PDF Attached

Data dump day with China CASDE, Conab Brazil supply, EIA weekly ethanol production/stocks, and USDA S&D update. Largest reaction in prices was tied to the USDA report. In general prices were volatile throughout the day but settled in the same direction where the day session started.

USDA released their February S&D report

Reaction: Initially bearish but a buying opportunity for bull traders.

USDA NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

USDA lowered Argentina corn and soybean production by a less than expected amount and this initially sent those markets lower post USDA report. Wheat was seen neutral. We remain bullish over the short term based on Argentina production cuts. Wheat may follow corn and soybeans higher.

Major highlights:

US soybean stocks 225 vs. 210 last month (15), +14 million vs. trade

US corn stocks 1267 vs. 1242 last month (25), +1 million vs. trade

US wheat stocks 568 vs. 567 last month (1), -8 million vs. trade

Brazil Soy 153.0 vs. 153.0 last month (0), 0.0 million vs. trade

Arg. Soy 41.0 vs. 45.5 last month (-4.5), -1.3 million vs. trade

Brazil Corn 125.0 vs. 125.0 last month (0), -0.2 million vs. trade

Arg. Corn 47.0 vs. 52.0 last month (-5), -1.5 million vs. trade

WLD soy stocks 102.0 vs. 103.5 last month (-1.5), 0.0 million vs. trade

WLD corn stocks 295.3 vs. 296.4 last month (-1.1), +0.6 million vs. trade

WLD wheat stocks 269.3 vs. 268.4 last month (0.9), +0.7 million vs. trade

The US soybean crush was lowered a needed 15 million bushels. A slow December crush and less than expected January NOPA rate warranted this, despite excellent US cash crush margins. As a result, US soybean stocks went up 15 million bushels to 225 million (14 million above a trade average), still below 274 million at the end of 2021-22. With a lower crush and modest increase in the soybean meal yield, USDA trimmed US soybean meal production by 200,000 short tons. They decided to offset the lower supply by cutting domestic usage by 200,000. For soybean oil, USDA raised the yield to 11.77 pounds per bushel from 11.72 previous month. This helped offset the decline in 2022-23 soybean oil production, seen at 26.245 billion pounds, down 65 million from January and compares to 26.143 billion pounds year earlier. USDA lowered 2022-23 US soybean oil exports by 100 million pounds to 700, nearly a billion and half pounds below 2021-22!

USDA lowered US corn for ethanol use by 25 million bushels. We thought the cut could have been as high as 50 million bushels. No other demand changes were made and ending stocks were raised 25 million to 1.267 billion bushels, in line with trade expectations. USDA made very little to its US all wheat balance sheet. US ending stocks were up 1 million bushels to 568 million and compares to 698 million year earlier. But by class, SRW wheat stocks were upward revised 12 million, White wheat lowered 11, durum down 1 million and HRW off one million from their January estimate.

For the world balance, the largest impact we saw was the less than expected cut to Argentina soybean and corn production, now estimated at 42.3 million and 48.5 million tons, respectively, 1.3 and 1.5 million below the average trade guesses. The Argentina soybean crop was down 4.5 million tons from January and corn by 5.0 million. Note much of the trade is near 35 million tons for Argentina soybean production and 41-43 MMT for corn. Brazil soybean and corn production was left unchanged by USDA from the previous month. Note USDA took Brazil’s soybean export projection up by 1 million tons to 92 million, a record, and left China soybean imports unchanged. Brazil corn exports were increased 3 million tons by USDA to 50.0 million, surpassing US exports of 48.9 million tons.

For wheat, we were a little surprised to see USDA raise Russia wheat production by 1 million tons after making comments that their crop was lower than what Russia’s AgMin had been reporting. Australia wheat output was upward revised 1.4 million, Brazil up 0.5 million and China by 0.8 million.

Global ending stocks for soybeans were downward revised by 1.5 million tons for soybeans and 1.1 million for corn. All-wheat was raised 0.9 million. Grain ending stocks are projected to decline from the previous year while global ending stocks for soybeans are still estimated to increase, now by 3.2 million tons, from 2021-22.

Attached PDF includes FI snapshot

MOST IMPORTANT WEATHER FOR THE DAY

· Not many changes occurred around the world overnight

· Argentina is wetter again from Monday into Wednesday of next week after Tuesday’s mid-day and evening model runs reduced some of the rain

· Argentina will see improved rainfall late this weekend and especially early next week with all crop areas getting rain and some of the greater amounts will occur in the north and east where it has been driest recently

· Argentina may trend drier again after Feb. 17 leaving a strong need for greater and more frequent rain

· Brazil rainfall in the far south along with Uruguay and Paraguay will be limited through the weekend, but rain is expected next week to bring some relief to recent heat and ongoing drying

o Resulting rainfall will be sufficient to improve crop conditions for a while, but more rain will still be needed

· Center west and a part of center south Brazil will continue to get rain frequently enough to keep harvest progress in some of the soybean areas a little slow along with the planting of Safrinha corn

o However, improved drying conditions have occurred in parts of Mato Grosso recently and that will continue, though there will be some showers and thunderstorms occurring periodically – which is normal at this time of year.

· Bahia, Brazil and immediate neighboring areas will be drier biased during much of the coming week to ten days favoring some crops, but there will eventually be need for greater rain

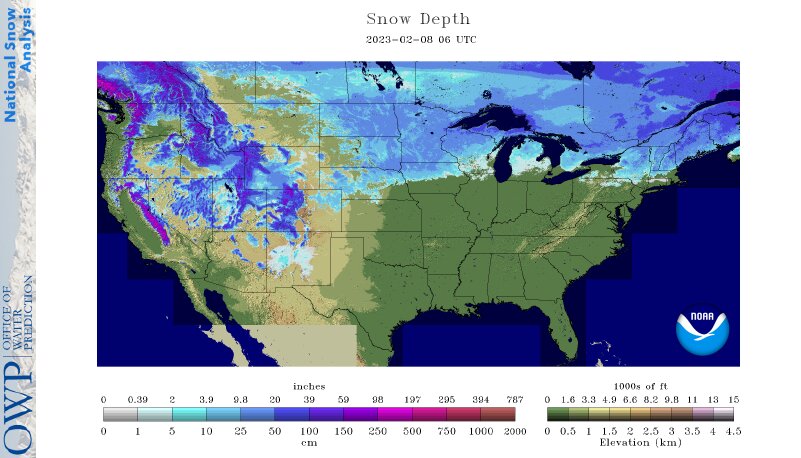

· U.S. hard red winter wheat areas will continue lacking precipitation of significance in the west through the weekend

o There is some potential for rain in the southwestern Plains Monday and in the remainder of the west during mid-week next week

§ Confidence is low, though

o Eastern portions of the region will experience the best precipitation maintaining favorable crop development potential in those areas

· U.S. central and eastern Midwest, Delta and southeastern states will be quite wet over the next ten days to two weeks inducing greater runoff in the Ohio River Valley and inducing a little flooding in the northern Delta, southeastern Missouri and Tennessee River Basin

· U.S. northern Plains and northwestern Corn Belt as well as Canada Prairies will continue to receive below normal precipitation for a while, though a short term bout of increased precipitation is expected before temperatures turn colder late next week

· Evidence continues to rise over the prospects for a Sudden Stratospheric Warming Event (SSW) that should begin to evolve a week from now and become notable in the last days of February and especially in March

o Cooler than usual temperatures will accompany the event from the central Canada Prairies into the heart of the Great Plains and a part of the Midwest during late February and especially March

o An increase in winter storminess is likely in the interior eastern U.S. through the New England states

· California and western Washington and western Oregon rainfall and heavy mountain snow will resume over the coming weekend and last through most of next week adding more moisture to the mountains for use in the spring

· Europe weather will be cool for a little while this week and then warmer than usual during the weekend and next week

o There is no risk of crop damaging cold during the next two weeks

o Weekend weather was mild to cool with rain and snow falling in the east from eastern Germany and Poland south into Romania and western Bulgaria

· Europe precipitation will continue unusually limited for the next ten days

o Dry soil is already present in parts of eastern Spain and a part of the lower Danube River Basin

· North Africa weather

o Some rain is expected over northeastern Algeria and northern Tunisia later this week and into the weekend with moisture totals of 1.00 to 2.00 inches near the coast

o Interior Tunisia, northwestern Algeria and Morocco precipitation will continue limited for the next ten days and possibly longer

§ Dryness is already a concern in these areas, although winter crops are dormant or semi-dormant and do not have much moisture requirement for now

· The need for moisture will be steadily rising this month as crop areas trend warmer and crops are stimulated to develop

· Western CIS crop areas will experience light and sporadic precipitation in this first week of the outlook and then experience some boost in rain and snowfall next week

o Winter crops are dormant

o Temperatures will be warmer than usual and there is no risk of winterkill during the next two weeks

· India will be mostly dry over the next ten days in key crop areas

o Winter crop areas will need rain soon to ensure the best production potential

§ Winter crops mostly reproduce in February and continue filling in March

· China will experience waves of rain this week and next week in the Yangtze River Basin and areas to the south coast

o The southern rapeseed areas will be wettest and should experience the best improvement in soil moisture supporting early spring crop needs

§ Rice planting will begin in early March or as soon as soil temperatures permit, and rapeseed will be breaking dormancy soon if it has not already

o Wheat areas in the North China Plain and Yellow River Basin may get some needed rain briefly late this week and into the weekend

· Australia rainfall is expected to occur erratically over the next ten days impacting central and southeastern Queensland most often

o Greater rain would be welcome in key summer crop areas, especially those not irrigated

· South Africa rainfall will stay erratic and light for a while this week and then increase during the second half of this week into next week

o Summer crop conditions will remain good and some will improve with the greater rain forthcoming

· Middle East precipitation is expected to increase this week, although not all areas will benefit

o Turkey will be wettest along with northern Iraq, northern Syria and portions of western and northern Iran

§ Greater precipitation will still be needed in some areas

· Southern Syria and much of Iraq away from the far north will be dry and moisture in parts of Iran will be lighter than usual as well

· Eastern Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year

· West Africa rainfall is expected to be mostly confined to coastal areas during the next ten days, but a few showers will occasionally reach into a few coffee and cocoa production areas

o Seasonal rains should begin over the next few weeks.

· Today’s Southern Oscillation Index was +9.62 and it will move erratically higher over the coming week.

Source: World Weather and FI

Bloomberg Ag calendar

Wednesday, Feb. 8:

- USDA’s World Agricultural Supply & Demand Estimates (WASDE), 12pm

- China’s agriculture ministry (CASDE) releases monthly supply and demand report

- EIA weekly US ethanol inventories, production, 10:30am

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

- RESULTS: Yara

Thursday, Feb. 9:

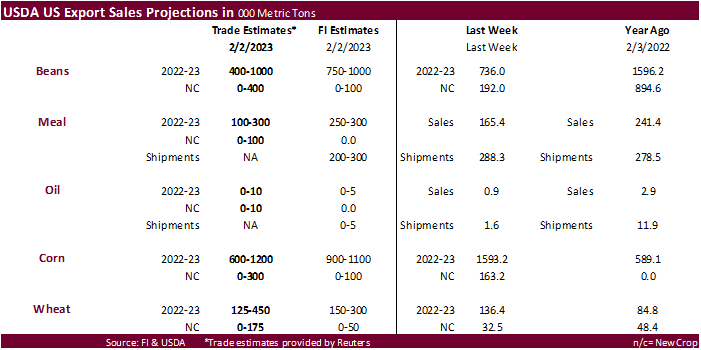

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

Friday, Feb. 10:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- Malaysian Palm Oil Board’s January data on stockpiles, production and exports

- Brazil’s Unica to release sugar output, cane crush data (tentative)

- Malaysia’s Feb. 1-10 palm oil export data

Source: Bloomberg and FI

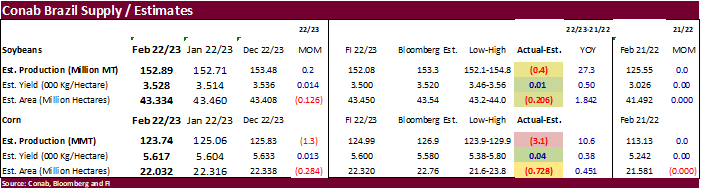

Brazil’s Conab

Macros

US MBA Mortgage Applications Feb 3: 7.4% (prev -9.0%)

US MBA 30-Yr Mortgage Rate Feb 3: 6.18% (prev 6.19%)

US DoE Crude Oil Inventories (W/W) 03-Feb: +2.423M (est +2.000M; prev +4.140M)

– Distillate: +2.932M (est +1.000M; prev +2.320M)

– Cushing: +1.043M (prev +2.315M)

– Gasoline: +5.008M (est +1.600M; prev +2.576M)

– Refinery Utilization: +2.2% (est +0.5%; prev -0.4%)

103 Counterparties Take $2.060 Tln At Fed Reverse Repo Op. (Prev $2.058 Tln, 104 Bids)

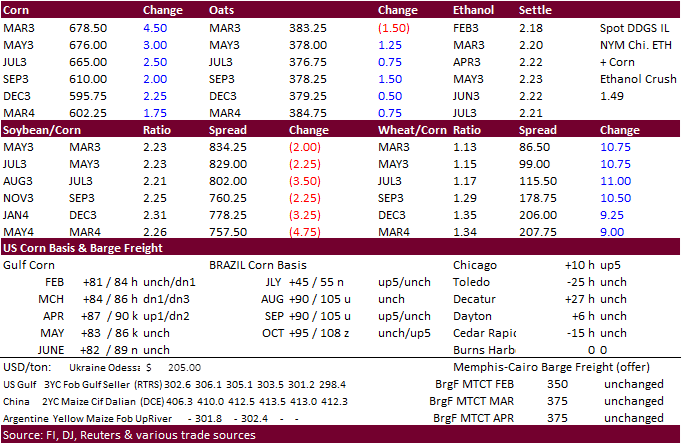

· CBOT corn ended higher on technical buying and strength in wheat. March corn ended above its 200-day MA. Some end users are still having a tough time sourcing cash corn across the ECB, where some cash prices topped $7.00 per bushel. USDA decided not to cut US corn exports in its USDA report. The downgrade in Argentina production and upward revision in Brazil corn exports by 3 million tons offset each other. It’s too early to address US corn exports, IMO, as Brazil exports won’t significantly increase until around June 1.

· Today was the second day of the Goldman Roll.

· Heavy rain is forecast from the southeastern Great Plains through the central Corn Belt over the next few days. The southeastern US will also see heavy rain.

· Conab lowered their Brazil total corn crop estimate by 1.3 million tons to 123.74 million tons and below 113.13 million tons year ago. The 123.74 million tons came in 3.1 million tons below an average trade guess. This was a little surprising for the trade. The corn area was lowered 284,000 hectares with Conab citing potential planting delays. Brazil’s second corn crop to total 94.9 million tons, down from 96.2 million tons in January.

· Argentina’s Rosario Grains exchange lowered its estimate for the Argentina corn crop to 42.5 million tons from the 45 million tons previously.

· Argentina’s AgMin reported 786,400 tons of the 2021-22 corn crop (59 million tons) was sold for the week ending February 1, bringing total sales to 77.9 percent, below 79.6% previous season.

· There were no major changes to China’s corn and soybean balance outlooks for 2022-23.

· The USDA Broiler Report showed broiler type eggs set up slightly from a year ago and chicks placed up slightly. Cumulative placements were up 1 percent from the same period a year earlier.

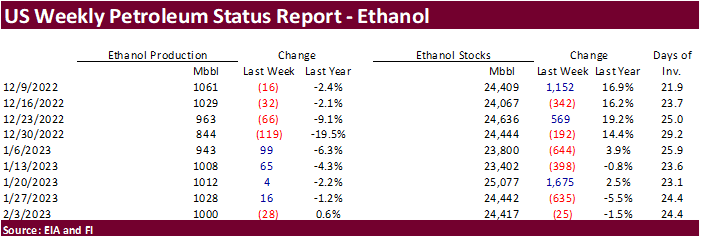

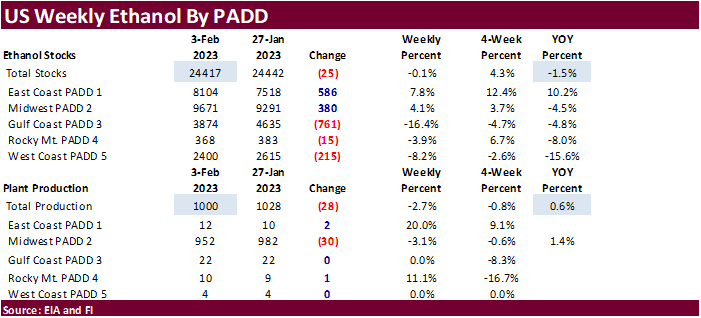

US weekly ethanol production fell 28,000 barrels per day to 1.0 million barrels (traders looked for a 11k decline) and stocks fell 25,000 barrels to 24.417 million barrels (trade average was looking for up 572k). US ethanol production is still up 14,000 barrels for the four-week average. Early September to date US ethanol production is running 4.6 percent below the same period year ago. US gasoline stocks increased by 5.008 million barrels to 239.6 million and are up six-consecutive weeks. Implied US gasoline demand fell 63,000 barrels to 8.429 million, with the 4-week average down about 2% from the same period a year ago. Refinery and blender net input of oxygenates fuel ethanol was 819,000 barrels, down 19,000 barrels from the previous week, and slightly above a 4-week average. The ethanol percent blend rate into finished US motor gasoline was 91.2%, down from 91.6% previous week.

US DoE Crude Oil Inventories (W/W) 03-Feb: +2.423M (est +2.000M; prev +4.140M)

– Distillate: +2.932M (est +1.000M; prev +2.320M)

– Cushing: +1.043M (prev +2.315M)

– Gasoline: +5.008M (est +1.600M; prev +2.576M)

– Refinery Utilization: +2.2% (est +0.5%; prev -0.4%)

Export developments.

- None reported.

Updated 02/8/23

March corn $6.45-$6.95 range. May $6.25-$7.00

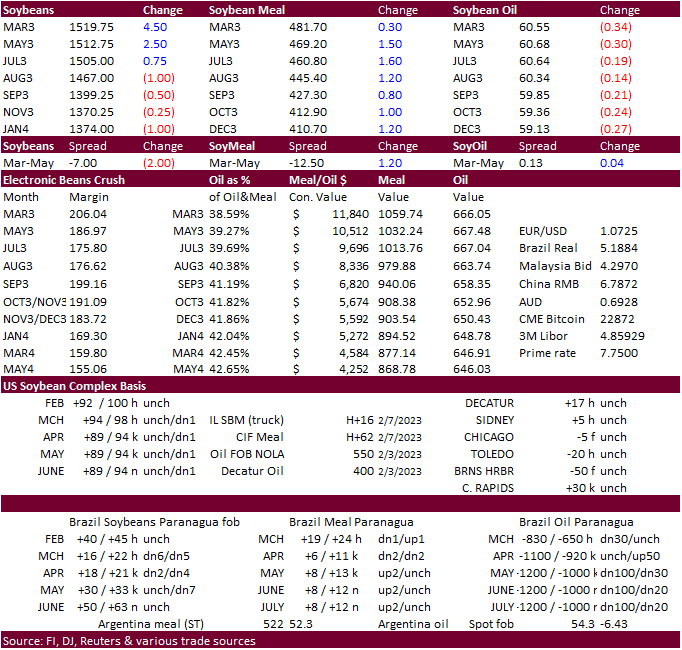

· CBOT soybeans ended higher bias front months. Prices were initially, and ended higher, likely led by a rebound in soybean meal from a reversal in product spreading. Soybean oil finished lower despite higher crude oil and palm trading at a one month high.

· Conab raised their estimate of the Brail soybean crop by 200,000 tons to 152.9 million, 400,000 tons below trade expectations.

· Bunge’s CEO warned Argentina’s soybean crop could end up in the mid-30MMT’s, down from 44 MMMT in 2022.

· Argentina’s Rosario Grains exchange lowered its soybean production estimate to 34.5 million tons from 37 MMT previous.

· Argentina’s AgMin reported 77,100 tons of the 2021-22 soybean crop (44 million tons) was sold for the week ending February 1, bringing total sales to 80.9 percent, below 83.8% previous season.

Export Developments

· None reported

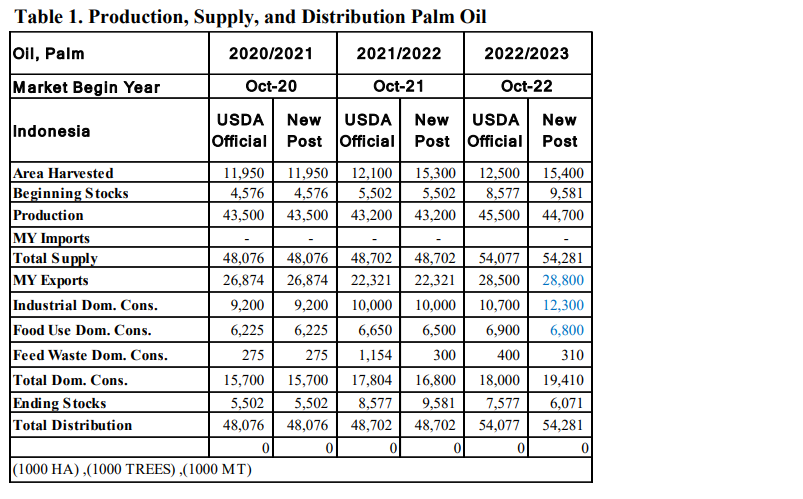

Indonesia: Attaché oilseeds update

Updated 02/07/23

Soybeans – March $14.85-$15.50, May $14.75-$16.00

Soybean meal – March $450-$520, May $425-$550

Soybean oil – March 58.50-63.00, May 58-70

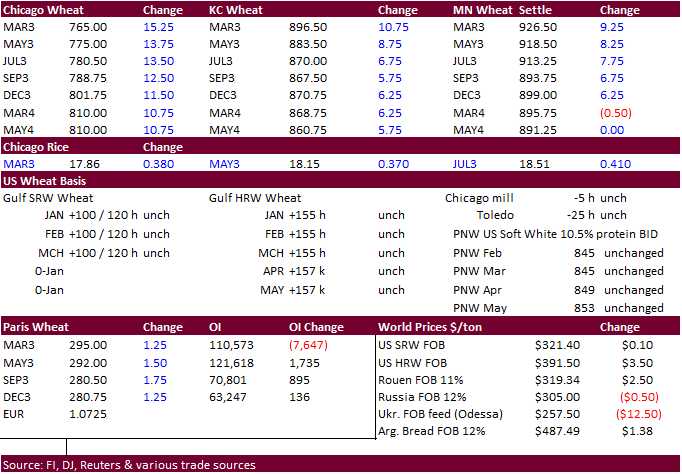

· Chicago wheat traded higher, leading KC and MN to the upside. Technical buying post USDA report was likely. The USD was lower. Persistent drought across the US Great Plains was seen supportive. Some rain is expected to fall across the southern GP during the 6-10 period but much more is needed to boost crop conditions.

· As expected, there were no major changes in the US and global balance sheets.

· Egypt is in talks to secure Serbian wheat. Up to 1 million tons could be bought. Egypt has been expanding origins to ensure long term grain supplies.

· China plans to auction off 140,000 tons of wheat from state reserves on February 15.

· Ukraine grain exports are down 29.2% so far in 2022-23 to 28.2 million tons, including 10.1 MMT wheat and 16.2 MMT corn.

· Paris March wheat was up 1.25 euros at 294.75 per ton.

· French producers are driving tractors around Paris in protest against pesticide bans. No disruption to exports are expected.

Export Developments.

· Thailand bought 60,000 tons of feed wheat and an unknow amount of barley from Australia. The feed wheat was bought at $337/ton c&f for April shipment. The feed barley was purchased at an estimated $309.80 a ton c&f for April 15-May 15 shipment.

· Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons oof feed barley on Feb 15 for loading by May 31.

· Taiwan seeks 48,100 tons of milling wheat from the US on February 9 for March 29 and April 12 shipment.

Rice/Other

· Today South Korea seeks 79,439 tons of rice for May 1-Dec 31 arrival.

· Egypt seeks at least 25,000 ton of rice from optional origin April-May shipment.

Updated 02/08/23

Chicago – March $7.30 to $7.90, May $7.00-$8.25

KC – March $8.55-$9.20, $7.50-$9.25

MN – March $9.00 to $9.60, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |