations will vary from 3 to 8 inches with local totals of 10 inches or more

-

Oklahoma

will get the greatest snowfall -

U.S.

weekend precipitation was greatest from the lower Delta through Georgia and into the Carolinas as well as northern Florida and parts of the Tennessee River Basin

-

Moisture

totals varied from 1.00 to 3.00 inches from central and southern Louisiana to the Carolinas and northern Florida with Tallahassee, Fl. Receiving 3.14 inches

-

The

Tennessee River Basin received up to 0.50 inch of moisture along with the northern Delta -

Light

snow fell from southern Iowa and northern Missouri to northern Illinois and southern Wisconsin with a trace to 3 inches common with a few local totals to 4 inches

-

Weekend

temperatures were near to above normal in the central and east and a little cooler than usual in the interior western states -

U.S.

precipitation next ten days will be most significant in the Delta, eastern Midwest and southeastern states; including a part of the southeastern Plains -

Moisture

totals of 1.00 to 4.00 inches are expected in the Delta and Tennessee River Basin as well as the Carolinas and Georgia -

Moisture

totals of 0.60 to 1.75 inches will occur in the lower and eastern Midwest -

Drier

weather is expected in the central U.S. Plains over the coming ten days, although not completely dry

-

Northern

Plains and upper Midwest will experience light snow and a little rain Thursday night into the weekend

-

U.S.

temperatures will be trending cooler this week in the central and east, although early week readings will be warmer than usual.

-

Weekend

temperatures and those early next week are expected to be cooler than usual especially from the north-central states into Canada and closer to normal elsewhere -

Brief

warming is expected late next week, and a more potent period of cooling should evolve later in early February -

U.S.

bottom line weather is favorable for moisture increases in the lower and eastern Midwest, Delta, Tennessee River Basin and southeastern states where the ground is expected to become wetter with increasing runoff. Recent precipitation has improved hard red

winter wheat soil moisture for better crop conditions late this winter and early spring. California precipitation will be more limited for a while and snow that falls in Montana and South Dakota will help add some protection to wheat areas ahead of colder

weather. -

Rain

developed in North Africa during the weekend with northern Algeria getting most of the rain. Moisture totals varied from 0.40 to 1.69 inches with a few local totals reaching 2.00 to nearly 3.00 inches

-

The

greater rainfall was rare -

Interior

Tunisia and much of Morocco away from the northeast was left dry -

Additional

rain will fall in virtually the same areas in North Africa during the coming week to ten days -

Eventually

the need for rain in interior Tunisia will become a much greater need and the same may be true for parts of Morocco as well -

Europe

precipitation during the weekend was greatest in the south-central and interior east

-

The

moisture was welcome and good for long term water supply and soil moisture -

Areas

from central Italy through the western Balkan Countries to the Danube River were wettest -

Europe’s

greatest rainfall in the next ten days will occur from the Italy into the lower Danube River Basin -

Improvements

in topsoil moisture are likely with the greatest need for such conditions remaining in the lower Danube River Basin

-

Temperatures

will be cooler than usual in western Europe early this week and near normal elsewhere -

Week

two temperatures should be near normal -

CIS

weather is expected to be relatively tranquil for a while with precipitation most likely from the Baltic States to the Volga Vyatsk where several inches of snow will accumulate -

Other

areas in the western CIS are unlikely to experience much precipitation for a while -

Temperatures

will be warmer than usual through the next two weeks -

Northern

and eastern India will experience a couple of weak weather disturbances this week and during the weekend that will lift topsoil moisture briefly in support of some short term improvements in crop and field conditions ahead of reproduction -

Moisture

totals of 1.00 to 4.00 inches and locally more will occur from Uttarakhand to Jammu and Kashmir -

Rainfall

in Punjab, Haryana and northern Uttar Pradesh will vary from 0.40 to 0.80 inch with a few amounts of 1.00 to 2.00 inches in the east part of the region -

A

trace to 0.60 inch of moisture is expected from eastern Rajasthan to central and southeastern Uttar Pradesh; including northern Madhya Pradesh -

Drier

weather will resume next week -

The

moisture will be good for improved pre-reproductive wheat, pulse crops and a few other winter grain and oilseed crops, but more rain will be needed to induce the best yields for unirrigated crops -

China

weekend precipitation was limited to the lower Yangtze River Basin and the southeastern coastal provinces, although amounts were light -

Moisture

totals varied up to 0.68 inch most often with a few totals around 1.00 inch -

China’s

precipitation this week will be limited with net drying most likely -

Some

rain will develop next week probably not until late next week and moisture totals will be light -

Temperatures

will be warmer than usual except for early this week in the northeast when readings will be colder than usual

-

Western

Turkey will receive frequent rain and mountain snow over the next ten days -

Eastern

Turkey will receive more limited precipitation until late this weekend into next week when southeastern parts of the nation will be wettest -

Other

areas in the Middle East will not receive significant precipitation this week -

Showers

will develop next week with northern Iraq and northern Syria wettest along with northwestern Iran -

Greater

rain will be needed in other Middle East Locations in February to ensure good wheat development potential this spring -

South

Africa rainfall in the coming week will be greatest in Eastern Cape and Natal while net drying occurs in other areas -

The

moisture will be welcome, but there will be a slowly rising bout of moisture stress in some of the drier areas from Northern Cape through Free State and North West to Limpopo and Mpumalanga -

A

timely boost in rainfall should evolve next week to reduce concerns of moisture stress -

Eastern

Australia received some important rainfall in the dryland areas of Queensland and northern New South Wales during the weekend -

Moisture

totals varied from 0.25 to 0.80 inch most often with local totals of more than 1.00 inch and one location reported 2.43 inches of rain in south-central Queensland -

Eastern

Australia precipitation will be limited over the coming five to six days with only a few showers expected and net drying likely -

Showers

and thunderstorms will begin to develop daily this week, but the greatest rainfall will hold until next week

-

The

moisture will bring some relief to dryness and benefiting unirrigated sorghum and cotton -

West-central

Africa will receive some coastal showers this week and the precipitation may increase and reach a little farther inland next week -

Some

of the advertised precipitation may be overdone, but it could be beneficial for a few coffee and cocoa production areas as long as there is follow up moisture once it begins to rain periodically -

Dry

weather occurred during the weekend -

Southeast

Asia rainfall during the weekend limited in the mainland areas and more significant across portions of Indonesia and Malaysia

-

The

eastern Philippines reported some heavy rainfall once again with amounts over 5.00 inches in southeastern Luzon Island -

Southeast

Asia rainfall will be most significant in Indonesia and Malaysia as well as eastern portions central and southern Philippines over the next ten days -

The

moisture will be good for ongoing crop development, although a few areas may become a little too wet -

East-central

Africa rainfall will remain most significant in Tanzania and southern Uganda while more limited in areas north into Ethiopia which is not unusual for this time of year -

Today’s

Southern Oscillation Index was +14.92 today and some additional fall in the index is expected, although the decline will slowly subside this week

Bloomberg

Ag calendar

Monday,

Jan. 23:

- MARS

monthly report on EU crop conditions - Brazil’s

Unica to release sugar output, cane crush data during the week (tentative) - HOLIDAY:

China, Hong Kong, Malaysia, Indonesia, Korea, New Zealand, Singapore, Vietnam

Tuesday,

Jan. 24:

- EU

weekly grain, oilseed import and export data - HOLIDAY:

China, Singapore, Hong Kong, Malaysia, Korea, Vietnam

Wednesday,

Jan. 25:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

Jan. 1-25 palm oil exports - US

cold storage data for pork, beef and poultry, 3pm - National

Coffee Association’s webinar on 2023 US coffee outlook - USDA

total milk production, 3pm - US

poultry slaughter, 3pm - HOLIDAY:

China, Hong Kong, Vietnam

Thursday,

Jan. 26:

- Paris

Grain Conference, day 1 - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

to release its outlook for world orange and orange-juice production - Port

of Rouen data on French grain exports - HOLIDAY:

China, India, Australia, Vietnam

Friday,

Jan. 27:

- Paris

Grain Conference, day 2 - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - US

cattle inventory, 3pm - HOLIDAY:

China

Source:

Bloomberg and FI

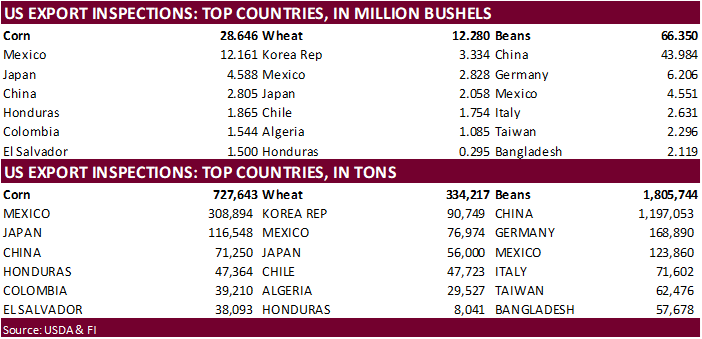

Out

last week

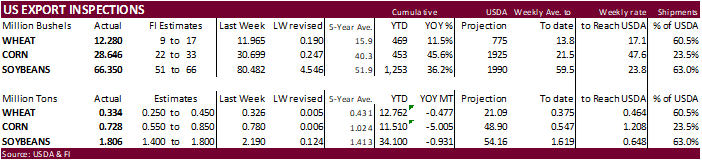

USDA

inspections versus Reuters trade range

Wheat

334,217 versus 250000-550000 range

Corn

727,643 versus 550000-1025000 range

Soybeans

1,805,744 versus 900000-1955000 range

Soybean

inspections included 168,890 tons to Germany out of the Gulf, and China picked up nearly 1.2 million tons.

GRAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JAN 19, 2023

-- METRIC TONS --

--------------------------------------------------------------------------

CURRENT PREVIOUS

Terry Reilly

Futures

International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook

Terrace, Il. 60181

W: 3126041366

DISCLAIMER:

The contents of this communication and

any attachments are for informational purposes only and under no circumstances

should they be construed as an offer to buy or sell, or a solicitation to buy

or sell any future, option, swap or other derivative. The sources for the information and any

opinions in this communication are believed to be reliable, but Futures

International, LLC does not warrant or guarantee the accuracy of such

information or opinions. This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and

other derivatives is risky and is not suitable for all persons. All of

these investment products are leveraged, and you can lose more than your

initial deposit. Each investment product is offered only to and from

jurisdictions where solicitation and sale are lawful, and in accordance with

applicable laws and regulations in such jurisdiction. The information

provided here should not be relied upon as a substitute for independent

research before making your investment decisions. Futures International,

LLC is merely providing this information for your general information and the information

does not take into account any particular individual's investment objectives,

financial situation, or needs. All investors should obtain advice based

on their unique situation before making any investment

decision. Futures International, LLC and its principals and

employees may take positions different from any positions described in this

communication. Past results are not necessarily indicative of future

results.

----------- WEEK ENDING ---------- MARKET YEAR MARKET YEAR

GRAIN 01/19/2023 01/12/2023 01/20/2022 TO DATE TO DATE

BARLEY 299 0 0 2,154 10,010

CORN 727,643 779,788 1,186,575 11,509,781 16,514,529

FLAXSEED 0 0 0 200 224

MIXED 0 0 0 0 0

OATS 0 0 0 6,486 400

RYE 0 0 0 0 0

SORGHUM 72,574 2,708 77,239 493,628 2,149,910

SOYBEANS 1,805,744 2,190,371 1,383,251 34,100,498 35,031,997

SUNFLOWER 0 0 0 2,160 432

WHEAT 334,217 325,643 417,638 12,761,882 13,239,200

Total 2,940,477 3,298,510 3,064,703 58,876,789 66,946,702

--------------------------------------------------------------------------

CROP MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED; SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES WATERWAY SHIPMENTS TO CANADA.

Macros

105

Counterparties Take $2.135 Tln At Fed Reverse Repo Op (prev $2.091 Tln, 98 Bids)

·

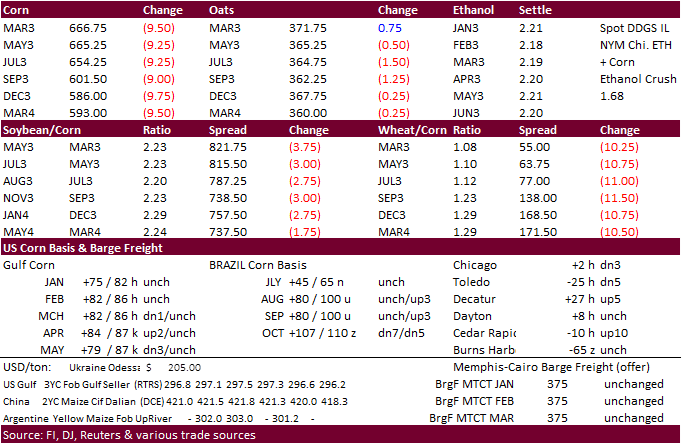

CBOT corn

traded

sharply lower as rain fell across Argentina over the weekend that brought widespread relief to summer crops.

·

USDA US corn export inspections as of January 19, 2023, were 727,643 tons, above a range of trade expectations, below 779,788 tons previous week and compares to 1,186,575 tons year ago. Major countries included Mexico for 308,894

tons, Japan for 116,548 tons, and China for 71,250 tons.

·

Greece detected African swine fever in a wild boar in the northern part of the country, boarding Bulgaria and North Macedonia.

·

AgRural reported 1 percent of the Brazil winter corn seeding progress was complete.

Export

developments.

·

None reported

Updated

01/19/23

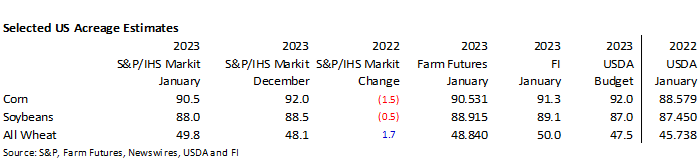

March

corn $6.50-$7.25 range. May

$6.25-$7.20

·

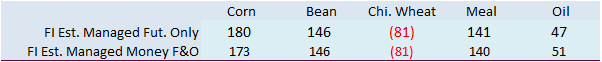

CBOT’s soybean complex opened lower led by soybean meal. Soybean oil and meal pared losses, with soybean oil closing higher despite a selloff in US WTI crude oil. Soybeans and meal remained on the defensive after Argentina received

good rains over the weekend. We think the decline in crop conditions should stabilize. With many Asian countries on holiday, news was light. Support for March soybeans is now seen at $14.75. Note the managed money position for soybean meal was a fresh record

as of last Tuesday. Long liquidation might have been in play.

·

CBOT crush basis March was down 4.25 cents earlier to $1.91 before rallying to close up 14.25 cents at $2.0950.

·

USDA US soybean export inspections as of January 19, 2023, were 1,805,744 tons, within a range of trade expectations, below 2,190,371 tons previous week and compares to 1,383,251 tons year ago. Major countries included China for

1,197,053 tons, Germany for 168,890 tons, and Mexico for 123,860 tons.

·

USDA announced 192,000 tons of soybean were sold to unknown destinations. January 1-23 USDA 24-hour sales for the combined old and new-crop soybean crop years are running at 1.085 million tons, down from 1.866 million tons during

the December 1-23 period.

·

There were 46 CBOT soybean registrations were cancelled Friday evening.

·

Argentina FOB soybean prices fell little more than $11/ton and remain at a discount to US Guld by around $20 per ton.

·

Brazil and Argentina at a summit in Buenos Aires this week will announce they are looking to create a common currency, called the “sur” (south), looking to boost “regional” trade (southern Brazil and Argentina) and reduce reliance

on the US dollar. Without details on the plan, one speculation for this move is to stabilize or create a fair-trade environment, for local (southern Brazil and Argentine) merchants that want to avoid the volatile currency fluctuations currently tied with the

US dollar.

·

After meeting with exporters last week, Argentina’s Economy Minister Sergio Massa will meet with farmers this next week to discuss some type of relief over the ongoing drought, which has halved the wheat crop and prompted some

analysts to chop soybean production estimates to low as 34 million tons. USDA is at 45.5 million tons for the Argentina soybean crop, likely to come down in its February update. Large prospects for Brazil’s should keep South American production for 2022-23

above what was produced in 2021-22, even if the USDA also lowers the Uruguay and Paraguay’s output.

·

Safras estimated Brazil 2023 soybean exports at a large 93 million tons, up from 78.9 million for 2022. This is a big increase despite the trade looking for anywhere from a one to four-million-ton increase in 2023 China soybean

imports. Brazil’s crush was seen at 52 million tons versus 50 during 2022.

·

AgRural sees Brazil’s soybean crop at 152.9 million tons, down 700,000 tons form their previous estimate. Only 1.8 percent of the Brazil soybean crop was harvested, below 4.7 percent year ago. The Brazil corn crop was estimated

at 123.9 million tons, down from 124.3 million previous.

·

Brazil’s Mato Grosso was 5.9 percent complete as of late last week for soybean harvesting, up nearly 4 points from the previous week, according to IMEA, and about 7 points below year earlier.

·

Malaysia is on holiday though the 24th, back Wednesday.

·

USDA under its 24-hour reporting system announced 192,000 tons of soybeans were sold for delivery to unknown destinations.

·

The CCC seeks 3,770 tons of vegetable oils on February 1 for last half March shipment.

Updated

01/19/23

Soybeans

– March $14.75-$15.75, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

60.00-68.00, May 58-70

·

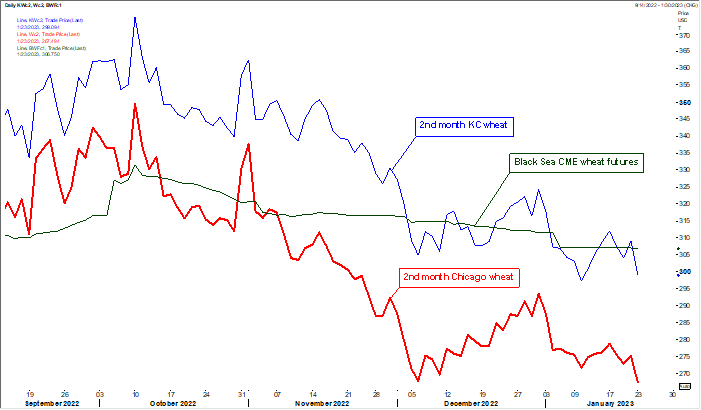

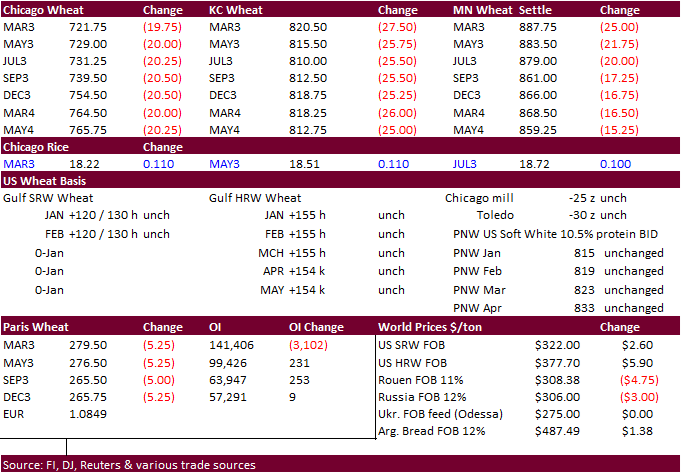

US wheat futures were lower from US wheat improving, from past events and future forecasts. Prices also fell on Black Sea export competition that drove Paris wheat to multi month lows.

·

The US saw a few storm rolls across the winter wheat region over the past 10 days. The latest snow event aided Kansas and Colorado. The US Great Plains will see snow favoring KS, OK, and northern Texas Tuesday. The snow cover

is welcome. US snow coverage this morning (52%) versus week ago (35%)…

US

snow probability of 4″ or more over the next 72 hours hits wheat areas that missed out over the past week.

·

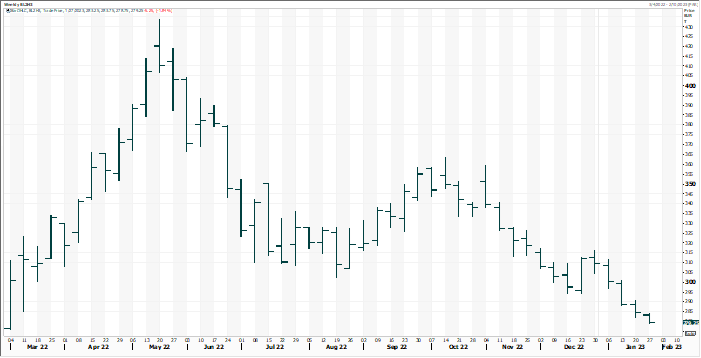

Paris March wheat was 5.25 euros lower at 279.25 per ton, lowest since early March 2022.

KC,

Chicago and Black Sea (futures) wheat…Black Sea wheat futures trading has been thin since the Ukraine/Russia conflict

Source:

Reuters and FI

·

There were no major global import tender announcements over the weekend.

·

USDA US all-wheat export inspections as of January 19, 2023, were 334,217 tons, within a range of trade expectations, above 325,643 tons previous week and compares to 417,638 tons year ago. Major countries included Korea Rep for

90,749 tons, Mexico for 76,974 tons, and Japan for 56,000 tons.

·

A Ukraine boat of 30,000 tons of wheat charted by the UN left for Ethiopia on Sunday.

·

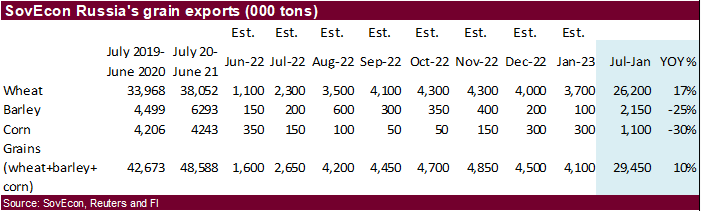

Russian wheat export prices for 12.5 percent protein were up $1.00 last week to $306.00 per ton, according to IKAR. About 800,000 tons of wheat was export last week out of Russia, according to SovEcon.

·

Domestic India wheat prices hit a record high Monday, just before the government planned to release reserves to cool prices after many producers ran out of stocks. 2-3 million tons is expected to be auctioned soon. India’s new-crop

should come online in March and so far, we are hearing India (2023-24 USDA timeline) wheat production could rise more than 112 million tons, a record, and well up from 106.8 million tons year earlier.

·

Western countries made progress with talks to supply Ukraine with tanks and other weapons. Russia warned of “West destruction” for arming Ukraine. “If Washington and NATO supply weapons that would be used for striking peaceful

cities and making attempts to seize our territory as they threaten to do, it would trigger a retaliation with more powerful weapons” (Reuters provided the quote).

·

Grain ships were briefly stopped at Turkey’s Bosphorus strait on Sunday due to rudder failure but resumed shortly.

Paris

March wheat – weekly

Source:

Reuters and FI

Export

Developments.

·

Japan seeks 70,000 tons of feed wheat and 40,000 tons of barley on January 25 for arrival in Japan by March 16.

Rice/Other

·

None reported

Updated

01/19/23

Chicago

– March $7.00 to $8.00, May $7.00-$8.25

KC

– March $7.75-$9.00, $7.50-$9.25

MN

– March $8.75 to $10.00,

$8.00-$10.00

#non-promo