PDF Attached

News

headlines out around 12:30 pm CT reporting US officials expect Russia to invade Ukraine next week sent markets in a frenzy. Agriculture was higher, USD higher, energy markets sharply higher, and equities lower. The soybean complex and grains were higher in

general today on SA crop production concerns. The USD was up about 49 points as of 1:10 pm CT and WTI crude nearly $3.70 higher. US equities traded two-sided and were lower at the CBOT ag market close.

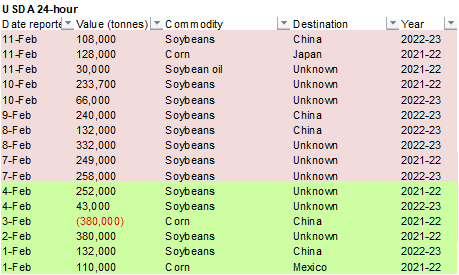

Private

exporters reported the following activity:

-108,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-128,000

metric tons of corn for delivery to Japan during the 2021/2022 marketing year

-30,000

metric tons of soybean oil for delivery to unknown destinations during the 2021/2022 marketing year

WEATHER

EVENTS AND FEATURES TO WATCH

- Tropical

Cyclone Dovi will bring heavy rain to portions of northern New Zealand this weekend - The

storm was located 765 miles east southeast of Brisbane, Australia and 795.6 miles north northwest of Auckland, New Zealand moving south southeasterly and producing maximum sustained wind speeds of 90 mph near its center - Dovi

will steadily weaken over the next two days and will be located 164 miles west southwest of Auckland around 1800 GMT Saturday with sustained wind speeds of 60 mph - The

storm will quickly lose its tropical characteristics, but it is still destined to bring some strong wind and heavy rain across North Island, New Zealand and some northern South Island locations as well tonight and especially Saturday - Rainfall

of 3.00 to 8.00 inches will accompany the storm through northern New Zealand resulting in some flooding at least some risk of damaging wind - Rain

from the system is already impacting a part of New Zealand at the time of this report - Some

welcome snowfall occurred across northwestern Kazakhstan Thursday and early today - Moisture

totals varied up to 0.40 inch through 0600 GMT and that snow has since moved to north-central and northeastern parts of the nation - Another

wave of snow is expected this weekend into early next week - The

precipitation will not only induce some significant snow totals of 3 to 12 inches and local totals to 15 inches, but moisture totals will vary from 0.20 to 0.75 inch with a few amounts to 1.25 inches - The

moisture will be extremely welcome and helpful in bolstering topsoil moisture in the region when the snow melts

- Soil

conditions have been notably dry since last summer’s heat and dryness - Rain

developed in Argentina overnight from western Buenos Aires and La Pampa into Cordoba and San Luis - Most

of the rain was light, but it maintained favorable topsoil moisture for many areas and increased it in other areas - Temperatures

were very warm to hot in northern Argentina and more seasonably warm in the south - Argentina’s

rain this morning will shift to the northeast, but it will diminish as it gets into the central and north part of Santa Fe and areas to the east and north are unlikely to get much significant moisture

- Any

precipitation will be welcome, but net drying is expected over the next ten days resulting in rising levels of crop stress for portions of that region - Some

improving rain will occur in the last days of February and early March, although rain amounts may still be a little light - Temperatures

are expected to be warmer than usual in this first week of the outlook and then a little cooler in the south during the following week - Brazil

rainfall Thursday was greatest from Minas Gerais to eastern Mato Grosso Thursday, though it was not heavy - Temperatures

were seasonable with a cooler bias in the wetter areas. - Hot

temperatures occurred again Thursday in Paraguay accelerating the region’s drying trend after some beneficial moisture fell earlier in this past week - Brazil

weather through early next week will be wettest in northern parts of the nation from center west through Minas Gerais and immediate neighboring areas - Fieldwork

will be slow, but some progress is expected - Rain

will fall late this weekend and early next week in central and southern Rio Grande do Sul into central and eastern Parana - Relief

from dryness in western Parana, Mato Grosso do Sul and Paraguay will be possible in the second half of next week and out farther in the second week of the outlook - No

heavy soaking of rain is expected, but any precipitation will prove to be beneficial and welcome - Northwest

Africa, Spain and Portugal precipitation will continue limited over the next ten days

- Moisture

is needed as winter crops begin to warm up and develop more aggressively - Moisture

must improve in late February and March to protect production in many unirrigated areas - Weather

in the remainder of the world has not changed much from that of Wednesday and most anomalies are not enough to move markets in a big way. - There

is no threatening cold weather coming to any part of Europe or Asia during the next ten days and probably not for two weeks - France,

the U.K. and most of eastern Europe into to the western parts of the CIS will see frequent bouts of precipitation including snow and some rain

- China’s

Yangtze River Basin and areas to the south to the coast will see waves of rain and with some snow in the north part of the region during the next two weeks - Soil

conditions will remain saturated in much of the region - Future

rice planting should have plenty of moisture to work with - Rapeseed

conditions will be good when greening begins, but a little drier bias might help protect crops until warming has occurred - Northern

China will get a few brief bouts of snow, but accumulations should be light - Xinjiang

China weather is becoming more active with waves of snow expected mostly in the northeast and throughout the mountainous areas in the northwest - The

moisture resulting from snow will improve topsoil moisture and runoff potential in the spring - the

first half of winter was quite dry this year - India’s

weather will be drier biased for a while, but light rainfall in some areas the past couple of days was welcome - More

precipitation is needed to ensure the best winter crop yields, but the nation is still poised to see very good yields this year - South

Africa precipitation will be limited for a while, but should increase next week

- Crop

conditions are rated favorably - West-central

Africa coffee and cocoa production areas will see some increase in shower activity this weekend, but most of the rain is not expected to be enough to greatly increase topsoil moisture - Additional

showers are expected in the Feb. 16-22 period that may stimulate a few areas of localized flowering - The

rainy season is expected to begin relatively well with March wetter than late February - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Southeast

Asia precipitation will continue erratic from one day to the next, but most of Indonesia and Malaysia precipitation will continue frequent and abundant - Mainland

areas of Southeast Asia seem poised to see an early start to scattered showers and thunderstorms during the next couple of weeks with next week wettest - Eastern

Australia sorghum, cotton and other crop areas; including some sugarcane areas, will see net drying over the next ten days to two weeks.

- The

environment will reduce soil moisture and could stress some dryland crops in the interior parts of the region - Coastal

showers are expected, but rainfall will be lighter than usual - Any

showers that occur in key cotton and sorghum areas will fail to produce enough rain to bolster soil moisture - U.S.

hard red winter wheat areas are advertised to receive significant moisture during the Wednesday/Thursday period of next week on both the European and GFS model runs today - Moisture

in the high Plains region should be light with a limited impact on drought and/or soil and crop conditions - Eastern

portions of hard red winter wheat country will get significant moisture with 0.40 to 1.50 inches possible with the southeastern corner of the region wettest - Some

snow is expected in Nebraska, northern Kansas and some areas in Colorado - Another

weather system might impact a part of the region after February 22, but it will likely disfavor the southwest as well - U.S.

storm next week will wallop the Midwest and Delta - Widespread

rain and some snow will fall during the middle to latter part of next week in the Midwest, Delta and southeastern states - Wednesday

and Thursday will be the stormier days - Moisture

totals will vary from 1.00 to more than 2.00 inches from the Delta to parts of Iowa and from there into the Great Lakes region and Ohio River Basin

- Impressive

snowfall will be possible in northern portions of the storm - Another

U.S. storm is possible in the second weekend of the outlook with the southeastern Plains, lower Delta and southeastern corner of the nation most impacted and it should occur mostly as rain

- Another

storm is expected in a part of the northern Plains and upper Midwest after Jan. 22, but confidence in this event is low - Precipitation

in the U.S. Plains and Midwest will be restricted until the middle part of next week - California

is unlikely to get significant moisture for the next couple of weeks - West

Texas may get some light precipitation briefly during mid-week next week as the new storm system begins to evolve in the central states - South

Texas precipitation is expected to be restricted over the next ten days - U.S.

Pacific Northwest precipitation will be lighter than usual over the next ten days, but at least some moisture is expected - Limited

precipitation will continue in the northwestern U.S. Plains and in southwestern Canada’s Prairies, although some moisture is expected - Canada’s

southwestern Prairies are still snow free with only light snowfall expected in the next ten days - North

America temperatures will be warmer biased in the central and western United States and western Canada during the coming week while readings are closer to normal in the eastern states - Second

week temperatures will bring some warming to the Atlantic Coast states and lower eastern Midwest while a cool bias lingers in the southern Plains and upper Midwest

- These

anomalies are not likely great enough influence energy markets very much - Middle

East snow cover has been favorable recently - Rain

and snow will move across Iran today into Saturday with drier weather in most other areas in the Middle East through the coming week - The

moisture will be good for winter crops - Today’s

Southern Oscillation Index is +9.56 - The

index will slowly level off over the next few days after its recent rise - New

Zealand will receive significant rain in North Island and in some western and northern parts of South Island through the weekend due to remnants of Tropical Cyclone Dovi - The

moisture will be welcome and help to raise topsoil moisture - There

is some potential for local flooding, however - Drier

weather is expected next week - Temperatures

will trend a little a little warmer after the rain passes - Mexico

will experience cooler than usual weather with rain in some of the east-central and southeastern parts of the nation periodically over the coming week

- The

moisture will be good for early season crop development late this month and in March - Sugarcane,

citrus and winter rice will benefit most, but some other fruits and vegetable crops will also benefit

- Early

season sorghum and corn planting will occur well this year if the precipitation is great enough

- The

remainder of the nation will be dry - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically - Western

Colombia, Ecuador and Peru rainfall may be greater than usual during the balance of this week and early into the coming weekend - Western

Venezuela will also experience a boost in rainfall - The

remainder of Venezuela will remain dry

Source:

World Weather Inc.

Bloomberg

Ag Calendar

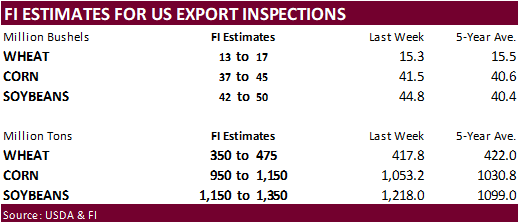

- USDA

export inspections – corn, soybeans, wheat, 11am - New

Zealand Food Prices - Ivory

Coast cocoa arrivals

Tuesday,

Feb. 15:

- EU

weekly grain, oilseed import and export data - Malaysia’s

Feb. 1-15 palm oil exports - Malaysia

crude palm oil export tax for March (tentative) - New

Zealand global dairy trade auction

Wednesday,

Feb. 16:

- EIA

weekly U.S. ethanol inventories, production - FranceAgriMer

report; monthly grains outlook - HOLIDAY:

Thailand

Thursday,

Feb. 17:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report

Friday,

Feb. 18:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly crop condition report

Source:

Bloomberg and FI

CFTC

Commitment of Traders report

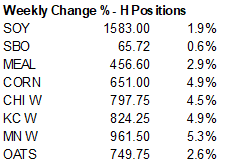

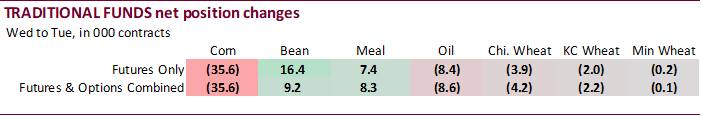

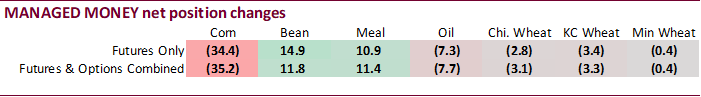

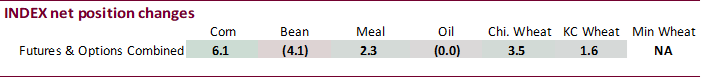

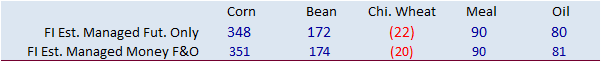

Traditional

funds trimmed their net long position as of February 8 for corn, oil, and all three wheat markets while building onto their net long positions for soybeans and meal. But the net long position for corn was 26,600 contracts less than expected. The funds position

for soybeans, meal and Chicago wheat were also less long than estimated. We see little implication from this report on futures prices for corn and other products as prices were very volatile over the last three business days. Index funds were good sellers

in corn of 35,700 contracts. There were no record positions for the notable positions we monitor.

Reuters

report:

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

253,614 -35,699 441,755 6,127 -669,709 19,098

Soybeans

139,522 7,039 187,798 -4,123 -291,540 -6,975

Soyoil

32,549 -5,562 118,969 -14 -163,929 6,430

CBOT

wheat -50,234 -3,772 143,160 3,493 -89,230 -433

KCBT

wheat 11,865 -2,558 57,099 1,564 -71,892 -108

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

337,332 -35,219 278,672 2,473 -662,918 22,679

Soybeans

166,315 11,827 127,305 -7,396 -296,525 -5,867

Soymeal

88,138 11,395 92,950 -2,029 -226,665 -4,442

Soyoil

72,782 -7,694 89,626 3,198 -171,296 6,209

CBOT

wheat -29,552 -3,100 93,613 4,169 -72,914 -632

KCBT

wheat 34,473 -3,326 26,985 1,493 -61,822 -403

MGEX

wheat 3,596 -363 2,365 -51 -14,740 -976

———- ———- ———- ———- ———- ———-

Total

wheat 8,517 -6,789 122,963 5,611 -149,476 -2,011

Live

cattle 81,842 12,570 83,879 3,151 -166,238 -10,326

Feeder

cattle 716 2,733 6,566 738 -1,585 -2,259

Lean

hogs 78,672 8,703 62,088 1,899 -133,137 -12,397

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

72,575 -408 -25,660 10,475 1,998,012 18,490

Soybeans

38,685 -2,623 -35,780 4,059 1,078,690 72,171

Soymeal

15,480 -3,112 30,098 -1,812 510,347 32,183

Soyoil

-3,524 -859 12,410 -855 484,568 -11,600

CBOT

wheat 12,549 -1,148 -3,696 711 486,477 -5,574

KCBT

wheat -2,564 1,133 2,929 1,103 240,374 -5,794

MGEX

wheat 3,910 262 4,870 1,128 72,269 289

———- ———- ———- ———- ———- ———-

Total

wheat 13,895 247 4,103 2,942 799,120 -11,079

Live

cattle 19,165 406 -18,648 -5,801 392,147 4,305

Feeder

cattle 3,206 802 -8,902 -2,015 56,382 461

Lean

hogs 6,251 1,457 -13,873 337 358,156 29,082

=================================================================================

Source:

CFTC, Reuters and FI

US

Believes Putin Has Decided To Invade Ukraine, Expect Invasion To Begin Next Week – NBC

US

Univ. Of Michigan Sentiment Feb P: 61.7 (est 67.0; prev 67.2)

–

Current Conditions: 68.5 (est 72.1; prev 72.0)

–

Expectations: 57.4 (est 64.5; prev 64.1)

–

1-Year Inflation: 5.0% (est 5.0%; prev 4.9%)

–

5-10 Year Inflation: 3.1% (prev 3.1%)

77

Counterparties Take $1.636 Tln At Fed Reverse Repo Op (prev $1.634 Tln, 76 Bids)

Corn

·

CBOT corn ended higher on increasing worries over a Ukraine/Russia conflict after the US projected an invasion as early as this weekend, and ongoing weather issues for Southern Brazil and Argentina.

·

Higher USD limited gains. Brent crude rose to $95 a barrel for the first time since September 2014 (BB).

·

March corn settled up 9.50 cents at $6.51, up 5% on the week, just shy of its contract high.

·

Today was the final day of the Goldman roll and March/May spread narrowed 0.75 cent.

·

Today Safras & Mercado estimated the Brazil total corn crop at 115.7 million tons, nearly unchanged from its previous figure.

·

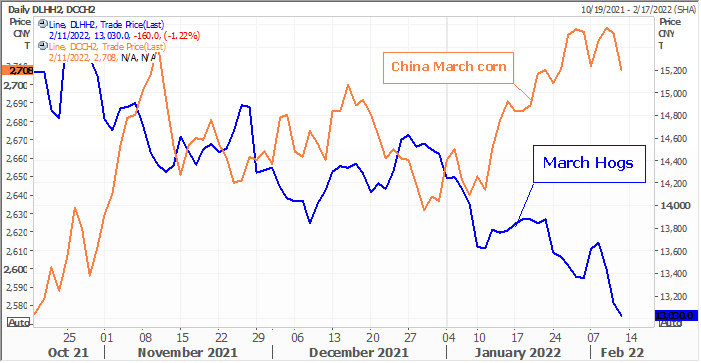

China’s hog prices fell sharply by an average 7.3% between Monday and Thursday to 12.7 yuan ($1.95) a kilogram, according to data from Shanghai JC Consulting Co Ltd. per a Reuters article.

·

China’s sow herd fell 2.9% by the end of the fourth quarter of last year from the previous quarter to 43.29 million head, 4% greater than the previous year. China’s pig herd at the end of December was up 10.5% from the previous

year, at 449.22 million head, and 2.6% higher on the quarter. (Reuters)

·

China’s AgMin looks for the countries meat production to increase 2.8% annually to 89 million tons by 2025, from 77.5 million tons produced in 2020. Pork production would remain stable at around 55 million tons. (Reuters)

Export

developments.

·

Private exporters reported the following activity:

-128,000 metric tons of corn for delivery to Japan during the 2021/2022 marketing year

U

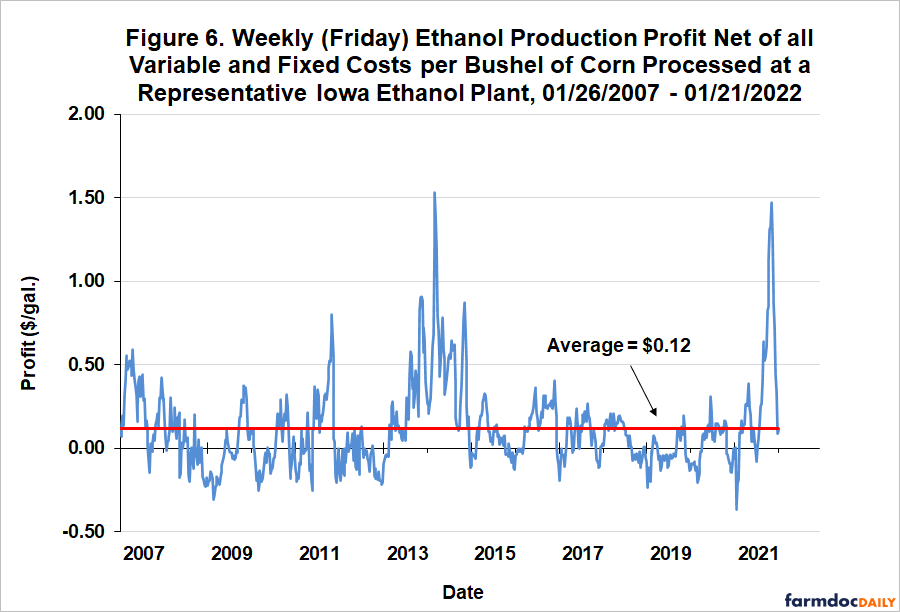

of I: Ethanol Production Profits in 2021: What a Ride!

Irwin,

S. “Ethanol Production Profits in 2021: What a Ride!.” farmdoc daily (12):18, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 10, 2022.

https://farmdocdaily.illinois.edu/2022/02/ethanol-production-profits-in-2021-what-a-ride.html

Updated

2/11/22

March

corn is seen in a $6.15 and $6.85 range (up 20, up 20)

December

corn is seen in a wide $5.25-$7.00 range

·

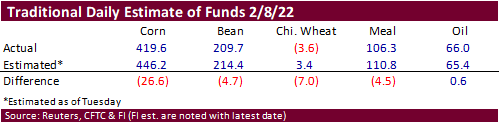

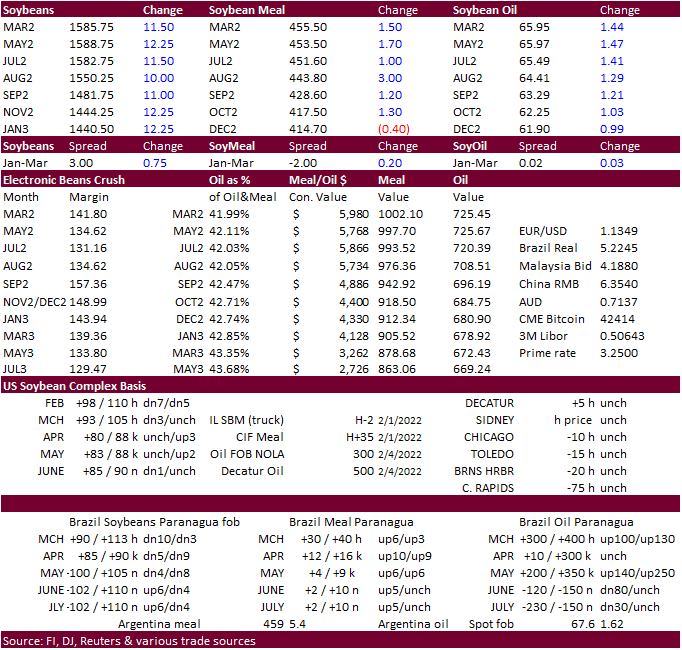

The US soybean complex extended gains on SA production concerns and additional USDA 24-hour sales announcements. USDA reported China bought 108,000 tons of new-crop soybeans and 30,000 tons of 2021-22 soybean oil to unknown. We

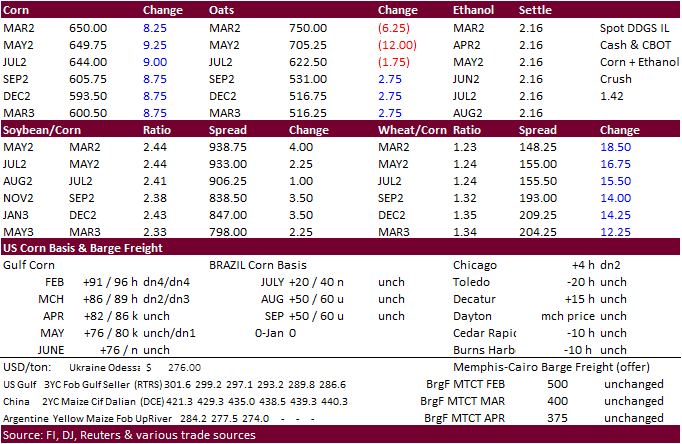

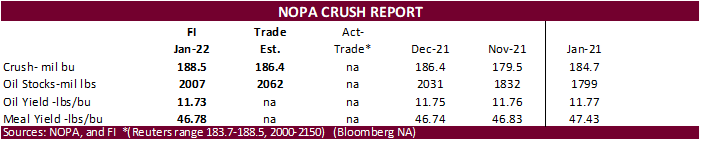

think that might have been India. Soybean oil gained over meal. Crush is up 10.75 basis March to $1.45. NOPA crush is due out Tuesday and estimates are below.

·

March soybeans settled 8.75 cents higher, well off session highs, at $15.83, up 2% for the week. March soymeal rallied $2.60 at $456.60 per short ton and March soyoil was up 1.21 cents at 65.72 cents, which saw a boost from related

energy markets.

·

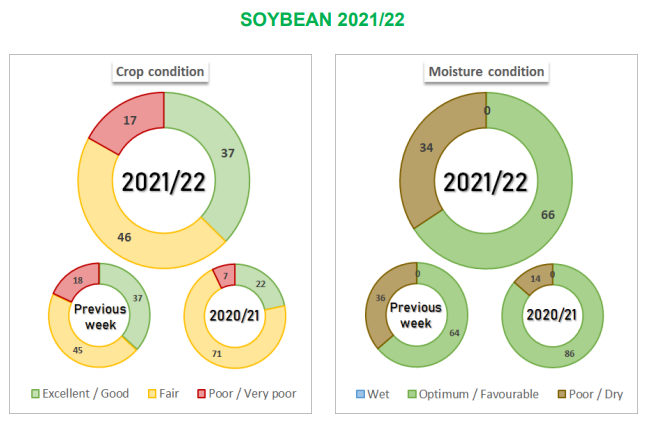

Warmer and dry conditions will occur for southern Brazil and Argentina over the next week.

·

Safras & Mercado estimated the Brazil soybean crop at 127.17 million tons, down from 132.3 million tons previously.

·

Paraguay’s AgMin estimated the soybean crop at around 5 million tons, lowest level in the last decade. Some estimates are around 4 million tons.

·

Parts of Indonesia’s Sumatra and Kalimantan will see heavy rain through the end of today.

·

Note China soybean meal futures are trading near their highest level since 2012. China returns on hog production are poor with the high meal and corn prices.

·

We see a record January NOPA crush when updated Tuesday and are at the high side of a range of expectations. There were a couple plants that saw unexpected downtime in the WCB but January was running full out for many crushing

plants taking advantage of good margins. Soybean oil stocks are seen by FI declining from December. Recall SBO stocks at the end of December were unusually high, especially when you compare them to the NASS crush report that came out at the beginning of the

month.

·

The Reuters trade guess for NOPA January crush came in at 186.7 million bushels, above 186.4 million for December and up from 184.7 year earlier. The range was 183.7-188.5 million. Many analysts expect a build in soybean oil stocks

to 2.062 billion pounds from 2.031 billion pounds at the end of December and compares to 1.799 billion year earlier. If realized US soybean oil stocks would be up seven consecutive months. End of January NOPA US soybean oil stocks ranged from 2.000 to 2.150

billion pounds. We are at 2.007 billion pounds.

- Iran

passed on 60,000 tons of soybean meal and 60,000 tons of barley due to high prices. Shipment was sought between Feb. 15 and March 15.

- Private

exporters reported the following activity:

-108,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-30,000

metric tons of soybean oil for delivery to unknown destinations during the 2021/2022 marketing year

Updated

2/7/22

Soybeans

– March $14.75-$16.50

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $420-$480

Soybean

oil – March 66.50-69.00

·

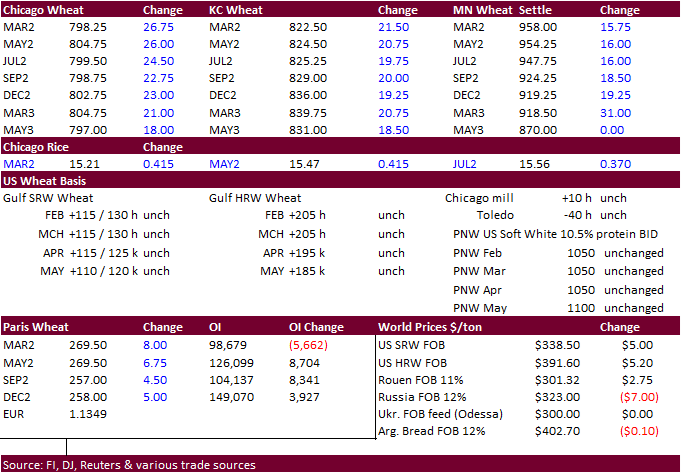

US wheat futures traded sharply higher on Ukraine/Russia conflict concerns that may disrupt wheat shipments out of the Black Sea, strong EU wheat prices, and fund buying. During the session, comments from US officials rallied

selected commodity markets. White House national security adviser warned Russia now has enough forces to conduct a military operation against Ukraine. Markets rallied post news headlines that started to hit the tapes around 12:30 pm CT. Volatility increased.

·

We saw unusual ‘insurance’ paid in the wheat options market:

-KWZ2 $12.00 calls traded 15.50c x 500 lots. Early. Rebid 15.50c without counter.

-WH2 $8.50 calls traded 2.50 – 3.00c x 3000 lots.

·

EU wheat futures settled up 7.25 euros, or 2.8%, at 268.75 euros ($306.38) a ton.

·

IKAR estimated Russia’s 2022 grain crop at 127 million tons, including 82.5 million tons of wheat, and grain exports in 2021-22 season at 46 million tons.

·

Russia’s wheat export duty will fall as of February 16 from $93.20 to $92.80 per ton, fifth weekly decline. Barley will fall from $73.30 to $74.10 per ton, and corn will be unchanged at $52.70 per ton.

·

Russia plans to buy 1.2 million tons of intervention grain this year.

·

Next week a major US winter storm is expected during mid to late week that could produce snow and rain across the Midwest and eastern hard red winter wheat areas.

·

Iran passed on 60,000 tons of soybean meal and 60,000 tons of barley due to high prices.

Shipment

was sought between Feb. 15 and March 15.

·

Results awaited: The Philippines seeks feed wheat from Australia and soybean meal from Argentina on February 11. Amounts are unknown.

·

Bangladesh seeks 50,000 tons of wheat set to close February 14.

·

Syria seeks 200,000 tons of wheat on February 14, open for 15 days.

·

Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on Feb 16 for arrival by July 28.

·

Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

Rice/Other

·

None reported

Updated

2/2/22

Chicago

March $7.25 to $8.30 range

KC

March $7.45 to $8.55 range

MN

March $8.75‐$10.00

Argentina BA Grains Exchange

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.