CFTC COT, fund estimate, and Jan 1 cattle inventories will be out later.

PDF Attached

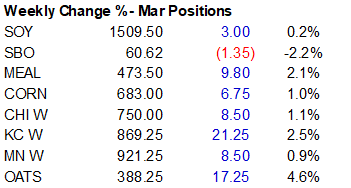

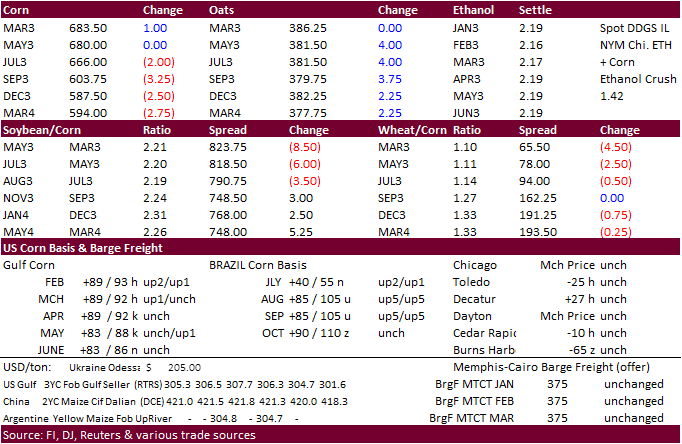

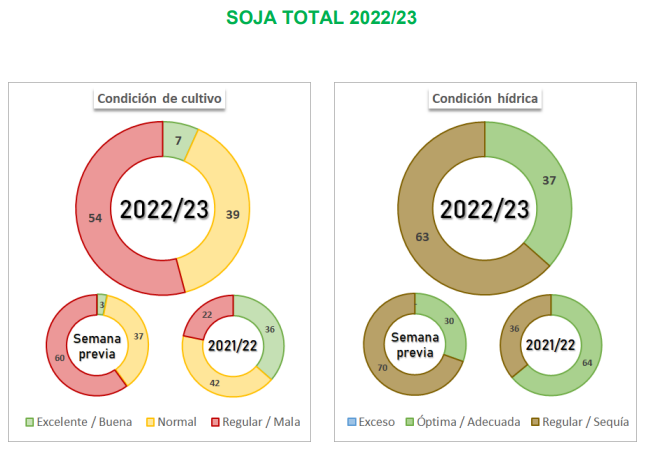

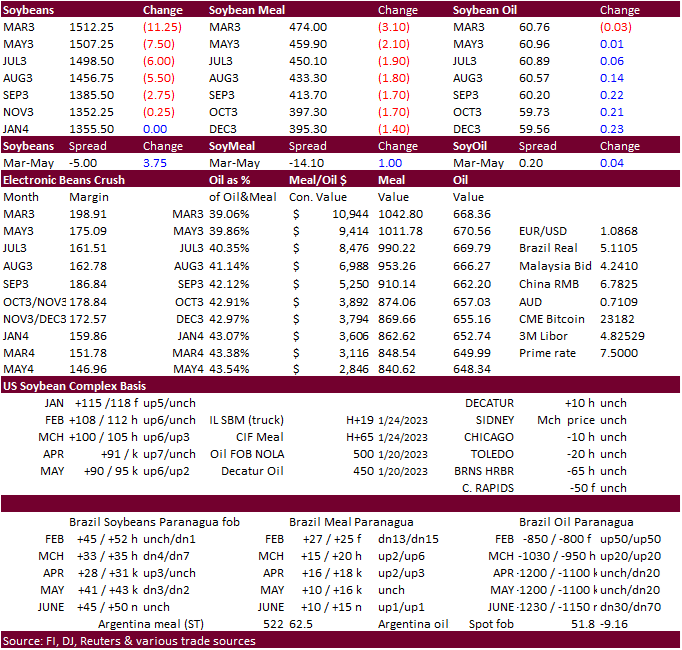

In a choppy trade, nearby positions for the soybean complex were on the defensive Friday, led by soybeans, after Argentina soybean crop conditions slightly improved from the previous week. Positioning was also noted. Corn closed mixed, Chicago wheat lower, and higher protein wheat higher.

MOST IMPORTANT WEATHER FOR THE COMING WEEK

- Very few changes occurred overnight that would drive the markets

- Rain fell significantly across northern Argentina overnight from northern and central Buenos Aires to southern Cordoba and San Luis with amounts of 0.50 to 1.50 inches and several areas getting 2.00 inches or more

- The event was the second of such a genera nature since the end of last week and the two events alone have improved topsoil moisture and should be stimulating much better summer grain and oilseed crop development

- Subsoil moisture is still low in many areas and additional rain is still needed and more should come soon

- Argentina, Brazil, Uruguay and Paraguay are all expecting periodic showers and thunderstorms during the next two weeks.

- All areas will benefit from the moisture, although there is still some concern over the frequency or rain in early season soybean and Safrinha crop areas of Brazil.

- Harvesting and planting delays are probable, but their duration is not likely to be dramatic….in other words fieldwork will still advance, but not as quickly as desired for a while

- Brazil’s rainfall pattern did improve for some areas at times over the past week and some field progress has likely occurred

- The frequency of rain is likely to increase once again and that may slow field progress down a little once again, but no serious harm is expected to come to maturing crops

- Delays in Safrinha corn planting may raise a little concern if they prevail too long, but for now the planting delays should not have a big impact

- Southern Brazil drying will continue for a little while longer, but relief should begin next week and last into the second week of February with alternating periods of rain and sunshine likely

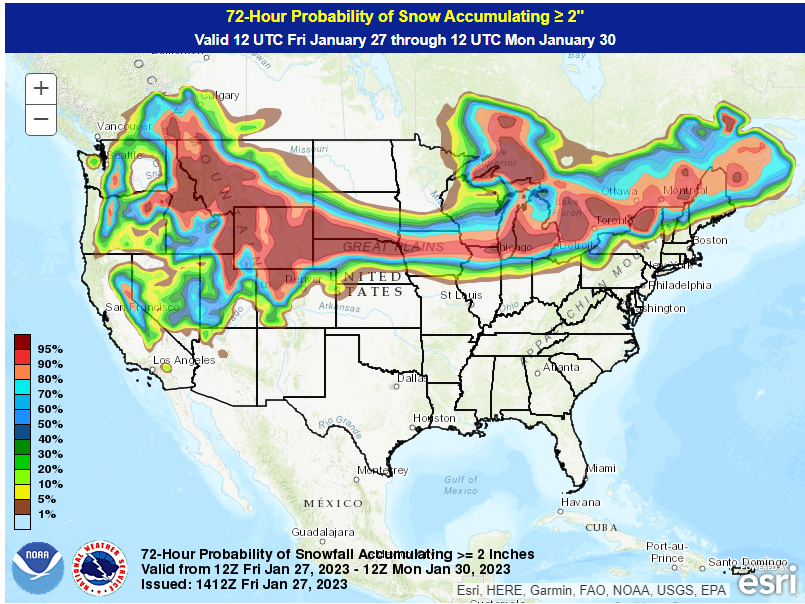

- U.S. hard red winter wheat areas are unlikely to encounter crop damaging cold this weekend or early next week, despite some very cold air slipping into the region

- Bitter cold air will most occur over areas that are still snow covered and damage is not very likely

- Snow cover should also be present in the northwestern Plains and southwestern Canada’s Prairies prior to the development of bitter cold this week to protect most crops

- There may be a few pockets of snow free conditions or where the snow is very thinly present, but the impact on crops should be low

- Temperature extremes in the northernmost U.S. Plains and Canada’s Prairies this weekend and early next week will slip into the -20s Fahrenheit with subzero degree temperatures occurring southward into the a part of Kansas and Colorado

- U.S. Delta, southern Plains and southeastern states will experience frequent rainfall over the next ten days maintaining moisture abundance and possibly raising the potential for some local flooding

- U.S. Pacific Northwest will also experience some bitter cold this weekend, but winter wheat in that part of the nation should not be harmed

- U.S. Midwest precipitation will be most limited in the northwest and west-central parts of the production region

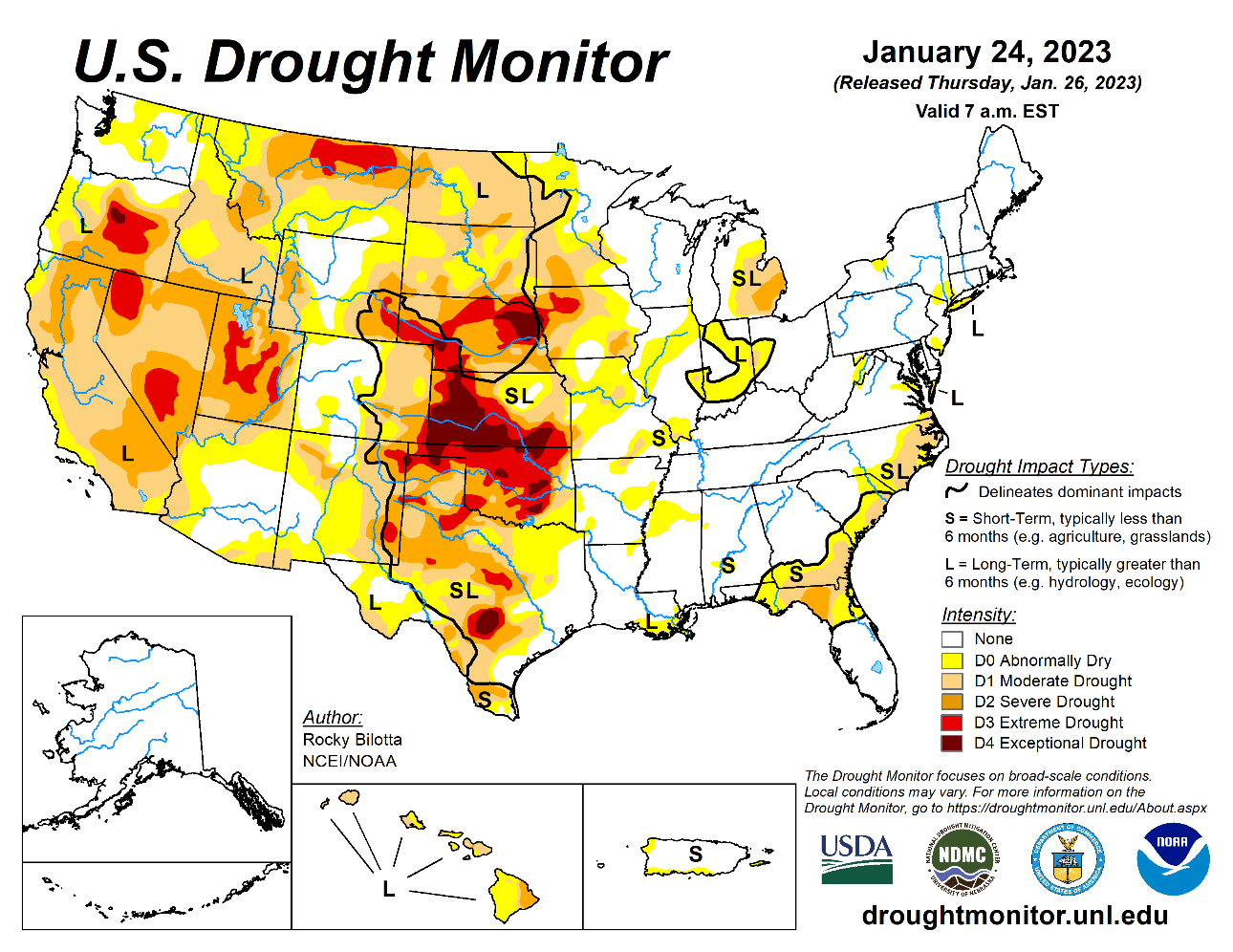

- West and South Texas precipitation will be restricted for a while, but not totally dry

- Snow and rain that impacted West Texas earlier this week brought on a short term lift in topsoil moisture

- West Texas will likely get additional moisture in the second half of next week

- California precipitation will be restricted through Saturday and then a succession of weak weather systems may bring brief periods of light snow and rain to the state and nearby areas starting Sunday and going into the first week of February

- Most of the precipitation will be too light to seriously change the environment, but the moisture will still be welcome

- Canada’s Prairies will see waves of snowfall during the next two weeks, although moisture content in the snow is expected to be light until after Feb. 4.

- China’s wheat and rapeseed production areas are experiencing good winter weather and production potentials are very good

- Precipitation has been a little lighter than usual, but with crops dormant or semi-dormant the impact is minimal

- A boost in precipitation will be needed this spring in a few areas

- Rain is already expected to be greater in the first week of February in rapeseed and minor wheat areas of the Yangtze River Basin

- Northern Algeria is getting routine rainfall while other areas in North Africa are a little too dry; including interior Tunisia and portions of southwestern Morocco

- Very little change is expected in these anomalies for a while

- North-central and northeastern India will receive some welcome rainfall this weekend helping to improve pre-reproductive conditions for wheat, pulses and other crops

- Greater rain will be needed throughout India’s winter crop areas of the central, north and east, although the situation is not a “crisis”

- Eastern Australia will get some needed moisture over the next ten days

- Southeastern Queensland has the greatest need for precipitation in its unirrigated summer crop production region

- Recent rain in both Queensland New South Wales offered some short-term moisture and crop improvements, but much more rain is needed for dryland production areas

- South Africa weather will remain good, although rainfall into the weekend will continue erratic and mostly light

- A boost in rainfall is expected next week and it will continue into the first week of February; the moisture will prove to be very good for ongoing crop development

- Europe and Asia temperatures will be mostly near to above normal during the next two weeks preventing any concern over possible winterkill of small grains or rapeseed

- Europe weather is expected to be tranquil into early next week, but there will be a gradual ramping up in precipitation over eastern parts of the region later next week and into the following weekend

- Western Europe will likely be drier than usual during the next ten days

- CIS weather is expected to be relatively tranquil for a while with precipitation most likely from the Baltic States to the Volga Vyatsk where several inches of snow will accumulate

- Other areas in the western CIS are unlikely to experience much precipitation for a while, but a boost in precipitation is expected later next week and into the first week of February

- Temperatures will be warmer than usual through the next two weeks

- Middle East weather is expected to gradually turn a little wetter during the coming week to ten days and the precipitation will help improve soil moisture for future wheat development and eventual cotton planting later in the year

- West-central Africa will receive some coastal showers in the coming week and the precipitation may increase and reach a little farther inland next week

- Some rain developed Tuesday in a few southern Ivory Coast locations benefiting coffee, cocoa and sugarcane production areas

- Some of the advertised precipitation may be overdone, but it could be beneficial for a few coffee and cocoa production areas as long as there is follow up moisture once it begins to rain periodically

- Dry weather occurred during the weekend

- Southeast Asia rainfall will be most significant in Indonesia and Malaysia as well as eastern portions central and southern Philippines over the next ten days

- The moisture will be good for ongoing crop development, although a few areas may become a little too wet

- East-central Africa rainfall will remain most significant in Tanzania and southern Uganda while more limited in areas north into Ethiopia which is not unusual for this time of year

- Today’s Southern Oscillation Index was +13.24 today and the index is expected to move erratically lower during the next week

Source: World Weather and FI

Bloomberg Ag calendar

Friday, Jan. 27:

Paris Grain Conference, day 2

ICE Futures Europe weekly commitments of traders report

CFTC commitments of traders weekly report on positions for various US futures and options

US cattle inventory, 3pm

HOLIDAY: China

Monday, Jan. 30:

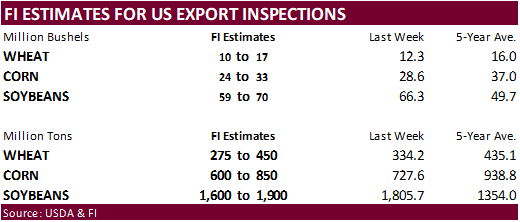

- USDA export inspections – corn, soybeans, wheat, 11am

Tuesday, Jan. 31:

- Malaysia’s January palm oil export data

- EU weekly grain, oilseed import and export data

- US cattle inventory, 3pm

- US agricultural prices paid, received, 3pm

Wednesday, Feb. 1:

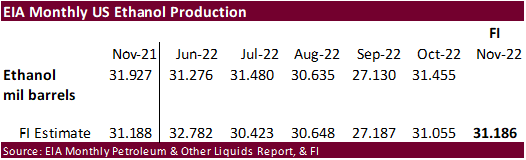

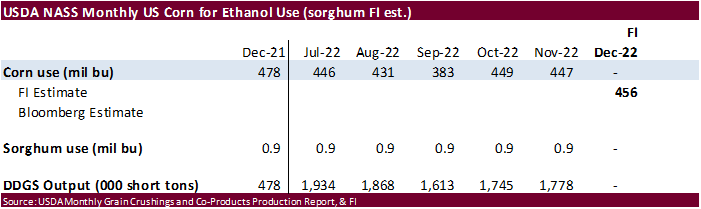

- EIA weekly US ethanol inventories, production, 10:30am

- USDA soybean crush, DDGS production, corn for ethanol, 3pm

- HOLIDAY: Malaysia

Thursday, Feb. 2:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

Friday, Feb. 3:

- FAO World Food Price Index

- FAO Cereal Supply and Demand Brief

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options

Source: Bloomberg and FI

Macros

US Personal Spending Dec: -0.2% (est -0.1%; prev 0.1%)

US Personal Income Dec: 0.2% (est 0.2%; prev 0.4%)

US PCE Core Deflator (M/M) Dec: 0.3% (est 0.3%; prev 0.2%)

US PCE Core Deflator (Y/Y) Dec: 4.4% (est 4.4%; prev 4.7%)

US PCE Deflator (M/M) Dec: 0.1% (est 0.0%; prev 0.1%)

US PCE Deflator (Y/Y) Dec: 5.0% (est 5.0%; prev 5.5%)

US Pending Home Sales NSA (Y/Y) Dec: -34.3% (est -35.4%; prev R -37.7%)

– Pending Home Sales (M/M): 2.5% (est -1.0%; prev R -2.6%)

US Univ. Of Michigan Sentiment Jan F: 64.9 (est 64.6; prev 64.6)

– Current Conditions: 68.4 (est 68.6; prev 68.6)

– Expectations: 62.7 (est 62.0; prev 62.0)

– 1-Year Inflation: 3.9% (est 4.0%; prev 4.0%)

– 5-10 Year Inflation: 2.9% (est 3.0%; prev 3.0%)

Corn

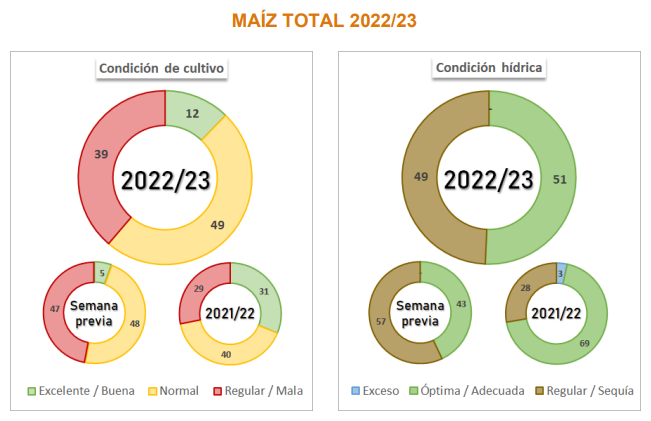

· CBOT corn futures traded two-sided, ending mixed on light positioning ahead of the weekend. They were lower earlier on positioning ahead of the weekend and slightly improvement to Argentina corn crop conditions.

· Bloomberg – (due out today) The US cattle herd as of Jan. 1 seen falling by 2.8m head from last year to 89.1m head, according to the avg of three analysts’ estimates. That would be the lowest level in nine years.

· Argentina BA Grains Exchange reported an increase in crop conditions, from 3 percent last week to 7 percent this week for the good excellent for soybeans and 5 to 12 percent for corn. The left both the soybean and corn area estimated unchanged. 98.8 percent of soybean crop had been planted and 94 percent for corn.

https://www.bolsadecereales.com/imagenes/pass/2023-01/962-ecc20230126.pdf

Export developments.

· Nothing reported.

Updated 01/19/23

March corn $6.50-$7.25 range. May $6.25-$7.20

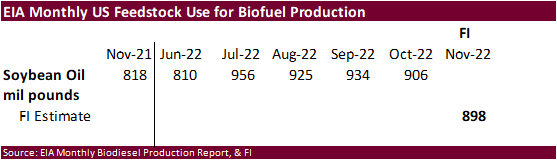

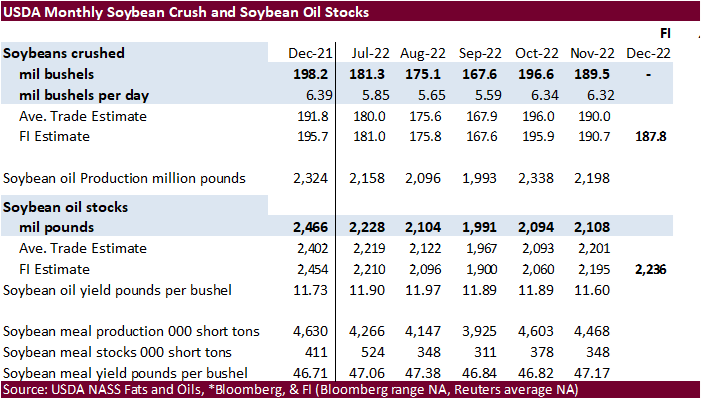

· Prices for the nearby positions for the soybean complex led most of the back months lower on Friday. Improving Argentina crop conditions weighted on soybeans. Back month soybean oil closed higher. News was light.

· There were 198 CBOT soybean registrations cancelled (Chicago) Thursday evening (819 total now). 363 have been cancelled since January 19.

· Deral lowered their soybean estimate for Brazil’s Parana state by 3 percent to 20.7 million tons. 81 percent of the crop was rated good.

· India’s January sunflower oil imports were a record 473,000 tons, nearly triple the regular monthly average. Black Sea was selling sunflower oil at a discount. Around early December Black Sea sunflower was trading at about $100 per ton below soybean oil. India will allow duty free sunflower oil imports through March 2024.

· Bloomberg: Indonesia is studying rules that would require exporters to trade at least some of their palm oil on local exchanges before shipping it overseas.

· South Korea’s feedmaker Nonghyup Feed Inc. (NOFI) bought 40,000 ton of rapeseed meal at an estimated $281.80 a ton c&f for shipment between May 21 and June 10.

· The CCC seeks 3,770 tons of vegetable oils on February 1 for last half March shipment.

Updated 01/19/23

Soybeans – March $14.75-$15.75, May $14.75-$16.00

Soybean meal – March $450-$520, May $425-$550

Soybean oil – March 60.00-68.00, May 58-70

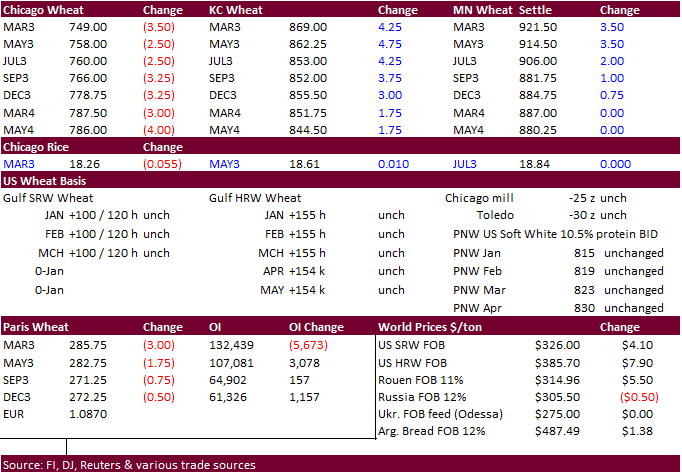

· US wheat was lower for Chicago and higher for KC and MN markets. Lack of direction was noted.

· Eastern Texas and southeastern Oklahoma will see precipitation this weekend into early next week. Single digit temperatures arrive late this week across the US central and northern Great Plains. US snow coverage should be sufficient to minimize damage, if any.

· Paris March wheat was 3.00 euros lower at 286 per ton.

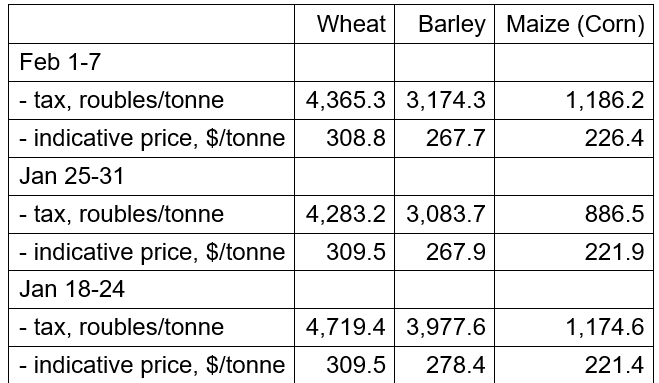

· Russia wheat export tax will increase for the February 1-7 period.

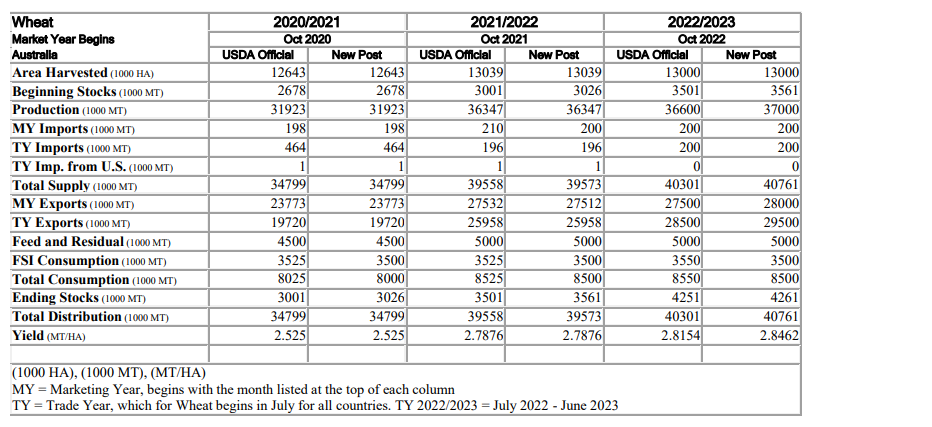

· The USDA Attaché estimated Australia wheat production at 37.0 million tons, up from 36.6 million previously.

USDA Attaché Canadian grain and feed update.

Export Developments.

· South Korea’s Major Feedmill Group (MFG) bought 68,000 tons of feed wheat from Australia at an estimated $343.85 a ton c&f for shipment between May 15 and June 15.

· Jordan seeks 120,000 tons of wheat on Jan 31 for May and June shipment.

· Jordan seeks 120,000 tons of feed barley on Feb 1 for May and June shipment.

Rice/Other

· South Korea’s rice consumption hit a record low last year. The per-capita rice consumption averaged 56.7 kg in 2022, down 0.4 percent from the previous year.

USDA may release selected state crop conditions on Monday, January 30th. Below is winter wheat reported by Bloomberg nearly a month ago for comparison.

Kansas: | V Poor | Poor | Fair | Good | Excel. | Combined G&E

Jan. 1 | 23| 26| 32| 17| 2| 19

Dec. 4 | 18 | 24| 36| 20| 2| 22

Difference | 5| 2| -4| -3| 0| -3

Oklahoma: | V Poor | Poor | Fair | Good | Excel. | Combined G&E

Jan. 1 | 4| 23| 35| 37| 1| 38

Nov. 27 | 12| 12| 45| 30| 1| 31

Difference | -8 | 11| -10| 7| 0| 7

Colorado: | V Poor | Poor | Fair | Good | Excel. | Combined G&E

Jan. 1 | 5| 10| 35| 50| 0| 50

Nov. 27 | 17| 21| 32| 29| 1| 30

Difference | -12| -11| 3| 21| -1| 20

Montana: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan. 1 | 1| 10| 67| 16| 6| 22

Nov. 27 | 0| 11| 45| 31| 13| 44

Difference | 1| -1| 22| -15| -7| -22

Nebraska: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan. 1 | 10| 26| 46| 16| 2| 18

Nov. 27 | 16| 23| 41| 19| 1| 20

Difference | -6| 3| 5| -3| 1| -2

South Dakota: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan. 1 | 5| 16| 63| 16| 0| 16

Nov. 27 | 5| 24| 44| 25| 2| 27

Difference | 0 | -8 | 19| -9| -2| -11

Source: Bloomberg

Updated 01/19/23

Chicago – March $7.00 to $8.00, May $7.00-$8.25

KC – March $7.75-$9.00, $7.50-$9.25

MN – March $8.75 to $10.00, $8.00-$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

Work: 312.604.1366

ICE IM: treilly1

Skype IM: fi.treilly

DISCLAIMER:

The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

#non-promo