PDF Attached

I

will be traveling through Thursday, February 10, but will be sending out limited emails.

Tonight

we will get updated Malaysian palm data and early in the morning Conab will be out with updated Brazil supply estimates.

![]()

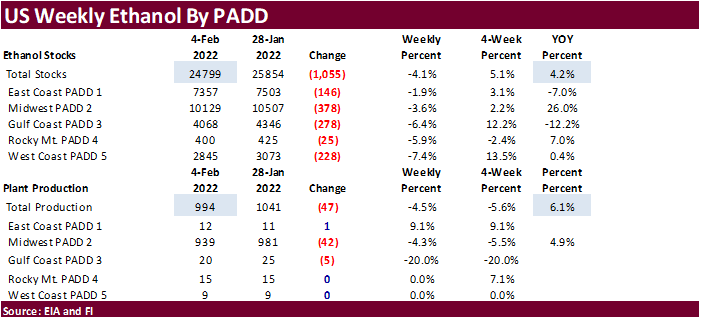

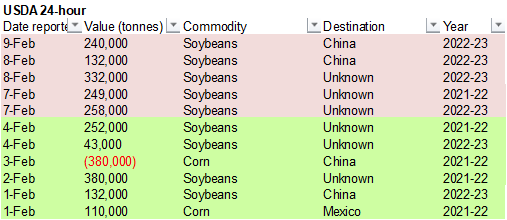

Private

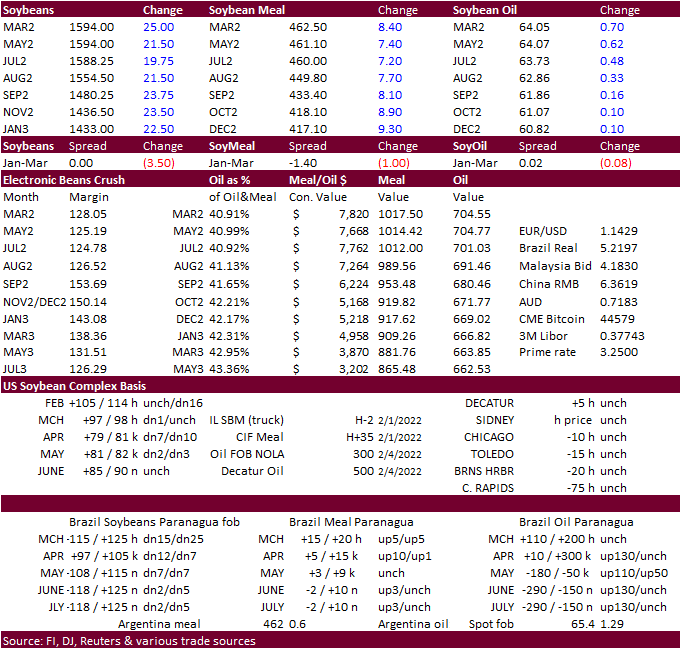

exporters reported sales of 240,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year.

We

like meal over oil over the short term.

Soybeans

are trading at “trade estimate” figures, not USDA, IMO.

Corn

should appreciate along with soybeans (16.00-16.50 area seen if SA weather does not improve).

We

see wheat trading around current levels, give and take 50 cent swing from low to high.

US

soybean stocks 325 vs. 350 last month (-25), 15 million vs. trade

US

corn stocks 1540 vs. 1540 last month (0), 28 million vs. trade

US

wheat stocks 648 vs. 628 last month (20), 19 million vs. trade

WLD

soy stocks 92.8 vs. 95.2 last month (-2.4), 1.3 million vs. trade

WLD

corn stocks 302.2 vs. 303.1 last month (-0.8), 1.9 million vs. trade

WLD

wheat stocks 278.2 vs. 280.0 last month (-1.7), -1.7 million vs. trade

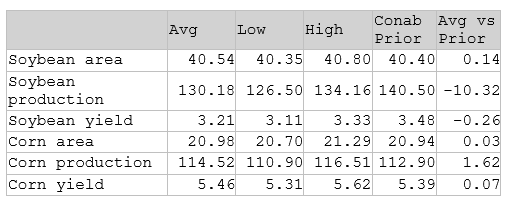

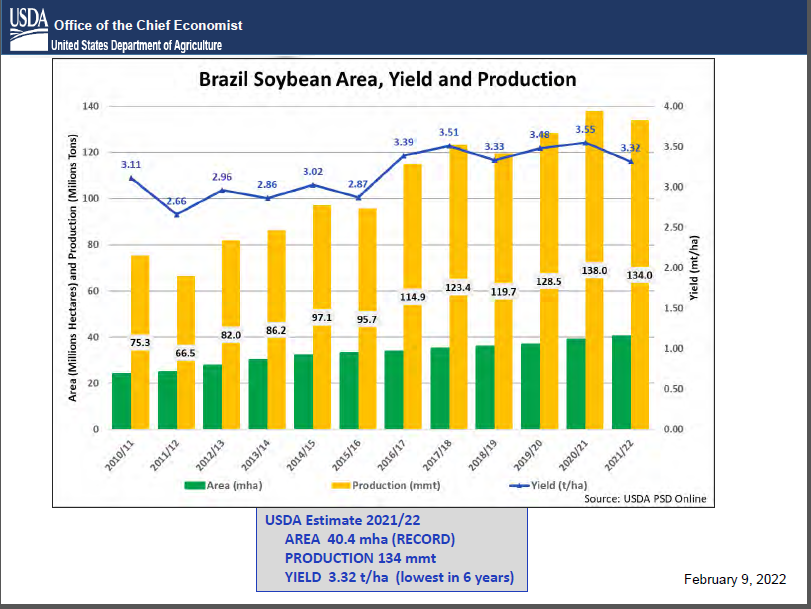

Brazil

Soy 134.0 vs. 139.0 last month (-5), 0.3 million vs. trade

Arg.

Soy 45.0 vs. 46.5 last month (-1.5), 0.5 million vs. trade

Brazil

Corn 114.0 vs. 115.0 last month (-1), 0.4 million vs. trade

Arg.

Corn 54.0 vs. 54.0 last month (0), 1.8 million vs. trade

China

soybean imports were lowered 3 million tons to 97 million, a large cut than expected. Last season they imported 99.8 million tons. We were a little surprised USDA did not make any adjustments to the US corn demand as SA crop production declines with Brazil’s

first crop corn and Argentina’s early corn planted crop are thought to shift export business to the US this summer. What was more surprising was USDA leaving its 2.050-billion-bushel US soybean export forecast unchanged. We are thinking they are at least

50 million bushels too low and exports could be even 75-100 million bushels higher. China has been securing a lot of new-crop soybeans, a signal that they might be covered for the next several months, but other importers may turn to the US for supplies if

they are unable to secure it from South America. FYI, overnight there was talk China bought US corn for spot shipment, but we didn’t see confirmation. USDA lowered Brazil corn production by 5 million tons and cut Argentina soybean production by 1.5 million

tons, to 134 and 45 million tons, respectively, both above trade expatiations. USDA left Argentina corn production unchanged at 54 million tons and lowered Brazil by 1 million tons to 114 million. We think USDA will address SA soybean and corn production

again next month. This month we thought they were too conservative. The higher-than-expected world corn and soybean stocks were surprising, in our opinion. For wheat, US wheat stocks were raised 20 million bushels to 648 million, 19 million above an average

trade guess, also unexpected. USDA lowered wheat exports by 15 million, which we agree. Combined food and seed were lowered 5 million.

Back

to the US soybean complex, the crush was upward revised by a much needed 25 million bushels, and this was the only revision in the balance sheet. The higher crush prompted USDA to add a large 295 million pounds to soybean oil supply. They increased food demand

by 135 million, which we agree, and increased stocks by 160 million pounds. Soybean meal production was increased 400,000 short tons and USDA increased exports by same amount. The changes in the product balance sheets further supports meal/oil spreading

as global vegetable oil supplies are rising and SA crop concerns are driving meal demand to the US.

Brazil

soybean exports were cut 3.5 million tons to 90.5 million, still too high in our opinion for the Oct-Sep crop year. USDA estimated Paraguay’s soybean crop at 6.3 million tons, down from 8.5 million last month. Some are as low as 5 million tons. Next month

we look for USDA to lower SA corn and soybean production, and at that time increase US soybean exports by around 50 million bushels and increase corn by 25-50 million. For wheat we look for little changes next month unless prices shoot higher.

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

- GFS

and ECMWF divergence in South America has been huge and that raises at least some market doubt as to the direction of weather in the second half of next week - The

GFS model has an aggressive trough of low pressure moving through southern Brazil and eastern Argentina starting in eastern Argentina a week from now and reaching southern Brazil on the following Thursday and Friday, Feb. 17-18. - The

European model has a meager trough of low pressure with very little precipitation associated with it leaving southern Brazil, eastern Argentina, Paraguay and Uruguay in a limited precipitation pattern - World

Weather Inc. favors the ECMWF (European) model run limiting precipitation at that time period - Today’s

mid-day GFS and European model runs will be important to watch to see which model might change - The

GFS has had this wetter bias for the past 3 model runs and the European model has been drier biased in the past two model runs - Argentina’s

best crop development conditions will continue from southern Cordoba and southern most Santa Fe through central Buenos Aires where subsoil moisture is good and where some timely showers will occur briefly Thursday and Friday - Central

and northern Santa Fe, northern Entre Rios, Corrientes, Chaco and Formosa will get some shower activity briefly during the weekend, but resulting rainfall will not be enough to change crop status

- Crop

moisture stress will be highest in these areas with further downward pressure on yields possible - Dry

weather then resumes in these areas at least into mid-week next week. That is when the model divergence kicks in with the GFS making rain late next week and the European model keeping it dry

- Southern

Brazil soil moisture will decline over the coming week, despite some shower activity this weekend and possible again late next week - The

precipitation will help to slow the drying rate and offer a little temporary relief from the dryness that precedes and follows the precipitation - Greater

rain will still be needed and it may evolve, but probably not before - Crop

stress will be highest in southern Paraguay and western Rio Grande do Sul where soil conditions are driest - Northern

Brazil rain will continue to fall frequently and significantly enough to maintain wet field conditions and some concern over the condition of crops in the region - Minas

Gerais will be wettest and most likely to encounter some flooding - Coffee

and sugarcane areas may be wetter than corn and soybean areas, but then entire state will get too much moisture - Goias

and Mato Grosso will also receive enough rain to keep the ground saturated and field progress moving slowly at times, but some harvest and Safrinha crop planting progress is likely

- U.S.

hard red winter wheat areas are still going to get a few showers of snow and rain during the middle to latter part of next week, but the high Plains region will not likely receive enough moisture to seriously bolster soil moisture - Most

of the significant moisture will be in the southeastern corner of wheat country

- A

below average precipitation bias will continue over the next couple of weeks - West

Texas cotton and grain areas will not receive much precipitation over the next two weeks, although a few showers may occur infrequently and mostly in an insignificant manner - Any

moisture will be welcome, but no trend changing moisture is expected - U.S.

Delta, lower eastern Midwest, Tennessee River Basin and southeastern states will experience periods of precipitation next week, but any precipitation that falls until then will be too light and brief to have much impact - The

middle and especially the second half of next week will be wettest - U.S.

precipitation in this first week of the outlook will be mostly limited to the northeastern Plains and the northern Midwest favoring the Great Lakes region and then farther to the east into the northeastern states - South

Texas precipitation is expected to be erratic and mostly light during the next ten days - Coastal

Bend cotton areas of the U.S. have good soil moisture for use in the spring - U.S.

temperatures will be warmer than usual in most of the western states from the central and northwestern Plains and western Canada’s Prairies to the Pacific Coast.

- Cooler

than usual temperatures will impact the northeastern Plains, and Midwest as well as a part of the mid-south region and Atlantic Coast States - Temperature

deviations from normal will not be very great outside of the northeastern Plains and Great Lakes region - U.S.

week two temperatures will be similar to this first week, but with less anomalously warm conditions in the western states and less coolness compared to normal in the east - There

is no threatening cold weather for Europe or any part of Asia during the next two weeks

- Winter

crop conditions are mostly good - India,

China and much of Europe should have a good start to the growing season this year based on today’s soil moisture - Spain

and northwestern Africa are still too dry and need rain in the next few weeks to support crop improvement as seasonal warming stimulates new crop development in the next few weeks - West-central

Africa coffee and cocoa production areas will see some increase in shower activity this weekend, but most of the rain is not expected to be enough to greatly increase topsoil moisture - Additional

showers are expected in the Feb. 16-22 period that may stimulate a few areas of localized flowering - The

rainy season is expected to begin relatively well - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - South

Africa weather includes a restricted amount of rainfall over the next ten days and that along with seasonably warm temperatures will eventually lead to firming ground - Crop

conditions will stay good - Southeast

Asia precipitation will continue erratic from one day to the next, but most of Indonesia and Malaysia precipitation will continue frequent and abundant - Mainland

areas of Southeast Asia seem poised to see an early start to scattered showers and thunderstorms during the next couple of weeks with next week wettest - Eastern

Australia sorghum, cotton and other crop areas; including some sugarcane areas, will see net drying over the next ten days to two weeks.

- The

environment will reduce soil moisture and could stress some dryland crops in the interior parts of the region - Coastal

showers are expected, but rainfall will be lighter than usual - Any

showers that occur in key cotton and sorghum areas will fail to produce enough rain to bolster soil moisture - China’s

weather will continue to support frequent bouts of snow and rain from the Yangtze River Basin to the south coast over the next ten days - The

moisture abundance will be good for early rice and other early season crops that get planted in late February and especially March - Winter

rapeseed and wheat are still rated in good condition with the bulk of wheat dormant and rapeseed in a state of semi-dormancy - Xinjiang

China will see a few waves of snow during the next ten days - The

precipitation will be greatest in the northeast, but the mountainous areas throughout the west will get some moisture as well - This

precipitation is needed after the early to middle part of winter was drier than usual - Middle

East snow cover has been decreasing recently - Rain

and snow will move across Turkey today and then to Iraq, Syria and eventually Iran later this week and into the weekend

- The

moisture will be good for winter crops - Drier

weather is expected next week - Today’s

Southern Oscillation Index is +8.82 - The

index will move a little higher this week and then level off for a while - New

Zealand will continue to receive significant rain in North Island and in some western and northern parts of South Island this week

- Drier

weather is expected next week - The

moisture will be welcome and help to raise topsoil moisture - Temperatures

will trend a little a little warmer after the rain passes - Mexico

will experience cooler than usual weather with rain in some of the east-central and southeastern parts of the nation periodically over the coming week

- The

moisture will be good for early season crop development late this month and in March - Sugarcane,

citrus and winter rice will benefit most, but some other fruits and vegetable crops will also benefit

- Early

season sorghum and corn planting will occur well this year if the precipitation is great enough

- The

remainder of the nation will be dry - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically - Western

Colombia, Ecuador and Peru rainfall may be greater than usual during the balance of this week and early into the coming weekend - Western

Venezuela will also experience a boost in rainfall - The

remainder of Venezuela will remain dry

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysian

Palm Oil Board’s data on palm oil reserves, output and exports - French

agriculture ministry releases 2022 winter grain and rapeseed planting estimates - Brazil’s

Conab report on yield, area and output of corn and soybeans - Brazil’s

Unica releases sugar output and cane crush data (tentative) - IKAR

grain conference in Moscow - Vietnam’s

customs department to publish data on coffee, rice and rubber exports in January - Malaysia’s

Feb. 1-10 palm oil exports

Friday,

Feb. 11:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - March

ICE white sugar contract expiry - HOLIDAY:

Japan

Source:

Bloomberg and FI

Bloomberg

Conab Brazil supply poll

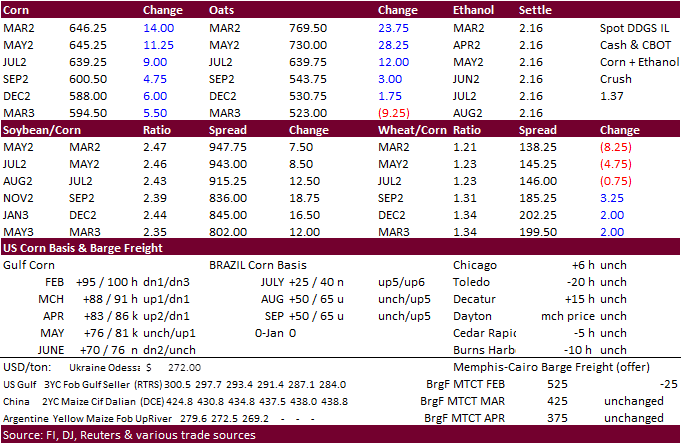

Corn

·

Nearby rolling corn futures hit their highest level since July. Corn was sharply higher in the nearby contracts on rumors China secured corn from the US but that has yet to be seen. Some speculate 3 million tons traded for nearby

delivery. We find it hard to believe after last week they cancelled 380,000 tons 2021-22 corn, but there was a break in the prices last week and again yesterday. The SA picture for corn production is still long away. Brazil’s second crop plantings are still

in progress with only 16 percent of the soybean crop reaped at the end of last week. USDA made no changes to their US corn demand. We were looking for exports to be up at least 25 million bushels. Next month we could see exports upward revised by 25 and corn

for ethanol use lowered by 25 million.

·

WTI crude was higher by early afternoon and USD lower.

·

March corn over the past three days rallied 4.2%.

·

Third day of the Goldman roll.

·

USDA reported a highly pathogenic avian bird flu case in Indiana, at a turkey farm, the first such case for the US since 2020.

·

China’s CASDE was mostly unchanged for corn and soybean demand, but they did raise the import price forecast for corn. No details were provided by Reuters on prices. S&D table is attached.

·

The Baltic Dry Index increased 13.8 percent to 1,711 points.

·

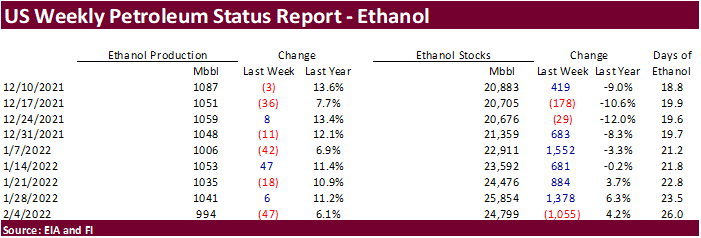

January corn use for ethanol likely declined sharply from December after production of ethanol slowed. We estimate January ethanol production at 31.93 million barrels, down from 32.99 estimated for December. Omitting 2021 because

of Covid and looking at January 2020, ethanol production was 33.346 million barrels.

·

Corn for ethanol use during January may come in at only 463 million bushels, down from 478 million estimated for December and compares to 469 million used two years earlier.

·

We left our 2021-22 US corn for ethanol use unchanged at 5.425 billion bushels. USDA is at 5.325 billion. If production fails to increase over the next six weeks, we will likely lower our estimate.

·

Reuters noted “the average ethanol margins in the Eastern Corn belt went from $1.11/gal in December to $0.23/gal in January. As of Feb 8, ethanol margins continued to drop to $0.02/gal.”

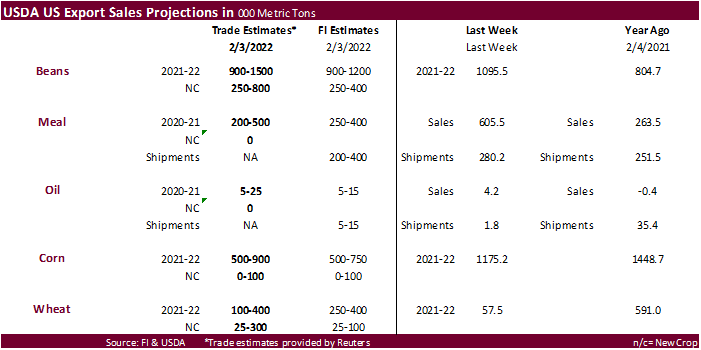

Export

developments.

·

South Korea’s Major Feedmill Group (MFG) bought 68,000 tons of corn at an estimated $341.89 a ton c&f for arrival in South Korea around May 18.

·

South Korea’s KFA passed on 68,000 tons of corn. Lowest offer was $347.74/ton c&f.

·

Taiwan’s MFIG seeks up to 65,000 tons of corn on Thursday, Feb 10 for April 1-20 shipment.

Updated

2/2/22

March

corn is seen in a $5.95 to $6.55

December

corn is seen in a wide $5.25-$7.00 range

·

Soybeans ended at a fresh 8-month high after taking a break on Tuesday. USDA’s S&D report was not bullish but was a reminder SA crop prospects are shrinking. We think the trade is below USDA’s Argentina, Brazil, and Paraguay soybean

production estimates, and that is reflected in current prices. We were surprised USDA did not raise their 2021-22 export projection, but they did take crush up 25 million. The boost in US soybean meal production was absorbed in exports, while USDA increased

food use for soybean oil and also increased the carryout. Soybean oil managed to close sharply higher today. Palm futures were higher on Wednesday. Flooding in Malaysia’s palm oil production regions rallied that market which spilled into CBOT soybean oil.

·

Soybean meal ended sharply higher, following ideas of a smaller SA crop will shift export business to the US.

·

Soybean oil share slipped today to around 40.9% basis the March position.

·

Nearby soybeans are already up 2.7% from last Friday, meal 4.1% higher while soybean oil is down 1.9%.

·

(Reuters) – Brazil’s soybean crop in 2022 was estimated at 133.3 million tons, a reduction of about 5 million tons compared to the January forecast, hEDGEpoint Global Markets said on Wednesday, citing a drought.

·

The Biden Administration is considering adding new tariffs on China goods if the talks break down over “Phase 1” purchasing commitments. No specific tariffs were noted. Reuters noted China has only fulfilled about 60 percent

of their commitments.

-

USDA

announced private exporters sold 240,000 tons of soybeans to China for 2022-23 delivery.

-

Iran’s

SLAL seeks up to 60,000 tons of animal feed barley and 60,000 tons of soybean meal. Shipment for both the barley and soymeal was sought between Feb. 15 and March 15.

Soybeans

– monthly continuation

Source:

CQG

Updated

2/7/22

Soybeans

– March $14.75-$16.50

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $420-$480

Soybean

oil – March 66.50-69.00

·

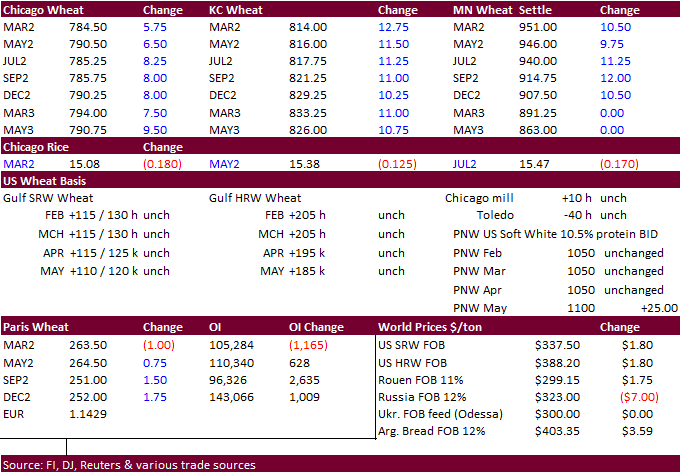

US wheat futures traded higher let by higher protein contracts on technical buying and renewed global import demand. Chicago was up 6.25 cents, KC up 13.75, and MN up 13.25.

·

Global weather still looks good, with exception of the US drying down through at least Sunday.

·

The USDA increased their wheat stocks for the US which was unexpected. USDA likely did not factor in a potential Ukraine/Russian conflict when updated their world balance sheets.

·

March Chicago wheat is up 2.8% since Friday, KC up 3.7% and MN up 4.5% (Canadian stocks led MN to gain over Chicago and KC).

·

We look for a mostly two-sided trading range over the short term.

·

March wheat settled down 1.75 euros, or 0.7%, at 262.75 euros ($300.64) a ton. Germany has been busy loading wheat destined for Iran.

·

South Korea’s FLC bought 65,000 tons of feed wheat at an estimated $330.98 a toe c&f for arrival in South Korea is around May 20.

-

Iran’s

SLAL seeks up to 60,000 tons of animal feed barley and 60,000 tons of soybean meal. Shipment for both the barley and soymeal was sought between Feb. 15 and March 15.

·

Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on Feb 16 for arrival by July 28.

·

Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

·

The Philippines seeks feed wheat from Australia and soybean meal from Argentina on February 11. Amounts are unknown.

·

Bangladesh seeks 50,000 tons of wheat set to close February 14.

·

Syria seeks 200,000 tons of wheat on February 14, open for 15 days.

Rice/Other

·

(Reuters) – ICE cotton futures fell on Wednesday after the U.S. Department of Agriculture (USDA) raised the estimate for U.S. stocks at the end of its 2021/22 crop year and projected a decline in the country’s exports in its monthly

supply-demand report. Cotton contracts for March CTH2 were down 0.83 cents, or 0.7%, at 126.32 cents per lb. by 13:50 ET.

Updated

2/2/22

Chicago

March $7.25 to $8.30 range

KC

March $7.45 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.