PDF Attached

(Reuters)

– The Federal Reserve on Wednesday signaled it is likely to raise U.S. interest rates in March and reaffirmed plans to end its bond purchases that month before launching a significant reduction in its asset holdings.

Sharply

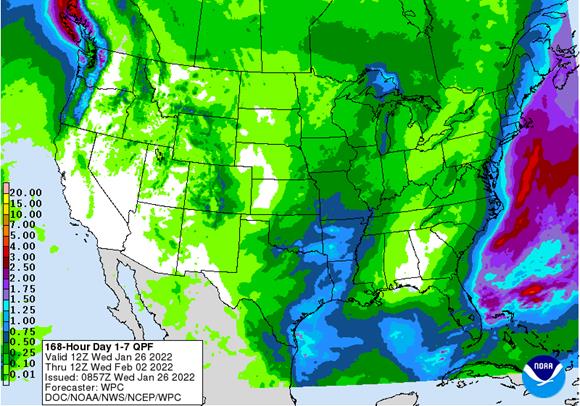

higher trade in the soybean complex with March soybean oil and March soybeans at multi month highs. Corn closed higher. Wheat futures fell on technical selling. Argentina saw additional precipitation with heavy local amounts across BA. Northeastern Argentina,

Paraguay and southwestern Brazil are expecting a few waves of rain during the next ten days. A dense snow event occurred Tuesday in eastern Colorado and western Kansas (small event compared to total US winter wheat area) where some areas saw 10-27 inches.

Cold weather in the eastern US will be abating after today.

WEATHER

EVENTS AND FEATURES TO WATCH

- Significant

snow fell in east-central Colorado and west-central Kansas Tuesday producing 1.00 inch of moisture in a few counties and piling up 10-27 inches of new snow - Surrounding

areas received 1 to 5 inches of snow and much less moisture - The

event was impressive, but it impacted such a small region that most of U.S. hard red winter wheat country was still considered too dry with drought prevailing in many areas - Not

much other relief is expected in the high Plains of the U.S. central or southwestern Plains during the next two weeks, although some brief bouts of very light moisture is expected - A

rain and snow event is advertised to impact eastern U.S. hard red winter wheat production areas during mid-week next week

- If

the event verifies there would be some welcome precipitation across the region

- There

is some potential the event may end up a little farther to the east - Florida

citrus and sugarcane areas will be vulnerable to frost and freezes Sunday morning - Temperatures

may slip into the upper 20s and lower 30s Fahrenheit - Damage

to citrus trees should be low with some leaf mass damage most likely - No

harm is expected to blossom buds for the 2022 crop - Citrus

fruit will not likely be cold enough for a long enough period of time for serious damage especially with the use of irrigation and other tools to protect crops - Sugarcane

harvesting should be nearly complete and freezes should have a low impact on crops for 2021 and 2022 crop years - The

situation will be closely monitored - Eastern

U.S. weather will become more active once again next week and there will potential for heavy to excessive precipitation in a part of the northern Delta, Tennessee River Basin and lower eastern Midwest - The

region will be closely monitored for possible flooding - Some

rain will also impact the southeastern states - Very

cold air present in the Midwest this morning most likely did not permanently harm winter wheat - Temperatures

did drop below zero Fahrenheit in snow covered areas of northern Illinois, northern Indiana and Ohio

- Some

temperatures in the negative and positive single digits did occur south of the snow field and a little damage to soft wheat cannot be ruled out, although the extent of winterkill should have been low - West

Texas is not expecting much precipitation for a while - California

will continue drier than usual for the next ten days - Southwestern

Canada’s Prairies and the northwestern U.S. Plains will get some snowfall in the next couple of weeks, but moisture totals will continue lighter than usual - Eastern

Canada temperatures this morning were brutally cold with lows in the -30s and -20s except in southwestern Ontario where readings were more reasonably cold - Extreme

lows below -40 Fahrenheit occurred north of crop areas in Quebec and northeastern Ontario - Argentina

rainfall Tuesday and early today was noted in several areas - More

than 4.00 inches of rain fell in northwestern Buenos Aires - Rain

totals of 0.20 to 1.00 inch occurred in west-central Cordoba, interior northern Buenos Aires and from Entre Rios to east-central Santa Fe - The

moisture maintained wet field conditions and some of it may have induced local flooding - Another

hot and dry day occurred Tuesday in northeastern Argentina, Paraguay and southwestern Brazil with highs in the range of 100 to 110 degrees Fahrenheit - These

areas have seen similar conditions for 12-13 days in a row and a similar bout of 10 days occurred in late December - Crop

conditions have to be deplorable in this region - Brazil

rainfall Tuesday and early today was scattered across central parts of the nation’s key agricultural areas and most of it was light, but some locally strong thunderstorms were noted as well - Temperatures

were seasonable - All

of Brazil will get rain over the next two weeks and some of it will be heavy - Northern

Parana, Sao Paulo and eastern and northern parts of Mato Grosso do Sul may become excessively wet this weekend into next week with some risk of flooding - Runoff

from the heavy rain may help improve water flow on the Parana River, but much more rain will be needed before the river rises enough to end barge restrictions - Crop

maturation and harvest delays are expected and farmers will have to move fast with fieldwork over the next day or two to collect as much crop as possible before the greater rain begins - Argentina’s

wet biased pattern is winding down - Much

less rain is expected late this week into next week and then a better alternating period of rain and sunshine is expected in the second week of the forecast - Crop

conditions continue to improve after recent rain - A

few areas are a little too wet, but should quickly dry down as the surplus moisture runs off and soaks deeper into the ground - Northeastern

Argentina, Paraguay and southwestern Brazil crop areas will see a few waves of erratic showers and thunderstorms during the next ten days - The

change will whittle down the drought and offer “some” relief - Temperatures

will become less oppressively hot and the precipitation will offer some improvement to crops - Drought

will not be eliminated, but it will be partially eased - Greater

rain will be needed before a more a lasting impact of improvement can take place - South

Africa weather will include isolated to scattered showers and thunderstorms periodically during the next ten days favoring fieldwork and crop development - The

environment should help improve crop conditions in those areas that became too wet for a while earlier this month and last - Temperatures

will be near to above average - Australia’s

eastern agricultural areas will experience periods of rain and sunshine over the next two weeks with mostly seasonable temperatures - Queensland

cotton and sorghum areas will get most of their rain in the second week of the forecast and eastern cotton and sugarcane areas should become wettest - New

South Wales will see a better distribution in rainfall favoring improved dryland summer grain, cotton and livestock conditions - India’s

weather is trending drier again - Recent

rain has been ideal for winter crops moving into reproduction and the outlook is good for high yields this year especially if some timely rain falls in February and temperatures do not turn hot - The

outlook favors near to below-average temperatures and an opportunity for rain later in February

- Showers

in the coming two weeks will occur mostly in and near Nepal as well as in a few far northern crop areas - Eastern

China’s weather will be typical for this time of year over the next couple of weeks with waves of rain and a little snow occurring across the east-central and southeastern parts of the nation favoring the Yangtze River Basin - Rainfall

of 2.00 to 5.00 inches will occur from near the Yangtze River southward to the coast during the next ten days with a few greater amounts possible

- Some

significant snow may impact northern parts of the Yangtze River Basin as well - Sufficient

moisture is expected to maintain a very good outlook for rapeseed and winter wheat - Local

flooding is possible, but crop damage is not very likely - Limited

moisture in the north is not unusual for this time of year and the soil is favorably rated for the start of spring - There

are no areas of drought in eastern China - Concern

has been rising over the lack of precipitation in Xinjiang this winter and especially the mountains which may cut into spring runoff potential for irrigated summer crops - CIS

weather over the next two weeks will continue offering periods of snow and some rain in the south with temperatures near to below average west of the Ural Mountains this week and then warmer again next week - The

bottom line is favorable for most winter crops which have not encountered much winterkill this year - Concern

remains for low groundwater in southern parts of Russia’s New Lands and northern Kazakhstan

- Similar

conditions are present in central and eastern Ukraine and Russia’s Volga Basin, but there is a deep accumulation of snow that should improve that situation in the spring snow melt season - Western

Europe will continue to experience less than usual precipitation during the next ten days while eastern Europe gets enough moisture to maintain favorable snow cover and soil moisture - A

boost in precipitation will soon be needed in Spain, Portugal and neighboring areas - Some

forecast model runs overnight suggested Spain, France and Portugal may get some rain after day ten of the forecast - Confidence

is low - Eastern

Europe precipitation will continue periodically while temperatures are near to above normal in this coming week - Less

precipitation is expected next week - Middle

East snow cover is more widespread than usual reaching across most of Turkey and into western and northern Iran - Then

moisture will be good for winter crops when warming melts the snow - North

Africa is unlikely to see much precipitation for a while, although a few showers are expected infrequently

- Drought

remains most serious in southwestern Morocco, but dryness is also a concern in northwestern Algeria and in a few northeastern Morocco locations - Ethiopia

has been seasonably dry recently while light showers occur in Uganda and southwestern Kenya - Tanzania

has been and will continue wettest which is normal for this time of year in east-central Africa

- Little

change is expected in these patterns through the next two weeks - West-central

Africa was dry and seasonably warm Tuesday with highs in the lower to middle 90s Fahrenheit - Similar

conditions were expected over the next ten days - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- No

excessive rainfall is expected - Northern

Vietnam will receive some scattered showers for a while this week - Precipitation

totals will be light, but the region has seen an abundance of rain recently - Showers

will develop southward in the remainder of Vietnam, Thailand and Cambodia during the weekend and especially next week - The

precipitation will be light - Today’s

Southern Oscillation Index is +1.22 - The

index may move erratically higher during the next seven days - New

Zealand rainfall will continue lighter than usual this week and then increase next week - The

nation has been drying out in recent weeks - Temperatures

have been seasonable and will continue that way - Mexico

will experience slightly cooler than usual weather with a few showers in the south and east during the coming week - Northern

and some western areas in the nation will be drier than usual - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia Ecuador and Peru rainfall may be greater than usual in the coming week

- Most

of Venezuela will be dry

Bloomberg

Ag Calendar

Wednesday,

Jan. 26:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

Australia, India

Thursday,

Jan. 27:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Paris

Grain Day conference, Jan. 27-28 - Port

of Rouen data on French grain exports

Friday,

Jan. 28:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

IHS

Markit 2022 US plantings via trade sources

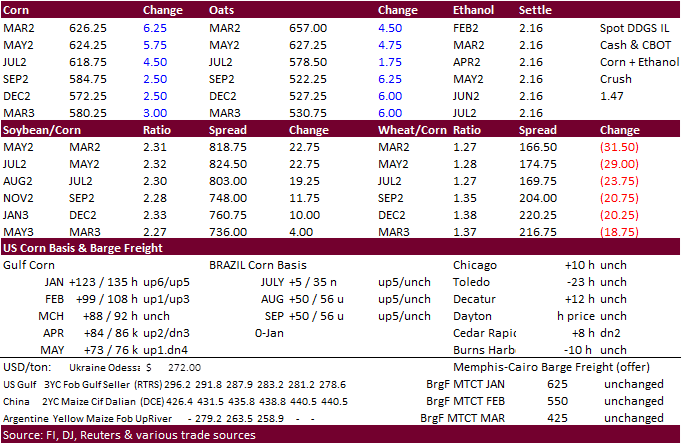

Corn

91.489 vs. 90.784 previous (+0.705) compared to 93.357 for 2021

Soybean

87.805 vs. 87.935 previous (-0.130) compared to 87.195 for 2021

All

48.157 vs. 49.373 previous (-1.216) compared to 46.703 for 2021

Winter

34.397 vs. 34.397 USDA Jan compared to 33.648 for 2021

Spring

12.010 vs. 13.030 previous (-1.020) compared to 11.420 for 2021

Durum

1.750 vs. 1.950 previous (-0.200) compared to 1.635 for 2021

Cotton

11.834 vs. 12.093 previous (-0.259) compared to 11.420 for 2021

Macros

79

Counterparties Take $1.613 Tln At Fed Reverse Repo Op. (prev $1.600 Tln, 81 Bids)

US

Wholesale Inventories (M/M) Dec P: 2.1% (est 1.2%; prev 1.4%)

–

US Retail Inventories (M/M) Dec P: 4.4% (est 1.5%; prev 2.0%)

OPEC+

Likely To Stick To Existing Policy At Feb 2 Meeting And Raise March Output Target By 400,000 Bpd – RTRS Sources

Canada

Dec Wholesale Prices Most Likely Unchanged – StatsCan Flash Estimate

US

Advance Goods Trade Balance Dec: -$101.0B (est -$96.0B; prev $97.8B; prevR -$98.0B)

DoE

Awards 13.4 Mln Barrels From Strategic Petroleum Reserve Exchange To Bolster Fuel Supply Chain

US

New Home Sales Change Dec: 811K (est 760K; prev 744K)

–

New Home Sales (M/M): 11.9% (est 2.2%; prev 12.4%)

–

Median Sale Price (USD): 377.7K or +3.4% (prev 146.9K, +18.8%)

US

DoE Crude Oil Inventories (W/W) 21-Jan: 2377K (est 1000K; prev 515K)

–

Distillate Inventories: -2798K (est -1183K; prev -1431K)

–

Cushing OK Crude: -1823K (prev -1314K)

–

Gasoline Inventories: 1297K (est 1900K; prev 5873K)

–

Refinery Utilization: -0.40% (est -0.40%; prev -0.30%)

Corn

·

Additional rain fell across parts of southern Brazil and Argentina.

·

President Joe Biden said he would consider sanctioning Vladimir Putin if there is an invasion.

·

Ukraine is on track to become the third largest exporter of corn and fourth-largest exporter of wheat.

·

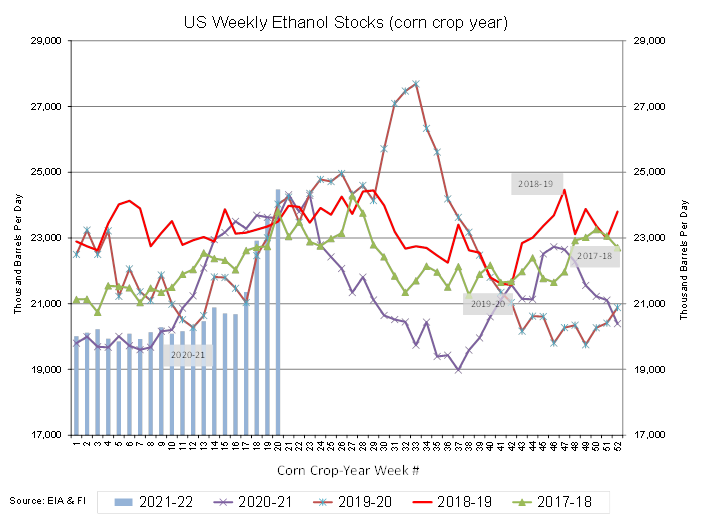

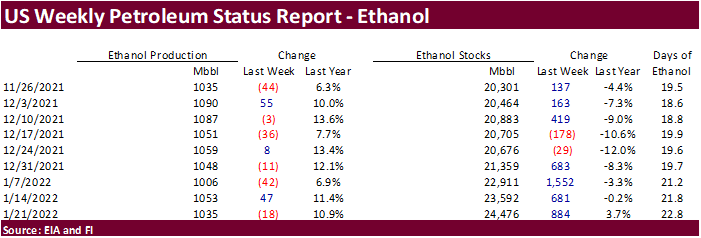

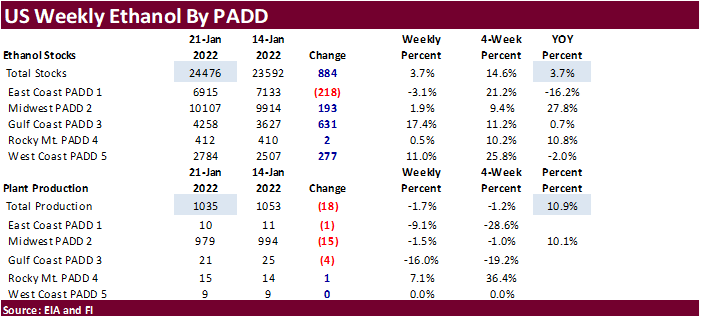

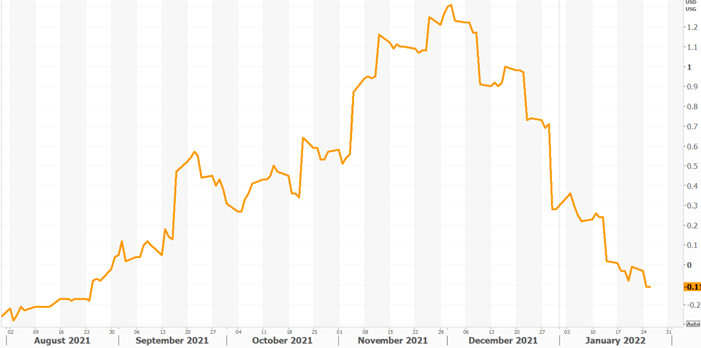

US corn ethanol margins are negative. Production last week slowed by a more than expected amount and stocks increased to their highest level since May 2020. A couple reasons for the high stocks include poor logistics (rail problems

causing stocks to build at the plant level) and slowdown in use over the past month because of Covid-19 cases forcing more workers to stay at home.

·

China will allow producers grow soybeans and corn in rows alongside each other on one million hectares of land. This is to help promote expansion of soybean production while not reducing corn production.

·

The USDA Broiler Report showed eggs set in the US up 1 percent and chicks placed down 2 percent. Cumulative placements from the week ending January 8, 2022 through January 22, 2022 for the United States were 553 million. Cumulative

placements were down 2 percent from the same period a year earlier.

NE

Iowa ethanol margins

Source:

Reuters and FI

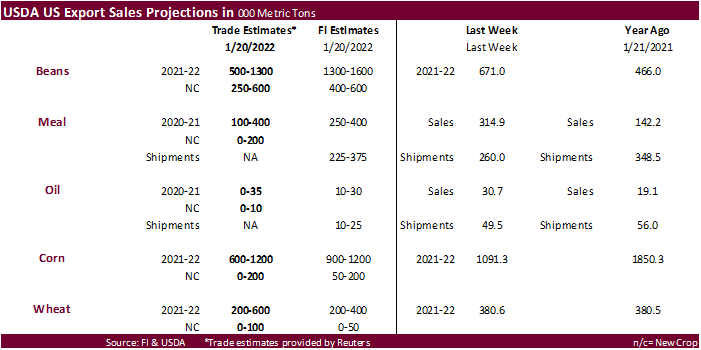

Export

developments.

·

South Korea’s Major Feedmill Group (MFG) bought 69,000 tons of optional origin corn at an estimated $332.70 a ton c&f for arrival in South Korea around May 30.

-

South

Korea’s NOFI group bought about 193,000 tons of corn in three consignments. -

62,000

tons for arrival around April 20 at $338.95 a ton c&f and at a premium of 245 U.S. cents over the May contract.

-

65,000

tons for arrival around April 30 at $336.77 a ton c&f and at a premium of 241.44 U.S. cents over May contract. -

66,000

tons for arrival around May 10 at $336.80 a ton c&f and at a premium of 238 U.S. cents over the May contract.

Updated

1/21/22

March

corn is seen in a $5.90 to $6.35

·

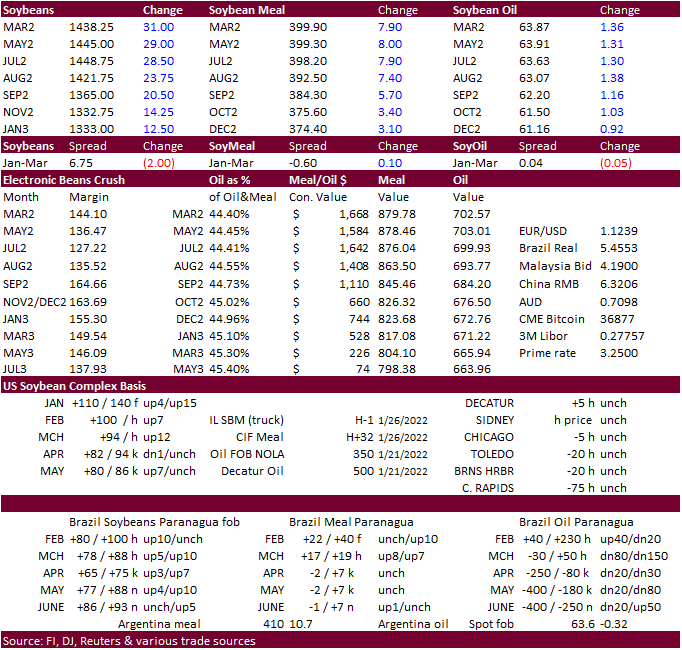

CBOT soybeans reversed to trade higher late in the electronic trade and never looked back. March contract hit a session high of $14.4375/bu, highest level not seen since August, on a rolling nearby contract basis. There was talk

of upcoming soybean business getting shifted to the US from South America. Followed by rumors of China buying at least three cargoes of new-crop US soybeans.

·

March soybean oil rallied to a multi month high (July 2021). It took out 63.74 cents, last week’s high and some buy stops were triggered at that level. Higher palm oil and energy prices lent support. Brent crude oil traded above

$90/barrel, first time in seven years. WTI appears its will eventually hit $90/barrel.

·

Soybean meal rallied from higher soybeans after its started the day lower.

·

Funds bought an estimated net 15,000 soybeans, bought 6,000 soybean meal and bought 6,000 soybean oil.

·

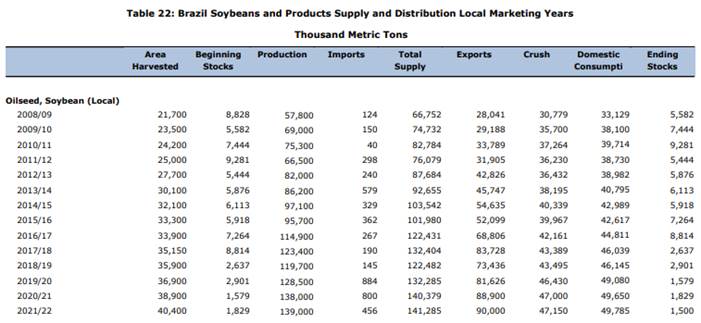

Safras & Mercado estimated Brazil’s 2022 soybean exports at 85.5 million tons, down from 90 million tons previously. That’s 165 million bushels. USDA in January projected 90 million tons for the Feb 2022-Jan 2023 local crop year.

Safras sees the crush at 47.5 million tons, above 46.5 million tons year ago. Production was last estimated at 132.3 million tons.

·

IHS Markit lowered their 2022 US soybean plantings by around 130,000 acres to 87.8 million acres and compares to 87.2 million for 2021.

Export

Developments

·

Turkey’s state grain board TMO seeks about 6,000 tons of crude sunflower oil on Jan. 28 for shipment between Feb. 8 and Feb. 25.

Source:

USDA

Updated

1/26/22

Soybeans

– March $13.75-$15.00 (up 50, up 25)

Soybean

meal – March $370-$435

Soybean

oil – March 59.50-65.00

(up 50, up 100)

·

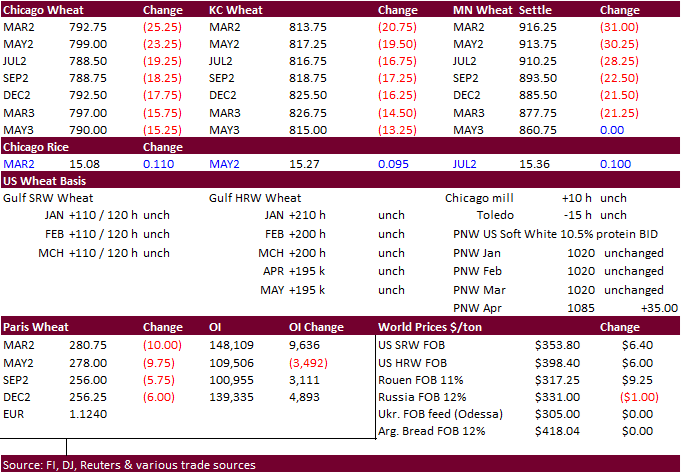

US wheat futures ended sharply lower led by MN type wheat. Some suggest the Ukraine/Russian tension eased a touch today. Technical selling was noted. Chicago hit a two-month high yesterday. Some needed snow fell across eastern

Colorado and western Kansas Tuesday. The event was small relative to the size of HRW wheat country. Cold weather in the eastern US will be abating after today. Cold temperatures earlier this week continues to stir up crop concerns, but it will take weeks

to determine if winterkill impacted crop areas. On Monday we should see selected state crop ratings. We are not confident there will be a general improvement from early January.

·

Funds sold an estimated net 12,000 Chicago wheat contracts.

·

EU wheat basis the March position was down 9.50 euros, or 3.3%, at 281.25 euros ($317.42) a ton.

-

Algeria

bought around 60,000 to 80,000 tons of wheat at around

$375 a ton c&f. Reuters noted the wheat was sought for shipment in three periods from the main supply regions including Europe: Feb. 16-28, March 1-15 and March 16-31. If sourced from South America or Australia, shipment is one month earlier. -

South

Korea’s FLC bought 60,000 tons of optional origin feed wheat at $331.95/ton c&f. The wheat was expected to be sourced from India with shipment between April 26 and May 15.

-

South

Korea’s NOFI group bought 55,000 tons of optional origin feed wheat at $339.49 a ton c&f for arrival in South Korea around April 25.

-

Three

groups from the Philippines are seeking feed wheat for April-May, April-October and/or May-July shipment.

-

The

Philippines bought 35,000 tons of Australian wheat this week and it was confirmed at a price of $356/ton for April shipment.

-

Jordan

postponed their import tender for 120,000 tons of feed barley. They likely passed.

·

Results awaited: Iran’s SLAL seeks 60,000 tons of barley, 60,000 tons of corn and 60,000 tons of soybean meal for Feb/Mar shipment.

·

Japan seeks 47,841 tons of food wheat later this week from Australia.

·

Results awaited: The Philippines seeks 36,000 tons of Australian wheat for April 1-30 shipment.

·

Jordan retendered on wheat seeking 120,000 tons on February 1 for July – August shipment.

Rice/Other

·

South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.