PDF Attached

The

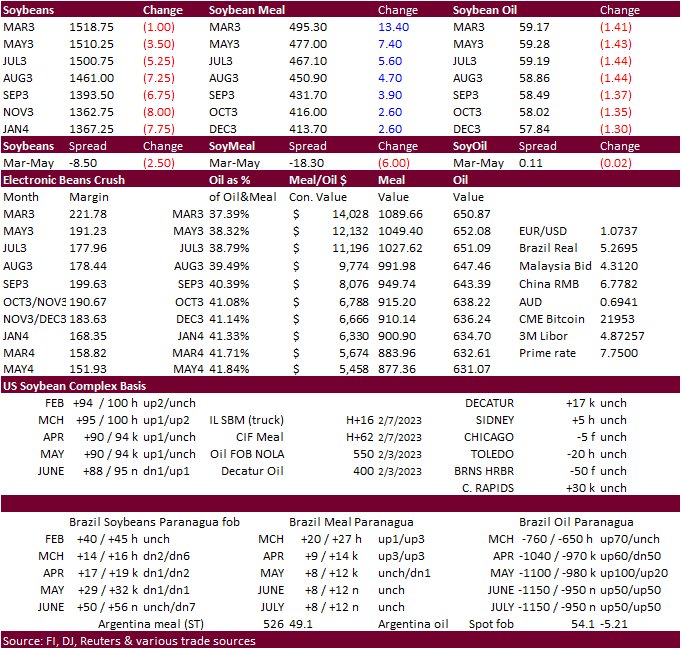

soybean meal market was the only major CBOT agriculture product that closed higher on Thursday. All other markets were under pressure from poor export sales, talk of improving weather, and lack of direction provided by USDA in their February S&D update.

![]()

The

US CPC sees a good chance for a neutral ENSO to develop during the March-May period.

The

trade will be watching Argentina rains expected to occur though Monday. The bulk of the rain will fall across La Pampa, BA, eastern Cordoba, Santa Fe, Entre Rios. It will remain on the drier side for northern and eastern Argentina. Brazil will continue to

see rain and the central growing area slowing harvesting progress. The US weather forecast is mostly unchanged. Central and northern Great Plains will not see much precipitation over the next week. The US Midwest will see additional rain bias far southern

areas and northern areas.

MOST

IMPORTANT WEATHER FOR THE DAY

-

No

significant changes occurred around the world overnight -

Argentina

is still expecting rain in all of its grain, oilseed, cotton and sugarcane production areas during the weekend and early next week -

Moisture

totals will be greatest in the northeast half of the nation where 1.00 to 3.00 inches and locally more are expected -

Southwestern

areas will not be as wet with 0.30 to 1.00 inch and local totals to 1.50 inches

-

Argentina

may trend drier again after Feb. 17 leaving a strong need for greater and more frequent rain

-

Brazil

rainfall in the far south along with Uruguay and Paraguay will be limited through the weekend, but rain is expected next week to bring some relief to recent heat and ongoing drying -

A

few showers are expected in the far south today and Friday, but next week’s rain will be greater, and the impact should be longer lasting -

Resulting

rainfall will be sufficient to improve crop conditions for a while, but more rain will still be needed

-

Center

west and a part of center south Brazil will continue to get rain frequently enough to keep harvest progress in some of the soybean areas a little slow along with the planting of Safrinha corn -

However,

improved drying conditions have occurred in parts of Mato Grosso recently and that will continue, though there will be some showers and thunderstorms occurring periodically – which is normal at this time of year.

-

Bahia,

Brazil and immediate neighboring areas will be drier biased during much of the coming week to ten days favoring some crops, but there will eventually be need for greater rain -

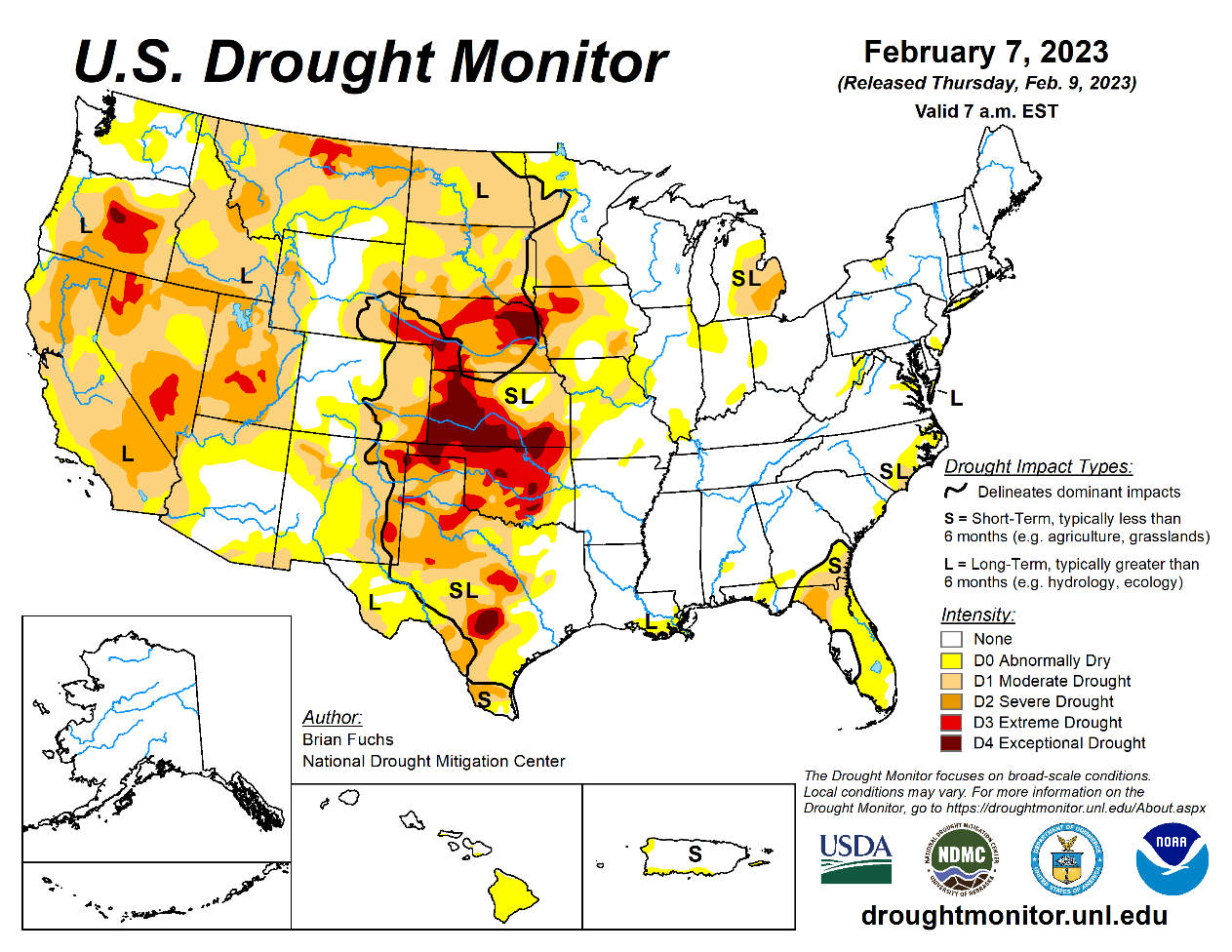

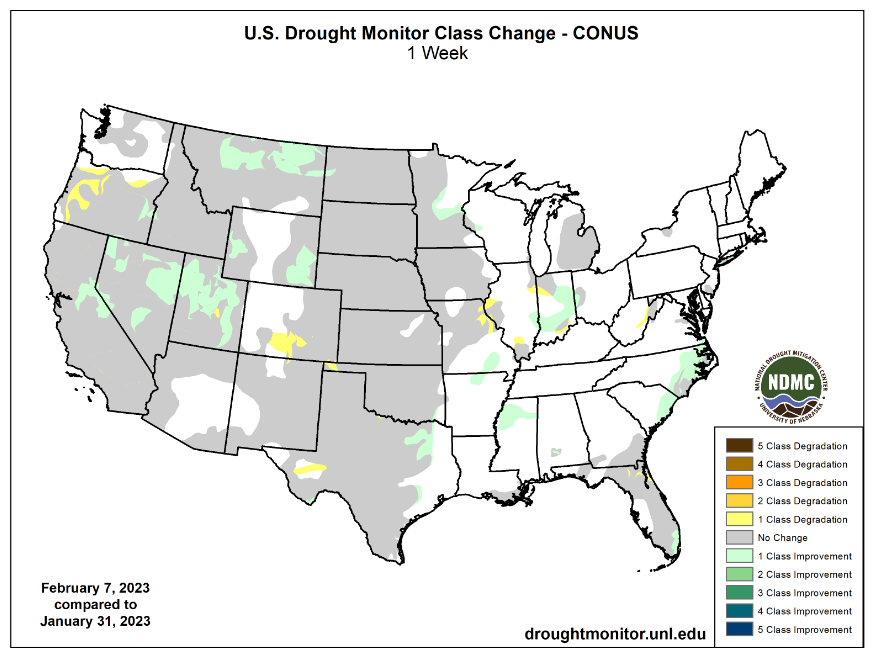

U.S.

hard red winter wheat areas will continue lacking precipitation of significance in the west through the weekend -

There

is some potential for rain in the southwestern Plains early next week -

Confidence

is low, though, and resulting amounts should not be great enough to end drought by any means -

Any

moisture would be welcome, though -

Eastern

portions of the region will experience the best precipitation maintaining favorable crop development potential in those areas -

U.S.

central and eastern Midwest, Delta and southeastern states will be quite wet over the next ten days to two weeks inducing greater runoff in the Ohio River Valley and inducing a little flooding in the northern Delta, southeastern Missouri and Tennessee River

Basin -

U.S.

northern Plains and northwestern Corn Belt as well as Canada Prairies will continue to receive below normal precipitation for a while, though a short term bout of increased precipitation is expected before temperatures turn colder late next week -

Evidence

continues to rise over the prospects for a Sudden Stratospheric Warming Event (SSW) that should begin to evolve next week from and become notable in the last days of February and especially in March -

Cooler

than usual temperatures will accompany the event from the central Canada Prairies into the heart of the Great Plains and a part of the Midwest during late February and especially March -

An

increase in winter storminess is likely in the interior eastern U.S. through the New England states -

California

and western Washington and western Oregon rainfall and heavy mountain snow will resume over the coming weekend and last through most of next week adding more moisture to the mountains for use in the spring -

Europe

weather will be cool for a little while longer this week and then warmer than usual during the weekend and next week -

There

is no risk of crop damaging cold during the next two weeks -

Europe

precipitation will continue unusually limited for the next ten days -

Dry

soil is already present in parts of eastern Spain and a part of the lower Danube River Basin -

North

Africa weather -

Some

scattered showers will occur during the next week to ten days, but resulting precipitation is not likely to be very great.

-

Interior

Tunisia, northwestern Algeria and Morocco precipitation will continue limited for the next ten days and possibly longer; although interior Tunisia did receive some much needed moisture Wednesday -

Dryness

is already a concern in these areas, although winter crops are dormant or semi-dormant and do not have much moisture requirement for now -

The

need for moisture will be steadily rising this month as crop areas trend warmer and crops are stimulated to develop -

Western

CIS crop areas will experience light and sporadic precipitation in this first week of the outlook and then experience some boost in rain and snowfall next week -

Winter

crops are dormant -

Temperatures

will be warmer than usual and there is no risk of winterkill during the next two weeks -

India

will be mostly dry over the next ten days in key crop areas -

Winter

crop areas will need rain soon to ensure the best production potential -

Winter

crops mostly reproduce in February and continue filling in March -

China

will experience waves of rain this week and next week in the Yangtze River Basin and areas to the south coast -

The

southern rapeseed areas will be wettest and should experience the best improvement in soil moisture supporting early spring crop needs -

Rice

planting will begin in early March or as soon as soil temperatures permit, and rapeseed will be breaking dormancy soon if it has not already -

Wheat

areas in the North China Plain and Yellow River Basin may get some needed rain briefly late this week and into the weekend

-

Australia

rainfall is expected to occur erratically over the next ten days impacting central and southeastern Queensland most often -

Greater

rain would be welcome in key summer crop areas, especially those not irrigated -

South

Africa rainfall will stay erratic and light for a while this week and then increase during the second half of this week into next week

-

Summer

crop conditions will remain good, and some will improve with the greater rain forthcoming -

Middle

East precipitation is expected to increase this week, although not all areas will benefit -

Turkey

will be wettest along with northern Iraq, northern Syria and portions of western and northern Iran -

Greater

precipitation will still be needed in some areas -

Southern

Syria and much of Iraq away from the far north will be dry and moisture in parts of Iran will be lighter than usual as well -

Eastern

Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year -

West

Africa rainfall is expected to be mostly confined to coastal areas during the next ten days, but a few showers will occasionally reach into a few coffee and cocoa production areas -

Seasonal

rains should begin over the next few weeks. -

Today’s

Southern Oscillation Index was +10.06 and it will move erratically higher over the coming week.

Source:

World Weather and FI

Bloomberg

Ag calendar

Thursday,

Feb. 9:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Feb. 10:

- Suspended

– CFTC commitments of traders weekly report on positions for various US futures and options

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Malaysian

Palm Oil Board’s January data on stockpiles, production and exports - Brazil’s

Unica to release sugar output, cane crush data (tentative) - Malaysia’s

Feb. 1-10 palm oil export data

Source:

Bloomberg and FI

USDA

Export Sales

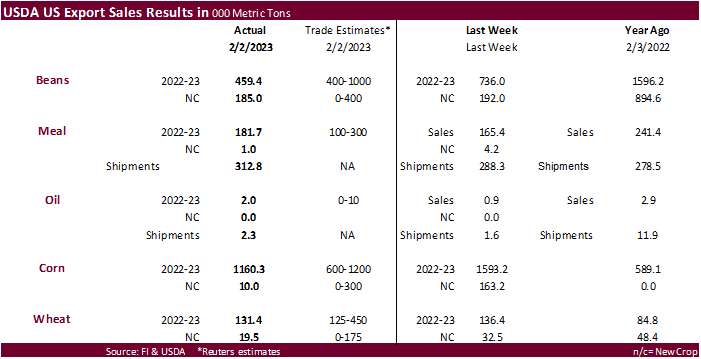

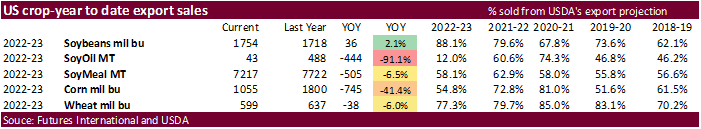

US

soybean export sales were at the low end of expectations for old crop and near the middle for new crop. There were a lot of sales switched from unknown. Increases primarily for China (518,900 MT, including 332,000 MT switched from unknown destinations). Soybean

meal sales were again below 200,000 short tons. At 181,700, there were slightly above the previous week, but shipments were very good at 312,800 short tons. The soybean meal sales included 64,900 tons for Columbia. Soybean oil sales again were slow at 2,000

tons and shipments were only 1,900 tons. USDA corn export sales of 1.160 million tons were near the upper end of a range of expectations. The corn sales included Japan (388,200 MT), unknown destinations (308,200 MT) and Mexico (107,000 MT, including decreases

of 28,900 MT). Sorghum sales were 53,000 tons, all for China. All-wheat export sales of 131,400 tons were poor for the second consecutive week. The wheat sales included Mexico and Columbia. Pork sales were 28,800 tons and included 12,700 tons for Mexico.

Macros

101

Counterparties Take $2.059 Tln At Fed Reverse Repo Op. (Prev $2.060 Tln, 103 Bids)

US

Initial Jobless Claims Feb 4: 196K (est 190K; prev 183K)

US

Continuing Claims Jan 28: 1688K (est 1660K; prevR 1650K)

US

EIA NatGas Storage Change (BCF) 03-Feb: -217 (est -201; prev -91)

–

Salt Dome Cavern NatGas Stocks (BCF): -26 (prev +3)

Brazilian

Retail Sales (M/M) Dec: -2.6% (est -0.8%; prev -0.6%)

Brazilian

Retail Sales (Y/Y) Dec: 0.4% (est 2.7%; prev 1.5%)

·

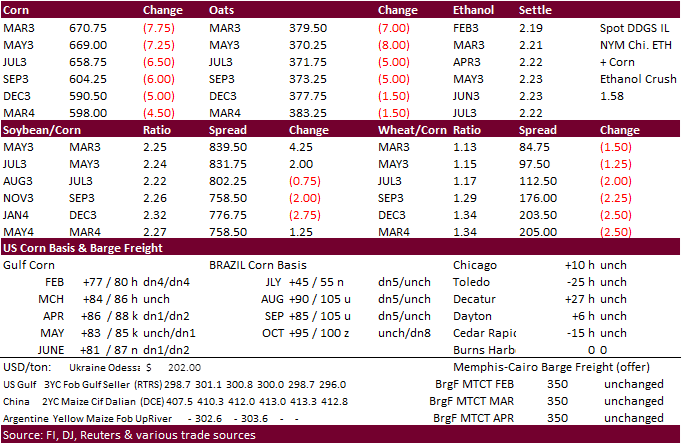

CBOT corn traded

lower from a selloff in wheat and lower WTI crude oil. A sharply lower USD limited some losses. ENSO conditions are expected to move into a neutral phase for the Northern Hemisphere by US spring seeding season.

·

Brazil producer corn hedging has slowed but soybean selling picked up after the USDA report. Brazil shipped 983,684 tons of corn to China during the January period, down from 1.16 million during December, but still an impressive

amount.

·

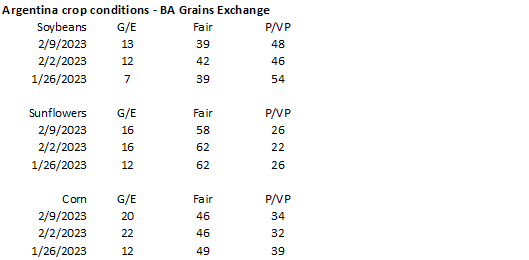

Argentina’s BA Grains left its estimate for the Argentina corn crop at 44.5 million tons, down from 52 million year earlier. Yesterday Argentina’s Rosario Grains exchange lowered its estimate for the Argentina corn crop to 42.5

million tons from the 45 million tons previously.

·

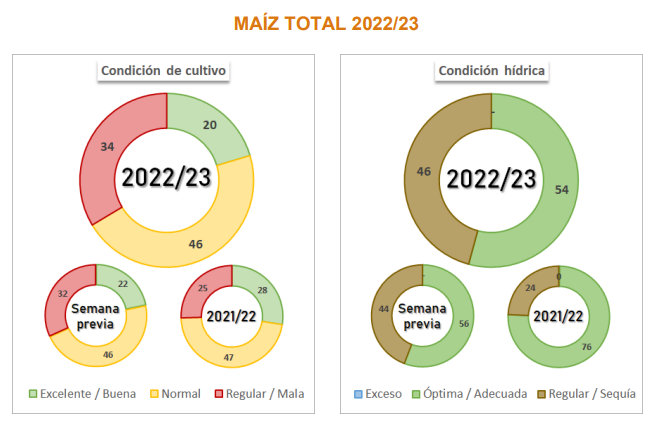

Argentina corn crop conditions declined 2 points for the good category to 20 percent from the previous week, and poor category increased 2 points to 34 percent.

·

The US Government Accountability Office (GOP Senators) said the EPA’s decision to deny 69 small refiner exemptions from federal requirements to add biofuel to diesel and gasoline is not considered a “rule” and therefore is immune

from being nullified from a vote under the Congressional Review Act. This is a blow for the small refineries appealing EPA’s biofuel requirements. Some companies had financial hardship to either blend biofuel or buy RINs to meet past mandates. Market impact

is seen as minimal .

·

Vietnam might be tendering for corn soon.

·

Today was the third day of the Goldman Roll.

Export

developments.

-

South

Korea’s MFG bought 67,000 tons of South American corn at $343.59/ton c&f and 198.50 cents over the May corn contract for arrival around May 30.

-

South

Korea’s FLC bought 65,000 tons of US corn at $337.95/ton c&f for arrival around April 25.

Updated

02/8/23

March

corn $6.45-$6.95 range. May

$6.25-$7.00

·

CBOT soybeans traded

lower despite a rally in soybean meal (bias nearby), in part to positioning and lack of direction provided by USDA’s February supply and demand report. Nearby soybean meal finished $13.60 higher and May up $8.40. Soybean oil was lower but crush margins ripper

higher in the nearby March position by 13.25 to $2.20.

·

We heard Brazil producers were busy today hedging soybeans.

·

Argentina’s BA Grains Exchange lowered its soybean production estimate to 38 million tons from 41 MMT previous. Yesterday Argentina’s Rosario Grains exchange lowered its soybean production estimate to 34.5 million tons from 37

MMT previous.

·

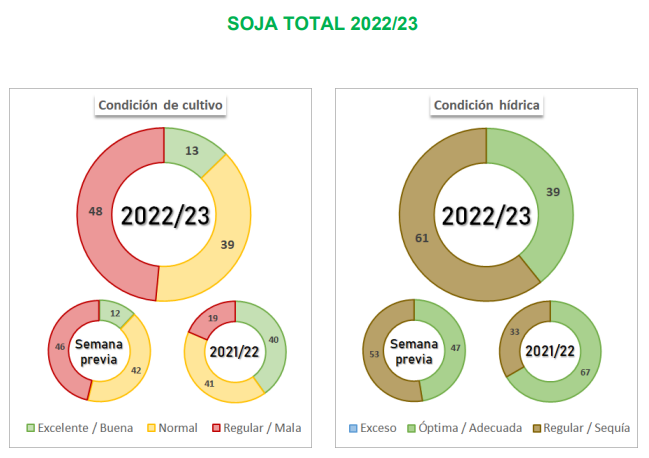

The Argentina soybean crop condition for the good category increased one point to 13 percent and poor increased 2 points to 48 percent from the previous week.

U

of I: Biodiesel and Renewable Diesel: What’s the Difference?

Gerveni,

M., T. Hubbs and S. Irwin. “Biodiesel and Renewable Diesel: What’s the Difference?”

farmdoc daily (13):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 8, 2023.

https://farmdocdaily.illinois.edu/2023/02/biodiesel-and-renewable-diesel-whats-the-difference.html

Export

Developments

·

None reported

Updated

02/07/23

Soybeans

– March $14.85-$15.50, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

58.50-63.00, May 58-70

·

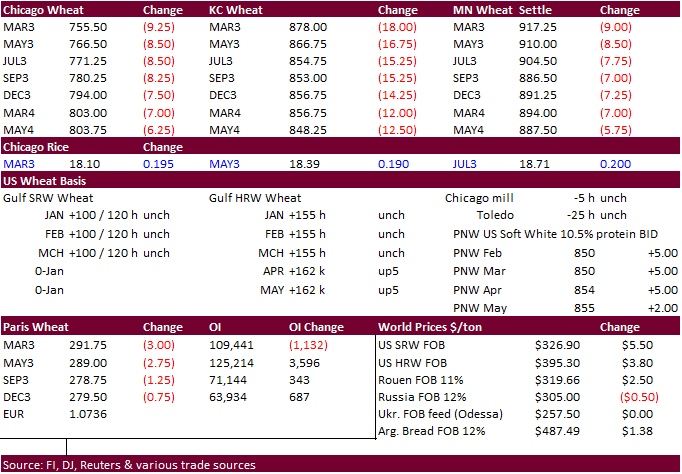

Chicago wheat traded

lower led by the KC wheat contract on talk of precipitation relief for drought stricken Kansas.

·

Traders are watching the Black Sea grain corridor shipping extension talks. We think it will be extended.

·

Paris March wheat was down 3.00 euros at 291.75 per ton.

Export

Developments.

·

Taiwan bought 48,100 tons of various class wheat from the US for March 29-April 12 shipment.

·

Algeria ended up buying about 360,000 to 390,000 tons of wheat at $329 to $332/ton c&f for April shipment. Some put the amount up to 450,000 tons.

·

Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons oof feed barley on Feb 15 for loading by May 31.

Rice/Other

·

Results awaited: Egypt seeks at least 25,000 ton of rice from optional origin April-May shipment.

Updated

02/08/23

Chicago

– March $7.30 to $7.90, May $7.00-$8.25

KC

– March $8.55-$9.20, $7.50-$9.25

MN

– March $9.00 to $9.60,

$8.00-$10.00

Export Sales

Highlights

This

summary is based on reports from exporters for the period January 27 – February 2, 2023.

Wheat:

Net sales of 131,400 metric tons (MT) for 2022/2023 were down 4 percent from the previous week and 56 percent from the prior 4-week average. Increases primarily for Mexico (76,000 MT, including decreases of 300 MT), Colombia (43,600 MT, including 31,600 MT

switched from unknown destinations and decreases of 800 MT), unknown destinations (39,000 MT), Ecuador (28,800 MT, including 19,400 MT switched from unknown destinations), and Japan (26,000 MT), were offset by reductions primarily for South Korea (60,000 MT)

and Iraq (47,900 MT). Net sales of 19,500 MT for 2023/2024 were reported for Colombia (12,500 MT), Mexico (6,500 MT), and Panama (500 MT). Exports of 538,100 MT were up 9 percent from the previous week and 70 percent from the prior 4-week average. The destinations

were primarily to the Philippines (121,100 MT), Mexico (81,300 MT), South Korea (55,200 MT), Iraq (52,100 MT), and Ecuador (45,800 MT).

Corn:

Net sales of 1,160,300 MT for 2022/2023 were down 27 percent from the previous week, but up 19 percent from the prior 4-week average. Increases were primarily for Japan (388,200 MT), unknown destinations (308,200 MT), Mexico (107,000 MT, including decreases

of 28,900 MT), Guatemala (70,800 MT), and Panama (67,000 MT). Total net sales of 10,000 MT for 2023/2024 were for Japan. Exports of 394,900 MT were down 34 percent from the previous week and 40 percent from the prior 4-week average. The destinations were primarily

to Mexico (283,900 MT), Costa Rica (33,200 MT), Canada (26,300 MT), Hong Kong (15,300 MT), and Nicaragua (12,200 MT).

Optional

Origin Sales:

For 2022/2023, new optional sales 100,000 MT were for South Korea. The current outstanding balance of 100,000 MT, all South Korea.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Total net sales of 53,000 MT for 2022/2023 were down 52 percent from the previous week and 43 percent from the prior 4-week average. The destination was for China. Exports of 200 MT were down 73 percent from the previous week and 99 percent from the prior

4-week average. The destination was to Mexico.

Rice:

Net sales of 112,800 MT for 2022/2023–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for Colombia (61,200 MT), Nicaragua (25,000 MT), Japan (13,000 MT), Saudi Arabia (8,500 MT),

and Mexico (1,500 MT). Exports of 33,800 MT were up 20 percent from the previous week, but down 7 percent from the prior 4-week average. The destinations were primarily to Japan (13,000 MT), Saudi Arabia (8,900 MT), Jordan (4,700 MT), Mexico (4,200 MT), and

Canada (2,200 MT).

Soybeans:

Net sales of 459,400 MT for 2022/2023 were down 38 percent from the previous week and 49 percent from the prior 4-week average. Increases primarily for China (518,900 MT, including 332,000 MT switched from unknown destinations, 52,000 MT switched from Pakistan,

and decreases of 67,200 MT), Spain (139,600 MT, including 132,000 MT switched from unknown destinations), the Netherlands (85,600 MT, including 77,000 MT switched from unknown destinations), Indonesia (73,800 MT, including 55,000 MT switched from unknown destinations,

300 MT switched from Taiwan, and decreases of 200 MT), and Colombia (26,700 MT, including 12,000 MT switched from unknown destinations and decreases of 1,200 MT), were offset by reductions primarily for unknown destinations (387,000 MT). Net sales of 185,000

MT for 2023/2024 were reported for unknown destinations (132,000 MT) and China (53,000 MT). Exports of 1,828,600 MT were down 7 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to China (1,181,900

MT), Mexico (248,800 MT), Spain (139,600 MT), the Netherlands (85,600 MT), and Indonesia (78,800 MT).

Optional

Origin Sales:

For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export

for Own Account: For

2022/2023, the current exports for own account outstanding balance is 1,500 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 181,700 MT for 2022/2023 were up 10 percent from the previous week, but down 13 percent from the prior 4-week average. Increases primarily for Colombia (64,900 MT, including decreases of 1,100 MT), South Korea (50,000 MT switched from unknown

destinations), Mexico (34,400 MT, including decreases of 12,700 MT), Canada (25,700 MT), and Honduras (20,800 MT, including decreases of 11,800 MT), were offset by reductions primarily for unknown destinations (42,000 MT), El Salvador (3,000 MT), and Ecuador

(1,500 MT). Total net sales of 900 MT for 2023/2024 were for Canada. Exports of 312,800 MT were up 9 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily to Ecuador (53,100 MT), the Philippines (51,500

MT), Chile (49,500 MT), Colombia (33,600 MT), and Denmark (32,700 MT).

Soybean

Oil: Net sales

of 1,900 MT for 2022/2023 were up noticeably from the previous week and up 79 percent from the prior 4-week average. Increases were primarily for the Dominican Republic (1,200 MT). Exports of 2,300 MT were up 51 percent from the previous week and up noticeably

from the prior 4-week average. The destinations were to the Dominican Republic (1,200 MT), Mexico (800 MT), and Canada (300 MT).

Cotton:

Net sales of 262,800 RB for 2022/2023–a marketing-year high–were up 54 percent from the previous week and 58 percent from the prior 4-week average. Increases primarily for China (87,700 RB, including 200 RB switched from Vietnam), Turkey (72,600 RB, including

decreases of 300 RB), Vietnam (45,300 RB, including 800 RB switched from South Korea), Indonesia (16,600 RB), and Pakistan (14,000 RB, including decreases of 4,200 RB), were offset by reductions for El Salvador (400 RB) and Mexico (300 RB). Net sales of 4,800

RB for 2023/2024 were primarily for Thailand (3,300 RB). Exports of 210,100 RB were down 1 percent from the previous week, but up 17 percent from the prior 4-week average. The destinations were primarily to Pakistan (45,200 RB), Vietnam (42,800 RB), China

(40,300 RB), Turkey (18,900 RB), and Mexico (13,000 RB). Net sales of Pima totaling 1,300 RB for 2022/2023 were down noticeably from the previous week and down 50 percent from the prior 4-week average. Increases were primarily for Vietnam (700 RB) and Bangladesh

(300 RB). Exports of 5,800 RB were down 25 percent from the previous week, but up 4 percent from the prior 4-week average. The destinations were primarily to Vietnam (2,200 RB), India (1,300 RB), China (1,100 RB), South Korea (400 RB), and Turkey (300 RB).

Optional

Origin Sales: For

2022/2023, the current outstanding balance of 9,300 RB, all Malaysia.

Export

for Own Account: For

2022/2023, new exports for own account totaling 15,400 RB were to China (8,300 RB), Turkey (3,800 RB), and Vietnam (3,300 RB). Exports for own account totaling 12,500 RB to China were applied to new or outstanding sales. The current exports for own account

outstanding balance of 117,600 RB are for China (83,900 RB), Vietnam (19,400 RB), Turkey (5,400 RB), Pakistan (5,000 RB), South Korea (2,400 RB), and India (1,500 RB).

Hides

and Skins:

Net sales of 395,300 pieces for 2023 primarily for China (226,400 whole cattle hides, including decreases of 32,600 pieces), South Korea (109,100 whole cattle hides, including decreases of 3,800 pieces), Mexico (38,500 whole cattle hides, including decreases

of 1,000 pieces), Taiwan (12,400 whole cattle hides, including decreases of 100 pieces), and Turkey (6,100 whole cattle hides), were offset by reductions primarily for Brazil (1,400 pieces) and Vietnam (1,200 pieces). In addition, net sales of 2,200 kip skins

primarily for Belgium (1,400 kip skins), were offset by reductions for China (700 kip skins). Exports of 494,000 whole cattle hides exports were primarily to China (349,200 pieces), Mexico (57,600 pieces), South Korea (34,300 pieces), Thailand (16,300 pieces),

and Brazil (11,300 pieces). In addition, exports of 5,100 kip skins were to China.

Net

sales of 91,700 wet blues for 2023 were primarily for Thailand (44,200 unsplit), Vietnam (17,400 unsplit), Mexico (8,800 unsplit), Italy (7,900 unsplit, including decreases of 100 unsplit), and Hong Kong (6,800 unsplit, including decreases of 200 unsplit).

Exports of 124,800 wet blues were primarily to Italy (37,400 unsplit and 1,900 grain splits), Vietnam (22,800 unsplit), Thailand (17,100 unsplit), China (16,500 unsplit), and Hong Kong (13,000 unsplit). No net sales or exports of splits were reported for the

week.

Beef:

Net sales of 16,400 MT for 2023 were primarily for South Korea (4,400 MT, including decreases of 400 MT), Japan (3,500 MT, including decreases of 400 MT), Mexico (2,700 MT), Canada (1,400 MT, including decreases of 100 MT), and China (1,400 MT, including decreases

of 200 MT). Exports of 15,600 MT were primarily to Japan (4,800 MT), South Korea (4,400 MT), China (1,900 MT), Mexico (1,200 MT), and Taiwan (900 MT).

Pork:

Net sales of 28,800 MT for 2023 were primarily for Mexico (12,700 MT, including decreases of 200 MT), South Korea (4,700 MT, including decreases of 1,200 MT), China (3,400 MT, including decreases of 200 MT), Colombia (1,600 MT, including decreases of 100 MT),

and Australia (1,500 MT). Exports of 30,400 MT were primarily to Mexico (14,000 MT), China (4,600 MT), Japan (3,000 MT), Canada (2,100 MT), and South Korea (2,100 MT).

U.S. EXPORT SALES FOR WEEK ENDING 2/2/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

93.9 |

894.5 |

1,936.6 |

104.6 |

3,592.2 |

4,957.6 |

10.0 |

101.3 |

|

SRW |

18.0 |

634.4 |

652.4 |

100.7 |

1,916.9 |

1,907.7 |

9.5 |

134.1 |

|

HRS |

47.5 |

1,167.7 |

1,182.3 |

127.6 |

3,708.2 |

3,466.2 |

0.0 |

49.8 |

|

WHITE |

-28.9 |

1,058.9 |

697.5 |

174.4 |

3,017.0 |

2,379.1 |

0.0 |

23.4 |

|

DURUM |

0.8 |

83.2 |

54.6 |

30.8 |

228.8 |

113.1 |

0.0 |

1.9 |

|

TOTAL |

131.4 |

3,838.8 |

4,523.4 |

538.1 |

12,463.2 |

12,823.7 |

19.5 |

310.5 |

|

BARLEY |

0.0 |

4.4 |

13.8 |

0.0 |

7.2 |

14.7 |

0.0 |

0.0 |

|

CORN |

1,160.3 |

13,786.7 |

24,997.3 |

394.9 |

13,005.5 |

20,715.1 |

10.0 |

1,437.1 |

|

SORGHUM |

53.0 |

490.5 |

4,112.6 |

0.2 |

293.7 |

2,244.1 |

0.0 |

0.0 |

|

SOYBEANS |

459.4 |

10,314.0 |

9,162.9 |

1,828.6 |

37,416.9 |

37,596.8 |

185.0 |

903.0 |

|

SOY MEAL |

181.7 |

3,018.6 |

3,226.6 |

312.8 |

4,198.1 |

4,495.4 |

0.9 |

53.4 |

|

SOY OIL |

1.9 |

18.2 |

169.4 |

2.3 |

25.1 |

318.2 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

87.3 |

172.4 |

306.7 |

3.9 |

249.6 |

708.4 |

0.0 |

0.0 |

|

M S RGH |

-0.5 |

10.3 |

9.6 |

0.3 |

16.0 |

4.1 |

0.0 |

0.0 |

|

L G BRN |

0.0 |

4.6 |

19.9 |

0.2 |

11.6 |

28.6 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

35.7 |

67.4 |

0.0 |

8.4 |

18.0 |

0.0 |

0.0 |

|

L G MLD |

9.4 |

143.8 |

83.8 |

10.5 |

350.7 |

465.4 |

0.0 |

0.0 |

|

M S MLD |

16.5 |

131.1 |

180.1 |

19.0 |

142.3 |

216.2 |

0.0 |

0.0 |

|

TOTAL |

112.8 |

498.0 |

667.5 |

33.8 |

778.6 |

1,440.8 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

262.8 |

4,916.8 |

7,973.2 |

210.1 |

4,799.2 |

4,202.8 |

4.8 |

1,261.2 |

|

PIMA |

1.3 |

48.6 |

199.1 |

5.8 |

83.1 |

200.7 |

0.0 |

3.5 |

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |