PDF Attached

Today’s theme was short-covering in wheat and gap-filling Sunday’s open in soybeans. With the recent run up in soybeans over the last two weeks and thought that beans may compete for acres in the US Northern Plains grown spring wheat, we saw soy versus wheat spreading. Today we saw unwinds of this themed trade.

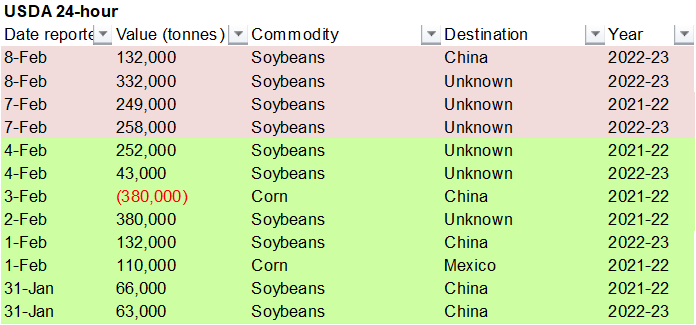

Private exporters reported the following activity:

132,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year

332,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year

Weather

WEATHER EVENTS AND FEATURES TO WATCH

- Only one rain event in Argentina, Uruguay and southern Brazil in the next ten days is not going to help crops in the driest areas perform very well and crop stress is expected to begin increasing once again as time moves along

- Showers Thursday and Friday in Argentina and this weekend in southern Brazil and neighboring areas will bring partial relief to the week’s drying, but those crop areas without good subsoil moisture may experience some moisture stress

- Buenos Aires and southern Cordoba, Argentina are in the best shape to handle the net drying bias that is forthcoming because of good subsoil moisture

- Central and northern Argentina crops will experience more crop stress and that could lead to a little more threat to production

- Recent rain in southern Brazil and Paraguay has temporarily moistened the soil, but this week’s limited rain and that which is expected next week will reverse the trend and return some moisture stress for many crops that only received light rainfall recently

- Unlike the drier periods in late December and January, temperatures in Argentina, Paraguay and southern Brazil should not be nearly as hot which may also help slow any decline in crop condition

- Center west and center south Brazil will continue to deal with excessive soil moisture

- Flood potentials remain high in many areas, but the greatest risk of flooding is in Minas Gerais – probably more so in coffee and sugarcane areas than in soybean and corn areas

- That does not mean all is well in the corn and soybean areas

- Drier weather is needed to firm the soil and support better soybean maturation and harvest conditions

- Safrinha corn and cotton planting are advancing relatively well in Brazil with cotton already more than 70% planted in Mato Grosso last week

- Safrinha corn planting has advanced favorably, but it would go quicker in parts of Mato Grosso if drier weather were to evolve, but the situation is not critical and more progress is expected around periods of rainfall

- U.S. storm system next week may be too intense for hard red winter wheat production areas and the system should get relocated to the southeast in future model runs

- Any moisture that falls in hard red winter wheat areas will be welcome and there should be more bouts of rain and snow coming up during the late winter and spring, although moisture totals will be less than usual leaving drought a viable threat during the warmer days of spring and summer in the Plains

- Next week’s U.S. storm will maintain wet field conditions in the lower and eastern parts of the Midwest, the northern Delta and Tennessee River Basin

- Some flooding may return to the region once again

- California precipitation and that of many western U.S. states will be restricted over the next two weeks

- Mountain snowpack and snow water equivalency is slipping below average in the Sierra Nevada relative to this date and remains 55-60% of the April 1 norm

- Precipitation in the Sierra Nevada will be well below average during the next two weeks putting greater pressure on late February and March precipitation to further improve mountain snowpack.

- Temperatures in western North America will be warmer than usual during the coming week with a slightly cooler during the second week of the forecast

- Temperatures in the Midwest, Delta and interior southeastern states will be near to below average in this coming week and warmer next week

- West Texas will get a little rain and snow during the middle to latter part of next week

- The moisture will be greatest in the Rolling Plains, but some light precipitation is expected in the High Plains briefly, as well

- South Texas precipitation is expected to be erratic and mostly light during the next ten days

- Coastal Bend cotton areas of the U.S. have good soil moisture for use in the spring

- U.S. Delta will remain plenty wet, although it will dry down for a while in the coming week before more storminess makes the north wet once again

- U.S. Southeastern States have good soil moisture today except in Florida and a few areas in southern Georgia where the ground is firming up

- There is no threatening cold weather for Europe or any part of Asia during the next two weeks

- Winter crop conditions are mostly good

- India, China and much of Europe should have a good start to the growing season this year based on today’s soil moisture

- Spain and northwestern Africa are still too dry and need rain in the next few weeks to support crop improvement as seasonal warming stimulates new crop development in the next few weeks

- West-central Africa coffee and cocoa production areas will see some increase in shower activity this weekend, but most of the rain is not expected to be enough to greatly increase topsoil moisture

- Additional showers are expected in the Feb. 16-22 period that may stimulate a few areas of localized flowering

- The rainy season is expected to begin relatively well

- East-central Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia is dry biased along with northern Uganda and that is also normal

- South Africa weather includes a restricted amount of rainfall over the next ten days and that along with seasonably warm temperatures will eventually lead to firming ground

- Crop conditions will stay good

- Southeast Asia precipitation will continue erratic from one day to the next, but most of Indonesia and Malaysia precipitation will continue frequent and abundant

- Mainland areas of Southeast Asia seem poised to see an early start to scattered showers and thunderstorms during the next couple of weeks with next week wettest

- Eastern Australia sorghum, cotton and other crop areas; including some sugarcane areas, will see net drying over the next ten days to two weeks.

- The environment will reduce soil moisture and could stress some dryland crops in the interior parts of the region

- Coastal showers are expected, but rainfall will be lighter than usual

- China’s weather will continue to support frequent bouts of snow and rain from the Yangtze River Basin to the south coast over the next ten days

- The moisture abundance will be good for early rice and other early season crops that get planted in late February and especially March

- Winter rapeseed and wheat are still rated in good condition with the bulk of wheat dormant and rapeseed in a state of semi-dormancy

- Xinjiang China will see a couple of snow events during the next ten days

- The precipitation will be greatest in the northeast, but the mountainous areas will get some moisture

- This precipitation is needed after the early to middle part of winter was drier than usual

- Middle East snow cover has been decreasing recently

- Rain and snow will move across Turkey today and Wednesday and then to Iraq, Syria and eventually Iran later this week and into the weekend

- The moisture will be good for winter crops

- Today’s Southern Oscillation Index is +7.61

- The index will move a little higher this week and then level off for a while

- New Zealand will continue to receive significant rain in North Island and in some western and northern parts of South Island this week

- Follow up precipitation is possible in the north next week

- The moisture will be welcome and help to raise topsoil moisture

- Temperatures will trend a little a little cooler than usual

- Mexico will experience cooler than usual weather with rain in some of the east-central and southeastern parts of the nation periodically over the coming week

- The moisture will be good for early season crop development late this month and in March

- Sugarcane, citrus and winter rice will benefit most, but some other fruits and vegetable crops will also benefit

- Early season sorghum and corn planting will occur well this year if the precipitation is great enough

- The remainder of the nation will be dry

- Central America precipitation will be greatest along the Caribbean Coast during the next seven to ten days

- Guatemala will also get some showers periodically

- Western Colombia, Ecuador and Peru rainfall may be greater than usual in the coming week

- Western Venezuela will also experience a boost in rainfall

- The remainder of Venezuela will remain dry

Source: World Weather Inc.

Bloomberg Ag Calendar

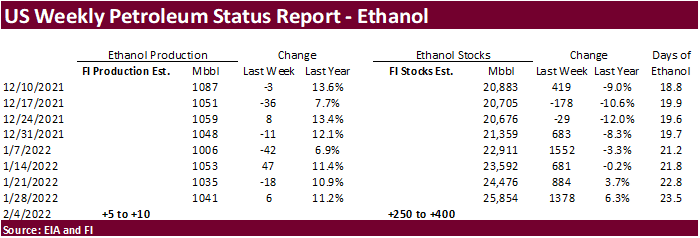

- EIA weekly U.S. ethanol inventories, production

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, 12pm

Thursday, Feb. 10:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Malaysian Palm Oil Board’s data on palm oil reserves, output and exports

- French agriculture ministry releases 2022 winter grain and rapeseed planting estimates

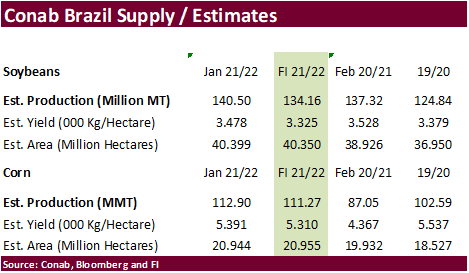

- Brazil’s Conab report on yield, area and output of corn and soybeans

- Brazil’s Unica releases sugar output and cane crush data (tentative)

- IKAR grain conference in Moscow

- Vietnam’s customs department to publish data on coffee, rice and rubber exports in January

- Malaysia’s Feb. 1-10 palm oil exports

Friday, Feb. 11:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- March ICE white sugar contract expiry

- HOLIDAY: Japan

Source: Bloomberg and FI

Reminder:

USDA Agricultural Projections to 2030

This report was released on February 16, 2021

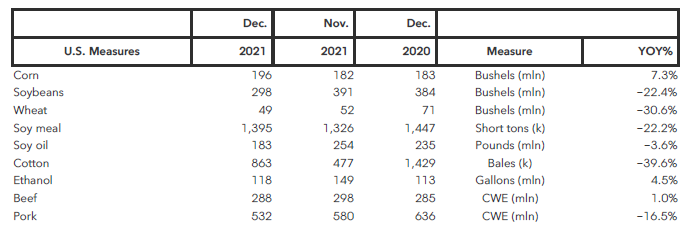

US Census Trade Data via Bloomberg

Soybean and Corn Advisory

2021/22 Brazil Soybean Estimate Unchanged at 130.0 Million Tons

2021/22 Argentina Soybean Estimate Unchanged at 42.0 Million Tons

2021/22 Paraguay Soybean Estimate Lowered 1.0 mt to 5.0 Million

2021/22 Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22 Argentina Corn Estimate Unchanged at 51.0 Million Tons

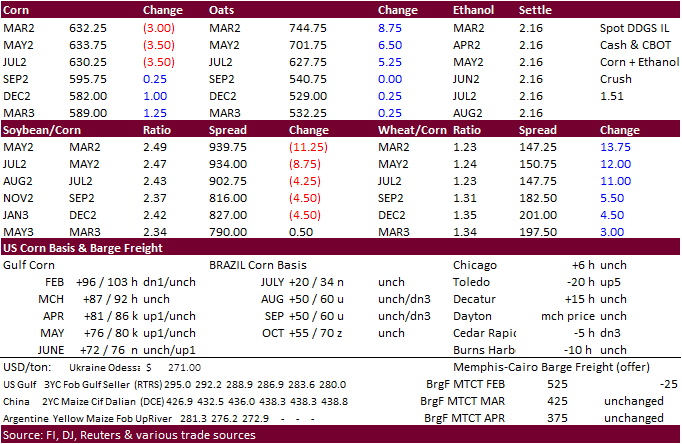

Corn

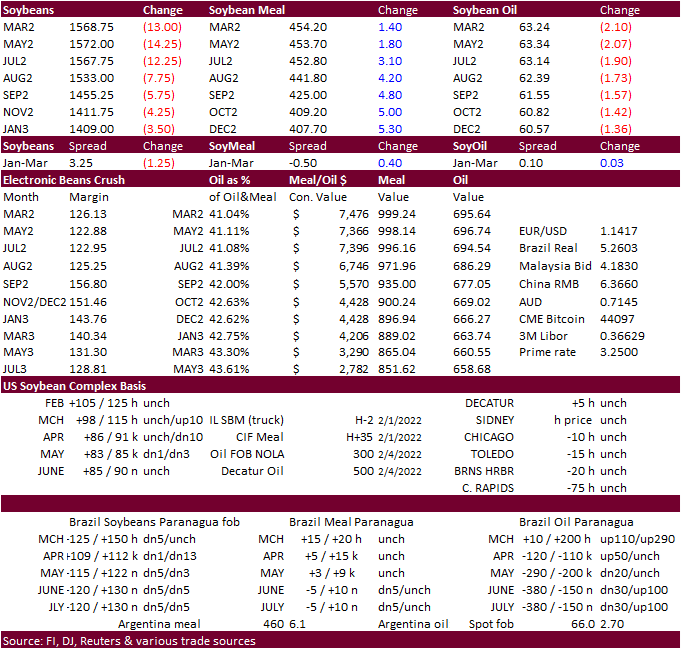

· Corn ended lower but gained on soybeans. USD finished firmer keeping a lid on grain prices.

· Traders wait for more developments over the Ukraine/Russian situation.

· Argentina and southern Brazil will remain dry with exception of late workweek rain event.

· Today was the second day of the Goldman roll.

· Brazil corn exports seen reaching 521,203 tons in February vs 447,404 tons forecast in previous week according to ANEC.

Export developments.

· Turkey’s TMO bought 325,000 tons of corn for Feb 25 and March 15 shipment. Prices ranged from $304.70 to $315.80/ton.

· Taiwan’s MFIG seeks up to 65,000 tons of corn on Thursday, Feb 10 for April 1-20 shipment.

Updated 2/2/22

March corn is seen in a $5.95 to $6.55

December corn is seen in a wide $5.25-$7.00 range

· Soybeans traded lower today and filled the gap in SH2 @ $15.6025/bu from Sunday evenings higher open. Soybeans were able to bounce from the lows as traders refocused on the hot and dry weather in South America.

· Meal/oil spreading was on topic this morning. March oil share could be headed to 35 percent if global vegetable oil prices drop hard over the next couple of weeks. Meal has been supported by shrinking SA soybean supplies.

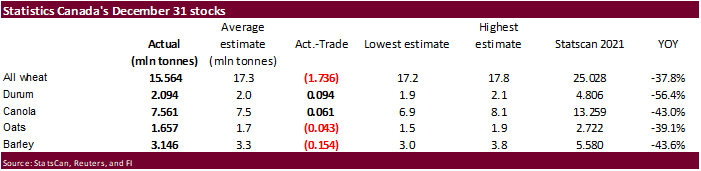

· StatsCan December 31 Canadian canola stocks were near expectations at 7.561 million tons, but well below 13.3 million tons a year ago, or down 43 percent.

· There are rumors China might be soon releasing 300,000 tons of soybean oil and 1.7 million tons of soybeans out of stocks.

· US December soybean exports were 298 million bushels. Although down from last year, were 8 million bu higher than our expectations and well above inspections. We took 2021-22 US soybean exports up 25 million bushels to 2.175 billion and raised new-crop 100 million to 2.250 billion as we see ONDJ 2022-23 exports at or just below its record.

· Only one rain event is expected in Argentina and southern Brazil during the next ten days and that is expected Thursday and Friday in Argentina and this weekend in Brazil. Less than an inch is expected across southern Brazil. Argentina will see trace amounts up to mostly half an inch of rain through Monday.

· Brazil soy exports seen reaching 7.500 million tons in February vs 9.923 million tons forecast in previous week – ANEC

· (Reuters) – European Union soybean imports in the 2021/22 season that started in July had reached 7.98 million tons by Feb. 6, data published by the European Commission on Tuesday showed. The volume compared with 8.98 million tons by the same week in the previous 2020/21 season, the data showed. EU rapeseed imports so far in 2021/22 had reached 3.08 million tons, compared with 4.28 million tons a year earlier. Soymeal imports so far in 2021/22 were at 9.85 million tons against 10.49 million a year ago, while palm oil imports stood at 3.14 million tons versus 3.55 million.

- USDA announced private exporters sold 132,000 tons of soybeans to China and 332,000 tons to unknown for new crop delivery.

- Ukraine will supply Turkey with 50,000 tons of sunflower seeds with zero export duty.

Updated 2/7/22

Soybeans – March $14.75-$16.50

Soybeans – November is seen in a wide $12.00-$15.75 range

Soybean meal – March $420-$480

Soybean oil – March 66.50-69.00

March oil share

Source: Reuters and FI

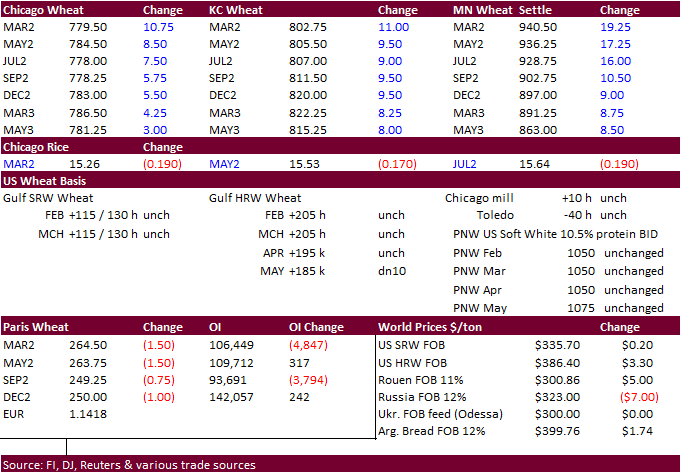

· US wheat futures rose today on the bullish StatsCan data and the persistent dry conditions in the US Plains for the dormant winter wheat.

· StatsCan December 31 all-wheat stocks decreased a more than expected 1.736 million tons from an average trade guess to 15.564 million tons, 38 percent below Dec 31, 2020.

· EU wheat futures are trading down 1.50 euros at 264.50 euros per ton.

· (Reuters) – Soft wheat exports from the European Union in the 2021/22 season that started in July had reached 16.92 million tons by Feb. 6, according to data published on Tuesday by the European Commission. That compared with 16.22 million tons by the same week in 2020/21, the data showed. EU 2021/22 barley exports had reached 5.14 million tons, against 4.75 million a year ago, while EU maize imports were at 9.79 million tons, against 10.28 million.

· Jordan’s state grain buyer bought 60,000 tons of optional origin animal feed barley at an estimated $301.25 a ton c&f for shipment in the first half of July.

· Syria seeks 200,000 tons of wheat on February 14, open for 15 days.

· The Philippines seeks feed wheat from Australia and soybean meal from Argentina on February 11. Amounts are unknown.

· Bangladesh seeks 50,000 tons of wheat set to close February 14.

Rice/Other

· (Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.29m bales, slightly above USDA’s previous est., according to the avg in a Bloomberg survey of ten analysts.

Estimates range from 3.0m to 3.7m bales

Global ending stocks seen at 84.95m bales vs 85.01m bales

Updated 2/2/22

Chicago March $7.25 to $8.30 range

KC March $7.45 to $8.55 range

MN March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.