PDF Attached

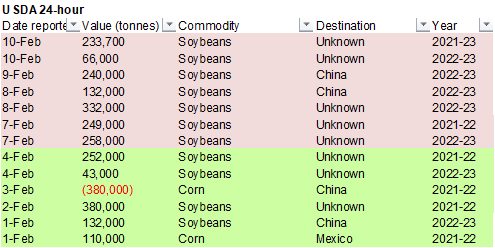

Private exporters reported sales of 299,700 metric tons of soybeans received during the reporting period for delivery to unknown destinations. Of the total, 233,700 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons during the 2022/2023 marketing year.

We saw a bullish start to the session following yesterday’s USDA WASDE report and this morning’s CONAB data. The agricultural markets were unable to hold gains after the bearish US CPI data triggered a macro selloff. What started as light profit-taking turned into technical selling and liquidation by the close. The US interest rate market broke as yields spiked, especially in the front-end of the yield curve. Fed’s Bullard talked of more aggressive 50bps rate hike and 100 total bps by July.

![]()

Weather

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

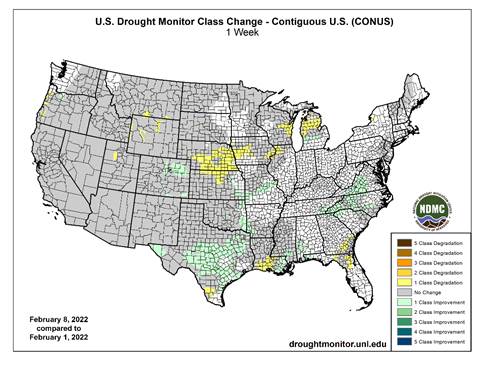

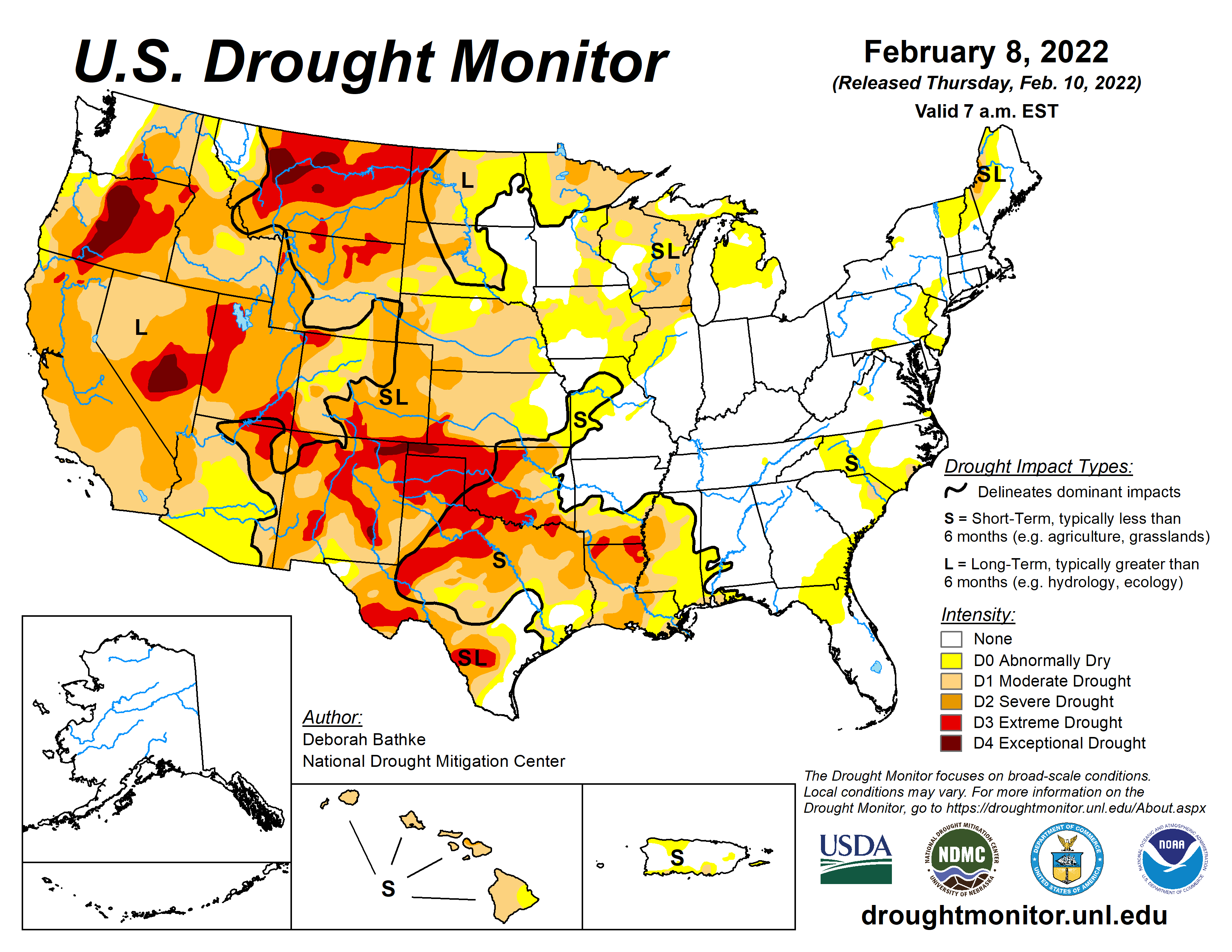

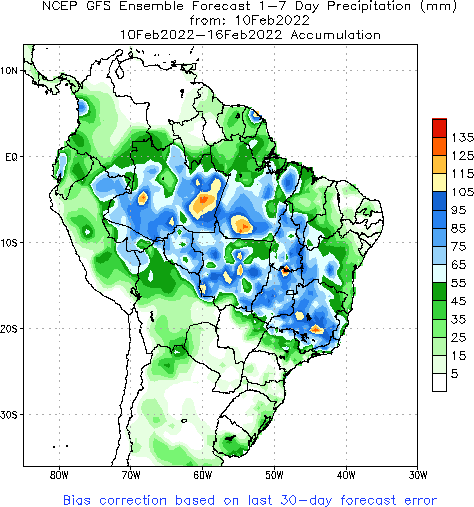

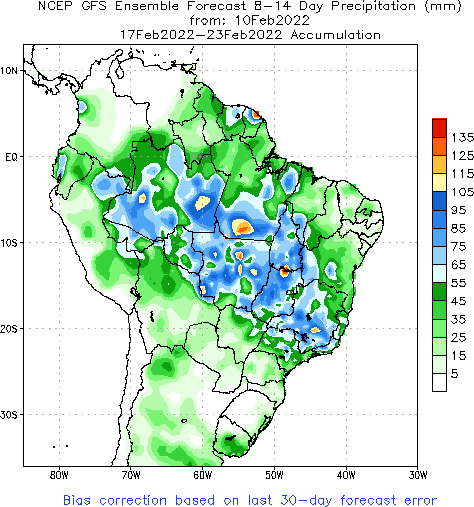

South America weather has fallen back into a familiar weather pattern of restricted rainfall in Argentina, Paraguay and southern Brazil for the next ten days. That raises some potential for crop moisture stress especially in central and eastern Argentina, Rio Grande do Sul and far southern Paraguay where recent rain was not very great. In the meantime, Mato Grosso to Minas Gerais, Brazil will remain wet worrying producers and traders over slow harvest progress and some crop quality issues, but progress will be made.

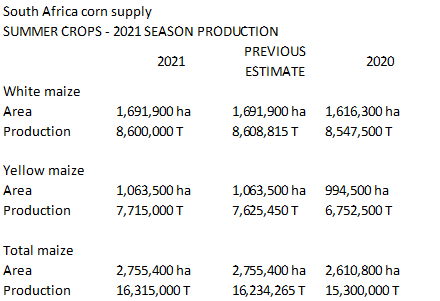

South Africa crops are in mostly good shape and should remain that way with net drying over the coming week helping to firm up the wettest areas. Most winter rapeseed areas in the Northern Hemisphere have experienced favorable weather this winter and should enter spring favorably. Southeast Asia oil palm production areas have favorable soil moisture, although peninsular Malaysia has reported lighter than usual rain recently.

Australia summer crops are drying down again in unirrigated areas with little change for ten days.

Overall, weather today will likely contribute additional bullish support to market mentality.

High temperatures in the first week of the outlook will be warmest today with upper 30s and 40s, and 50s to near 60 in the southwest. Highs Friday will then be coldest with negative teens and negative single digits in the east and upper 20s and 30s in the southwest. Morning low temperatures will be coldest Saturday with -20s and some -30s in Manitoba and eastern Saskatchewan and positive teens in southwestern areas.

Temperatures in the second week will likely be variable with alternating periods of above and below average readings. Northeastern areas will be generally the coldest and southwestern areas generally the warmest.

MARKET WEATHER MENTALITY FOR WHEAT: No threatening weather is expected in any major wheat production region in the world for the next ten days and some needed rain may fall next week in a part of U.S. hard red winter wheat country. Most of the U.S. Plains will remain drier than usual into March, but there is some potential for moisture to benefit a part of the region next Wednesday and Thursday.

India, China, Europe and the western CIS winter crops are still in favorable condition and expected to develop well in the early spring if there are no threatening conditions over the next few weeks. Spain and Portugal remain a little too dry along with portions of Morocco and northwestern Algeria and only a few erratic showers and thunderstorms are expected in those areas for a while.

Overall, weather today may have a neutral to slight bearish influence on market mentality because of limited change in key production areas.

Source: World Weather Inc.

Bloomberg Ag Calendar

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- March ICE white sugar contract expiry

- HOLIDAY: Japan

Monday, Feb. 14:

- USDA export inspections – corn, soybeans, wheat, 11am

- New Zealand Food Prices

- Ivory Coast cocoa arrivals

Tuesday, Feb. 15:

- EU weekly grain, oilseed import and export data

- Malaysia’s Feb. 1-15 palm oil exports

- Malaysia crude palm oil export tax for March (tentative)

- New Zealand global dairy trade auction

Wednesday, Feb. 16:

- EIA weekly U.S. ethanol inventories, production

- FranceAgriMer report; monthly grains outlook

- HOLIDAY: Thailand

Thursday, Feb. 17:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- International Grains Council monthly report

Friday, Feb. 18:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly crop condition report

Source: Bloomberg and FI

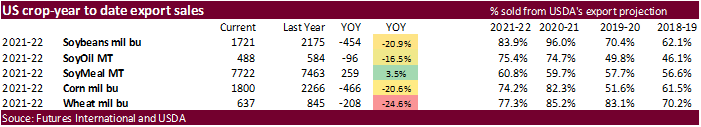

USDA Export Sales

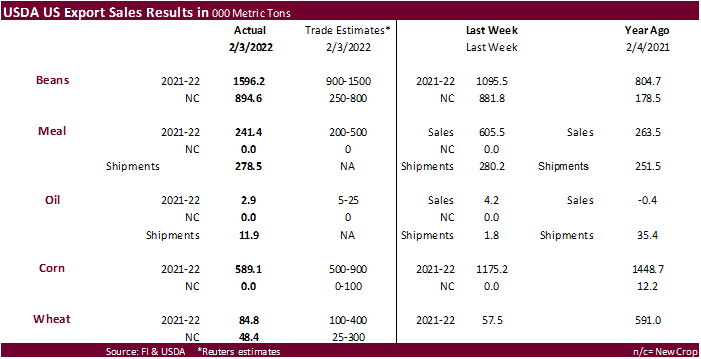

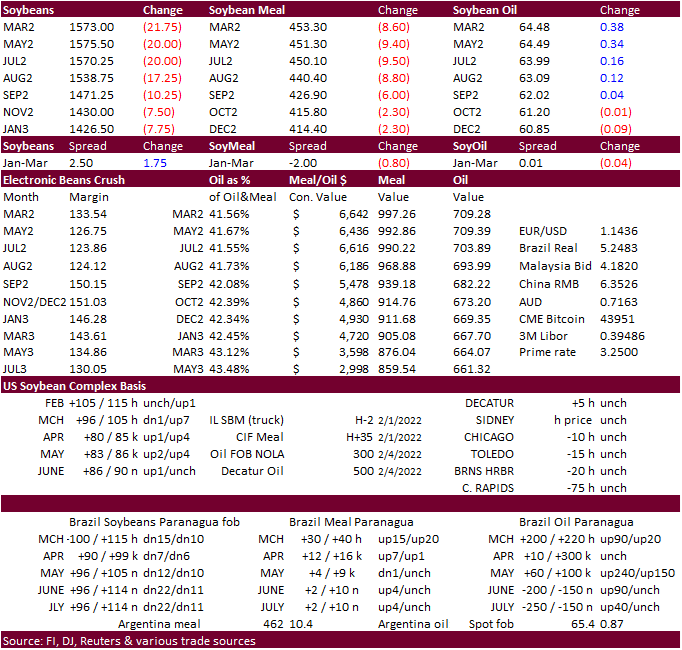

USDA export sales for soybeans topped expectations, meal was withing, and soybean oil was reported below a range of estimates. Shipments for meal and oil were ok. Soybean sales included unknown destinations (804,400 MT), China (298,100 MT, including 129,000 MT switched from unknown destinations and decreases of 5,700 MT). Corn export sales were at the low end of expectations while wheat was only 84,800 tons for old crop. Sorghum sales were 140,700 tons. Pork sales were 18,100 tons.

Macros

US CPI (M/M) Jan: 0.6% (est 0.4%; prevR 0.6%)

– CPI (Y/Y) Jan: 7.5% (est 7.3%; prev 7.0%)

– Core CPI (M/M) Jan: 0.6% (est 0.5%; prev 0.6%)

– Core CPI (Y/Y) Jan: 6.0% (est 5.9%; prev 5.5%)

US Initial Jobless Claims Jan: 223K (est 230K; prev 238K; prevR 239K)

– Continuing Claims Jan: 1621K (est 1615K; prev 1628K; prevR 1621K)

U.S. Rate Futures Show Nearly 6 Hikes In 2022 After CPI Data

U.S. Rate Futures Now See 50% Chance Of 50Bps Hike In March, From 30% Pre CPI Data

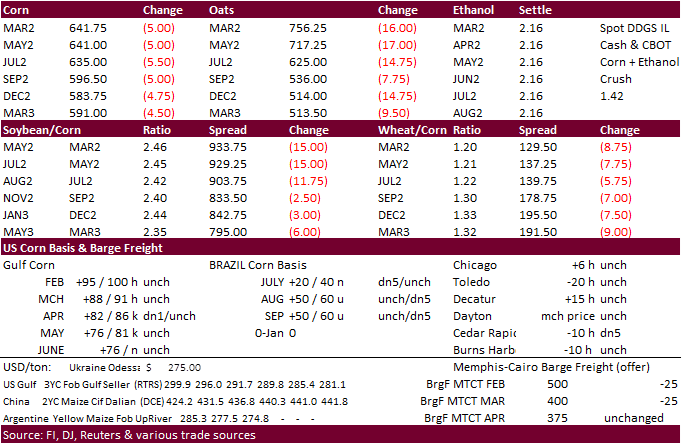

Corn

· March corn ended lower on profit-taking and risk-off liquidation. Farmer selling was there to meet the bid following the bullish CONAB data.

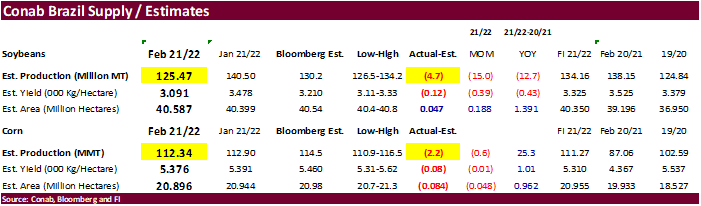

· Brazil’s Conab lowered their corn production by 0.8 MMT to 112.34 million tons (USDA @ 114.0), 2.2 million tons below an average trade guess and up from 87.1 MMT year ago.

· Today was the Fourth day of the Goldman roll.

· Baltic Exchange’s Main Index Rises 13.4%, Capesize Jumps 26.7% – Reuters News

· Argentina’s BA Exchange reduced its corn harvest to 51 million tons from 57 million tons last week. Drought was cited as the main driver for the reduction.

Export developments.

· Taiwan’s MFIG bought 65,000 tons of corn sourced from Argentina at an estimated premium of 253.42 cents/bu c&f over the July 2022 contract. The lowest U.S. price was 264.41 cents over July. Shipment is between April 1 and 20.

Source: CEC, Reuters and FI

Updated 2/2/22

March corn is seen in a $5.95 to $6.55

December corn is seen in a wide $5.25-$7.00 range

· Soybeans hit a 9-month high before profit-taking and technical selling pushed the oilseed market lower for the session settling 58 cents from the highs. South America’s dry weather and shrinking crop theme still persists, so that should continue to provide support.

· Brazil’s Conab reported a large decline in their soybean production, by 15 million tons to 125.5 million tons, 4.7 million below trade expectations, and below 138.2 MMT year ago. USDA is at 134 MMT for comparison. Dry weather in the southern states of Brazil severely impacted yields.

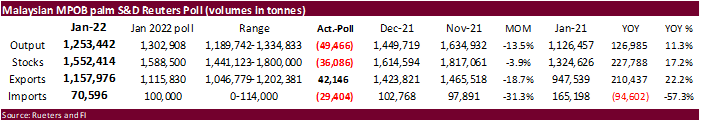

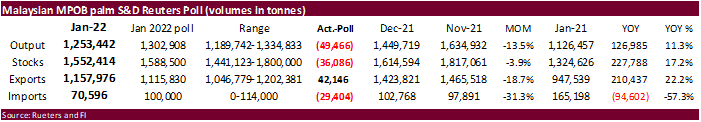

· The Malaysian Palm Oil Board reported end of January stocks at 1.552 million tons, 36,000 tons below an average trade guess and down from December. Stocks are at a 6-month low. December stocks were upward revised 32,000 tons. Palm production during January slowed more than expected. Exports were higher than expected at 1.158 MMT, but well below 1.424 MMT exported during December. Traders are looking for February daily adjusted exports to improve but that has yet to be seen.

· AmSpec reported Malaysian palm oil exports during the February 1-10 period at 320,508 tons, up slightly from 318,928 tons. ITS reported a 5% drop to 318,078 tons. Meanwhile SGS reported at 6.5% decline to 304,415 tons.

- Private exporters reported sales of 299,700 metric tons of soybeans received during the reporting period for delivery to unknown destinations. Of the total, 233,700 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons during the 2022/2023 marketing year.

- Iran’s SLAL seeks up to 60,000 tons of animal feed barley and 60,000 tons of soybean meal. Shipment for both the barley and soymeal was sought between Feb. 15 and March 15.

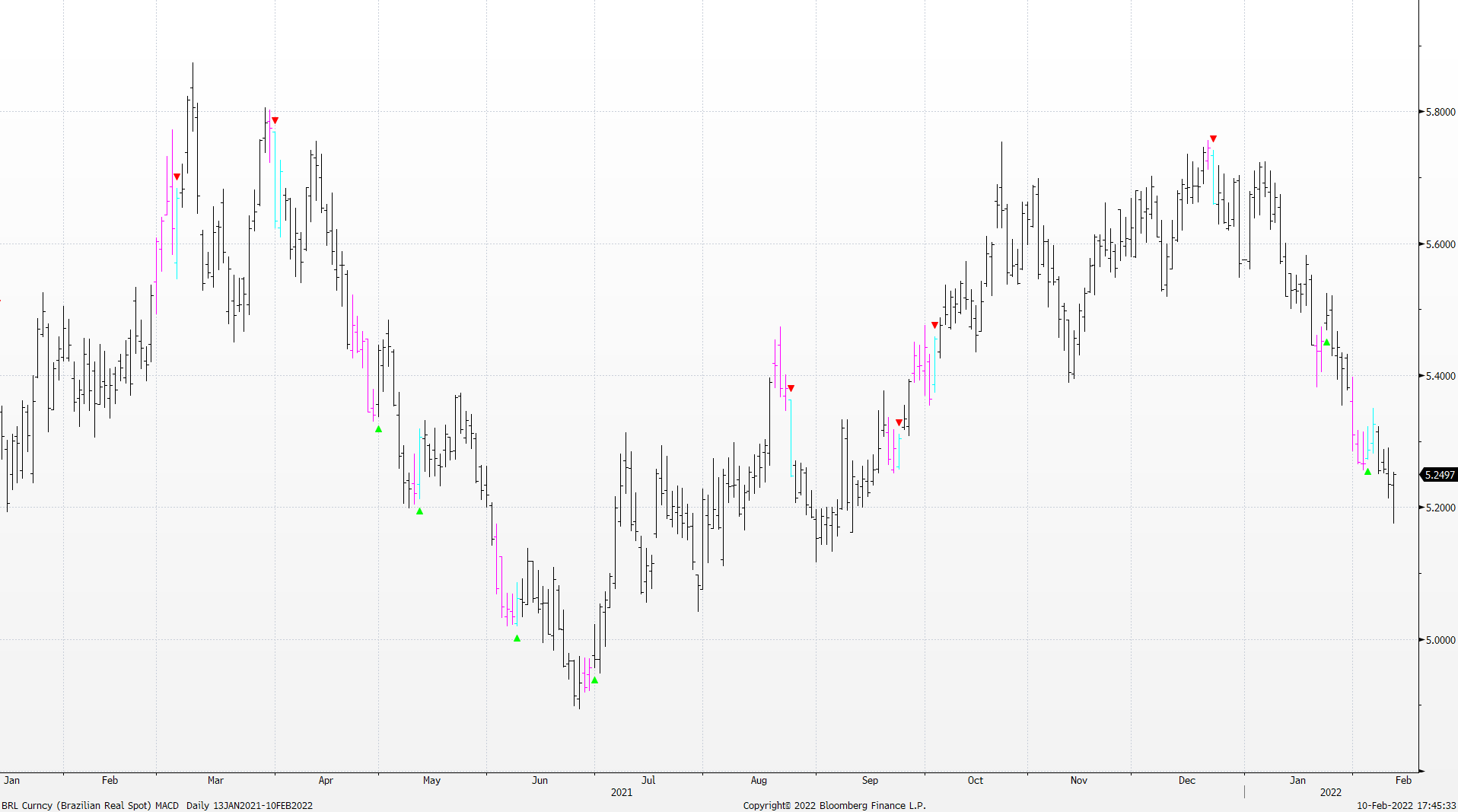

USD/Brazilian Real daily chart

Updated 2/7/22

Soybeans – March $14.75-$16.50

Soybeans – November is seen in a wide $12.00-$15.75 range

Soybean meal – March $420-$480

Soybean oil – March 66.50-69.00

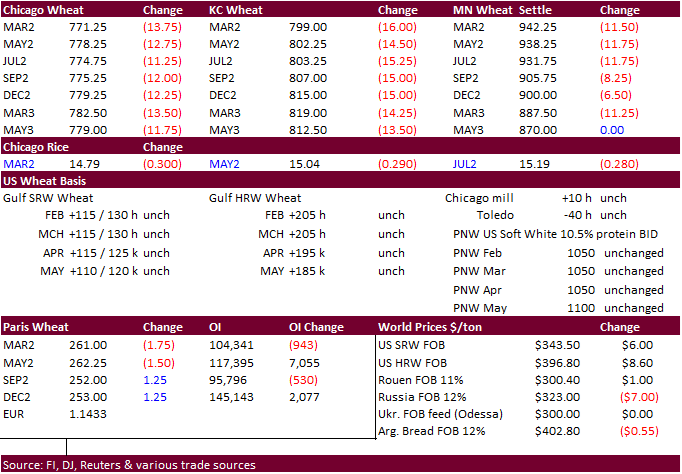

· US wheat futures fell following corn and oilseeds and the weak export numbers. The increasing tensions between Ukraine and Russia weighed on the market as the military presence in the Black Sea has nearly halted private vessel traffic.

· EU wheat futures closed down 1.25 euros at 261.50 euros per ton.

· Strategie Grains increased their estimate for the 2022-23 EU soft wheat crop to 128.0 million tons from 127.7 million previously and compares to 129.6 million year ago. They lowered their EU soft wheat export forecast to 30.4 million tons from 31.2 million previously.

· Ukraine said the Russian navel drills near the southern coast made navigation in the Black Sea and Azov Sea “virtually impossible.”

· Japan’s weather bureau sees a 70% change of the La Nina phenomenon ending this spring (down from 80% last month).

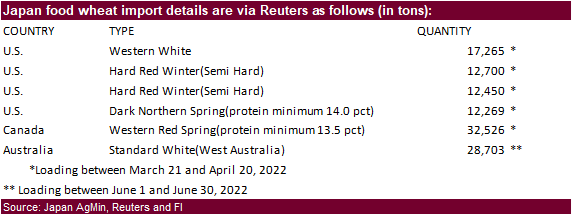

· Japan bought 115,913 tons of food wheat.

- Iran’s SLAL seeks up to 60,000 tons of animal feed barley and 60,000 tons of soybean meal. Shipment for both the barley and soymeal was sought between Feb. 15 and March 15.

· The Philippines seeks feed wheat from Australia and soybean meal from Argentina on February 11. Amounts are unknown.

· Bangladesh seeks 50,000 tons of wheat set to close February 14.

· Syria seeks 200,000 tons of wheat on February 14, open for 15 days.

· Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on Feb 16 for arrival by July 28.

· Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

Rice/Other

· None reported

Updated 2/2/22

Chicago March $7.25 to $8.30 range

KC March $7.45 to $8.55 range

MN March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.