PDF Attached

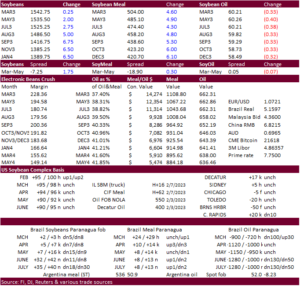

USD was down 35 points by 3 pm CT. WTI crude oil lower and US equities higher. A reversal in grains was seen today while soybeans, which saw a two-sided trade, ended higher. Soybean meal once again rallied, pulling down soybean oil. Weather, outside markets and meal cash prices were in focus. News was light but a few developments did arise, such as ASF detected in Hong Kong. Black Sea export corridor concerns remain ongoing.

![]()

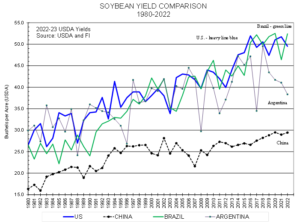

Weather forecasts improved from late last week for the US and Brazil. Argentina was about unchanged. Weekend rains are debatable for Argentina. The trade will be monitoring Brazil this week with ongoing planting and harvesting delays from too much rain. However, the Brazil second corn crop planting progress did advance last week and may weigh on US corn futures. Mato Grosso, MGDS, south Minas, Sao Paulo, Parana, Santa Catarina, and north RGDS will all see rain this week. Argentina rain should favor Cordoba, Santa Fe, Enter Rios, Buenos Aires through Tuesday. Far western US Great Plains will see snow this week, which includes eastern CO and KS.

MOST IMPORTANT WEATHER FOR THE DAY

- Argentina rainfall overnight was welcome, but it was not nearly enough to change the bottom and drying will resume

- Rainfall during the weekend was greatest Sunday into today with 1.00 to 3.00 inches in southeastern Buenos Aires and 0.50 to 1.25 inches in southwestern Cordoba

- Lighter rainfall of up to0.40 inch occurred in other areas from northern Cordoba and central Santa Fe to Buenos Aires.

- All of the moisture was welcome, but the most areas did not get enough to counter evaporation from the weekend when highs were in the 90s to 104 degrees Fahrenheit

- Some improvement in topsoil moisture occurred in southwestern Cordoba and in central through southeastern Buenos Aires. Most other areas will likely dry out again later today and certainly be the end of the day Tuesday

- Argentina temperatures will be cooler this week resulting in slower drying rates which will help to conserve soil moisture a little longer

- Topsoil moisture Sunday morning was very short in most of the nation while subsoil moisture was rated marginally adequate to very short

- Argentina weather pattern changes this week include no large volumes of rain

- Rain over the next ten days will be concentrated on today into Thursday with the remainder of the 10-day forecast period staying dry or mostly dry

- Another trace to 0.65 inch will occur in parts of Buenos Aires and especially from Cordoba and Santa Fe into Salta

- Some areas in Cordoba and Santiago del Estero will receive upwards to 1.50 inches of rain, but much of it will be lighter

- Salta and parts of both Formosa and Chaco will receive some moderate to heavy rain with 1.00 to 3.00 inches expected in Salta

- Argentina’s bottom line will be one of improvement in the northern one third of the nation as well as in west-central Cordoba and a part of Buenos Aires. All other areas will experience status quo conditions or deteriorating soil moisture and crop conditions resulting in some additional crop moisture stress. The cooler temperatures expected later this week into next week will help conserve soil moisture, but crop stress will still be high in many locations threatening production potentials.

- Mato Grosso, Brazil rainfall decreased enough last week and during the weekend to promote firmer topsoil conditions and perhaps some faster early season soybean maturation and harvest progress

- Safrinha corn and cotton planting may have also advanced a little better

- Brazil weekend precipitation continued abundant in southern Goias, Mato Grosso do Sul and areas southward into northern Parana and western and southern Sao Paulo

- Rainfall in these areas ranged from 0.60 to 1.57 inches with as much as 2.40 inches resulting in southern Goias

- These wetter areas received enough rain to maintain saturated soil conditions and further restricted field progress

- Drying is needed most in these areas, but this is the same region that should be a part of the wettest region for the next ten days

- Brazil rainfall over the coming week will be above normal from Mato Grosso do Sul and parts of Paraguay into Parana, Santa Catarina and portions of Sao Paulo where totals by this time next week will range from 2.00 to more than 4.00 inches keeping the ground saturated and limiting field progress

- Rain will occur in other crop areas across the nation but resulting amounts will vary from 0.60 to 2.00 inches with eastern Bahia, northeastern Minas Gerais, Espirito Santo and northern Rio de Janeiro driest.

- Western and southern Brazil should trend drier during the coming weekend and continue through the first half of next week

- That will shift the greatest rainfall to the region from Mato Grosso and areas southeast into Minas Gerais and Tocantins where 1.00 to 3.00 inches is expected

- Feb. 23 -28 will generate scattered showers across Argentina, Uruguay, Paraguay and southern Brazil while daily rain continues farther north in Brazil just like in the first ten days of the outlook.

- Temperatures will fall below normal in Argentina during mid- to late-week this week and into Paraguay, Uruguay and far southern Brazil briefly during the weekend and early next week

- A more normal temperature distribution is expected in the Feb. 22-28 period.

- Brazil’s bottom line today will remain challenging for crops in center west and center south crop areas due to frequent rainfall. The improved field progress in Mato Grosso late last week and during the weekend is expected to dissipate with the onset of more frequent rain later this week and into next week. Concern over field progress and crop quality in soybean production areas will continue. Drier and warmer weather is needed for a couple of weeks to get field progress back on track so that crop production potentials are not threatened. World Weather, Inc. does not see much reason to worry over soybean production, although a slight quality decline might occur. The bigger worry may be over getting Safrinha crops planted as quickly as possible so that their production is not negatively impacted if seasonal rains ending a little earlier than usual.

- U.S. hard red winter wheat areas will receive rain and snow early this week with Tonight into late Wednesday or early Thursday wettest

- Moisture totals varying from 0.15 to 0.65 inch will occur most often with the southwestern wheat areas driest

- Kansas, east-central and southeastern Colorado and a part of Nebraska should be wettest

- Drier weather will resume late this week and last through the first half of next week, but World Weather, Inc. anticipates additional opportunities for precipitation this spring to set the stage for favorable crop development

- U.S. Midwest, Delta and southeastern states are slated to receive frequent waves of precipitation during the next ten days maintaining a favorable outlook for spring planting moisture

- One concern for the region will be the cooler temperatures that may come in March and again periodically in April that may slow drying rates and possible delay the onset for some early season fieldwork

- West and South Texas are still slated to received restricted precipitation over the next ten days

- There is plenty of time for rain to fall significantly in West Texas, but South Texas and the Texas Coastal Bend will be planting in March with a few areas near the Rio Grande to begin planting late this month

- Dryness in the south part of Texas is not as serious as that of last year, but moisture is needed to supporting planting of corn, sorghum and eventually cotton in unirrigated fields

- Florida, southern Georgia and southern South Carolina will be drier biased for the next ten days, although a few showers will be possible

- Temperatures will be warmer than usual throughout the forecast period

- Cold air is advertised to build up across central and western Canada this weekend and especially next week

- Temperatures will be notably below average in the Prairies next week with some areas in the northern Plains and also impacted by the cold

- Until the weekend, temperatures this week will be warmer than usual in the eastern half of the United States

- Canada’s Prairies and the northern U.S. Plains will receive limited precipitation this week until the cold begins to build up in Canada at which time snow will begin to fall in the northern Plains and across a part of the northern Plains.

- California ‘s precipitation bias is expected to be limited for the next ten days while rain and mountain snow continue in western Washington and western Oregon

- Europe precipitation will continue restricted most of this workweek as it has been for nearly ten days

- Precipitation may increase in Eastern Europe briefly during the weekend and early next week offering a boost in topsoil moisture.

- Some snow accumulation may occur from the Baltic Plain into northern Ukraine

- Western Europe will continue drier biased through the second week of the forecast, although at least some light precipitation will develop briefly

- Western CIS weather conditions will not change greatly this week with waves of rain and snow likely through the next ten days maintaining status quo soil moisture and snow cover while crops are dormant

- Spring soil moisture will be abundant this spring

- India precipitation is still advertised to be minimal over the next ten days to two weeks outside of minor production areas from Uttarakhand northwest to Jammu and Kashmir

- Dryness will soon become a concern for wheat, rapeseed, mustard, sorghum, corn, dry bean and peas as well as other crops

- Temperatures will be warmer than usual in west-central and northwestern parts of the nation, but no extreme heat is presently expected

- Rain and a little snow fell in eastern China during the weekend

- The moisture was good for long term rapeseed development potential as well as for some winter wheat development

- Additional moisture is expected briefly tonight into Monday in the Yangtze River Basin and areas to the south

- A brief break in the precipitation will then occur until the weekend and especially next week when precipitation may be more abundant once again

- The bottom line for China is still looking very good for spring rice planting in the southeast, resuming rapeseed development later this month in the Yangtze River Basin and a good start to wheat growing in March.

- Eastern Australia will continue to struggle for rain in unirrigated summer crop areas for the next ten days and possibly longer

- Crop moisture stress will remain a concern in the dryland areas of Queensland with a few areas in New South Wales also hurting for moisture

- South Africa rainfall during the weekend was heavy at times in northeastern Limpopo and in coastal areas from Nata where local rain totals of 2.50 to more than 4.00 inches were common

- Extreme amounts reached 6.77 inches in northeastern Limpopo and 7.67 inches in one Natal location

- Most summer grain, cotton and oilseed crop areas were not impacted by nearly as much rain and a few pockets are likely still a little dry while others have had timely rainfall supporting good crop development

- South Africa rainfall will continue to occur routinely in the next ten days to two weeks in eastern parts of the nation while the precipitation remains a little more sporadic in the west

- The bottom line should still be good for 2023 production

- North Africa rainfall was restricted during the weekend and more of the same is expected

- Rain may fall later this week and into the weekend in the drought stricken region of southwestern Morocco, but the region could not be planted this year because of no water supply and the moisture will not likely induce any change on production for this year.

- Other areas in North Africa are unlikely to get much moisture, but rain was common in northeastern Algeria and Tunisia last week

- Evidence continues to rise over the prospects for a Sudden Stratospheric Warming Event (SSW) that should begin to evolve this week from and become notable in the last days of February and especially in March

- Cooler than usual temperatures will accompany the event from the central Canada Prairies into the heart of the Great Plains and a part of the Midwest during late February and especially March

- An increase in winter storminess is likely in the interior eastern U.S. through the New England states

- Middle East precipitation is expected to be erratic over the next couple of weeks raising some need for greater precipitation prior to cotton and rice planting season.

- Wheat conditions are rated favorably

- Eastern Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year

- West Africa rainfall is expected to be mostly confined to coastal areas during the next ten days, but a few showers will occasionally reach into a few coffee and cocoa production areas especially in Ivory Coast

- Seasonal rains should begin over a larger part of west-central Africa in a few weeks.

- Today’s Southern Oscillation Index was +13.09 and it will move erratically higher over the next several days.

Source: World Weather and FI

Monday, Feb. 13:

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

- USDA export inspections – corn, soybeans, wheat, 11am

Tuesday, Feb. 14:

- France farm ministry’s report on output in 2022 and winter plantings in 2023

- New Zealand food prices

- EU weekly grain, oilseed import and export data

Wednesday, Feb. 15:

- EIA weekly US ethanol inventories, production, 10:30am

- Malaysia’s Feb. 1-15 palm oil export data

- FranceAgriMer’s monthly grains balance sheet report

Thursday, Feb. 16:

- International Grains Council’s monthly report

- USDA weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Russia Grain Conference, Sochi

Friday, Feb. 17:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

Source: Bloomberg and FI

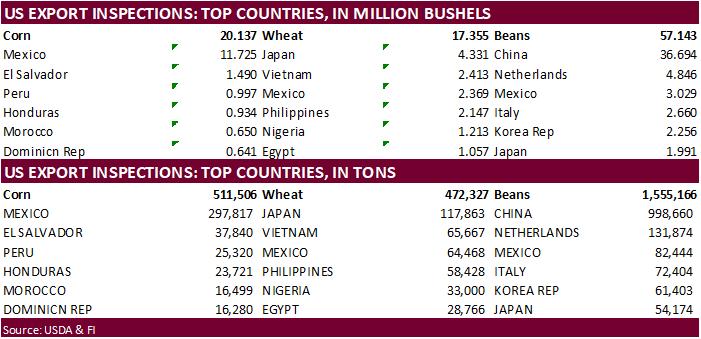

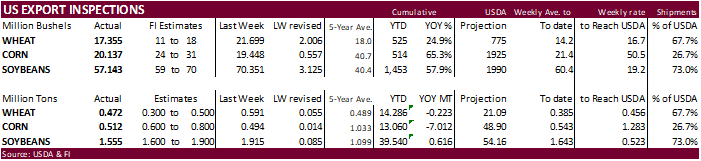

USDA inspections versus Reuters trade range

Wheat 472,327 versus 250000-600000 range

Corn 511,506 versus 360000-800000 range

Soybeans 1,555,166 versus 650000-1920000 range

GRAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING FEB 09, 2023