PDF attached include US what by class working estimates

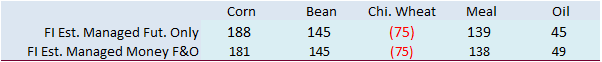

Two-sided

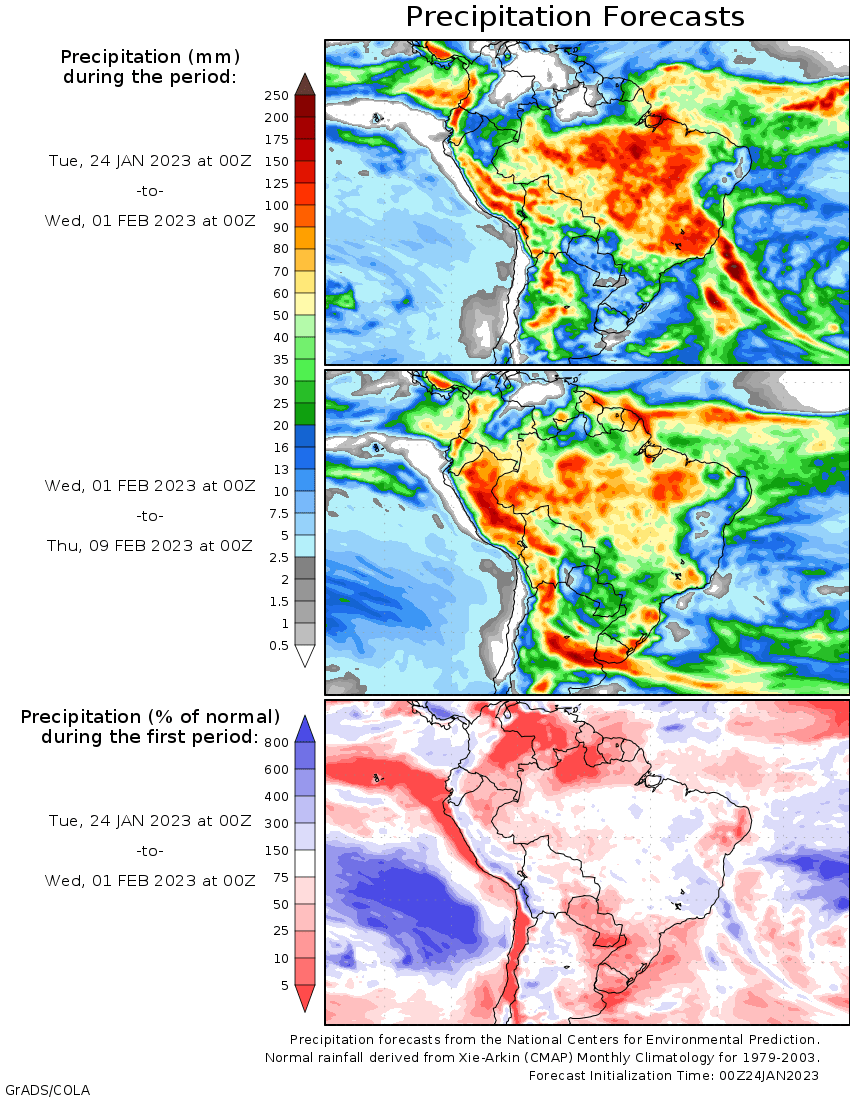

trade in the soybean complex. Sharply lower soybean oil pulled nearby soybeans lower. Meal ended higher but well-off intraday highs. Corn and wheat rallied on bottom picking. The morning weather forecast still called for Argentina to see rain through Friday,

then late in the week into next week bias northern areas. Brazil will see rain on and off over the next week. RGDS will see the lightest amounts for the southern areas. The US Great Plains will see precipitation bias southern areas.

Weather

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Not

many changes occurred overnight -

Snow

and rain will fall from West Texas and the Texas Panhandle across Oklahoma and northern Texas today resulting in a welcome boost in topsoil moisture -

The

Texas Rolling Plains, will receive another 0.20 to 0.75 inch of rain with a few totals near 1.00 inch in the east -

The

Texas Blacklands will receive 0.75 to 1.50 inches of rain today -

The

middle and upper Texas coast will receive 0.25 to 0.75 inch of moisture today -

West

Texas moisture will be less than 0.20 inch in the south while varying from 0.20 to 0.75 inch in the north along with the Texas Panhandle -

Oklahoma

moisture totals will vary from 0.20 to 0.75 inch in the north and 0.50 to 1.50 inches in the south

-

Snowfall

will vary from 3 to 8 inches and a few amounts to 10 inches from northern parts of West Texas and the Texas Panhandle through Oklahoma -

The

moisture will be very helpful in raising topsoil moisture for improving winter wheat conditions later this season -

Southern

U.S. Plains storm will move across the Delta and through the lower and eastern Midwest, Tennessee River Basin and southeastern States tonight and Wednesday.

-

Snowfall

of 4 to 10 inches and locally more will occur from southern Missouri and northern Arkansas to Indiana, southeastern Michigan and Ohio -

Waves

of snow will move across the northern Plains and northern Midwest during the coming week

-

The

snow will help protect winter crops from bitter cold temperatures especially in Montana and South Dakota where snow free conditions have been present for a while -

Additional

waves of precipitation (three in the next two weeks) will move through the Delta, lower Midwest and southeastern states maintaining wet field conditions and raising runoff for some improved river flow -

California

precipitation will be restricted over the next two weeks and parts of the Pacific Northwest will see less frequent and less significant precipitation as well -

Canada’s

Prairies will see waves of snowfall during the next two weeks, although moisture content in the snow is expected to be light -

Argentina

will continue to experience waves of rain during the next ten days with possibly drier weather thereafter -

The

additional moisture will be deemed timely and beneficial for summer crops of all kinds and better development potential will result -

Temperatures

will be a little warmer biased in this first week of the outlook and then a little cooler -

Southern

Brazil and Paraguay precipitation is expected to be light and sporadic during the coming week to possibly ten days and then some improvement is expected -

Crop

stress may evolve for a while, but it is only going to be stressful for crops in Rio Grande do Sul where some areas are already drier biased -

Center

south and center west Brazil rainfall is expected to continue frequent and significant enough to slow farming activity at times -

Some

concern over field working delays and early season soybean maturation is expected, although the greatest intensity and frequency of rain is likely in Minas Gerais, northeastern Sao Paulo and immediate neighboring areas -

Other

areas will see less frequent and less significant rainfall allowing some field progress to take place.

-

Rain

in North Africa will continue for a while with northern Algeria getting most of the rain

-

Interior

Tunisia and much of Morocco are not likely to get much moisture and the need for significant rain will be rising soon

-

Europe

weather is expected to be tranquil during the coming week, but there may be a boost in precipitation during the second week of the forecast -

CIS

weather is expected to be relatively tranquil for a while with precipitation most likely from the Baltic States to the Volga Vyatsk where several inches of snow will accumulate -

Other

areas in the western CIS are unlikely to experience much precipitation for a while -

Temperatures

will be warmer than usual through the next two weeks -

Northern

and eastern India will experience a couple of weak weather disturbances this week and during the weekend that will lift topsoil moisture briefly in support of some short term improvements in crop and field conditions ahead of reproduction -

Moisture

totals of 1.00 to 4.00 inches and locally more will occur from Uttarakhand to Jammu and Kashmir -

Rainfall

in Punjab, Haryana and northern Uttar Pradesh will vary from 0.40 to 0.80 inch with a few amounts of 1.00 to 2.00 inches in the east part of the region -

A

trace to 0.60 inch of moisture is expected from eastern Rajasthan to central and southeastern Uttar Pradesh; including northern Madhya Pradesh -

Drier

weather will resume next week -

The

moisture will be good for improved pre-reproductive wheat, pulse crops and a few other winter grain and oilseed crops, but more rain will be needed to induce the best yields for unirrigated crops -

China’s

precipitation this week will be limited with net drying most likely -

Some

rain will develop next week probably not until late next week and moisture totals will be light -

Temperatures

will be warmer than usual except for early this week in the northeast when readings will be colder than usual

-

Western

Turkey will receive frequent rain and mountain snow over the next ten days -

Eastern

Turkey will receive more limited precipitation until late this weekend into next week when a boost in precipitation is expected -

Other

areas in the Middle East will not receive significant precipitation this week, but greater precipitation is expected next week -

South

Africa rainfall in the coming week will be greatest in Eastern Cape and Natal while net drying occurs in other areas -

The

moisture will be welcome, but there will be a slowly rising bout of moisture stress in some of the drier areas from Northern Cape through Free State and North West to Limpopo and Mpumalanga -

A

timely boost in rainfall should evolve next week to reduce concerns of moisture stress -

Eastern

Australia precipitation will be limited over the coming five days with only a few showers expected and net drying likely -

Showers

and thunderstorms will begin to develop daily this week, but the greatest rainfall will hold until next week

-

The

moisture will bring some relief to dryness and benefiting unirrigated sorghum and cotton -

West-central

Africa will receive some coastal showers this week and the precipitation may increase and reach a little farther inland next week -

Some

of the advertised precipitation may be overdone, but it could be beneficial for a few coffee and cocoa production areas as long as there is follow up moisture once it begins to rain periodically -

Dry

weather occurred during the weekend -

Southeast

Asia rainfall will be most significant in Indonesia and Malaysia as well as eastern portions central and southern Philippines over the next ten days -

The

moisture will be good for ongoing crop development, although a few areas may become a little too wet -

East-central

Africa rainfall will remain most significant in Tanzania and southern Uganda while more limited in areas north into Ethiopia which is not unusual for this time of year -

Today’s

Southern Oscillation Index was +14.90 today and the index is expected to level off for a while.

Bloomberg

Ag calendar

Tuesday,

Jan. 24:

- EU

weekly grain, oilseed import and export data. - HOLIDAY:

China, Singapore, Hong Kong, Malaysia, Korea, Vietnam

Wednesday,

Jan. 25:

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

Jan. 1-25 palm oil exports - US

cold storage data for pork, beef and poultry, 3pm - National

Coffee Association’s webinar on 2023 US coffee outlook - USDA

total milk production, 3pm - US

poultry slaughter, 3pm - HOLIDAY:

China, Hong Kong, Vietnam

Thursday,

Jan. 26:

- Paris

Grain Conference, day 1 - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

to release its outlook for world orange and orange-juice production. - Port

of Rouen data on French grain exports - HOLIDAY:

China, India, Australia, Vietnam

Friday,

Jan. 27:

- Paris

Grain Conference, day 2 - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options - US

cattle inventory, 3pm - HOLIDAY:

China

Source:

Bloomberg and FI

Soybean

and Corn Advisory

2022/23

Brazil Soybean Estimate Unchanged at 151.0 Million Tons

2022/23

Brazil Corn Estimate Unchanged at 125.0 Million Tons

2022/23

Argentina Soybean Estimate Unchanged at 39.0 Million Tons

2022/23

Argentina Corn Estimate Unchanged at 44.0 Million Tons

Macros

Bank

Of England To Lift Rates To 4% On Feb 2, Finish At 4.25% In March – RTRS

European

Union €5b 3% 3/2053 Tap MS+86

US

Philadelphia Fed Non-Manufacturing Activity Jan: -6.5 (prevR -12.8)

US

Richmond Fed Manufacturing Index Jan: -11 (est -5.0; prev 1.0)

100

Counterparties Take $2.048 Tln At Fed Reverse Repo Op (prev $2.135 Tln, 105 Bids)

·

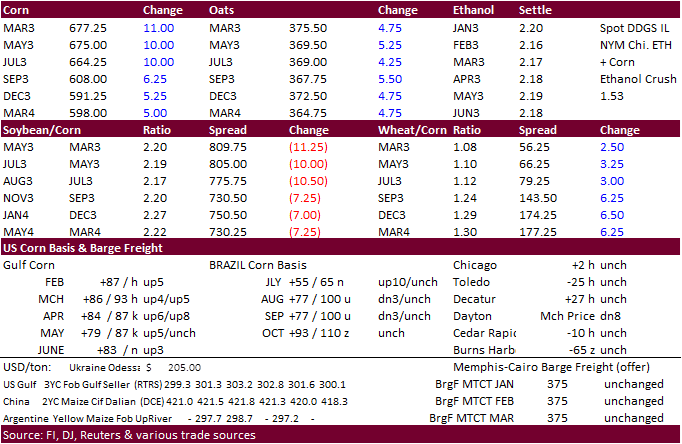

CBOT corn

futures

ended sharply higher led by the front three contracts on technical buying after wheat rallied.

·

CIF corn was mostly 4-8 cents higher today, with February up 5 to 87 over.

·

US agriculture officials have been addressing the Mexico GMO yellow corn import ban issue, citing it is insufficient and raised “grave concerns” if the government goes through with it.

·

AgriCensus noted Brazil exported 4.2 million tons of corn during the first three week of January, above the 2.7 million tons exported during the whole month of January 2022.

·

Anec sees Brazil’s January corn exports reaching 5.2 million tons versus 5.178 million previously estimated.

·

Two vessels of Ukrainian corn and barley left Ukraine for Israel and the Netherlands.

·

AgRural reported 1 percent of the Brazil winter corn seeding progress was complete.

·

The Baltic dry index hit a new 2-1/2 year low on Tuesday, in large part to lower capesize and panamax vessel rates.

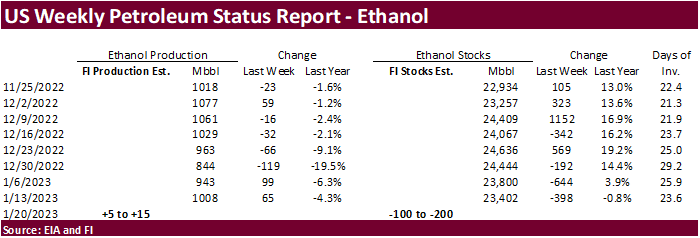

·

A Bloomberg poll looks for weekly US ethanol production to be up 6,000 thousand barrels to 1014k (1000-1022 range) from the previous week and stocks up 235,000 barrels to 23.637 million.

Export

developments.

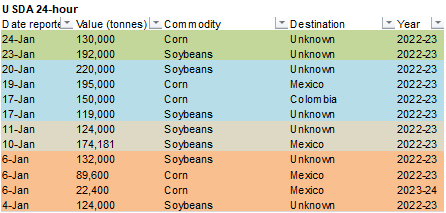

·

Under the 24-hour reporting system, USDA reported private exporters reported sales of 130,000 tons of corn for delivery to unknown destinations during the 2022-23 marketing year.

Updated

01/19/23

March

corn $6.50-$7.25 range. May

$6.25-$7.20

·

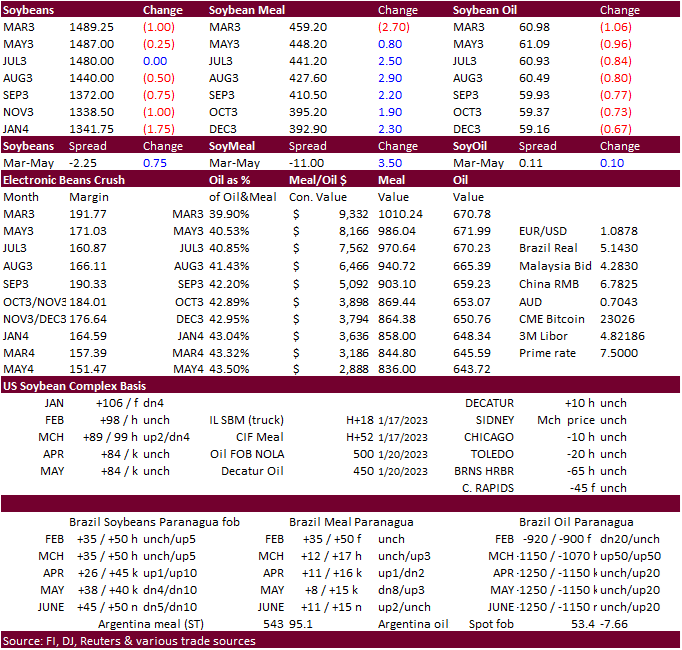

US soybeans were higher earlier but closed slightly lower on late selling, traders paring gains in soybean meal and sharply lower soybean oil. WTI crude oil was down nearly $1.50 by 2 pm CT, and that pressured soybean oil. Meal

ended higher in the back months. March meal closed $2.10 short ton lower.

·

There were 42 CBOT soybean registrations were cancelled Monday evening.

·

Brazil January to date soybean exports have slowed to less than 600,000 tons versus 2.4 million tons for the whole month of January 2022.

·

Anec sees Brazil’s January soybean exports reaching 1.356 million tons versus 1.999 million previously estimated. Soybean meal exports were projected at 1.521 million tons versus 1.587 million previously estimated.

·

Malaysia is on holiday though the 24th, back Wednesday.

·

China is on holiday all week.

·

ITS reported Indonesia’s December palm oil exports fell 13.7 percent from November to 2.33 million tons, which included 409,673 tons of crude palm oil.

·

The CCC seeks 3,770 tons of vegetable oils on February 1 for last half March shipment.

Updated

01/19/23

Soybeans

– March $14.75-$15.75, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

60.00-68.00, May 58-70

·

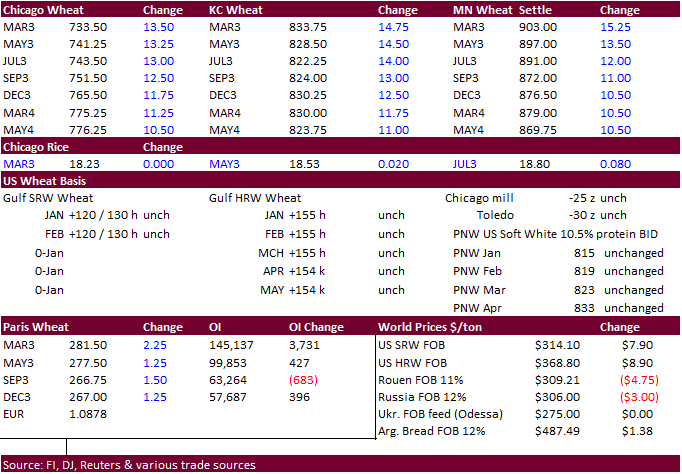

US wheat futures ended higher on technical buying after the market viewed prices as “oversold.” News was light. Futures hit their lowest price basis Chicago since 2021 on Monday.

·

Paris March wheat was 2.25 euros higher at 281.75 per ton, after trading yesterday at its lowest level since early March 2022.

·

The US will see beneficial precipitation bias the lower Great Plains this week. These areas include TX and OK where some of the winter wheat growing areas missed out on precipitation over the past week.

·

Jordan’s wheat reserves are large enough to cover one year’s worth of consumption.

·

Domestic India wheat prices hit a record high Monday, just before the government planned to release 2-3 MMT of wheat reserves to cool prices.

·

We lowered our 2022-23 US wheat import forecast by 5 million bushels to 125 million, 5 million above USDA. Our wheat for feed use is estimated at 60 million bushels, 20 million below USDA and 1 million above the previous year.

USDA

may release selected state crop conditions on Monday, January 30th.

Below is winter wheat reported by Bloomberg nearly a month ago for comparison.

Bloomberg

table on selected state winter wheat crop conditions.

Kansas:

| V Poor | Poor | Fair | Good | Excel. | Combined G&E

Jan.

1 | 23| 26| 32| 17| 2| 19

Dec.

4 | 18 | 24| 36| 20| 2| 22

Difference

| 5| 2| -4| -3| 0| -3

Oklahoma:

| V Poor | Poor | Fair | Good | Excel. | Combined G&E

Jan.

1 | 4| 23| 35| 37| 1| 38

Nov.

27 | 12| 12| 45| 30| 1| 31

Difference

| -8 | 11| -10| 7| 0| 7

Colorado:

| V Poor | Poor | Fair | Good | Excel. | Combined G&E

Jan.

1 | 5| 10| 35| 50| 0| 50

Nov.

27 | 17| 21| 32| 29| 1| 30

Difference

| -12| -11| 3| 21| -1| 20

Montana:

| V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan.

1 | 1| 10| 67| 16| 6| 22

Nov.

27 | 0| 11| 45| 31| 13| 44

Difference

| 1| -1| 22| -15| -7| -22

Nebraska:

| V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan.

1 | 10| 26| 46| 16| 2| 18

Nov.

27 | 16| 23| 41| 19| 1| 20

Difference

| -6| 3| 5| -3| 1| -2

South

Dakota: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan.

1 | 5| 16| 63| 16| 0| 16

Nov.

27 | 5| 24| 44| 25| 2| 27

Difference

| 0 | -8 | 19| -9| -2| -11

Source:

Bloomberg

·

Iraq seeks 50,000 tons of milling wheat around January 25 but no definite date was provided.

·

Japan seeks 70,000 tons of feed wheat and 40,000 tons of barley on January 25 for arrival in Japan by March 16.

Rice/Other

·

None reported.

Updated

01/19/23

Chicago

– March $7.00 to $8.00, May $7.00-$8.25

KC

– March $7.75-$9.00, $7.50-$9.25

MN

– March $8.75 to $10.00,

$8.00-$10.00

Terry Reilly

Analyst

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo