PDF Attached

Soybeans

were up for the fourth consecutive day and March soybean oil made another new contract high. Soybean meal was higher on technical buying and South Korea interest. Corn rebounded. Wheat prices traded two-sided, ending higher. Today was the last day of trading

for many Asian markets ahead of the Lunar New Year/Spring Festival holiday. China will be off all next week (resumes February 7). Malaysian palm markets will be closed from January 31 through February 2 (trading resumes Feb. 3).

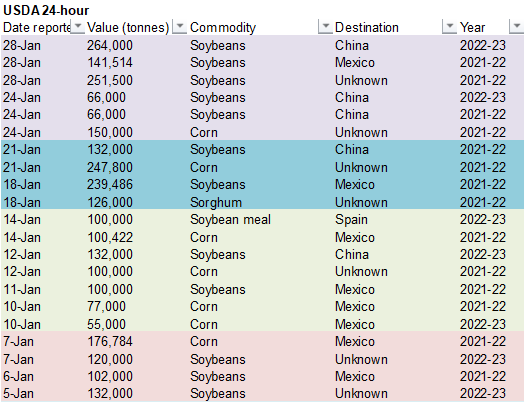

Private

exporters reported the following activity:

-264,000

metric tons of soybeans for delivery to China during the 2022-23 marketing year

-141,514

metric tons of soybeans for delivery to Mexico during the 2021-22 marketing year

-251,500

metric tons of soybeans received in the reporting period for delivery to unknown destinations during the 2021-22 marketing year

Weather

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Florida

citrus and some sugarcane areas will experience frost and freeze conditions Sunday morning with frost again Monday - The

impact on citrus and sugarcane should be low - Most

of the 2021 cane has been harvested, but a little late season fieldwork remains to be done - Sugarcane

will be burned back by frost and freezes, but the cold will not be serious enough to permanently harm crops - Citrus

trees will see low temperatures of 26 to 31 degrees Fahrenheit with frost possible throughout the production region - Freezes

should be most significant in the northern and western counties of central Florida’s primary production region - The

duration of cold is not likely to be long enough to permanently harm trees and citrus fruit should be protected by irrigation systems and other means to keep groves warm during the coldest night and morning - Unprotected

trees could experience leaf damage, but blossom buds for 2022-23 fruit should not be seriously harmed - Unharvested

fruit in unprotected groves could be slightly damaged in the coldest areas in northwestern counties - There

is some potential for a few extreme lows of 24-25, but such readings will be extremely rare - Monday

morning will also be cool with some frost again, but morning temperatures will mostly be in the 30s Fahrenheit

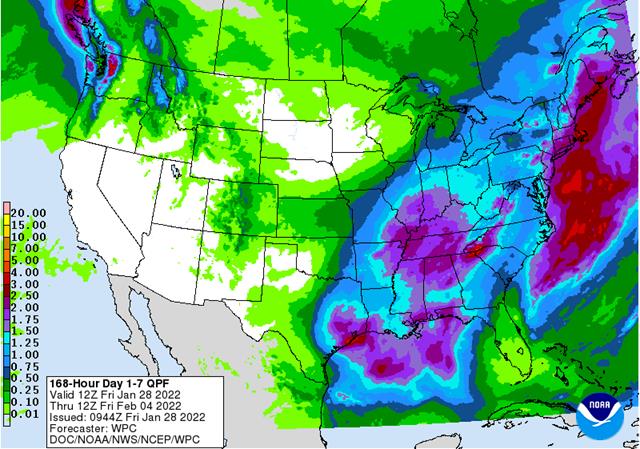

- U.S.

hard red winter wheat areas will have a good chance for snow and a little rain and freezing rain during mid-week next week - The

precipitation will help boost topsoil moisture, but the status of drought is unlikely to change - This

will not be a trend changer, but significant snowfall is expected followed by bitter cold temperatures - The

cold will not harm wheat as long as the snow falls as expected - Southwestern

portions of the Plains will not get significant amounts of moisture, but some snow will fall there, as well - California

and the far western U.S. will experience limited precipitation during the next ten days to two weeks.

- the

lack of moisture will maintain concern over drought, although there is still more time for improved rain and snowfall later in the year - Mountain

snowpack in the Sierra Nevada is still normal to slightly above normal for this time of year, but relative to the April 1 peak of the season snow water equivalency is only 55-60% of normal - Eastern

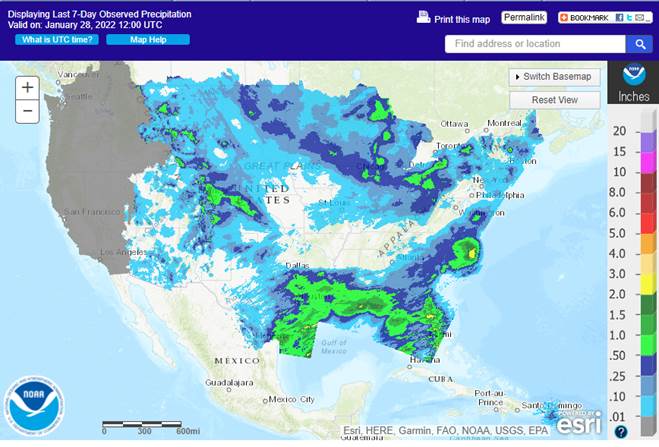

U.S. weather will become more active once again next week and there will potential for heavy to excessive precipitation in a part of the northern Delta, Tennessee River Basin and lower eastern Midwest in the middle to latter part of the week

- The

region will be closely monitored for possible flooding - Some

rain will also impact the southeastern states - Heavy

snowfall is expected in the Midwest - Atlantic

Coast storm today and Saturday will produce strong wind and some heavy rain and snow along the northern half of the U.S. Atlantic Coast and on into southeastern Canada - Coastal

areas of New England will be most impacted by blizzard conditions - Snow

accumulations of 5-12 inches will occur in eastern Massachusetts with local totals possibly more in coastal areas while 2 to 8 inches occurs farther to the south into Delaware - Snowfall

of 8 to 20 inches will occur in eastern Maine and southeastern Quebec may get 10 to 20 inches - Blizzard

conditions are expected especially in New England and Quebec as well as Nova Scotia, Canada - Eastern

U.S. Midwest and Atlantic Coast States will experience cold weather through weekend

- Another

round of positive and negative single digit lows will occur in the Midwest Saturday morning with similar conditions in the northeastern and middle Atlantic Coast states Sunday - Warming

is expected for a little while early to mid-week next week and then colder weather will come after another winter storm impacts the Midwest and northeastern U.S. as well as southeastern Canada during the second half of next week

- The

cold will continue into the following weekend - West

Texas is not expecting much precipitation for a while, although some snow and rain may occur briefly during mid- to late week next week - Resulting

moisture totals will not be great enough to seriously change soil conditions - Flooding

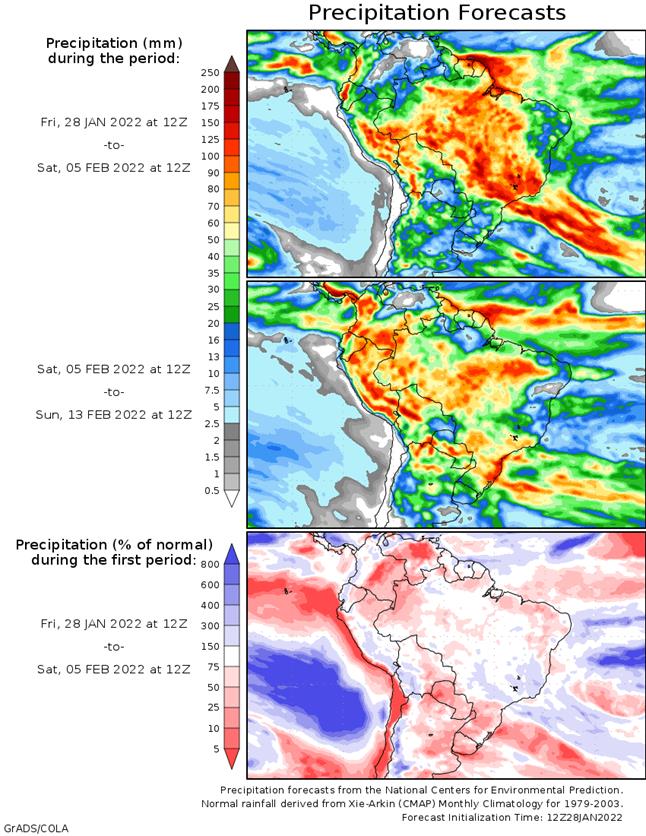

is expected in far northern Parana and Sao Paulo tonight through Monday as rainfall of 3.00 to more than 8.00 inches results - The

region was drier biased earlier in the growing season and the moisture will help improve deep soil moisture and water supply - Some

improvement in the water flow along the Parana River should be expected, but the river will not come back to “normal” levels - Flooding

could negatively impact soybeans readying for harvest and will certainly delay fieldwork through the coming week - Less

frequent and less significant rain should evolve later next week - Sugarcane

may be in standing water for a while which might not be best for the crop, but the region’s excess moisture should slowly drain away in the following week - Minor

coffee production areas impacted by the flooding rain should not be seriously impacted, but less rain might eventually be welcome - Excessive

heat in northeastern Argentina, Paraguay and southwestern Brazil has ended for a while - Temperatures

will be more seasonably warm over the next ten days - The

heat and dryness has crippled most crops in the region especially Paraguay especially after being accompanied by very dry conditions - Some

rain will fall in these areas during the second week of the forecast, Feb. 4-10, but it is still debatable how significant the relief will be - A

larger Safrinha crop of corn might be attempted in Paraguay if enough rain falls, but only temporary improvements in topsoil moisture are anticipated - Argentina

will experience net drying for a little while - The

bottom line for the bulk of corn, soybean, sorghum, sunseed and peanut production areas should be good during the next week to ten days with alternating periods of rain and sunshine - Subsoil

moisture is improving after recent rain has been percolating downward through the soil after the topsoil became saturated earlier in the past week - Southwestern

Argentina will get some rain during the coming week, but most other areas will be dry until the Feb. 4-10 period when showers and thunderstorms will occur once again in an erratic manner - Argentina

still has a good chance for seeing another high pressure ridge during the middle part of February, but its impact may not be as great on the nation as that of earlier this month - Southwestern

Canada’s Prairies and the northwestern U.S. Plains will get some snowfall in the next couple of weeks, but moisture totals will continue lighter than usual away from the Rocky Mountains - South

Africa weather will include increasing scattered showers and thunderstorms periodically during the next ten days favoring fieldwork and crop development - The

environment should help improve crop conditions in those areas that became too wet for a while earlier this month and last - Temperatures

will be near to above average - Australia’s

eastern agricultural areas will experience periods of rain and sunshine over the next two weeks with mostly seasonable temperatures - Queensland

cotton and sorghum areas will get most of their rain in the second week of the forecast and eastern cotton and sugarcane areas should become wettest - New

South Wales will see a better distribution in rainfall favoring improved dryland summer grain, cotton and livestock conditions - India’s

weather will be dry biased for a while except in the extreme north and east - Recent

rain has been ideal for winter crops moving into reproduction and the outlook is good for high yields this year especially if some timely rain falls in February and temperatures do not turn hot - The

outlook favors near to below-average temperatures and an opportunity for rain later in February

- Showers

in the coming two weeks will occur mostly in and near Nepal as well as in a few far northern crop areas - Eastern

China’s weather will be typical for this time of year over the next couple of weeks with waves of rain and a little snow occurring across the east-central and southeastern parts of the nation favoring the Yangtze River Basin - Rainfall

of 1.50 to 5.00 inches will occur from near the Yangtze River southward to the coast during the next ten days with a few greater amounts possible

- Some

significant snow may impact northern parts of the Yangtze River Basin as well - Sufficient

moisture is expected to maintain a very good outlook for rapeseed and winter wheat - Local

flooding is possible, but crop damage is not very likely - Limited

moisture in the north is not unusual for this time of year and the soil is favorably rated for the start of spring - There

are no areas of drought in eastern China - Concern

has been rising over the lack of precipitation in Xinjiang this winter and especially the mountains which may cut into spring runoff potential for irrigated summer crops - CIS

weather over the next two weeks will continue offering periods of snow and some rain in the south with temperatures frequently warmer than usual - The

bottom line is favorable for most winter crops which have not encountered much winterkill this year - Concern

remains over low groundwater in southern parts of Russia’s New Lands and northern Kazakhstan

- Similar

conditions are present in central and eastern Ukraine and Russia’s Volga Basin, but there is a deep accumulation of snow that should improve that situation in the spring snow melt season - Western

Europe will continue to experience less than usual precipitation during the next week while eastern Europe gets enough moisture to maintain favorable snow cover and soil moisture - A

boost in precipitation will soon be needed in Spain, Portugal and neighboring areas - Some

forecast model runs overnight suggested Spain, France and Portugal may get some rain in the second week of the outlook

- Eastern

Europe precipitation will continue periodically while temperatures are near to above normal in this coming week - Less

precipitation is expected next week - Middle

East snow cover is more widespread than usual reaching across most of Turkey and into western and northern Iran - Then

moisture will be good for winter crops when warming melts the snow - North

Africa is unlikely to see much precipitation for a while, although a few showers are expected infrequently

- Drought

remains most serious in southwestern Morocco, but dryness is also a concern in northwestern Algeria and in a few northeastern Morocco locations - Some

increase in precipitation is advertised for Feb. 4-10, but it will be light precipitation and confidence is a little low on its significance

- Ethiopia

has been seasonably dry recently while light showers occur in Uganda and southwestern Kenya - Tanzania

has been and will continue wettest which is normal for this time of year in east-central Africa

- Little

change is expected in these patterns through the next two weeks - West-central

Africa will continue seasonably dry with near normal temperatures for the next ten days - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- No

excessive rainfall is expected - Northern

Vietnam’s weather is expected to trend a little drier, but some showers may still occur infrequently - Today’s

Southern Oscillation Index is +1.21 - The

index may move higher during the next seven days - New

Zealand rainfall will continue lighter than usual this week and then increase next week - The

nation has been drying out in recent weeks - Temperatures

will trend a little warmer than usual - Mexico

will experience slightly cooler than usual weather with a few showers in the east during the coming week - Northern

and western areas in the nation will be drier than usual - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia Ecuador and Peru rainfall may be greater than usual in the coming week

- Western

Venezuela will soon begin receiving rain once again after a bout of dryness - The

remainder of Venezuela will remain dry - A

tropical Cyclone moving through open water in the Indian Ocean may eventually bring a threat of rain and wind to Mauritius and Reunion Islands placing some sugarcane at risk of damage - There

is plenty of time for the storm to veer to the south and it will be closely monitored

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Friday,

Jan. 28:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

Monday,

Jan. 31:

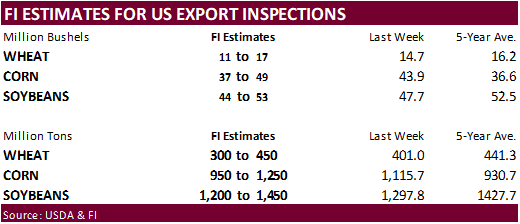

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysia’s

palm oil exports in January - U.S.

agricultural prices paid, received, 3pm - U.S.

cattle inventory, 3pm - Ivory

Coast cocoa arrivals - HOLIDAY:

China, South Korea, Vietnam

Tuesday,

Feb. 1:

- International

Cotton Advisory Committee releases market outlook report - EU

weekly grain, oilseed import and export data - U.S.

Purdue Agriculture Sentiment - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - Honduras,

Costa Rica monthly coffee exports - Australia

commodity index - India’s

federal budget - New

Zealand global dairy trade auction - ProZerno

holds Mountain Grain Assembly in Sochi, Russia, Feb. 1-4 - HOLIDAY:

China, Hong Kong, Malaysia, Indonesia, South Korea, Singapore, Vietnam

Wednesday,

Feb. 2:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

China, Hong Kong, Malaysia, South Korea, Singapore, Vietnam

Thursday,

Feb. 3:

- FAO

World Food Price Index and grains supply/demand outlook - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price - Port

of Rouen data on French grain exports - HOLIDAY:

China, Hong Kong, Vietnam

Friday,

Feb. 4:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

China, Vietnam

Source:

Bloomberg and FI

CFTC

Commitment of Traders

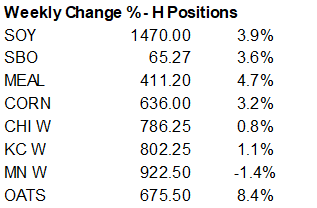

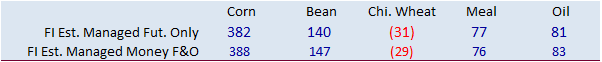

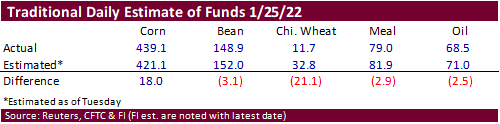

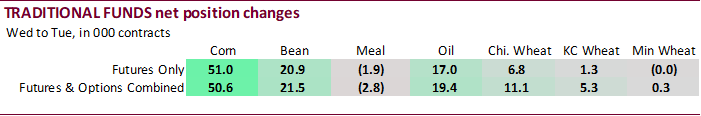

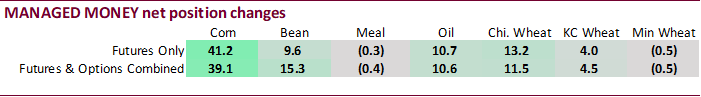

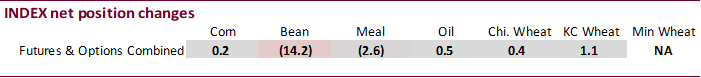

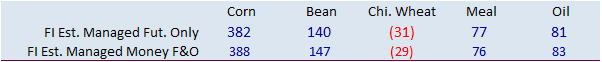

After

a volatile week leading up to January 25, traditional funds were 18,000 contracts more long than expected in corn, and 21,100 contracts less long than expected for Chicago wheat.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

276,521 51,693 442,390 234 -681,756 -49,211

Soybeans

89,651 18,334 191,114 -14,149 -243,793 -5,938

Soyoil

27,538 15,582 119,470 468 -158,080 -17,648

CBOT

wheat -33,001 9,143 138,222 402 -97,077 -10,568

KCBT

wheat 15,775 3,951 56,055 1,104 -72,632 -2,796

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

365,605 39,082 291,383 -310 -678,313 -47,538

Soybeans

114,895 15,255 144,350 -15,711 -257,085 -7,581

Soymeal

64,334 -410 100,095 -26 -204,726 4,405

Soyoil

68,773 10,565 88,119 -815 -167,464 -20,169

CBOT

wheat -13,427 11,474 88,186 -4,203 -80,838 -7,957

KCBT

wheat 40,634 4,516 25,844 -316 -62,479 -2,724

MGEX

wheat 3,340 -516 1,949 -28 -13,326 -1,926

———- ———- ———- ———- ———- ———-

Total

wheat 30,547 15,474 115,979 -4,547 -156,643 -12,607

Live

cattle 49,321 -12,855 81,365 -915 -135,998 16,724

Feeder

cattle 184 -5,281 4,638 107 645 2,719

Lean

hogs 66,907 18,113 60,350 59 -116,933 -16,939

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

58,480 11,482 -37,155 -2,715 1,903,794 75,478

Soybeans

34,813 6,283 -36,972 1,752 883,842 42,369

Soymeal

11,911 -2,384 28,387 -1,585 451,424 -7,199

Soyoil

-498 8,821 11,071 1,598 455,930 21,131

CBOT

wheat 14,224 -336 -8,145 1,022 498,029 29,251

KCBT

wheat -4,800 784 803 -2,259 242,083 2,211

MGEX

wheat 3,813 774 4,224 1,697 72,609 682

———- ———- ———- ———- ———- ———-

Total

wheat 13,237 1,222 -3,118 460 812,721 32,144

Live

cattle 15,579 -3,087 -10,267 134 386,440 8,865

Feeder

cattle 1,100 313 -6,567 2,144 57,392 4,258

Lean

hogs 4,610 -2,556 -14,934 1,322 314,486 38,018

Macros

81

Counterparties Take $1.615 Tln At Fed Reverse Repo Op. (prev $1.584 Tln, 85 Bids)

Biden

Sanctions Plan Targets Russian Banks, Companies And Imports If Ukraine Is Attacked – WSJ

Traders

Now Said To See 100 Basis Points Of Fed Rate Increases By September Versus November Previously

NATO’s

Secretary General: Russia Is Deploying Thousands Of Combat-Ready Troops, S-400s Into Belarus

US

Personal Income Dec: 0.3% (est 0.5%; prev 0.4%; prevR 0.5%)

–

US Personal Spending Dec: -0.6% (est -0.6%; prev 0.6%; prevR 0.4%)

–

US Real Personal Spending Dec: -1.0% (est -1.1%; prev 0.0%; prevR -0.2%)

US

Univ. Of Michigan Sentiment Jan F: 67.2 (est 68.8; prev 68.8)

–

Current Conditions: 72.0 (est 73.2; prev 73.2)

–

Expectations: 64.1 (est 65.9; prev 65.9)

–

1-Year Inflation: 4.9% (est 4.9%; prev 4.9%)

–

5-10 Year Inflation: 3.1% (prev 3.1%)

IMF

Staff Statement on Argentina

https://www.imf.org/en/News/Articles/2022/01/28/pr2218-argentina-imf-staff-statement-on-argentina

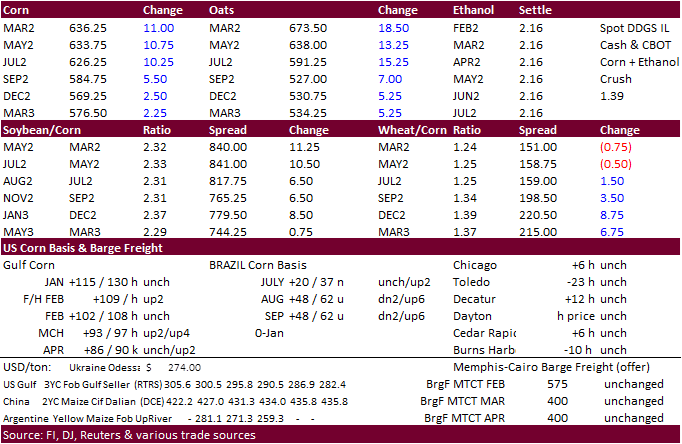

Corn

·

CBOT corn rebounded by 5.0-10.75 cents in old crop led by the March contract. New crop was up only 2.75 cents, a reversal for the old/new crop spreads from yesterday. Widespread commodity buying aided corn prices today, along

with sharply higher soybeans and wheat.

·

Baltic Dry Index increased 6.1% to 1,381 points.

·

Funds bought an estimated net 19,000 contracts.

·

The EPA finalized the proposed rule to extend refinery compliance deadlines for small refiners. This move to delay biofuel compliance may support RIN prices during first half 2022, but already might be factored in the market as

it was announced back in November. Ethanol 2022 RIN’s were around 1.15-1.17 this morning.

·

USDA Attaché: Argentina corn production 51 million tons, 3 million below USDA.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Update_Buenos%20Aires_Argentina_01-20-2022

·

Bloomberg: U.S. cattle herd as of Jan. 1 seen falling by over a million head to 92.5m, the lowest level in six years, according to the avg in a Bloomberg survey of four analysts.

Export

developments.

·

None reported

Updated

1/28/222

March

corn is seen in a $6.10 to $6.55 (up 20 cents both ends)

December

corn is seen in a wide $5.25-$7.00 range

·

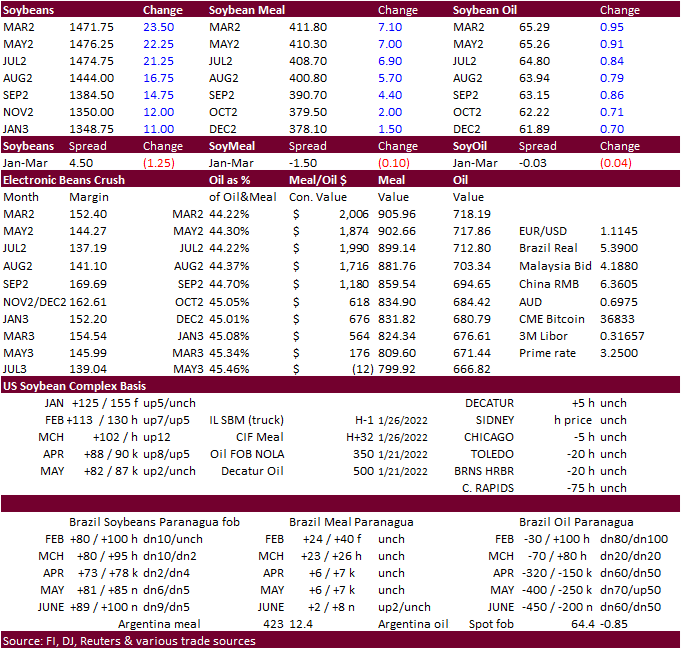

CBOT soybeans, meal and oil were higher on follow through buying initially led by strength in soybean oil. Crush rallied again today but closed well off session highs for the March position. March soybeans hit an absolute contract

high of $14.79. We would not rule out $15.00-$15.10/bu sometime next month if commodities in general continue to rally and soybean demand shifts from South America to the US.

·

Funds bought an estimated net 13,000 soybeans, bought 4,000 soybean meal and bought 6,000 soybean oil.

·

USDA this morning reported a combined 657,014 tons of old and new-crop soybeans sold by private exporters under the 24-hour announcement system.

·

Buenos Aires grains exchange lowered their estimate of the Argentina soybean planted area by 100,000 hectares to 16.3 million. They are currently at 44 million tons for soybean production. USDA official is at 49.5MMT and USDA

Attaché at 46.5MMT.

·

South Korea bought another 60,000 tons of soybean meal overnight and that might be supporting CBOT meal futures.

·

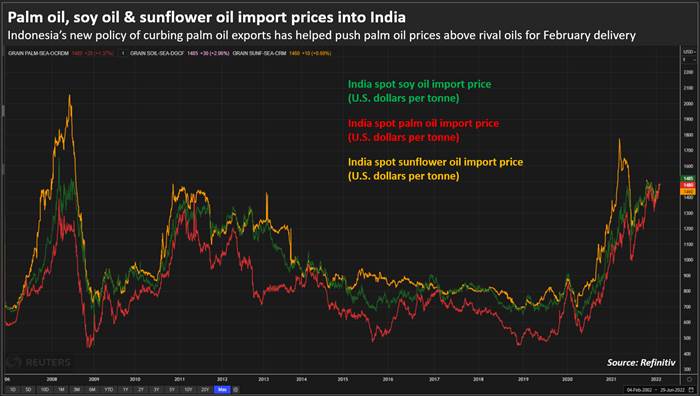

CBOT soybean oil was higher from strength in other global vegetable oil prices. There are concerns Ukraine sunflower oil shipments could be disrupted. March soybean oil broke above a trend channel of 65.72 going back to June 2021

but closed below that level at 65.27. Stops were triggered 1300x running it to highs at 8:56 a.m.

·

Palm futures went out on a strong note before their holiday. April Malaysian palm futures traded higher by 184 ringgit to 5,528, a new record, and the futures market was up 6 consecutive weeks. Malaysian cash CPO was up $38.50/ton

to $1,400.00.

·

Much of the rally in palm oil late this week was related to higher Black Sea sunflower oil cash prices, slow global crush rates despite amble supply of oilseeds, and Indonesia curbing palm exports over the medium term. This has

also supported CBOT soybean oil.

·

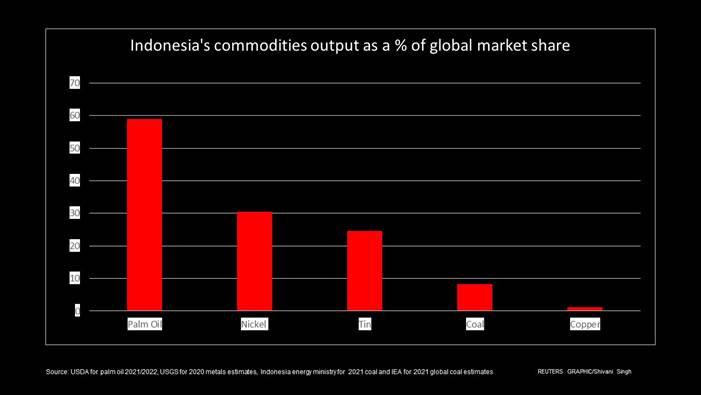

Indonesia was in the news again with a focus on policy changes announced this month for commodities. The latest included that all cooking oil producers will be required to sell 20% of their planned export to the domestic market.

This comes after they banned coal exports and were looking into an export tax on nickel pig iron. Indonesia’s GAPKI sees palm oil exports during 2022 down 3 percent to 33.21 million tons from 34.23 million tons for 2021, even though they look for 2022 production

to expand 4.5% to 49 million tons for CPO (palm kernel seen at 4.8MMT) from 46.89 million tons. Remember 2021 both Indonesia and Malaysia saw production problems. For the month of February, Indonesia will leave its export tax and levy for CPO unchanged at

the highest brackets of $200 per ton and $175 per ton, respectively. The CPO reference price for February is at $1,314.78 per ton, up from January’s 1,307.76 per ton.

·

Third month palm oil futures…

·

Under the 24-hour reporting system, private exporters reported:

-264,000

tons of soybeans for delivery to China during the 2022-23 marketing year

-141,514

tons of soybeans for delivery to Mexico during the 2021-22 marketing year

-251,500

tons of soybeans received in the reporting period for delivery to unknown destinations during the 2021-22 marketing year

-

South

Korea’s FLC and FBG bought a combined 60,000 tons of soybean meal from South America at an estimated $544.99 a ton c&f for arrival in South Korea around May 17. Yesterday NOFI bought 60,000 tons of soybean meal.

-

Iran’s

SLAL bought 60,000 tons of feed barley and 60,000 tons of soybean meal for Feb-Mar shipment. It’s not known if they bought 60,000 tons of corn. The feed barley was expected to be sourced from Germany.

-

Turkey’s

state grain board TMO bought about 6,000 tons of crude sunflower oil at an estimated $1,410.90 a ton c&f. Shipment was sought between Feb. 8 and Feb. 25.

Updated

1/28/22

Soybeans

– March $14.25-$15.25 (up 50 cents, up 25)

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $390-$440 (up $15, up $5)

Soybean

oil – March 61.50-69.00

(up 200, up 400)

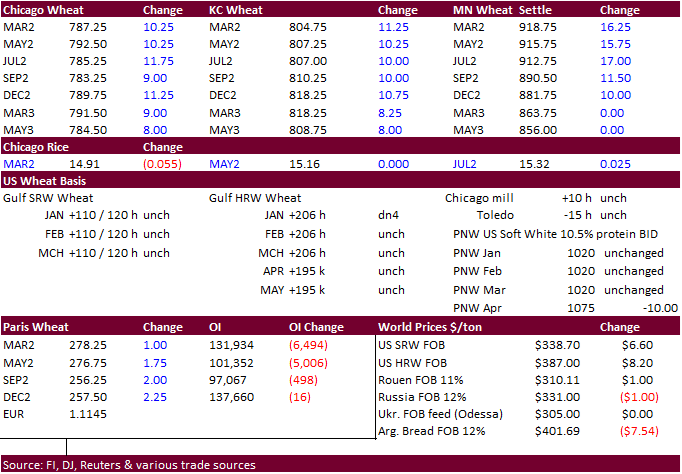

·

US wheat futures traded two-sided, ending higher led by the MN type contracts. Ukraine/Russia tensions remain in focus. Egypt bought 420,000 tons of wheat and did not include French origin.

·

Funds bought an estimated net 6,000 Chicago wheat contracts.

·

U.S. hard red winter wheat production areas will get some welcome snow and a little rain during the middle to latter part of next week.

·

Russia set their February wheat export tax to $93.90/ton for the February 2-8 period, down from $95.80/ton from the January 26-February 1 period. Barley increases to $74.60/ton from $74.40/ton and corn decreases to $49.20/ton

from $50.60/ton

·

March Euronext futures settled 1.50 euros, or 0.5%, higher at 278.75 euros ($310.97) a ton.

-

Egypt’s

GASC bought 420,000 tons of wheat for March 5-15 and March 16-26 shipment. There was no French wheat origin. The purchase comprised 60,000 tons of Ukrainian wheat, 60,000 tons of Russian wheat, and 60,000 tons of Romanian wheat for shipment March 5-15, and

120,000 tons of Ukrainian wheat, 60,000 tons of Romanian wheat and 60,000 tons of Russian wheat for shipment March 16-26. Reuters provided the following:

Shipment

between March 5-15:

-Ukrainian

$326.00 FOB plus $20.89 = $346.89 c&f

-Russian

$329.65 FOB plus $20.35 = $350 c&f

-Romanian

$329.65 FOB plus $19.75 = $349.40

Shipment

between March 16-26:

-Ukrainian

$326.00 FOB plus $20.89 = $346.89 c&f

-Romanian

$329.65 FOB plus $19.75 = $349.40 c&f

-Ukrainian

$328.77 FOB plus $21.23 = $350 c&f

-Russian

$329.20 FOB plus $20.35 = $349.55 c&f

-

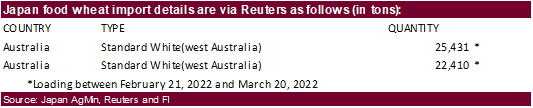

Japan’s

AgMin bought 22,410 tons of food wheat from Australia. Yesterday they bought 25,431 tons. Original details as follows.

-

The

Philippines bought around 50,000 tons of feed wheat from Australia at about $338 to $340 a ton c&f for June shipment.

-

Three

groups from the Philippines are seeking feed wheat for April-May, April-October and/or May-July shipment.

·

Results awaited: Iran’s SLAL seeks 60,000 tons of barley, 60,000 tons of corn and 60,000 tons of soybean meal for Feb/Mar shipment.

·

Jordan seeks 120,000 tons of wheat on February 1 for July – August shipment.

-

Jordan

seeks 120,000 tons of feed barley on February 2.

Rice/Other

·

Results awaited: South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.