PDF Attached

FI

US soybean complex balance sheets are attached

Private

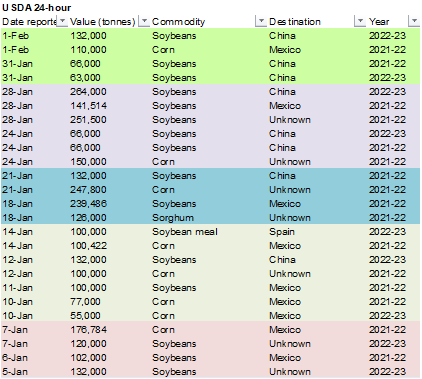

exporters reported the following activity:

-132,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-110,000

metric tons of corn for delivery to Mexico during the 2021/2022 marketing year

New

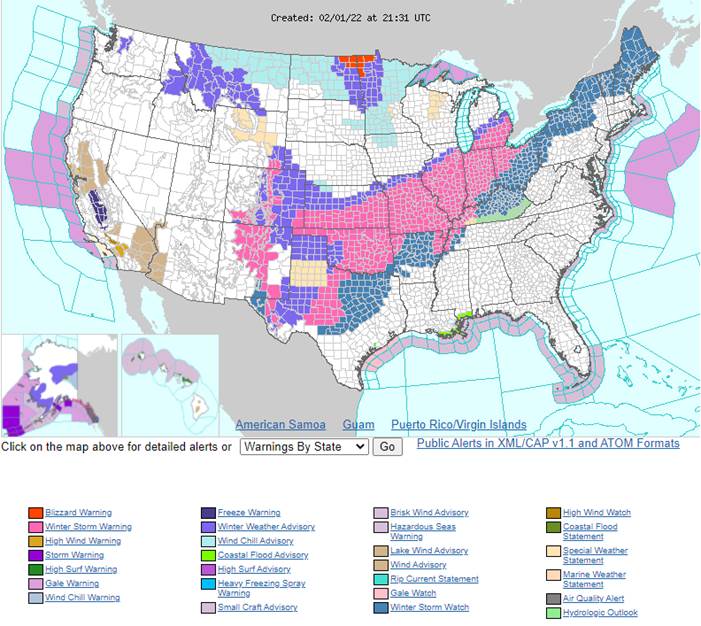

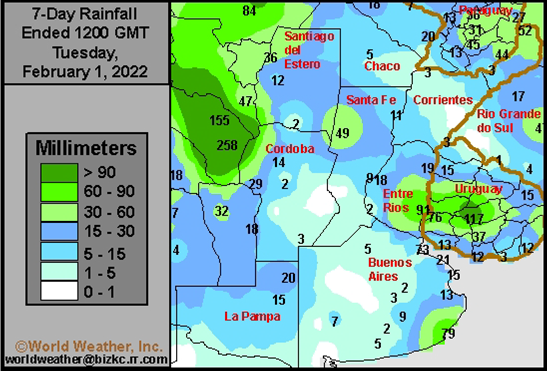

month / new money. Soybeans, soybean products, corn and wheat rallied on strong demand, rising export premiums, downgrades in the SA crops, and a lower USD. The weather outlook did not change much. The US will see a large snowstorm over the next 48 hours

from the Rockies to northeast. Argentina will see a mix of rain and sunshine, but net drying is expected from Sunday through Friday of next week, followed by rain during the second week of the outlook. Scattered rain in Brazil may slow farming activity bias

Minas Gerais, northern Sao Paulo and parts of Goias. Paraguay will get rain late this week. Waves of snow and some rain will impact eastern Europe and the western CIS. Queensland, Australia will get rain today into Thursday.

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

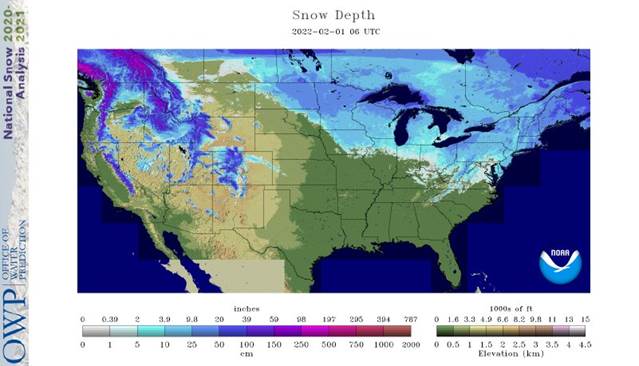

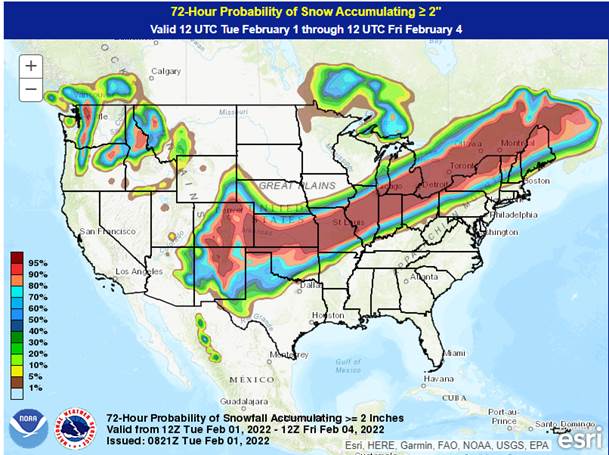

- A

major winter storm is brewing for the United States - Snowfall

of 2-6 inches will occur in hard red winter wheat production areas except in Nebraska where a dusting to 2 inches will result - Eastern

parts of wheat country will get the greatest snow - Snow

will fall more significantly from eastern Oklahoma and northwestern Arkansas through central Missouri to the heart of Illinois, northern Indiana, southeastern Michigan and northern Ohio where 6 to 15 inches and local totals to 20 inches are likely - Freezing

rain, sleet and rain will mix in the Ohio River Valley while heavy rain and some flooding occur in the Tennessee River Basin and northern Delta - Moisture

totals will range from 1.00 to 3.00 inches and local totals to nearly 4.00 inches in a part of the Delta and Tennessee River Basin

- Moisture

totals in the lower and eastern Midwest will vary from 0.50 to 2.00 inches

- Travel

delays, power outages and livestock stress will impact all of these areas - This

storm will move through the northeastern part of the nation late this week as well impacting those areas with similar conditions - Bitter

cold will return to the north-central United States Wednesday into Friday morning with extreme lows Wednesday and Thursday down to the -20 and negative teens with a few readings below -30 in northern Minnesota - Thursday

will be coldest - U.S.

hard red winter wheat areas will benefit from snow with moisture totals of 0.10 to 0.35 inch resulting in the west and up to 0.60 inch in the east

- Concern

is rising over snow free conditions that may occur in Nebraska with bitter cold expected Wednesday and Thursday mornings

- Damage

is only possible and not necessarily probable - Most

of wheat country will have sufficient snow cover to protect crops from the cold conditions of Thursday morning - This

week’s snow event does not represent a trend changer and below average soil moisture will prevail - California

and the intermountain western United States will not be seeing large amounts of moisture in the next two weeks - Snow

accumulations will remain lighter than usual - West

Texas will received some snow and rain Wednesday into Thursday - Moisture

totals in the Rolling Plains will vary from 0.50 to 0.75 inch - Moisture

totals in the High Plains will vary from 0.15 to 0.35 inch with local totals to 0.50 inch

- The

moisture will be good, but much more is needed to improve long term soil conditions for use in the spring - Heavy

rain fell along the central Texas coast overnight with more than 7.00 inches resulting - Rain

will fall across the lower Texas coast later this week with 0.20 to 0.75 inch resulting - North

America temperatures will be cold biased in Canada’s Prairies, the northern U.S. Plains and a part of the far western U.S. during the second week of today’s outlook - Eastern

U.S. temperatures will bounce around over the next two weeks with no dominating temperature anomaly expected leaving energy demand close to normal - South

America weather did not change greatly overnight - Buenos

Aires was advertised a little wetter - Minas

Gerais was advertised wetter - Sao

Paulo has a little less rain in its outlook - None

of these changes will have a market influence - Brazil

weather will be plenty wet over the next two weeks with alternating periods of rain and sunshine for Mato Grosso through Mato Grosso do Sul to Sao Paulo and Parana maintaining a great outlook for Safrinha crops and allowing soybean harvest progress to be made

around the shower activity - Heavy

rain will fall in Minas Gerais, northeastern Sao Paulo and Goias at times in the next couple of weeks, but rainfall over the next several days will not be heavy – just frequent - Temperatures

will be seasonable - Paraguay,

northeastern Argentina and neighboring areas in southern Brazil will receive waves of rain late this week into the weekend followed by nearly a week of drying and then another “opportunity” for rain - The

moisture will help bring relief to the region’s persistent hot, dry, environment that has damaged crops and cut production this summer - Argentina’s

high pressure ridge aloft that was advertised last weekend and disappeared Monday was back into the forecast models today

- Dry

and warmer weather was advertised for Sunday through Friday of next week when the ridge is most dominating - The

ridge is supposed to break down Feb. 13-15 offering rain and thunderstorms, but watch this feature because it may not verify very well - Argentina’s

showers Monday were limited to central parts of the nation and were mostly less than 0.30 inch - Brazil’s

weather overnight included scattered showers and thunderstorms in many areas from Mato Grosso to Sao Paulo and Minas Gerais with resulting rainfall mostly light - Southwestern

Europe and northwestern Africa will continue to receive a limited amount of rain for the next couple of weeks leaving parts of Morocco and northwestern Algeria too dry

- Spain

is also a little dry, but as long as these areas get improved precipitation later in this month and in March wheat and barley performance should go relatively well - Eastern

Europe and the western CIS will continue to receive frequent snow and some rain through the next ten days maintaining moisture abundance and snow cover will remain widespread - There

is no threatening cold for the next two weeks in any of these areas - South

Africa has been and will continue to receive alternating periods of rain and thunderstorms through the next two weeks - Sufficient

rain will fall to maintain good soil moisture for all summer crops over the next two weeks - Temperatures

will be seasonable with a few locations a little cooler biased this week and then a little warmer again next week - Eastern

Australia’s greatest rain will occur later today through Thursday favoring Queensland - Rainfall

of 0.50 to 1.50 inches and local totals over 2.00 inches will result and the moisture will prove extremely beneficial to dryland sorghum, cotton and other crops - Livestock

grazing conditions should improve as well - Central

and southwestern New South Wales rainfall should be limited, but some greater rain will occur near the Queensland border - Net

drying is expected during the late weekend through the first half of next week - Temperatures

will be close to normal with a short term bout of cooler than usual conditions in the southeastern corner of the nation this week - Australia’s

bottom line will be one of improvement for some summer crops because of rain later this week in Queensland; however, a greater amount of rain will be needed to more fully restore soil moisture and water supply for long term crop and farming needs. - Tropical

Cyclone Batsirai was located 236 miles northeast of Port Louis, Mauritius near 17.45 north, 59.7 east at 1500 GMT today

- The

storm was moving west southwesterly at 12 mph while producing maximum sustained wind speeds to 104 mph - Hurricane

force wind was occurring out 30 miles from the center of the storm - Batsirai

will move west southwesterly over the next few days staying north of Mauritius and La Reunion Islands - The

storm will pass close enough to the islands to generate some breezy conditions, a few waves of rain and rough coastal seas, but no damaging conditions are expected as long as the storm takes the prescribed path - Batsirai

will reach Madagascar Friday and Saturday bringing heavy rain and strong wind speeds inland across central and southwestern parts of the nation - Flooding

and some damaging wind is expected - India’s

weather will trend a little wetter in the far north and eastern most portions of the nation during the second half of this week and into the weekend - Sufficient

moisture will occur to support reproducing winter crops, but the area impacted will be limited to the far north, areas near Nepal and from Bihar and Jharkhand and West Bengal through Bangladesh to India’s far Eastern states - Net

drying is expected elsewhere - Eastern

China’s weather will be typical for this time of year over the next couple of weeks with waves of rain and a little snow occurring across the east-central and southeastern parts of the nation favoring the Yangtze River Basin - Rainfall

of 1.00 to 4.00 inches will occur from near the Yangtze River southward to the coast during the next ten days with a few greater amounts possible

- Some

significant snow may impact northern parts of the Yangtze River Basin as well - Local

moisture totals may reach up over 5.00 inches in the interior southeast - Sufficient

moisture is expected to maintain a very good outlook for rapeseed and winter wheat - Local

flooding is possible, but crop damage is not very likely - Limited

moisture in the north is not unusual for this time of year and the soil is favorably rated for the start of spring - There

are no areas of drought in eastern China - Concern

has been rising over the lack of precipitation in Xinjiang this winter and especially the mountains which may cut into spring runoff potential for irrigated summer crops - Middle

East snow cover is more widespread than usual reaching across most of Turkey and into western and northern Iran - Additional

snow is expected over the next ten days - The

moisture will be good for winter crops when warming melts the snow - Ethiopia

has been seasonably dry recently while light showers occur in Uganda and southwestern Kenya - Tanzania

has been and will continue wettest which is normal for this time of year in east-central Africa

- Little

change is expected in these patterns through the next two weeks - West-central

Africa will continue seasonably dry with near normal temperatures for the next ten days - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- No

excessive rainfall is expected - Mainland

Southeast Asia’s weather is expected be a little unsettled for a while with sporadic light showers periodically, but no general soaking rain is expected - Vietnam’s

Central Highlands may get rain next week, but confidence is low - Today’s

Southern Oscillation Index is +3.41 - The

index will move higher during the next seven days - New

Zealand will receive some welcome rain today through Friday of this week easing a long period of below average precipitation

- Follow

up precipitation is possible next week - The

moisture will be welcome and help to raise topsoil moisture - Temperatures

will trend a little warmer than usual - Mexico

will experience slightly cooler than usual weather with a few showers in the east during the coming week - The

remainder of the nation will be dry - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia, Ecuador and Peru rainfall may be greater than usual in the coming week

- Western

Venezuela will soon begin receiving rain once again after a bout of dryness - The

remainder of Venezuela will remain dry

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Tuesday,

Feb. 1:

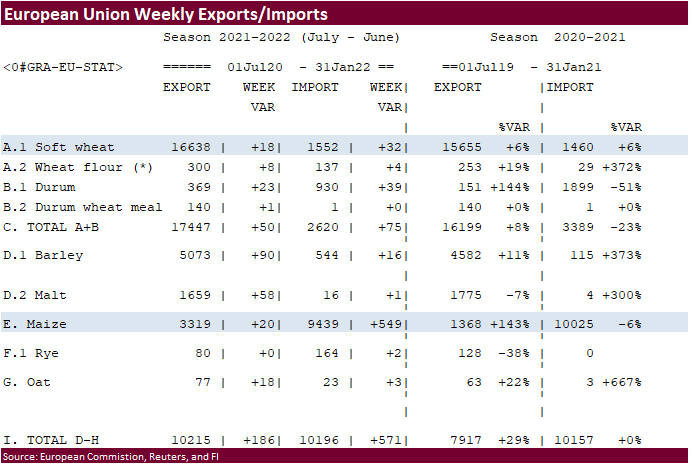

- International

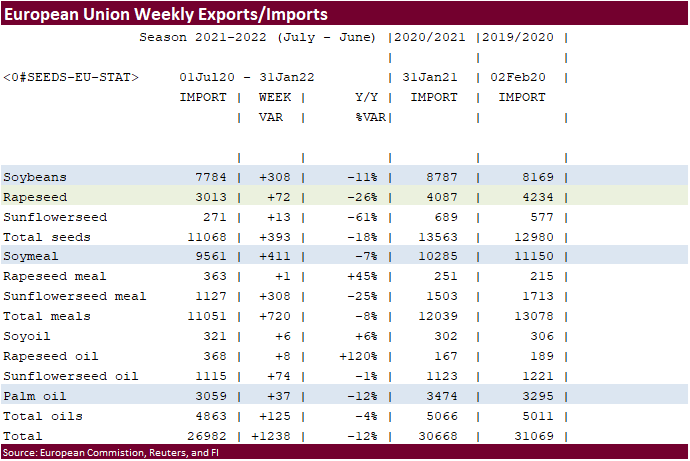

Cotton Advisory Committee releases market outlook report - EU

weekly grain, oilseed import and export data - U.S.

Purdue Agriculture Sentiment - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - Honduras,

Costa Rica monthly coffee exports - Australia

commodity index - India’s

federal budget - New

Zealand global dairy trade auction - ProZerno

holds Mountain Grain Assembly in Sochi, Russia, Feb. 1-4 - HOLIDAY:

China, Hong Kong, Malaysia, Indonesia, South Korea, Singapore, Vietnam

Wednesday,

Feb. 2:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

China, Hong Kong, Malaysia, South Korea, Singapore, Vietnam

Thursday,

Feb. 3:

- FAO

World Food Price Index and grains supply/demand outlook - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price - Port

of Rouen data on French grain exports - HOLIDAY:

China, Hong Kong, Vietnam

Friday,

Feb. 4:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

China, Vietnam

Source:

Bloomberg and FI

Brazil’s

selected commodity export data for the month of January.

Commodity

January 2022 January 2021

CRUDE

OIL (TNS) 4,606,830 4,864,085

IRON

ORE (TNS) 25,210,769 28,926,440

SOYBEANS

(TNS) 2,469,702 49,498

CORN

(TNS) 2,822,658 2,346,303

GREEN

COFFEE(TNS) 178,093 221,966

SUGAR

(TNS) 1,363,426 2,002,795

BEEF

(TNS) 140,543 107,327

POULTRY

(TNS) 317,727 268,688

PULP

(TNS) 1,628,515 1,229,885

Source:

Brazil AgMin and Reuters

2021/22

Brazil Soybean Estimate Lowered 4.0 mt to 130.0 Million

2021/22

Argentina Soybean Estimate Lowered 1.0 mt to 42.0 Million

2021/22

Paraguay Soybean Estimate Unchanged at 6 Million Tons

2021/22

Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 51.0 Million Tons

Corn

·

Another strong session for corn in large part to following higher soybeans. News was light. USDA announced 110,000 tons of 2020-21 corn was sold to Mexico. Gulf corn basis is strong on logistical issues, but we don’t see a major

downturn in the pace of corn inspections unless soybeans take precedence. Corn and soybean exports at the Gulf, we are told, have been spoken for through the end of this month.

·

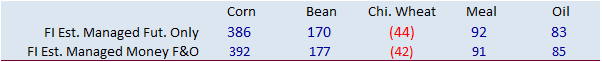

Funds bought an estimated net 12,000 corn contracts.

·

StoneX lowered their Brazil first corn crop estimate to 25.3 million tons from 26.8 million previous. In January Brazil Conab estimated the first crop at 24.787 million tons, down from 29.066 million for December and compares

to 24.722 million for 2020-21. Conab sees the total crop at 112.9 million tons versus 87.1 MMT last year.

·

For the purpose of the USDA report

next week, we see them lowering Brazil corn production from 115 MMT to 113 million tons, and Argentina from 54.0 MMT to 53.0 million. That’s a 3 million ton reduction for those both of those countries.

·

Anec: Brazil February corn exports are seen at 447,404 tons.

·

Conab sees Brazil’s first corn crop 11 percent harvested, a couple points above year ago.

·

A Bloomberg poll looks for weekly US ethanol production to be down 9,000 barrels to 1.026 million (1005-1050 range) from the previous week and stocks up 232,000 barrels to 24.708 million.

·

We estimate US corn for ethanol use at 5.425 billion bushels, 100 million above USDA. Our estimate is unchanged from late December.

Export

developments.

-

Turkey

seeks 325,000 tons of corn on February 8. -

Private

exporters reported the following activity: 110,000 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year

Updated

1/28/222

March

corn is seen in a $6.10 to $6.55

December

corn is seen in a wide $5.25-$7.00 range

·

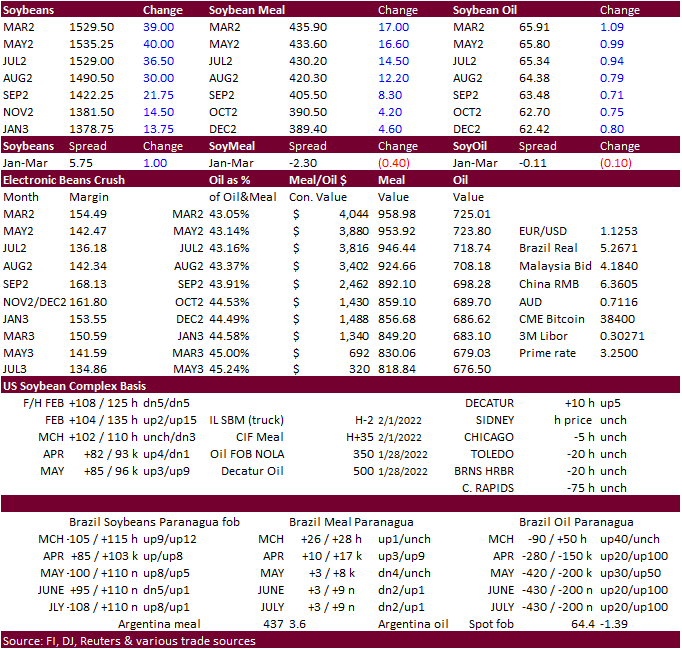

CBOT soybeans rallied again on shrinking SA soybean production. New fund long positioning with the first day of the month added to the strength.

March

soybeans rallied above $15.25/bu, highest since June. This is justified in our opinion. We are looking at a US carryout around 230 million bushels.

·

Funds today bought an estimated net 18,000 soybeans, bought 10,000 soybean meal and bought 4,000 soybean oil.

·

CIF market was again very firm led by rising Brazil soybean and soybean oil export premiums.

·

USDA reported China bought 132,000 tons of new-crop soybeans.

·

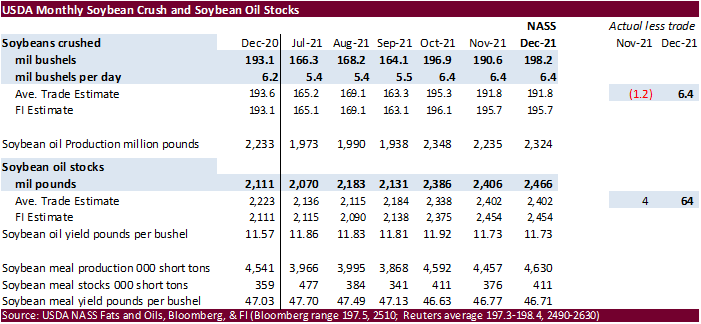

USDA’s NASS crush for December was a record and supportive for soybeans.

·

CBOT soybean meal was very strong on meal/oil spreading and recent increase in global soybean meal demand. The March through September soybean meal contracts all made new contract highs. Two weeks ago, we would not of thought

of that occurring.

·

Soybean oil started lower but found support after soybeans made several legs higher and energies paired some losses.

·

Central Argentina will dry down through the end of this workweek and again next week.

Source:

World Weather Inc.

·

Soybean and Corn Advisor lowered their estimate of the Brazil soybean crop by 4 million tons to 130MMT and Argentina by 1 million tons to 42MMT. USDA official is at 139 and 46.5 million, respectively.

·

StoneX lowered their Brazil soybean estimate to 126.5 million tons from 134 million previous.

·

For the purpose of the USDA report

next week, we see them lowering Brazil soybean production from 139 MMT to 132 million tons, and Argentina from 46.5 MMT to 43.0 million. Paraguay is seen lowered from 8.5 million tons to 7.0 million. That’s a 12 million ton reduction for those three countries.

·

USDA could lower China

imports by 2 million tons to 98 million given the slow pace of imports during the first four months of the October-September crop year. US exports could be upward revised 100 million bushels )2.7 million tons) to 2.150 billion, or more. We are using 2.150

billion bushels for US soybean exports, which might be a conservative amount.

·

In our opinion, we think the trade is closer to 130 million tons for Brazil, 42 MMT for Argentina, and 6.5 million tons for Paraguay.

·

Anec: Brazil February soybean exports are seen at 9.9MMT.

·

Conab reported 12 percent of the Brazil soybean crop harvested, well above last year when it was delayed. Several states are running ahead of normal. About a quarter of the crop was mature.

·

Producers across the US WCB have been good sellers of soybeans over the past several weeks. CBOT crush margins remain favorable and we still think the US will crush at least 15 million more bushels than USDA’s 2.190 billion estimate.

But for next week USDA may leave its crush estimate unchanged.

·

Malaysian Palm Oil Council sees palm oil export demand increasing for the UAE. In a press statement, they said total trade between the UAE and Malaysia increased by 10.2% between 2020 and 2021.

·

We made no changes to our crush estimate, already about 15 million bushels above USDA.

-

Private

exporters reported the following activity: 132,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year -

Iran’s

SLAL seeks 60,000 tons of soybean meal (combo with barley) on Wednesday for February and March shipment. They bought meal and barley last week.

Updated

2/1/22

Soybeans

– March $14.50-$15.75 (up 25, up 50 cents)

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $400-$460 (up $10, up $20)

Soybean

oil – March 62.50-69.00

(up 100, unch)

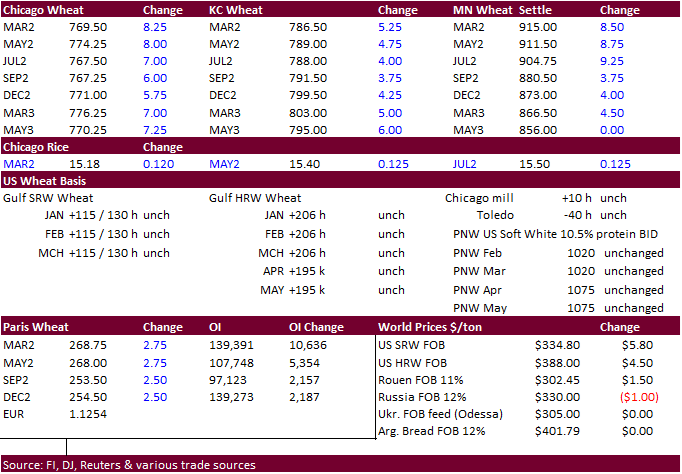

·

US wheat futures traded higher on technical buying and lower USD, very strong soybean futures, despite easing concerns over Black Sea trade disruptions and favorable weather for major global wheat producers.

·

Ukraine, Russia and Belarus saw additional snow. The region has little exposure to winter kill threat.

·

Funds bought an estimated net 4,000 Chicago wheat contracts.

·

March milling wheat settled up 3.25 euros, or 1.2%, at 269.25 euros ($302.58) a ton.

·

The U.S. hard red winter wheat production areas will get some welcome snow and a little rain during the middle to latter part of this week. Precipitation amounts could be very large bias the eastern winter wheat areas.

NASS:

Flour Milling Products

All

wheat ground for flour during the fourth quarter 2021 was 235 million bushels, up 2 percent from the third quarter 2021 grind of 231 million bushels and up 1 percent from the fourth quarter 2020 grind of 231 million bushels. Fourth quarter 2021 total flour

production was 108 million hundredweight, up 2 percent from the third quarter 2021 and up 1 percent from the fourth quarter 2020. Whole wheat flour production at 5.26 million hundredweight during the fourth quarter 2021 accounted for 5 percent of the total

flour production. Millfeed production from wheat in the fourth quarter 2021 was 1.70 million tons. The daily 24-hour milling capacity of wheat flour during the fourth quarter 2021 was 1.59 million hundredweight.

2″+

over the next 72-hours

·

Jordan saw three participants for 120,000 tons of wheat for July – August shipment. They bought 60,000 tons of hard milling wheat, optional origin, at an estimated $326.00 a ton c&f for shipment in the second half of August.

·

Tunisia seeks 75,000 tons of durum wheat, 100,000 tons of soft wheat and 75,000 tons of feed barley on Feb. 2, for Feb-Apr shipment.

·

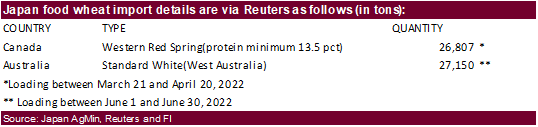

Japan seeks 53,957 tons of wheat from Canada and Australia later this week.

-

Iran’s

SLAL seeks 60,000 tons of barley (combo with soybean meal) on Wednesday for February and March shipment. They bought meal and barley last week.

-

Jordan

seeks 120,000 tons of feed barley on February 2.

Rice/Other

·

(Bloomberg) — Cotton futures touched a fresh decade high Monday, with a global deficit of the fiber squeezing mills holding huge short positions. The March contract climbed as much as 3.2% to $1.2771 a pound in New York, the

highest for a most-active contract since June 2011. Its rare premium over May futures has risen 58% this year and is 275 times more than a year ago.

·

Bloomberg – Honduras Coffee Exports Climbed 12% in January, Institute Says

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.