PDF Attached

Wednesday is USDA report day. FI pre-report snapshot is attached. Heavy rains across Brazil are starting to concern the trade as harvesting progress lags from this time year ago. Soybeans, however, basis the nearby positions closed lower on positioning. Soybean meal and corn fell from mild US temperatures and soybean oil closed higher in part to higher US WTI crude oil. US wheat was mixed. HRW type wheat hit multi year highs on US production concerns.

MOST IMPORTANT WEATHER FOR THE DAY

- Not many changes occurred around the world overnight

- Argentina will continue to dry down through Friday with most showers that evolve unlikely to be enough to counter evaporation

- Argentina will see improved rainfall late this weekend and especially next week with all crop areas getting rain and some of the greater amounts will occur in the north and east where it has been driest recently

- Argentina may trend drier again after Feb. 17

- Brazil rainfall in the far south along with Uruguay and Paraguay will be limited through the weekend, but rain is expected next week to bring some relief to recent and ongoing drying

- Center west and a part of center south Brazil will continue to get rain frequently enough to keep harvest progress in some of the soybean areas a little slow along with the planting of Safrinha corn

- Bahia, Brazil and immediate neighboring areas will be drier biased during much of the coming week to ten days.

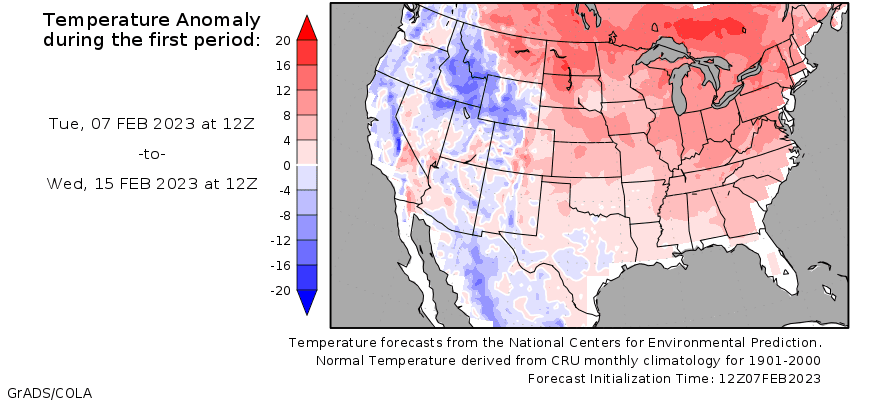

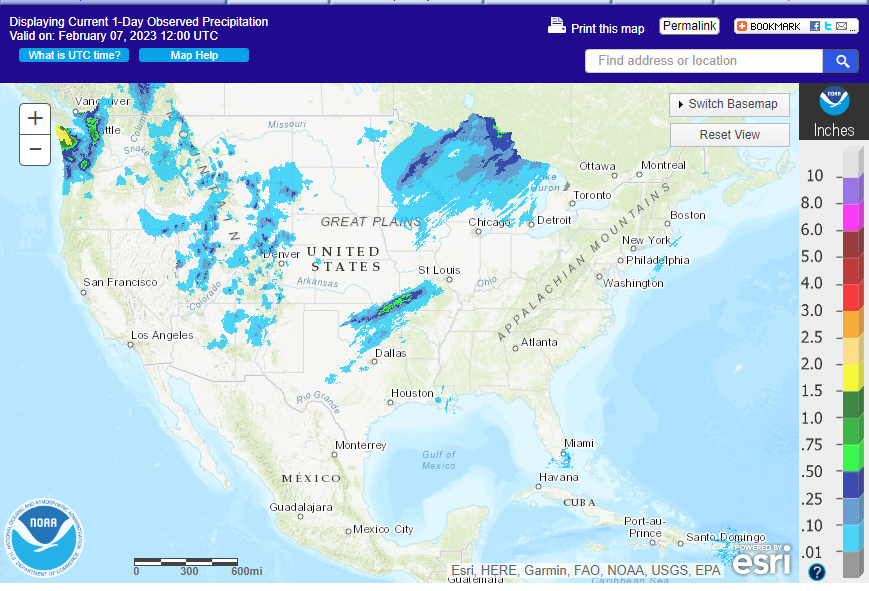

- U.S. hard red winter wheat areas will continue lacking precipitation of significance in the west during the next ten days

- U.S. central and eastern Midwest, Delta and southeastern states will be quite wet over the next ten days to two weeks inducing greater runoff in the Ohio River Valley and inducing a little flooding in the northern Delta, southeastern Missouri and Tennessee River Basin

- U.S. northern Plains and northwestern Corn Belt as well as Canada Prairies will continue to receive below normal precipitation for a while, though a short term bout of increased precipitation is expected before temperatures turn colder away next week

- Evidence continues to rise over the prospects for a Sudden Stratospheric Warming Event (SSW) that should begin to evolve a week from now and become notable in the last days of February and especially in March

- Cooler than usual temperatures will accompany the event from the central Canada Prairies into the heart of the Great Plains and a part of the Midwest during late February and especially March

- An increase in winter storminess is likely in the interior eastern U.S. through the New England states

- California and western Washington and western Oregon rainfall and heavy mountain snow will resume over the coming weekend and last through most of next week adding more moisture to the mountains for use in the spring

- Europe weather will be cool for a little while this week and then warmer than usual during the weekend and next week

- There is no risk of crop damaging cold during the next two weeks

- Weekend weather was mild to cool with rain and snow falling in the east from eastern Germany and Poland south into Romania and western Bulgaria

- Europe precipitation will continue unusually limited for the next ten days

- Dry soil is already present in parts of eastern Spain and a part of the lower Danube River Basin

- North Africa weather

- Some rain is expected over northeastern Algeria and northern Tunisia later this week and into the weekend with moisture totals of 1.00 to 2.00 inches near the coast

- Interior Tunisia, northwestern Algeria and Morocco precipitation will continue limited for the next ten days and possibly longer

- Dryness is already a concern in these areas, although winter crops are dormant or semi-dormant and do not have much moisture requirement for now

- The need for moisture will be steadily rising this month as crop areas trend warmer and crops are stimulated to develop

- Western CIS crop areas will experience light and sporadic precipitation in this first week of the outlook and then experience some boost in rain and snowfall next week

- Winter crops are dormant

- Temperatures will be warmer than usual and there is no risk of winterkill during the next two weeks

- India will be mostly over the next ten days in key crop areas

- Winter crop areas will need rain soon to ensure the best production potential

- Winter crops mostly reproduce in February and continue filling in March

- China will experience waves of rain this week and next week in the Yangtze River Basin and areas to the south coast

- The southern rapeseed areas will be wettest and should experience the best improvement in soil moisture supporting early spring crop needs

- Rice planting will begin in early March or as soon as soil temperature permit and rapeseed will be breaking dormancy soon if it has not already

- Wheat areas in the North China Plain and Yellow River Basin may get some needed rain briefly late this week and into the weekend

- Australia rainfall is expected to occur erratically over the next ten days impacting central and southeastern Queensland most often

- Greater rain would be welcome in key summer crop areas, especially those not irrigated

- South Africa rainfall will stay erratic and light for a while this week and then increase during the second half of this week into next week

- Summer crop conditions will remain good, and some will improve with the greater rain forthcoming

- Middle East precipitation is expected to increase this week, although not all areas will benefit

- Turkey will be wettest along with northern Iraq, northern Syria and portions of western and northern Iran

- Greater precipitation will still be needed in some areas

- Southern Syria and much of Iraq away from the far north will be dry and moisture in parts of Iran will be lighter than usual as well

- Eastern Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year

- West Africa rainfall is expected to be mostly confined to coastal areas during the next ten days, but a few showers will occasionally reach into a few coffee and cocoa production areas

- Seasonal rains should begin over the next few weeks.

- Today’s Southern Oscillation Index was +9.3 and it will move erratically this week

Source: World Weather and FI

Bloomberg Ag calendar

Tuesday, Feb. 7:

- New Zealand commodity prices

- EU weekly grain, oilseed import and export data

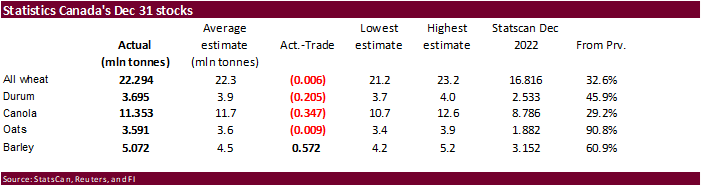

- Canada’s StatsCan to release wheat, soybean, canola and barley reserves data, 8:30am

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

- New Zealand global dairy trade auction

Wednesday, Feb. 8:

- USDA’s World Agricultural Supply & Demand Estimates (WASDE), 12pm

- China’s agriculture ministry (CASDE) releases monthly supply and demand report

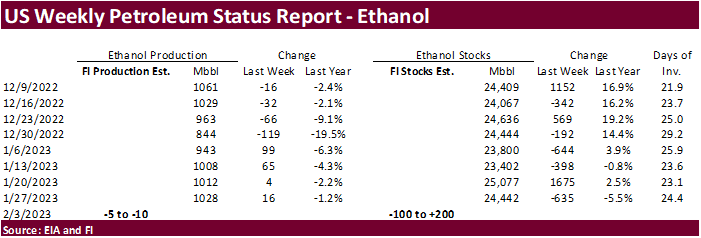

- EIA weekly US ethanol inventories, production, 10:30am

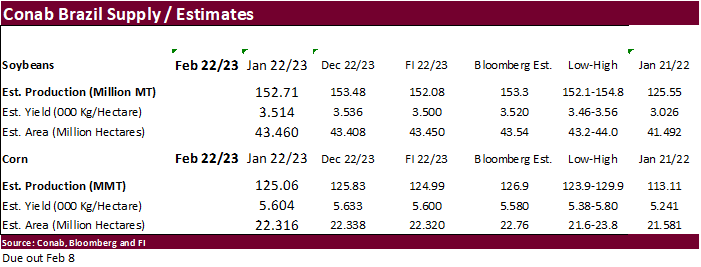

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- RESULTS: Yara

Thursday, Feb. 9:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

Friday, Feb. 10:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- Malaysian Palm Oil Board’s January data on stockpiles, production and exports

- Brazil’s Unica to release sugar output, cane crush data (tentative)

- Malaysia’s Feb. 1-10 palm oil export data

Source: Bloomberg and FI

Brazil’s Conab will be out Wednesday at 6 am CT with updated soybean and corn production

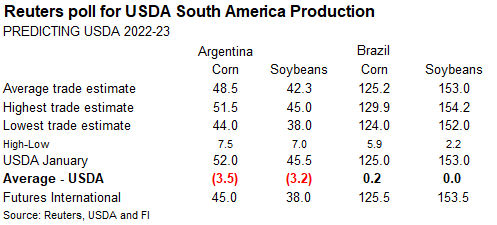

Soybean and Corn Advisory

2022/23 Brazil Soybean Estimate Unchanged at 151.0 Million Tons

2022/23 Brazil Corn Estimate Unchanged at 125.0 Million Tons

2022/23 Argentina Soybean Estimate Lowered 1.0 mt to 38.0 Million

2022/23 Argentina Corn Estimate Unchanged at 44.0 Million Tons

Stats Canada was seen supportive for high protein wheat and canola.

Macros

US Trade Balance Dec: -$67.4B (est -$68.5B; prevR -$61.0B)

104 Counterparties Take $2.058 Tln At Fed Reverse Repo Op. (Prev $2.072 Tln, 103 Bids)

Fed’s Powell: ‘Base Case Is That It Will Take Time, More Rate Increases, To Finish The Process’

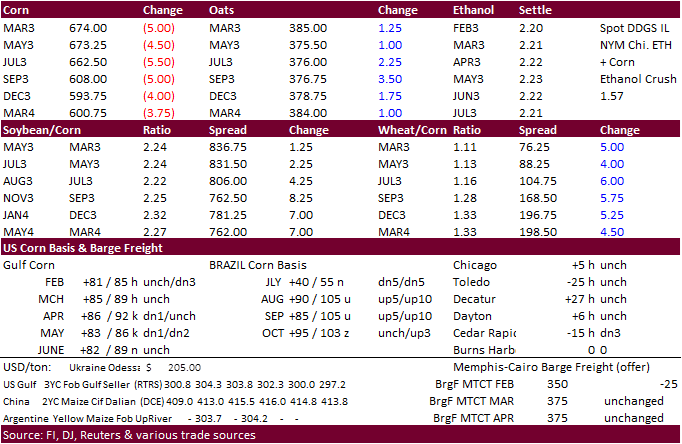

· CBOT corn was lower on fund selling. News was light, so where export developments since USDA announced a couple corn sales on Monday. Mild US temperatures are easing feed demand rates for corn and soybean meal.

· Goldman roll kicked off today and corn TAS volume (based off the settlements) was high by mid-morning (higher than usual for a roll for March/May).

· Traders are looking for US corn acres to expand in 2023, which is no surprise given the December corn contract is trading just below $6.00 per bushel. November soybeans are near $13.70, which favors corn plantings.

· Mexico is expected soon to issue a new decree over GMO corn imports.

· The US trade deficit widened to a record during December oof 67.4 billion USD.

· China is looking to buy local pork for state reserves to prop up prices.

· CNBC reported US egg prices are off about 50 percent from record highs during December.

Export developments.

- South Korea’s MFG bought 138,000 tons of corn from South America at $339.50/ton (70k) and $339.83/ton (68k), both for May arrival.

Updated 02/7/23

March corn $6.40-$6.85 range. May $6.25-$7.00

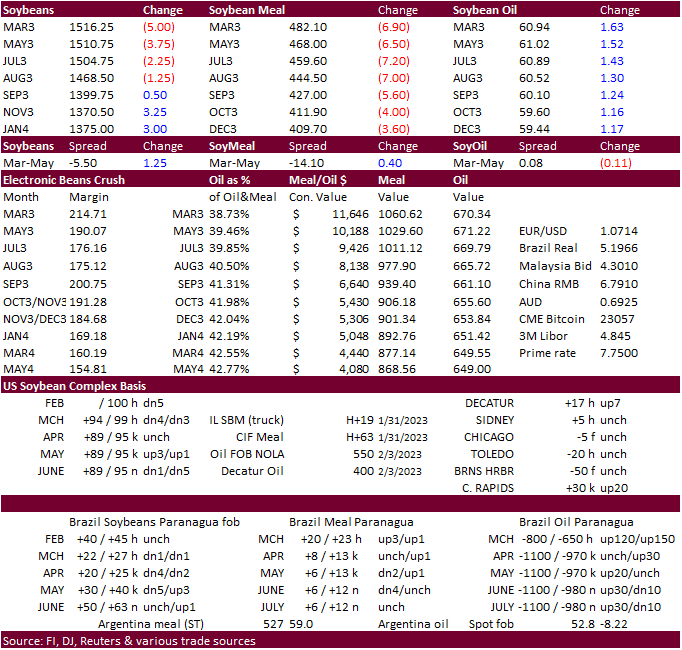

· Heavy rains across Brazil is a concern as harvesting progress lags, but Brazil has a long way to go. Soybean rust cases in Brazil are starting to increase, but not a factor unless they persists over the next month. Nine percent or 14 million tons of the AgRural Brazil production estimate had been collected, below 16 percent year ago. Parana, Brazil, is 2 percent complete versus 15 percent year ago. Meanwhile, Argentina is not expected to see any meaningful rain through the end of this workweek. Not all areas will be totally dry for Argentina. Some weather models are diverging, meaning there is a possibility Argentina could see rain time to time.

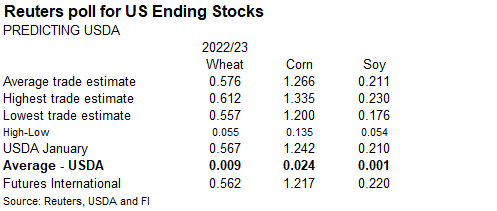

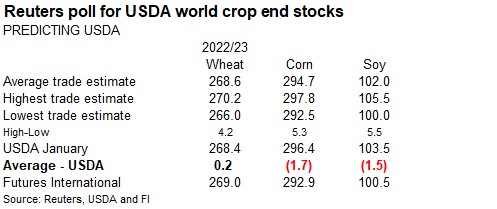

· Soybeans traded two-sided, twice, during the day session. Nearby positions were lower on the day. Positioning ahead of three reports could be the case. China S&D, Conab supply and USDA are due out Wednesday. For the USDA report, the trade should focus on Argentina soybean and corn production, global ending stocks, followed by changes to the US S&D’s, in that order. We think the average trade guesses for Argentina soybean and corn production are very conservative. We don’t see USDA making any significant changes to China demand.

· Soybean oil was higher following strength in WTI crude oil, spreading against meal and higher Malaysian palm oil (main session). Some were eyeing the long fund position for soybean oil which has nearly halved since mid-January.

· Soybean meal basis fell $2-$3/short ton for Midwestern locations. An increase in US processing was noted.

· Goldman roll started today. TAS volume for both soybeans and corn by mid-morning was impressive.

· Indonesia plans to suspend some palm oil export permits to cool internal prices and secure domestic supplies ahead of the Islamic festivals. Two thirds of existing quotas are suspended until May 1. The government noted traders accumulated large shipment quotas last year and have no intention to divert the palm supplies back to the domestic market. Exporters were holding about 5.9 million tons worth of export permits at the end of January. Companies had been ordered to supply 450,000 tons per month to the domestic market, up from 300,000 tons previously.

Export Developments

· Last week USDA bought 46,670 tons of soybean meal for shipment to Ghana, Ivory Coast and Senegal at $596.34 fob.

Updated 02/07/23

Soybeans – March $14.85-$15.50, May $14.75-$16.00

Soybean meal – March $450-$520, May $425-$550

Soybean oil – March 58.50-63.00, May 58-70

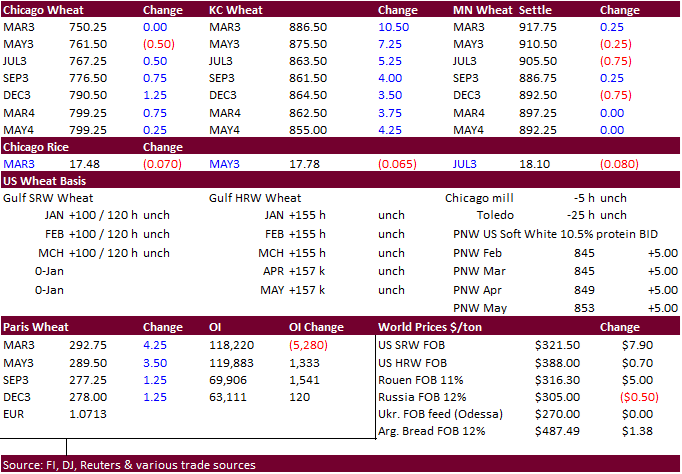

· US wheat was mixed. Chicago was lower for the front two contracts from improving US weather and slow US exports. KC reached a 12-year high in part to 21 percent of KS winter wheat conditions rated G/E. MN traded two-sided. Russian wheat is trading at about a 7 percent discount to HRW wheat. Canadian StatsCan reported a supportive durum stocks estimate but that was shrugged off by afternoon trading.

· Winter weather advisories are advertised for many parts of the US, including far western Great Plains. Rain in the central GP was welcome over the past day.

· Paris March wheat was up 4.25 euros at 293.75 per ton.

· Ukraine exported 27.7 million tons of grain so far for the 2022-23 marketing year, down from 39.2 million tons last season.

· Traders don’t see a disruption in grain trading in Syria and Turkey post devastating earthquake.

Export Developments.

· Jordan passed on 120,000 tons of optional origin milling wheat for May-June shipment.

· Taiwan seeks 48,100 tons of milling wheat from the US on February 9 for March 29 and April 12 shipment.

Rice/Other

· South Korea seeks 79,439 tons of rice on February 8 for May 1-Dec 31 arrival.

· Egypt seeks at least 25,000 ton of rice from optional origin April-May shipment.

Updated 02/02/23

Chicago – March $7.25 to $7.90, May $7.00-$8.25

KC – March $8.40-$9.10, $7.50-$9.25

MN – March $9.00 to $9.75, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |