PDF Attached

Due

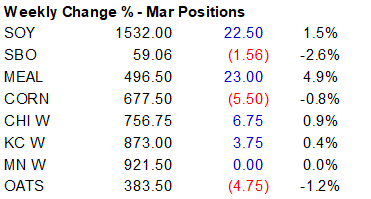

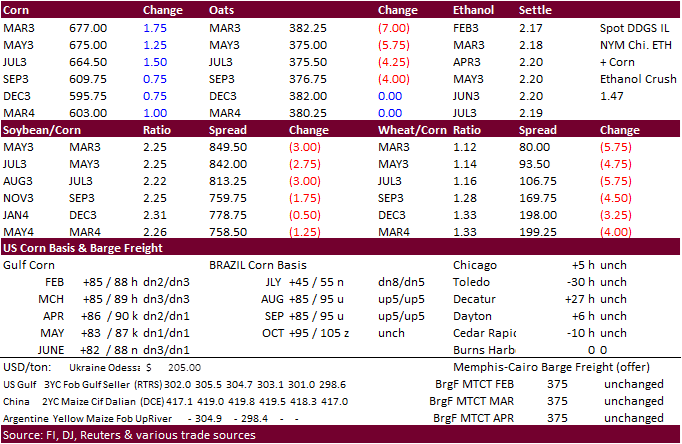

to reporting issues, the CFTC COT report will be delayed until further notice. Another volatile trade with a lower day session open for the CBOT agriculture markets with a mixed settle. Soybeans closed lower, meal higher, and soybean oil sharply lower. Soybean

oil share reached a contract low for the nearby positions. Corn finished higher despite weakness in wheat and lower WTI crude oil. The USD was up sharply, by 122 points by 2:35 pm CT.

Malaysian markets will be closed on Monday for holiday.

![]()

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

-

Not

many changes overnight -

Another

day of favorable drying occurred in center west and northern parts of center south Brazil Thursday and early today -

There

have been several days like this recently that have helped to begin firming the topsoil or at least reducing the surplus moisture for faster early season soybean maturation and harvest progress -

This

trend will not last much longer with a resumption of more frequent precipitation expected this weekend and next week -

Field

progress (including planting of Safrinha crops) will continue, although it must advance around the precipitation which should slow the pace a bit -

Argentina

rainfall diminished Thursday as expected and the outlook now promises nine days of dry or mostly conditions with warming temperatures -

Crop

stress will be greatest in the northeastern one-third to one half of the nation where the ground is already too dry

-

Crop

moisture in western Argentina is rated favorably today, but it will become short to very short of moisture by the end of next week and into the following weekend -

Brazil

rainfall will be increasing across center west and some center south crop areas later this weekend through all of next week to slow fieldwork, but to ensure moisture abundance continues in the soil -

U.S.

hard red winter wheat areas will not receive significant precipitation in the west during the next two weeks

-

Some

rain is expected during mid-week next week from central Oklahoma into eastern Kansas, but the heart of wheat country should not be impacted -

U.S.

Delta and southeastern states, including the Tennessee River Basin, will continue to receive waves of rain through the next ten days keeping the ground wet, but winter crops should stay favorably rated -

The

moisture abundance will be good for spring planting which begins in March -

California

will receive a few waves of light rain and mountain snowfall during the next ten days to two weeks resulting in status quo conditions in soil moisture and mountain snowpack.

-

Snow

water equivalents in the mountains are still near and greater than those of the April 1 norm -

West

Texas will be drier biased over the next ten days with little to no precipitation expected -

Far

South Texas precipitation is expected to be minimal during the next ten days -

Coastal

Bend crop areas in the state will see a little more rain, but might also need greater precipitation later this month ahead of spring planting -

Eastern

North America will be bitterly cold today and Saturday with extreme wind chills and “some” light snow -

Livestock

stress and a strong energy demand is likely in Ontario and Quebec Canada with some impact on the U.S. Great Lakes region and northeastern states as well -

Big

warm up likely in North America this weekend in the central U.S. and Canada Prairies and in the eastern parts of the continent next week

-

No

threatening cold is expected in Europe or Asia through the next ten days, although Europe temperatures will trend briefly colder next week -

Western

Europe will continue drier than usual for the next week to ten days while eastern Europe receives periods of snow and rain -

Western

areas will begin to receive precipitation again in the second week of the forecast

-

Western

Russia, the Baltic States and Belarus as well as Ukraine will receive brief periods of light precipitation through the next ten days -

Winter

crops are still dormant, and most are sufficiently buried in snow -

Winterkill

has been low so far this winter -

South

Africa rainfall is expected to ramp up over the coming week and greater than usual rainfall is expected this weekend and especially next week -

The

wetter bias will help return favorable field moisture and better reproductive conditions for many summer crops -

Production

potentials are still high in most of the nation -

India’s

recent rain was welcome, but not nearly enough to seriously change soil or crop conditions in the majority of winter crop areas -

Vegetative

health indies suggest crops are in mostly good shape, but perhaps a little less so in a part of Uttar Pradesh and eastern pulse production areas -

Greater

rain is needed in all winter crop areas -

Production

should be average if excessive heat is avoided in February, but if it gets hot too soon the crop will do poorly because of the limited moisture situation -

Dry

and warm weather is expected over the next ten days -

Southeastern

China will be trending wetter over the next ten days -

Areas

near and south of the Yangtze River will become abundantly wet soon which should help reduce market concerns about moisture in the region -

Rapeseed

is still poised to perform well this year – at least from World Weather, Inc.’s perspective -

North

Africa rainfall has diminished, and net drying is expected over the coming week -

Soil

moisture is rated favorably in northern Algeria and near the coast in both northern Morocco and northern Tunisia, but all other areas need rain -

Rain

should resume in the second week of the outlook, but mostly in northern Algeria and coastal Tunisia once again -

Eastern

Australia soil moisture briefly improved earlier this week because of rain, but net drying is expected for the next few days -

The

most abundant rain has been in the Darling Downs region of northeastern New South Wales and far southeastern Queensland

-

Net

drying is expected through the weekend -

The

next best opportunity for rain will evolve next week and it should fall in mostly the same areas impacted earlier this week -

Middle

East weather is expected to turn a little wetter during the coming week to ten days and the precipitation will help improve soil moisture for future wheat development and eventual cotton planting later in the year -

Turkey

will be one of the wetter nations -

Central

and southern Iraq and southeastern Syria along with portions of Iran will be driest and a net decline in soil moisture may result in those areas -

West-central

Africa will receive some coastal showers in the coming week with some of the precipitation expected to drift northward into coffee, cocoa and sugarcane production areas -

Any

rain that reaches into crop areas will be sporadic and light for a while, but mid- to late-week next week is advertised to be the best chance for rain in Ivory coast and southern Ghana production areas

-

Seasonal

rains usually develop in February -

Southeast

Asia rainfall will be most significant in Indonesia and Malaysia as well as eastern portions of central and southern Philippines over the next ten days -

The

moisture will be good for ongoing crop development, although a few areas may become a little too wet -

Central

Sumatra may be one of the drier areas -

East-central

Africa rainfall will remain most significant in Tanzania and southern Uganda while more limited in areas north into Ethiopia which is not unusual for this time of year -

Today’s

Southern Oscillation Index was +10.00 today and the index is expected to move erratically over the next week

Source:

World Weather and FI

Friday,

Feb. 3:

- FAO

World Food Price Index - FAO

Cereal Supply and Demand Brief - ICE

Futures Europe weekly commitments of traders report - Suspended

– CFTC commitments of traders weekly report on positions for various US futures and options

Monday,

Feb. 6:

- USDA

export inspections – corn, soybeans, wheat, 11am - HOLIDAY:

Malaysia, New Zealand

Tuesday,

Feb. 7:

- New

Zealand commodity prices - EU

weekly grain, oilseed import and export data - Canada’s

StatCan to release wheat, soybean, canola and barley reserves data, 8:30am - New

Zealand global dairy trade auction

Wednesday,

Feb. 8:

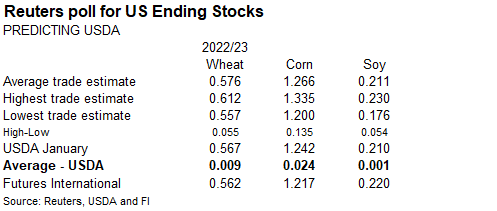

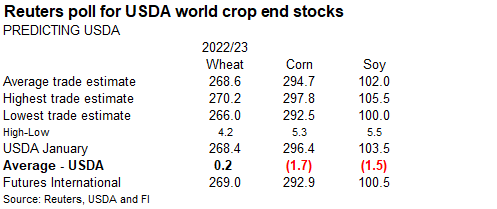

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - EIA

weekly US ethanol inventories, production, 10:30am - Brazil’s

Conab issues production, area and yield data for corn and soybeans - RESULTS:

Yara

Thursday,

Feb. 9:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Feb. 10:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Malaysian

Palm Oil Board’s January data on stockpiles, production and exports - Brazil’s

Unica to release sugar output, cane crush data (tentative) - Malaysia’s

Feb. 1-10 palm oil export data

Source:

Bloomberg and FI

Special

Announcement: Commitments of Traders Market Report

February

2, 2023: An ongoing issue with a third-party service provider is impacting some reporting firms’ ability to provide the CFTC with timely and accurate data. As a result, the Commitments of Traders report for publication date February 3, 2023, will be delayed.

A report will be published upon receipt and validation of data from those firms.

CFTC

Statement on ION and the Impact to the Derivatives Markets

https://www.cftc.gov/PressRoom/SpeechesTestimony/cftcstatement020223

Macros

US

Change In Nonfarm Payrolls Jan: 517K (est 189K; prevR 260K)

US

Unemployment Rate Jan: 3.4% (est 3.6%; prev 3.5%)

US

Average Hourly Earnings (M/M) Jan: 0.3% (est 0.3%; prevR 0.4%)

US

Average Hourly Earnings (Y/Y) Jan: 4.4% (est 4.3%; prev 4.6%)

US

Labour Force Participation Rate Jan: 62.4% (est 62.3%; prev 62.3%)

US

Underemployment Rate Jan: 6.6% (prev 6.5%)

US

Change In Private Payrolls Jan: 443K (est 190K; prevR 269K)

US

Change In Manufact. Payrolls Jan: 19K (est 7K; prevR 12K)

US

ISM Services Index Jan: 55.2 (est 50.5; prev 49.2)

–

Prices Paid: 67.8 (prev 68.1)

–

Employment: 50.0 (prev 49.4)

–

New Orders: 60.4 (prev 45.2)

101

Counterparties Take $2.050 Tln At Fed Reverse Repo Op. (Prev $2.038 Tln, 100 Bids)

US

Crude Oil Futures Settle At $73.39/Bbl, Down $2.49 Or 3.28%

·

CBOT corn traded higher from light unwinding of soybean/corn spreading despite lower WTI crude oil and improving Argentina crop conditions. The US jobs figures sent the USD sharply higher.

·

Funds bought an estimated net 1,000 corn contracts.

·

Ukraine harvest 97% of the 2022 grain crop as of February 2, or 53.2 million tons of the AgMin’s projected output. It includes 25.9 million tons of corn.

·

Based on improving US commitments and inspections, we look for USDA to make no changes to their US corn export projection next week. For ethanol, we would not be surprised to see a 25-50 million bushel decline, based on latest

corn for ethanol usage reported by NASS and slow recovery in US gasoline consumption post pandemic.

·

CME live cattle futures rose to contract highs. The Jan 1 cattle inventory number reported earlier this week continues to support prices.

Export

developments.

·

South Korea’s KFA bought an estimated 126,000 tons of corn for Arrival around April 20. 60,000 tons was sourced from South America at $337.80/ton c&f and 66,000 optional origin at $336.60/ton c&f.

USDA

Attaché Mexico Grain and Feed Update

Updated

01/31/23

March

corn $6.60-$7.00 range. May

$6.25-$7.00

·

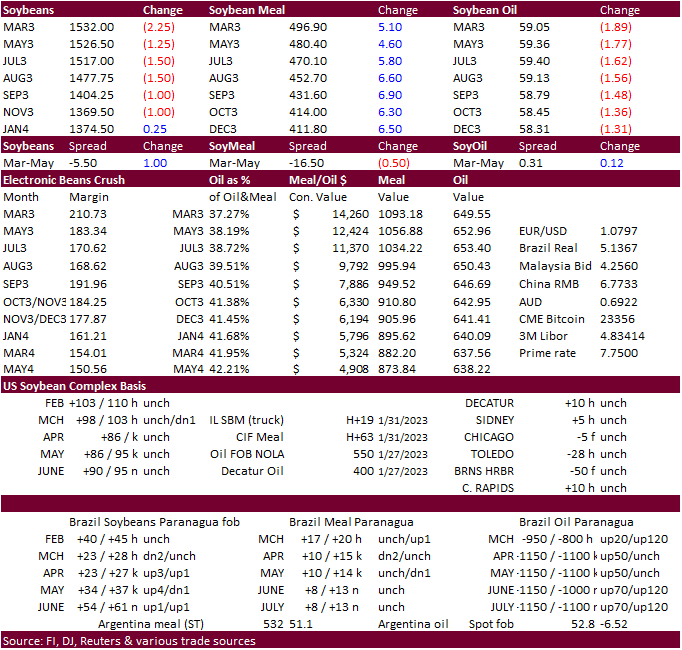

Soybeans traded tow-sided, ending lower on improving Argentina soybean crop conditions, sharply higher USD, and positioning. Shortly after the day session open, US soybean meal futures jumped to their highest level since June

2014. Soybean meal ended the day higher, at fresh contract highs, while soybean oil broke hard from product spreading and WTI crude trading more than $2.30 lower by the time CBOT ags closed. Soybean oil share collapsed. Basis the March position, the share

traded below a support level of 37.50%. Next support is seen at 37.00%, followed by 36.00%. Downside will depend on soybean meal. Some noted upside momentum for soybean meal could soon stall from Brazil harvesting pressure and overbought conditions. Soybeans

were down today in part to prospects for a record Brazil crop. Our top end of a trading range for March soybean meal is $5.20 short ton.

·

Brazilian Patria Agronegocios consultancy reported the soybean harvest progress at 9.9 percent versus 20 percent year ago.

·

Safras reported forward sales of Brazil’s soybean crop reached 30.5%, or 46.7 million tons of the expected production of 153.3 million tons. This compares to 44.1% of the crop year earlier and five-year average of 44.8%.

·

Funds sold an estimated net 2,000 soybean contracts, bought 3,000 soybean meal and sold 6,000 soybean oil.

·

USDA reported 24-hour sales of 132,000 tons of soybeans sold to unknown destinations.

·

Earlier this morning we heard China might soon auction off old crop vegetable oils to make way for new-crop, typical rotation.

·

Some union workers went on strike Thursday at a soybean and grain processing facility in Decatur, IL, over contract terms.

Soybean

oil March oil share

Source:

Reuters and FI

Export

Developments

·

USDA reported private exporters sold 132,000 tons of soybeans to unknow destinations for 2022-23 delivery.

Updated

01/31/23

Soybeans

– March $15.00-$15.80, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

60.00-67.00, May 58-70

·

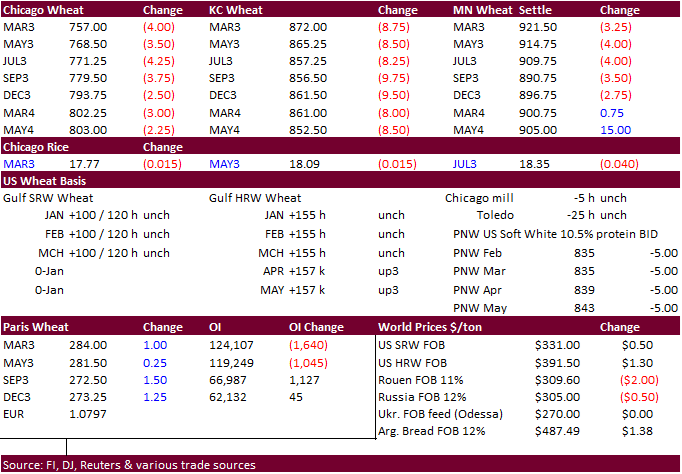

Chicago wheat was lower on fund selling of an estimated 2,000 contracts. KC and MN also ended lower. The sharply higher USD pressured wheat. (US dollar was up 122 points as of 2:40 pm CT).

·

FOA food price index averaged 131.2 points January versus a revised (lower) 132.2 for December, and lowest Since September 2021. It’s down 10 consecutive months, longest down streak since at least 1990. The 131.2 index is down

from its peak of 159.7 set March 2022, or off 17.9 percent. The vegetable oils led the monthly decline in the index, followed by dairy.

·

Paris March milling wheat settled up 1.00 euro or 0.5% at 284.50 euros ($308.17) a ton.

·

Russia will increase its wheat export tax to 4,497 rubles per ton for the February 8-14 period, from 4,365 rubles.

·

IKAR lowered their estimate of the Russian 2023 wheat crop to 84 million tons from 87 million due to poor weather. The AgMin is at 80-85 MMT versus a large 104.4 million tons for 2022. Note USDA thinks Russia is overstating their

2022 crop production forecast.

Export

Developments.

·

South Korea’s Major Feedmill Group (MFG) bought additional feed wheat. 65,000 tons of Black Sea origin was bought at an estimated $334.50 a ton c&f for June 20-July 20 shipment. Earlier this week they bought about 60,000 tons

optional origin at an estimated $339.60 a ton c&f for May through June 30 shipment, depending on origin.

·

Taiwan seeks 48,100 tons of milling wheat from the US on February 9 for March 29 and April 12 shipment.

·

Jordan seeks 120,000 tons of optional origin milling wheat on February 7 for May-June shipment.

Rice/Other

·

South Korea seeks 79,439 tons of rice on February 8 for May 1-Dec 31 arrival.

·

(Bloomberg) — US 2022-23 ending stocks seen 123,000 bales lower than USDA’s previous estimate, according to the avg in a Bloomberg survey of ten analysts.

Avg

est. at 4.08m bales, ranging from 3.9m to 4.4m bales

Global

ending stocks seen slightly higher at 90.06m bales vs 89.93m in Jan.

Updated

02/02/23

Chicago

– March $7.25 to $7.90, May $7.00-$8.25

KC

– March $8.40-$9.10, $7.50-$9.25

MN

– March $9.00 to $9.75,

$8.00-$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

Work: 312.604.1366

ICE IM: treilly1

Skype IM: fi.treilly

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo