PDF Attached

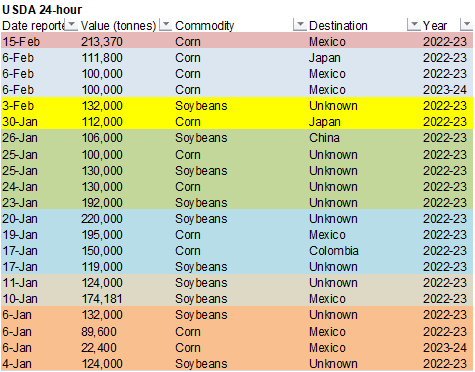

Private exporters reported sales of 213,370 metric tons of corn for delivery to Mexico during the 2022/2023 marketing year.

Soybeans, corn, and wheat traded lower on negative macro sentiment that pressure many outside commodity and US equity markets. The USD was sharply higher. Soybean oil rallied post US NOPA crush report after end of January soybean oil stocks were reported below expectations. Soybean meal was sharply lower. Several countries across Central and South America reported outbreaks of bird flu disease, including first timer Argentina.

Estimate of fund positions

![]()

MOST IMPORTANT WEATHER FOR THE DAY

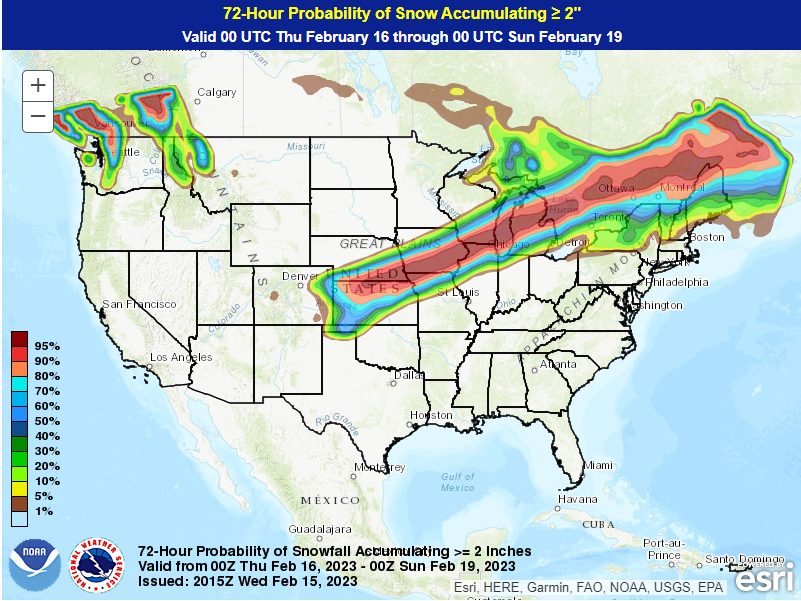

- U.S. hard red winter wheat areas from Colorado through Kansas to Nebraska will receive 3-7 inches of snow today with a few greater amounts

- The moisture content in the snow will not be heavy, but some benefit is expected when the snow melts

- Other waves of precipitation must occur this late winter and spring to induce the best improvement for root and tiller systems throughout the region.

- No moisture of much significance will impact the Texas Panhandle

- Snow water equivalents in the snow should vary from 0.05 to 0.35 inch with a few totals over 0.50 inch

- Not much other precipitation is expected in hard red winter wheat areas for a while after today and Thursday’s storm passes

- Snow from the central U.S. Plains will also extend northeast through the Great Lakes region tonight and Thursday with 3 to 10 inches of accumulation likely.

- U.S. Delta, Tennessee River Basin and immediate neighboring areas will receive the most frequent and significant precipitation during the next ten days keeping soil conditions saturated and flood potentials running high

- Waves of snow and rain will also impact other U.S. Midwestern locations during the next ten days maintaining a good outlook for spring planting

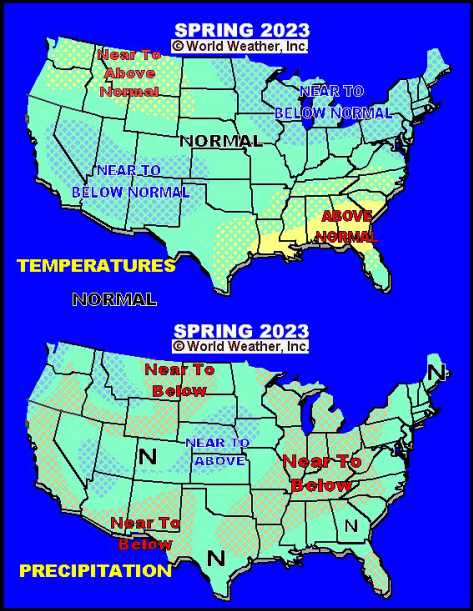

- U.S. temperatures will be warmer than usual for a little while longer in the eastern states and then followed by cooling in the northern states next week while the southern states become the warmest area relative to normal

- U.S. Pacific Northwest would benefit from greater precipitation between the Cascades and Rocky Mountains

- California will be drier biased for a while, but mountain snowpack is still considered above normal for this time of year and for the April 1 normal

- South Texas and the Texas Coastal Bend need significant rain to support spring planting late this month and in March, but not much is expected in the next two weeks.

- Florida, southern Georgia and southern South Carolina may not get much moisture for a while

- Canada’s Prairies will continue to receive less than usual precipitation through the end of February except possibly in far western Alberta where precipitation may be a little greater than usual

- Canada temperatures will turn colder than usual this weekend and continue that way next week

- Some of the cold will seep southward into the northern U.S. Plains

- Southern Argentina will finish out the month of February drier than usual with crop moisture stress still pressuring production potentials

- Northern Argentina will get some timely rainfall during the next two weeks to improve minor grain and oilseed production areas as well as cotton production areas

- Locally heavy rain is possible, but most of the region will need follow up precipitation to maintaining the improving trend

- Argentina temperatures will trend cooler than usual for a little while this weekend and early next week and then warm back to near normal.

- Mato Grosso, Brazil has seen some improved soybean harvest weather recently and it may continue into the weekend

- Some Safrinha corn planting progress has likely been made as well

- Mato Grosso, Brazil will experience increasing rainfall frequency coverage and intensity this weekend into next week slowing fieldwork and raising a new wave of concern over Safrinha corn and cotton production potentials

- Brazil’s wettest conditions will remain in Parana, Mato Grosso do Sul, Sao Paulo and southern Minas Gerais during the next two weeks

- Fieldwork progress will be slowest in these areas and concern over unharvested soybean and rice conditions may rise

- Coffee, citrus and sugarcane areas might also become a little too wet later this month after rain increases later this week into next week

- Sugarcane already has need to more sunshine and warmer temperatures

- Northeastern Brazil has the greatest need for rain along with portions of Rio Grande do Sul, Brazil and neighboring areas of Paraguay

- Precipitation may continue restricted in these areas for the next two weeks

- Europe precipitation will continue restricted most of this workweek as it has been for nearly ten days

- Precipitation may increase in Eastern Europe briefly during the weekend and early next week offering a boost in topsoil moisture.

- Some snow accumulation may occur from the Baltic Plain into northern Ukraine

- Western Europe will continue drier biased through the second week of the forecast, although at least some light precipitation will develop briefly

- Western CIS weather conditions will not change greatly this week with waves of rain and snow likely through the next ten days maintaining status quo soil moisture and snow cover while crops are dormant

- Heavy snow accumulation is possible from eastern Belarus to parts of Russia’s Southern Region

- Soil moisture will be abundant this spring

- India precipitation is still advertised to be minimal over the next ten days to two weeks outside of minor production areas from Uttarakhand northwest to Jammu and Kashmir

- Dryness will soon become a concern for wheat, rapeseed, mustard, sorghum, corn, dry bean and peas as well as other crops

- Temperatures will be warmer than usual in west-central and northwestern parts of the nation, but no extreme heat is presently expected

- China precipitation will be restricted for a while

- The greatest precipitation will fall from Sichuan to Yunnan with much of that expected this weekend into much of next week

- Precipitation elsewhere will be limited for much of the next two weeks

- The bottom line for China is still looking very good for spring rice planting in the southeast, resuming rapeseed development later this month in the Yangtze River Basin and a good start to wheat growing in March.

- Eastern Australia will continue to struggle for rain in unirrigated summer crop areas for the next ten days and possibly longer

- Crop moisture stress will remain a concern in the dryland areas of Queensland with a few areas in New South Wales also hurting for moisture

- Rain is most likely near the lower Queensland coast and from there southward into eastern New South Wales missing most of the summer crops west of the Great Dividing Range

- South Africa rainfall will continue to occur routinely in the next ten days to two weeks in eastern parts of the nation while the precipitation remains a little more sporadic in the west

- The bottom line should still be good for 2023 production

- North Africa rainfall will remain restricted over the next couple of weeks

- Rain will fall later this week and into the weekend in the drought stricken region of southwestern Morocco, but the region could not be planted this year because of no water supply and the moisture will not likely induce any change on production for this year.

- Other areas in North Africa are unlikely to get much moisture, but rain was common in northeastern Algeria and Tunisia last week

- Evidence continues to rise over the development of a Sudden Stratospheric Warming Event (SSW) that may not have much impact on Northern Hemisphere weather anomalies for at least the next two weeks

- Cooler than usual temperatures will accompany the event in the central Canada Prairies into the far northern U.S. Plains during late February and especially March

- An increase in winter storminess is possible in the interior eastern U.S. through the New England states during March

- Middle East precipitation is expected to be erratic over the next couple of weeks raising some need for greater precipitation prior to cotton and rice planting season.

- Wheat conditions are rated favorably

- Eastern Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year

- West Africa rainfall is expected to be mostly confined to coastal areas during the next ten days, but a few showers will occasionally reach into a few coffee and cocoa production areas especially in Ivory Coast

- Seasonal rains should begin over a larger part of west-central Africa in a few weeks.

- Today’s Southern Oscillation Index was +13.86 and it will move erratically higher over the next several days.

Source: World Weather and FI

Source: World Weather and FI

Wednesday, Feb. 15:

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

- EIA weekly US ethanol inventories, production, 10:30am

- Malaysia’s Feb. 1-15 palm oil export data

- FranceAgriMer’s monthly grains balance sheet report

Thursday, Feb. 16:

- International Grains Council’s monthly report

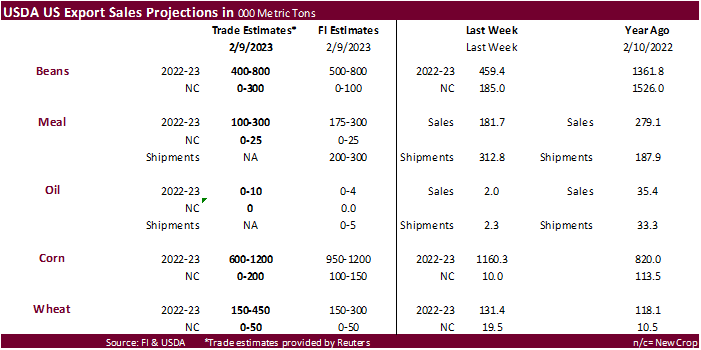

- USDA weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Russia Grain Conference, Sochi

Friday, Feb. 17:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

Macros

96 Counterparties Take $2.012 Tln At Fed Reverse Repo Op. (Prev $2.077 Tln, 109 Bids)

U.S. Retail Sales’ 3% Jump In January Is Fastest Monthly Pickup In 22 Months

US Retail Sales Advance (M/M) Jan: 3.0% (est 2.0%; prev -1.1%)

US Retail Sales Ex Auto (M/M) Jan: 2.3% (est 0.9%; prev -1.1%)

US Retail Sales Ex Auto And Gas Jan: 2.6% (est 0.9%; prev -0.7%)

US Retail Sales Control Group Jan: 1.7% (est 1.0%; prev -0.7%)

US Empire Manufacturing Feb: -5.8 (est -18.0; prev -32.9)

US Retail Sales Ex Auto (M/M) Jan: 2.3% (est 0.9%; prevR -0.9%)

US Retail Sales Ex Auto And Gas Jan: 2.6% (est 0.9%; prevR -0.4%)

Canadian Manufacturing Sales (M/M) Dec: -1.5% (est -1.5%; prevR -0.2%)

Canadian Wholesale Trade Sales (M/M) Dec: -0.8% (est -1.6%; prevR -0.7%)

US Industrial Production (M/M) Jan: 0.0% (est 0.5%; prev -0.7%)

US Capacity Utilization Jan: 78.3% (est 79.1%; prev 78.8%)

US Manufacturing (SIC) Production Jan: 1.0% (est 0.8%; prev -1.3%)

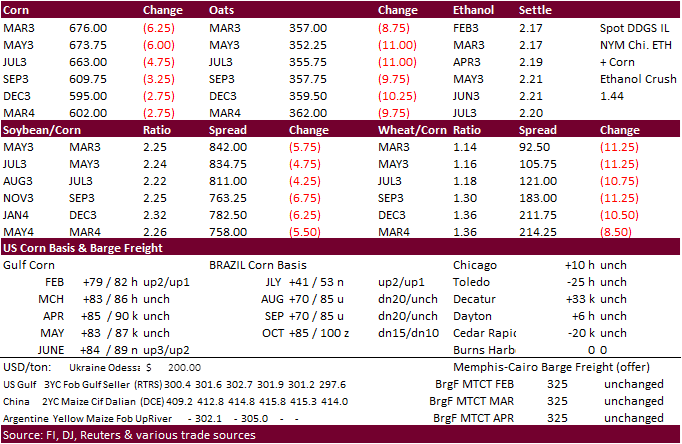

· CBOT corn futures traded lower from widespread commodity selling, higher USD, and lower WTI. EIA ethanol production was better than expected but US gasoline demand still lags behind pre-pandemic levels.

· WTI crude oil prices extended losses post EIA report. US crude oil build was apparently the fourth largest in history, behind the third largest that was posted for the week ending January 6, 2023. We read that US crude oil inventories are about 8 percent above its respected 5-year average.

· Argentina detected its first case of bird flu in wild birds and declared a health emergency. Since mid-December, several Central and South American countries, including Uruguay & Bolivia, have reported an outbreak(s) of bird flu in wild and domestic flocks, even marine animals, but the Argentina find is concerning because the cases are spreading south.

· Brazil’s AgMin said they are bird flu free.

· Bird Flu was thought to be a large driver from the rise in US egg prices late 2022. But still, earlier this week we heard a dozen of eggs at the US retail price, at least at selected locations, are more expensive than a pound of beef.

· The USDA Broiler Report showed eggs set in the US up slightly and chicks placed up 2 percent from a year ago. Cumulative placements were up 1 percent from the same period a year earlier.

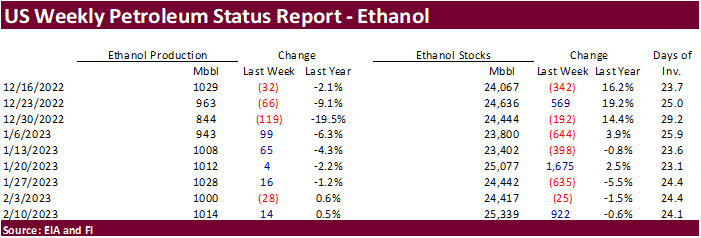

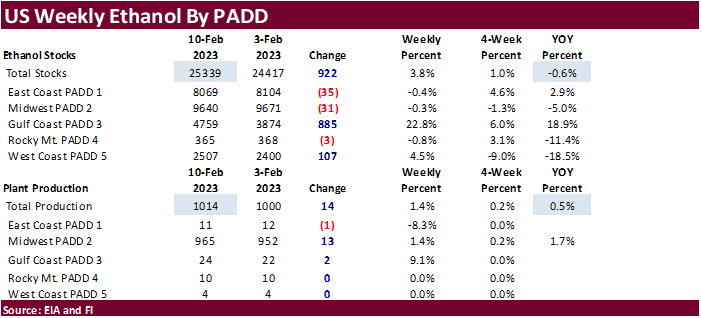

· Weekly US ethanol production increased a more than expected 14,000 barrels to 1.014 million, highest in two weeks. Traders were looking for a 4,000 barrel increase. US ethanol stocks increased a large 922,000 barrels to 25.339 million. Traders were looking for a 115,000 barrel increase. There were no imports. US ethanol production since early September 2022 is running 4.4 percent below the same period year earlier. US gasoline stocks of 241.9 million barrels were up 2.316 million from the previous week, sixth consecutive weekly increase. Implied US gasoline demand was down 154,000 barrels to 8.274 million, about 2.8 percent below year ago level when looking at an average over the past four week. Refinery and blender net input of oxygenates fuel ethanol was 874,000 barrels, up 55,000 from the previous week and 4.7% above this time year ago, and above the previous 4-week average of 830,000 barrels. Net production of combined finished reformulated and conventional motor gasoline with ethanol was 8.593 million barrels, up 499,000 barrels from the previous week and represents 92.3 percent of total finished motor gasoline, up from 91.2% previous week.

EIA US Crude Oil Stocks Change (Barrels) Feb 10: 16283k (exp 2000k; prev 2423k)

Distillate Inventory: -1285k (exp 1000k; prev 2932)

Cushing OK Crude Inventory (Barrels): 659k (prev 1043k)

Gasoline Inventories: 2316k (exp 1500k; prev 5008k)

Refinery Utilization (W/W): -1.40% (exp 0.80%; prev 2.20%)

Export developments.

- USDA reported private exporters reported sales of 213,370 tons of corn for delivery to Mexico during the 2022/2023 marketing year.

Updated 02/13/23

March corn $6.55-$6.95 range. May $6.25-$7.00

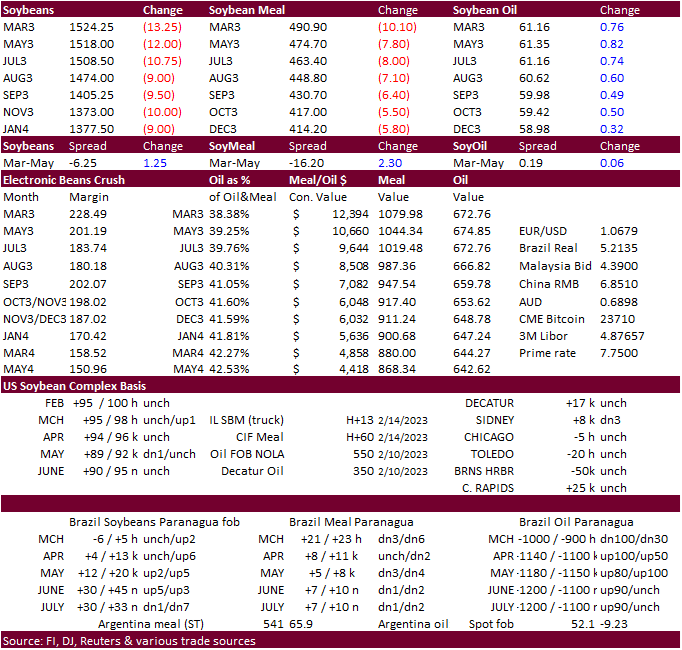

· CBOT soybeans, meal and soybean oil all started lower from weakness in outside markets and Brazil soybean harvest pressure, but the NOPA crush supported soybean oil futures after the report was release at 11 am CT. Soybean oil ended up closing higher and meal sharply lower led by the nearby contracts. Soybeans saw bear spreading in part to long liquidation.

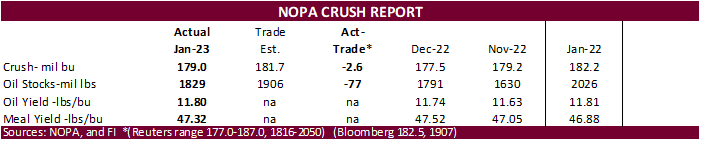

· NOPA released their January US soybean processing update. The January NOPA crush report appeared to be supportive for SBO with lower-than-expected end of month SBO stocks. The January crush was 2.6 million bushels below trade expectations at 179.0 million bushels and appears bearish for soybeans. Month over month the daily crush improved only 0.048 million bushels from December and was down 1.8% from a year ago. Soybean oil stocks were up 38 million pounds from month earlier and down 197 million pounds from year ago. The SBO yield improved to 11.80 pounds per bushel from 11.74. The meal yield fell to 47.32 from 47.52. The January crush enforces our idea USDA is still too high for the 2022-23 crop year, by about 10 million bushels.

· The NOPA January soybean oil yield prompted us to increase our forecast for the 2022-23 crop year to 11.73 pounds from 11.65 pounds per bushel previous. USDA’s current crop year yield is 11.77 pounds per bu, below 11.85 for 2021-22. We normally base our crop year yield based on October and November data, but December and January came in above expectations.

· We heard about 28 cargoes of soybeans were bought by China last week, including 5 US and 23 Brazil origin.

· The drought in Argentina has Asian buyers looking for soybean meal elsewhere. India Feb-May soybean meal shipments were estimated to grow to 500,000 tons, according to a Reuter article. Oct-Jan soybean meal exports were up 65 percent to 631,000 tons from the previous year. Oct-Sep 2021-22 total soybean meal exports were 644,000 tons. Indian soymeal is being offered for around $580 to $585 per ton on a free-on-board (FOB) basis for March shipments, compared to $598 offered by Argentina. (Reuters)

· Ukraine has increased exports of soybeans. January soybean exports were 406,000 tons, highest for any month in three years. 2022 soybean production was 3.7 million tons for Ukraine, highest since 2017. 2022 total soybean exports were nearly 2 million tons.

· Malaysian palm oil ended lower from a slowdown in shipments during the last 5 days relative to the 1-10 period. AmSpec reported February 1-15 Malaysian palm oil shipments at 437,327 tons versus 401,749 tons previous month. ITS reported an 18.4 percent increase to 484,950 tons from 409,731 tons FH last month.

Export Developments

· None reported

Updated 02/13/23

Soybeans – March $14.85-$15.50, May $14.75-$16.00

Soybean meal – March $450-$515, May $425-$500

Soybean oil – March 58.50-63.00, May 58-70

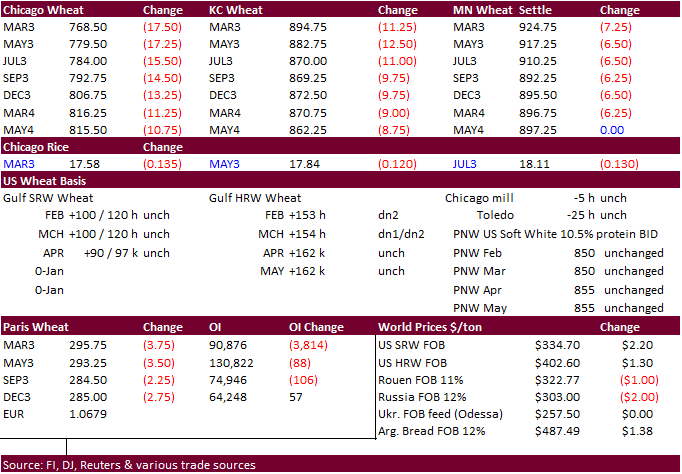

· US wheat was lower on widespread commodity selling, higher USD, and snow forecast for the heart of the Great Plains.

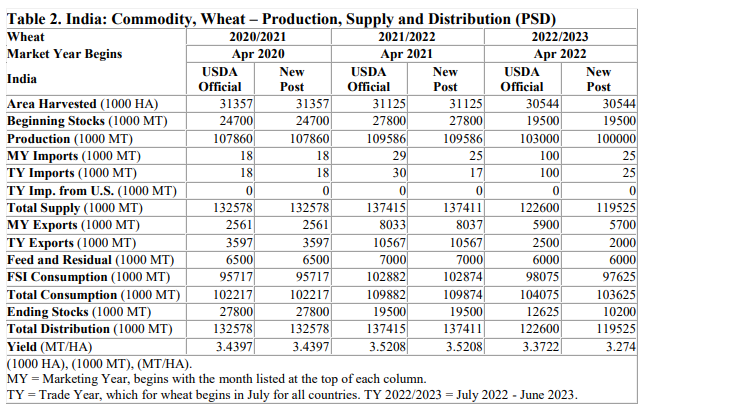

· The USDA Attaché estimated 2022-23 India wheat crop at 100 million tons, 3 million tons below USDA official. This contradicts India’s AgMin numbers. Yesterday India’s government estimated 2023 wheat production at a record 112.2 million tons, a 4.1% increase from year earlier. 2022 output was 107.74 million tons and 2021 at 109.59 million. Harvesting of new-crop wheat starts next month. India may still extend their ban on wheat exports despite the large crop in order to cool inflation. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=India%20Grain%20and%20Feed%20Update%20-%20February%202023_New%20Delhi_India_IN2023-0015

· France’s FranceAgriMer lowered its outlook for French soft wheat exports for outside the European Union to 10.45 million tons from the 10.60 million tons forecast in January, 19% above the 2021/22 level. For within the EU, the agency lowered its estimate to 6.59 million tons from 6.64 million tons previously.

· Paris May wheat was down 3.50 euros or 1.2% at 293.75 per ton.

· SovEcon 2022-23 Russia wheat exports were raised 100,000 tons to 44.2 million tons. 39.1 MMT of grains were exported by Russia so far this season.

· Ukraine exported 29.7 million tons of grain so far in 2022-23, off 29.3 percent from year earlier.

Export Developments.

· Russia donated 25,000 tons of wheat to Cuba. The two countries have been allies for decades.

· Japan in a SBS import tender passed on 70,000 tons of feed wheat and 40,000 tons oof feed barley for loading by May 31.

· Jordan’s state grain buyer seeks up to 120,000 tons of optional origin milling wheat on Feb. 21 for shipment between June 1-15, June 16-30, July 1-15 and July 16-31.

· Jordan’s state grain buyer seeks up to 120,000 tons of optional origin feed barley on Feb. 22 for shipment between June 1-15, June 16-30, July 1-15 and July 16-31.

· Thailand bought 60,000 tons of Australian feed wheat at $337 c&f for July shipment.

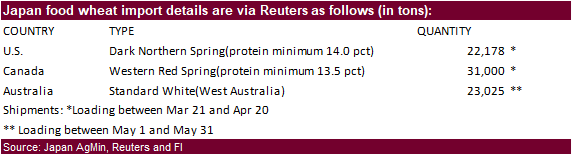

· Japan’s AgMin seeks 76,203 tons of food wheat from the US, Canada and Australia, later this week for March 21-May 31 loading.

Rice/Other

· The Philippines are in for sugar.

Updated 02/10/23

Chicago – March $7.50 to $8.10, May $7.00-$8.25

KC – March $8.55-$9.20, $7.50-$9.25

MN – March $9.00 to $9.60, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |