PDF Attached

![]()

The

weather forecast turned slightly unfavorable for the Delta, unchanged for the US Midwest & Great Plains, improved for Brazil and unchanged for Argentina. The southeastern Great Plains will see lingering precipitation today before trending drier this weekend.

The Midwest will be mostly dry through the end of the week. Argentina will see rain today across Cordoba, Buenos Aires, and southern Santa Fe, before turning drier this weekend. Argentina will trend drier next week. Brazil will see rain bias central and

southern areas but also slow soybean harvest and second crop corn planting progress.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

No

major changes occurred overnight -

Argentina

rainfall overnight occurred from Cordoba to Santiago del Estero and also from central through south-central Buenos Aires -

Most

other areas were dry -

The

rain was good for maintaining status quo in soil moisture except in central Buenos Aires there a small pocket of moderate rain likely bolstered topsoil moisture -

Northern

Argentina was very warm to hot Wednesday due to drought with highs in the upper 90s to 102 degrees Fahrenheit -

Temperatures

elsewhere were more seasonable with a slight cooler than usual bias in the wetter areas from southern Cordoba into Buenos Aires where highs were in the 70s

-

Rain

in Argentina today will end and the next ten days will be dry for most of the nation

-

Any

rain that falls will be lost to evaporation within a short period of its occurrence -

There

is some potential for rain in Buenos Aires early to mid-week next week, but it will be too light for a lasting increase in soil moisture

-

Rain

changes in Argentina may improve near mid-month, but not before then -

Argentina’s

bottom line is still one of great concern for all crops in northeastern portions of the nation including Formosa, Chaco, Corrientes, northern Entre Rios and northeastern Santa Fe where little to no rain is expected for ten days to nearly two weeks and the

ground is already critically dry. Recent rain in western parts of the nation should carry crops through the first week of dry weather, but rain will be needed after that to limit crop stress and help maintain a better outlook for crop development. The second

half of February weather will be of critical importance to Argentina crops because of the drying coming in the next ten days and the low soil moisture already present in the northeast part of the nation.

-

Western

Rio Grande do Sul, Brazil will also be dry for at least the next ten days – like Argentina and crop stress will be rising -

Recent

weather from Mato Grosso do Minas Gerais and a part of Sao Paulo has been less wet with some net drying and some warmer temperatures which has helped to begin firming the topsoil for faster soybean and other early season crop maturation -

Drying

will continue into the weekend for some areas and that will translate into a better environment for early season crop harvesting and Safrinha corn and cotton planting -

Brazil’s

greatest rainfall in this coming week will be from Parana and parts of western and southern Sao Paulo to Mato Grosso do Sul where soil moisture will be either lifted to the point of saturation or maintained at that level -

Fieldwork

will be stalled for a while because of the increasing rainfall -

The

weekend will be wettest in this corridor -

Brazil

rainfall next week and on into mid-month should be greatest from center west into center south production areas once again and that will translate into a very good environment for ongoing crop development -

The

wetter bias may slow early season soybean maturation and harvest progress -

Brazil’s

bottom line is a little better than it has been with just enough improvement in Mato Grosso and areas southeast to Minas Gerais for some improved harvest progress – at least for a little while into the weekend. Next week will trend wetter in these areas again

and that may slow farm progress once again. Other than the maturation and harvest of early season soybeans and the planting of Safrinha corn, the environment in Brazil will be good for ongoing crop development. Citrus, sugarcane and coffee all benefitted greatly

from less frequent and less significant rain these past few days. -

U.S.

hard red winter wheat areas are unlikely to get much moisture of significance during the next ten days except possible in Oklahoma and southeastern Kansas

-

U.S.

Delta and southeastern states will continue in a wet weather model for the next ten days resulting in ongoing saturated soil conditions

-

Some

drying might be welcome especially late this month and into March as the planting season approaches -

U.S.

northern Plains and Canada’s Prairies will continue to receive only light amounts precipitation for an extended period of time -

California

will receive a couple of waves of rain and mountain snow this weekend and next week

-

The

moisture will be good for protecting soil moisture and water supply, although no serious change in the snowpack is expected relative to normal -

Bitter

cold temperatures will linger today in eastern Canada’s Prairies and will drop into the upper Midwest and northeastern Plains before shifting to the east Friday and Saturday -

Extreme

wind chills and extremely cold temperatures will impact eastern Canada and the northeastern United States briefly tonight and Friday and ending Saturday -

No

threatening cold is expected in Europe or Asia through the next ten days, although Europe temperatures will trend briefly colder next week -

Western

Europe will continue drier than usual for the next week to ten days while eastern Europe receives periods of snow and rain -

Western

Russia, the Baltic States and Belarus as well as Ukraine will receive brief periods of light precipitation through the next ten days -

Winter

crops are still dormant and most are sufficiently buried in snow -

Winterkill

has been low so far this winter -

South

Africa rainfall is expected to ramp up over the coming week and greater than usual rainfall is expected this weekend and especially next week -

The

wetter bias will help return favorable field moisture and better reproductive conditions for many summer crops -

Production

potentials are still high in the most of the nation -

India’s

recent rain was welcome, but not nearly enough to seriously change soil or crop conditions in the majority of winter crop areas -

Vegetative

health indies suggest crops are in mostly good shape, but perhaps a little less so in a part of Uttar Pradesh and eastern pulse production areas -

Greater

rain is needed in all winter crop areas -

Production

should be average if excessive heat is avoided in February, but if it gets hot too soon the crop will do poorly because of the limited moisture situation -

Southeastern

China will be trending wetter over the next ten days -

Areas

near and south of the Yangtze River will become abundantly wet soon which should help reduce market concerns about moisture in the region -

Rapeseed

is still poised to perform well this year – at least from World Weather, Inc.’s perspective -

North

Africa rainfall has diminished and net drying is expected over the coming week -

Soil

moisture is rated favorably in northern Algeria and near the coast in northern Morocco and northern Tunisia, but all other areas need rain -

Rain

should resume in the second week of the outlook, but mostly in northern Algeria and coastal Tunisia once again -

Eastern

Australia rainfall was briefly improved earlier this week, but net drying is expected for the next several days -

The

most abundant rain has been in the Darling Downs region of northeastern New South Wales and far southeastern Queensland

-

Net

drying is expected through the weekend -

The

next best opportunity for rain will evolve next week -

Middle

East weather is expected to turn a little wetter during the coming week to ten days and the precipitation will help improve soil moisture for future wheat development and eventual cotton planting later in the year -

Turkey

will be one of the wetter nations -

West-central

Africa will receive some coastal showers in the coming week with some of the precipitation expected to drift northward into coffee, cocoa and sugarcane production areas -

Any

rain that reaches into crop areas will be sporadic and light for a while, but mid- to late-week next week is advertised to be the best chance for rain in Ivory coast and southern Ghana production areas

-

Seasonal

rains usually develop in February -

Southeast

Asia rainfall will be most significant in Indonesia and Malaysia as well as eastern portions of central and southern Philippines over the next ten days -

The

moisture will be good for ongoing crop development, although a few areas may become a little too wet -

Central

Sumatra may be one of the drier areas -

East-central

Africa rainfall will remain most significant in Tanzania and southern Uganda while more limited in areas north into Ethiopia which is not unusual for this time of year -

Today’s

Southern Oscillation Index was +9.91 today and the index is expected to move erratically over the next week

Source:

World Weather and FI

Bloomberg

Ag calendar

Thursday,

Feb. 2:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Feb. 3:

- FAO

World Food Price Index - FAO

Cereal Supply and Demand Brief - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options

Monday,

Feb. 6:

- USDA

export inspections – corn, soybeans, wheat, 11am - HOLIDAY:

Malaysia, New Zealand

Tuesday,

Feb. 7:

- New

Zealand commodity prices - EU

weekly grain, oilseed import and export data - Canada’s

StatCan to release wheat, soybean, canola and barley reserves data, 8:30am - New

Zealand global dairy trade auction

Wednesday,

Feb. 8:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - EIA

weekly US ethanol inventories, production, 10:30am - Brazil’s

Conab issues production, area and yield data for corn and soybeans - RESULTS:

Yara

Thursday,

Feb. 9:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Feb. 10:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Malaysian

Palm Oil Board’s January data on stockpiles, production and exports - Brazil’s

Unica to release sugar output, cane crush data (tentative) - Malaysia’s

Feb. 1-10 palm oil export data

Source:

Bloomberg and FI

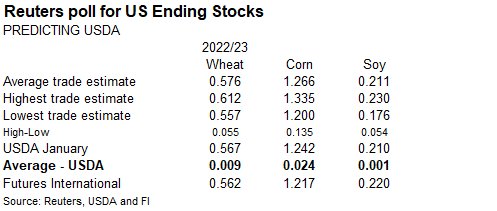

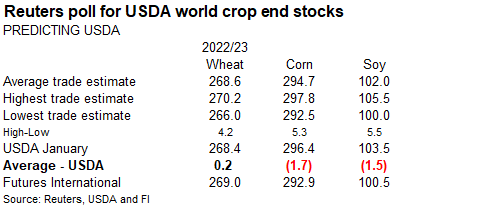

USDA

Export Sales

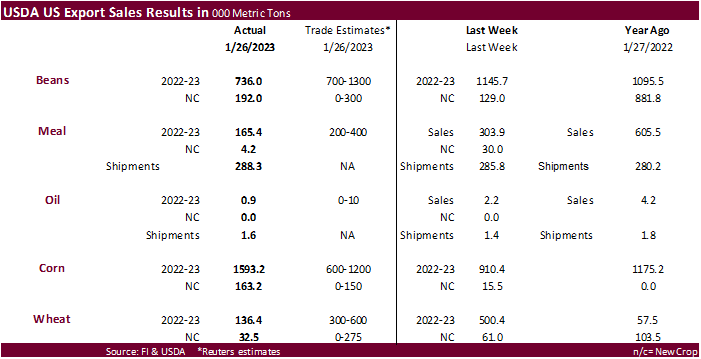

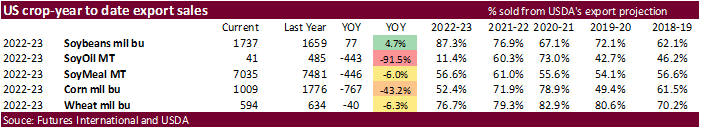

Soybean

sales were near the low end of trade expectations while corn came in above a trade range. The corn sales included 432,100 tons for unknown and 319,500 tons for China (136,000 switched from unknown). The Soybean sales included China for 782,400 tons but 613,000

tons were switched from unknown. Soybean meal sales were poor and soybean oil again well below its respected average. All-wheat sales significantly slowed. One cargo was booked by Egypt. Sorghum sales were good at 110,500 tons (57,500 unknown and 53,000 China).

Pork sales of 30,900 tons were good again and included 15,100 tons for Mexico and 3,700 for Japan.

Special

Announcement: Commitments of Traders Market Report

February

2, 2023: An ongoing issue with a third-party service provider is impacting some reporting firms’ ability to provide the CFTC with timely and accurate data. As a result, the Commitments of Traders report for publication date February 3, 2023, will be delayed.

A report will be published upon receipt and validation of data from those firms.

Macros

BoE

policymakers vote 7-2 to raise bank rate by 50 bps to 4.0% (Reuters poll: 4.0%)

US

Challenger Job Cuts (Y/Y) Jan: +440.0% (prev 129.1%)

US

Initial Jobless Claims (W/W) 28-Jan: 183k (est 195K; prev 186K)

–

Continuing Claims (W/W) 21-Jan: 1655k (est 1684K; prev 1675K)

US

Nonfarm Productivity (Q/Q) Q4 P: 3.0% (est 2.4%; prev R 1.4%)

–

Unit Labor Costs (Q/Q): 1.1% (est 1.5%; prev R 2.0%)

Canadian

Building Permits (M/M) Dec: -7.3% (est -3.9%; prev R 14.1%)

EIA

Natural Gas Storage Change -151 (est -144, prev -91)

U.S.

30-Yr Fixed Rate Mortgages 6.09 Pct Feb 2 Week VS 6.13 Pct Prior Week-Freddie Mac

101

Counterparties Take $2.050 Tln At Fed Reverse Repo Op. (Prev $2.038 Tln, 100 Bids)

·

Despite very good USDA export sales that included China and good amount of corn to unknown destinations, corn futures traded lower by mid-morning and ended lower, in part to a recovery in the US dollar.

·

Funds sold an estimated net 5,000 corn contracts.

·

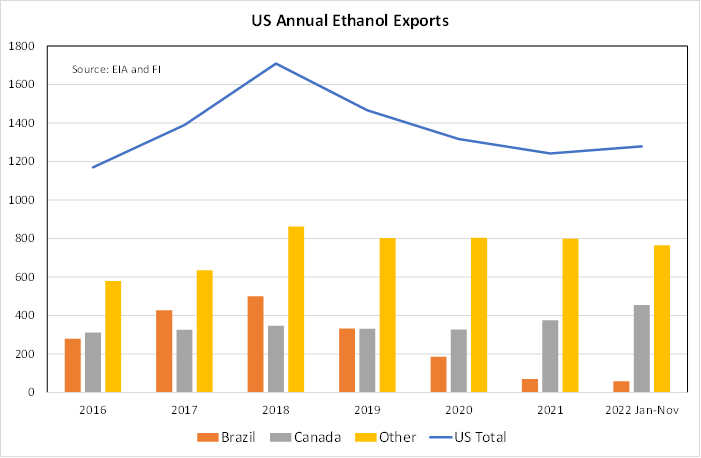

Brazil announced they ended the tax exemption on ethanol imports, effective immediately. Brazil ethanol importers will now have to pay a 16% tax until the end of the year before it rises to 18% for 2024. This will impact about

5-6% of the US export program. Brazil used to be a big market share of US ethanol exports, consisting of 23-31 percent during the 2016-2019 calendar years. But since 2020, market share dropped sharply. Since 2016, Brazil was the US largest importer from 2017

through 2019 while Canada claimed that spot in 2016 and 2019 through 2021.

·

Based on improving US commitments and inspections, we look for USDA to make no changes to their US corn export projection next week. For ethanol, we would not be surprised to see a 25-50 million bushel decline, based on latest

corn for ethanol usage reported by NASS and slow recovery in US gasoline consumption post pandemic.

·

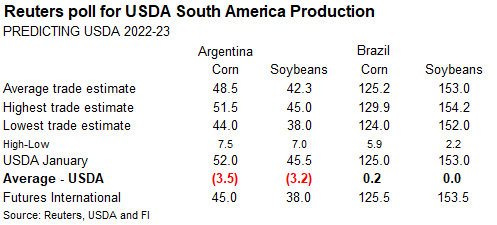

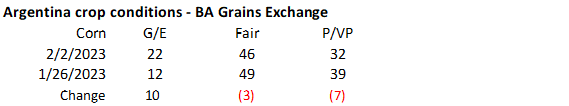

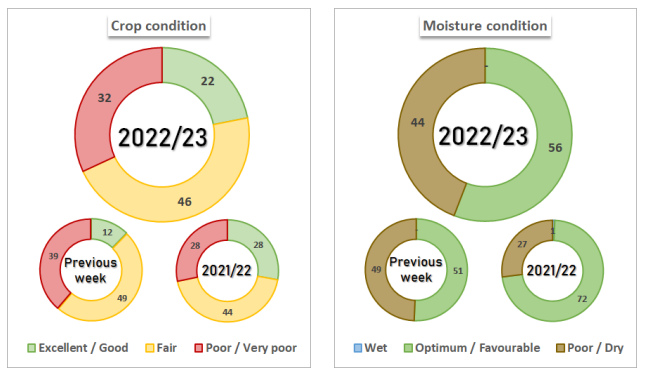

The Buenos Aires Grains Exchange reported Argentina corn crop conditions increased for the combined good/excellent categories by 10 points from the previous week to 22 percent.

Export

developments.

·

Algeria bought about 30,000 tons of corn from Argentina last week and around $339/ton c&f for March 1-15 shipment.

Updated

01/31/23

March

corn $6.60-$7.00 range. May

$6.25-$7.00

·

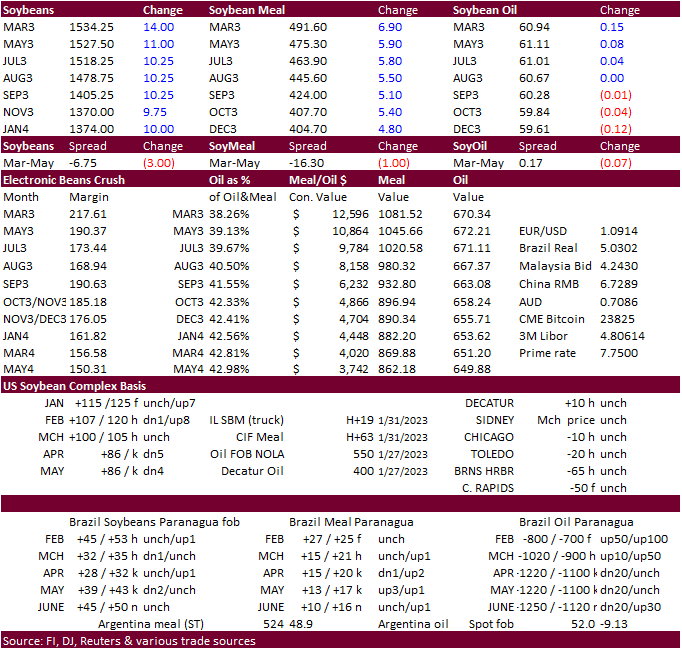

The CBOT soybean complex traded higher from ongoing Argentina crop concerns and talk of China returning to market. Yesterday we heard of pricing for Brazil and US origin for soybeans. March soybean meal hit a fresh contract high

as the funds added an estimated net 4,000 soybean contracts. Funds bought an estimated net 1,000 soybeans and 1,000 soybean oil.

·

Ukraine’s AgMin said the surge in sunflower seed exports could threaten that component of the agriculture sector. Before the war, Ukraine crushed the seed for sunflower oil exports, a vital component for the economy, but crush

disruptions across the country shifted trade flows. Ukraine exported 2.75 million tons of sunflower seed during 2022, up from only 100,000 tons year before. 70 percent of the exports last year went to the EU and 20 percent to Turkey.

·

Abiove sees the 2023 Brazil soybean crop at 152.6 million tons, crush at 52.5 million, and exports at 92 million tons, all unchanged from their January 12 estimate. The 2022 soybean crop production was raised to 128.6 million

tons from 128.5 million previous. Yesterday StoneX raised its forecast of the Brazil soybean crop to a record-high 154.2 million tons from 153.79 million last month.

·

India January palm oil imports declined 31% from December to 770,000 tons, lowest since July 2022, according to a Reuters estimate.

·

(Reuters) – Argentina’s central bank will adopt measures to ease financing for the country’s key grains sector that has been badly hit by drought, the entity said on Thursday, which will include more flexible terms on non-payment

and subsidized credit lines. The measures will ease rules until Dec. 31 on defaults by farmers who are grappling with the worst drought in some sixty years that has cut the wheat harvest in half, and delayed soy and corn planting, hurting yields of the key

cash crops.

·

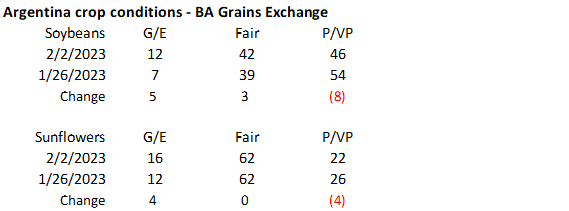

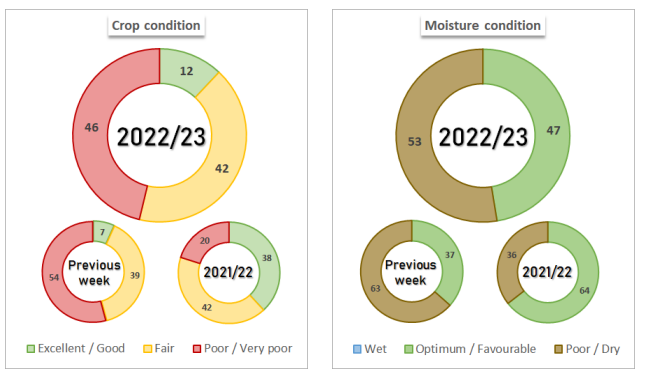

The Buenos Aires Grains Exchange reported Argentina soybean crop conditions increased for the combined good/excellent categories by 5 points from the previous week to 12 percent. They may reduce soybean production to 41 million

tons.

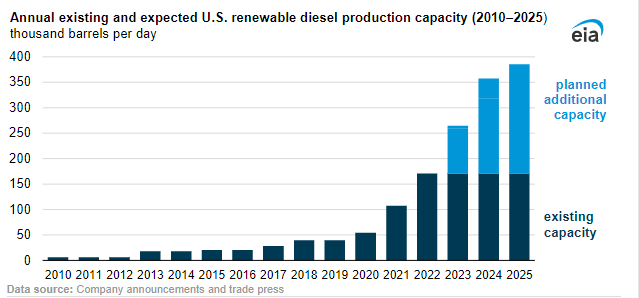

EIA:

Domestic renewable diesel capacity could more than double through 2025

https://www.eia.gov/todayinenergy/detail.php?id=55399&src=email

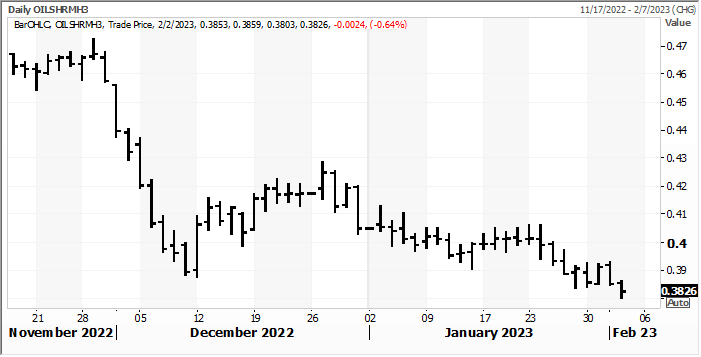

March

soybean oil share is at contract low

Source:

Reuters and FI

·

Today the CCC seeks a total of 100,320 tons of bulk hi-pro soybean meal for shipment to Ghana, Ivory Coast and Senegal. One half will be shipped Mar 21-31, with the balance for Apr 1-10 shipment. All offers are due by Feb 2 at

2 PM CT.

Updated

01/31/23

Soybeans

– March $15.00-$15.80, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

60.00-67.00, May 58-70

·

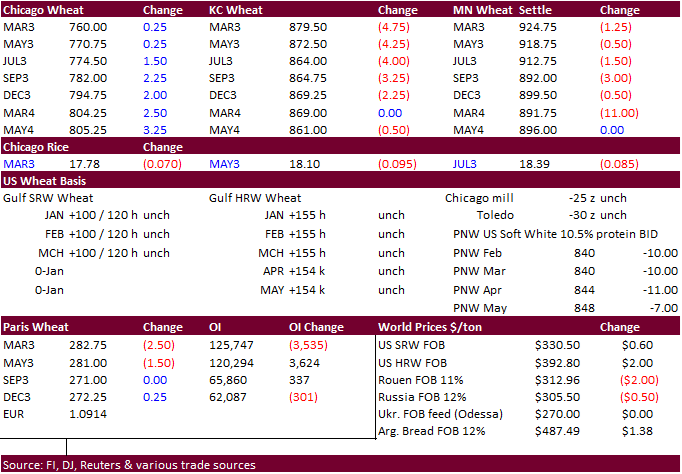

US wheat traded two-sided. The Chicago contract hit a one-month high and ended higher. The poor pace of US export shipments and weak export sales limited gains. KC and MN finished lower.

·

Funds bought an estimated net 1,000 Chicago wheat contracts.

·

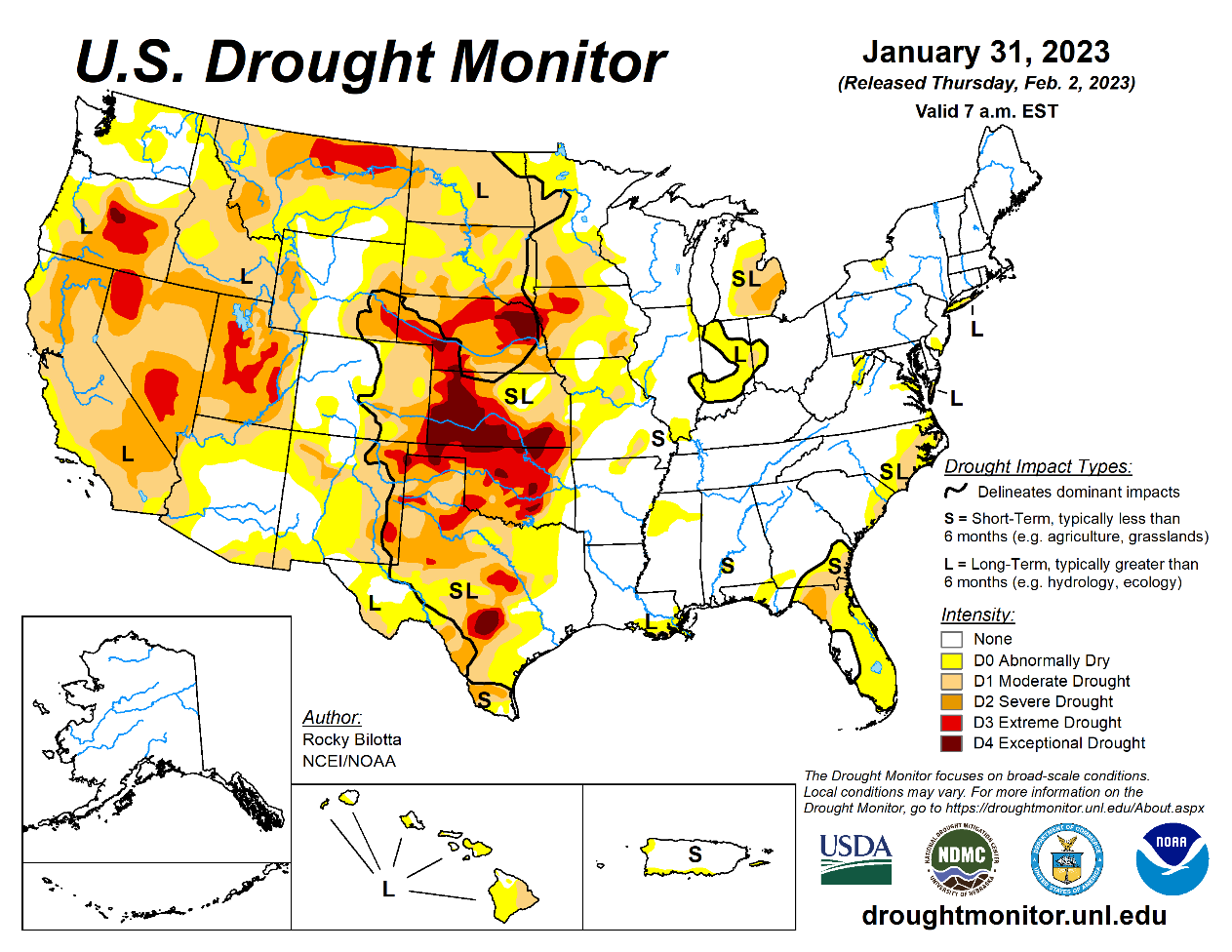

Cold temperatures were noted for the northern Great Plains Wednesday into Thursday, but we think no damage occurred. But when it comes to precipitation, drought conditions for parts of the Great Plains is of concern. The US

needs to see good rains this spring across the heart of the country to allow winter wheat crop conditions to rebound after a very poor start.

·

EU officials are visiting Ukraine ahead of the one-year anniversary of the Russia/Ukraine conflict. They may announce another round of support, including arms and financial assistance.

·

Paris March wheat was 2.50 euro lower at 283.00 per ton.

·

Iraq said they should see a good amount of locally grown wheat if rainfall continues. No production estimate was provided. They imported around 800,000 tons of wheat since October. Iraq consumes about 4.6 million tons of wheat.

·

(Bloomberg) — State-run Food Corp. of India sold 888,000 tons of wheat through an auction on the first day of a planned open market sale of the grain to cool local prices, according to a statement by the food ministry. The company

offered to sell 2.2 million tons of wheat on Wednesday. More than 1,100 bidders from 22 states participated in the auction.

Export

Developments.

·

Lowest price for Egypt’s import tender for wheat was $322.80/ton c&f, Russia origin, for late February through March 20 shipment. The tender is under the Food Security and Resilience Support Program funded by the World Bank with

at sight financing.

·

South Korea’s Major Feedmill Group (MFG) bought about 60,000 tons of optional origin feed wheat at an estimated $339.60 a ton c&f for May through June 30 shipment, depending on origin.

·

Jordan seeks 120,000 tons of optional origin milling wheat on February 7 for May-June shipment.

Rice/Other

·

Indonesia’s Bulog looks for the country to produce 2.4 million tons of rice in 2023.

·

South Korea seeks 79,439 tons of rice on February 8 for May 1-Dec 31 arrival.

·

Orange juice hit a record today.

Updated

02/02/23

Chicago

– March $7.25 to $7.90, May $7.00-$8.25

KC

– March $8.40-$9.10, $7.50-$9.25

MN

– March $9.00 to $9.75,

$8.00-$10.00

U.S. EXPORT SALES FOR WEEK ENDING 1/26/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

14.9 |

905.2 |

2,036.6 |

137.9 |

3,487.6 |

4,815.0 |

0.0 |

91.3 |

|

SRW |

24.2 |

717.2 |

710.6 |

28.7 |

1,816.2 |

1,848.1 |

23.0 |

124.6 |

|

HRS |

38.5 |

1,247.8 |

1,266.7 |

204.8 |

3,580.6 |

3,366.3 |

0.0 |

49.8 |

|

WHITE |

60.9 |

1,262.2 |

751.0 |

95.2 |

2,842.6 |

2,300.2 |

9.1 |

23.4 |

|

DURUM |

-2.0 |

113.2 |

54.6 |

29.5 |

198.0 |

113.1 |

0.4 |

1.9 |

|

TOTAL |

136.4 |

4,245.6 |

4,819.5 |

496.2 |

11,925.0 |

12,442.8 |

32.5 |

291.0 |

|

BARLEY |

0.0 |

4.4 |

17.1 |

0.0 |

7.2 |

13.4 |

0.0 |

0.0 |

|

CORN |

1,593.2 |

13,021.3 |

25,557.6 |

598.3 |

12,610.6 |

19,565.7 |

163.2 |

1,427.1 |

|

SORGHUM |

110.5 |

437.8 |

4,130.0 |

0.9 |

293.4 |

2,086.0 |

0.0 |

0.0 |

|

SOYBEANS |

736.0 |

11,683.1 |

8,868.1 |

1,959.6 |

35,588.3 |

36,295.4 |

192.0 |

718.0 |

|

SOY MEAL |

165.4 |

3,149.6 |

3,263.6 |

288.3 |

3,885.4 |

4,216.9 |

4.2 |

52.5 |

|

SOY OIL |

0.9 |

18.5 |

178.5 |

1.5 |

22.9 |

306.3 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

6.6 |

89.0 |

215.4 |

1.5 |

245.7 |

671.5 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

11.1 |

9.9 |

1.1 |

15.8 |

3.8 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

4.8 |

20.0 |

0.5 |

11.4 |

28.4 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

35.8 |

68.3 |

0.1 |

8.4 |

17.0 |

0.0 |

0.0 |

|

L G MLD |

16.0 |

144.8 |

76.9 |

23.4 |

340.2 |

435.4 |

0.0 |

0.0 |

|

M S MLD |

1.7 |

133.6 |

155.1 |

1.5 |

123.3 |

213.6 |

0.0 |

0.0 |

|

TOTAL |

24.4 |

419.0 |

545.6 |

28.2 |

744.8 |

1,369.8 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

171.2 |

4,864.1 |

8,087.6 |

212.2 |

4,589.1 |

3,903.1 |

20.2 |

1,256.4 |

|

PIMA |

-0.8 |

53.1 |

214.8 |

7.8 |

77.2 |

179.8 |

2.4 |

3.5 |

Export Sales Highlights

This

summary is based on reports from exporters for the period January 20-26, 2023.

Wheat:

Net sales of 136,400 metric tons (MT) for 2022/2023 were down 73 percent from the previous week and 51 percent from the prior 4-week average. Increases primarily for Egypt (60,000 MT switched from unknown destinations), Jamaica (22,000 MT), Singapore (22,000

MT switched from Thailand), Trinidad and Tobago (17,400 MT, including 9,500 MT switched from the Dominican Republic), and Peru (12,500 MT), were offset by reductions primarily for Thailand (19,600 MT), the Dominican Republic (9,200 MT), Japan (6,900 MT), Mexico

(2,700 MT), and Panama (1,500). Net sales of 32,500 for 2023/2024 were primarily for Mexico (23,000 MT) and Japan (9,100 MT). Exports of 496,200 MT were up 88 percent from the previous week and up noticeably from the prior 4-week average. The destinations

were primarily to Japan (98,500 MT), Mexico (85,900 MT), Thailand (58,100 MT), Iraq (52,500 MT), and Chile (47,400 MT).

Corn:

Net sales of 1,593,200 MT for 2022/2023 were up 75 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for unknown destinations (423,100 MT), Mexico (323,600 MT, including decreases of 78,000 MT), China (319,500

MT, including 136,000 MT switched from unknown destinations and 140,000 MT – late), Colombia (196,500 MT), and El Salvador (55,300 MT, including 34,800 MT switched from Guatemala and decreases of 2,800 MT), were offset by reductions for Guatemala (22,500 MT)

and Canada (500 MT). Net sales of 163,200 MT for 2023/2024 were reported for Mexico (152,200 MT) and Japan (11,000 MT). Exports of 598,300 MT were down 34 percent from the previous week and 14 percent from the prior 4-week average. The destinations were primarily

to Mexico (227,900 MT), China (138,700 MT), Japan (102,000 MT), El Salvador (58,600 MT), and Panama (18,000 MT).

Late Reporting:

For 2022/2023, net sales totaling 140,000 MT of corn were reported late for China.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales of 110,500 MT for 2022/2023 were up 56 percent from the previous week and 70 percent from the prior 4-week average. Increases were reported for unknown destinations (57,500 MT) and China (53,000 MT). Exports of 900 MT were down 99 percent from the

previous week and 95 percent from the prior 4-week average. The destination was to Mexico.

Rice:

Net sales of 24,400 MT for 2022/2023 were down 43 percent from the previous week and 21 percent from the prior 4-week average. Increases were primarily for Haiti (15,100 MT, including decreases of 200 MT), Honduras (5,600 MT), Canada (1,100 MT, including decreases

of 100 MT), Guatemala (1,000 MT), and Mexico (500 MT). Exports of 28,200 MT were down 58 percent from the previous week and 33 percent from the prior 4-week average. The destinations were primarily to Haiti (22,200 MT), Mexico (2,900 MT), Canada (2,200 MT),

Belgium (200 MT), and the Netherlands (100 MT).

Soybeans:

Net sales of 736,000 MT for 2022/2023 were down 36 percent from the previous week and 18 percent from the prior 4-week average. Increases primarily for China (782,400 MT, including 613,000 MT switched from unknown destinations and decreases of 10,200 MT),

Japan (96,300 MT, including 73,700 MT switched from unknown destinations and decreases of 2,100 MT), Indonesia (86,000 MT, including 68,000 MT switched from unknown destinations and decreases of 300 MT), Taiwan (71,300 MT, including 66,000 MT switched from

unknown destinations and decreases of 1,200 MT), and the Netherlands (68,000 MT, including 66,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (523,200 MT). Net sales of 192,000 MT for 2023/2024 were

reported for unknown destinations (132,000 MT) and China (60,000 MT). Exports of 1,959,600 MT were up 3 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to China (1,415,300 MT), Japan (123,600 MT),

Taiwan (94,100 MT), Indonesia (90,700 MT), and Vietnam (70,900 MT).

Optional Origin Sales:

For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export for Own Account:

For 2022/2023, the current exports for own account outstanding balance is 1,500 MT, all Canada.

Soybean Cake and Meal:

Net sales of 165,400 MT for 2022/2023 were down 46 percent from the previous week and 12 percent from the prior 4-week average. Increases primarily for the United Kingdom (30,000 MT switched from Ireland), Panama (29,500 MT, including decreases of 100 MT),

Morocco (27,000 MT), Colombia (26,700 MT, including decreases of 2,300 MT), and Canada (20,400 MT, including decreases of 5,400 MT), were offset by reductions primarily for Ireland (30,000 MT) and Spain (14,000 MT). Total net sales of 4,200 MT for 2023/2024

were for Canada. Exports of 288,300 MT were up 1 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to Venezuela (64,400 MT), the Philippines (50,200 MT), Colombia (45,800 MT), Mexico (31,800 MT), and

Honduras (26,300 MT).

Soybean Oil:

Net sales of 900 MT for 2022/2023 were down 62 percent from the previous week and 12 percent from the prior 4-week average. Increases were primarily for Mexico (700 MT). Exports of 1,500 MT were up 10 percent from the previous week and 99 percent from the

prior 4-week average. The destinations were to Mexico (1,000 MT) and Canada (500 MT).

Cotton:

Net sales of 171,200 RB for 2022/2023 were down 20 percent from the previous week, but up 28 percent from the prior 4-week average. Increases primarily for China (119,800 RB, including decreases of 3,300 RB), Turkey (44,000 RB, including decreases of 11,800

RB), Indonesia (8,800 RB, including 1,600 RB switched from Japan and decreases of 300 RB), Taiwan (2,000 RB), and Japan (900 RB), were offset by reductions primarily for Mexico (2,800 RB) and Thailand (1,200 RB). Net sales of 20,200 RB for 2023/2024 were reported

for Turkey (18,000 RB) and Thailand (2,200 RB). Exports of 212,200 RB were up 21 percent from the previous week and 41 percent from the prior 4-week average. The destinations were primarily to China (59,200 RB), Pakistan (45,300 RB), Turkey (24,400 RB), Vietnam

(20,400 RB), and Mexico (18,000 RB). Net sales reductions of Pima totaling 800 RB for 2022/2023 were down noticeably from the previous week and from the prior 4-week average. Increases reported for Turkey (1,100 RB, including 100 RB switched from India), Egypt

(900 RB), Pakistan (400 RB), and Japan (200 RB), were more than offset by reductions for Italy (1,300 RB), Taiwan (900 RB), Peru (900 RB), India (200 RB), and China (100 RB). Total net sales of Pima totaling 2,400 RB for 2023/2024 were for Italy. Exports of

7,800 RB were up noticeably from the previous week and up 72 percent from the prior 4-week average. The destinations were primarily to India (5,400 RB), Indonesia (1,000 RB), Turkey (500 RB), Thailand (400 RB), and Japan (200 RB).

Optional Origin

Sales: For 2022/2023, the current outstanding balance of 9,300

RB, all Malaysia.

Export for

Own Account: For 2022/2023, new exports for own account totaling

24,800 RB were to China (19,400 RB), South Korea (2,400 RB), Turkey (1,600 RB), and Vietnam (1,400 RB). Exports for own account totaling 14,000 RB primarily to Vietnam (7,200 RB) and China (6,300 RB) were applied to new or outstanding sales. The current exports

for own account outstanding balance of 114,700 RB are for China (88,100 RB), Vietnam (16,100 RB), Pakistan (5,000 RB), South Korea (2,400 RB), Turkey (1,600 RB), and India (1,500 RB).

Hides and Skins:

Net sales of 356,200 pieces for 2023 primarily for China (213,700 whole cattle hides, including decreases of 19,600 pieces), South Korea (52,700 whole cattle hides, including decreases of 3,600 pieces), Mexico (48,900 whole cattle hides, including decreases

of 1,000 pieces), Turkey (22,400 whole cattle hides, including decreases of 100 pieces), and Indonesia (7,400 whole cattle hides), were offset by reductions primarily for Thailand (1,200 pieces). Total net sales reductions of 4,500 calf skins were for Italy.

In addition, net sales of 2,100 kip skins were reported for China (1,200 kip skins) and Italy (1,100 kip skins), were offset by reductions for Canada (200 kip skins). Exports of 505,800 whole cattle hides exports were primarily to China (315,200 pieces), South

Korea (84,100 pieces), Mexico (55,700 pieces), Turkey (12,900 pieces), and Thailand (9,800 pieces). Exports of 5,800 calf skins were to Italy. In addition, exports of 1,300 kip skins were to Canada.

Net sales of

62,200 wet blues for 2023 primarily for Italy (25,300 unsplit, including decreases of 900 unsplit), Vietnam (24,000 unsplit), China (5,200 unsplit), Thailand (4,500 unsplit), and South Korea (3,200 grain splits), were offset by reductions for Brazil (200 grain

splits). Exports of 107,300 wet blues were primarily to Italy (56,700 unsplit), Vietnam (14,400 unsplit), China (10,800 unsplit), Mexico (7,200 unsplit), and Thailand (6,200 unsplit). Net sales reductions of 15,700 splits for 2023 were reported for Hong Kong

(8,800 pounds), Vietnam (6,500 pounds), and China (400 pounds). No exports of splits were reported this week.

Beef:

Net sales of 25,200 MT for 2023 were primarily for South Korea (7,100 MT, including decreases of 400 MT), Japan (6,800 MT, including decreases of 700 MT), China (4,300 MT, including decreases of 100 MT), Mexico (3,300 MT, including decreases of 100 MT), and

Canada (2,100 MT, including decreases of 200 MT). Exports of 18,900 MT were primarily to South Korea (5,300 MT), Japan (4,900 MT), China (3,500 MT), Mexico (1,800 MT), and Taiwan (1,000 MT).

Pork:

Net sales of 30,900 MT for 2023 primarily for Mexico (15,100 MT, including decreases of 400 MT), Japan (3,700 MT, including decreases of 700 MT), Canada (3,100 MT, including decreases of 500 MT), Colombia (2,200 MT, including decreases of 200 MT), and Australia

(2,200 MT), were offset by reductions for Vietnam (100 MT). Exports of 35,500 MT were primarily to Mexico (16,400 MT), China (5,700 MT), Japan (3,800 MT), South Korea (2,800 MT), and Canada (2,400 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

Work: 312.604.1366

ICE IM: treilly1

Skype IM: fi.treilly

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo