PDF Attached

Another

day of a volatile trade but tamer than that of yesterday. USD eased from session highs. Equities sold off, traded higher, then lower. WTI crude was up $1.95/barrel. Ukraine/Russian tensions are creating more speculation than warranted, in our opinion, but

extremely important to monitor. Many countries are developing contingency plans if a conflict develops, from energies to agriculture.

https://www.bloomberg.com/news/articles/2022-01-25/ukraine-risks-prompt-india-to-look-elsewhere-for-sunflower-oil

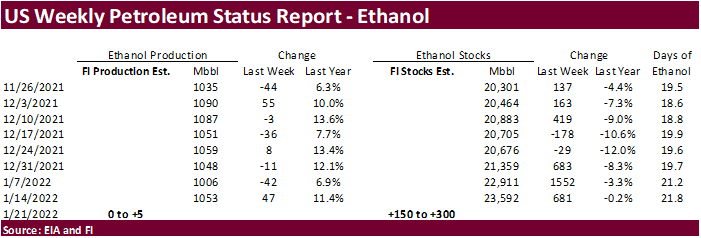

A

Bloomberg poll looks for weekly US ethanol production to be down 10,000 barrels to 1.043 million (1005-1072 range) from the previous week and stocks up 363,000 barrels to 23.955 million.

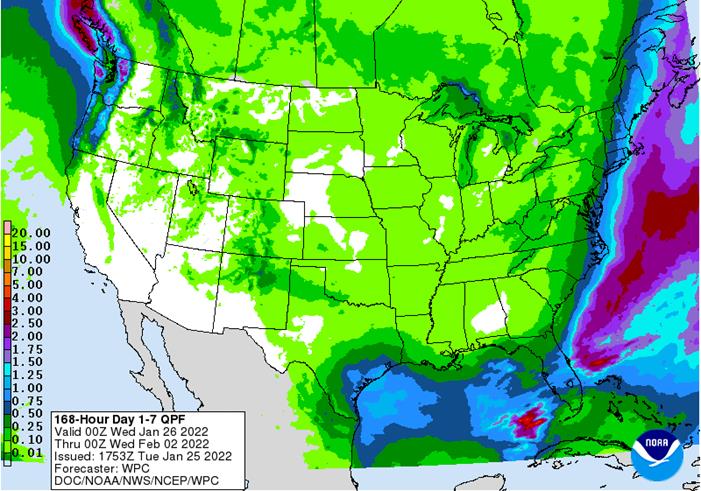

US

will see precipitation across the US Great Plains towards the back of the US 7-day forecast.

WEATHER

EVENTS AND FEATURES TO WATCH

- Another

round of rain occurred in Argentina overnight from western Entre Rios to Santiago del Estero - 2.75

inches occurred near the southeastern Santiago del Estero/Santa Fe border while 0.20 to 1.14 inches occurred elsewhere - The

remainder of Argentina was dry - Hot

and dry conditions continued in Chaco, Formosa and northern Argentina Monday as well as in Paraguay and immediate neighboring areas of Brazil - Extreme

high temperatures of 100 to 110 degrees Fahrenheit - Temperatures

in these areas have been in the middle 90s to 110 degrees for the past 11 days and there were ten days of similar conditions that occurred in late December.

- Very

little rain has fallen during this period of time and crops were already struggling with dryness in Paraguay and neighboring areas long before that - Crop

production from Paraguay and neighboring areas of western Parana, southwestern Mato Grosso do Sul and a few other areas has been dramatically cut - Rain

is expected in the drier and hotter areas of Paraguay, northeastern Argentina and southwestern Brazil during the next ten days to two weeks, although the each of the events may be a little too brief with rainfall a little light to restore soil moisture

- Temporary

relief to crop stress is likely, but a fix all is not expected for a while - Interior

southern and center south Brazil will likely receive more frequent rain later this week through most of next week resulting in a little too much moisture - Portions

of northern Parana, Sao Paulo and eastern and central Mato Grosso do Sul will likely become too wet - Some

flooding may occur in low-lying areas - The

Parana River Basin may experience better runoff during early February to improve water levels at least for a little while - Early

soybean harvest and maturation progress may be slowed during the expected rainy weather period - Some

concern over unharvested soybean quality might evolve - Some

disruption to Safrinha cotton and corn planting is possible, but both crops are still expected to perform well in 2022 - Argentina’s

key grain and oilseed production areas will experience a good mix of rain and sunshine during the next ten days to possibly two weeks - A

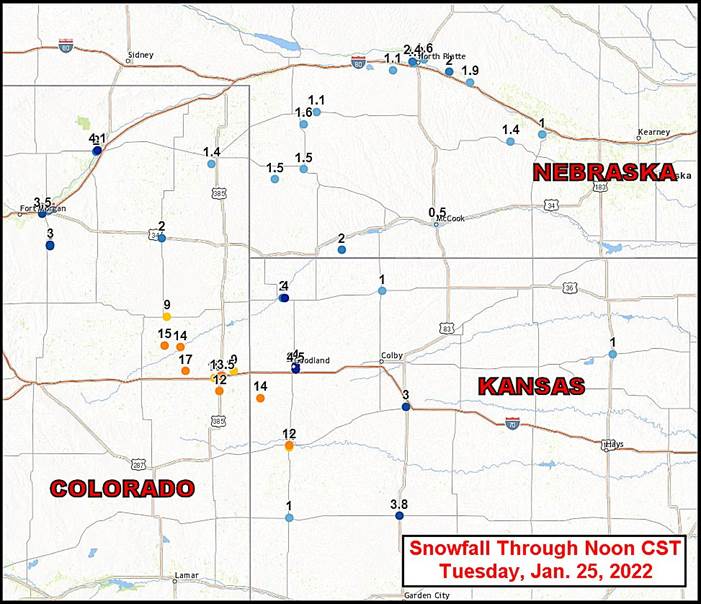

ridge of high pressure is still possible during February that may return a bout of drying and warmer than usual weather, but the impact of this will not be nearly as great as that which occurred earlier this month - Snow

is falling in the west-central U.S. high Plains this morning with up to 3 inches noted so far this morning in northwestern Kansas and northeastern Colorado - The

event will continue today, but it will not change drought status - A

more frequent U.S. precipitation pattern is expected starting in the second half of next week in the central and eastern parts of the nation - This

may bring some infrequent moisture to the far northern and eastern most portions of the hard red winter wheat production region, but no relief of significance is expected in the high Plains region - U.S.

Midwest and Delta will be wettest during this period of time and the ground will become saturated once again for some areas while other areas remain saturated.

- Flood

potentials are expected to rise over time - Precipitation

was removed from the northern Plains, Canada’s Prairies and upper Midwest in the overnight GFS model runs for late next week - Some

of this change was needed as previously model runs were too wet - Today’s

forecasts are much better for the region - A

more active weather pattern in the western U.S. next week will occur only briefly, but any precipitation that falls in California and the Intermountain West will be welcome - U.S.

southeastern states will continue to see less precipitation for a while - Eastern

U.S. cool weather will prevail for a few more days, but warming this weekend and next week will reduce energy demand - North

America’s coldest air will shift back to Canada’s Prairies, the U.S. Pacific Northwest and northern Plains next week - No

serious change to dryness in West Texas or the high Plains region of U.S. hard red winter wheat areas during the next two weeks - South

Texas and Coastal Bend areas of Texas will get some periodic precipitation to help hold soil moisture at a more favorable level than in recent past winters, although more moisture will still be needed prior to planting

- Tropical

Cyclone Ana moved across Mozambique Monday with some rain continuing today - Flooding

has likely resulted - Crop

assessments have not been completed for Madagascar or Mozambique, but a small amount of crop damage is suspected in both areas due to flooding - South

Africa rainfall will include isolated to scattered showers and thunderstorms periodically during the next ten days favoring fieldwork and crop development - The

environment should help improve crop conditions in those areas that became too wet for a while earlier this month and last - Temperatures

will be near to above average - Australia’s

eastern agricultural areas will experience periods of rain and sunshine over the next two weeks with mostly seasonable temperatures - Queensland

cotton and sorghum areas will get most of their rain in the last days of January and more likely in early February - The

rain in Queensland will be very important for unirrigated summer crops - New

South Wales will see a better distribution in rainfall favoring improved dryland summer grain, cotton and livestock conditions - India’s

weather is trending drier again - Recent

rain has been ideal for pre-reproductive winter crops and the outlook is good for high Yields this year especially if some timely rain falls in February and temperatures do not turn hot - The

outlook favors near to below-average temperatures and an opportunity for rain later in February

- Showers

in the coming two weeks will occur mostly in and near Nepal as well as in a few far northern crop areas - Eastern

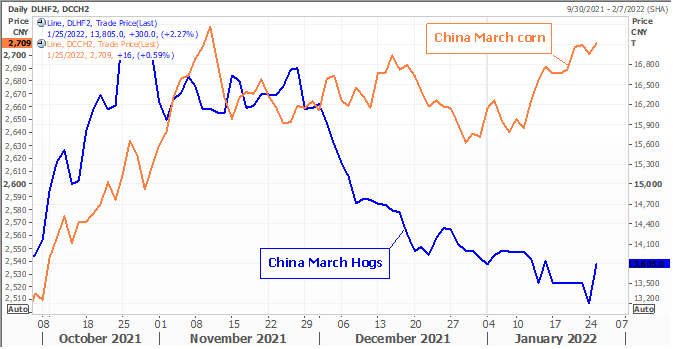

China’s weather will be typical for this time of year over the next couple of weeks with waves of rain and a little snow occurring across the east-central parts of the nation favoring the Yangtze River Basin - Rainfall

of 1.00 to 3.00 inches will occur from near the Yangtze River southward to the coast during the next ten days with a few amounts getting close to 5.00 inches - Some

significant snow may impact northern parts of the Yangtze River Basin as well - Sufficient

moisture is expected to maintain a very good outlook for rapeseed and winter wheat - Local

flooding is possible, but crop damage is not very likely - Limited

moisture in the north is not unusual for this time of year and the soil is favorably rated for the start of spring - There

are no areas of drought in eastern China - Concern

has been rising over the lack of precipitation in Xinjiang this winter and especially the mountains which may cut into spring runoff potential for irrigated summer crops - CIS

weather over the next two weeks will continue offering periods of snow and some rain in the south with temperatures near to below average west of the Ural Mountains this week and then warmer again next week - The

bottom line is favorable for most winter crops which have not encountered much winterkill this year - Concern

remains for low groundwater in southern parts of Russia’s New Lands and northern Kazakhstan

- Similar

conditions are present in central and eastern Ukraine and Russia’s Volga Basin, but there is a deep accumulation of snow that should improve that situation in the spring snow melt season - Western

Europe will continue to experience less than usual precipitation during the next ten days while eastern Europe gets enough moisture to maintain favorable snow cover and soil moisture - A

boost in precipitation will soon be needed in Spain, Portugal and neighboring areas - Some

forecast model runs overnight suggested Spain, France and Portugal may get some rain after day ten of the forecast - Confidence

is low - Eastern

Europe precipitation will continue periodically while temperatures are near to above normal in this coming week - Less

precipitation is expected next week - North

Africa is unlikely to see much precipitation for a while, although a few showers are expected infrequently

- Drought

remains most serious in southwestern Morocco, but dryness is also a concern in northwestern Algeria and in a few northeastern Morocco locations - Ethiopia

was dry Monday while light showers occurred in Uganda and southwestern Kenya - Tanzania

was wettest with periods of rain and thunderstorms producing light to moderate rain and a few strong thunderstorms producing heavy rain - Little

change is expected in these patterns through the next two weeks - West-central

Africa was dry and seasonably warm Monday with highs in the lower to middle 90s Fahrenheit - Similar

conditions were expected over the next two weeks - Canada’s

southwestern Prairies may experience a boost in snowfall in the middle to latter part of next week

- Confidence

is low and most of the precipitation will not change drought status - The

southwestern Prairies continue to suffer from prolonged drought, very little snow is on the ground in central or southern Alberta or central, west-central, south-central or southwestern Saskatchewan and drought remains in the ground - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- No

excessive rainfall is expected - Northern

Vietnam will receive some scattered showers for a while this week - Precipitation

totals will be light, but the region has seen an abundance of rain recently - Northern

Laos and Thailand dried out Monday after getting some rain during the weekend

- Today’s

Southern Oscillation Index is +1.59 - The

index may move erratically higher in the coming week - New

Zealand rainfall will continue lighter than usual this week and then increase next week - The

nation has been drying out in recent weeks - Temperatures

have been seasonable and will continue that way - Mexico

will experience slightly cooler than usual weather with a few showers in the south and east later this week - Northern

and some western areas in the nation will be drier than usual - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia Ecuador and Peru rainfall may be greater than usual in the coming week

- Most

of Venezuela will be dry

Bloomberg

Ag Calendar

Tuesday,

Jan. 25:

- EU

weekly grain, oilseed import and export data - Malaysia’s

Jan. 1-25 palm oil exports - Moscow

Agros Expo conference, Jan. 25-27

Wednesday,

Jan. 26:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

Australia, India

Thursday,

Jan. 27:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Paris

Grain Day conference, Jan. 27-28 - Port

of Rouen data on French grain exports

Friday,

Jan. 28:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

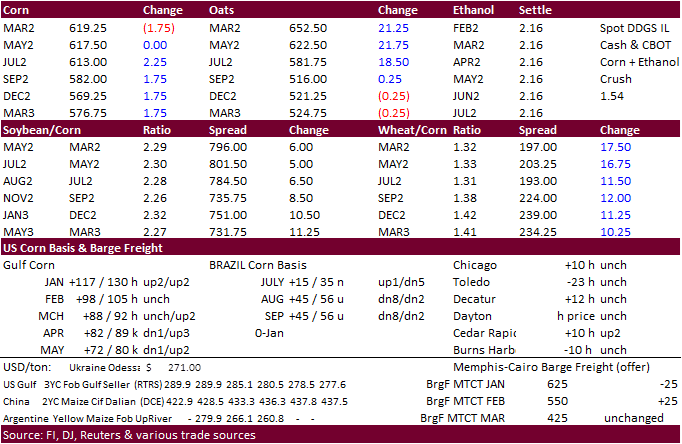

Corn

and Soybean Advisor

2021/22

Brazil Soybean Estimate Unchanged at 134.0 Million Tons

2021/22

Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22

Argentina Soybean Estimate Unchanged at 43.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 51.0 Million Tons

Macros

US

Philadelphia Fed Non-Manufacturing Regional Business Activity Index Dec: -16.2 (prevR 27.3)

US

CB Consumer Confidence Jan: 113.8 (est 111.1; prev R 115.2)

–

Expectations: 90.8 (prev 96.9)

–

Present Situation: 148.2 (prev 144.1)

·

Canadian feeders are scrambling to source feedgrains after a record drought followed by strong US import demand strained supplies.

·

South American crop estimates are starting to flatten out, a sign the recent rains benefited Brazil’s late first planted crops that are still maturing and aided second crop plantings. The rain helped Argentina soybeans but there

is speculation they were too late for the first and primary corn crop.

·

A Bloomberg poll looks for weekly US ethanol production to be down 10,000 barrels to 1.043 million (1005-1072 range) from the previous week and stocks up 363,000 barrels to 23.955 million.

Export

developments.

·

None reported

Updated

1/21/22

March

corn is seen in a $5.90 to $6.35

·

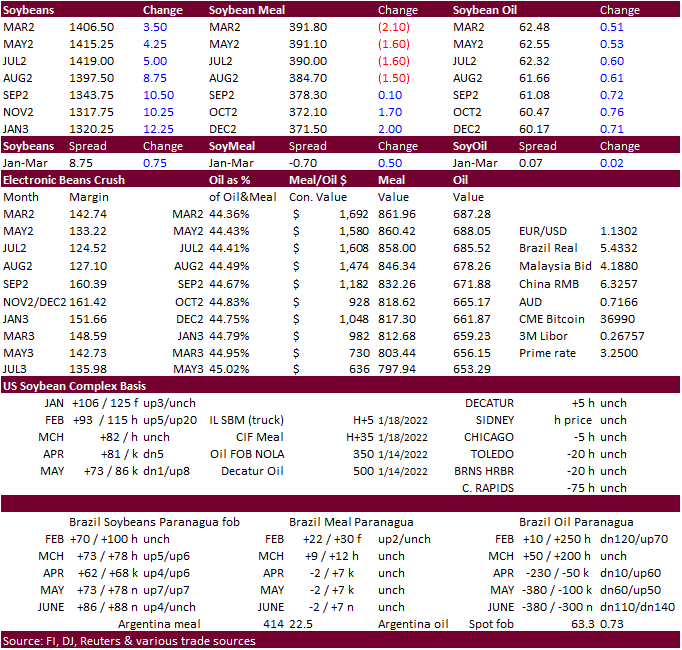

CBOT soybeans ended higher led by the back months, meal lower in the nearby front four months and soybean oil higher from higher WTI crude oil and palm oil.

·

News was light and SA weather looks good over the next week.

·

India was said to be seeking alternative vegetable oils, recently buying 60,000 tons of sunflower oil from Russia and Argentina.

·

Palm oil remains near all-time contract highs despite slowing exports.

·

SGS reported Malaysian palm oil export for the Jan 1-25 period at 847,520 tons, down 36.7 percent from the same period month earlier. AmSpec reported 829,022 tons, down from 1.24 million tons for the same period month earlier.

ITS reported a 33 percent decrease to 876,056 tons.

Export

Developments

·

Turkey’s state grain board TMO seeks about 6,000 tons of crude sunflower oil on Jan. 28 for shipment between Feb. 8 and Feb. 25.

Updated

1/20/22

Soybeans

– March $13.25-$14.75

Soybean

meal – March $370-$435

Soybean

oil – March 59.00-64.50

·

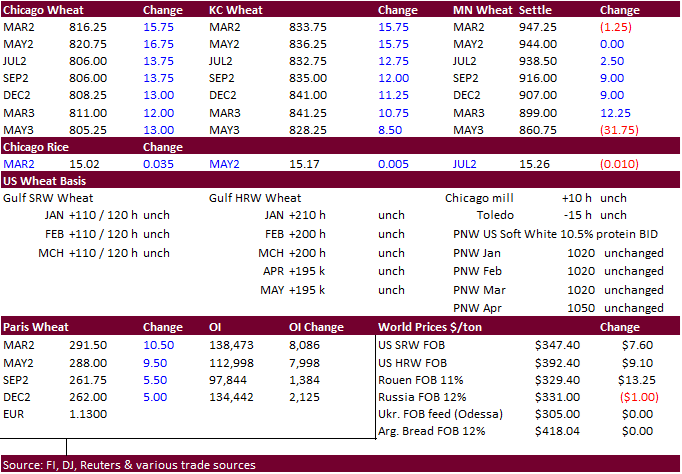

US wheat futures were sharply higher through much of the session from ongoing concerns over the Ukraine/Russian situation. The US ordered 8,500 troops to be on standby if there is an escalation in the area. But as MN wheat sold

off, the Chicago and KC markets softened.

·

EU wheat basis the March position was up a large 10.50 euros at 290.75 eros a ton.

·

The EU awarded 77,833 tons of Ukraine wheat imports under quota, with 329,220 tons remaining.

·

Some of the Great Plains will see precipitation around this time next week. The far western Great Plains saw snow.

·

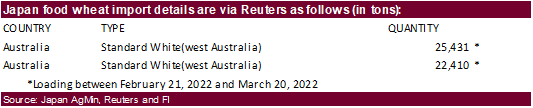

Japan seeks 47,841 tons of food wheat later this week from Australia.

·

Iran’s SLAL seeks 60,000 tons of barley, 60,000 tons of corn and 60,000 tons of soybean meal on Wednesday for Feb/Mar shipment.

·

Results awaited: The Philippines seeks 36,000 tons of Australian wheat for April 1-30 shipment.

·

Jordan seeks 120,000 tons of feed barley on January 26 for July – August shipment.

·

Jordan retendered on wheat seeking 120,000 tons on February 1 for July – August shipment.

Rice/Other

·

South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.