PDF Attached does not include daily estimate of funds as they were NA at the time this was sent.

No

USDA 24-hour announcements.

Another

day of headline trading over the Ukraine / Russia situation. Grains and the soybean complex were lower throughout much of the day as traders assumed relations improved only for negative headlines develop early afternoon. Wednesday was thought to be the date

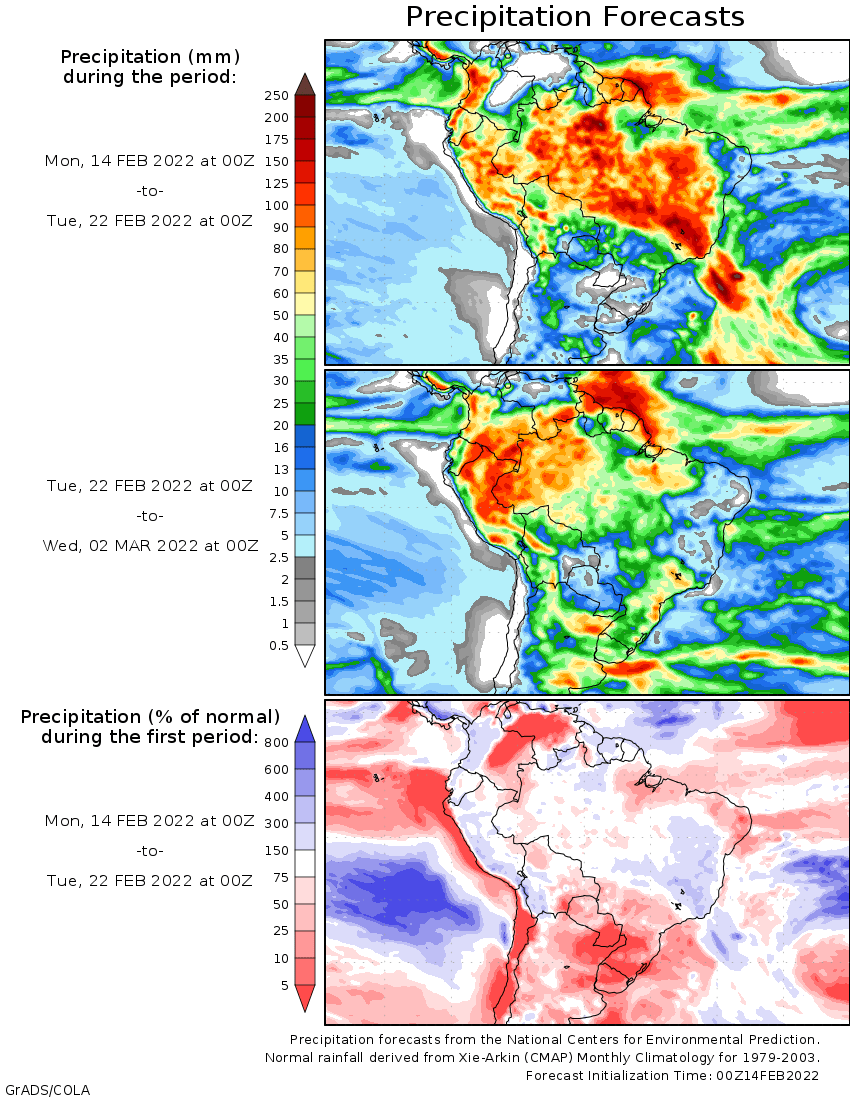

Russia could attack Ukraine, but we see this as speculation. Many question the US media headlines and rightfully so. Anyway, we look for this type of trading to continue at least through midweek. The US will see an important winter storm midweek. Some models

vary but expect some of the winter wheat areas to see precipitation.

48-hour

forecast

WEATHER

EVENTS AND FEATURES TO WATCH

- Tropical

Cyclone Dumako was expected to move into northern Madagascar Tuesday producing some heavy rain and flooding - Dumako

was located 240 miles north of St. Denis, Reunion near 16.6 south, 54.6 east moving west southwesterly at 18 mph and producing maximum sustained wind speeds of 58 mph - Dumako

was moving toward the upper east coast of Madagascar where landfall is possible around 1400 GMT Tuesday north of Toamasina - The

storm will move inland with wind speeds of 45 mph and some heavy rain - The

storm will weaken as it approaches land with 2.00 to 8.00 inches of moisture expected with landfall for the following day or two

- Damage

to crops and property should be low, but some flooding will induce a little damage - La

Nina events tend to produce a more active southwestern Indian Ocean tropical cyclone season and that has been the case this year - Tropical

cyclone Ana impacted Madagascar Jan. 22-23 and Tropical Cyclone Batsirai impacted the island in early February

- Tropical

Cyclone Dovi dissipated to a low pressure center as it moved through northern New Zealand during the weekend, but it still damaged trees, property power lines

- The

storm produced 80 mph wind speeds across northern parts of the nation with emphasis on North Island and northern most ports of South Island - Damage

assessments continue, but power outages have been widespread along with tree and property damage - Weather

conditions have already improved in the past couple of days - South

America weather offered no big surprises Friday through Sunday afternoon - Scattered

showers and thunderstorms occurred in Brazil with areas from southern Minas Gerais to southeastern Goias wettest where 1.00 to 2.00 inches resulted and local amounts of 2.00 to nearly 4.00 inches

- Rain

in eastern Parana reached 2.00 inches and one location in central Bahia reported 1.93 inches and another in the southeast had 1.58 inches. - Moisture

totals elsewhere varied from nothing to 0.68 inch most often with a local amount to 1.10 inches in central Mato Grosso - Temperatures

were seasonable with a slight warmer than usual bias near the Paraguay border and a little cooler bias in the heavier rainfall areas - Argentina

reported scattered showers in many areas during the weekend, but much of the resulting rainfall was not enough to counter evaporative moisture losses - Rainfall

varied up to 0.62 inch most often with many amounts less than 0.50 inch - Net

drying occurred in most of the nation, although cool temperatures slowed the drying rates - Highest

temperatures were in the upper 60s and 70s in central and southern Argentina through Saturday and in the 90s to 105 degrees Fahrenheit from northern Entre Rios through Corrientes to Formosa and Paraguay - Morning

lows slipped to the middle and upper 40s and 50s. - Argentina’s

10-day outlook minimizes rainfall from across much of the nation excepting the far northwest and extreme southeast

- Northwestern

Argentina rainfall will vary from 0.50 to 2.00 inches with several areas in northwestern Santiago de Estero and Salta getting 2.00 to 6.00 inches and locally more - The

heart of Argentina gets less than 0.60 inch of rain while southeastern Buenos Aries receives a few 1.00 to 2.00-inch totals – most of which occurs late this week and into the weekend - Temperatures

will be near to above normal - Please

note that the GFS model is notably wetter than the European model - Argentina’s

weather during the middle to latter part of next week should trend a little wetter especially in the last week of this month and on into early March - Temperatures

will be warm to hot in the north and milder in the south - Argentina’s

bottom line will be one of concern for this first week to ten days across portions of the nation due to ongoing dry and warm conditions. Significant rainfall will be confined to the northwestern and far southeastern parts of the nation while the central and

east dry down additionally raising the potential for more serious crop stress in the drier areas of central and northern Santa Fe, Entre Rios, Corrientes, southeastern Santiago del Estero and portions of both Chaco and Formosa. Rain in southern Argentina late

next week will maintain good soil moisture from Buenos Aires into southern Cordoba and southern most Santa Fe while most other areas continue to dry out. Concern over yield potentials will continue in central and some eastern crop areas while Buenos Aires

to southern Cordoba stay sufficiently wet to support good yields. - Brazil

weather in the coming week to ten days will leave most of Rio Grande do Sul without more than 0.40 inch of moisture - Many

areas in Paraguay and western Rio Grande do Sul will be dry – at least in this first week of the outlook - Rainfall

in interior southern Brazil from Santa Catarina through Parana to Mato Grosso do Sul will vary from 0.50 to 1.50 inches with local totals over 2.00 inches - Areas

from Minas Gerais and southern Bahia to Mato Grosso will receive 2.00 to 5.00 inches of rain during the coming week - Temperatures

will be near to below average except near the Paraguay border where some readings may be above normal especially in the dry areas of southern Paraguay and western Rio Grande do Sul - Brazil

weather next week begins the same as this week, but rain may evolve in the far south during the latter part of the week and into the following weekend while center south and center west crop areas possibly dry down for a little while - A

high pressure system aloft evolves in interior southern and northern parts of center South Brazil restricting precipitation for a while - Confidence

is not high, but if this change evolves a much better environment is expected in northern grain, oilseed and cotton areas due to less frequent and less significant rain - Faster

drying and better harvest conditions may evolve for a while - Temperatures

will be near to above average in the center west and a part areas nearby while varying in a normal range in most other areas - Brazil’s

bottom line is still not as bad as it was in January. There is concern about immature crops in Rio Grande do Sul and southern Paraguay, but most other areas either get timely rain or stay adequately to abundantly wet in this first week of the outlook with

some improving conditions next week as rain becomes less intensive and less frequent in the central and northern parts of the nation. Not much change in production potentials is expected except possibly in the driest areas of Rio Grande do Sul in this first

week of the outlook. Western Rio Grande do Sul continues to experience a lack of soil moisture and crop stress.

- Spain

and Portugal precipitation will continue sporadic and light over the next ten days leading to a greater need for rain soon as crops come out of dormancy - Irrigated

crops will develop normally, but dryland production areas need rain - All

of the watersheds for irrigation systems need rain and snow as well - Most

other areas in Europe either have sufficient soil moisture or will be getting timely precipitation during the next two weeks to support future crop development - Frequent

snow and rain will fall in Russia, Belarus, the Baltic States and northern Ukraine during the next ten days to two weeks - The

pattern is indifferent to that of the past few weeks and will maintain moisture abundance in the soil and deep snowpack in northern and western parts of Russia - Warmer

than usual temperatures may allow a further melting of southern snow fields, but temperatures will not be warm enough for any premature greening - Recent

snowfall in Kazakhstan and neighboring areas of Russia’s southeastern New Lands will help improve spring planting potentials when the snow melts - Additional

snow is predicted for the region periodically over the next two weeks - Xinjiang,

China has reported some light snow in the far northeast and in the mountains of the north and west recently

- Much

more precipitation is needed to induce better soil conditions and improved runoff potentials for irrigation water during the spring and summer - Periodic

precipitation is expected, but no major rain or snow events are perceived for a while - The

greatest precipitation this week will be Tuesday into Thursday when snow will fall in the northeast of Xinjiang and in the mountains of the west and north - China’s

most recent precipitation has been concentrated on the Yangtze River Basin and areas south to the coast - The

region is plenty wet, if not a little too wet - Some

drying would be welcome - Additional

waves of precipitation will continue to come and go through the next ten days to two weeks - Resulting

precipitation will maintain a wet environment for rapeseed and future rice and corn planting - Temperatures

will be near to below average in most of the nation this week - Australia

weather during the weekend included very little rain and warm to hot conditions in some areas - Temperatures

were in the 90s to 106 Fahrenheit in Queensland and north-central New South Wales and 100 to 111 in Western Australia while more seasonable elsewhere - Australia’s

summer crop areas in the east will be dry or mostly dry away from the Pacific Coast this week and temperatures will continue near to above average - Rain

next week should increase in the form of scattered showers and thunderstorms - The

precipitation will be erratic benefiting some areas more than others - Australia’s

summer crop areas in the east would benefit from scattered showers and thunderstorms especially in unirrigated late-planted fields where moisture stress is threatening production - Most

of the irrigated crops are rated favorably with little change likely - Early

maturing crops will benefit from ongoing dry and warm biased conditions this week - Sugarcane

areas along the Pacific Coast will get some periodic rain - South

Africa rainfall will increase during this coming week to ten days - The

moisture boost will be welcome for some areas after recent drying - The

drying was more beneficial than detrimental, though, as parts of the nation have been a little too wet at times this growing season - Temperatures

will be seasonable - U.S.

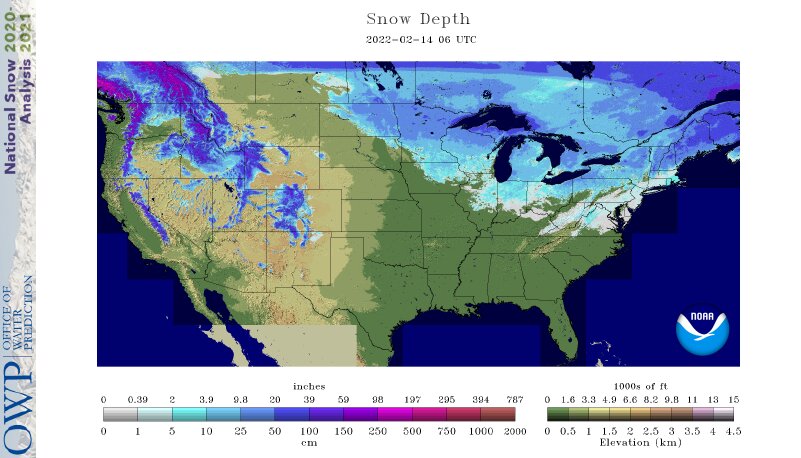

weather this week will be dominated by a major winter storm expected Wednesday and Thursday from the southeastern Plains through the heart of the Midwest and into the northeastern states - The

storm system should produce widespread rain from the southeastern Plains through the Delta and Tennessee River Basin as well as the lower Midwest while heavy snow falls from a part of Missouri into Ohio and southern Michigan

- Snow

accumulations of 6 to 10 inches and locally more will be possible in a narrow band - Moisture

totals will vary from 0.50 to 2.00 inches with a few 2.00 to 3.00-inch amounts

- Some

flooding and a risk of severe thunderstorms will evolve in the southeastern Plains, mid-south and lower Midwest crop areas

- Precipitation

early this week will be mostly in the interior northwestern states, northern Rocky Mountain region and eventually in the northeastern Plains and upper Midwest

- Light

snow will result except in the mountains and near the northern Great Lakes region where some moderate to heavy snow is possible - Temperatures

this week will start out cool in the northeastern Plains and Midwest as well as the southeastern states, but warming during mid-week will raise temperatures above normal until cooling occurs behind the Wednesday and Thursday storm - Temperatures

will turn cooler in the central and southern Plains and a part of the Midwest late this week and into the weekend and the same is expected for the Delta and southeastern states as well as the middle and northern Atlantic coast states late this week and into

the weekend. - Warming

is expected late in the weekend into early next week in the central and eastern U.S. before more cooling occurs during mid to late week next week - Next

week’s U.S. weather may bring some rain and mountain snow to the southwestern states early in the week before bringing snow and a little rain to the northeastern Plains and northern Midwest during mid-week next and another round of rain in the northern Delta,

lower Midwest and interior southeastern states during the middle to latter part of next week - Temperatures

will turn cooler in the western states during the week while warming occurs in the eastern states - Some

cooling should impact the Plains during the latter part of next week after some mid-week warming.

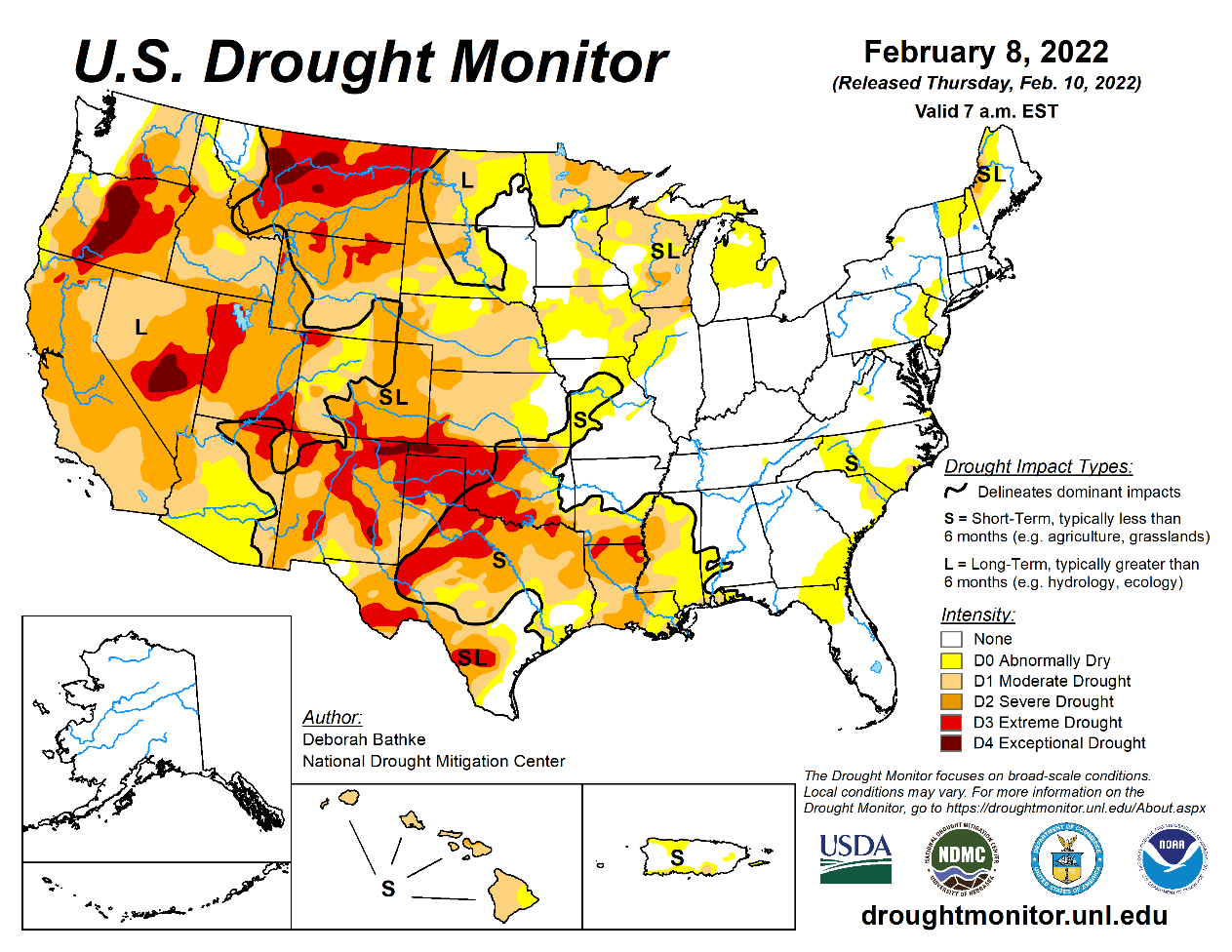

- Precipitation

in the U.S. High Plains region will be restricted over the next two weeks, although a little light snow and rain will be possible briefly as storm systems pass through Wednesday into Thursday of this week and again during the middle to latter part of next

week – no change in drought status is expected, although the moisture will be welcome - California

is unlikely to get significant moisture for the next couple of weeks, although a few showers are possible from time to time - West

Texas may get some very brief and light showers during mid-week this week as a new storm system begins to evolve in the central states - Another

chance for showers will evolve during mid- to late-week next week - None

of the precipitation is expected to change drought conditions - South

Texas precipitation is expected to be restricted over the next ten days - U.S.

Pacific Northwest precipitation will be greatest in the higher elevated areas than in the valleys and that will be good for spring runoff as snow melts - Limited

precipitation will continue in the northwestern U.S. Plains and in southwestern Canada’s Prairies, although some moisture is expected - Canada’s

southwestern Prairies are still snow free with only light snowfall expected in the next ten days - U.S.

weather during the weekend was tranquil with only a little precipitation in the Midwest - Temperatures

were bitter cold in the upper Midwest - International

Falls, MN dropped to -42 Fahrenheit Sunday morning - Arctic

air was mostly confined to northeastern North Dakota, Minnesota and northern Wisconsin.

- India’s

weather was drier biased during the weekend and similar conditions were expected for a while - A

few thunderstorms occurred in the far south - Additional

showers and thunderstorms are likely in the extreme south and far easternmost parts of India as well as in far north - Most

of the key winter crop areas will be dry. - West-central

Africa coffee and cocoa production areas experienced some increase in shower activity during the weekend, but most of the rain was enough to increase topsoil moisture - Additional

showers are expected in the Feb. 16-22 period that may stimulate a few areas of localized flowering, but most of the precipitation will be too light and sporadic to have much impact on crops - The

rainy season is expected to begin relatively well with March wetter than late February - Late

February rainfall is expected to be sporadic and mostly light with a few pockets of moderate rain - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Southeast

Asia precipitation will continue erratic from one day to the next, but most of Indonesia and Malaysia precipitation will continue frequent and abundant - Mainland

areas of Southeast Asia seem poised to see an early start to scattered showers and thunderstorms during the next couple of weeks with next week wettest - Weekend

rainfall was greatest in central Sarawak and Sabah, Malaysia where some amounts of 4.00 to 6.73 inches resulted in some local flooding - Middle

East snow cover has been favorable recently - Rain

and snow will be limited in this coming week - Some

greater precipitation is possible next week - Today’s

Southern Oscillation Index is +10.28 - The

index will drift a little lower this week. - Mexico

will experience cooler than usual weather with rain in some southeastern parts of the nation periodically over the coming week

- The

moisture will be good for early season crop development late this month and in March - Sugarcane,

citrus and winter rice will benefit most, but some other fruits and vegetable crops will also benefit

- The

remainder of the nation will be dry - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically - Colombia,

Ecuador and Peru rainfall will be near to above normal this week and early into next week - Western

Venezuela will also experience some rain - The

remainder of Venezuela will be dry

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - New

Zealand Food Prices - Ivory

Coast cocoa arrivals

Tuesday,

Feb. 15:

- EU

weekly grain, oilseed import and export data - Malaysia’s

Feb. 1-15 palm oil exports - Malaysia

crude palm oil export tax for March (tentative) - New

Zealand global dairy trade auction

Wednesday,

Feb. 16:

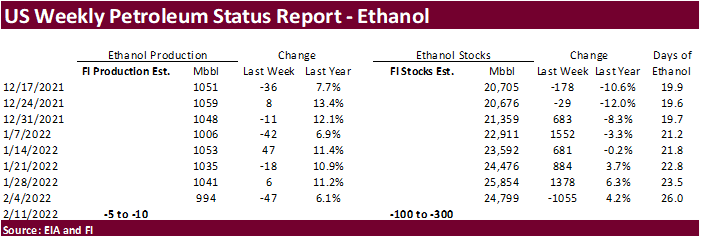

- EIA

weekly U.S. ethanol inventories, production - FranceAgriMer

report; monthly grains outlook - HOLIDAY:

Thailand

Thursday,

Feb. 17:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report

Friday,

Feb. 18:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly crop condition report

Source:

Bloomberg and FI

CFTC

Commitment of Traders report

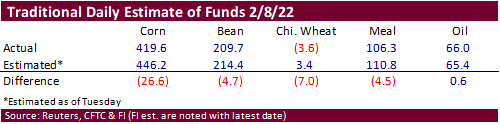

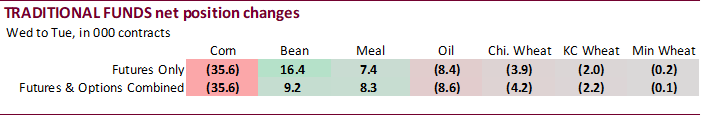

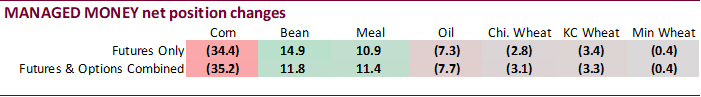

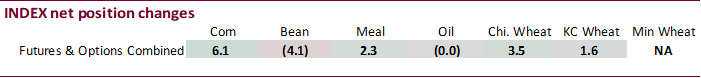

Traditional

funds trimmed their net long position as of February 8 for corn, oil, and all three wheat markets while building onto their net long positions for soybeans and meal. But the net long position for corn was 26,600 contracts less than expected. The funds position

for soybeans, meal and Chicago wheat were also less long than estimated. We see little implication from this report on futures prices for corn and other products as prices were very volatile over the last three business days. Index funds were good sellers

in corn of 35,700 contracts. There were no record positions for the notable positions we monitor.

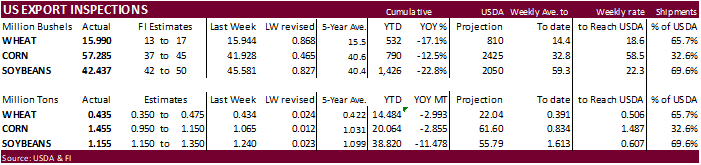

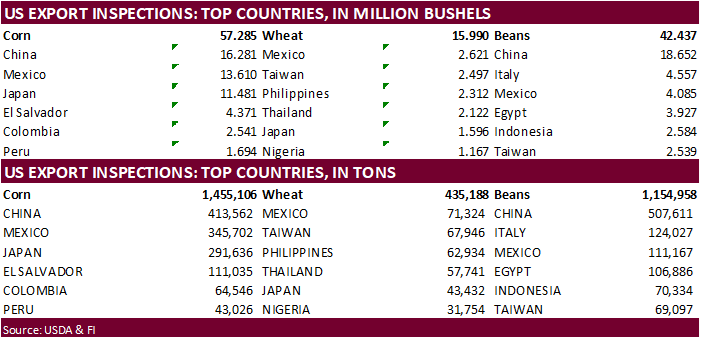

USDA

inspections versus Reuters trade range

Wheat

435,188 versus 200000-550000 range

Corn

1,455,106 versus 950000-1400000 range

Soybeans

1,154,958 versus 1000000-1500000 range

Corn

sales were impressive. China picked up 414,000 tons of US corn and 507,600 tons of soybeans. Yet, crop year to date sales are still running behind year ago (soybeans -23%, corn -12%, all wheat -17%, sorghum -22%).

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING FEB 10, 2022

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 02/10/2022 02/03/2022 02/11/2021 TO DATE TO DATE

BARLEY

0 0 1,597 10,010 26,233

CORN

1,455,106 1,065,018 1,314,984 20,064,194 22,919,061

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 0 400 2,693

RYE

0 0 0 0 0

SORGHUM

182,310 155,893 71,696 2,615,754 3,340,844

SOYBEANS

1,154,958 1,240,499 923,993 38,820,354 50,298,584

SUNFLOWER

0 0 0 432 0

WHEAT

435,188 433,921 425,049 14,483,734 17,477,162

Total

3,227,562 2,895,331 2,737,319 75,995,202 94,065,086

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

Fed

Meeting- Monday Feb 14th. (close door). Monday at 11:30 EST, Fed is set for their scheduled closed door session to determine if they should raise rates and/or change the speed of Fed asset purchases.

US

Rate Futures Imply 66% Chance Of Fed Raising Rates By 50 Bps At March Meeting After Bullard – Fedwatch

80

Counterparties Take $1.666 Tln At Fed Reverse Repo Op (prev $1.636 Tln, 77 Bids)

US

Official: Satellite Images Show Russian Troops Leaving Assembly Points And Moving To Attack Positions – CBS

Ukrainian

President Reportedly Said Ukraine Has Been Informed Wednesday Will Be The Day Of The Attack – CNN Via @Conflicts

Corn

·

March corn closed 4.75 cents higher at $6.5575 after headlines reversed a lower trade. Apparently, Russia started assembling troops into attack mode. That was one of many headlines that spooked the market. Prices were lower during

much of the trade as traders thought the situation was deescalating. Corn was also lower up until early afternoon following weaker soybeans and lack of fresh news. WTI crude oil rallied above $95 and was trading just below that level at 2.45 pm CT.

·

USDA US corn export inspections as of February 10, 2022 were 1,455,106 tons, above a range of trade expectations, above 1,065,018 tons previous week and compares to 1,314,984 tons year ago. Major countries included China for 413,562

tons, Mexico for 345,702 tons, and Japan for 291,636 tons.

·

Brazil’s Rio Grande do Sul local forecaster, Emater, lowered their estimate for corn production for the state to 2.77 million tons from 6.11 million from their initial projection due to drought. This is below Conab’s 2.98 million

ton estimate (4.4 MMT for 2020-21).

·

US poultry producers have tightened up safety measures after a bird flu case was detected this week and last week at a turkey farm in Indiana.

·

USDA today announced an outbreak of a highly lethal form of bird flu at a commercial chicken farm in Kentucky and in a backyard flock of birds in Virginia.

·

The DTN average price for domestic distillers dried grains (DDG) from 34 locations reporting for the week ended Feb. 10 was $234 per ton, up $6 per ton versus one week ago. (DTN)

Export

developments.

·

None reported

China’s

Hog Feed Output Explodes – Dim Sums

http://dimsums.blogspot.com/2022/02/chinas-hog-feed-output-explodes.html

Trade

News Service:

Updated

2/11/22

March

corn is seen in a $6.15 and $6.85 range

December

corn is seen in a wide $5.25-$7.00 range

·

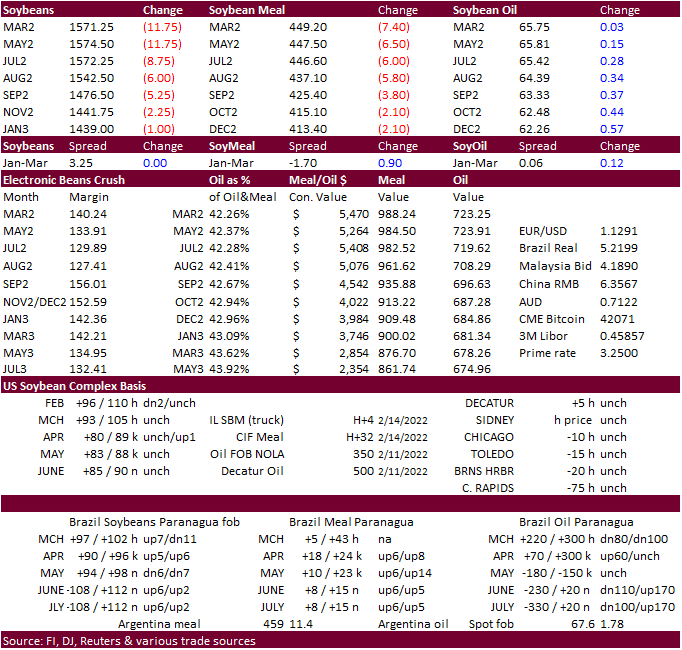

Soybeans were lower on technical selling and a weather forecast calling for increasing rainfall for Argentina during the second week of the outlook and reduction in rainfall for northern Brazil during that time as well. Some losses

were paired after grains and soybean oil rallied. Both Brazil and Argentina saw rain over the weekend, providing relief for Argentina and southern Brazil but delaying soybean harvesting in the central & northern Brazil.

·

Soybean oil finished 9 points higher in the front month in part to a $2.00 rally in crude oil (around the time CBOT soybean oil settled). March meal paired some losses, closing $8.20 lower basis March. March soybeans were 13

cents lower with bear spreading in focus.

·

AgriCensus noted China washed out at least 5 Brazilian cargoes from the beginning of last week. One source told them two cargoes were switched to the US.

·

USDA US soybean export inspections as of February 10, 2022 were 1,154,958 tons, within a range of trade expectations, below 1,240,499 tons previous week and compares to 923,993 tons year ago. Major countries included China for

507,611 tons, Italy for 124,027 tons, and Mexico for 111,167 tons.

·

AgRural reported Brazil harvested 24% of the soybean crop through the end of last week, against 16% a week earlier and 9% in the same period last year. AgRural estimates soybean production at 128.5 million tons and corn production

at 110.9 million tons this season.

·

Safras & Mercado estimated Brazil soybean harvest progress at 25.6%, up from the delayed 7.1% at this time last year and compares to 16.2% average. Mato Grosso was 60% complete. Last week they pegged Brazil’s soybean crop at

127.17 million tons, down from 132.3 million tons previously.

·

Brazil’s Rio Grande do Sul (RS) local forecaster, Emater, lowered their estimate for soybean production for the state by 44 percent to 11.2 million tons from 19.9 million from their initial projection due to drought. This is below

Conab’s 13.74 million ton estimate (20.8 MMT for 2020-21).

·

Pátria Agronegócios estimated Brazil 2021-22 soybean production at 122 million tons, down from a previous forecast of 136.24 million tons.

Most

recent Brazil soy estimates:

Pátria

Agronegócios 122

Conab

125.5 million tons

AgRural

128.5 million tons

USDA

134 million tons

USDA

last year 138

·

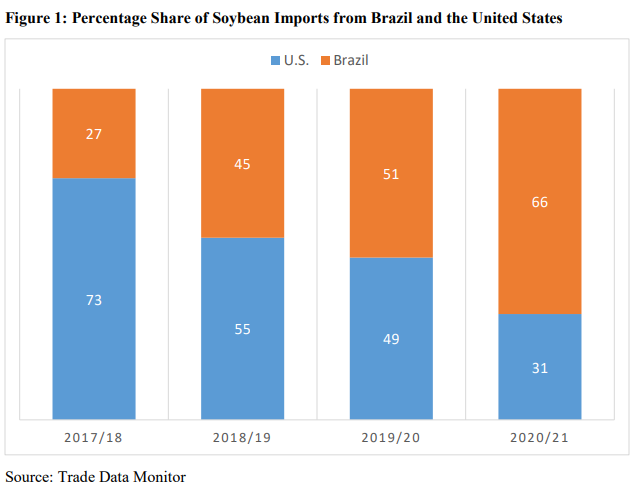

Chinese Vice Premier Hu Chunhua called on soybean production provinces to expand soybean production at a meeting held in Shandong province, Xinhua on Sunday. China aims to produce 23 million tons of soybeans the end-2025. This

may flatten the import curve somewhat over the next three years.

·

China’s Inner Mongolia region (second-largest soybean growing area) will expand soybean plantings by 287,000 hectares in 2022. Planting acreage of soybeans in Inner Mongolia in 2021 was about 1.15 million hectares, 13.7% of the

country’s total planting acreage of 8.4 million hectares.

·

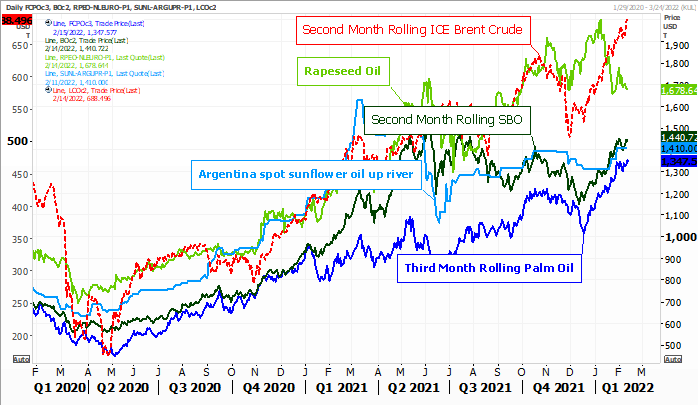

India lowered the tax on crude palm oil imports to 5% from 7.5% until Sept. 30. This widened the duty gap between CPO and refined palm oil (gap 11 points) and will likely increase CPO imports and slow imports of refined oil.

·

India January imports of palm oil fell 29% to 553,084 tons, compared with 780,741 tons a year earlier and 565,943 tons in December 2021. SEA also reported soybean oil imports were up 341% from a year ago to 391,158 tons last

month, while sunflower oil imports jumped 50% to 307,684 tons. In January crude palm oil (CPO) was being offered at around $1,510 a ton, including cost, insurance and freight (CIF), in India, compared with $1,506 for crude soybean oil and $1,475 for crude

sunflower oil. A year ago, CPO was trading at a $74 per-ton discount to soyoil and $272 discount to sunflower oil. (Reuters)

·

We think the 30,000 tons of soybean oil announced on Friday to unknown was likely India.

·

February 1-15 Malaysian palm oil export data will be released tonight. We look for an improvement from the 1-10 period (two of the three reporting agencies for the Feb. 1-10 period reported a decrease of 5% and 6.5%).

·

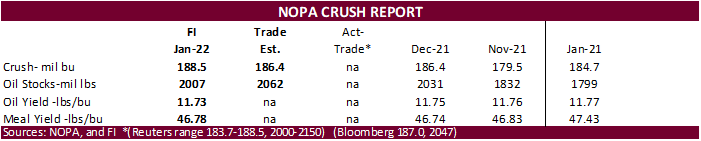

The Reuters trade guess for NOPA January crush came in at 186.7 million bushels, above 186.4 million for December and up from 184.7 year earlier. The range was 183.7-188.5 million. Many analysts expect a build in soybean oil stocks

to 2.062 billion pounds from 2.031 billion pounds at the end of December and compares to 1.799 billion year earlier. If realized US soybean oil stocks would be up seven consecutive months. End of January NOPA US soybean oil stocks ranged from 2.000 to 2.150

billion pounds. We are at 2.007 billion pounds.

Market

share for Pakistan soybean imports

from the US have been on the decline over the recent years according to the USDA Attaché

- Egypt’s

GASC seeks vegetable oils on February 16 for April 5-25 arrival. They seek a minimum 10,000 tons of sunflower oil and 30,000 tons of sunflower oil. They are also seeking local vegetable oils of at least 3,000 tons of soyoil and 1,000 tons of sunflower oil

for arrival April 1-20.

Source:

Reuters and FI

Updated

2/7/22

Soybeans

– March $14.75-$16.50

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $420-$480

Soybean

oil – March 66.50-69.00

·

US wheat futures turned lower after a higher trade for much of the overnight session only to rally again late in the session after negative Ukraine/Russia headlines. Chicago March closed 1.50 cents higher, KC March 4.25 cents

higher and MN March up 6.50 cents.

·

USDA US all-wheat export inspections as of February 10, 2022 were 435,188 tons, within a range of trade expectations, above 433,921 tons previous week and compares to 425,049 tons year ago. Major countries included Mexico for

71,324 tons, Taiwan for 67,946 tons, and Philippines for 62,934 tons.

·

This week a major US winter storm expected during mid to late week was pushed southward and is not as large than that of Friday. Abundant rain is seen near and south of the Ohio River and into the Delta and mid-south region Wednesday

and Thursday with a band of snow coming out of the southern Plains into the lower eastern Midwest.

·

Egypt over the weekend noted the Ukraine/Russian situation raised market uncertainty.

·

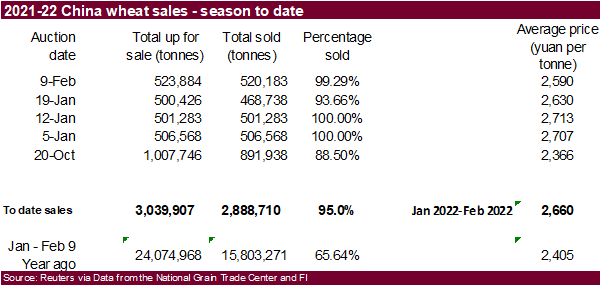

China sold 520,183 tons of wheat from auction on February 9, nearly all what was offered, at an average price of 2,590 yuan per ton ($407.22). October 2021-February 9 China wheat sales total 2.889 million tons, 95% of the 3.040

million tons offered. The Jan 5-Feb 9 wheat auction price averaged 2.660 yuan per ton, up 10.6% from the same period year ago.

·

EU wheat futures are trading up 1.50 euros at 270.25 euros per ton at the time this was written.

·

After gaining 3% on Friday, Paris March wheat closed 5.25 euros higher at 274.00 euros.

·

Turkish government have reduced the VAT on basic food products from 8% to 1%.

·

Algeria seeks 50,000 tons of milling wheat on Feb 16, open until Feb 17, for April shipment. They last bought wheat on Jan 26, paying around $375/ton.

·

Turkey seeks 255,000 tons of feed barley on February 22. Shipment is sought for March 1-31.

·

Taiwan seeks 54,920 tons of US wheat on February 18, for April 4-18 shipment if off the PNW.

·

The Philippines seek 45,000 tons of feed wheat on Tuesday. Shipment is sought in June and July.

·

Results awaited: The Philippines seeks feed wheat from Australia and soybean meal from Argentina on February 11. Amounts are unknown.

·

Bangladesh saw offers for 50,000 tons of wheat and lowest was $390.92/ton CIF.

·

Results awaited: Syria seeks 200,000 tons of wheat on February 14, open for 15 days.

·

Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on Feb 16 for arrival by July 28.

·

Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

Rice/Other

·

None reported

Updated

2/2/22

Chicago

March $7.25 to $8.30 range

KC

March $7.45 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.