PDF Attached

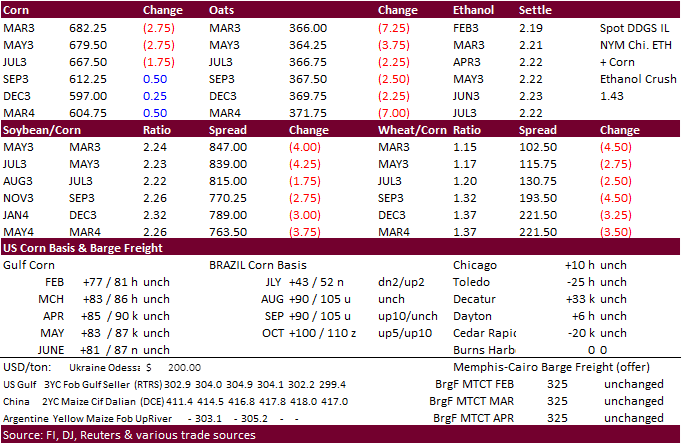

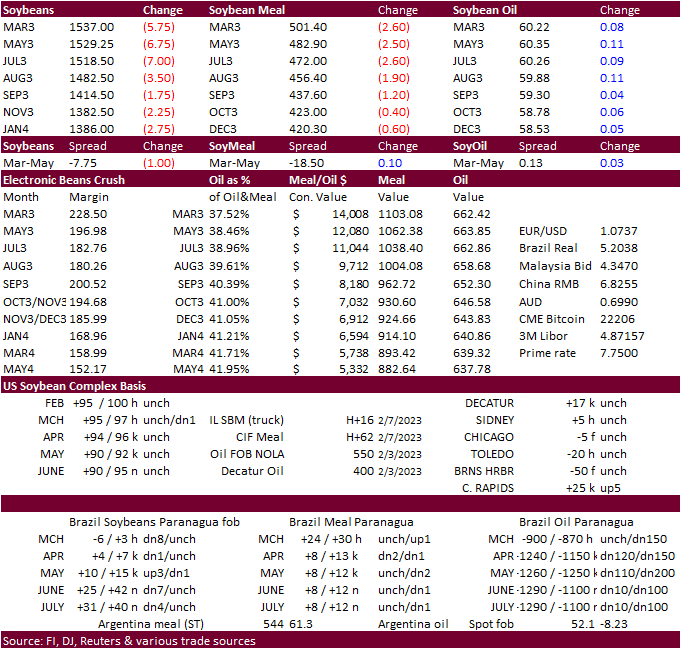

Lower trade in soybean meal pressured soybeans. The reversal in meal/oil spreads did lift most SBO contracts higher. Corn ended mixed and Chicago wheat lower. Lack of direction and volatile outside commodity markets led to a choppy trade in US ags. A Bloomberg poll looks for weekly US ethanol production to be up 4,000 thousand barrels to 1004k (980-1020 range) from the previous week and stocks up 115,000 barrels to 24.532 million.

The trade will be monitoring rain across Brazil this week with ongoing planting and harvesting delays from too much rain. Mato Grosso, MGDS, south Minas, Sao Paulo, Parana, Santa Catarina, and north RGDS will all see rain this week. Argentina rain should favor Cordoba, Santa Fe, Enter Rios, Buenos Aires through today. Far western US Great Plains will see snow this week, which includes eastern CO and KS.

MOST IMPORTANT WEATHER FOR THE DAY

- Southern Argentina will finish out the month of February drier than usual with crop moisture stress still pressuring production potentials

- Northern Argentina will get some timely rainfall during the next two weeks to improve minor grain and oilseed production areas as well as cotton production areas

- Locally heavy rain is possible, but most of the region will need follow up precipitation to maintaining the improving trend

- Argentina temperatures will trend cooler than usual for a little while this weekend and early next week and then warm back to near normal.

- Mato Grosso, Brazil has seen some improved soybean harvest weather recently and it may continue into the weekend

- Some Safrinha corn planting progress has likely been made as well

- Mato Grosso, Brazil will experience increasing rainfall frequency coverage and intensity this weekend into next week slowing fieldwork and raising a new wave of concern over Safrinha corn and cotton production potentials

- Brazil’s wettest conditions will remain in Parana, Mato Grosso do Sul, Sao Paulo and southern Minas Gerais during the next two weeks

- Fieldwork progress will be slowest in these areas and concern over unharvested soybean and rice conditions may rise

- Coffee, citrus and sugarcane areas might also become a little too wet later this month after rain increases later this week into next week

- Sugarcane already has need to more sunshine and warmer temperatures

- Northeastern Brazil has the greatest need for rain along with portions of Rio Grande do Sul, Brazil and neighboring areas of Paraguay

- Precipitation may continue restricted in these areas for the next two weeks

- U.S. hard red winter wheat areas in the central Plains will get some needed snow and rain tonight and Wednesday ending Thursday

- Moisture totals will be sufficient to induce some better topsoil conditions, but additional rain will be needed

- Snow accumulations of 2 to 6 inches are expected

- Not much follow up precipitation is expected for a while

- Southwestern U.S. Plains are unlikely to get much precipitation for a while leaving West Texas, the Texas Panhandle and western Oklahoma looking for greater precipitation

- South Texas and the Texas Coastal Bend need significant rain to support spring planting late this month and in March, but not much is expected in the next two weeks.

- Florida, southern Georgia and southern South Carolina may not get much moisture for a while

- U.S. Midwest, Delta and Tennessee River Basin will be plenty wet over the next two weeks

- Precipitation in the U.S. Midwest will be sufficient to maintain favorable soil moisture over the next two weeks

- California and neighboring areas of the far west are not likely to see much precipitation of significance for a while

- Cold air is advertised to build up across central and western Canada this weekend and especially next week

- Temperatures will be notably below average in the Prairies next week with some areas in the northern Plains and also impacted by the cold

- Until the weekend, temperatures this week will be warmer than usual in the eastern half of the United States

- Canada’s Prairies and the northern U.S. Plains will receive limited precipitation this week until the cold begins to build up in Canada at which time snow will begin to fall in the northern Plains and across a part of the northern Plains.

- Europe precipitation will continue restricted most of this workweek as it has been for nearly ten days

- Precipitation may increase in Eastern Europe briefly during the weekend and early next week offering a boost in topsoil moisture.

- Some snow accumulation may occur from the Baltic Plain into northern Ukraine

- Western Europe will continue drier biased through the second week of the forecast, although at least some light precipitation will develop briefly

- Western CIS weather conditions will not change greatly this week with waves of rain and snow likely through the next ten days maintaining status quo soil moisture and snow cover while crops are dormant

- Heavy snow accumulation is possible from eastern Belarus to parts of Russia’s Southern Region

- Soil moisture will be abundant this spring

- India precipitation is still advertised to be minimal over the next ten days to two weeks outside of minor production areas from Uttarakhand northwest to Jammu and Kashmir

- Dryness will soon become a concern for wheat, rapeseed, mustard, sorghum, corn, dry bean and peas as well as other crops

- Temperatures will be warmer than usual in west-central and northwestern parts of the nation, but no extreme heat is presently expected

- China precipitation will be restricted for a while

- The greatest precipitation will fall from Sichuan to Yunnan with much of that expected this weekend into much of next week

- Precipitation elsewhere will be limited for much of the next two weeks

- The bottom line for China is still looking very good for spring rice planting in the southeast, resuming rapeseed development later this month in the Yangtze River Basin and a good start to wheat growing in March.

- Eastern Australia will continue to struggle for rain in unirrigated summer crop areas for the next ten days and possibly longer

- Crop moisture stress will remain a concern in the dryland areas of Queensland with a few areas in New South Wales also hurting for moisture

- South Africa rainfall will continue to occur routinely in the next ten days to two weeks in eastern parts of the nation while the precipitation remains a little more sporadic in the west

- The bottom line should still be good for 2023 production

- North Africa rainfall was restricted during the weekend and more of the same is expected

- Rain may fall later this week and into the weekend in the drought stricken region of southwestern Morocco, but the region could not be planted this year because of no water supply and the moisture will not likely induce any change on production for this year.

- Other areas in North Africa are unlikely to get much moisture, but rain was common in northeastern Algeria and Tunisia last week

- Evidence continues to rise over the prospects for a Sudden Stratospheric Warming Event (SSW) that should begin to evolve this week and become notable in the last days of February and especially in March

- Cooler than usual temperatures will accompany the event from the central Canada Prairies into the heart of the Great Plains and a part of the Midwest during late February and especially March

- An increase in winter storminess is likely in the interior eastern U.S. through the New England states

- Middle East precipitation is expected to be erratic over the next couple of weeks raising some need for greater precipitation prior to cotton and rice planting season.

- Wheat conditions are rated favorably

- Eastern Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year

- West Africa rainfall is expected to be mostly confined to coastal areas during the next ten days, but a few showers will occasionally reach into a few coffee and cocoa production areas especially in Ivory Coast

- Seasonal rains should begin over a larger part of west-central Africa in a few weeks.

- Today’s Southern Oscillation Index was +13.32 and it will move erratically higher over the next several days.

Source: World Weather and FI

Tuesday, Feb. 14:

- France farm ministry’s report on output in 2022 and winter plantings in 2023

- New Zealand food prices

- EU weekly grain, oilseed import and export data

Wednesday, Feb. 15:

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

- EIA weekly US ethanol inventories, production, 10:30am

- Malaysia’s Feb. 1-15 palm oil export data

- FranceAgriMer’s monthly grains balance sheet report

Thursday, Feb. 16:

- International Grains Council’s monthly report

- USDA weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Russia Grain Conference, Sochi

Friday, Feb. 17:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

Source: Bloomberg and FI

Macros

109 Counterparties Take $2.077 Tln At Fed Reverse Repo Op. (Prev $2.108 Tln, 102 Bids)

US CPI (M/M) Jan: 0.5% (est 0.5%; prevR 0.1%)

US CPI Ex Food and Energy (M/M) Jan: 0.4% (est 0.4%; prevR 0.4%)

US CPI (Y/Y) Jan: 6.4% (est 6.2%; prev 6.5%)

US CPI Ex Food and Energy (Y/Y) Jan: 5.6% (est 5.5%; prev 5.7%)

US Real Avg Hourly Earning (Y/Y) Jan: -1.8% (prevR -1.5%)

US Real Avg Weekly Earnings (Y/Y) Jan: -1.5% (prevR -2.6%)

U.S. Dec PPI For Final Demand Revised To -0.4 PCT (PREV -0.5 PCT)

U.S. Dec PPI For Final Demand Exfood/Energy Unrevised At +0.1 PCT

U.S. Dec PPI Final Demand Exfood/Energy/Trade Unrevised At +0.1 PCT

U.S. PPI Revisions Reflect Recalculated Seasonal Adjustment Factors

· CBOT corn futures traded tow-sided, ending mixed with nearby contracts lower. Lack of direction was noted. Back month corn gained on soybeans in an attempt to buy some corn acres back. We are using 91.3 million acres for corn and 89.1 million for soybeans for our working March Intentions estimate.

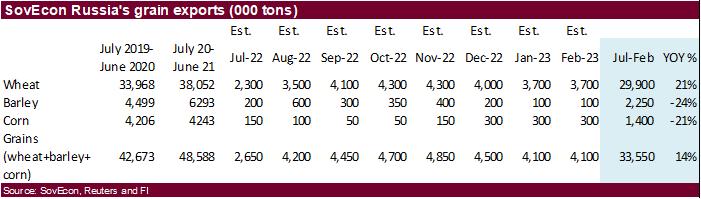

· Black Sea shipping concerns continue to underpin prices. To extend the grain shipping deal, Russia would like to see some sanctions lifted.

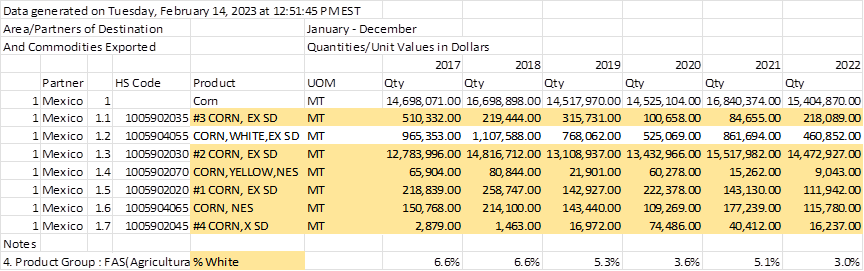

· Mexico scrapped their plan to ban GMO corn imports for feed and industrial use but will still phase out genetically modified corn for human consumption as well as the herbicide glyphosate. Mexico depends on about 17 million tons of GMO yellow corn from the US, most of it used for feed.

US corn exports to Mexico by year

· The Baltic Dry index fell 8.6% to 563 points.

· Brazil’s Anec estimated February corn exports at 2.116 MMT from 2.292 seen previous week.

· A Bloomberg poll looks for weekly US ethanol production to be up 4,000 thousand barrels to 1004k (980-1020 range) from the previous week and stocks up 115,000 barrels to 24.532 million.

Export developments.

- None reported.

Updated 02/13/23

March corn $6.55-$6.95 range. May $6.25-$7.00

· CBOT soybeans ended lower following a reversal in soybean meal. SBO was higher from the reversal in meal/oil spreading. The weakness in WTI crude oil failed to pressure soybean oil. News was light. The morning weather forecast turned little more favorable for South America.

· Agroconsult estimated Brazilian soybean production at 153 million tons for 2022-23, down from previous 153.4 million tons.

· Brazil’s Anec estimated February soybean exports at 9.390 MMT from 9.693 seen previous week. SBM was pegged at 1.860 MMT from 1.740 MMT previous week.

· India’s government estimated 2023 rapeseed production at a record 12.8 million tons, a 7.1% increase from year earlier.

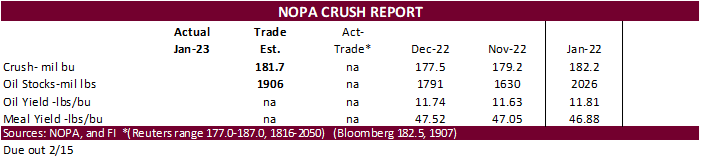

· A Reuters poll calls for the January NOPA crush to end up near 181.7 million bushels, up 2.3% percent from December. The range was 177.0 to 187.0 million bushels. End of January stocks are seen at 1.906 billion pounds, up 6.4% from the end of December and down 5.9% from 2.026 billion at the end of January 2022. Stocks ranged from 1.816 billion to 2.050 billion pounds.

Export Developments

· None reported.

Updated 02/13/23

Soybeans – March $14.85-$15.50, May $14.75-$16.00

Soybean meal – March $450-$515, May $425-$500

Soybean oil – March 58.50-63.00, May 58-70

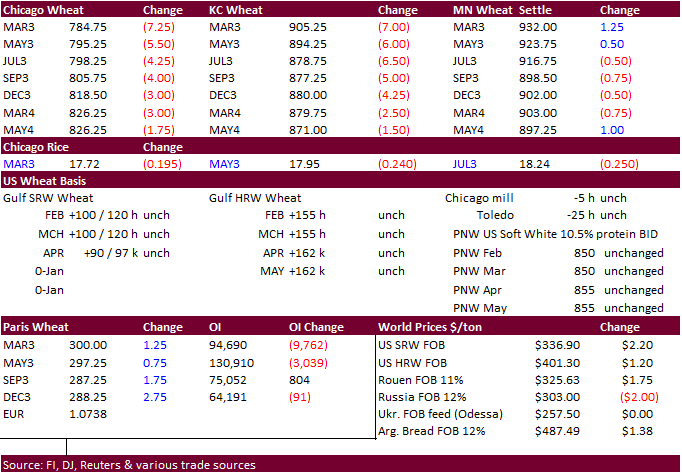

· Chicago wheat futures were lower but remain near a 6-week high from ongoing Black Sea grain shipping concerns as traders expect fighting to intensify. Funds booked some profits today. KC was settled lower and MN higher in the nearby positions. A lower USD limited losses.

· Paris March wheat was up 1.25 euros at 299.50 per ton.

· Euronext reported non-commercial market participants slightly lifted their net short position in Euronext’s milling wheat futures and options in the week to Feb. 3, to 46,629 contracts from 46,354 a week earlier.

· India’s government estimated 2023 wheat production at a record 112.2 million tons, a 4.1% increase from year earlier. 2022 output was 107.74 million tons and 2021 at 109.59 million. Harvesting of new-crop wheat starts next month. India may still extend their ban on wheat exports despite the large crop in order to cool inflation.

· Russia’s AgMin estimates 95 percent of their crops are rated in good or satisfactory position.

· Ukraine warned over the risk of mines potentially drifting along the coastline near Odesa. The mines that are anchored could break away during storms, Ukraine said.

Export Developments.

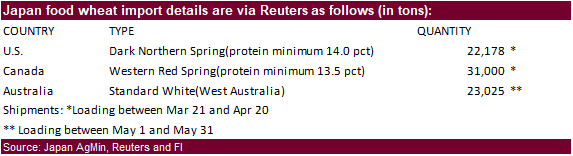

· Japan’s AgMin seeks 76,203 tons of food wheat from the US, Canada and Australia, later this week for March 21-May 31 loading.

Rice/Other

· The Philippines are in for sugar.

Updated 02/10/23

Chicago – March $7.50 to $8.10, May $7.00-$8.25

KC – March $8.55-$9.20, $7.50-$9.25

MN – March $9.00 to $9.60, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |