PDF Attached

Private

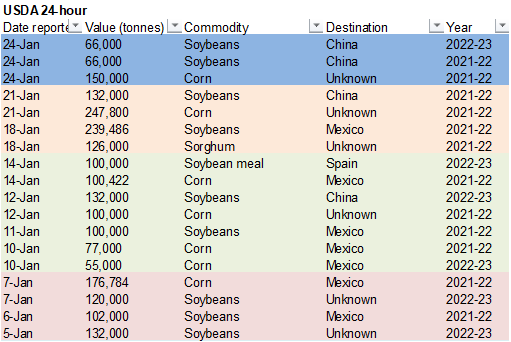

exporters reported the following activity:

- 150,000

metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year -

132,000

metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons is for delivery during the 2022/2023 marketing year

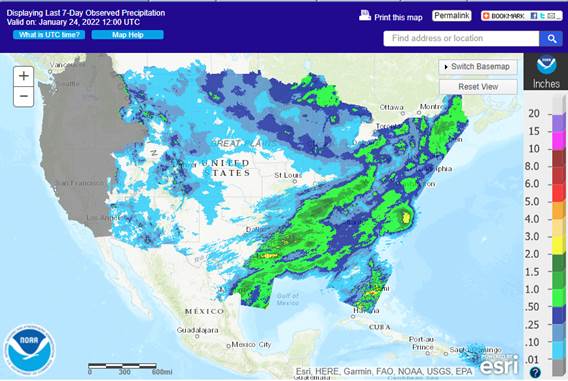

7-day

US precipitation

WORLD

WEATHER HIGHLIGHTS FOR JANUARY 24, 2022

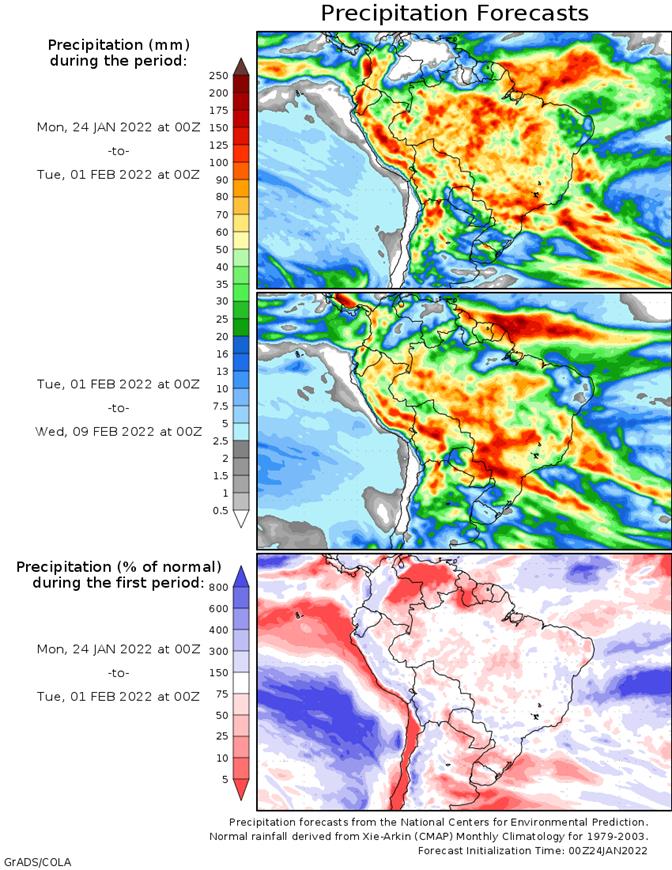

- Topsoil

conditions in Argentina are now saturated with moisture except in the far northeast where hot and dry conditions have prevailed and further harmed minor grain, oilseed and cotton crops.

- Subsoil

moisture is still rated low, but it will be increasing this week as the topsoil moisture percolates downward in the soil.

- Additional

showers are expected in Argentina early this week and then about seven days of drying and warming will occur followed by additional precipitation in the first weekend of February.

- Southwestern

Brazil and Paraguay have been baking in a hot and dry weather pattern of lately and that pattern should break down late this week as a brief period of rain evolves; however, follow up rain will be desperately needed and it will not likely occur until late

in the first week of February. - A

good mix of rain and sunshine should occur in the remainder of Brazil for the next couple of weeks.

- In

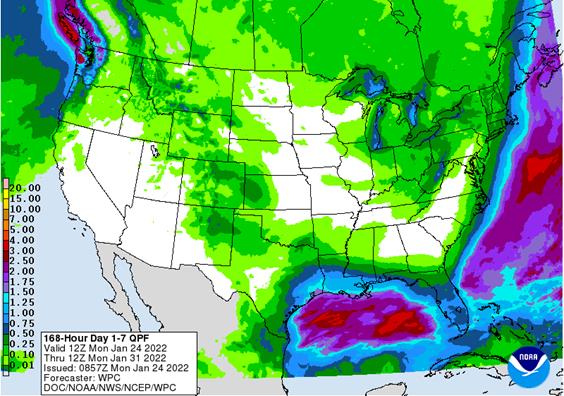

the U.S., hard red winter wheat areas will get a little snow in the west during mid-week this week, but moisture totals will be limited.

- Other

areas in the Plains, Midwest, Delta and southeastern states will experience restricted precipitation pattern this week and for a little while next week.

- A

trend change during mid- to late-week next week will bring rain and snow back to the western United States and that may eventually bring a new storm system to the northern Plains and upper Midwest late in the week next week or more likely in the following

weekend. - Cool

weather in the eastern U.S. this week will shift back to western Canada and a few areas in the northern Plains and northwestern states while the east turns warmer.

- In

the rest of the world, Spain, southern France and Portugal will remain dry biased.

- A

few showers will occur in Morocco, but dryness will remain in place throughout northwestern Africa.

- Eastern

Europe and the western CIS will continue to see waves of snow and some rain in the south.

- India’s

weather will trend drier this week - East-central

and southeastern China will see waves of rain and a little snow. - Eastern

Australia will experience scattered showers and thunderstorms. - Indonesia

will be favorably and some net drying will occur in South Africa. - A

tropical cyclone that moved across Madagascar during the weekend will move through Mozambique early this week producing flooding rain and some property and crop damage

Source:

World Weather, inc.

Monday,

Jan. 24:

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals - Brazil’s

Unica to release cane crush, sugar output data during the week (tentative) - U.S.

cold storage data for pork, beef and poultry; poultry slaughter, 3pm - USDA

total milk production, 3pm

Tuesday,

Jan. 25:

- EU

weekly grain, oilseed import and export data - Malaysia’s

Jan. 1-25 palm oil exports - Moscow

Agros Expo conference, Jan. 25-27

Wednesday,

Jan. 26:

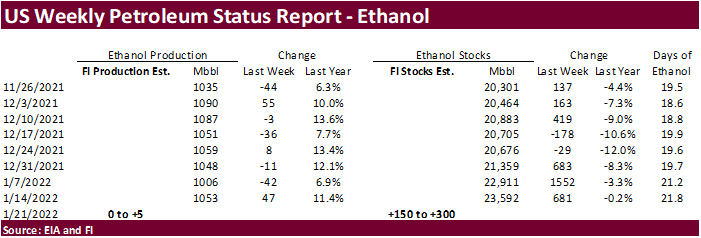

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

Australia, India

Thursday,

Jan. 27:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Paris

Grain Day conference, Jan. 27-28 - Port

of Rouen data on French grain exports

Friday,

Jan. 28:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

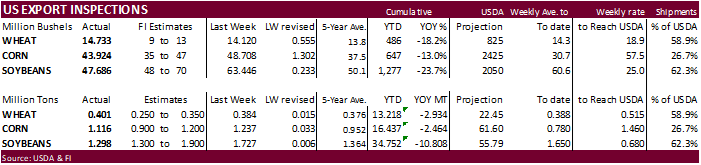

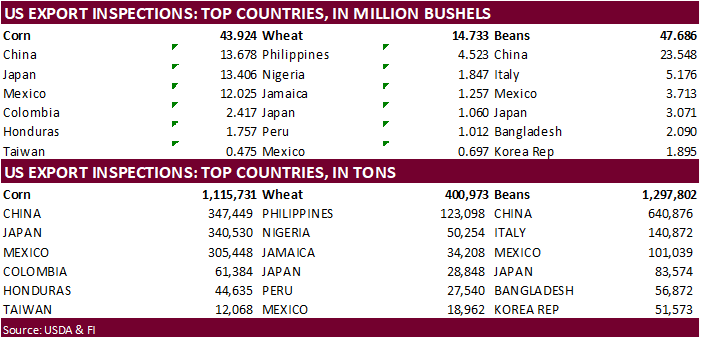

USDA

inspections versus Reuters trade range

Wheat

400,973 versus 250000-450000 range

Corn

1,115,731 versus 900000-1600000 range

Soybeans

1,297,802 versus 1200000-1900000 range

All

within range but China topped corn and soybeans as largest taker.

Macros

ICE

chat:

US

Oil Output Likely To Be North Of 12 Mln Bpd Into 2023, Unlikely To Reach Previous 13 Mln Bpd Peak – Occidental CEO Vicki Hollub

US

Chicago Fed National Activity Index Dec: -0.15 (Prev 0.37; PrevR 0.44)

·

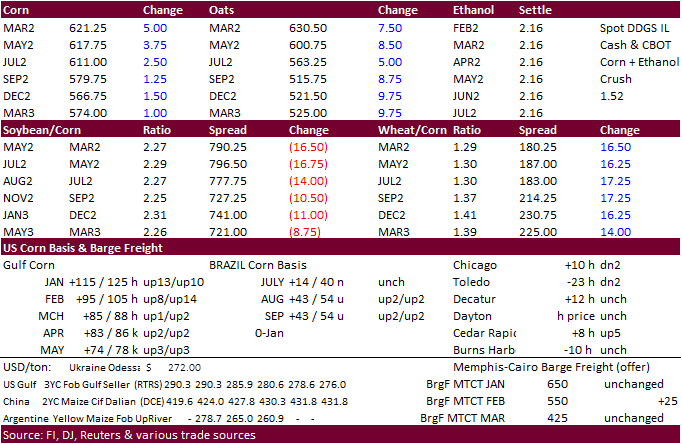

CBOT corn ended lower from quiet export developments over the weekend, sharply higher USD, lower WTI crude oil and a decline in soybeans.

·

USDA US corn export inspections as of January 20, 2022 were 1,115,731 tons, within a range of trade expectations, below 1,237,248 tons previous week and compares to 1,403,063 tons year ago. Major countries included China for 347,449

tons, Japan for 340,530 tons, and Mexico for 305,448 tons.

·

We lifted our 2021-22 US corn import projection to 35 million bushels, 10 million above USDA, based on strong demand from Canada.

https://calgary.ctvnews.ca/alberta-feedlot-operators-running-low-on-grain-for-cattle-1.5748405

·

A week from today we will see monthly EIA US ethanol production and a week from Tuesday corn for ethanal use.

Export

developments.

·

Under the 24-hour announcement system, private exporters sold 150,800

metric tons of corn to unknown destinations during the 2021-22 marketing year.

Updated

1/21/22

March

corn is seen in a $5.90 to $6.35

·

CBOT soybeans ended up loser on Monday after Argentina saw very good rains over the weekend. The USD was higher but came off from earlier highs. Soybean oil was lower to start from weakness in palm oil and unwinding of oil/meal

spreading. WTI crude kept it lower until that market rebounded late. Look for a higher trade in SBO on Tuesday.

·

USDA announced 132,000 tons of soybeans were sold to China, of that 66,000 tons for this crop-year. 900,000 tons of soybeans were announced by USDA under the 24-hour system this month so far for the 2021-22 delivery (does not

include new-crop of 198,000). Year ago, USDA announced only 390,500 tons for current and new-crop combined for the month of January.

·

USDA US soybean export inspections as of January 20, 2022 were 1,297,802 tons, within a range of trade expectations, below 1,726,719 tons previous week and compares to 2,103,465 tons year ago. Major countries included China for

640,876 tons, Italy for 140,872 tons, and Mexico for 101,039 tons.

·

A week from today we will see monthly EIA US soybean oil and tallow/grease for biodiesel production and a week from Tuesday soybean crush.

Export

Developments

·

Under the 24-hour announcement system, private exporters sold

132,000

metric tons of soybeans for delivery to China. Of

the total, 66,000 metric tons is for delivery during the 2021-22 marketing year and 66,000 metric tons is for delivery during the 2022-23 marketing year.

·

Turkey’s state grain board TMO seeks about 6,000 tons of crude sunflower oil on Jan. 28 for shipment between Feb. 8 and Feb. 25.

Updated

1/20/22

Soybeans

– March $13.25-$14.75

Soybean

meal – March $370-$435

Soybean

oil – March 59.00-64.50

·

US wheat futures were higher today led by KC from ongoing Russia/Ukraine tensions and persistent dryness across the US. The KC/Chicago spread is impressive.

·

Producer selling across the Black Sea has not slowed according to a local source.

·

USDA US all-wheat export inspections as of January 20, 2022 were 400,973 tons, within a range of trade expectations, above 384,291 tons previous week and compares to 571,677 tons year ago. Major countries included Philippines

for 123,098 tons, Nigeria for 50,254 tons, and Jamaica for 34,208 tons.

·

The European Union said they are ready to impose “never-seen-before” economic sanctions on Russia if it attacks Ukraine, and EU foreign ministers said they would send a unified warning to Moscow. (Reuters)

·

Russia wheat exports are running 21 percent below the same season year ago through January 20.

·

Reuters confirmed that China on January 19 sold 468,738 tons of wheat out of reserves, or 94 percent of what was offered.

Below

Bloomberg story covering MARS EU winter grain crops…

(Bloomberg)

— Winter crops in Europe have had favorable conditions due to relatively mild temperatures and normal precipitation across most of the continent, the EU’s Monitoring Agricultural Resources unit said Monday in a report. “These conditions allowed stands that

were lagging behind in development to partially catch up, and currently, winter crops are generally in fair to good (or very good) condition.” No significant frost damage seen so far in winter-grain fields. However, most areas have only built up a weak tolerance

to frost due to the mild weather, which is a risk in case of cold snaps. That’s a particular concern in areas near the Black Sea where snow cover is limited. There’s been a significant increase in rapeseed plantings versus last year, while grains hold stable

·

The Philippines seeks 36,000 tons of Australian wheat on January 25 for April 1-30 shipment.

·

Jordan seeks 120,000 tons of feed barley on January 26 for July – August shipment.

·

Jordan retendered on wheat seeking 120,000 tons on February 1 for July – August shipment.

Rice/Other

·

South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.