PDF Attached

Private exporters reported sales of 106,000 metric tons of soybeans for delivery to China during the 2023/2024 marketing year. USD was higher, WTI crude oil up $1.61 and US equity futures ended higher, US treasuries were lower on stronger-than-expected 4Q GDP data. Export sales were good for soybeans and wheat, while within expectations for corn, soybean meal and soybean oil. Sorghum and pork sales were very good. Follow through fund buying was seen today for US agriculture markets.

Weather

MOST IMPORTANT WEATHER FOR THE COMING WEEK

- Despite market rumors, China’s wheat and rapeseed production areas are experiencing good winter weather and production potentials are very good

- Precipitation has been a little lighter than usual, but with crops dormant or semi-dormant the impact is minimal

- A boost in precipitation will be needed this spring in a few areas

- Rain is already expected to be greater in the first week of February in rapeseed and minor wheat areas of the Yangtze River Basin

- Northern Algeria is getting routine rainfall while other areas in North Africa are a little too dry; including interior Tunisia and portions of southwestern Morocco

- Very little change is expected in these anomalies for a while

- North-central and northeastern India will receive some welcome rainfall in the next few days helping to improve pre-reproductive conditions for wheat, pulses and other crops

- Greater rain is needed throughout India’s winter crop areas of the central, north and east, although the situation is not a “crisis”

- Eastern Australia will get some needed moisture in the second week of the forecast while this first week outlook remains a little dry

- Southeastern Queensland has the greatest need for precipitation in its unirrigated summer crop production region

- Recent rain in both Queensland New South Wales offered some short-term moisture and crop improvements, but much more rain is needed for dryland production areas

- Argentina weather will continue well mixed over the next ten days, although the most frequent and abundant rain will be in the west-central and northwestern crop areas

- Southeastern portions of crop country will be driest for a while, though some rain is expected

- Most of Argentina still has low subsoil moisture and until that gets fixed the risk of returning dryness will remain

- General crop conditions are still better today than earlier this month, but more rain is needed and many areas will see additional rain in the next ten days

- Less oppressive heat will likely improve crop condition greatly and should help slow drying rates between rain events to help crops perform a little better for a little longer

- Brazil weather is still expected to be dry biased in the south over the next several days while rain frequency and intensity ramps up once again in center west and center south

- These anomalies will continue until next week at which time the pattern should begin to reverse with greater rain in the south and lighter rain in the north

- Fieldwork will advance around the precipitation, but rain frequency will remain a little too great for aggressive soybean harvesting for a while

- Slowly improving harvest rates are expected during February and Safrinha corn planting should advance better as well

- Safrinha cotton planting has advanced slower than usual and drier weather is needed to get the remaining crop planted

- South Africa weather will remain good, although rainfall into the weekend will continue erratic and mostly light

- A boost in rainfall is expected next week and it will continue into the first week of February; the moisture will prove to be very good for ongoing crop development

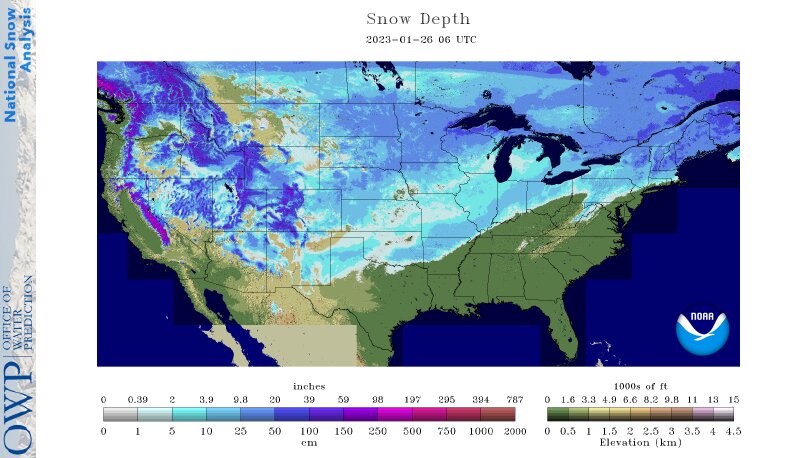

- U.S. hard red winter wheat country will warm up over the next few days melting snow in the south and reducing snow depths in the north

- Bitter cold will be back late this weekend and especially early next week which has the marketplace and producers nervous over possible winterkill, but World Weather, Inc. believes snow will remain on the ground in areas that will be vulnerable to the coldest and most threatening temperatures

- We do not anticipated any crop damage from the event, but a close watch on lingering snow cover and temperatures is warranted through early next week

- Snow cover will return to Montana, southern Alberta, southwestern Saskatchewan and western South Dakota in the next few days adding protection for wheat against bitter cold temperatures anticipated this weekend

- No crop damage is expected as long as the snow falls as predicted

- Too much rain is expected in the U.S. Delta, Tennessee River Basin and southeastern states over the next week to ten days raising the potential for at least local flooding

- A period of drier weather will soon be needed

- U.S. Midwest will be favorably moist over the next two weeks and wheat in the region will not be vulnerable to any winterkill

- U.S. Pacific Northwest will turn bitterly cold during the weekend, but winter wheat in the region is unlikely to be seriously impacted

- Temperatures will fall to near the damage threshold and snow cover may be limited, but crop damage is not presently anticipated

- West and South Texas precipitation will be restricted for a while, but not totally dry

- Snow and rain that impacted West Texas earlier this week brought on a short term lift in topsoil moisture

- California precipitation will be restricted through Saturday and then a succession of weak weather systems may bring brief periods of light snow and rain to the state and nearby areas starting Sunday and going into the first week of February

- Most of the precipitation will be too light to seriously change the environment, but the moisture will still be welcome

- Canada’s Prairies will see waves of snowfall during the next two weeks, although moisture content in the snow is expected to be light

- Europe and Asia temperatures will be mostly near to above normal during the next two weeks preventing any concern over possible winterkill of small grains or rapeseed

- Europe weather is expected to be tranquil during the coming week, but there will be a gradual ramping up in precipitation

- CIS weather is expected to be relatively tranquil for a while with precipitation most likely from the Baltic States to the Volga Vyatsk where several inches of snow will accumulate

- Other areas in the western CIS are unlikely to experience much precipitation for a while, but a boost in precipitation is expected later next week and into the first week of February

- Temperatures will be warmer than usual through the next two weeks

- Middle East weather is expected to gradually turn a little wetter during the coming week to ten days and the moisture will help improve soil moisture for future wheat development and eventual cotton planting later in the year

- West-central Africa will receive some coastal showers in the coming week and the precipitation may increase and reach a little farther inland next week

- Some rain developed Tuesday in a few southern Ivory Coast locations benefiting coffee, cocoa and sugarcane production areas

- Some of the advertised precipitation may be overdone, but it could be beneficial for a few coffee and cocoa production areas as long as there is follow up moisture once it begins to rain periodically

- Dry weather occurred during the weekend

- Southeast Asia rainfall will be most significant in Indonesia and Malaysia as well as eastern portions central and southern Philippines over the next ten days

- The moisture will be good for ongoing crop development, although a few areas may become a little too wet

- East-central Africa rainfall will remain most significant in Tanzania and southern Uganda while more limited in areas north into Ethiopia which is not unusual for this time of year

- Today’s Southern Oscillation Index was +14.29 today and the index is expected to move erratically lower during the next week

Bloomberg Ag calendar

Thursday, Jan. 26:

Paris Grain Conference, day 1

USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

USDA to release its outlook for world orange and orange-juice production.

Port of Rouen data on French grain exports

HOLIDAY: China, India, Australia, Vietnam

Friday, Jan. 27:

Paris Grain Conference, day 2

ICE Futures Europe weekly commitments of traders report

CFTC commitments of traders weekly report on positions for various US futures and options

US cattle inventory, 3pm

HOLIDAY: China

Source: Bloomberg and FI

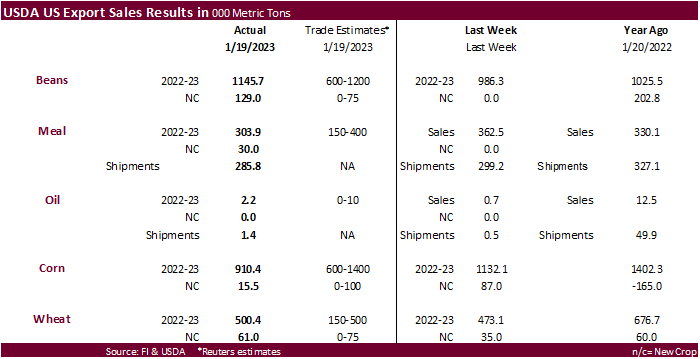

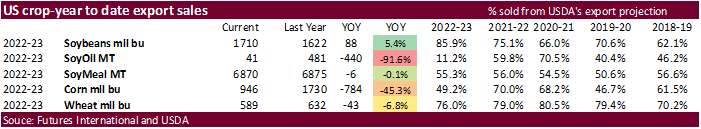

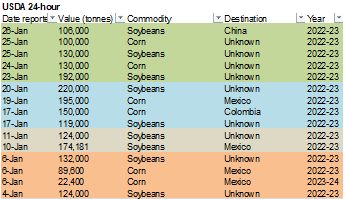

USDA export sales

USDA Export Sales were very good for soybeans and wheat. Corn, soybean meal and soybean oil were within expectations. China booked 940,000 tons of 2022-23 US soybeans that included 386,000 tons switched from unknown. 303,900 tons of soybean meal sales fell from 362,500 tons previous week and included Central American countries and the Philippines. Only 2,200 tons of soybean oil was booked. All wheat export sales were 500,400 tons, up from 473,100 tons previous week. Corn export sales were 910,400 tons, down from 1.132 million previous week and included China for 71,800 tons (68k switched), Mexico for 407,000 tons and Columbia for 209,700 tons. Sorghum sales were 70,800 tons, all for China. US pork sales were very good at 44,700 tons, including 17,700 ton for Mexico and 12,500 tons for China.

Macros

US GDP Annualized (Q/Q) Q4 A: 2.9% (est 2.6%; prev 3.2%)

US Core PCE (Q/Q) Q4 A: 3.9% (est 3.9%; prev 4.7%)

US GDP Price Index Q4 A: 3.5% (est 3.2%; prev 4.4%)

US Personal Consumption Q4 A: 2.1% (est 2.9%; prev 2.3%)

US Initial Jobless Claims Jan 21: 186K (est 205K; prev 190K)

US Continuing Claims Jan 14: 1675K (est 1658K; prev 1647K)

US Durable Goods Orders Dec P: 5.6% (est 2.5%; R prev -1.7%)

Durables Ex-Transportation Dec P: -0.1% (est -0.2%; prev 0.1%)

US Advance Goods Trade Balance Dec: -$90.3B (est -$88.1B; prevR -$82.9)

US Wholesale Inventories (M/M) Dec P: 0.1% (est 0.5%; prevR 0.9%)

US Retail Inventories (M/M) Dec: 0.5% (est 0.2%; prev 0.1%)

US Chicago Fed Nat Activity Index Dec: -0.49 (prevR -0.51)

Canadian Payroll Employment Change – SEPH Nov: 7.1K (prev -5.4K)

US New Home Sales Change Dec: 616K (est 612K; prev 640K)

– New Home Sales (M/M): +2.3% (est -4.4%; prev R +0.78%)

– Median Sale Price (Y/Y) (USD): 442.1K (prev 471.2K or +9.5%)

US EIA NatGas Storage Change (BCF) 20-Jan: -91 (est -83; prev -82)

– Salt Dome Cavern NatGas Stocks (BCF): +3 (prev +12)

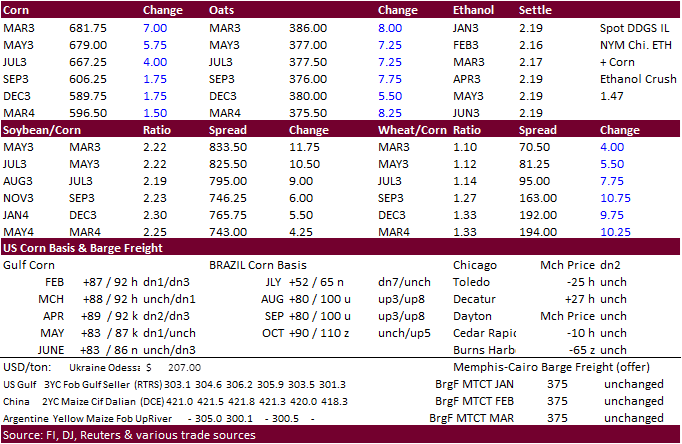

· CBOT March corn futures rose today on technical buying after trading through and settling above the 100-day and 200-day moving averages.

· Talk of US corn export business and firm outside markets are also supporting futures.

· Ukraine’s corn crop is not expected to exceed 18 million tons for 2023, second annual decline in production, according to the Ukraine Grain Association (UGA). This was a “best case” scenario. Meanwhile they see the wheat crop no higher than 16 million tons.

· South Africa’s CEC sees the 2023 corn planted areas at 2.544 million hectares, down from 2.623 million in 2022.

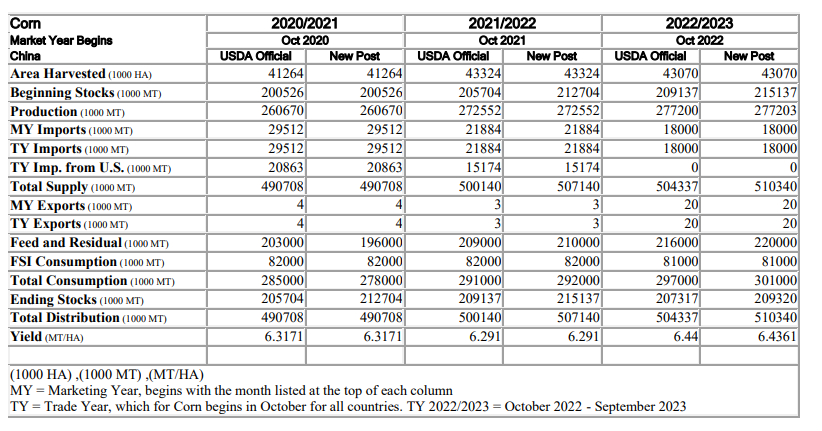

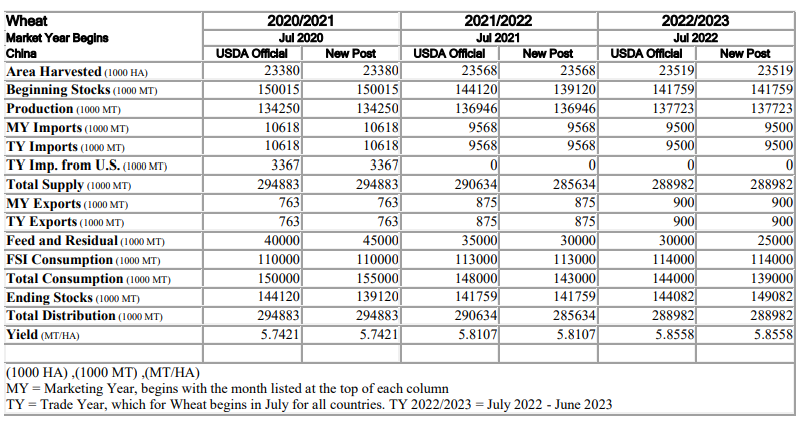

China: Grain and Feed Update

US Price Inflation – Focus on Farm Prices

Zulauf, C. and G. Schnitkey. “US Price Inflation – Focus on Farm Prices.” farmdoc daily (13):14, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 25, 2023.

https://farmdocdaily.illinois.edu/2023/01/us-price-inflation-focus-on-farm-prices.html

Export developments.

· Nothing reported

Updated 01/19/23

March corn $6.50-$7.25 range. May $6.25-$7.20

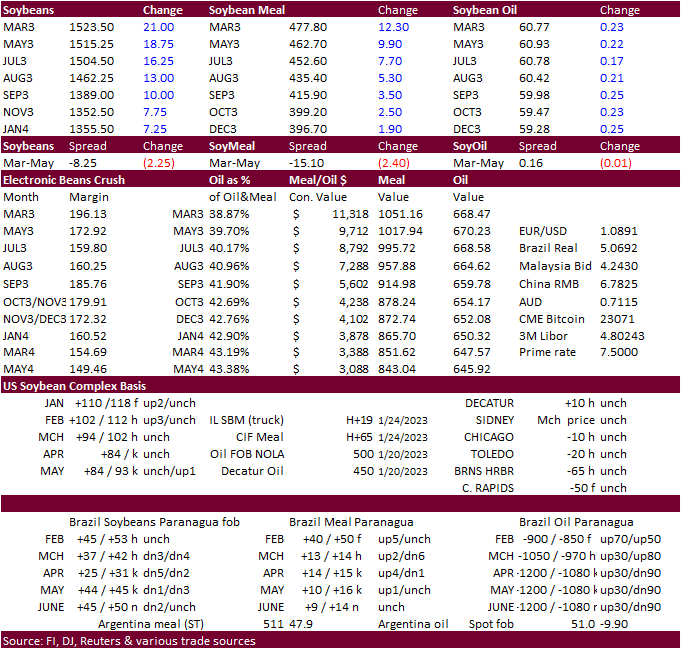

· US soybeans, meal and soybean oil ended higher from strength in outside related markets also with higher grain prices.

· Argentina expected to get more rain this week and Brazil soybean harvesting is picking up across the northern growing regions. 24-hour sales this week and talk of tight US soybean supplies during the summer period is supportive. China will remain on holiday through the end of the week.

· Nearby soybean meal is gaining on the back months. Several cash oilmeal prices appreciated yesterday across South America and EU.

· Parana’s Deral cut estimates of the state’s soybean crop to 20.7 million tons from 21.33 million tons last month.

· Argentina BA Grains Exchange updated the trade with unchanged crop area and production for corn and soybeans.

· Argentina soybean sales were 80.6% of the projected 44 million ton crop, according to the AgMin, below 82.6% at this time year ago.

· Canada canola crushing were 0.826 MMT during December, down 6 percent from November but up 17% from year earlier (Jan-Dec 8.769 MMT versus 9.842 million 2021). Soybean processing during December was 169,000 tons, an 8-month high (2022 soybean crush 1.875 MMT versus 1.649 MMT for 2021).

· The US energy department announced they will allocate $118 million in funding for biofuel projects to cut greenhouse gas emissions from transportation and meet climate goals. There are 17 projects on deck (private companies and universities) to accelerate the production of biofuels, including using food waste, soybean oil and animal fats. In 2021, 16.8 billion gallons of biofuels were consumed in the US. That compares to 134.8 billion gallons of motor gasoline.

· Germany is still looking at phasing out crop-based biofuels by the end of the decade and focus on other methods to increase zero carbon emissions, such as boosting use of used vegetable oils.

· Cargo surveyor reported Malaysian palm oil shipments during the January 1-25 period fell 28.4 percent to 876,193 tons from 1.224 million shipped during the December 1-25 period.

· Malaysia will leave its February export tax for crude palm oil at 8% and raised its reference price to 3,893.25 ringgit ($917.14) per ton.

· There were 22 CBOT soybean registrations were cancelled (Chicago) Wednesday evening (1,017 total). 165 have been cancelled since January 19.

· China is on holiday all week.

BA Grains Exchange Climate report

· USDA under its 24-hour reporting system announced private exporters reported sales of 106,000 tons of soybeans for delivery to China during the 2023-24 marketing year.

· South Korea seeks up to 40,000 tons of rapeseed meal from India today for May 21-June 10 shipment.

· The CCC seeks 3,770 tons of vegetable oils on February 1 for last half March shipment.

Updated 01/19/23

Soybeans – March $14.75-$15.75, May $14.75-$16.00

Soybean meal – March $450-$520, May $425-$550

Soybean oil – March 60.00-68.00, May 58-70

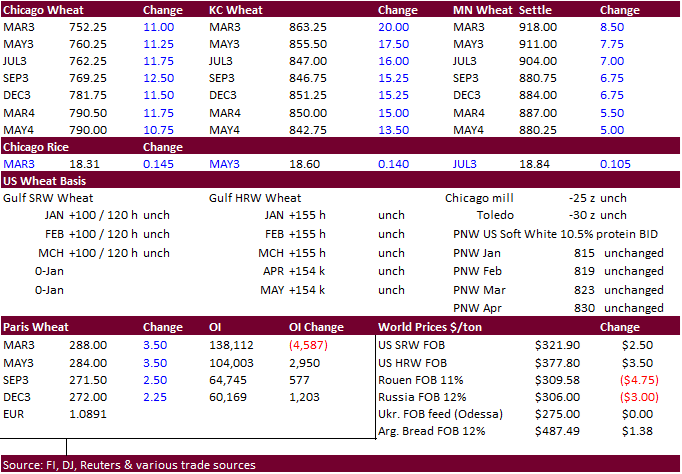

· US wheat climbed today on a lower-than-expected Ukraine crop and on follow through buying. Single digit temperatures arrive late this week across the US central and northern Great Plains. US snow coverage should be sufficient to minimize damage, if any.

· Paris March wheat was 4.25 euros higher at 288.75 per ton.

· French Foreign Minister Catherine Colonna is visiting Odesa to see on hand some of the damage caused by the conflict and strengthen their relationship with Ukraine, see what needs they have.

· South Africa’s CEC sees the 2022 wheat crop at 2.177 million tons, down from 2.285 million in 2021.

China wheat S&D from the Attaché

Export Developments.

· South Korea bought 11,000 tons of US feed wheat in a private deal out of 20,000 tons sought at $350/ton c&f for shipment out of the PNW between March 10-March 30 arrival. Lowest offer earlier was $351.50/ton for 20,000 tons.

· Iraq bought 150,000 tons of milling wheat yesterday, 100,000 tons more than what was announced. No details of the tender was provided.

· Japan earlier this week received no offers for 70,000 tons of feed wheat and 40,000 tons of barley for arrival in Japan by March 16.

· Jordan seeks 120,000 tons of wheat on Jan 31 for May and June shipment.

· Jordan seeks 120,000 tons of feed barley on Feb 1 for May and June shipment.

Rice/Other

· None reported.

Updated 01/19/23

Chicago – March $7.00 to $8.00, May $7.00-$8.25

KC – March $7.75-$9.00, $7.50-$9.25

MN – March $8.75 to $10.00, $8.00-$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

Work: 312.604.1366

ICE IM: treilly1

Skype IM: fi.treilly

DISCLAIMER:

The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

#non-promo