PDF Attached

Thank

you those for the recent feedback from the US acreage, soybean and corn balance sheets we recently released.

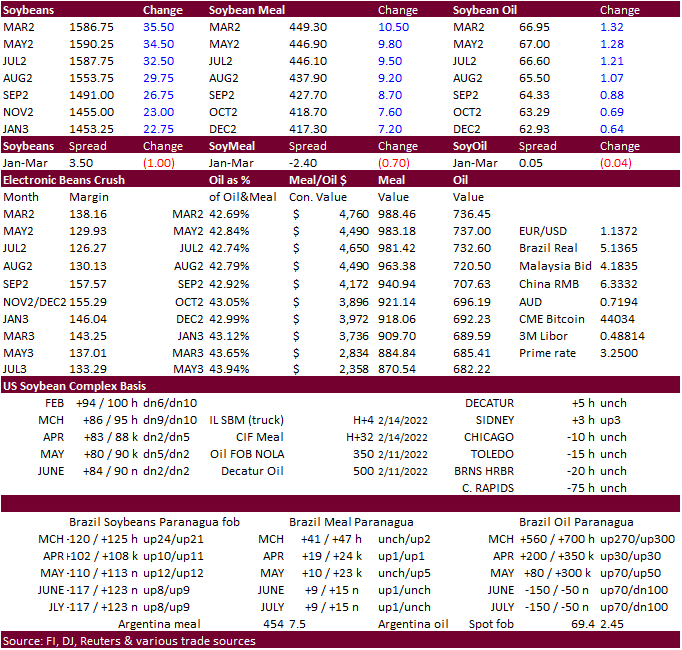

Private

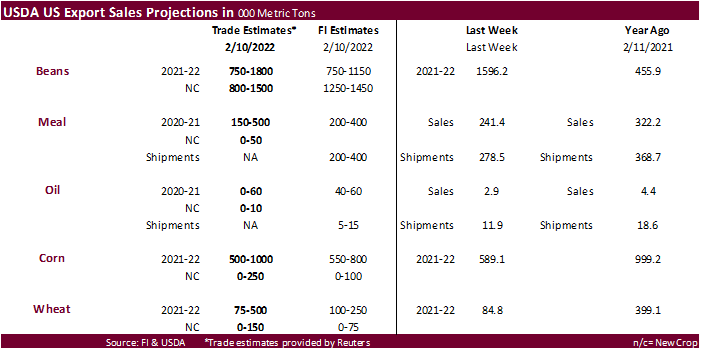

exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year.

Macro

headline trading appears to be fading. Soybeans were higher as traders retuned focus on SA supply concerns. Corn followed wheat higher, but wings were clipped from a mixed trade in US wheat.

South

America’s Argentina and southern Brazil may see decent rain February 23-27th.

A

major US winter storm is underway, with rain, ice and snow expected a large portion of the lower central Great Plains and eastern US. 48-hour precipitation outlook below.

![]()

Weather

– 2

big systems to hit the US ECB/Delta over the next 7 days….

1-2

day

6-7

day

WEATHER

EVENTS AND FEATURES TO WATCH

- Argentina

crop stress continues to rise in the central, northern and east-central parts of the nation Tuesday due to dry and very warm to hot weather - The

areas from central and northern Santa Fe, southeastern Santiago del Estero, Chaco, eastern Formosa and Corrientes are experiencing the greatest crop stress

- Production

cuts are expected from these areas primarily because of favorable soil moisture elsewhere - Argentina’s

dryness will continue threatening to production through Tuesday in the drier areas noted above - Favorable

soil moisture from Buenos Aires into Cordoba will carry crops through the drier period without an issue - Argentina’s

central and southern crop areas will experience timely rainfall in the second half of next week and into the following weekend

- Relief

from stress is expected in most crop areas, although frequent follow up rain will be needed to protect late season crop development - Showers

in the first half of March should occur often enough to prevent another period of serious crop moisture stress from evolving in central or southern Argentina - Some

cotton and minor grain and oilseed areas of far northern Argentina may continue dealing with heat and dryness periodically during March - Vegetative

Health indices continue to show Paraguay and most crop areas near its border in both Brazil and Argentina dealing with heat and moisture stress - The

worst weather was noted earlier in January, but topsoil moisture is in decline again and crops in these areas are starting to feel the pressure of heat and dryness again after some partial relief earlier this month - Crops

in southern Brazil and Paraguay will likely continue to dry out for the next 8 or 9 days before scattered showers come along to produce enough rain for partial relief.

- Periodic

showers and thunderstorms will occur late next week and into the following weekend offering “some” relief, but greater rain will still be needed - Brazil’s

center west and northern portions of center south crop areas continue to experience the greatest rainfall most frequently, but the environment has not been so wet that no fieldwork has advanced - Drier

and warmer weather is needed to promoted faster early soybean and other crop maturation to support harvesting - Less

rain will also help get the remaining Safrinha crops planted - A

boost in Safrinha rainfall will be needed to support good yields this year - Ecuador,

Peru and Colombia crop areas will continue to see frequent rain over the next week maintaining moisture abundance for some areas and raising soil moisture in other areas - Spain

and Portugal need greater rainfall of their unirrigated winter and spring crops. Dryness could fester into a larger problem in the next few weeks as new crop development begins - Not

much rain is expected for at least the next ten days - Northwestern

Africa continues too dry and any rain that evolves will be restricted over the next ten days to two weeks.

- Morocco

is driest with a cut in area planted in the southwest because of a multi-year drought and no irrigation water - North-central

Morocco crops were favorably established in the autumn, but are dry now and will need significant moisture soon to support aggressive crop development ahead of spring reproduction - Northeastern

Morocco and northwestern Algeria are also quite dry and poised to suffer a production cut without significant rain soon - Northeastern

Algeria and Tunisia winter wheat and barley are best established and have the greatest potential for high yields as long as timely rain falls over the next few weeks

- Middle

East winter crop conditions have improved in recent weeks because of a short term boost in precipitation, but more rain is needed to ensure the best possible production - Most

of Europe outside of the Iberian Peninsula and parts of Romania are favorably moist with routinely occurring precipitation in the next ten days supporting status quo winter crop conditions.

- Greater

rain must occur soon for Spain and Portugal and at some time in the next few weeks in Romania to prevent dryness from threatening early season crop development - Western

Russia, northwestern Ukraine, Belarus and Baltic States have abundant soil moisture underneath a significant accumulation of snow - Flood

potentials may be high for the spring this year if the region heats up too fast and all of the snow melts over a short period of time - There

is no threatening cold temperatures expected in Europe or any part of Europe during the next ten days to two weeks - Kazakhstan

and southern Russia’s New Lands will receive only light amounts of precipitation in the next ten days, but any moisture would be welcome for improved topsoil conditions in the spring - Recent

snowfall has changed the early spring moisture outlook at least a little, but the region still has moisture deficits left over from drought last summer and greater precipitation will be needed in the spring.

- India

precipitation will be limited to a few sporadic very light showers during the next ten days except in the far north and extreme east where some moderate rain may impact a few areas - The

bulk of winter crops in the nation are poised to perform well barring no excessive heat in the next few weeks - At

least one more timely rain event would help push yields high than usual - Some

precipitation will impact southeastern U.S. hard red winter wheat production areas later today and Thursday resulting in a short term improvement in topsoil moisture - Oklahoma

will see the greatest increase in topsoil moisture along with some crop areas in southeastern Kansas wheat areas - These

areas could receive 0.50 to 1.50 inches of moisture - The

Texas and Oklahoma Panhandles will receive4 0.10 to 0.30 inch of moisture

- Partial

relief from drought is expected, but the relief will be limited in the southwestern Plains - U.S.

hard red winter wheat areas may also get some moisture from another storm system late next week impacting some of the same areas with lighter amounts of moisture - One

more disturbance is possible in early March - U.S.

storm today into Friday will produce severe thunderstorms in the southeastern Plains, Delta and possibly the Tennessee River Basin as well as a few areas north to the Ohio River - U.S.

storm today and Thursday will produce heavy rain from southeastern Kansas and central Oklahoma into the lower eastern Midwest where 1.00 to 2.00 inches and locally more will result - A

band of heavy snow will extend from a part of eastern Kansas to Michigan with 3 to 8 inches and locally more than 10 inches possible - West

Texas is not likely to get much precipitation this week, although a few showers may occur briefly today into Thursday morning - Another

opportunity for rain is expected one week later on Feb. 23-24 - Moisture

from this latter event should be light as well - California

precipitation is expected to be limited over the next couple of weeks - U.S.

Rocky Mountain region will get some welcome precipitation from storm systems this week and again next week - The

snowfall boost will be good for spring runoff and water supply - U.S.

northwestern Plains “may” get some snow late this coming weekend into early next week - U.S.

Delta and Tennessee River Basin could become too wet by the end of next week with one storm system impacting the region Wednesday into Thursday and another about one week later - Rainfall

from the second storm may be greater than that of this week - There

is some potential for a third storm in early March. - Xinjiang,

China has reported some light snow in the far northeast and in the mountains of the north and west recently

- Much

more precipitation is needed to induce better soil conditions and improved runoff potentials for irrigation water during the spring and summer - Periodic

precipitation is expected, but no major rain or snow events are perceived for a while - The

greatest precipitation this week will be today into Thursday when snow will fall in the northeast of Xinjiang and in the mountains of the west and north - China’s

most recent precipitation has been concentrated on the Yangtze River Basin and areas south to the coast - The

region is plenty wet, if not a little too wet - Some

drying would be welcome - Additional

waves of precipitation will continue to come and go through the next ten days to two weeks - Resulting

precipitation will maintain a wet environment for rapeseed and future rice and corn planting - Temperatures

will be near to below average in most of the nation this week - Australia’s

summer crop areas in the east will be dry or mostly dry away from the Pacific Coast this week and temperatures will continue near to above average - Rain

late in the weekend and next week should increase in the form of scattered showers and thunderstorms - The

precipitation will be erratic benefiting some areas more than others - South

Africa rainfall will increase during this coming week to ten days - The

moisture boost will be welcome for some areas after recent drying - The

drying was more beneficial than detrimental, though, as parts of the nation have been a little too wet at times this growing season - Temperatures

will be seasonable - West-central

Africa coffee and cocoa production areas experienced some increase in shower activity during the weekend, but most of the rain was not enough to increase topsoil moisture - Additional

showers are expected in the coming week that may stimulate a few areas of localized flowering, but most of the precipitation will be too light and sporadic to have much impact on crops - The

rainy season is expected to begin relatively well with March wetter than late February - Late

February rainfall is expected to be sporadic and mostly light with a few pockets of moderate rain - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Southeast

Asia precipitation will continue erratic from one day to the next, but most of Indonesia and Malaysia precipitation will continue frequent and abundant - Mainland

areas of Southeast Asia seem poised to see an early start to scattered showers and thunderstorms during the next couple of weeks with next week wettest - Today’s

Southern Oscillation Index is +10.45 - The

index will move lower over the next seven days - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

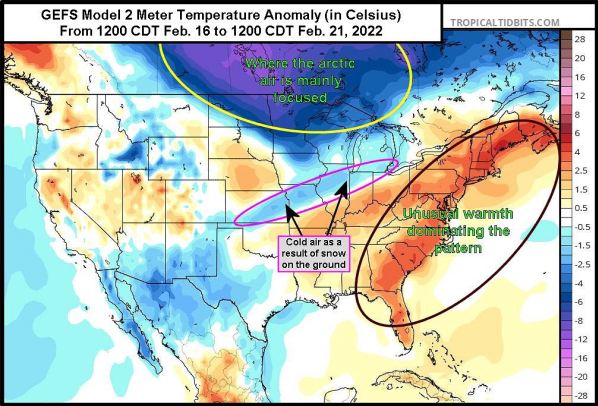

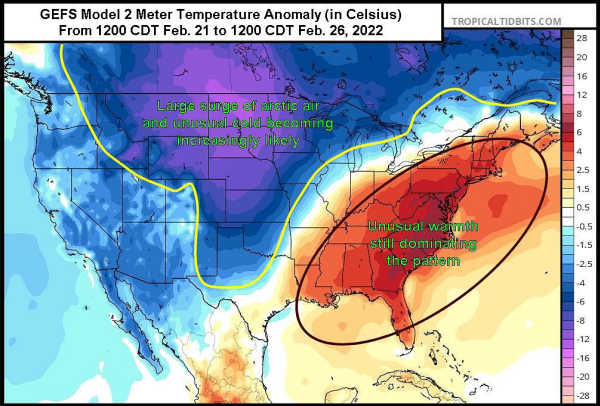

US

cold surge expected to start next week…

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- EIA

weekly U.S. ethanol inventories, production - FranceAgriMer

report; monthly grains outlook - HOLIDAY:

Thailand

Thursday,

Feb. 17:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report

Friday,

Feb. 18:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly crop condition report

Source:

Bloomberg and FI

USDA

Agriculture Outlook Forum

will be held February 24-25. The USDA 2022-23 Commodity Outlooks will be released Friday, February 25 and will give a glimpse into what USDA projects 2022-23 US supply and demand using latest data.

This

is not to be confused with baseline projections that were compiled late 2021 for the budget, and completed early 2022. USDA Agricultural Projections to 2031 (baseline) were

released today at 2:00 PM CT. 2022-23 are same as what was released back in November.

https://www.usda.gov/oce/commodity-markets/baseline

https://www.usda.gov/oce/ag-outlook-forum

2/16/22

For the purpose of March Intentions we lowered rice acreage by 200k acres to 2.5 million (2.532 million last year) and raised soybeans by like amount to 89.550 million.

Macros

US

Retail Sales Advance (M/M) Jan: 3.8% (est 2.0%; prev -1.9%; prevR -2.5%)

–

US Retail Sales Ex Auto (M/M) Jan: 3.3% (est 1.0%; prev -2.3%; prevR -2.8%)

–

US Retail Sales Ex Auto And Gas Jan: 3.8% (est 1.0%; prev -2.5%; prevR -3.2%)

US

Import Price Index (M/M) Jan: 2.0% (est 1.2%; prev -0.2%; prevR -0.4%)

–

US Import Price Index Ex Petroleum (M/M) Jan: 1.4% (est 0.4%; prev 0.3%; prevR 0.4%)

–

US Import Price Index (Y/Y) Jan: 10.8% (est 10.0%; prev 10.4%; prevR 10.2%)

US

Export Price Index (M/M) Jan: 2.9% (est 1.3%; prev -1.8%; prevR -1.6%)

–

US Export Price Index (Y/Y) Jan: 15.1% (est 13.1%; prev 14.7%; prevR 14.8%)

Canadian

CPI Inflation (M/M) Jan: 0.9% (est 0.6%; prev -0.1%)

–

Canadian CPI Inflation (Y/Y) Jan: 5.1% (est 4.8%; prev 4.8%)

–

Canadian CPI Core (M/M) Jan: 0.8% (prev 0.0%)

–

Canadian CPI Core (Y/Y) Jan: 4.3% (prev 4.0%)

US

Industrial Production (M/M) Jan: 1.4% (est 0.5%; prev -0.1%)

–

US Capacity Utilisation Jan: 77.6% (est 76.8%; prev 76.5%)

–

US Manufacturing (SIC) Production Jan: 0.2% (est 0.2%; prev -0.3%)

US

DoE Crude Oil Inventories 11-Feb: 1121K (est -2174K; prev -4756K)

–

Distillate Inventories: -1552K (est -1500K; prev -930K)

–

Cushing OK Crude Inventories: -1900K (prev -2801K)

–

Gasoline Inventories: -1332K (est 500K; prev -1644K)

–

Refinery Utilization: -2.90% (est 0.00%; prev 1.50%)

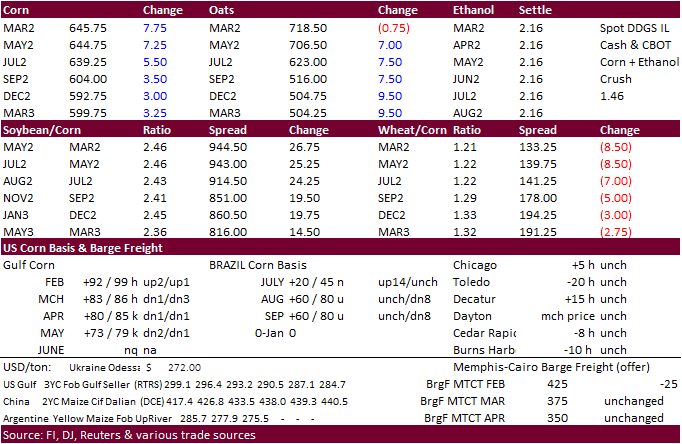

Corn

·

March corn ended higher led by front months from strength in soybeans and WTI crude oil. News was light and with bird flu spreading across the US ECB, that may have limited gains. March corn settled 9 cents higher. In comparison

March soybeans were up 36.25 cents.

·

Funds bought an estimated net 9,000 CBOT corn contracts.

·

March options expire Friday. Traders today were eying the soybean $6.40 strike.

·

USDA reported an outbreak of H5 bird flu in a flock of 26,473 birds in Dubois County, Indiana.

·

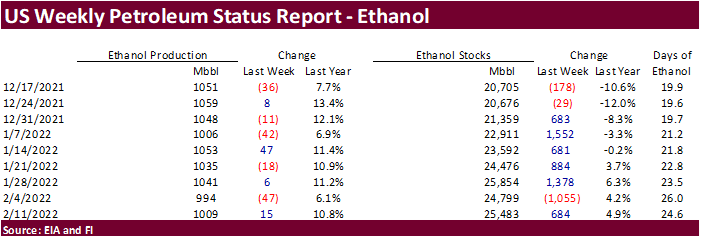

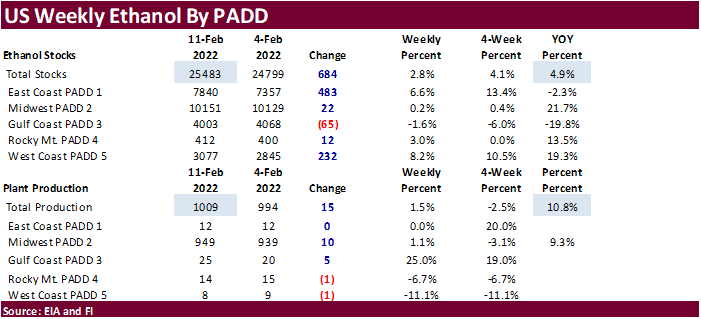

US weekly ethanol production increased 15,000 barrels per day to 1.009 million barrels after declining 47,000 barrels week earlier. Traders were looking for a 9,000 barrel increase. Stocks increased 684,000 barrels to 25.483

million. Traders were looking for a 167,000 barrel increase. Recall stocks fell 1.055 million previous week. Logistical problems, such as rail, was noted. Production fell 11,000 barrels on average over the past four weeks. Ethanol stocks are at record

levels for this time of year. US gasoline stocks decreased 1.33 million barrels from the previous week to 247.1 million barrels. Gasoline demand slipped 550,000 barrels to 8.570 million, and on a rolling 4-week average up 7.9% from year ago but down 2.9 percent

from 2020.

US

DoE Crude Oil Inventories 11-Feb: 1121K (est -2174K; prev -4756K)

–

Distillate Inventories: -1552K (est -1500K; prev -930K)

–

Cushing OK Crude Inventories: -1900K (prev -2801K)

–

Gasoline Inventories: -1332K (est 500K; prev -1644K)

–

Refinery Utilization: -2.90% (est 0.00%; prev 1.50%)

EIA:

US Oil Inventories At Cushing, Oklahoma At Lowest Since Sep 2018 In Latest Week

EIA

U.S.

crude oil production forecast to rise in 2022 and 2023 to record-high levels

https://www.eia.gov/todayinenergy/detail.php?id=51318&src=email

Export

developments.

- Iran’s

SLAL seeks up to 60,000 tons of animal feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal. Shipment for all the grains and soymeal was sought in February and March. On Feb. 11 they passed on 60,000 tons of feed barley and 60,000 tons of soymeal.

Updated

2/11/22

March

corn is seen in a $6.15 and $6.85 range

December

corn is seen in a wide $5.25-$7.00 range

·

Soybeans traded sharply higher as traders returned to focus on shrinking South American supplies. Paraguay warned they may have to import soybeans to meet crush requirements. SA weather forecasts were calling for net drying bias

Argentina and southern Brazil over the next 7 days. South America’s Argentina and southern Brazil may see decent rain February 23-27th.

·

We see $16.00 soybeans soon, then $16.25-$16.50 area based on shrinking US and SA stock projections.

·

Funds bought an estimated net 22,000 soybeans, bought 5,000 meal and bought 5,000 soybean oil.

·

CBOT March crush was up 4.50 cents at $1.4050. Crush margins are about 30 cents off highs but still healthy enough to entice crushing.

·

March soybean oil hit a contract high today and on a weekly rolling basis, hit its highest level since the week ending July 26. March 2022 soybean oil took out the absolute high of 66.92 made on Feb 2. That contract closed today

134 points higher at 66.97 points. Bloomberg also noted the average price this week for a type called B100 in Iowa was $5.48 a gallon, compared to $3.88 in February of 2021.

·

A fire at a soybean processor in Claypool, IN, halted production of meal and oil, and biodiesel production. The crushing plant is one of the largest in the country (173k bu/day), and biodiesel production alone represents about

3.6%% oof the countries total of 2.389 billion gallons, using latest government data per Bloomberg story.

·

The fire at Claypool didn’t just affect soybean oil. US soybean meal basis rallied $3.00 short ton at Chicago, Decatur (IL), Morristown (IN), and Fostoria (OH) – all ECB locations.

·

Soybean meal futures rallied $7.70-$10.75 short ton bias nearby to upside on technical buying. Yesterday the March and May contracts hit a all time high but closed well off highs.

·

CBOT March options expire Friday. Traders today were eying the soybean $15.70 strike. Soybean oil option trading was active today.

·

China agriculture officials, citied in a local news article picked up by Reuters, stated China could reduce soybean demand by 30 million tons. We have no thoughtful comment or insight on this, unless the country makes a drastic

shift in types of animal unit production that supports a massive increase in demand for feedgrains and wheat, which has yet to be seen. Not to mention domestic demand for vegetable oils.

·

Paraguay’s trade industry body warned soybean crush could run out of beans to process by the middle of the year and were in talks to import beans for the first time ever. The estimated a drop of around 60% compared with the previous

campaign. Idle crushing capacity could be 60%-70% in the latter half of 2022. If Paraguay imports soybeans, they may look to Argentina and Bolivia.

·

The South American soybean crop (5 countries) could see a decline of 850 million to 1.0 billion bushels from the 2021 harvest, to about 6.4 billion total (7.3 billion year ago). This is a large reduction, and we expect major

importers to turn to the US this summer. We recently lowered our US carryout to below 200 million for the US. USDA is at 325 million. See balance sheets from 2/15 evening comment.

·

India oilmeal exports during January were up 3.6% from December to 176,815 tons from 170,623 tons, but well down from 501,552 tons in January 2021. They included 52,771 tons in January 2022 versus 43,260 tons in December 2021.

·

Delayed SGS data showed Malaysian palm oil exports for the Feb 1-15 period rose 11.3 percent to 507,673 tons. Other agencies reported a 23.6% and 18.8% increase.

Earlier

this week India raised the base import prices of palm oil, soyoil, gold and silver.

Commodity New price in $ Old price in $

Crude palm oil 1,359 1,346

RBD palm oil 1,376 1,368

RBD palmolein 1,385 1,377

Crude soya oil 1,455 1,449

Gold 601 576

Silver 771

- Egypt’s

GASC bought 34,500 tons of vegetable oils for April 5-25 arrival. 6,000 tons of international soybean oil was purchased at $1,567/tons, and 28,500 tons of international sunflower oil at $1,463/ton. They passed on local vegetable oils. For comparison, on

December 12, Egypt bought a combined 69,000 tons of vegetable oils, paying $1,342.10 (37k local) to $1,354.50/ton (30k international) tons of soybean oil and $1,390/ton (39k international) of sunflower oil.

- Private

exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year. - Iran’s

SLAL seeks up to 60,000 tons of animal feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal. Shipment for all the grains and soymeal was sought in February and March. On Feb. 11 they passed on 60,000 tons of feed barley and 60,000 tons of soymeal.

- Turkey

seeks 6,000 tons of sunflower oil on February 23 for shipment between March 2 and March 25.

Updated

2/15/22

Soybeans

– March $14.75-$16.50

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $420-$480

Soybean

oil – March 64.00-68.00

·

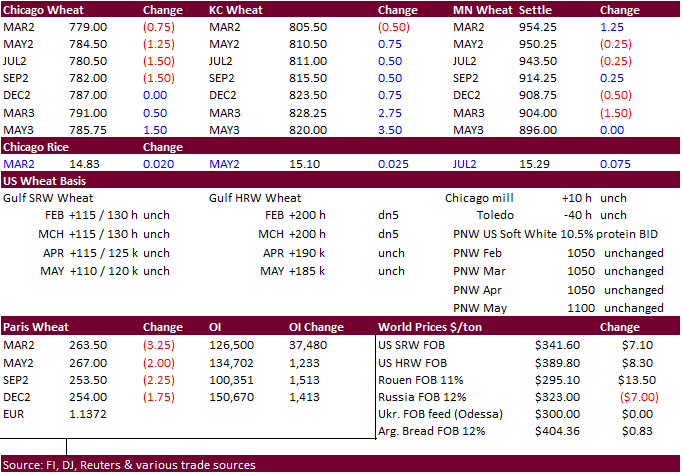

US wheat futures ended mixed (Chicago up moderately, KC up 2.0-3.0 cents, and MN up 0.25 to 1.50 cents lower) on easing Ukraine/Russia tensions, favorable global weather lower EU wheat futures that declined 3.25 euros at 363.00

euros per ton.

·

Black Sea wheat futures and options trading has come off a big amount since this Ukraine/Russian situation began to develop.

·

After the close Egypt announced they seek wheat on February 17 for April 1-10 shipment.

·

Funds were an estimated net even for Chicago wheat.

·

A major US winter storm is underway, with rain, ice and snow expected a large portion of the lower central Great Plains and eastern US. 48-hour precipitation outlook below.

·

The northern Plains and upper Midwest may get some precipitation next week.

·

(Bloomberg) — Indonesia’s food-grade wheat imports may increase about 5% as economy recovers and two new flour mills are completed this year, according to the Association of Flour Producers in Indonesia.

·

Russia’s wheat export tax for the February 16-22 period was lowered to $92.80 per ton from $93.20 per ton in the previous period, fifth consecutive week that the duty has declined.

·

Algeria bought at least 60,000 tons of milling wheat so far in an import tender open until Feb 17, for April shipment. $345.50/ton c&f was a reference price noted. They last bought wheat on Jan 26, paying around $375/ton.

·

Egypt seeks wheat on February 17 for April 1-10 shipment.

·

South Korean flour millers bought 82,000 tons of wheat from the US (50k) and Canada (32k) for shipment in the second half of April, all purchased fob.

o

US soft white wheat of 11% protein bought at in the mid $380s a ton

o

US soft white wheat of a maximum 9% protein at an undisclosed price

o

US hard red winter of 11.5% protein bought in the mid $380s per ton

o

US northern spring/dark northern spring wheat of 14% protein bought around $405 a ton.

o

Canadian western red spring wheat bought at under $400 a ton

·

Jordan’s state grain buyer seeks 120,000 tons of milling wheat, optional origins, on Feb. 23, with shipment in 60,000 ton consignments, for July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15. They also seek 120,000 tons of feed

barley on Feb. 22.

·

Syria’s passed on 200,000 tons of milling wheat. Shipment was for 60 days after confirmation of the purchase contract.

·

Japan passed on 80,000 tons of feed wheat and 100,000 tons of barley on Feb 16 for arrival by July 28.

·

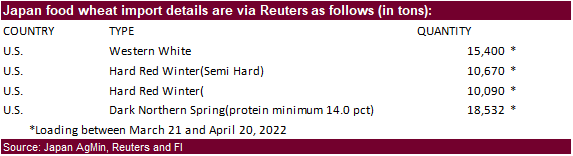

Japan seeks 54,692 tons of food wheat from the US this week.

·

Results awaited: The Philippines seek 45,000 tons of feed wheat on Tuesday. Shipment is sought in June and July.

·

Egypt seeks wheat next week.

·

Taiwan seeks 54,920 tons of US wheat on February 18, for April 4-18 shipment if off the PNW.

·

Turkey seeks 255,000 tons of feed barley on February 22. Shipment is sought for March 1-31.

·

Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp. passed on 46,344 tons of rice.

·

South Korea seeks 72,200 tons rice from U.S. and Vietnam on Feb. 25.

Updated

2/2/22

Chicago

March $7.25 to $8.30 range

KC

March $7.45 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.