PDF Attached

Weekend

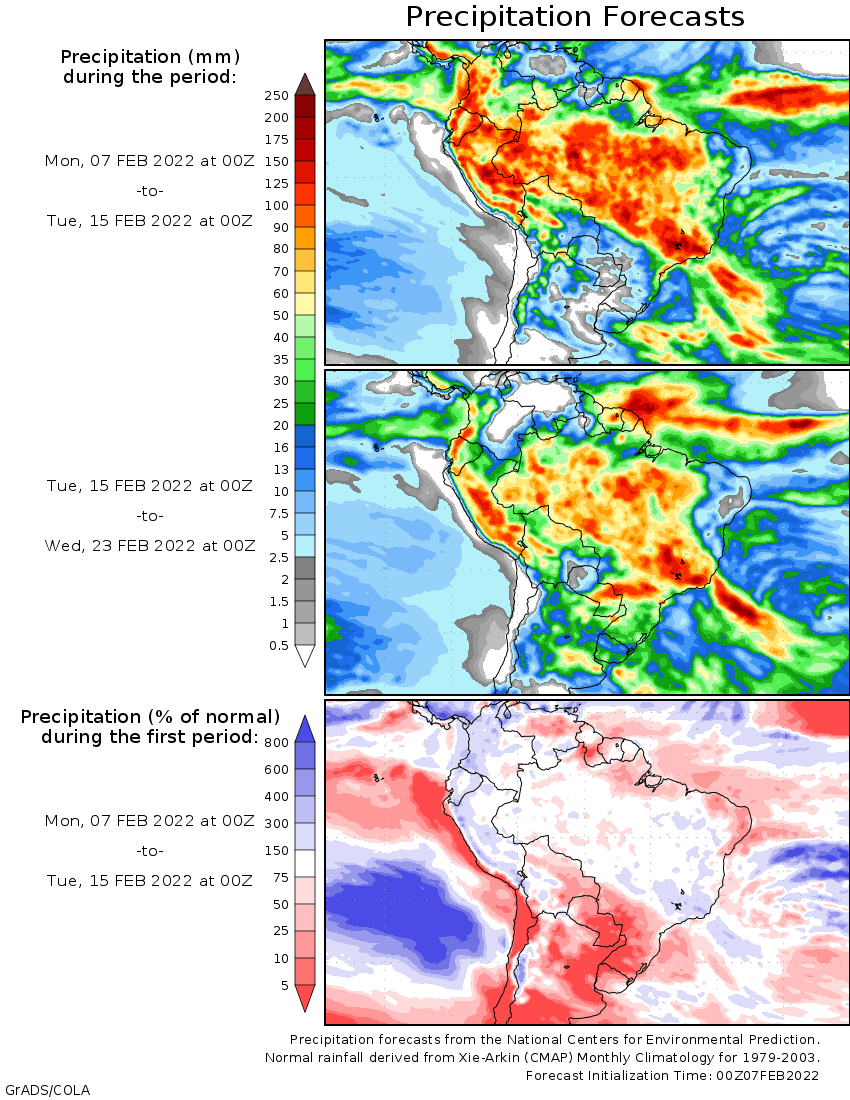

rains across Argentina and Paraguay were not heavy enough to combat drought conditions. Central and Northern Brazil are too wet for soybean harvesting. Soybeans traded higher on strong US demand and ongoing SA crop concerns. Corn rallied following soybeans.

Wheat was higher but gains were limited on softer Black Sea wheat export prices and favorable Black Sea weather. The Goldman roll began today.

WEATHER

EVENTS AND FEATURES TO WATCH

- Changes

overnight included; wetter weather in France during the coming ten days, a few more showers in northern Africa than advertised late last week and drier biased conditions from central Argentina into southern Brazil

- Weekend

precipitation was less than expected in northern cotton areas of Argentina and in southeastern Paraguay - U.S.

frost and freezes occurred as far south as southern Texas during the weekend possibly damaging some fruit and vegetable crops, but the losses were not nearly as great as those of last February - Tropical

Cyclone Batsirai impacted central and southern Madagascar with intensity Category 3 wind speeds and torrential rain resulting in flooding during the weekend - Damage

to personal property and infrastructure was widespread, although the assessments are still under way.

- Damage

to agriculture was suspected, although no specific details were available as of the time of this reporting

- The

storm has since left Madagascar and will move away from the nation and southern Africa this week ending its potential impact on the region - Tropical

Cyclone Batsirai was located 169 miles south southeast of Europa Island at 1500 GMT today moving southward at 11 mph - The

storm was producing maximum sustained wind speeds to 46 mph - Tropical

Storm force wind was occurring out 210 miles from the center of the storm - Batsirai

will continue moving southerly the next couple of days - The

storm will no longer produce adverse weather over Madagascar or any other landmass through the remainder of its existence - Little

change in intensity is expected over the next couple of days - Heavy

rain fell in central parts of Paraguay during the weekend bringing some much needed relief to one of the hottest and driest summers in recent memory - Rainfall

reached over 7.00 inches in central parts of the nation while the southeast (where many crops are produced) did not receive nearly as much rain - Rainfall

near the Misiones, Argentina border and the Parana border were not much more than 1.00 inch, but central areas did receive 3.00 to 6.00 inches and that locally greater amount over 7.00 inches noted above - The

rain in Paraguay was welcome, but some areas got too much and others not enough

- The

precipitation also fell a little too late to seriously change soybean and other early season crop production, but the moisture might be good for Safrinha planting - Brazil

rainfall during the weekend was welcome and sufficient for a boost in topsoil moisture from western and southern Mato Grosso do Sul, western Parana and near Paso Fundo, Rio Grande do Sul through parts of Sao Paulo to Minas Gerais - Some

areas in central Mato Grosso also reported beneficial rain, but the greatest coverage was in the interior south and center south - Rain

totals were mostly in the 1.00 to 2.25 inch range - Lighter

rainfall occurred elsewhere - Temperatures

were seasonable - Brazil

weather over the next ten days will generate less than usual rainfall in most of the south

- This

includes the region from Rio Grande do Sul and portions of Paraguay to southwestern Sao Paulo and southern Mato Grosso do Sul - Totally

dry weather is not expected, but rain totals of 0.20 to 0.80 inch may not be enough to counter evaporation leading to net drying - Recent

rainfall should carry most crops in southern Brazil for a while during the net drying biased period, but some areas in Rio Grande do Sul and southernmost Paraguay are going to need follow up rain soon to support crops and to minimize plant stress. However,

follow up rain will be needed after mid-month to prevent a more serious bout of crop stress from taking place. Rio Grande do Sul will already have some significant moisture stress in parts of the state in the next two weeks, but other areas will manage the

situation relatively well after recent rain. - Center

west and northern parts of center south Brazil will get frequent rain during the next ten days slowing fieldwork and possibly inducing some new flooding - Minas

Gerais, and parts of Goias will be wettest, but portions of Mato Grosso will also be plenty wet – especially in the northeast - Concern

about too much moisture hurting unharvested soybean quality and delaying Safrinha planting will continue this week until a better period of net drying evolves. - Argentina

rainfall during the weekend was greatest in the southern and far northern thirds of the nation while central areas failed to get enough rain to counter evaporation - Rainfall

varied from 0.20 to 1.00 inch in Buenos Aires with 1.00 to 2.00 inches in southwestern Buenos Aires and along the central east coast southeast of the city of Buenos Aires - General

Pico, La Pampa reported the greatest rainfall of 2.50 inches - Northernmost

rainfall was mostly less than 1.20 inches which was lighter than expected for Formosa and Chaco

- Temperatures

were close to normal - Argentina

rainfall is expected to be restricted during the next ten days, although not totally absent - Most

of the rain will not be enough to counter evaporation, although the exceptions will be in parts of Buenos Aires, La Pampa, western Cordoba and the far northwestern corner of the nation where showers and thunderstorms are possible periodically – mostly late

Thursday into Saturday - Rainfall

of 0.30 to 1.25 inches is expected most often with a few totals over 2.00 inches - Heavier

rain will fall in parts of Salta and near the south coast of Buenos Aires - Net

drying is expected in much of the nation and for central areas that missed the weekend rain (central and northern Cordoba, much of Santa Fe and parts of both Corrientes and Entre Rios) crop moisture stress is expected and pressure on yields may resume - Feb.

20-21 may bring some relief to the drier areas, but confidence is low on the timing and how significant the rain may be - The

bottom line will be one of concern for central Argentina crop areas and for many locations in the far north as well. Southern crop areas should do well because of timely rain and favorable soil moisture. Northern Argentina received some needed moisture during

the weekend, but it was not nearly enough and crop stress will be quick to resume. Southern Argentina has the best soil moisture and timely rainfall will see to it that crop development advances well. Southern Argentina is where most of the late season soybeans

are produced. Central Argentina production potential potentials could fall significantly if rain does not evolve soon.

- Argentina

temperatures should be seasonable this week and a little warmer than usual next week - South

Africa reported flooding rainfall in Gauteng, southeastern Free State and southern Natal during the weekend - Rain

totals surpassed 4.00 inches in a few areas which may not sound like much, but some of the areas impacted have seen too much rain already this summer and flooding impacted urban and some rural areas - Crop

damage has not been assessed, but World Weather, Inc. believes it will be localized - Several

other bouts of local flooding have impacted parts of the nation this summer which may cut into production and crop quality, but many other areas have seen a good mix of weather - Production

may not be quite as good as the previous year, but it will still be a good summer for grain, oilseeds, sugarcane, citrus and rice - Much

of the cotton will perform well too except in areas that have been too wet - South

Africa will experience a more restricted rainfall pattern this week which will improve the wetter areas - Most

summer crops will remain in favorable condition - A

boost in rainfall should occur again next week - Heavy

rain and flooding occurred along the central west coast of Sumatra, Indonesia during the weekend

- One

location reported 12.48 inches of rain while other reported over 6.00 inches - Damage

reports were not available at the time of this writing - Southeast

Asia will experience erratic rainfall over the next ten days - The

majority of crops in Indonesia, Malaysia and the Philippines will benefit from the environment - Some

showers may also impact the mainland areas of Southeast Asia periodically with only light amounts of rain resulting - U.S.

weekend precipitation was not very great, but rain fell in the southeastern states Friday while snow and rain ended in the northeastern and middle Atlantic Coast states - Saturday

morning temperatures were bitter cold in the southern Plains and Delta - Lowest

readings were in the upper single digits and teens in the Texas Panhandle, teens and 20s in central Texas, the 20s lower 30s in South Texas and in the upper teens and 20s in the Delta - Damage

to some fruit and vegetable crops occurred in southern Texas, although the losses were not nearly as great as those of last year in February when another bout of extreme cold occurred - Temperatures

were already warming during the weekend with highest readings Saturday and Sunday returning to the 50s in much of Texas with 60s in the south

- Lowest

morning temperatures in the Midwest were in the negative and possible single digits with a few readings in the teens near and south of the Ohio River - Snow

cover was sufficient to protect winter crops from any threat of damage - Freezes

occurred as far south as the central U.S. Gulf of Mexico coast, but no freezes occurred in Florida, southern Georgia or southern South Carolina - U.S.

precipitation in the next ten days will be limited in in the Great Plains, lower Midwest, Delta, Tennessee River Basin, interior southeastern states and in many areas in southern Rocky Mountain region and southwestern states - Waves

of snow will occur in the northern Plains and northern Midwest where some significant snowfall is possible, but it comes in short term waves

- No

threatening cold will impact winter crop areas during the next ten days - Any

precipitation in hard red winter wheat areas will be too light to change the condition of soil or crops - West

Texas will also fail to get much moisture during the forecast period, although the Texas Panhandle will not be completely dry - U.S.

weather Feb. 17-22 may become more active once again in the southeastern portions of hard red winter wheat country, a part of central and eastern Texas, the Delta and lower eastern Midwest as well as the middle and northern Atlantic Coast states with at least

one storm and possibly two - Temperatures

may trend a little cooler in the western states during this period of time while some warming occurs in the southern Plains, southeastern States, Delta and lower Midwest - Readings

in some of these warming areas will become near to above average - Europe

and the western Commonwealth of Independent States temperatures will remain non-threatening to winter crops for the next two weeks - Readings

will be near to above normal with the warmest weather relative to normal in Russia, and parts of eastern Europe - Precipitation

in Europe will continue lighter than usual in Spain and Portugal where no serious improvement in soil moisture is expected during the next ten days - Waves

of snow and rain will fall across eastern Europe and the western CIS; including most of Russia and parts of Ukraine - Some

southern areas may not get much significant moisture, but the ground will remain snow covered and brief bouts of additional snow and rain will be possible - Northwestern

Africa will continue missing out on “significant” precipitation during the next ten days, although some showers are expected - Seasonal

warming will begin later this month and continue in March raising the need for precipitation and this region will need to be more closely monitored - Southwestern

and northeastern Morocco and northwestern Algeria have the poorest soil moisture and the greatest need for precipitation - Tunisia

and northeastern Algeria crops are still rated favorably and will produce well as long as timely rainfall occurs this late winter and spring - India

weekend precipitation shifted from the far north Friday to the Eastern States with sufficient moisture to bolster topsoil moisture for a little while - Last

week’s moisture was greatest for winter wheat and a few other crops - Moisture

is still needed in rapeseed, millet, sorghum and pulse production areas as well as for other crops in the central and west to ensure the best yields this year - Most

crop conditions are rated quite favorably, though - Northern

India may get a few showers late Monday and Tuesday of this week with amounts of 0.05 to 0.35 inch

- Rajasthan,

Punjab, northern Uttar Pradesh and areas to the north will get most of that moisture - A

few locations might get as much as 0.50 inch, but such occurrences will be rare - Mostly

conditions are likely in the majority of other India crop areas during the coming week and perhaps for ten days - China’s

weather will continue to support frequent bouts of snow and rain from the Yangtze River Basin to the south coast over the next ten days - The

moisture abundance will be good for early rice and other early season crops that get planted in late February and especially March - Winter

rapeseed and wheat are still rated in good condition with the bulk of wheat dormant and rapeseed in a state of semi-dormancy - Eastern

Australia weather will be relatively quiet over the next ten days - Any

showers that evolve will be extremely brief and light leaving soil conditions to slowly dry down - Coastal

areas of New South Wales and the upper Queensland coast, Australia were wettest during the weekend leaving most key summer crop areas in the nation dry - Middle

East snow cover remains more widespread than usual reaching across most of Turkey and into western and northern Iran - Some

snow melt is expected - The

moisture will be good for winter crops when warming melts the snow - Ethiopia

has been seasonably dry recently while periodic showers and thunderstorms occur in Uganda and southwestern Kenya - Tanzania

has been and will continue wettest which is normal for this time of year in east-central Africa

- Little

change is expected in these patterns through the next two weeks - West-central

Africa will continue seasonably dry with near normal temperatures for the next ten days - A

few showers are possible in coastal areas, but very little rain will reach into coffee or cocoa production areas - Today’s

Southern Oscillation Index is +6.44 - The

index will move higher over the next few days - New

Zealand will continue to receive significant rain in North Island and in some western and northern parts of South Island this week

- Follow

up precipitation is possible in the north next week - The

moisture will be welcome and help to raise topsoil moisture - Temperatures

will trend a little a little cooler than usual - Mexico

will experience cooler than usual weather with rain in some of the east-central parts of the nation periodically over the coming week

- The

moisture will be good for early season crop development late this month and in March - Sugarcane,

citrus and winter rice will benefit most, but some other fruits and vegetable crops will also benefit

- Early

season sorghum and corn planting will occur well this year if the precipitation is great enough

- The

remainder of the nation will be dry - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically - Western

Colombia, Ecuador and Peru rainfall may be greater than usual in the coming week

- Western

Venezuela will soon begin receiving rain once again after a bout of dryness - The

remainder of Venezuela will remain dry

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals - HOLIDAY:

New Zealand

Tuesday,

Feb. 8:

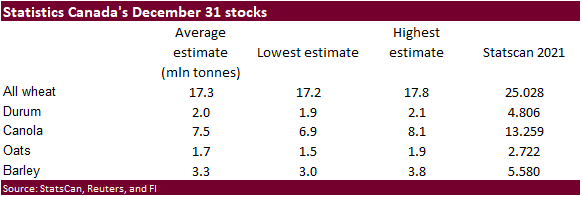

- Canada’s

StatCan releases wheat, durum, canola, soybeans and barley stockpile data, 8:30am - EU

weekly grain, oilseed import and export data

Wednesday,

Feb. 9:

- EIA

weekly U.S. ethanol inventories, production - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm

Thursday,

Feb. 10:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysian

Palm Oil Board’s data on palm oil reserves, output and exports - French

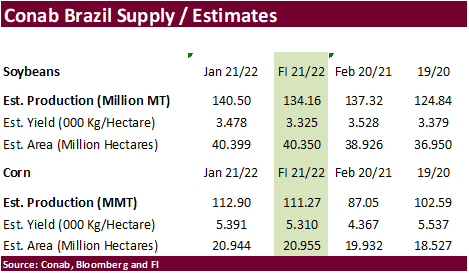

agriculture ministry releases 2022 winter grain and rapeseed planting estimates - Brazil’s

Conab report on yield, area and output of corn and soybeans - Brazil’s

Unica releases sugar output and cane crush data (tentative) - IKAR

grain conference in Moscow - Vietnam’s

customs department to publish data on coffee, rice and rubber exports in January - Malaysia’s

Feb. 1-10 palm oil exports

Friday,

Feb. 11:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - March

ICE white sugar contract expiry - HOLIDAY:

Japan

Source:

Bloomberg and FI

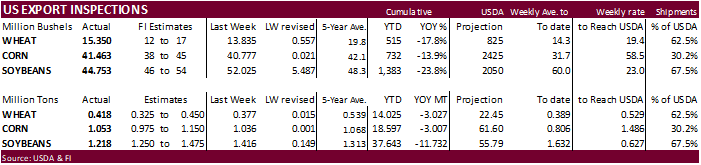

USDA

inspections versus Reuters trade range

Wheat

417,750 versus 250000-450000 range

Corn

1,053,202 versus 975000-1300000 range

Soybeans

1,217,991 versus 1000000-1850000 range

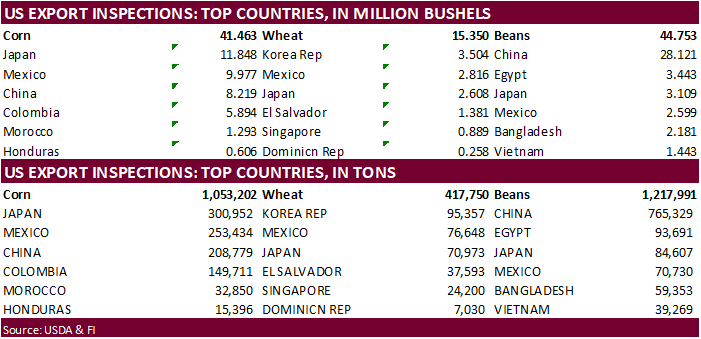

China

was a large taker of 765,329 tons of soybeans, followed by Egypt of 93,691 tons. Last week China had 2.55 million tons of outstanding soybean sales while Egypt had 590,000 tons.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING FEB 03, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 02/03/2022 01/27/2022 02/04/2021 TO DATE TO DATE

BARLEY

0 0 0 10,010 24,636

CORN

1,053,202 1,035,783 1,586,642 18,597,272 21,604,077

FLAXSEED

0 100 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 0 400 2,693

RYE

0 0 0 0 0

SORGHUM

155,534 127,641 201,462 2,433,085 3,269,148

SOYBEANS

1,217,991 1,415,892 1,906,263 37,642,888 49,374,591

SUNFLOWER

0 0 0 432 0

WHEAT

417,750 376,524 485,545 14,024,919 17,052,113

Total

2,844,477 2,955,940 4,179,912 72,709,330 91,327,767

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

81

Counterparties Take $1.680 Tln At Fed Reverse Repo Op (prev $1.643 Tln, 79 Bids)

US

CDC Raises Japan Travel Advisory To Level 4, Very High

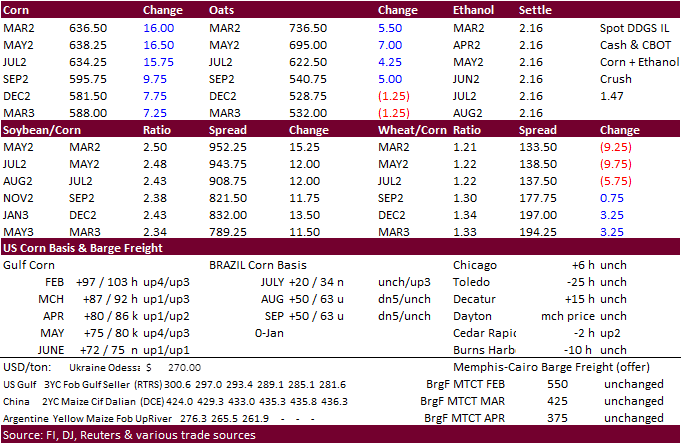

Corn

·

Corn traded higher led by the front months (March up 14.75 cents to $63525) following soybeans on SA crop concerns. $6.2450 is the March absolute contract high. SK bought corn over the weekend. WTI was more than $1.15 lower

by 1:10 pm CT and the USD up 29 points.

·

USDA US corn export inspections as of February 03, 2022 were 1,053,202 tons, within a range of trade expectations, above 1,035,783 tons previous week and compares to 1,586,642 tons year ago. Major countries included Japan for

300,952 tons, Mexico for 253,434 tons, and China for 208,779 tons.

·

Several reports will be out this week starting with StatsCan on Tuesday.

·

The Goldman roll began today.

·

Iraq’s state news agency reported the country plans to import yellow corn and soybeans to fulfill domestic needs.

Export

developments.

·

South Korea’s Feed Leaders Committee (FLC) bought about 66,000 tons of corn to be sourced from optional origins at an estimated $339.74 a ton c&f for arrival in South Korea around May 20.

·

South Korea’s NOFI bought an estimated 133,000 tons of corn in two consignments. The first consignment of about 66,000 tons was bought at an estimated $339.74 a ton c&f for arrival around May 20. The second consignment of about

67,000 tons was bought at an estimated $339.49 a ton c&f for arrival around May 25.

Updated

2/2/222

March

corn is seen in a $5.95 to $6.55

December

corn is seen in a wide $5.25-$7.00 range

·

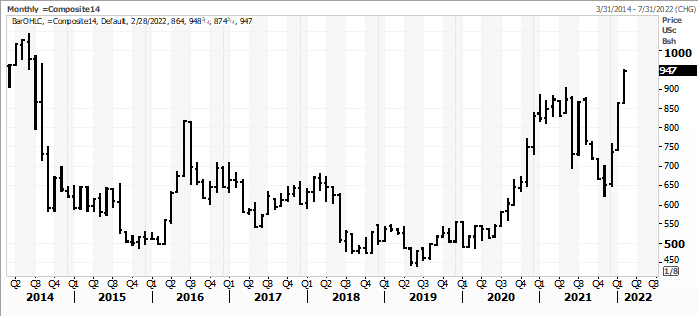

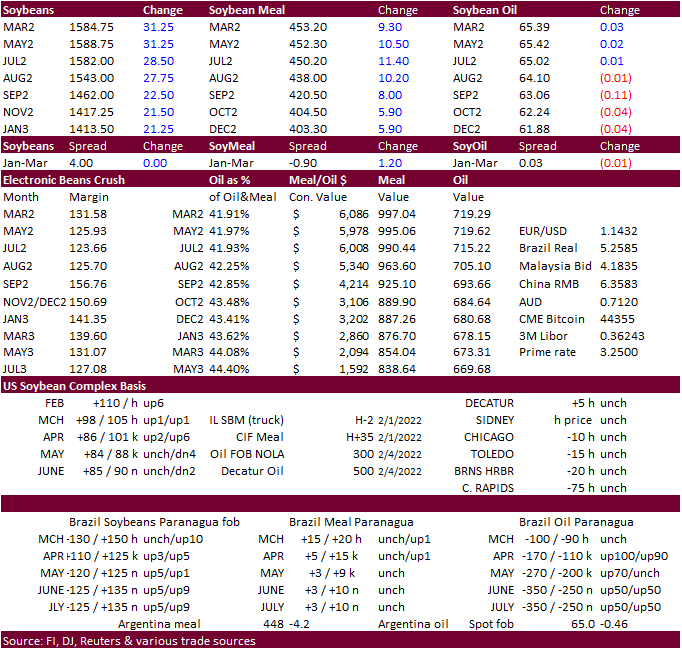

Soybeans were 20.25-28.75 cents higher, with march at an 8-moonth high, on strong US demand and ongoing SA crop concerns. Meal was sharply higher while spreading against soybean oil caused that market to traded tow-sided, ending

mixed. We upward revised our meal and soybean price ranges for the nearby contract. The March contract rallied above $15.80/bu and has made new highs 9 times over the past month, according to Barchart. March is up about 160 cents since January 1. $15.8950

was the contract high today. We think $16.00 is not out of reach by mid-week if SA weather models fail to improve.

·

Weekend rains across Argentina and Paraguay were not heavy enough to combat the drought conditions. Central and Northern Brazil are too wet for soybean harvesting. Rio Grande do Sul will see dry conditions intensify this week.

Argentina will see hot and dry conditions this week, although conditions improve in the 11-15 forecast.

·

StatsCan will issued December 31 grain and oilseed stocks Tuesday morning. Traders are looking for canola stocks to decrease 43 percent from Dec 31, 2020, or 5.8 million tons to 7.5 million tons.

·

AgRural: Brazil harvested 16 percent of the soybean crop, up from 10 percent previous week and above 4 percent year ago. They mentioned wet weather has slowed harvesting.

·

USDA US soybean export inspections as of February 03, 2022 were 1,217,991 tons, within a range of trade expectations, below 1,415,892 tons previous week and compares to 1,906,263 tons year ago. Major countries included China for

765,329 tons, Egypt for 93,691 tons, and Japan for 84,607 tons.

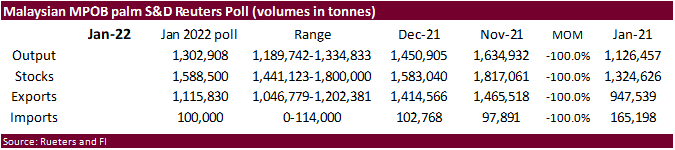

·

Palm oil futures hit a record high on Monday before settling lower. They it rallied slightly during the short overnight third session. Traders are looking for end of January Malaysian palm oil stocks to be little changed from

December. Production and exports likely dropped from December.

·

China is back from holiday and as expected the market traded sharply higher led by SBM following CBOT gains last week.

·

China and Argentina on Sunday pledged to expand their commodity and currency trading relationship over a five year period. China buys a large amount of soybeans and beef from Argentina.

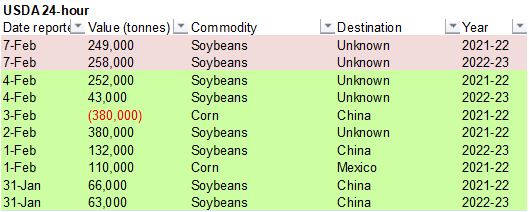

-

Ukraine

will supply Turkey with 50,000 tons of sunflower seeds with zero export duty.

-

Private

exporters reported sales of 507,000 metric tons of soybeans for delivery to unknown destinations. Of the total, 249,000 metric tons is for delivery during the 2021/2022 marketing year and 258,000 metric tons is for delivery during the 2022/2023 marketing year.

Nearby

soybeans – nearby corn spread widened to its highest level since 2014

Source:

Reuters and FI

Updated

2/7/22

Soybeans

– March $14.75-$16.50

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $420-$480

Soybean

oil – March 66.50-69.00

·

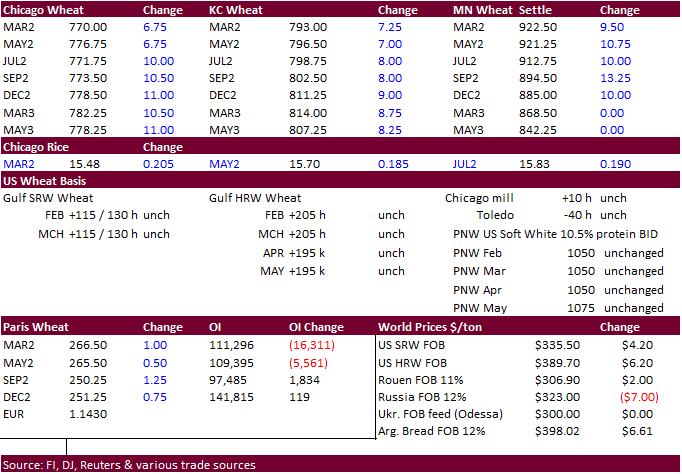

US wheat futures traded higher (few contracts traded two-sided during the session) with gains limited on favorable global weather for the major wheat producing countries and slow US export demand. MN led the 3 US markets.

·

USDA US all-wheat export inspections as of February 03, 2022 were 417,750 tons, within a range of trade expectations, above 376,524 tons previous week and compares to 485,545 tons year ago. Major countries included Korea Rep for

95,357 tons, Mexico for 76,648 tons, and Japan for 70,973 tons.

·

StatsCan will issued December 31 grain and oilseed stocks Tuesday morning. Traders are looking for all-wheat stocks to decrease 31 percent from Dec 31, 2020, or 7.7 million tons to 17.3 million tons.

·

EU wheat futures were up 1 euros to 266.50 euros per ton. On Thursday Paris milling wheat hit a 4-month low.

·

Black Sea wheat prices eased last week by $7-9/ton to $323 and $319/ton, respectively, according to private trade groups. Today it was unchanged to slightly lower.

·

(Reuters) – Ukrainian winter grain crops sown to 2022 harvest were mostly in good or satisfactory condition as of Feb 3, APK-Inform agriculture consultancy reported on Monday, citing Ukraine’s service of food protection.

·

The Russian wheat export tax adjusted this week to $93.20/ per ton from $93.90.

·

Iraq sees a 3-million-ton wheat crop. Consumption is around 4.5-5.0 million tons. Ukraine exported 39.2 million tons of grain so far in the 2021/22 July-June season, up 32.8% from the same stage a season earlier. The total volume

included 17.2 million tons of wheat, 5.5 million tons of barley and 16.1 million tons of corn. (Reuters)

·

(Interfax) – Russia exported 2.95 million tons of wheat in December 2021, down 7.5% year-on-year, the Federal Customs Service said on Monday.

·

Syria seeks 200,000 tons of wheat on February 14, open for 15 days.

·

The Philippines seeks feed wheat from Australia and soybean meal from Argentina on February 11. Amounts are unknown.

·

Bangladesh seeks 50,000 tons of wheat set to close February 14.

·

Jordan seeks 120,000 tons of feed barley on February 8.

Rice/Other

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.29m bales, slightly above USDA’s previous est., according to the avg in a Bloomberg survey of ten analysts.

Estimates

range from 3.0m to 3.7m bales

Global

ending stocks seen at 84.95m bales vs 85.01m bales

Updated

2/2/22

Chicago

March $7.25 to $8.30 range

KC

March $7.45 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.