PDF Attached includes our updated US all-wheat balance sheet

Volatile

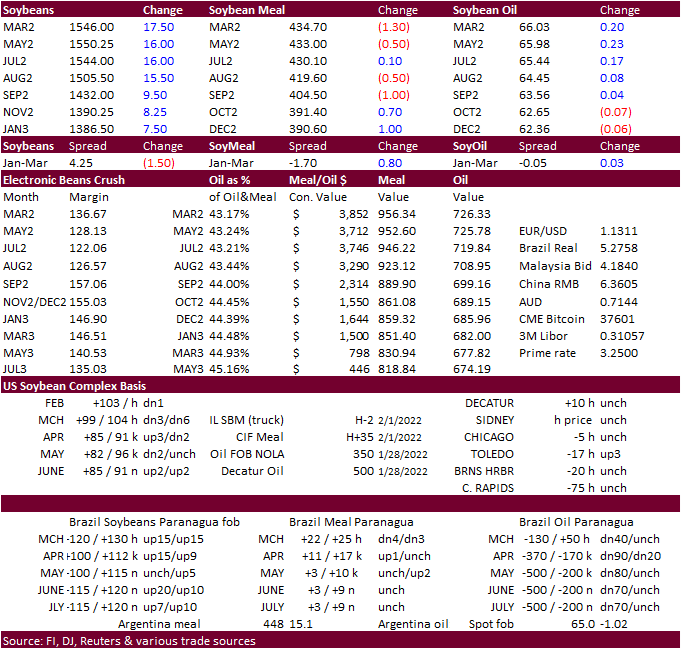

trade today in the US agriculture markets with soybeans higher, meal mixed, and soybean oil up in the front months. Corn, Chicago wheat and KC wheat saw an outside day lower.

![]()

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

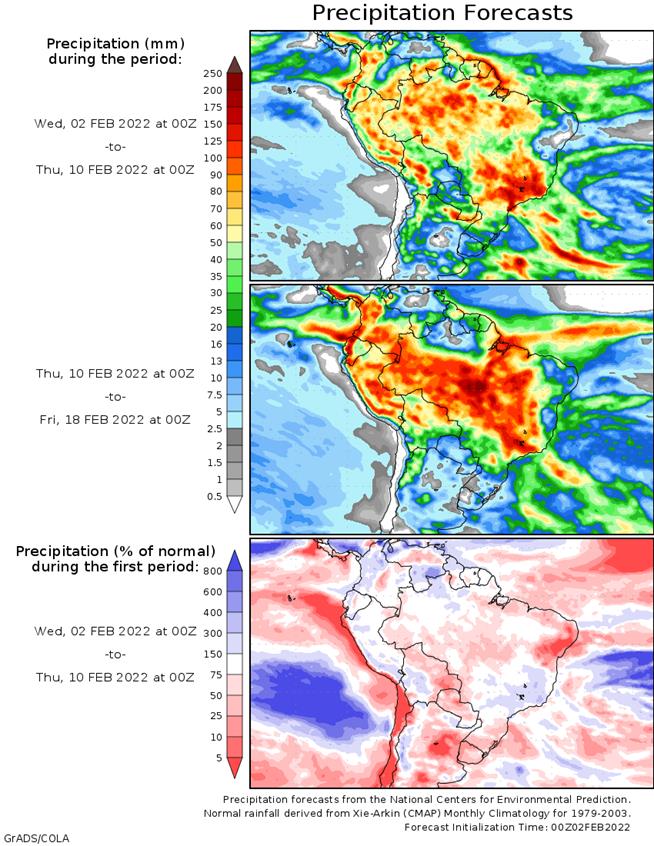

- Argentina’s

ridge of high pressure advertised for next week is stronger and more dominating in this morning’s forecast relative to that of Tuesday, but the evening and overnight forecast models have already been trending in this direction - The

advertised ridge will verify, and it matches well with what was predicted by our Trend Model a few weeks ago - The

impact will be to dry out Argentina and return warmer temperatures after Saturday and the ridge will be influential for a week to ten days - Argentina

rainfall Tuesday and early today was minimal and precipitation through the weekend is expected to remain restricted in central parts of the nation - Somewhat

greater rain will impact far southern and northeastern Argentina during this same period of time.

- Rain

in Buenos Aires, southern Cordoba and far southwestern Santa Fe will be sufficient to maintain good subsoil moisture and enough to bolster topsoil moisture - That

should allow crops in these areas to develop well during the ridge of high pressure next week and during the weekend - Northeastern

Argentina’s cotton and minor corn and soybean areas in northeastern Chaco, Formosa and Corrientes will get some very important rain late Thursday into Sunday morning - The

moisture will bring a needed break from hot, dry, conditions - Cotton

will benefit from the moisture more than other crops - The

heart of Chaco may not get the greatest rain and will have some ongoing need for greater rain - Hot

and dry weather will be quick to resume next week and prevail into mid-month - Paraguay

will get some needed rain late this week and especially during the weekend to ease the nation from serious drought and crop stress - The

rain will be welcome and might improve some Safrinha crops, but it will come too late after weeks of hot, dry, weather have already taken a serious toll on crops - Argentina’s

ridge of high pressure next week will bring back dry and warm to hot weather to Paraguay and neighboring areas - Southern

Brazil crops from Rio Grande do Sul to western Mato Grosso do Sul and western Parana will also get some beneficial rain late this week and during the weekend offering some relief - Dry

biased weather will be quick to resume next week and prevail into mid-month - A

short term benefit to crop development is expected - Each

of these areas will need more rain soon, but will experience drier and warmer biased weather for a while next week and into mid-month - Frequent

rain in center west through center south Brazil is still going to cause some disruption to farming activity periodically - Soybean

harvest progress and Safrinha corn and cotton planting will advance around the precipitation - Progress

should be made from Mato Grosso to Parana and Sao Paulo since rain frequency and intensity in those areas should be better than in Minas Gerais or Goias - Too

much rain may fall in Minas Gerais and parts of Goias over the next week to ten days resulting in more flooding - Too

much cloudiness may negatively impact coffee and sugarcane crops as well as grain and oilseeds - Some

concern about soybean quality is expected - A

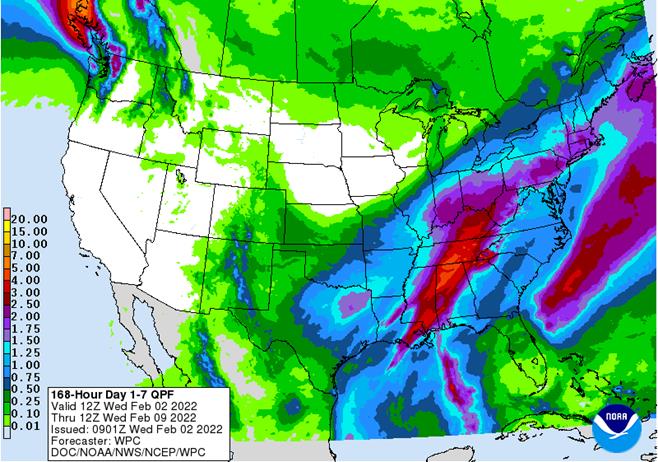

major winter storm is under way in the United States - Snowfall

of 1-4 inches will occur in hard red winter wheat production areas except in Nebraska and north-central Kansas where a dusting to 2 inches will result - Some

areas in Nebraska may be snow free - Eastern

parts of wheat country will get the greatest snow - Snow

will fall more significantly from eastern Oklahoma, north-central Texas and northwestern Arkansas through central Missouri to the heart of Illinois, northern Indiana, southeastern Michigan and northern Ohio where 6 to 15 inches are likely - Freezing

rain, sleet and rain will mix from central Texas through the Ohio River Valley while heavy rain and some flooding occur in the Tennessee River Basin and northern Delta - Moisture

totals will range from 1.00 to 3.00 inches and local totals to nearly 4.00 inches in a part of the Delta and Tennessee River Basin

- Moisture

totals in the lower and eastern Midwest will vary from 0.50 to 2.00 inches

- Travel

delays, power outages and livestock stress will impact all of these areas - This

storm will move through the northeastern part of the nation late this week as well impacting those areas with similar conditions - Bitter

cold will return to the north-central United States into Friday morning with extreme lows Wednesday and Thursday down to the -20s and negative teens with a few readings below -30 in northern Minnesota - Thursday

will be coldest - U.S.

hard red winter wheat areas will benefit from snow with moisture totals of 0.10 to 0.30 inch resulting in the west and up to 0.60 inch in the east

- Concern

is rising over snow free conditions that may occur in Nebraska with bitter cold expected Thursday morning

- Damage

is only possible and not necessarily probable - Parts

of South Dakota and Nebraska will see negative and positive single digit lows Thursday with little to no snow on the ground - Most

of hard red winter wheat country will have sufficient snow cover to protect crops from the cold conditions of Thursday morning - This

week’s snow event does not represent a trend change and below average soil moisture will prevail - California

and the intermountain western United States will not be seeing large amounts of moisture in the next two weeks - Snow

accumulations will remain lighter than usual - West

Texas will receive some snow today into Thursday - Moisture

totals in the Rolling Plains will vary from 0.50 to 0.75 inch - Moisture

totals in the High Plains will vary from 0.10 to 0.35 inch - The

moisture will be good, but much more is needed to improve long term soil conditions for use in the spring - Rain

along the lower Texas coast has been reduced through the weekend with a trace to 0.25 inch expected - South

Texas may not see much precipitation of significance for a while - North

America temperatures will trend warmer than usual in the northwestern Plains and western Canada Prairies over the coming week while below normal in much of the southern Plains, Delta and Midwest - Temperatures

next week will be cooler than usual in the northern Plains and northern Midwest and more seasonable to slightly warmer biased in the southern Plains.

- Eastern

U.S. temperatures will bounce around over the next two weeks with no dominating temperature anomaly expected leaving energy demand close to normal - Southwestern

Europe and northwestern Africa will continue to receive a limited amount of rain for the next couple of weeks leaving parts of Morocco and northwestern Algeria too dry

- Spain

is also a little dry, but as long as these areas get improved precipitation later in this month and in March wheat and barley performance should go relatively well - Eastern

Europe and the western CIS will continue to receive frequent snow and some rain through the next ten days maintaining moisture abundance and snow cover will remain widespread - There

is no threatening cold for the next two weeks in any of these areas - South

Africa has been and will continue to receive alternating periods of rain and thunderstorms through the next two weeks - Sufficient

rain will fall to maintain good soil moisture for all summer crops over the next two weeks - Temperatures

will be seasonable with a few locations a little cooler biased this week and then a little warmer again next week - Eastern

Australia’s greatest rain will occur into Thursday favoring Queensland - Rainfall

of 0.50 to 1.50 inches and local totals over 2.00 inches will result, and the moisture will prove extremely beneficial to dryland sorghum, cotton and other crops - Livestock

grazing conditions should improve as well - Central

and southwestern New South Wales rainfall should be limited, but some greater rain will occur near the Queensland border - Net

drying is expected during the late weekend through the first half of next week - Temperatures

will be close to normal with a short term bout of cooler than usual conditions in the southeastern corner of the nation this week - Australia’s

bottom line will be one of improvement for some summer crops because of rain later this week in Queensland; however, a greater amount of rain will be needed to more fully restore soil moisture and water supply for long term crop and farming needs. - Tropical

Cyclone Batsirai was located 80 miles north northwest of Port Louis, Mauritius near 19.0 south, 56.3 east at 1500 GMT today

- The

storm was moving west southwesterly at 11 mph while producing maximum sustained wind speeds to 144 mph - Hurricane

force wind was occurring out 55 miles from the center of the storm - Batsirai

will move west southwesterly over the next few days staying north of Mauritius and La Reunion Islands - The

storm will pass close enough to the islands to generate some windy conditions, a few waves of rain and rough coastal seas, but no damaging conditions are expected as long as the storm takes the prescribed path - Batsirai

will reach Madagascar Friday and Saturday bringing heavy rain and strong wind speeds inland across central and southwestern parts of the nation - Flooding

and some damaging wind are expected - India’s

weather will trend a little wetter in the far north and eastern most portions of the nation today into Saturday - Sufficient

moisture will occur to support reproducing winter crops, but the area impacted will be limited to the far north, areas near Nepal and from Bihar and Jharkhand and West Bengal through Bangladesh to India’s far Eastern states - Net

drying is expected elsewhere - Eastern

China’s weather will be typical for this time of year over the next couple of weeks with waves of rain and a little snow occurring across the east-central and southeastern parts of the nation favoring the Yangtze River Basin - Rainfall

of 1.00 to 4.00 inches will occur from near the Yangtze River southward to the coast during the next ten days with a few greater amounts possible

- Some

significant snow may impact northern parts of the Yangtze River Basin as well - Local

moisture totals may reach up over 5.00 inches in the interior southeast - Sufficient

moisture is expected to maintain a very good outlook for rapeseed and winter wheat - Local

flooding is possible, but crop damage is not very likely - Limited

moisture in the north is not unusual for this time of year and the soil is favorably rated for the start of spring - There

are no areas of drought in eastern China - Concern

has been rising over the lack of precipitation in Xinjiang this winter and especially the mountains which may cut into spring runoff potential for irrigated summer crops - Middle

East snow cover is more widespread than usual reaching across most of Turkey and into western and northern Iran - Some

snow melt is expected - The

moisture will be good for winter crops when warming melts the snow - Ethiopia

has been seasonably dry recently while light showers occur in Uganda and southwestern Kenya - Tanzania

has been and will continue wettest which is normal for this time of year in east-central Africa

- Little

change is expected in these patterns through the next two weeks - West-central

Africa will continue seasonably dry with near normal temperatures for the next ten days - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- No

excessive rainfall is expected - Mainland

Southeast Asia’s weather is expected be a little unsettled for a while with sporadic light showers periodically, but no general soaking rain is expected - Vietnam’s

Central Highlands may get rain next week, but confidence is low - Today’s

Southern Oscillation Index is +3.81 - The

index will move higher during the next seven days - New

Zealand will receive some welcome rain today through the weekend easing a long period of below average precipitation

- Follow

up precipitation is possible next week - The

moisture will be welcome and help to raise topsoil moisture - Temperatures

will trend a little warmer than usual - Mexico

will experience slightly cooler than usual weather with a few showers in the east during the coming week - A

band of rain will impact the interior northwest from western Durango to southwestern Chihuahua

- The

remainder of the nation will be dry - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia, Ecuador and Peru rainfall may be greater than usual in the coming week

- Western

Venezuela will soon begin receiving rain once again after a bout of dryness - The

remainder of Venezuela will remain dry

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Wednesday,

Feb. 2:

- EIA

weekly U.S. ethanol inventories, production - HOLIDAY:

China, Hong Kong, Malaysia, South Korea, Singapore, Vietnam

Thursday,

Feb. 3:

- FAO

World Food Price Index and grains supply/demand outlook - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price - Port

of Rouen data on French grain exports - HOLIDAY:

China, Hong Kong, Vietnam

Friday,

Feb. 4:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

China, Vietnam

Source:

Bloomberg and FI

Corn

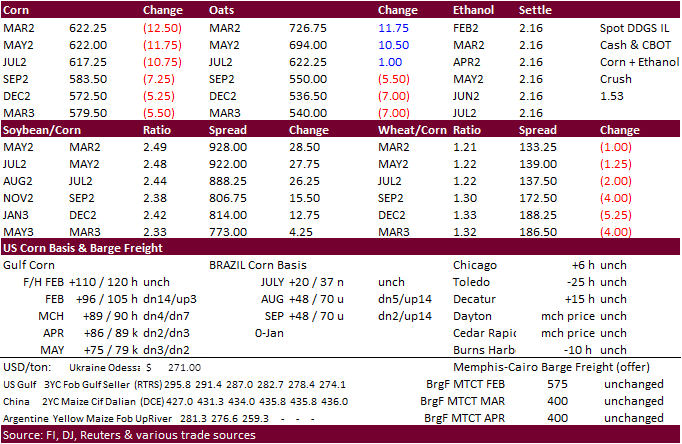

·

Corn started higher and closed sharply lower led by the front months after EIA reported a large increase in US weekly ethanol stocks. A large portion of the Midwest, bias ECB, is seeing a large snow event, with exception of the

southern areas that are under ice/rainfall advisories. Some areas across the “I” states of IL and IN (not IA) will see 15 plus inches of snow (the poor person’s fertilizer).

·

Funds sold an estimated net 15,000 corn contracts.

·

The USDA Broiler report showed eggs set in the US up 3 percent and chicks placed down slightly from a year ago. Cumulative placements from the week ending January 8, 2022 through January 29, 2022 for the United States were 740

million. Cumulative placements were down 2 percent from the same period a year earlier.

·

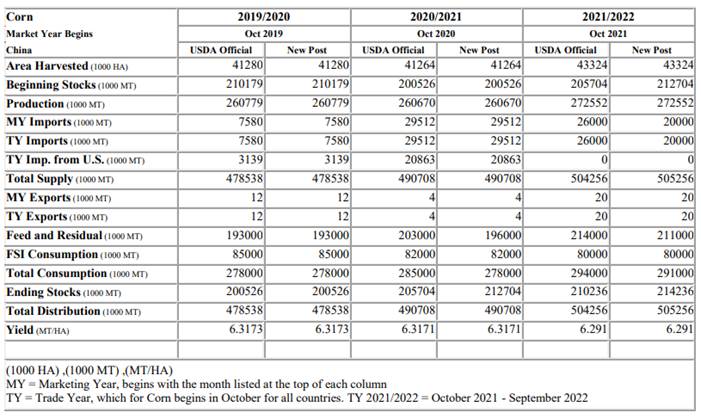

USDA Attaché on China corn:

-Production

272.6 million tons, up 11.9 MMT from 2020-21

-Imports

of corn projected at 20 MMT, 6 MMT below USDA official

-2021-22

barley and corn imports are expected to be down from 2020-21, while sorghum is expected to increase

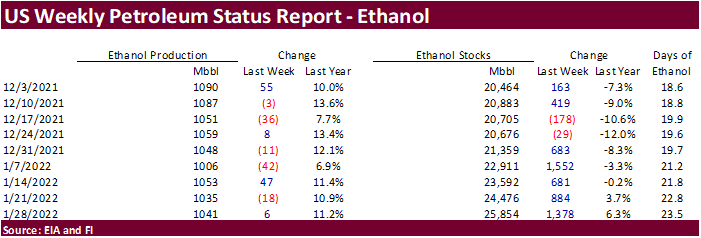

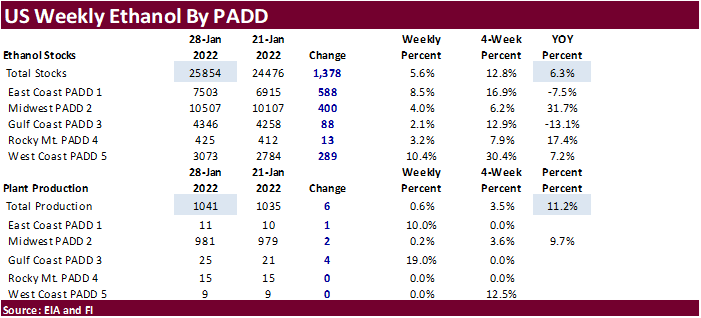

Weekly

US ethanol production

increased 6,000 barrels per day to 1.041 million. Traders were looking for a 9,000 barrel decrease. Stocks increased a large 1.378 million barrels to 25.854 million, highest since April 24, 2020. Traders were looking for an increase of 232,000 barrels. US

gasoline demand last week slipped 279,000 barrels to 8.226 million, a two-week low. Logistic problems and the recent increase in Covid-19 cases keeping people at home likely contributed to the build in ethanol stocks.

Crop

Insurance Decisions and Risk in 2022 – University of IL

Schnitkey,

G., N. Paulson, K. Swanson, C. Zulauf and J. Baltz. “Crop Insurance Decisions and Risk in 2022.”

farmdoc

daily

(12):13, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 1, 2022.

https://farmdocdaily.illinois.edu/2022/02/crop-insurance-decisions-and-risk-in-2022.html

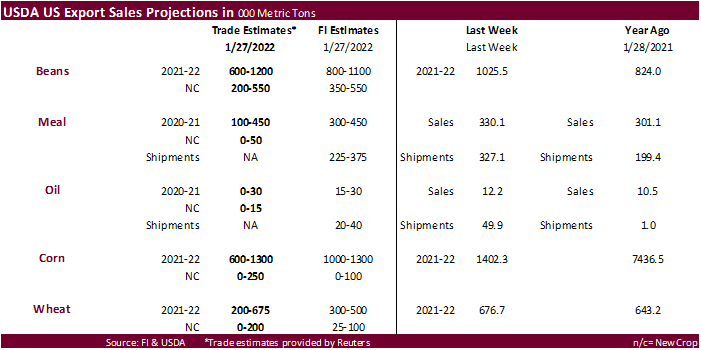

Export

developments.

·

None reported

Updated

2/2/222

March

corn is seen in a $5.95 to $6.55 (down 15, unch)

December

corn is seen in a wide $5.25-$7.00 range

·

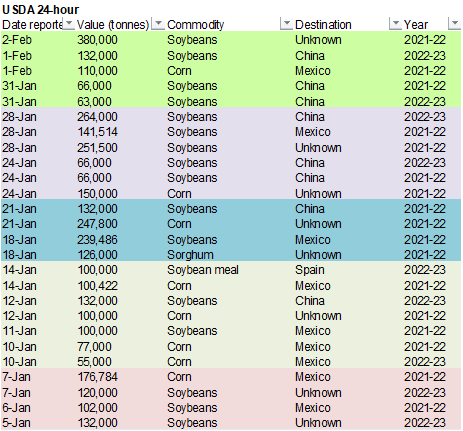

CBOT soybeans traded higher led by bull spreading that lifted the March contract 16.75 cents higher, May 15.25 cents higher and July 14.75 higher. USDA under its 24-hour reporting system announced 380,000 tons of soybeans were

sold to unknown. A combined 512,000 soybeans (old and new) were announced so far since Monday.

·

Soybean meal ended mixed on light profit taking. Soybean oil ended higher in the front 4 months. March crush fell 18.25 cents to $.3850.

·

Funds bought an estimated net 9,000 soybeans, sold 1,000 soybean meal and bought 1,000 soybean oil.

·

The USD was down about 45 points as of 2:30 pm CT.

·

Conab is due out February 10 and we look for them to be at the top end of a wide range of Brazilian soybean crop estimates.

·

Reuters noted two more consultants lowered their Brazil soybean production estimates:

-Cogo

125 million tons, down from a previous forecast of 131 million tons and 14.2% below its initial projection for this season.

-Datagro

130 million tons, versus 142.05 million in its December projection and 144.06 million tons initially forecast.

·

Results are awaited in Iran seeking soybean meal and corn.

·

Malaysia will return from holiday on Thursday while China will be closed for the remainder of the week.

·

Bloomberg: Thailand Cuts Biodiesel Blending Ratio to 5% as Palm Oil Soars from 7% from February 5 to March 31.

-

USDA

24-hour: Private exporters report sales of 380,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year. -

Results

awaited: Iran’s SLAL seeks 60,000 tons of soybean meal (combo with barley) on Wednesday for February and March shipment. They bought meal and barley last week.

Updated

2/1/22

Soybeans

– March $14.50-$15.75

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $400-$460

Soybean

oil – March 62.50-69.00

·

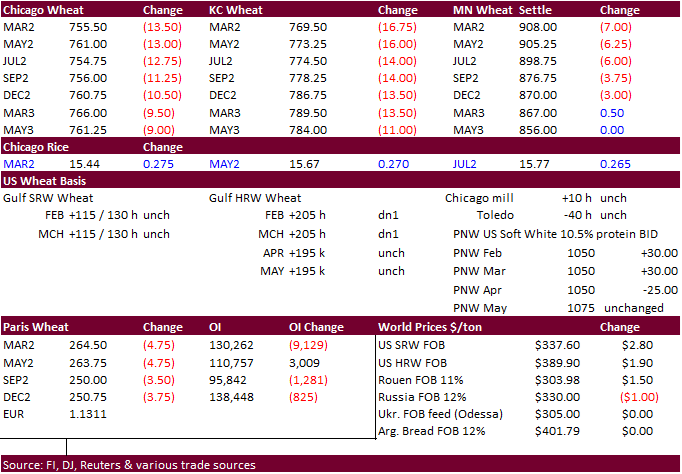

US wheat futures started higher on a lower USD but general commodity selling and weakness in corn triggered profit taking. Wheat was also under pressure from slow global export developments, fund selling, and favorable global

weather. The US is also seeing a large precipitation event across parts of HRW and SRW wheat country.

·

EU March wheat was down 4.75 euros at 264.25 euros.

·

Funds sold an estimated net 10,000 Chicago wheat contracts.

·

Ukraine exported 38.6 million tons of grain so far this season (July-June), up 31.6% from year earlier. This included 17 million tons of wheat, 5.5 million tons of barley and 15.6 million tons of corn. The crop-year target for

exports included 24.5 million tons of wheat, 30.9 million of corn and 5.2 million of barley. Two Ukraine Black Sea ports restricted grain loading because of poor weather.

·

Low water levels on the Rhine River in Germany continue to hamper shipping, even after seeing levels tick up after rain fell this week.

·

India is looking to buy 1 million tons of potash from Belarus in rupees. This comes after the EU and US sanctioned selected companies in Belarus, preventing euro/USD trades. India heavily relies on potash imports and about one-fifth

of it normally comes from Belarus.

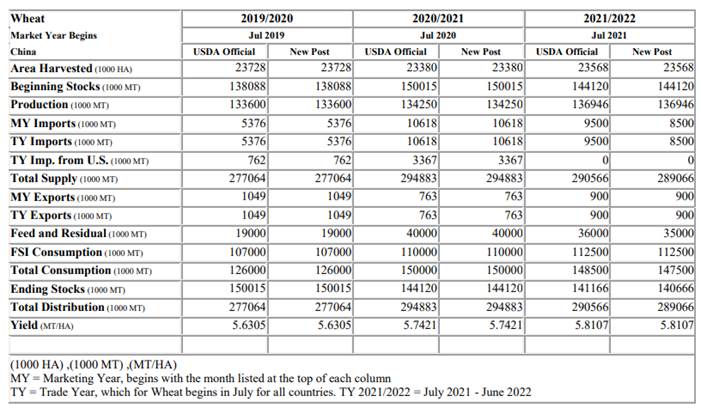

USDA

Attaché on China wheat

·

Tunisia’s state grains agency bought 100,000 tons of soft wheat, 75,000 tons of durum and 75,000 tons of barley, all optional origin. The soft wheat was sought in four 25,000 ton consignments for shipment between March 20 and

April 25, depending on origin supplied. One wheat consignment was bought at $350.64, another at $348.69, one at $350.69 and $350.77. Durum was for shipment between Feb. 25 and March 30, bought at $643, $646 and $649 all per ton c&f. The barley was sought

in three 25,000 ton consignments for shipment between March 5 and April 15, at $342, $332.69 and $339.70 all per ton c&f. (Reuters)

·

Bangladesh seeks 50,000 tons of wheat set to close February 14.

·

Jordan saw three offers for 120,000 tons of barley.

-

Results

awaited: Iran’s SLAL seeks 60,000 tons of barley (combo with soybean meal) on Wednesday for February and March shipment. They bought meal and barley last week.

·

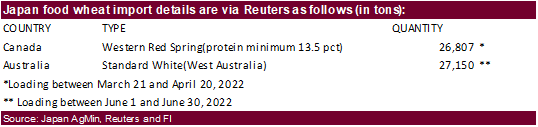

Japan seeks 53,957 tons of wheat from Canada and Australia later this week.

Rice/Other

·

Thailand estimated 2022 rice shipments at 7 million tons, a 15 percent increase from 2021 as paddy production is forecast to expand 18 percent to 19.5 million.

Updated

2/2/22

Chicago

March $7.25 to $8.30 range (down 25, unchanged)

KC

March $7.45 to $8.55 range (down 20, unchanged)

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.