PDF Attached does not include daily estimate of funds

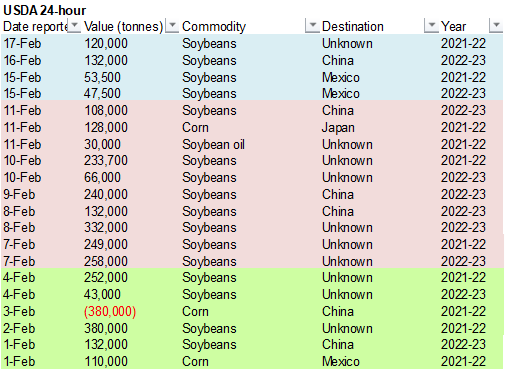

Private

exporters reported sales of 120,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

Soybean

complex traded two-sided. The higher trade in soybeans reflected South American weather concerns and rising Brazil premiums. Corn and wheat ended higher. Wheat led the grains higher from strong global import demand and concerns over a potential Russian invasion.

CME

is raising margins for several CBOT products.

https://www.cmegroup.com/notices/clearing/2022/02/Chadv22-054.html

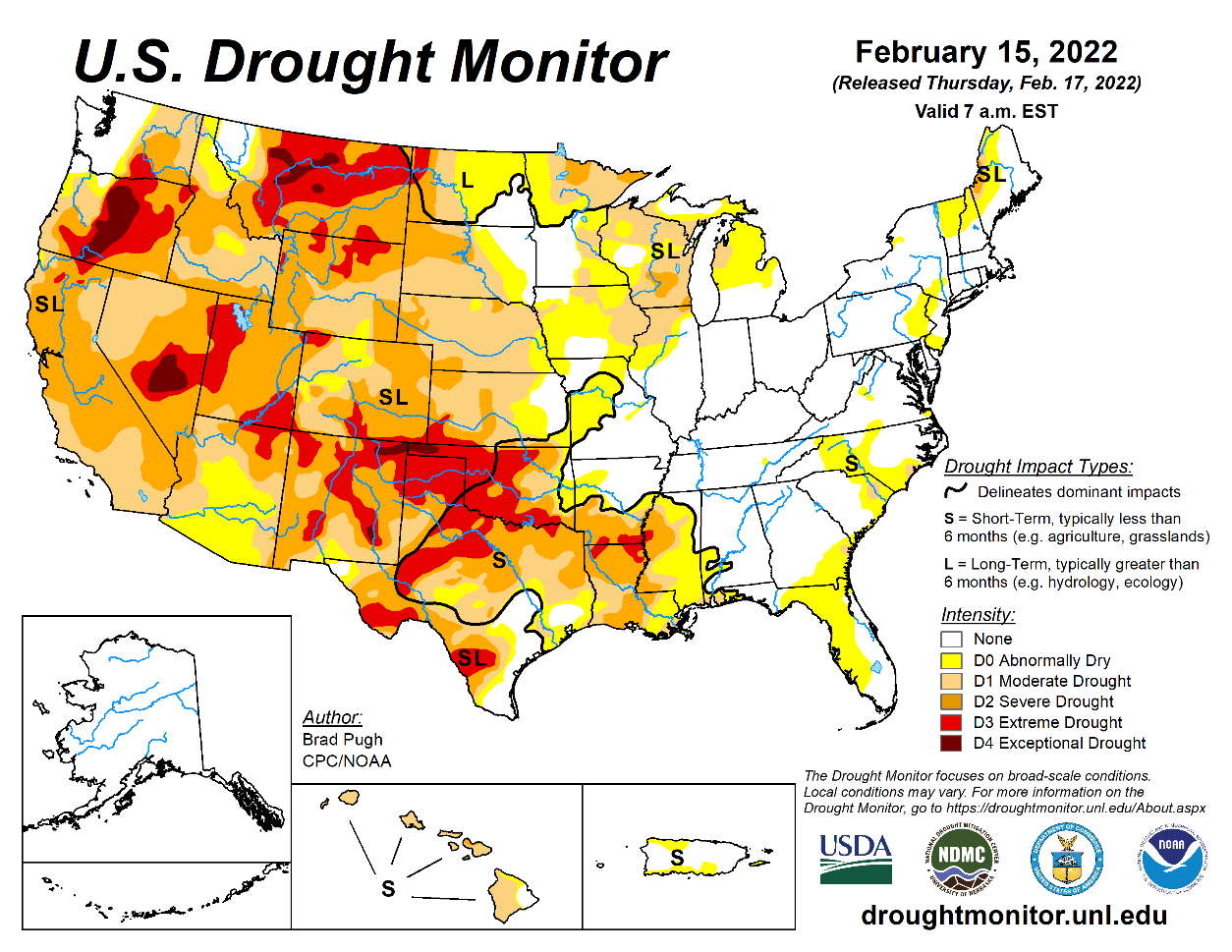

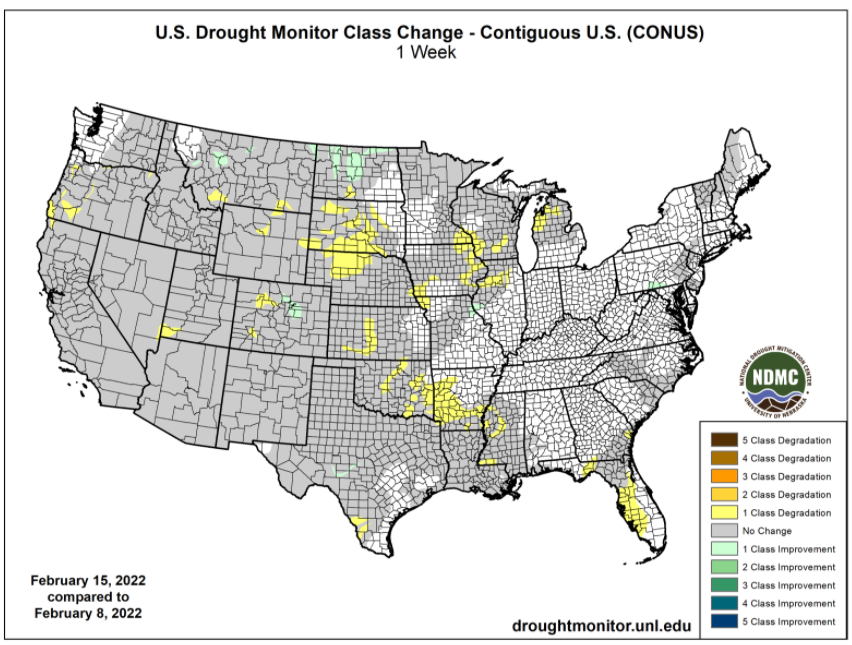

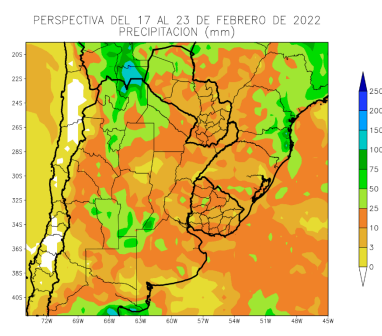

WEATHER

EVENTS AND FEATURES TO WATCH

- Argentina,

southern Brazil and Paraguay will continue struggling for the kind of moisture that would stop declining crop moisture and crop conditions during the next week

- Weather

patterns are not suggesting enough good soaking rainfall to fix the region’s moisture deficits, but there will be some rain infrequently enough to slow the declining trend for some areas - A

general soaking of rain is needed and with Argentina’s late crop reproducing and filling over the next few weeks this is an extremely important time for rain - Argentina’s

soil moisture is still well rated in Buenos Aires, southern Cordoba, northeastern La Pampa, parts of San Luis and far southern Santa Fe which includes a large amount of 2022 crop, but dryness to the north and east is still a serious concern - Cotton

areas in northern Argentina and Paraguay are too dry, but rain reported earlier this month did offer a short term boost in crop development - Safrinha

cotton and corn areas in Mato Grosso are experiencing good crop weather, but some of the Safrinha crop areas in western Parana and Mato Grosso do Sul are drying down once again and rain will have to fall soon to protect development - Coffee,

citrus and sugarcane production areas in Brazil are still rated favorably with little change likely over the next ten days - Brazil’s

center west and northern parts of its center south region will continue to see frequent rainfall keeping some of the harvest progress and other fieldwork moving along a little sluggishly - Less

frequent and less significant rain is expected next week that will start to improve the moisture profile and support better field working conditions in those areas that have been too wet - Ecuador,

Peru and Colombia crop areas will continue to see frequent rain over the next week maintaining moisture abundance for some areas and raising soil moisture in other areas - U.S.

weather has not changed much in the general theme; however, today’s forecast brings some much needed snowfall to the northwestern Plains and southwestern parts of Canada’s Prairies beginning late this weekend into Monday - U.S.

lower and eastern Midwest, portions of the Delta, Tennessee River Basin and northwestern parts of the southeastern States will see frequent storm systems over the next two weeks - Some

of the region is expected to become too wet and that will result in some rising flood potentials especially with next week’s storm system - California

will continue to see less than usual precipitation, although a little snowfall is expected periodically in the mountains over the next couple of weeks - Resulting

moisture totals will be below normal - U.S.

Pacific Northwest will see periods of light precipitation with the mountains getting nearly all of the significant moisture - U.S.

hard red winter wheat production areas are getting some snowfall today and will do so again with another storm during the middle to latter part of next week - Both

events will not produce substantial moisture in the high Plains, but a little improvement in topsoil moisture may occur after each event’s snow melts - Eastern

parts of hard red winter wheat country will see greater volumes of moisture supporting future crop development when seasonal warming occurs - West

Texas is not likely to get much precipitation this week, although a few showers are possible briefly today

- Another

opportunity for rain is expected one week later on Feb. 23-24 - Moisture

from this latter event should be light as well - Spain

and Portugal need greater rainfall of their unirrigated winter and spring crops. Dryness could fester into a larger problem in the next few weeks as new crop development begins - Not

much rain is expected for at least the next ten days - Northwestern

Africa continues too dry and any rain that evolves will be restricted over the week - Morocco

is driest with a cut in area planted in the southwest because of a multi-year drought and no irrigation water - North-central

Morocco crops were favorably established in the autumn, but are dry now and will need significant moisture soon to support aggressive crop development ahead of spring reproduction - Northeastern

Morocco and northwestern Algeria are also quite dry and poised to suffer a production cut without significant rain soon - Northeastern

Algeria and Tunisia winter wheat and barley are best established and have the greatest potential for high yields as long as timely rain falls over the next few weeks

- There

is some potential for a boost in precipitation during the middle part of next week, but initial rainfall is expected to be too light for a serious increase in topsoil moisture - Middle

East winter crop conditions have improved in recent weeks because of a short term boost in precipitation, but more rain is needed to ensure the best possible production - Most

of Europe outside of the Iberian Peninsula and parts of Romania are favorably moist with routinely occurring precipitation in the next ten days supporting status quo winter crop conditions.

- Greater

rain must occur soon for Spain and Portugal and at some time in the next few weeks in Romania to prevent dryness from threatening early season crop development - Western

Russia, northwestern Ukraine, Belarus and Baltic States have abundant soil moisture underneath a significant accumulation of snow - Flood

potentials may be high for the spring this year if the region heats up too fast and all of the snow melts over a short period of time - There

is no threatening cold temperatures expected in Europe or any part of Europe during the next ten days to two weeks - Kazakhstan

and southern Russia’s New Lands will receive only light amounts of precipitation in the next ten days, but any moisture would be welcome for improved topsoil conditions in the spring - Recent

snowfall has changed the early spring moisture outlook at least a little, but the region still has moisture deficits left over from drought last summer and greater precipitation will be needed in the spring.

- India

precipitation will be limited to a few sporadic very light showers during the next ten days except in the far north and extreme east where some moderate rain may impact a few areas - The

bulk of winter crops in the nation are poised to perform well barring no excessive heat in the next few weeks - At

least one more timely rain event would help push yields high than usual - Xinjiang,

China reported some light snow in the far northeast and in the mountains of the north and west earlier this month, but the region is expected to be dry biased again for the next ten days - Much

more precipitation is needed to induce better soil conditions and improved runoff potentials for irrigation water during the spring and summer - China’s

most recent precipitation has been concentrated on the Yangtze River Basin and areas south to the coast - The

region is plenty wet, if not a little too wet - Some

drying would be welcome - Additional

waves of precipitation will continue to come and go through the next ten days to two weeks - Resulting

precipitation will maintain a wet environment for rapeseed and future rice and corn planting - Temperatures

will be near to below average in most of the nation this week - Australia’s

summer crop areas in the east will be dry or mostly dry away from the Pacific Coast into the weekend and temperatures will continue near to above average - Rain

late in the weekend and next week should increase in the form of scattered showers and thunderstorms in both Queensland and northeastern New South Wales - The

precipitation will be erratic benefiting some areas more than others - South

Africa rainfall will increase through the weekend and then most of next week will be dry biased - The

moisture boost will be welcome for some areas after recent drying - The

drying was more beneficial than detrimental, though, as parts of the nation have been a little too wet at times this growing season - Temperatures

will be seasonable - West-central

Africa coffee and cocoa production areas experienced some increase in shower activity during the weekend, dry weather has occurred since then

- Additional

showers are expected in the coming week that may stimulate a few areas of localized flowering, but most of the precipitation will be too light and sporadic to have much impact on crops - The

rainy season is expected to begin relatively well with March wetter than late February - Late

February rainfall is expected to be sporadic and mostly light with much of it near the coast only - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Southeast

Asia precipitation will continue erratic from one day to the next, but most of Indonesia and Malaysia precipitation will continue frequent and abundant - Mainland

areas of Southeast Asia seem poised to see an early start to scattered showers and thunderstorms during the next couple of weeks with next week wettest - Today’s

Southern Oscillation Index is +10.60 - The

index will move lower over the next seven days - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly crop condition report

Source:

Bloomberg and FI

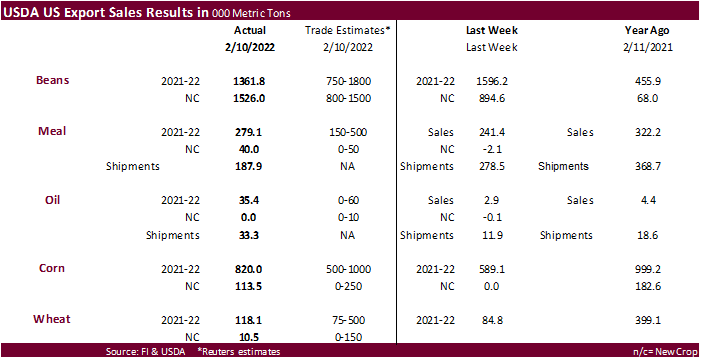

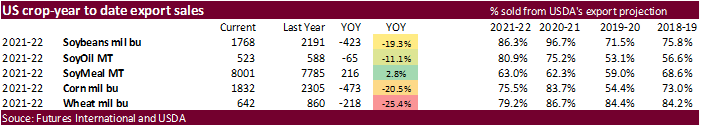

USDA

Export Sales

USDA

Export Sales were all within expectations with exception of new-crop soybeans slightly topping the high end of a range. Year to date commitments for soybeans, corn, wheat, and soybean oil are still lagging year ago.

USDA

export sales for soybeans of 1,361,800 MT included unknown destinations (371,700 MT), China (224,500 MT, including decreases of 2,300 MT), and the Netherlands (188,300 MT, including 112,600 MT switched from unknown destinations). New crop sales were a large

1,526,000 MT and included China (876,000 MT), unknown destinations (530,000 MT), and Egypt (106,000 MT).

Soybean

meal sales were 279,100 MT and included the Philippines, Ecuador and Morocco. Shipments were 187,900 tons. Soybean oil sales of 35,400 significantly improved and were highest since December 16. That included the 30,000 ton unknow sale we though was for India.

Shipments were 33,300 tons, also excellent.

CBOT

corn export sales of 820,000 tons for 2021-22 and 113,500 tons for new-crop were within expectations. Japan and Mexico were largest buyers for both crop years. China was not mentioned in the text. Sorghum sales of 148,400 MT for 2021-22 were up 5 percent

from the previous week, but down 42 percent from the prior 4-week average. Increases reported for China (208,400 MT, including 65,000 MT switched from unknown destinations). Pork sales of 18,300 MT for 2022 were down 46 percent from the prior 4-weekaverage.

All-wheat

USDA export sales of 118,100 tons were within expectations but still very low for this time of year. The slowdown in wheat commitments (past three weeks) has increased the gap from year to date commitments of 642 million bushels against previous year of 860

million, down 25 percent.

Macros

US

Initial Jobless Claims Feb 12: 248K (est 218K; prev 223K; prevR 225K)

–

US Continuing Claims Feb 5: 1593K (est 1605K; prev 1621K; prevR 1619K)

7:36:08

AM livesquawk US Philadelphia Fed Business Outlook Feb: 16.0 (est 20.0; prev 23.2)

US

Housing Starts Jan: 1638K (est 1695K; prev 1702K; prevR 1708K)

–

Housing Starts (M/M) Jan: -4.1% (est -0.4%; prev 1.4%; prevR 0.3%)

US

Building Permits Jan: 1899K (est 1750K; prev 1873K; prevR 1885K)

–

Building Permits (M/M) Jan: 0.7% (est -7.2%; prev 9.1%; prevR 9.8%)

US

EIA Natural Gas Storage Change (BCF) 11-Feb: -190 (est -195; prev -222)

–

Salt Dome Cavern NatGas Stocks (BCF): -34 (prev -24)

Argentina

Interest Rates- ARS …ARS CB hikes rates 250bps to 42.5% vs 40%.

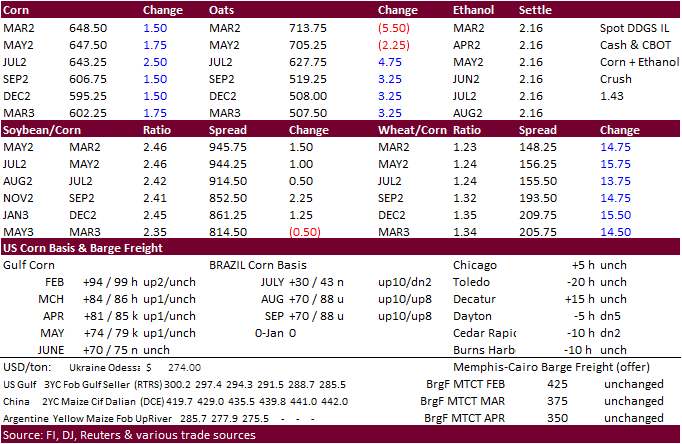

Corn

·

CBOT corn futures ended 2.50-4.25 cents higher on strength in wheat and renewed concerns over Ukraine/Russia tensions. USDA export sales were good.

·

The International Grains Council (IGC) – global corn production 1.203 billion tons, down 4 million tons from previous.

·

March options expire Friday.

Export

developments.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of animal feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal. Shipment for all the grains and soymeal was sought in February and March. On Feb. 11 they passed on 60,000 tons of feed barley and 60,000

tons of soymeal.

Updated

2/11/22

March

corn is seen in a $6.15 and $6.85 range

December

corn is seen in a wide $5.25-$7.00 range

·

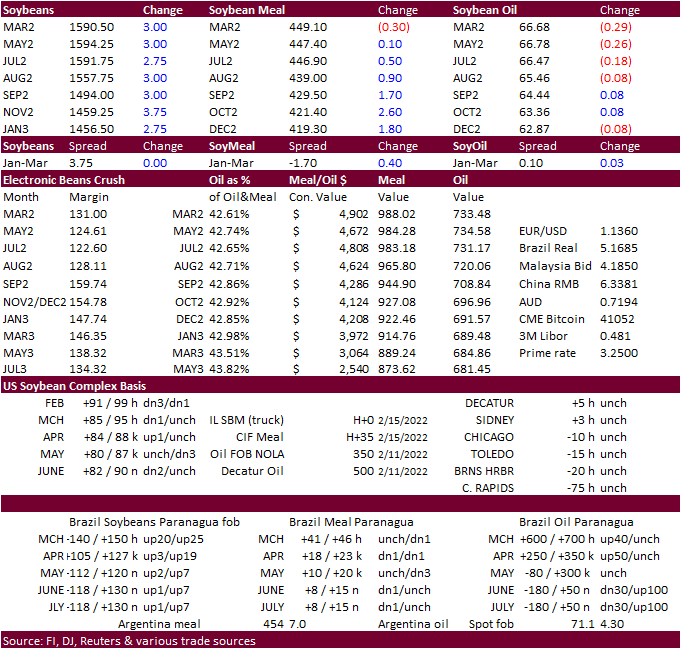

In a two-sided trade, soybeans settled 4.40-5.25 cents higher in part to follow through buying amid South American weather concerns. USDA reported 120,000 tons of soybeans were sold to unknown for 2021-22 delivery. USDA export

sales were good for the soybean complex.

·

Soybean meal settled $0.20 lower for March, $0.20 higher for May and $0.70 higher for July. Back months were up more than $1.00. SA supply concerns underpinned the back months.

·

Soybean oil ended 16 points lower for March and higher in the back months. Sharply lower WTI crude oil weighed on front month contracts.

·

The US generated 355 million biodiesel D4 blending credits in January, down from 584 million during December. For January 2021, EIA reported 300.2 million RINs were generated. January 2022 is on the low side, in our opinion.

We will have to wait a couple months to verify and see if renewable biodiesel contributed to an increase in production from January 2021.

·

Brazil’ Rio Grande do Sul into Mato Grosso do Sul will see less than an inch of rain through next Wednesday. Mato Grosso in Bahia will see too much rain during that period. Argentina rainfall amounts over the next week vary with

nothing to 2 inches locally. The heavier rain for Argentina will occur towards the end of the month. Overall southern Brazil and Argentina remain of concern.

·

Bloomberg noted as many as 10 cargos of soybeans have been washed out to China from Brazil but, premiums would say otherwise as they remain very firm.

·

AgriCensus noted Brazil soybean oil “basis premiums surged to 5.7 ct/lb above soyoil futures on CBOT, firming nearly 600 points since the start of the month, and resulting in flat prices to reach $1,573/mt FOB.”

·

March options expire Friday.

·

The soybean processor in Claypool, IN that had a fire earlier this week was back up and receiving deliveries today.

·

CNGOIC reported China’s crush volume totaled 660,000 tons last week, up sharply from 150,000 during the New Year holiday but well of 1.5 million for the comparable period year ago. They were just ramping up volume, which is now

expected to increase back to a normal level, around 1.7 million tons, according to AgriCensus citing CNGOIC.

University

of Illinois – 2021 Was a Devastating Year for Biodiesel Production Profits

Irwin,

S. “2021 Was a Devastating Year for Biodiesel Production Profits.” farmdoc

daily

(12):21, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 16, 2022.

- Private

exporters reported sales of 120,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year. - Results

awaited: Iran’s SLAL seeks up to 60,000 tons of animal feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal. Shipment for all the grains and soymeal was sought in February and March. On Feb. 11 they passed on 60,000 tons of feed barley and 60,000

tons of soymeal. - Turkey

seeks 6,000 tons of sunflower oil on February 23 for shipment between March 2 and March 25.

Updated

2/15/22

Soybeans

– March $14.75-$16.50

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $420-$480

Soybean

oil – March 64.00-68.00

·

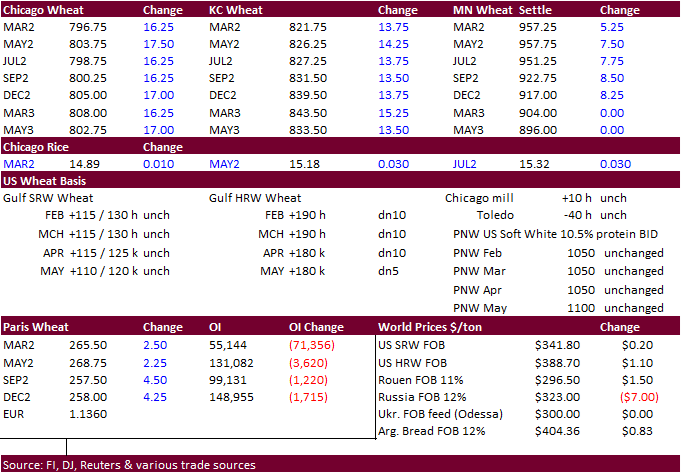

US wheat futures settled sharply higher on renewed Ukraine/Russia tensions, sizeable increase in global import demand, and higher EU wheat futures. Egypt bought 180,000 tons of Romanian wheat.

·

Despite ample offers in Egypt’s import tender for wheat today, May EU wheat futures traded up 2.25 euros at 368.25 euros per ton. But Russia/Ukraine tensions and Algeria picking up around 700,000 tons of wheat supported EU wheat.

·

All-wheat USDA export sales of 118,100 tons were within expectations but still very low for this time of year. The slowdown in wheat commitments (past three weeks) has increased the gap from year to date commitments of 642 million

bushels against previous year of 860 million, down 25 percent.

·

The International Grains Council (IGC) – global wheat production 781 million tons, unchanged.

·

India projected a record wheat crop of 111.3 million tons for the current local marketing year, ending June 2020. The five year average is 103.9 million tons.

·

A major US winter storm is underway, with rain, ice and snow expected a large portion of the lower central Great Plains and eastern US. 48-hour precipitation outlook below. The lower ECB will see additional precipitation mid

next week.

·

Egypt bought 180,000 tons of Romanian wheat at $318/ton fob ($338.55 CIF) for shipment April 1–10.

·

Algeria bought 700,000 tons of wheat at $346.50-$345.50/ton. They were in for optional origin for April shipment. They last bought wheat on Jan 26, paying around $375/ton.

·

The Philippines bought around 45,000 tons of feed wheat from Australia around $330-$340/ton for shipment in June and July.

·

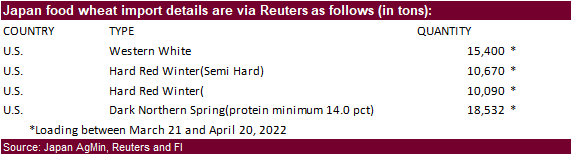

Japan bought 54,692 tons of food wheat from the US. Original details as follows:

·

Taiwan seeks 54,920 tons of US wheat on February 18, for April 4-18 shipment if off the PNW.

·

Turkey seeks 255,000 tons of feed barley on February 22. Shipment is sought for March 1-31.

·

Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

·

Jordan’s state grain buyer seeks 120,000 tons of milling wheat, optional origins, on Feb. 23, with shipment in 60,000 ton consignments, for July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15. They also seek 120,000 tons of feed

barley on Feb. 22.

Rice/Other

·

Reuters: Vietnam’s 5% broken rice was offered at $400 per ton on Thursday, the highest since mid-December and up from $395 a week ago. India’s 5% broken parboiled variety was unchanged at $368-$374 per ton.

South

Korea seeks 72,200 tons rice from U.S. and Vietnam on Feb. 25.

Updated

2/2/22

Chicago

March $7.25 to $8.30 range

KC

March $7.45 to $8.55 range

MN

March $8.75‐$10.00

USDA Export Sales

U.S. EXPORT SALES FOR WEEK ENDING 2/10/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

72.1 |

1,825.4 |

1,430.9 |

183.3 |

5,140.9 |

6,448.1 |

0.0 |

67.8 |

|

SRW |

14.2 |

610.9 |

439.0 |

55.7 |

1,963.4 |

1,264.0 |

10.5 |

135.6 |

|

HRS |

25.0 |

1,119.6 |

2,057.9 |

87.8 |

3,554.0 |

4,906.5 |

0.0 |

61.0 |

|

WHITE |

5.7 |

618.3 |

2,476.4 |

84.9 |

2,464.0 |

3,715.8 |

0.0 |

67.0 |

|

DURUM |

1.0 |

55.6 |

172.2 |

0.0 |

113.1 |

492.9 |

0.0 |

47.0 |

|

TOTAL |

118.1 |

4,229.8 |

6,576.3 |

411.6 |

13,235.3 |

16,827.5 |

10.5 |

378.4 |

|

BARLEY |

0.0 |

13.8 |

12.6 |

0.0 |

14.7 |

20.0 |

0.0 |

0.0 |

|

CORN |

820.0 |

24,199.8 |

35,584.7 |

1,617.6 |

22,332.7 |

22,969.6 |

113.5 |

1,565.5 |

|

SORGHUM |

148.4 |

4,119.3 |

3,094.1 |

141.6 |

2,385.7 |

2,837.0 |

-53.0 |

0.0 |

|

SOYBEANS |

1,361.8 |

9,311.7 |

9,178.4 |

1,213.0 |

38,809.9 |

50,460.9 |

1,526.0 |

4,499.3 |

|

SOY MEAL |

279.1 |

3,317.8 |

2,913.2 |

187.9 |

4,683.3 |

4,871.8 |

40.0 |

174.7 |

|

SOY OIL |

35.4 |

171.5 |

193.1 |

33.3 |

351.5 |

395.0 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

12.2 |

299.3 |

271.9 |

19.6 |

728.0 |

899.3 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

9.4 |

11.7 |

0.2 |

4.3 |

17.2 |

0.0 |

0.0 |

|

L G BRN |

0.5 |

19.9 |

13.1 |

0.5 |

29.1 |

23.6 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

45.1 |

97.3 |

22.4 |

40.4 |

54.4 |

0.0 |

0.0 |

|

L G MLD |

10.6 |

76.2 |

88.0 |

18.1 |

483.6 |

356.4 |

0.0 |

0.0 |

|

M S MLD |

0.7 |

179.2 |

223.5 |

1.6 |

217.8 |

282.1 |

0.0 |

0.0 |

|

TOTAL |

24.0 |

629.2 |

705.5 |

62.4 |

1,503.2 |

1,633.0 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

158.5 |

7,861.6 |

5,700.8 |

270.0 |

4,472.8 |

7,460.1 |

34.7 |

1,844.5 |

|

PIMA |

3.1 |

197.6 |

276.0 |

4.6 |

205.3 |

412.8 |

0.0 |

12.6 |

This

summary is based on reports from exporters for the period February 4-10, 2022.

Wheat: Net

sales of 118,100 metric tons (MT) for 2021/2022 were up 39 percent from the previous week, but down 61 percent from the prior 4-week average. Increases primarily for Guatemala (38,300 MT switched from unknown destinations), Mexico (28,100 MT), Japan (26,000

MT), Colombia (18,500 MT), and El Salvador (8,200 MT switched from unknown destinations), were offset by reductions for unknown destinations (21,500 MT). Total net sales for 2022/2023 of 10,500 MT were for Peru. Exports of 411,600 MT were up 8 percent from

the previous week and 9 percent from the prior 4-week average. The destinations were primarily to Mexico (93,800 MT), Taiwan (67,900 MT), the Philippines (62,900 MT), Thailand (57,700 MT), and Japan (43,400 MT).

Corn:

Net sales of 820,000 MT for 2021/2022 were up 39 percent from the previous week, but down 23 percent from the prior 4-week average. Increases primarily for Japan (600,200 MT, including 175,000 MT switched from unknown destinations and decreases of 700 MT),

Mexico (103,300 MT, including decreases of 38,600 MT), Canada (45,600 MT), the Dominican Republic (40,000 MT), and Colombia (32,500 MT, including decreases of 32,000 MT), were offset by reductions primarily for unknown destinations (68,900 MT). Net sales

of 113,500 MT for 2022/2023 were reported for Mexico (90,000 MT) and Japan (23,500 MT).

Exports of 1,617,600 MT–a marketing-year high–were up 41 percent from the previous week and 28 percent from the prior 4-week average. The destinations were primarily to Mexico (477,300 MT, including 136,300 MT – late), China (413,600 MT), Japan (291,700

MT), Canada (114,200 MT), and Colombia (64,500 MT).

Optional

Origin Sales:

For 2021/2022, new optional origin sales of 65,000 MT were reported for unknown destinations. Options were reported for exercised to export 60,000 MT to unknown destinations from the United States. The current outstanding balance

of 220,800 MT is for unknown destinations (115,000 MT), South Korea (65,000 MT), Italy (31,800 MT), and Saudi Arabia (9,000 MT). For 2022/2023, new optional origin sales of 2,400 MT were reported for Italy. The current outstanding balance of 3,900 MT is

for Italy.

Late

Reporting:

For 2021/2022, exports totaling 136,300 MT of corn were reported late to Mexico.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales of 148,400 MT for 2021/2022 were up 5 percent from the previous week, but down 42 percent from the prior 4-week average. Increases reported for China (208,400 MT, including 65,000 MT switched from unknown destinations) and Mexico (5,000 MT), were

offset by reductions for unknown destinations (65,000 MT). Total net sales reductions for 2022/2023 of 53,000 MT were for China. Exports of 141,600 MT were down 10 percent from the previous week, but up 15 percent from the prior 4-week average. The destinations

were to China (140,500 MT) and Mexico (1,100 MT).

Rice:

Net sales of 24,000 MT for 2021/2022 were down 88 percent from the previous week and 80 percent from the prior 4-week average. Increases primarily for Haiti (7,300 MT), Mexico (7,000 MT, including decreases of 600 MT), Costa Rica (5,000 MT), Canada (1,800

MT), and Jordan (1,700 MT), were offset by reductions for Taiwan (300 MT) and Honduras (300 MT). Exports of 62,400 MT were down 12 percent from the previous week, but up 12 percent from the prior 4-week average. The destinations were primarily to South Korea

(22,200 MT), Haiti (15,300 MT), Honduras (11,700 MT), Costa Rica (5,500 MT), and Mexico (3,300 MT).

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 1,361,800 MT for 2021/2022 were down 15 percent from the previous week, but up 26 percent from the prior 4-week average. Increases primarily for unknown destinations (371,700 MT), China (224,500 MT, including decreases of 2,300 MT), the Netherlands

(188,300 MT, including 112,600 MT switched from unknown destinations), Spain (121,500 MT, including 51,000 MT switched from unknown destinations), and Indonesia (94,500 MT, including 55,000 MT switched from unknown destinations, 200 MT switched from Vietnam,

and decreases of 3,300 MT), were offset by reductions for Costa Rica (400 MT). Net sales of 1,526,000 MT for 2022/2023 were reported for China (876,000 MT), unknown destinations (530,000 MT), Egypt (106,000 MT), Mexico (10,000 MT), and Taiwan (4,000 MT).

Exports of 1,213,000 MT were down 7 percent from the previous week and 19 percent from the prior 4-week average. The destinations were primarily to China (575,700 MT), the Netherlands (122,300 MT), Mexico (120,600 MT), Taiwan (68,800 MT), and Germany (66,000

MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 3,000 MT, all Canada.

Export

Adjustment:

Accumulated exports of soybeans to the Netherlands were adjusted down 65,997 MT for week ending January 27th. The correct destination for this shipment is Germany.

Soybean

Cake and Meal:

Net sales of 279,100 MT for 2021/2022 were up 16 percent from the previous week, but down 25 percent from the prior 4-week average. Increases primarily for the Philippines (95,100 MT, including decreases of 600 MT), Ecuador (68,900 MT), Morocco (31,600 MT,

including decreases of 400 MT), Canada (20,400 MT, including decreases of 400 MT), and Colombia (19,400 MT), were offset by reductions primarily for Ireland (40,000 MT). Total net sales of 40,000 MT for 2022/2023 were for Ireland. Exports of 187,900 MT were

down 33 percent from the previous week and 34 percent from the prior 4-week average. The destinations were primarily to the Philippines (50,000 MT), Mexico (26,400 MT), Canada (21,300 MT), Guatemala (19,000 MT), and Honduras (17,800 MT).

Soybean

Oil:

Net sales of 35,400 MT for 2021/2022 were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for unknown destinations (30,000 MT), Mexico (3,300 MT), Honduras (1,000 MT), and the Dominican Republic (800 MT).

Exports of 33,300 MT were up noticeably from the previous week and up 18 percent from the prior 4-week average. The destinations were primarily to South Korea (17,300 MT), the Dominican Republic (9,000 MT), Venezuela (3,000 MT), Mexico (2,100 MT), and Colombia

(1,500 MT).

Cotton:

Net sales of 158,500 RB for 2021/2022 were down 14 percent from the previous week and 46 percent from the prior 4-week average. Increases primarily for China (47,800 RB), Pakistan (23,900 RB), Vietnam (23,800 RB, including, 5,900 RB switched from South Korea

and 1,000 RB switched from Japan), Turkey (22,300 RB), and Peru (11,900 RB), were offset by reductions for South Korea (5,900 RB). Net sales of 34,700 RB for 2022/2023 were primarily for Pakistan (14,100 RB), Mexico (5,400 RB), Turkey (4,400 RB), Indonesia

(3,500 RB), and Portugal (2,200 RB). Exports of 270,000 RB were down 10 percent from the previous week, but up 8 percent from the prior 4-week average. The destinations were primarily to China (117,000 RB), Pakistan (46,300 RB), Vietnam (33,000 RB), Turkey

(20,200 RB), and Mexico (17,800 RB). Net sales of Pima totaling 3,100 RB were down 42 percent from the previous week and 40 percent from the prior 4-week average. Increases primarily for India (1,700 RB, including decreases of 900 RB), Peru (500 RB), China

(400 RB), and Vietnam (400 RB), were offset by reductions for Greece (400 RB). Exports of 4,600 RB were down 78 percent from the previous week and 61 percent from the prior 4-week average. The destinations were primarily to China (2,100 RB), Thailand (600

RB), Bangladesh (500 RB), Peru (400 RB), and India (300 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 61,600 RB is for Vietnam (52,800 RB) and Pakistan (8,800 RB).

Exports

for Own Account: For

2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales of 434,800 pieces for 2022 were up 60 percent from the previous week and 2 percent from the prior 4-week average. Increases primarily for China (219,300 whole cattle hides, including decreases of 13,600 pieces), South Korea (89,400 whole cattle

hides, including decreases of 1,200 pieces), Mexico (44,000 whole cattle hides, including decreases of 500 pieces), Brazil (27,200 whole cattle hides, including decreases of 100 pieces), and Thailand (21,500 whole cattle hides, including decreases of 1,200

pieces), were offset by reductions primarily for Italy (6,600 pieces). Total net sales of 1,800 calf skins were for Italy. In addition, total net sales of 5,600 kip skins were for Italy. Exports of 415,000 pieces were up 28 percent from the previous and

12 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (269,800 pieces), South Korea (52,100 pieces), Mexico (29,200 pieces), Thailand (15,800 pieces), and Indonesia (13,900 pieces).

Net

sales of 151,900 wet blues for 2022 were up noticeably from the previous week and up 6 percent from the prior 4-week average. Increases were primarily for Italy (30,800 unsplit, 12,700 grain splits, including decreases of 200 unsplit and 200 grain splits),

Vietnam (36,800 unsplit, including decreases of 100 unsplit), China (32,000 unsplit), India (10,800 grain splits), and Mexico (10,300 unsplit).

Exports of 167,700 wet blues were up noticeably from the previous and up 19 percent from the prior 4-week average. The destinations were primarily to China (52,100 unsplit), Vietnam (45,800 unsplit), Italy (29,400 unsplit and 11,700 grain splits), Thailand

(10,900 unsplit), and Mexico (4,200 grain splits and 2,800 unsplit). Net sales of 37,800 splits were reported for Vietnam (32,800 pounds), South Korea (2,500 pounds, including decreases of 6,900 pounds), and China (2,500 pounds). Exports of 449,000 pounds

were to Vietnam (320,000 pounds) and China (129,000 pounds).

Beef:

Net sales of 23,000 MT for 2022 were up 18 percent from the previous week and 38 percent from the prior 4-week average. Increases were primarily for South Korea (10,100 MT, including decreases of 600 MT), Japan (7,200 MT, including decreases of 200 MT), Canada

(1,600 MT, including decreases of 200 MT), Mexico (1,200 MT, including decreases of 100 MT), and China (600 MT, including decreases of 1,100 MT). Exports of 16,500 MT were up 13 percent from the previous week and 10 percent from the prior 4-week average.

The destinations were primarily to South Korea (4,900 MT), Japan (4,300 MT), China (2,400 MT), Taiwan (1,400 MT), and Mexico (1,200 MT).

Pork:

Net sales of 18,300 MT for 2022 were up 1 percent from the previous week, but down 46 percent from the prior 4-week average. Increases were primarily for Mexico (4,800 MT, including decreases of 900 MT), South Korea (3,400 MT, including decreases of 400 MT),

Japan (3,300 MT, including decreases of 1,100 MT), Canada (2,400 MT, including decreases of 400 MT), and the Dominican Republic (1,600 MT). Exports of 31,000 MT were up 2 percent from the previous week, but unchanged from the prior 4-week average. The destinations

were primarily to Mexico (14,200 MT), Japan (4,900 MT), China (3,500 MT), South Korea (2,600 MT), and Canada (1,700 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.