NOPA

crush was seen supportive for the soybean complex. CBOT futures were initially higher led by wheat from the extreme winter weather conditions and widespread commodity buying. Outside energy markets provided additional support to US ags.

Reuters

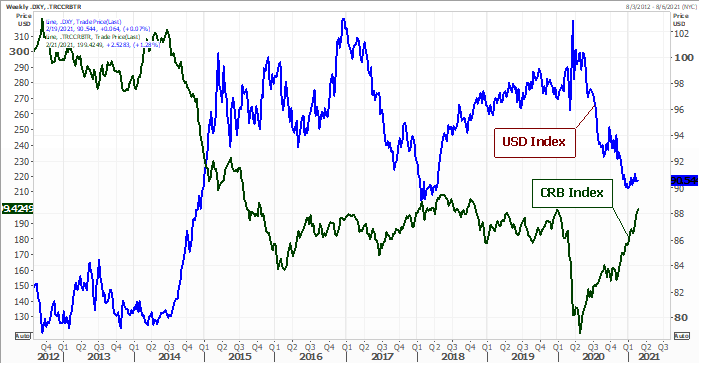

CRB total return index vs. USD

US

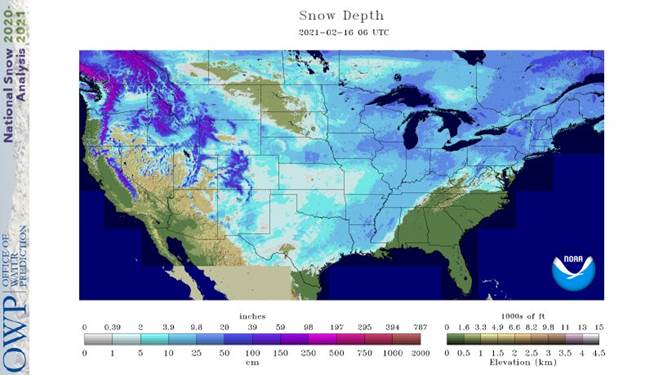

snow coverage improved over the long holiday weekend, but bitter cold temperatures tested winter wheat.

NOT

MANY CHANGES OVERNIGHT

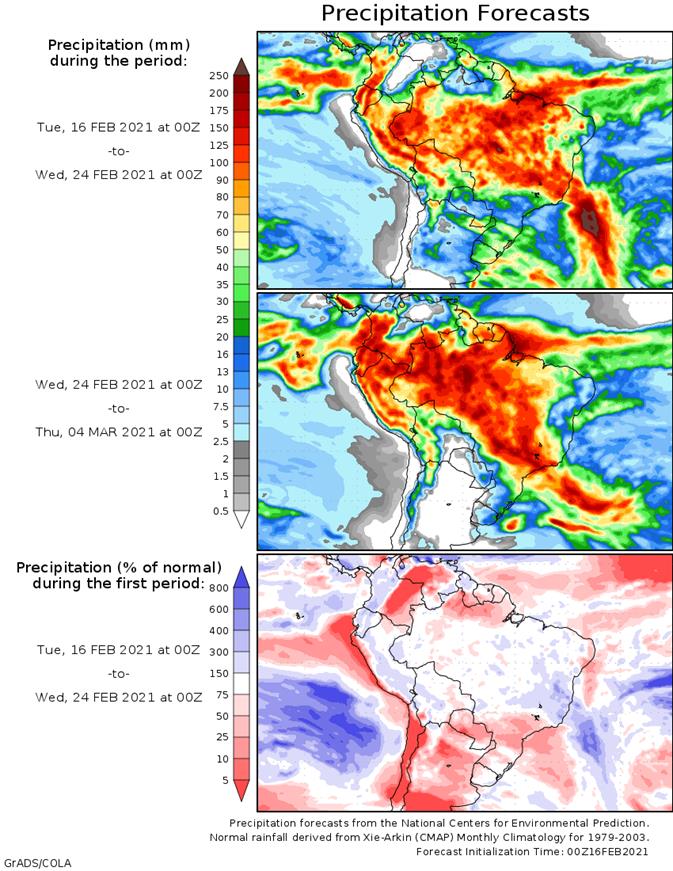

- Argentina

will enter a period of restricted precipitation and net drying that will firm the soil and eventually lead to crop stress during the balance of February - An

assessment of soil conditions will be made later today to help determine the level of urgency in rainfall - Mostly

likely there has not been much stress recently and that which is coming will evolve in pockets for a while leaving the majority of crop conditions still good for the first week of this outlook - Brazil

weather over the past four days brought scattered showers and thunderstorms to many areas with some of the greatest rain occurring in Mato Grosso and Minas Gerais slowing fieldwork of all kinds - The

rain was not excessive and fieldwork advanced around the precipitation - Rain

will continue most frequent in these same areas and in a part of Goias over the next ten days keeping fieldwork a little slow

- Crop

areas to the south from Mato Grosso do Sul and southwestern Sao Paulo into Rio Grande do Sul and Paraguay will experience a favorable mix of rain and sunshine supporting full season and late season crop development while allowing some favorable early season

crop maturation and harvest progress - Extremely

cold temperatures occurred across the central United States and portions of Canada’s Prairies Friday through this morning - Lowest

temperatures fell below zero Fahrenheit as far south as southern portions of West Texas all of Oklahoma, north-central and northeastern Texas, southern Arkansas and the northern Delta

- Some

of the coldest temperatures recorded included -30 in Holyoke, Colorado, -28 at Lamar, Colorado and Kendal, Kansas, -18 at Marshall, Mo, -35 southwest of Sidney, Nebraska, -13 at Norman, Illinois, -35 in Wakefield, Michigan (in western Upper Michigan), -38

at Barnes, Wisconsin, -42 near Stephen, Minnesota, -33 at Clam Lake, South Dakota, -35 at Hazen, ND., -18 at Glencoe, Oklahoma, Knobnoster and west of Sedalia, MO and -15 in northwestern Arkansas.

- Two

unconfirmed extremes of -49 were noted Sunday morning at Coleharbor and Manning, N.D.

- An

extreme of -1 occurred west and north of Shreveport, La - Sugarcane

on the Louisiana coast was likely damaged by temperatures in the teens this morning - Production

cuts for 2021 are possible unless growing conditions are ideal this spring and summer - During

the past week winterkill from extreme cold temperatures likely occurred in minor wheat production areas of Alberta, Saskatchewan and western North Dakota as well as some production areas in central and western South Dakota - During

the long holiday weekend temperatures in western Kansas and eastern Colorado were near the damage threshold Saturday morning, but very little damage was suspected even though snow free conditions were present - Snow

cover increased Sunday, but there were still portions of west-central Kansas that were snow free and temperatures near the damage threshold - Snow

cover was best in Kansas and Colorado Monday morning which was coldest with extreme lows in the -20s and negative teens Fahrenheit

- Damage

in Kansas and Colorado cannot be ruled out, but losses are suspected of being low because of snow cover being widespread when the coldest readings were in place. Crops were sufficiently hardened for the borderline damaging temperatures Saturday and Sunday

and snow depths were likely sufficient to protect many crops from the coldest conditions Monday morning.

- Injured

plants can recover by setting new tillers in the spring, but to be successful in recovering the plants will need abundant moisture and mild temperatures during the early spring.

- Areas

suffering from winterkill will experience permanent production cuts - Snow

cover in the U.S. southern Plains and Midwest provided adequate protection to wheat that was also subjected to cold temperatures - Snow

melt will begin today and is expected to increase in the U.S. Plains over the next couple of days as warming begins - No

further risk of crop damage is expected - Wheat

in eastern Europe and the western Commonwealth of Independent States was not injured by temperatures near and slightly below zero Fahrenheit because of snow cover - Very

few areas were snow free and those that were failed to be cold enough for permanent damage - China

precipitation the past three days occurred farther north than expected bringing moisture to the southern Yellow River Basin and parts of the North China Plain and parts of Liaoning and Jilin - The

moisture boost will be of great use to crops in the spring - Winter

wheat and rapeseed are still rated favorably - Recent

warm temperatures has brought on some greening in southern rapeseed areas - China

precipitation this week will be limited to the far northeastern provinces as snow and to the Yangtze River Basin as rain this weekend - The

moisture will be welcome for use in the spring - Next

week’s precipitation will be more broad-based in the east-central and interior southeastern parts of the nation while more snow falls in the far northeast - Temperatures

will be cool early this week in northeastern China and then warm up for a while - East-central

and southern China will continue to experience periods of mild to warm temperatures - India

was dry the past four days and temperatures were mild to warm - Central

and a part of interior southeastern India will get some welcome rain today into the weekend lifting topsoil moisture for improved winter crop development. - The

far north will be left dry - Temperatures

will be seasonable this week - India

will trend drier and warmer next week which may stress some winter crops that have not received much precipitation recently - Australia’s

cotton and sorghum areas of interior southeastern Queensland and northeastern and north-central New South Wales received some very important rainfall during the past three days - Rain

amounts varied from 0.50 to 2.50 inches with some of that occurring in a very important cotton and sorghum area of Queensland - Rain

amounts of 1.00 to 2.00 inches occurred in north-central New South Wales - Temperatures

were seasonable - The

bottom line for Australia and a welcome improvement to summer grain and cotton in both irrigated and dryland production areas - Australia

will receive less rain this week and net drying may result except along the lower Queensland and upper New South Wales coast where more significant rain will impact sugarcane production areas

- Heavy

rain will also impact the Cape York Peninsula this week - Next

will bring back a few more showers to Queensland and New South Wales cotton and sorghum areas, although resulting rainfall will be light and sporadic - Extreme

eastern parts of South Africa received heavy rain during the past three days - Rain

totals of 3.50 to more than 8.00 inches occurred in southeastern Mpumalanga - Rainfall

elsewhere was more limited and net drying resulted - Temperatures

were mild in east-central parts of the nation and seasonably warm elsewhere - South

Africa will experience erratic rainfall over the next ten days benefiting some crops more than others, but the moisture will help preserve favorable production potentials for 2021 - Net

drying is expected through the weekend - Showers

will resume next week - Temperatures

will be seasonable - Bitter

cold will expand across Russia during the coming week and prevail into next week - The

cold will occur while snow is widespread and sufficient to protect winter crops form any potential damage - Europe

temperatures will be a little warmer than usual in the west and more seasonably cool in the east this week and next week - Precipitation

is expected to be erratic and mostly lighter than usual - Some

of the flood potential in Europe will ease as rainfall diminishes and runoff continues - Crop

conditions will remain favorable - North

Africa precipitation will remain limited over the next ten days to two weeks - Winter

crops are semi-dormant and do not have much need for moisture - Temperatures

will be seasonable - Eastern

Ghana and Ivory Coast received some rain during the past few days - Erratic

flowering might have occurred especially when that moisture was combined with rain that fell in a few areas last week - Greater

and more uniform rain is needed to induce a more generalized bout of flowering in coffee and cocoa areas, but the showers occurring now are not unusual for February and should increase next month - Other

areas in west-central Africa will see most of this week’s rain occurring near the coast - Southeast

Asia rainfall occurred typically during the past three days with mainland areas dry, and moderate to locally heavy rain in parts of Philippines, Indonesia and Malaysia - Rainfall

reached over 6.00 inches in central Mindanao during the weekend and slightly less rain occurred in southern Samar Island while rainfall elsewhere in Philippines, Indonesia and Malaysia was light to moderate and beneficial for developing crops - Central

and northern Sumatra, western Kalimantan and Peninsula Malaysia were left in a net drying mode - Southeast

Asia weather is not likely to change much in the coming week, although some additional heavy rain will overtake much of the Philippines this weekend into early next week causing some local flooding - A

tropical cyclone is possible - East-central

Africa precipitation over the next ten days will be most significant in Tanzania and lightest in Ethiopia - All

of the rain will be welcome and beneficial - U.S.

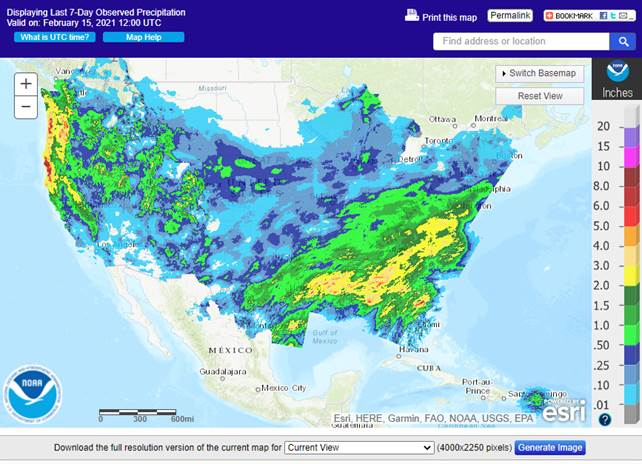

weather over the past few days was snowy besides cold - Snow

fell over most of the central and southern Plains through the northern Delta and heart of the Midwest to the central and eastern Great Lakes region - Accumulations

of 2 to 5 inches occurred in the central Plains, although central Kansas reported less than 1 inch along with northern Missouri - Snowfall

reached over 6 inches in the western and northern Texas Panhandle and varied from 3 to 9 inches from portions of West Texas through central and interior southeastern Texas to Michigan, Indiana and Illinois

- Abilene,

Texas reported nearly 15 inches of snow while up to 11 inches occurred in central Arkansas

- Snowfall

Sunday ranged from 4 to 10 inches with local totals over 12 inches from eastern Texas to southern Michigan and northwestern Ohio - Valparaiso,

Indiana reported 18 inches as did Evanston, IL - The

snow protected winter wheat from the bitter cold - Monday’s

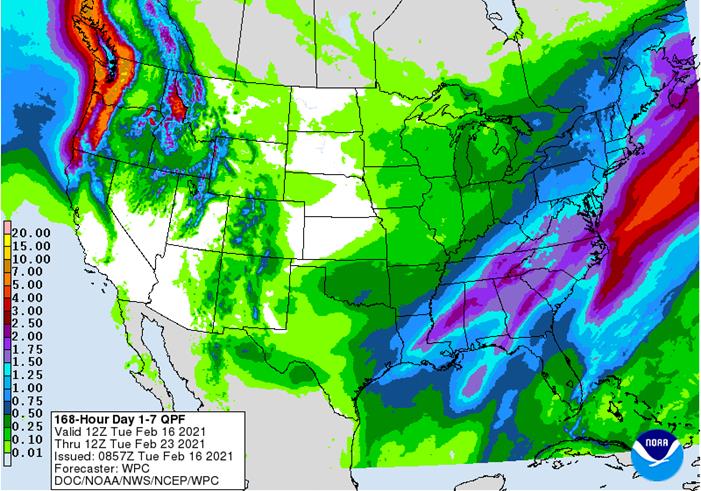

U.S. Midwest snow storm will shift to the northeastern states and southeastern Canada through today - Snow

accumulations of 3 to 9 inches will result with local totals to 12 inches - Northern

New York, northern New England and southern Quebec will get most of the snow - A

follow up storm is expected in the Delta Wednesday after producing some snow in Oklahoma, southern Kansas and northern Texas tonight that will also move into the northeastern states during the day Thursday and Friday - Travel

in the northeastern states, the Middle Atlantic Coast states and parts of the mid-south will be extremely difficult because of this week’s storms

- Additional

Snowfall of 2 to 6 inches and local totals to over 10 inches are expected with the Appalachian Mountains and areas from North Carolina to Pennsylvania getting the greatest snow from this second storm - A

few strong thunderstorms will accompany the mid-week storm this week in the southeastern states - A

weak weekend storm center will move across the northern Plains to the upper Midwest producing light snow and a little wintry mix of precipitation types - That

system will also produce some rain in the lower Midwest - Another

storm will impact the upper Midwest and Great Lakes region during the last days of February - U.S.

bitter cold will linger through today and into Wednesday and then give way to more seasonable temperatures - Southern

Oscillation Index weakened during the weekend and this trend will continue this week - Today’s

SOI was +12.33 today and the index will continue to move lower this week - Mexico

precipitation this week and next week will be mostly confined to the east coast. although a few showers may occur briefly in the far north too - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast is relatively dry - Canada

Prairies will experience warmer temperatures this week with readings becoming much closer to normal - Precipitation

will continue limited - Southeast

Canada will experience greater than usual precipitation this week and seasonably cool temperatures

Source:

World Weather Inc. and FI

Tuesday,

Feb 16:

- USDA

Export Inspections, 11am - Abares

February Australian crop report - MPOB

and Universiti Kebangsaan Malaysia webinar on palm oil’s marketability to EU - Green

Coffee Association releases U.S. monthly green coffee stockpiles data - USDA

sugar and sweeteners outlook - New

Zealand dairy trade auction - Tereos

earnings - HOLIDAYS:

China, Carnival holiday throughout much of South America

Wednesday,

Feb 17:

- KL

Kepong earnings - HOLIDAY:

China

Thursday,

Feb 18:

- EIA

weekly U.S. ethanol inventories, production - USDA

Net Export Sales, 8:30am - USDA

Corn, Cotton, Soybean, Wheat Acreage Outlook, 8:30am - Sime

Darby Plantation earnings - Port

of Rouen data on French grain exports

Friday,

Feb 19:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgiMer

crop conditions report - USDA

Corn, Cotton Soybean, Wheat End Stock Outlook, 7am - U.S.

Cattle on Feed, 3pm

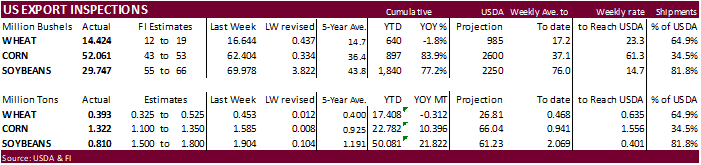

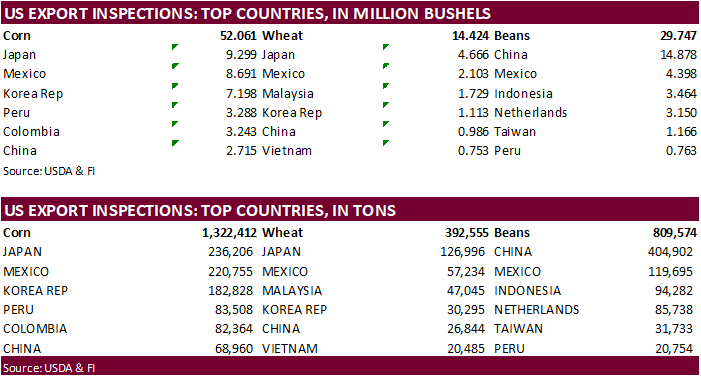

USDA

inspections versus Reuters trade range

Wheat

392,555 versus 300000-600000 range

Corn

1,322,412 versus 1000000-1400000 range

Soybeans

809,574 versus 950000-1800000 range

Blizzard

Cuts US Oil Output By Over 2M Bpd

US

Empire Manufacturing Feb 12.1 (est 6.0; prev 3.5)

–

Six Month Business Conditions 34.9 (prev 31.9)

–

Employment 12.1 (prev 11.2)

–

Prices Paid 57.8 (prev 45.5)

–

New Orders 10.8 (prev 6.6

Texas

Grid Operator Expects All Power To Be Back Tuesday Evening

Corn.

-

Corn

futures ended higher today following strength in soybeans and wheat. Widespread commodity buying led by energy products also supported futures. Earlier March corn bounced this morning on its 20-day MA. With March back above $5.50, look for some US producer

selling to increase. -

Corn

volume was light today. Several countries are on holiday and US intermittent power outages across the central areas likely cause of lower than normal trading volume.

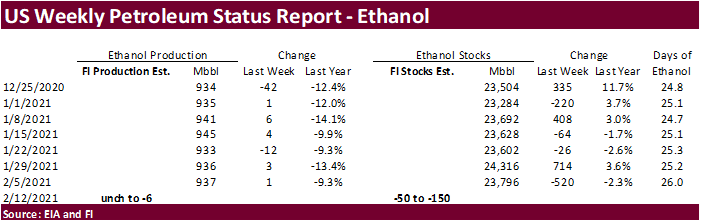

-

We

are hearing some ethanol plants are selling natural gas back to the grid and closing for a while. Some of them made a profit by doing this. With the spike in natural gas prices, it might be too expensive to run some of the US ethanol plants. Natural gas

basis spiked at several US locations from mid-last week. Several ag related processing plants are experiencing natural gas problems. Sourcing the product from Texas to the Great Lakes has become a real problem.

-

USDA

is due out with commodity outlooks for the US 2021-22 supply and demand on Friday. Thursday we will see baseline projections followed by updated S&D’s by NASS on Friday.

https://www.usda.gov/oce/ag-outlook-forum

-

USDA

Agriculture projections through 2030 https://www.usda.gov/sites/default/files/documents/USDA-Agricultural-Projections-to-2030.pdf -

The

Baltic Dry Index climbed to 1,495 points, a 9.6

percent increase. -

Bloomberg

– Feb. 1 herd seen rising y/y to 12.038m, seventh straight y/y expansion since June of last year. January placements seen down 0.2% …

The

Renewable Fuels Association: “more than 1.334 billion gallons, or about 10 percent of the ethanol produced in the United States, were exported in 2020 to 90 countries on six continents. While this is 9 percent lower than 2019, it remains the fourth largest

export volume in history…Distillers grains exports totaled 10.958 million metric tons in 2020, a slight improvement on 2019 and the seventh straight year these exports exceeded 10 million metric tons. A record high share of total U.S. distillers grains production,

38 percent, was exported in 2020.” http://energy.agwired.com/2021/02/16/exports-a-bright-spot-in-the-ethanol-picture/

Soybean

and Corn Advisory:

-

2021

U.S. Acreage – 93 Million Acres of Corn and 91 Million of Soy -

2020/21

Brazil Corn Estimate Unchanged at 105.0 Million Tons -

2020/21

Argentina Corn Estimate Increased 1.0 mt to 45.5 Million

Corn

Export Developments

·

None reported

Updated

2/10/21

March

corn is seen trading in a $5.20 and $6.00 range

May

corn is seen in a $5.15 and $6.00 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.75-$5.50 range.