PDF Attached

CFTC Commitment of Traders report is still delayed due to some firms unable to report positions.

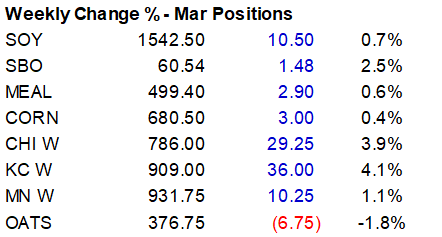

Russia’s “special operation” escalated in Ukraine with fresh attacks, including Kyiv. This renewed Black Sea shipping concerns and sent grains sharply higher. Soybeans rallied on strength in meal and a weather forecast for Argentina calling for less than previously expected rain over the weekend into early next week. Soybean oil was higher on meal/soybean oil spread profit taking and higher WTI crude oil. Soybean meal traded two-sided. The nearby meal contract gained over the back months on good US domestic and export demand and a slowdown in Argentina crush rates.

MOST IMPORTANT WEATHER FOR THE DAY

- Argentina’s predicted weekend and early next week rainfall was reduced in the overnight forecast model runs

- 0.25 to 0.75 inch and locally more is now predicted which is lighter than the 0.50 to 1.50 inches that had been advertised earlier this week

- Northern Argentina rainfall is still going to be significant enough to bolster soil moisture for long term crop development after a prolonged period of dryness

- Southern Brazil is still expected to receive significant rain during the next ten days to two weeks

- Sufficient moisture will occur to improve crop and field conditions in both Rio Grande do Sul and Paraguay

- All of Brazil gets rain at one time or another during the next two weeks

- Northeastern areas will be driest including Bahia, Espirito Santo and northern Minas Gerais

- Center west Brazil will experience better field progress in coming week, although showers and thunderstorms will still occur from time to time slowing fieldwork.

- Brazil rainfall in the far south along with Uruguay and Paraguay will be limited through the weekend, but rain is expected next week to bring some relief to recent heat and ongoing drying

- A few showers are expected in the far south today and Friday, but next week’s rain will be greater and the impact should be longer lasting

- Resulting rainfall will be sufficient to improve crop conditions for a while, but more rain will still be needed

- Bahia, Brazil and immediate neighboring areas will be drier biased during much of the coming week to ten days favoring some crops, but there will eventually be need for greater rain

- U.S. hard red winter wheat areas will continue lacking precipitation of significance in the west through the weekend

- There is some potential for rain and snow in the western Plains early next week

- Confidence is low, though, and resulting amounts should not be great enough to end drought by any means

- Any moisture would be welcome, though

- Eastern portions of the region will experience the best precipitation maintaining favorable crop development potential in those areas

- Another storm system will bring snow to many areas during mid-week next week

- U.S. central and eastern Midwest, Delta and southeastern states will be quite wet over the next ten days to two weeks inducing greater runoff in the Ohio River Valley and inducing a little flooding in the northern Delta, southeastern Missouri and Tennessee River Basin

- U.S. northern Plains and northwestern Corn Belt as well as Canada Prairies will continue to receive below normal precipitation for a while, though a short term bout of increased precipitation is expected before temperatures turn colder late next week

- Evidence continues to rise over the prospects for a Sudden Stratospheric Warming Event (SSW) that should begin to evolve next week from and become notable in the last days of February and especially in March

- Cooler than usual temperatures will accompany the event from the central Canada Prairies into the heart of the Great Plains and a part of the Midwest during late February and especially March

- An increase in winter storminess is likely in the interior eastern U.S. through the New England states

- California and western Washington and western Oregon rainfall and heavy mountain snow will resume over the coming weekend and last through most of next week adding more moisture to the mountains for use in the spring

- Europe weather will be cool for a little while longer this week and then warmer than usual during the weekend and next week

- There is no risk of crop damaging cold during the next two weeks

- Europe precipitation will continue unusually limited for the next ten days

- Dry soil is already present in parts of eastern Spain and a part of the lower Danube River Basin

- North Africa weather

- Some scattered showers will occur during the next week to ten days, but resulting precipitation is not likely to be very great.

- Interior Tunisia, northwestern Algeria and Morocco precipitation will continue limited for the next ten days and possibly longer; although interior Tunisia did receive some much needed moisture Wednesday

- Dryness is already a concern in these areas, although winter crops are dormant or semi-dormant and do not have much moisture requirement for now

- The need for moisture will be steadily rising this month as crop areas trend warmer and crops are stimulated to develop

- Western CIS crop areas will experience light and sporadic precipitation in this first week of the outlook and then experience some boost in rain and snowfall next week

- Winter crops are dormant

- Temperatures will be warmer than usual and there is no risk of winterkill during the next two weeks

- India will be mostly dry over the next ten days in key crop areas

- Winter crop areas will need rain soon to ensure the best production potential

- Winter crops mostly reproduce in February and continue filling in March

- China will experience waves of rain this week and next week in the Yangtze River Basin and areas to the south coast

- The southern rapeseed areas will be wettest and should experience the best improvement in soil moisture supporting early spring crop needs

- Rice planting will begin in early March or as soon as soil temperatures permit and rapeseed will be breaking dormancy soon if it has not already

- Wheat areas in the North China Plain and Yellow River Basin may get some needed rain briefly late this week and into the weekend

- Australia rainfall is expected to occur erratically over the next ten days impacting central and southeastern Queensland most often

- Greater rain would be welcome in key summer crop areas, especially those not irrigated

- South Africa rainfall will stay erratic and light for a while this week and then increase during the second half of this week into next week

- Summer crop conditions will remain good and some will improve with the greater rain forthcoming

- Middle East precipitation is expected to increase this week, although not all areas will benefit

- Turkey will be wettest along with northern Iraq, northern Syria and portions of western and northern Iran

- Greater precipitation will still be needed in some areas

- Southern Syria and much of Iraq away from the far north will be dry and moisture in parts of Iran will be lighter than usual as well

- Eastern Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year

- West Africa rainfall is expected to be mostly confined to coastal areas during the next ten days, but a few showers will occasionally reach into a few coffee and cocoa production areas

- Seasonal rains should begin over the next few weeks.

- Today’s Southern Oscillation Index was +10.06 and it will move erratically higher over the coming week.

Source: World Weather and FI

Friday, Feb. 10:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

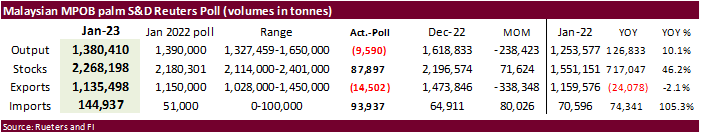

- Malaysian Palm Oil Board’s January data on stockpiles, production and exports

- Brazil’s Unica to release sugar output, cane crush data (tentative)

- Malaysia’s Feb. 1-10 palm oil export data

Monday, Feb. 13:

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

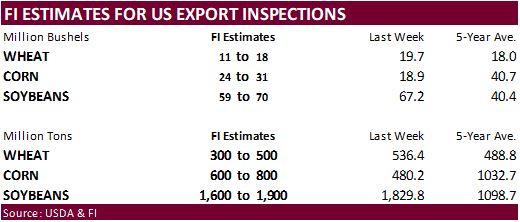

- USDA export inspections – corn, soybeans, wheat, 11am

Tuesday, Feb. 14:

- France farm ministry’s report on output in 2022 and winter plantings in 2023

- New Zealand food prices

- EU weekly grain, oilseed import and export data

Wednesday, Feb. 15:

- NOPA Crush

- EIA weekly US ethanol inventories, production, 10:30am

- Malaysia’s Feb. 1-15 palm oil export data

- FranceAgriMer’s monthly grains balance sheet report

Thursday, Feb. 16:

- International Grains Council’s monthly report

- USDA weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Russia Grain Conference, Sochi

Friday, Feb. 17:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

Source: Bloomberg and FI

Macros

97 Counterparties Take $2.043 Tln At Fed Reverse Repo Op. (Prev $2.059 Tln, 101 Bids)

Russia to cut oil production half million barrels per day (out this morning) or 5% next month.

US December CPI Revised To +0.1% (prev -0.1%)

US December CPI Ex-Food/Energy Revised To +0.4% (prev +0.3%)

– CPI Revisions Reflect Updated Seasonal Adjustment Factors

Canadian Unemployment Rate Jan: 5.0% (est 5.1%; prev 5.0%)

Canadian Net Change In Employment Jan: 150.0K (est 15.0K; prevR 69.2K)

Canadian Full Time Employment Change Jan: 121.1K (prevR 70.9K)

Canadian Part Time Employment Change Jan: 28.9K (prevR -1.7k)

Canadian Participation Rate Jan: 65.7% (est 65.4%; prevR 65.4%)

US Univ. Of Michigan Sentiment Feb P: 66.4 (est 65.0; prev 64.9)

– Current Conditions: 72.6 (est 68.5; prev 68.4)

– Expectations: 62.3 (est 63.1; prev 62.7)

– 1-Year Inflation: 4.2% (est 4.0%; prev 3.9%)

– 5-10 Year Inflation: 2.9% (est 2.9%; prev 2.9%)

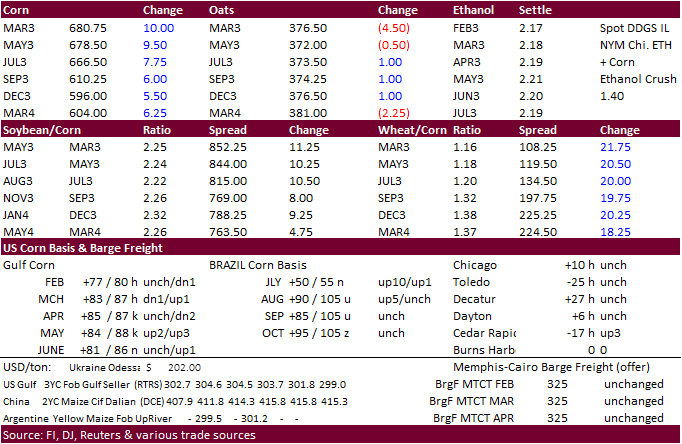

· CBOT corn rallied during the day session after hitting its lowest level in 3 weeks overnight. Strength in wheat and outside markets along with concerns over the extension of the Black Sea grain corridor agreement supported prices. WTI crude oil rallied after Russia announced they plan to cut oil production by 500,000 barrels or 5% next month.

· The US has given Mexico until February 14 to respond to a request to explain the science behind Mexico’s planned ban on GMO corn and glyphosate herbicide imports. A dispute settlement process under the US-Mexico-Canada Agreement (USMCA) on trade is not off the table.

· Ukraine’s grain harvest was 97% or 53.7 million tons, including 26.4 million tons of corn (93% of the expected area).

· Argentina corn crop conditions declined 2 points for the good category to 20 percent from the previous week, and poor category increased 2 points to 34 percent.

· Argentina’s BA Grains left its estimate for the Argentina corn crop at 44.5 million tons, down from 52 million year earlier.

· Monday will be the last day of the Goldman Roll.

· Spain reported a case of mad cow disease in a dead cow in the northwestern region of Galicia. The case was classified as isolated.

Export developments.

- South Korea’s KFA bought 64,000 tons of optional origin corn at $335.48/ton c&f for arrival around May 20. It excludes Russia and Ukraine ports of origin.

- Yesterday SK’s MFG and FLC bought US and SA corn, one cargo each.

Updated 02/8/23

March corn $6.45-$6.95 range. May $6.25-$7.00

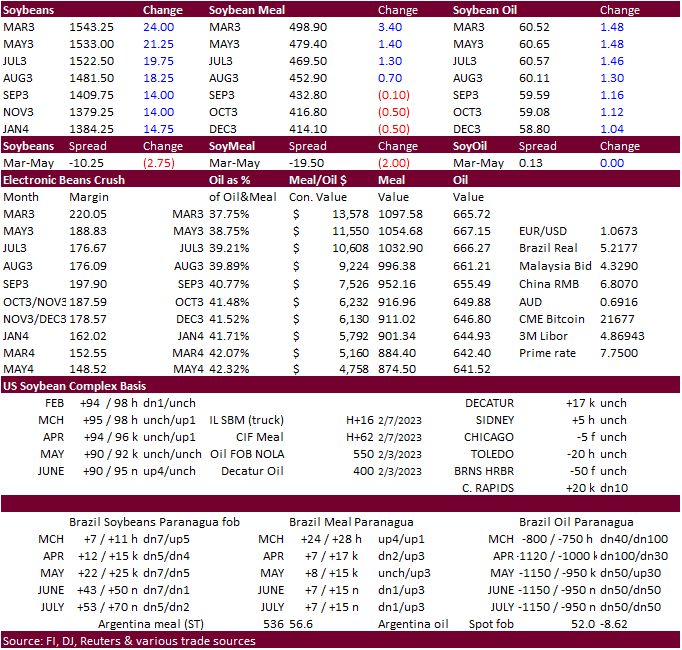

· CBOT soybeans traded sharply higher (bull spreading) from a downgrade in the Argentina weather forecast, sharply higher wheat, and talk of China soybean import interest for US soybeans.

· Soybean meal traded two-sided, ending higher. Bull spreading was a feature on tight US and Argentina supplies. During the session the March soybean meal contract reach an all-time high by trading above $500. Earlier meal lost ground to (a sharply higher) soybean oil market amid profit taking in product spreads. WTI crude oil was higher and offshore values earlier this morning were leading SBO higher and meal lower. Look for the trade to monitor the rains expected to fall across Argentina over the next 3-4 days.

· On a rolling contract basis, soybean meal reached its highest level since the second week of January (expiring January contract continued to rally after FND). Upside is seen for the March soybean meal contract in the $510-$515 area, with strong resistance at $520.

· Malaysian palm oil stocks at the end of January increased 3.3% to 2.268 million tons, first time in three months, in large part from an 80,000-ton increase in imports from December to 144,937 tons, largest since August. Stocks came in 87,897 tons above expectations and are up 46 percent from a year ago. Exports of 1.135 million tons were slightly below expectations and down 338,348 tons from what was exported during December, a 23 percent decline. Cargo surveyors, for comparison, estimated palm exports during January fell 26-27 percent. January Malaysian palm oil production fell nearly 15 percent to 1.38 million tons, lowest level in 11 months.

· Malaysia April palm futures were up 2% for the week.

· AmSpec reported February 1-10 Malaysia palm oil export increased 32.51% to 312,092 tons from 235,529 tons shipped during Jan 1-10.

· Indonesia set their February 16-28 CPO reference price at $880.03/ton for February 16-28, up from $879.31 during February 1-15. That puts Indonesia’s CPO export tax at $74 per ton and export levy at $95 per ton.

· There were a total of 198 soybean registrations cancelled Thursday evening, leaving 599 left. Thoughts are that little deliveries will be posted First Notice Day.

Export Developments

· We heard China’s Sinograin bought 3-4 US soybean cargoes this week to increase reserve supplies. AgriCensus noted February shipment at $2.15 over the March futures contract.

Updated 02/07/23

Soybeans – March $14.85-$15.50, May $14.75-$16.00

Soybean meal – March $450-$520, May $425-$550

Soybean oil – March 58.50-63.00, May 58-70

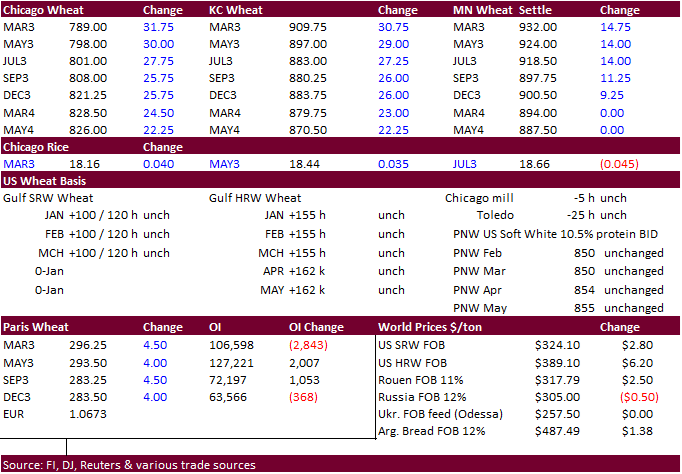

· Russia’s “special operation” escalated in Ukraine with fresh attacks, including Kyiv. This underpinned US wheat futures. Rumors circulated that a couple Russian missiles flew over Romanian air space, which Russia denied. Funds short covering added to the support today which helps explain the large rally for Chicago.

· Nearby KC wheat rallied the most, settling 30 cents higher basis March, near its session high. On a rolling contract basis, KC wheat reached its highest level since late November. In retrospect, KC wheat is still trading near year ago levels, just before that market rallied well beyond $10 on Ukraine/Russia conflict concerns.

· February 24, 2022, was the start of the Ukraine/Russia conflict.

· Russia said they are having a hard time exporting grain as part of the Black Sea grain deal. Currently Ukraine, Turkey, and other countries are negotiating to extend the deal set to expire soon.

· Meanwhile, IKAR agriculture consultancy expects Russia’s wheat exports for the 2022-23 season to end up at a record 46 million tons.

· Ukraine’s backlog of boats waiting for either inspection and for arrival prompted the AgMin to advise slightly larger vessels should be used to load grain and vegetable oils going forward.

· Paris March milling wheat settled 4.50 euros or 1.5% higher at 297 euros ($316.93) a ton. For the week it was up 4.4%.

Export Developments.

· Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons oof feed barley on Feb 15 for loading by May 31.

Rice/Other

· Results awaited: Egypt seeks at least 25,000 ton of rice from optional origin April-May shipment.

Updated 02/10/23

Chicago – March $7.50 to $8.10, May $7.00-$8.25

KC – March $8.55-$9.20, $7.50-$9.25

MN – March $9.00 to $9.60, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |