PDF Attached

Private

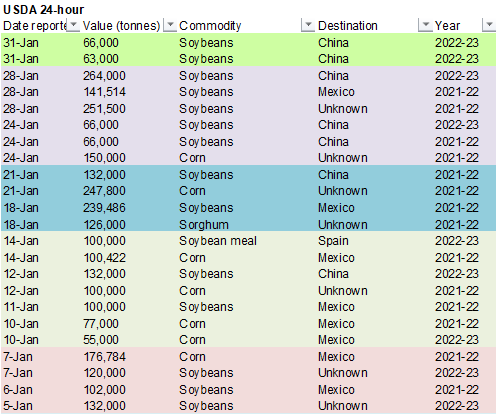

exporters reported sales of 129,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 63,000 metric tons is for delivery during the 2022/2023 marketing year.

Volatile

trade today with grains mostly lower and soybeans higher. SBO/meal unwinding was noted. Corn spreading favored new crop. USD was sharply lower. Ongoing SA crop production concerns supported soybeans. The Ukraine/Russian tensions will continue to be in focus

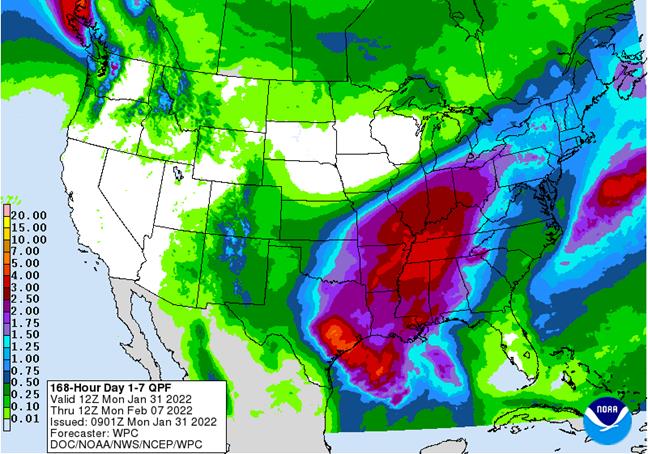

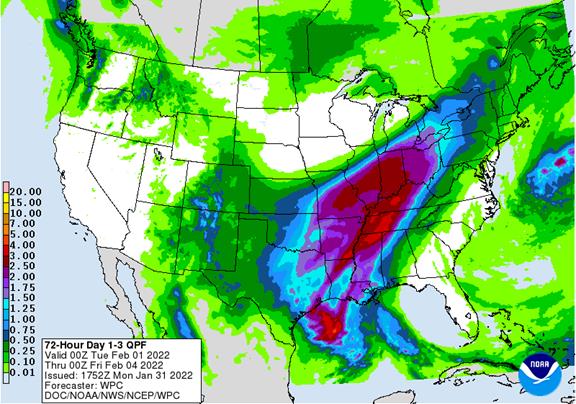

this week. Argentina will see erratic rains this week while Brazil will see rain on and off through mid-February. A snowstorm will hit the central U.S. Plains and Midwest during mid-week this week with 2-6 inches of snow in wheat areas of the Plains and 6

to 15 inches of snow across the lower and eastern Midwest to the northeastern states.

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Frost

and light freezes occurred again this morning in Florida’s citrus production region, but the impact citrus, sugarcane and other crops was not nearly as great as that of Sunday Morning when temperatures were much colder.

- Florida

was impacted by frost and freezes Sunday possibly damaging some unprotected citrus, sugarcane and many other fruits and vegetables

- Protected

crops may not have been seriously impacted by low temperatures of 25 to 32 degrees Fahrenheit across many areas in the central and interior southern peninsula - Damage

to non-citrus fruits and vegetables may have also occurred in northern Florida and southern Georgia - An

extreme low temperature of 22 Fahrenheit was noted as far to the south as Palmdale, Florida

- Sugarcane

may have been damaged in Glades County - The

coldest temperatures in citrus areas occurred in western and northeastern crop areas of central Florida where ground level temperatures were mostly 25 to 32, but tree level temperatures were rarely colder than 27. - Outside

of Palmdale, other extreme lows of 24-26 occurred north of Interstate Highway 4

- Temperatures

were below 28 at the ground level for 3-5 hours, but the use of irrigation, portable heaters, wind machines and helicopters should have kept the air stirred and warm enough to avoid much damage - Citrus

fruit damage should have been confined to the colder areas where no irrigation was used to protect the crop - Not

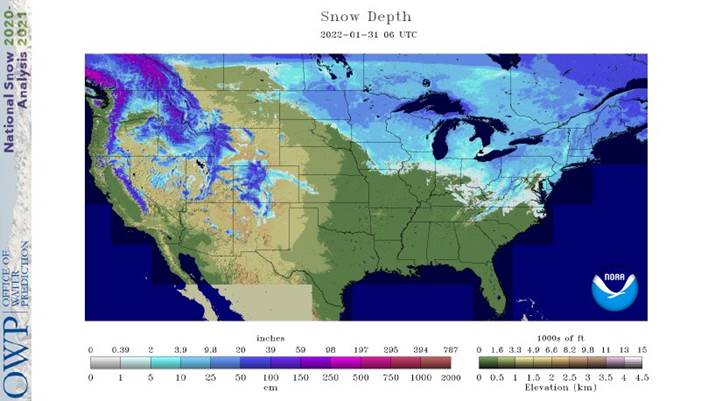

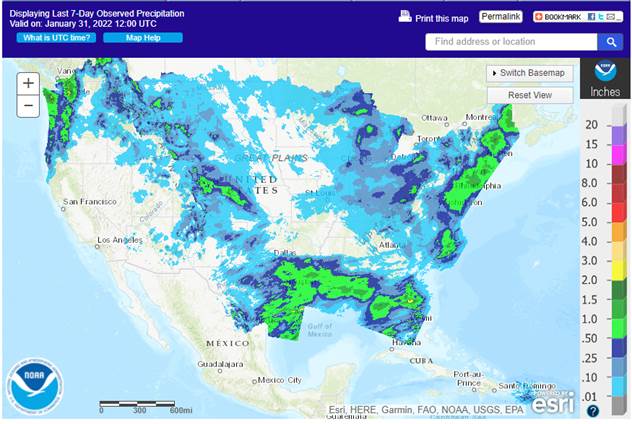

much precipitation fell in U.S. crop areas during the weekend, but a blizzard did impact the northeastern corner of the nation and southeastern Canada - Snowfall

of 24-30 inches occurred in eastern Massachusetts while 8 to 24 inches occurred in many other areas from the northern U.S. Atlantic Coast into Quebec and Nova Scotia, Canada - Wind

speeds gusted to more than 50 mph and visibilities were down to zero at times along the coast from New York to Quebec and Maine - The

storm is over now for the U.S., but is continuing in eastern most Canada - U.S.

weekend temperatures soared above normal in the central and southern Plains once again with highest readings Saturday and Sunday rising into the 60s and 70s Fahrenheit respectively - In

contrast, lowest temperatures were in the negative and positive single digits Fahrenheit in the eastern Midwest and in the -20s and negative teens in a part of the interior northeastern states - Low

temperatures in the teens occurred in the Tennessee River Basin and in the 20s in Georgia, northern Florida and the lower Delta

- U.S.

weather this week will be dominated by a winter storm that will evolve in the central and southeastern Plains and then move through the Midwest to the northeastern states Tuesday into Friday - This

storm promises to produce 2 to 6 inches of snow in the central Plains, 6 to 15 inches from southern Missouri to southeastern Michigan, Ohio, Pennsylvania and the northeastern states

- There

is potential for more than 20 inches of snow in the eastern Midwest and a part of the interior northeastern states

- The

greatest snow will occur mostly in the lower and eastern Midwest - Blizzard

or near-blizzard conditions are possible in a part of the Midwest - Heavy

rain, freezing rain and sleet are also expected - Lighter

snow will fall in the southwestern Plains - Travel

delays, livestock stress and disruption to commerce will accompany this storm - Bitter

cold air will drop back into the central U.S. late this week following the snowstorm and into the Midwest during the weekend coming up

- The

cold will not last long and a return to normal temperatures should return relatively soon after a few days of bitter cold - Another

surge of bitter cold may impact the central and eastern U.S. during the weekend and the week of February 7 - Western

portions of the U.S. will be a little cooler than usual this week and more normal next week

- Another

winter storm of significance is possible in the U.S. eastern states late next week and into the following weekend after the second storm system abates from the region - U.S.

hard red winter wheat production areas will get snow during mid-week this week.

- 2-6”

of accumulation is expected and moisture content will vary up to 0.30” in the west and 0.75 inch to possibly an inch in central Oklahoma and eastern Kansas - The

moisture will be welcome, but it may not survive all the way into spring unless frequent follow up precipitation takes place.

- Winter

crops are still dormant or semi-dormant and not likely to develop much for a while which is normal for this time of year.

- West

Texas will get some snow and rain briefly during mid-week this week. The moisture will be welcome and should not change long term soil moisture very much - Moisture

totals will vary up to 0.30” - California

and most of the far western U.S. is expected to remain dry or mostly dry for the next couple of weeks and precipitation during the second half of February may not increase greatly, but a short term bout of moisture is possible - U.S.

Delta and southeastern states will receive periods of rain and some snow and freezing rain over the next two weeks maintaining status quo soil conditions - U.S.

northern Plains and upper Midwest precipitation is expected to be light during the next two weeks with this week’s precipitation most limited - Waves

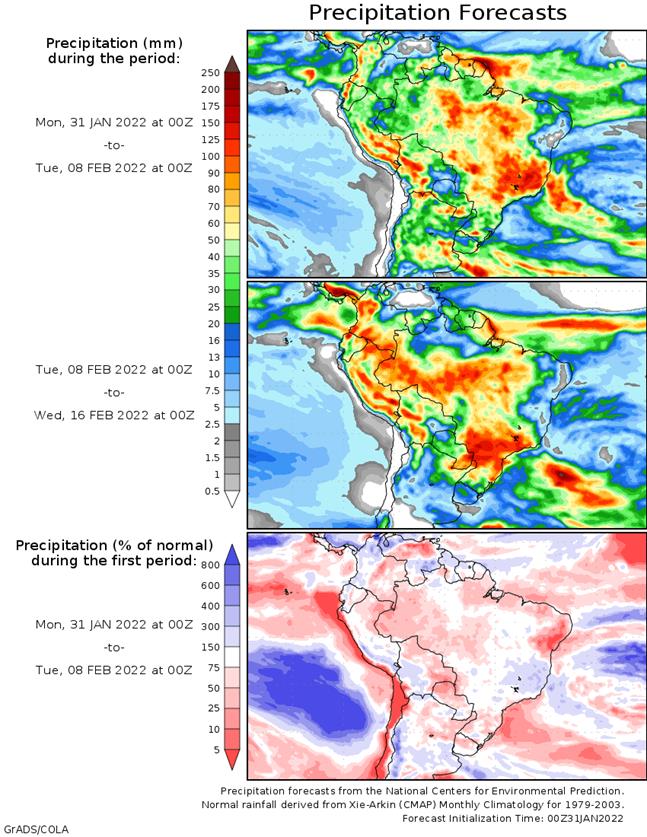

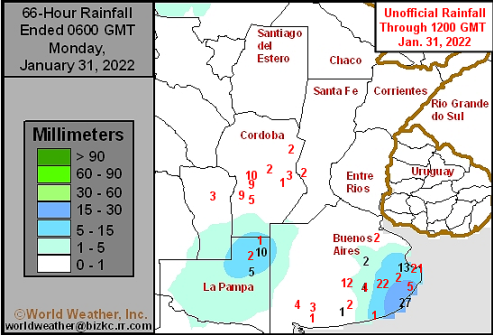

of bitter cold will continue to come and go across the region - Argentina

weather Friday into Sunday afternoon was generally dry - Some

rain fell in northeastern La Pampa and in southern Buenos Aires where moisture totals were as great as 0.86 inch - Most

areas reported less than 0.50 inch - Another

area of rain developed Sunday night in central Cordoba with amounts to 0.40 inch - The

remainder of the nation was dry with seasonable temperature - Argentina

weather will remain mostly dry into Wednesday of this week with some warming expected followed by showers and thunderstorms - Showers

and thunderstorms will begin impacting the nation from time to time during the second half of this week through the weekend - Rain

totals by next Monday, Feb. 7, will be less than 0.50 inch in Entre Rios and much of central Santa Fe while 0.40 to 2.00 inches will occur elsewhere with some greater amounts in northern most parts of the nation including some of the driest cotton areas of

Formosa and Salta - Mostly

dry weather will occur early to mid-week next week - The

next best opportunity for rain will evolve in northern Argentina in the latter part of next week into the following weekend when northern areas may receive 0.30 to 1.00 inch of rain and a few amounts to 2.00 inches

- Confidence

is low, though - A

new ridge of high pressure is expected to build across Argentina near mid-February that will bring back warmer temperatures and extend a period of net drying - Argentina’s

weather over the next two weeks will be well mixed, but net drying may impact a fair amount of the region especially in the second and third weeks of the outlook. For now, the outlook is very good for crops in the heart of grain and oilseed production regions,

but northern cotton and minor gain and oilseed areas will need greater rain for a better recovery from recent hot, dry, conditions. Some relief is expected in the north, but it may be more limited than that advertised today. - Rain

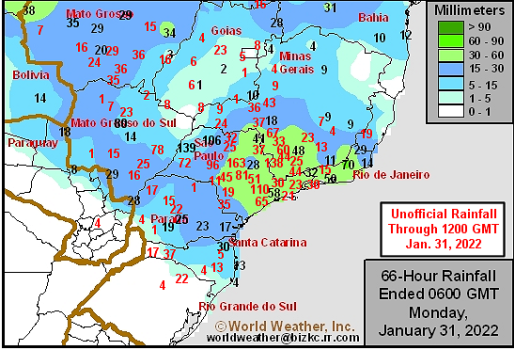

in Brazil during the weekend occurred from Parana, Mato Grosso do Sul and some Santa Catarina locations northward through Mato Grosso, Goias and Minas Gerais to parts of Bahia and Tocantins - Amounts

varied from 0.75 to 1.00 inch in parts of Parana and Mato Grosso do Sul while Sao Paulo and southern Minas Gerais reported rainfall of 1.00 to 4.00 inches with a few local totals to 6.42 inches

- Little

to no rain fell in Rio Grande do Sul, Paraguay, central and northern Minas Gerais, Goias and northeastern Mato Grosso do Sul where net drying occurred despite some showers - Temperatures

were seasonable with a slight cooler than usual bias in eastern Parana and eastern Santa Catarina - All

Brazil crop areas will get rain at one time or another during the next ten days - The

precipitation will concentrate into Tuesday from Sao Paulo and far southern Minas Gerais to Mato Grosso and northeastern Mato Grosso do Sul - Additional

rainfall will vary from 2.00 to 5.00 inches and a few greater amounts to over 6.00 inches - Far

southern Brazil and Paraguay will be dry through Wednesday, but showers and thunderstorms are likely after that into Monday, Feb. 9, with rainfall of 1.50 to 3.00 inches and a few greater amounts - Showers

and thunderstorms in all other areas from late this week through next week will eventually impact all crop areas, but Bahia, northeastern Minas Gerais and northern Espirito Santo will end up with 0.20 to 0.80 inch of rain with a couple of locations getting

more than 1.00 inch - Daily

rainfall elsewhere through Feb. 7 will vary from 0.20 to 0.80 inch and local totals of 1.50 inches

- The

most repetitive rainfall is expected in Minas Gerais, western Bahia, Goias, Mato Grosso and Tocantins - Temperatures

will be seasonable during much of the forecast period - Brazil’s

weather should improve in the south late this week and into the weekend, but follow up rain will be very important and it may not occur often enough to fully restore soil moisture or greatly improve late summer crop development potential. All other areas in

Brazil will get sufficient rain to support late full season crops and Safrinha corn and cotton. Bahia and northeastern Minas Gerais may not get much rain for a while and will need a boost in time. Some harvest delays are possible for early season soybeans,

but field progress will advance around the precipitation. - South

Africa has been and will continue to receive alternating periods of rain and thunderstorms through the next two weeks - Sufficient

rain will fall to maintain good soil moisture for all summer crops over the next two weeks - Temperatures

will be seasonable with a few locations a little cooler biased this week and then a little warmer again next week - Australia

weekend rainfall was greatest in Victoria and the southwestern half to two thirds of New South Wales - The

greatest rain was in the southern Great Dividing Range and in central and eastern Victoria where 1.00 to 2.25 inches resulted.

- Crop

areas in New South Wales received 0.20 to 1.25 inches with much of the rain light - Most

other areas in New South Wales and Queensland were dry or mostly dry keeping dryland crops in need of moisture – especially in Queensland - Temperatures

were warm in most summer crop areas keeping evaporation rates high and the demand for soil moisture also high - Eastern

Australia’s greatest rain will occur during mid- to late week this week as a disturbance brings 0.50 to 2.00 inches of rain across northern New South Wales and Queensland - This

rain event will be ideal in bolstering soil moisture for dryland crops - Much

of the rain will be less than 1.25 inches, but every bit of it will be good for better dryland crop development - Central

and southwestern New South Wales rainfall should be limited - Net

drying is expected during the late weekend through the first half of next week - Temperatures

will be close to normal with a short term bout of cooler than usual conditions in the southeastern corner of the nation this week - Australia’s

bottom line will be one of improvement for some summer crops because of rain later this week and into the weekend; however, a greater amount of rain will be needed to more fully restore soil moisture and water supply for long term crop and farming needs. - North

Africa is unlikely to see much precipitation for a while, although a few showers are expected infrequently

- Drought

remains most serious in southwestern Morocco, but dryness is also a concern in northwestern Algeria and in a few northeastern Morocco locations - Tropical

Cyclone Batsirai was located 466 miles east northeast of Port Louis, Mauritius near 16.45 north, 64.1 east at 0300 GMT today

- The

storm was moving west northwesterly at 8 mph and producing maximum sustained wind speeds to 109 mph - Hurricane

force wind was occurring out 30 miles from the center of the storm - Batsirai

will move west southwesterly over the next few days staying north of Mauritius and La Reunion Islands - The

storm will pass close enough to the islands to generate some breezy conditions, a few waves of rain and rough coastal seas, but no damaging conditions are expected as long as the storm takes the prescribed path - Batsirai

will reach Madagascar late this week bringing heavy rain and strong wind speeds inland across central and southwestern parts of the nation - Flooding

and some damaging wind is expected - India’s

weather will trend a little wetter in the far north and eastern most portions of the nation during the second half of this week and into the weekend - Sufficient

moisture will occur to support reproducing winter crops, but the area impacted will be limited to the far north, areas near Nepal and from Bihar and Jharkhand and West Bengal through Bangladesh to India’s far Eastern states - Net

drying is expected elsewhere - Eastern

China’s weather will be typical for this time of year over the next couple of weeks with waves of rain and a little snow occurring across the east-central and southeastern parts of the nation favoring the Yangtze River Basin - Rainfall

of 1.00 to 3.00 inches will occur from near the Yangtze River southward to the coast during the next ten days with a few greater amounts possible

- Some

significant snow may impact northern parts of the Yangtze River Basin as well - Local

moisture totals may reach up over 4.00 inches in the interior southeast - Sufficient

moisture is expected to maintain a very good outlook for rapeseed and winter wheat - Local

flooding is possible, but crop damage is not very likely - Limited

moisture in the north is not unusual for this time of year and the soil is favorably rated for the start of spring - There

are no areas of drought in eastern China - Concern

has been rising over the lack of precipitation in Xinjiang this winter and especially the mountains which may cut into spring runoff potential for irrigated summer crops - CIS

weather over the next two weeks will continue offering periods of snow and some rain in the south with temperatures frequently warmer than usual - The

bottom line is favorable for most winter crops which have not encountered much winterkill this year - Concern

remains over low groundwater in southern parts of Russia’s New Lands and northern Kazakhstan

- Similar

conditions are present in central and eastern Ukraine and Russia’s Volga Basin, but there is a deep accumulation of snow that should improve that situation in the spring snow melt season - Western

Europe will continue to experience less than usual precipitation during the next week to ten days while eastern Europe gets enough moisture to maintain favorable snow cover and soil moisture - A

boost in precipitation will soon be needed in Spain, Portugal and neighboring areas - The

latest forecast models have backed off of the precipitation potential advertised late last week for the coming week to ten days - Eastern

Europe precipitation will continue periodically while temperatures are near to above normal in this coming week - Less

precipitation is expected next week - Middle

East snow cover is more widespread than usual reaching across most of Turkey and into western and northern Iran - Additional

snow is expected over the next ten days - The

moisture will be good for winter crops when warming melts the snow - Ethiopia

has been seasonably dry recently while light showers occur in Uganda and southwestern Kenya - Tanzania

has been and will continue wettest which is normal for this time of year in east-central Africa

- Little

change is expected in these patterns through the next two weeks - West-central

Africa will continue seasonably dry with near normal temperatures for the next ten days - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- No

excessive rainfall is expected - Mainland

Southeast Asia’s weather is expected be a little unsettled for a while with sporadic light showers periodically, but no general soaking rain is expected - Today’s

Southern Oscillation Index is +2.61 - The

index will move higher during the next seven days - New

Zealand will receive some welcome rain Tuesday through Friday of this week easing a long period of below average precipitation

- Follow

up precipitation is possible next week - The

moisture will be welcome and help to raise topsoil moisture - Temperatures

will trend a little warmer than usual - Mexico

will experience slightly cooler than usual weather with a few showers in the east during the coming week - The

remainder of the nation will be dry - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia Ecuador and Peru rainfall may be greater than usual in the coming week

- Western

Venezuela will soon begin receiving rain once again after a bout of dryness - The

remainder of Venezuela will remain dry

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Monday,

Jan. 31:

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysia’s

palm oil exports in January - U.S.

agricultural prices paid, received, 3pm - U.S.

cattle inventory, 3pm - Ivory

Coast cocoa arrivals - HOLIDAY:

China, South Korea, Vietnam

Tuesday,

Feb. 1:

- International

Cotton Advisory Committee releases market outlook report - EU

weekly grain, oilseed import and export data - U.S.

Purdue Agriculture Sentiment - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - Honduras,

Costa Rica monthly coffee exports - Australia

commodity index - India’s

federal budget - New

Zealand global dairy trade auction - ProZerno

holds Mountain Grain Assembly in Sochi, Russia, Feb. 1-4 - HOLIDAY:

China, Hong Kong, Malaysia, Indonesia, South Korea, Singapore, Vietnam

Wednesday,

Feb. 2:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

China, Hong Kong, Malaysia, South Korea, Singapore, Vietnam

Thursday,

Feb. 3:

- FAO

World Food Price Index and grains supply/demand outlook - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price - Port

of Rouen data on French grain exports - HOLIDAY:

China, Hong Kong, Vietnam

Friday,

Feb. 4:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

China, Vietnam

Source:

Bloomberg and FI

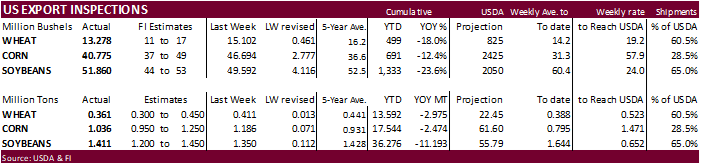

USDA

inspections versus Reuters trade range

Wheat

361,375 versus 300000-500000 range

Corn

1,035,734 versus 950000-1400000 range

Soybeans

1,411,411 versus 800000-1450000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JAN 27, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 01/27/2022 01/20/2022 01/28/2021 TO DATE TO DATE

BARLEY

0 0 1,297 10,010 24,636

CORN

1,035,734 1,186,085 1,116,097 17,543,531 20,017,435

FLAXSEED

100 0 24 324 509

MIXED

0 0 0 0 0

OATS

0 0 100 400 2,693

RYE

0 0 0 0 0

SORGHUM

127,519 77,239 247,288 2,277,429 3,067,686

SOYBEANS

1,411,411 1,349,664 1,908,442 36,275,554 47,468,328

SUNFLOWER

0 0 0 432 0

WHEAT

361,375 411,011 414,248 13,592,020 16,566,568

Total

2,936,139 3,023,999 3,687,496 69,699,700 87,147,855

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

U.S.

Department of Agriculture, Economic Research Service. Farm

Sector Income & Finances: Highlights From the Farm Income Forecast, December 1, 2021.

“Net

farm income, a broad measure of profits, is estimated to have increased by $15.7 billion (19.9 percent) in 2020 relative to 2019 and is forecast to increase by another $22.0 billion (23.2 percent) in 2021 relative to 2020. Forecast at $116.8 billion in 2021,

net farm income would be at its highest level since 2013 and 24.2 percent above its 2000–20 average of $94.0 billion when prior years are adjusted for inflation. In inflation-adjusted 2021 dollars, net farm income is forecast to increase by $18.4 billion (18.7

percent) in 2021 from the previous year. “

Corn

·

CBOT corn prices were volatile today as old crop fell as much as 10 cents and new-crop rallied 4 cents. The spreading was impressive. Some expect US 2022 corn acres may come in lower than expected and/or we will see a yield drag

given less US fertilizer applications. March 31 US Prospective Plantings report will be a hot topic over the next couple of months.

·

There seems to be a large disconnect between soybeans and corn prices as SA production concerns are affecting both crops, which should result in business shifting to the US for both commodities. But we are only hearing of analysts

increasing their US soybean export projections, and ignoring the potential increase in US corn exports. If China turns to the US for corn over the near future, we could see a jump in CBOT corn prices. Note US sorghum sales to China have picked up recently.

·

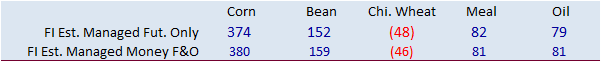

Funds sold an estimated net 8,000 corn contracts.

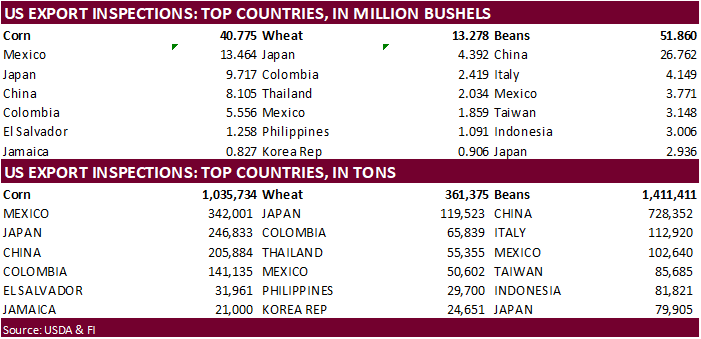

·

USDA US corn export inspections as of January 27, 2022 were 1,035,734 tons, within a range of trade expectations, below 1,186,085 tons previous week and compares to 1,116,097 tons year ago. Major countries included Mexico for

342,001 tons, Japan for 246,833 tons, and China for 205,884 tons.

·

Agresource sees the Brazil corn crop at only 106.82 million tons. USDA official is at 115 versus 87 MMT year earlier.

·

The Philippines lifted their suspension on Canadian been imports.

·

Nepal reported a H5N1 bird flu outbreak at a poultry farm.

·

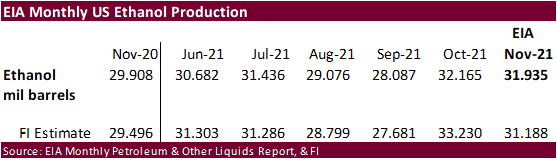

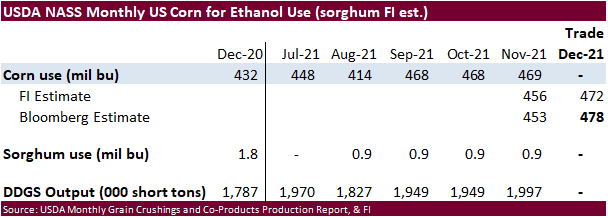

EIA reported November 2021 ethanol production at 31.935 million barrels, larger than expected and above 29.908 million during November 2020.

·

We estimate US corn for ethanol use at 5.425 billion bushels, 100 million above USDA. Our estimate is unchanged from late December.

·

DTN – January 28, 2022 By Mary Kennedy. The DTN average price for domestic distillers dried grains (DDG) from 34 locations reporting for the week ended Jan. 27 was $215 per ton, up $3 per ton versus one week ago. DDG prices

have been moving higher during the month of January, fueled by strong soybean meal prices and strong demand from feeders. Wednesday’s Energy Information Administration (EIA) report showed U.S. ethanol production fell 18,000 barrels per day (bpd) as of Jan.

21 to 1.035 million bpd, but remained above 1 million bpd for a 16th consecutive week. Output in the week profiled was 11% more than the same time in 2021. (Source: DTN)

·

Lowest in six years…U.S. cattle herd as of Jan. fell 2 percent from a year ago to 91.9 million head (92.5 estimate by Bloomberg).

https://release.nass.usda.gov/reports/catl0122.txt

Export

developments.

·

None reported

Updated

1/28/222

March

corn is seen in a $6.10 to $6.55

December

corn is seen in a wide $5.25-$7.00 range

·

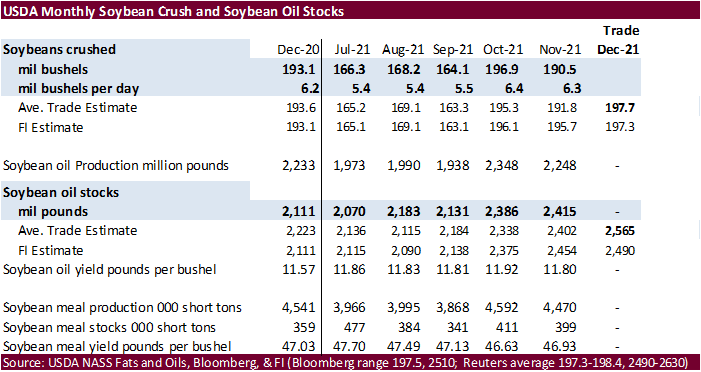

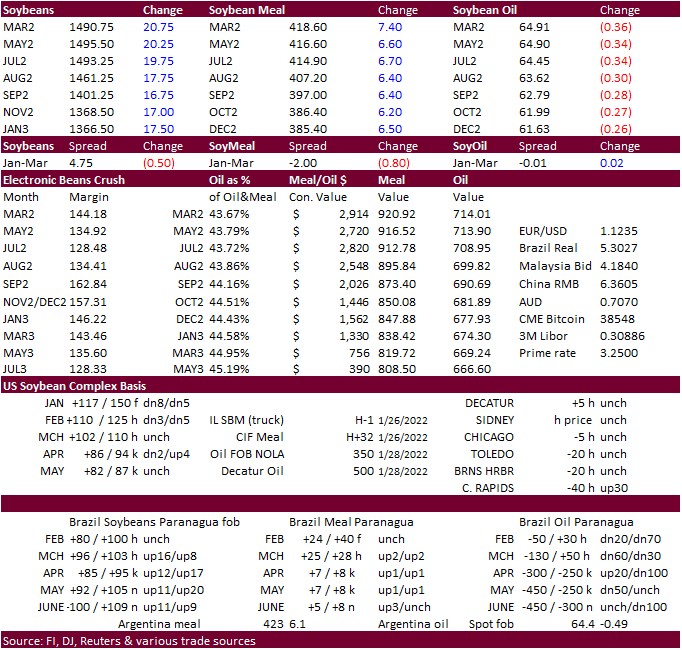

CBOT soybeans ended higher led by strength in soybean meal, but the crush fell sharply from soybean oil contracts under pressure. We see March soybean support at $14.84. End of month positioning was noted. Fundamentals have

not changed. Two downgrades to Brazil’s soybean production estimates were seen as supportive. USDA may trim their production for Brazil and Argentina by a combined 6 million tons next week. This could pump 75-125 million bushels, at minimum, into US exports

if they don’t lower China soybean imports. We are likely going to raise our US soybean export forecast by 150 million bushels from our current 2.0 billion outlook, which is 50 million below USDA.

·

Look for updated FI US S&D’s post USDA NASS crush report.

·

USDA US soybean export inspections as of January 27, 2022 were 1,411,411 tons, within a range of trade expectations, above 1,349,664 tons previous week and compares to 1,908,442 tons year ago. Major countries included China for

728,352 tons, Italy for 112,920 tons, and Mexico for 102,640 tons.

·

Funds today bought an estimated net 12,000 soybeans, bought 5,000 soybean meal and sold 2,000 soybean oil.

·

AgRural estimated the Brazil soybean crop at 128.5 million tons, down from 133.4 million estimated January 6. They started out the season at 144.7 million tons. They pegged harvesting at 10 percent.

·

Agresource also downgraded their estimate to 125 million tons from 131 previously.

·

USDA official is at 139 MMT versus 138 year earlier.

·

Brazil’s Safras reported 2021-22 soybean harvest progress at 11.3% by January 28, well above a year ago when only 1.4% of the 2020-21 crop was collected. Last week they estimated Brazil soybean exports at a low 85.5 million tons

for 2022 (USDA @ 90 for the Feb-Jan crop year, up from 88.9MMT for 2020-21).

·

Separately Brazil’s Mato Grosso state agency (IMEA) estimated 32 percent of the soybean crop had been harvested, well up from 5% year ago and above a 5-year average of 21 percent.

·

AmSpec January Malaysian palm oil exports were reported at 1.105 million tons. ITS had 1.176 MMT, down 25.6% from 1.581 million during December.

·

Low water levels are hampering shipping along the Rhine River in Germany.

·

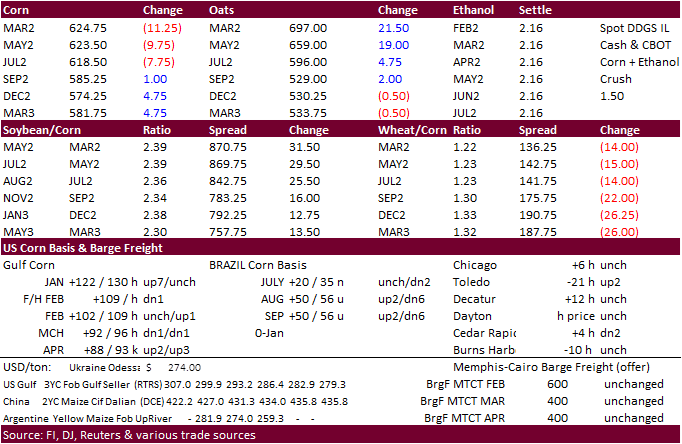

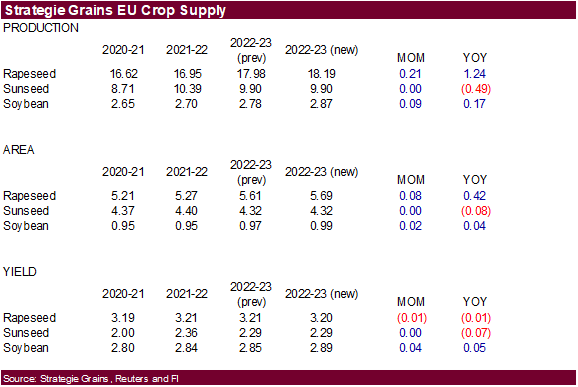

Strategie Grains increased its estimate for the European Union rapeseed crop to 18.2 million tons from 18.0 million previously. 2021 was pegged at 16.95 MMT.

·

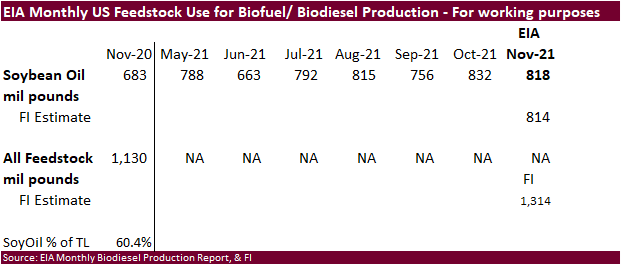

Monthly US biodiesel production showed soybean oil use for biofuel at 818 million pounds, near our expectations.

·

We are using 11 billion pounds for SBO for biofuel use, same as USDA.

Export

Developments

-

Iran’s

SLAL seeks 60,000 tons of soybean meal (combo with barley) on Wednesday for February and March shipment. They bought meal and barley last week.

-

Private

exporters reported sales of 129,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 63,000 metric tons is for delivery during the 2022/2023 marketing year.

Updated

1/28/22

Soybeans

– March $14.25-$15.25

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $390-$440

Soybean

oil – March 61.50-69.00

·

US wheat futures started higher on follow through buying, Egypt stockpiling, and a lower USD, but prices eroded after EU wheat futures dropped by more than 2 percent. Iran is back in for barley and soybean meal.

·

Funds sold a large net 17,000 Chicago wheat contracts.

·

The U.S. hard red winter wheat production areas will get some welcome snow and a little rain during the middle to latter part of this week. Precipitation amounts could be very large bias the eastern winter wheat areas.

·

USDA US all-wheat export inspections as of January 27, 2022 were 361,375 tons, within a range of trade expectations, below 411,011 tons previous week and compares to 414,248 tons year ago. Major countries included Japan for 119,523

tons, Colombia for 65,839 tons, and Thailand for 55,355 tons.

·

Late on Friday Egypt bought 420,000 tons of wheat and did not include French origin.

·

EU March wheat was down 13.25 euros or 4.75% at 266.00 euros/ton.

·

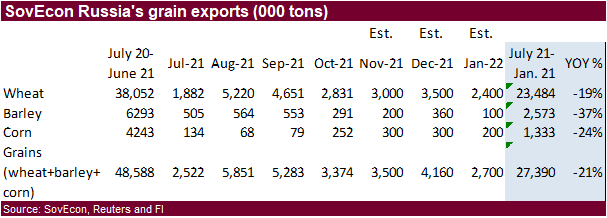

SovEcon estimated the Russian 2021-22 wheat export projection at 34.3 million tons, up 200,000 tons from previous.

-

Iran’s

SLAL seeks 60,000 tons of barley (combo with soybean meal) on Wednesday for February and March shipment. They bought meal and barley last week.

·

Jordan seeks 120,000 tons of wheat on February 1 for July – August shipment.

-

Jordan

seeks 120,000 tons of feed barley on February 2.

Rice/Other

·

Results awaited: South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.