PDF Attached

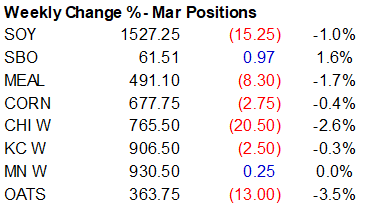

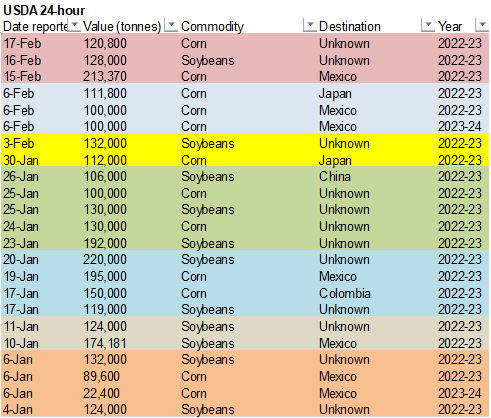

Attached are our updated US soybean complex S&D’s. US markets are closed Monday during the day for President’s holiday, with trading resuming 7 pm CT Monday evening. USDA reported private exporters reported sales of 120,800 tons of corn for delivery to unknown destinations during the 2022-23 marketing year. Choppy trade occurred today in the CBOT soybean complex and grains. Meal was leading soybeans before the overnight electronic close. Soybean oil opened and ended lower. Soybean meal during the day session gave up early gains, but soybeans managed to close higher on SA weather concerns. Grains were mixed with corn higher, Chicago wheat near unchanged, KC higher and MN mixed. Why corn was higher is a head scratcher. WTI crude tanked and the March corn position was in a narrow two-sided range headed into Friday (lack of direction?). Brazil is still in the early stage of second corn crop planting season. April and May rains are more important than a slow start in sowings for the second Brazil corn crop. The CFTC Commitment of Traders report will be released Feb 24, starting with positions as of January 31. They plan to catch up by early March.

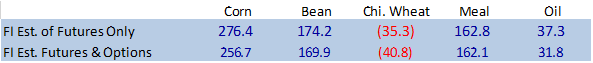

Estimate of fund positions

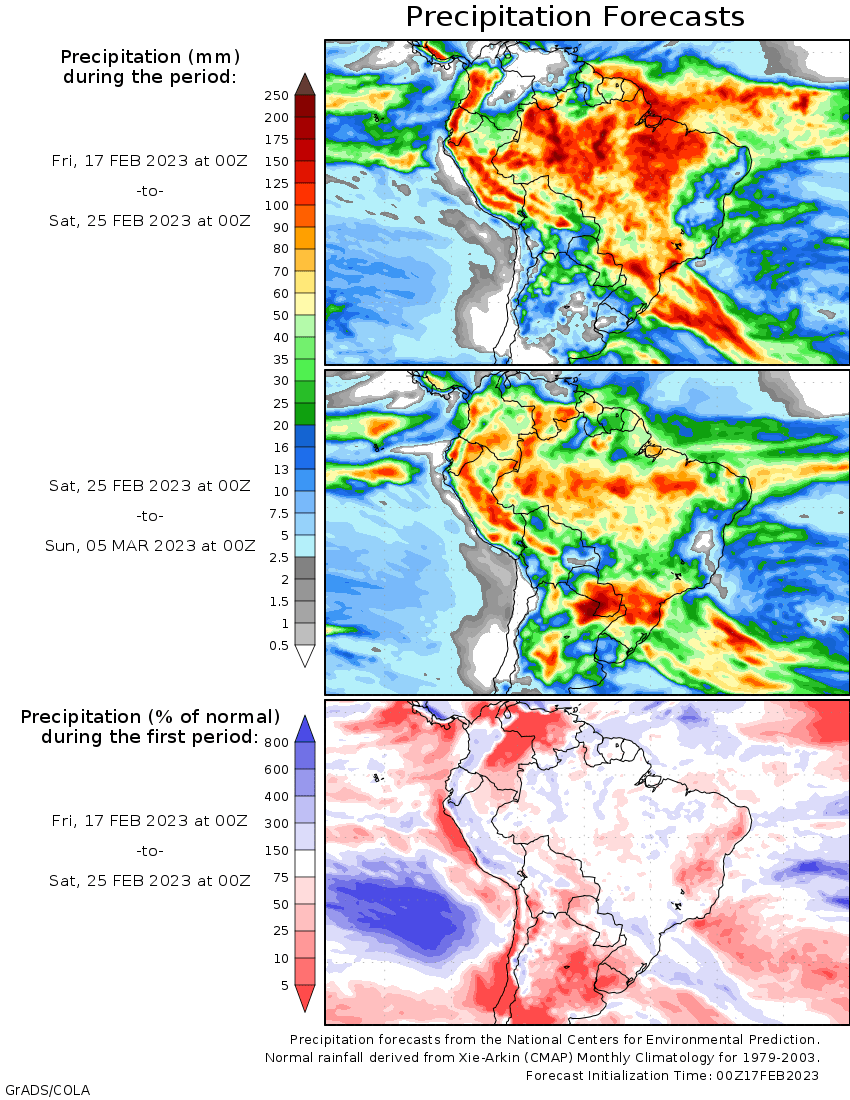

WORLD WEATHER HIGHLIGHTS FOR FEBRUARY 17, 2023

- Unusually cool temperatures occurred in southwestern Argentina this morning with extreme lows of 37 to 46 degrees Fahrenheit or +2 to +8C

- Readings were not cold enough for a long enough period of time to induce any threat of damage, although crop growth rates were slowed

- Argentina is advertised to be dry through Wednesday of next week

- Showers and thunderstorms that develop late next week are unlikely to soak the ground, but any moisture would be welcome

- The precipitation will be greatest in the north where some relief from dryness is likely; however, southern parts of the nation are unlikely to get significant moisture through the first day in March

- No change in Brazil’s forecast was noted overnight

- A disruption to farming activity is likely in Mato Grosso this weekend and next week for a little while and then drier weather will resume again late this month and in early March

- Brazil’s wettest weather is still expected in Parana, Sao Paulo, Mato Grosso do Sul and southern Minas Gerais where delays in harvesting are most likely

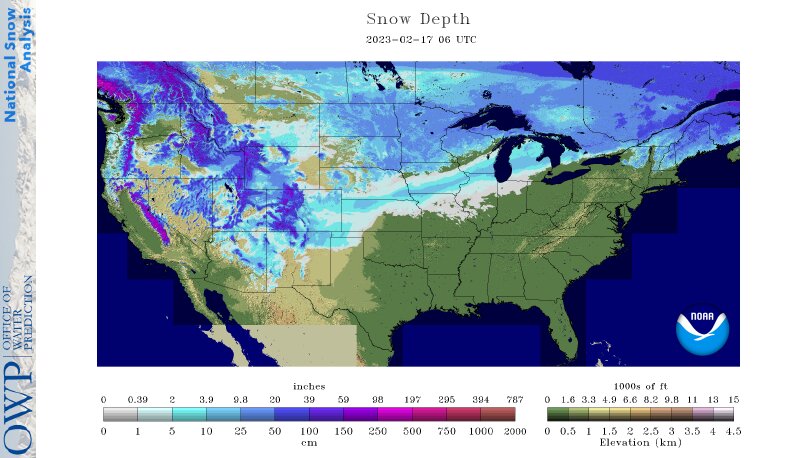

- U.S. hard red wheat areas received significant snow Wednesday into Thursday morning with most of the snow occurring during the day Thursday falling from central and southwestern Iowa to northern and central Lower Michigan

- Total accumulations from Colorado to Michigan the past two days ranged from 4 to 11 inches and moisture from the eventual melting snow will lift topsoil moisture in a part of the central Plains

- Snow will fall in the northern U.S. Plains and upper Midwest during the middle part of next week slowing travel, but providing some beneficial moisture when the snow melts

- Florida, southern Georgia and South Carolina will experience net drying over the next 10-12 days while precipitation is much more abundant in the Tennessee River Basin and the immediate Ohio River Valley

- Western Europe will experience a boost in precipitation next week improving topsoil moisture for France, northern Spain and northern Portugal as well as across much of the North and Baltic Sea regions

- Southeastern Europe will be driest over the next ten days

- North Africa precipitation will be restricted over the next week except in Morocco where some welcome rain is likely

- No change in production potential is expected, though

- Waves of snow will move from the Baltic States and Belarus through southwestern Ukraine to the southern Ural Mountain region and northwestern Kazakhstan crop areas during the coming week to ten days

- The snow may slow travel and stress livestock

- India is still advertised to receive a restricted amount of rain during the next two weeks resulting in crop moisture stress during reproduction

- China weather will continue mostly good for its winter crops during the next two weeks

- Southeast Asia oil palm weather will be mostly good over the next two weeks

- Eastern Australia summer crop areas will continue to experience an erratic rainfall pattern that will not benefit very many crops for a while

Source: World Weather and FI

Monday, Feb. 20:

- Suspended until February 24 – CFTC commitments of traders

- MARS monthly report on EU crop conditions

- Malaysia’s Feb. 1-20 palm oil export data

- HOLIDAY: US, Argentina

Tuesday, Feb. 21:

- National Farmers’ Union Conference, Birmingham, UK, day 1

- Grain Forum Dubai 2023, day 1

- New Zealand global dairy trade auction

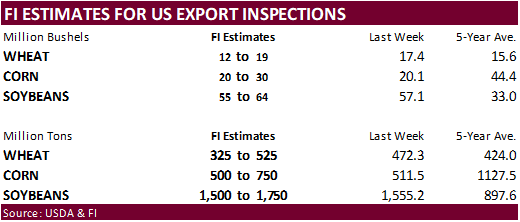

- USDA export inspections – corn, soybeans, wheat, 11am

- EU weekly grain, oilseed import and export data

- HOLIDAY: Argentina, Bangladesh

Wednesday, Feb. 22:

- National Farmers’ Union Conference, Birmingham, day 2

- Grain Forum Dubai 2023, day 2

- USDA total milk production, 3pm

- US poultry slaughter, 3pm

Thursday, Feb. 23:

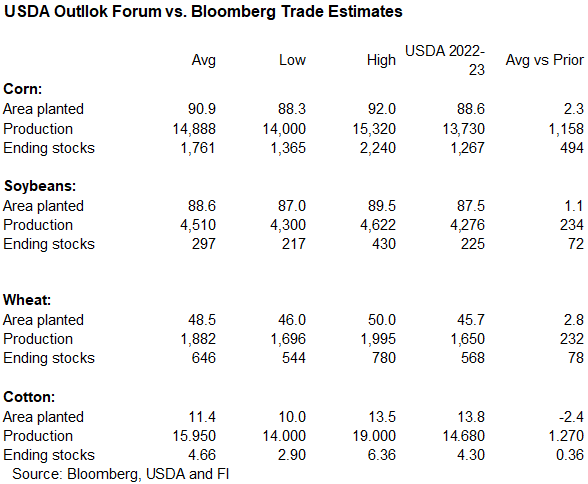

- USDA’s acreage outlook for corn, soy, wheat and cotton

- The USDA’s Agricultural Outlook Forum, Arlington, day 1

- EIA weekly US ethanol inventories, production, 10:30am

- Port of Rouen data on French grain exports

- Sugar production and cane crush data from Brazil’s Unica (tentative)

- USDA red meat production, 3pm

- HOLIDAY: Russia

Friday, Feb. 24:

- USDA’s full outlook for corn, soy, wheat and cotton

- The USDA’s Agricultural Outlook Forum, Arlington, day 2

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

- US cattle on feed, 3pm

- US cold storage data for beef, pork and poultry, 3pm

CFTC Commitment of Traders report delayed until Feb 24; catch up by mid-March

February 16, 2023

Washington, D.C. — Staff of the Commodity Futures Trading Commission Divisions of Clearing and Risk, Market Participants, Data, and Market Oversight today released the following statement to update the public on reporting delays due to the cyber-related incident at ION Cleared Derivatives (a subsidiary of ION Markets), a third-party service provider of cleared derivatives order management, order execution, trading, and trade processing:

“Following the ION cyber-related incident, reporting firms are continuing to experience some issues submitting timely and accurate data to the CFTC. As a result, the weekly Commitments of Traders (CoT) report that normally would have been published on Friday, February 17, will be postponed.

“CFTC staff intends to resume publishing the CoT report as early as Friday, February 24, 2023. Staff will begin with the CoT report that was originally scheduled to be published on Friday, February 3, 2023. Thereafter, staff intends to sequentially issue the missed CoT reports in an expedited manner, subject to reporting firms submitting accurate and complete data. Staff anticipates that, pending the timely, accurate and complete submission of backlogged data by reporting firms to the CFTC, these missed CoT reports will be published by mid-March. After that, CoT report publication will resume its usual weekly schedule.”

https://www.cftc.gov/PressRoom/PressReleases/8662-23

Macros

98 Counterparties Take $2.060 Tln At Fed Reverse Repo Op. (prev $2.032 Tln, 98 Bids)

US Import Price Index (M/M) Jan: -0.2% (est -0.1%; prev 0.4%)

US Export Price Index (M/M) Jan: 0.8% (est -0.2%; prev -2.6%)

US Import Price Index (Y/Y) Jan: 0.8% (est 1.4%; prev 3.5%)

US Export Price Index (Y/Y) Jan: 2.3% (est 2.8%; prev 5.0%)

Canadian Industrial Product Price (M/M) Jan: 0.4% (est -0.1%; prev -1.1%)

Canadian Int. Securities Transactions Dec: C$21.22B (prev C$12.76B)

Canadian Raw Materials Price Index (M/M) Jan: -0.1% (est -0.2%; prev -3.1%)

US Leading Index (M/M) Jan: -0.3% (est -0.3%; prev -0.8%)

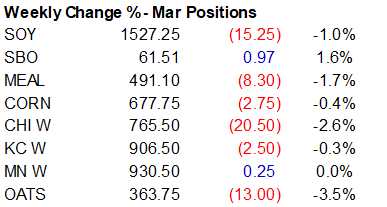

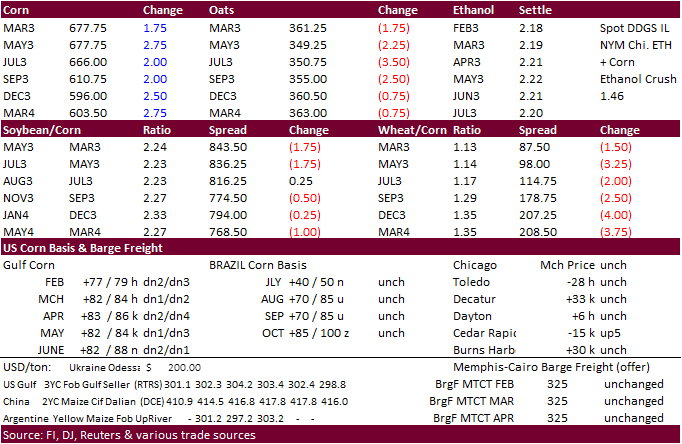

· CBOT corn futures ended Friday 1.75-2.50 cents higher on light technical buying after the contract recorded some losses headed into the last trading session of the week ahead of the long holiday weekend. Lack of direction was seen. March corn was down 0.4% for the week. Traders are still focused the impact the drought has had on Argentina and RGDS, Brazil, crop production.

· Without any major market moving news, the May corn contract is seen in a $6.68 to $6.84 trading range. March position fulfilling hedges is nearly done, and we would think about closing or rolling positions early next week, after the holiday. Due to the US holiday, CBOT ag trading resumes for Monday evening (7 pm CT) (President’s Day). Argentina is also on holiday Monday.

· WTI crude oil fell hard on ideas the US Fed will hike interest rates by at least 25 basis points during their next meeting and global economic concerns. Russian oil producers may keep their current level of exports unchanged in March. This comes after the government said they were going to scale back.

· USDA reported private exporters reported sales of 120,800 tons of corn for delivery to unknown destinations during the 2022-23 marketing year.

· Bird flu vaccines might be adopted by several more countries after cases skyrocketed across the globe since mid-December.

· On February 24 USDA NASS will issue 2023-24 US S&D and selected world (exports, etc.) projections. This report may have some impact on new-crop futures prices. https://www.usda.gov/oce/ag-outlook-forum

· Guatemala reported a H5N1 bird flu outbreak in wild birds.

Export developments.

- South Korea’s NOFI group bought 68,000 tons of corn out of 138k sought, optional origin, for June shipment at an estimated $336.72/ton c&f.

- USDA reported private exporters reported sales of 120,800 tons of corn for delivery to unknown destinations during the 2022-23 marketing year.

Updated 02/17/23

March corn $6.60-$6.90 range. May $6.25-$7.15

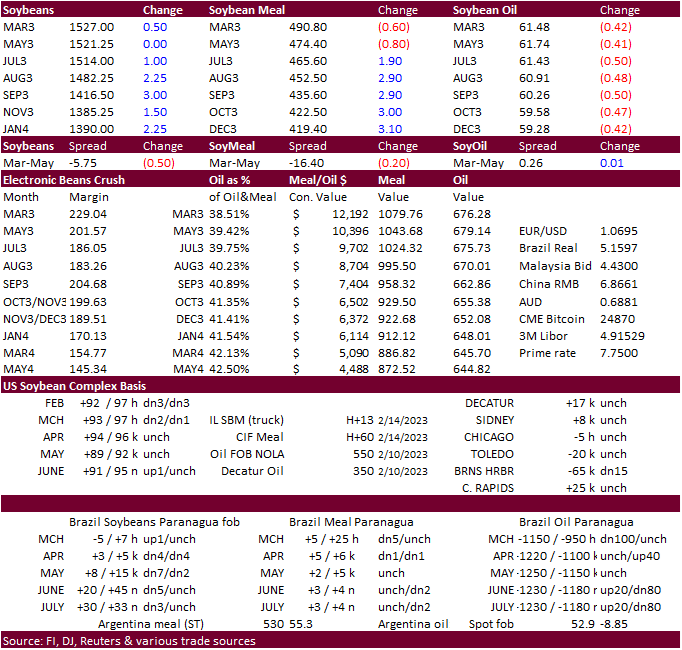

· CBOT soybeans ended higher, but not from the lead in soybean meal. Uncertainty over Argentina crop production and Brazil harvesting progress lifted soybeans higher. Brazil will get soybeans harvested, but some shippers are concerned meeting early deadlines. CBOT soybean meal traded in a wide range. After it rallied a few times during the session, long traders took profits. The market settled lower basis March and May and higher back months. Soybean oil opened and settled lower from a large decline in WTI crude oil and profit taking. Palm oil closed at their highest level in six weeks, but this did little to support CBOT prices. Note palm futures gapped higher for the third consecutive day. It will be interesting to see how it trades Monday but may have some direction from Brent crude oil futures and any palm trade developments. Malaysian trade data for the 1-20 February period should be out Monday.

· USDA’s annual Outlook Forum will start Thursday and trade estimates for US supply are supplied above the corn comment. Note the wide range in 2023 US soybean and corn acreage for the US (2.5 million acre range for soybeans and nearly 4 million corn).

· We updated our US soybean complex supply and demand estimates. Some FI changes for US included:

- Oct-Dec crush down to 2.227 from 2233 and Sep-Aug crush to 2222 from 2231.

- No major changes to demand for US soybeans

- SBM production slightly higher due to cut in yield from 47.50 to 47.28

- Meal imports are down about 100k short tons, exports down 300k, and domestic use up 150k

- Soybean oil yield was raised from 11.65 to 11.73

- Imports lowered from 600 million pounds to 500

- Exports were lowered to 600 million pounds from 800 million

- SBO food use increased 100 to 14.250 billion pounds from 14.150 billion pounds

· Malaysia May position palm futures on Friday were up 62 ringgit to 4,131 and May cash was up $7.50/ton to $972.50/ton.

Export Developments

· China’s Sinograin seeks 10,875 tons of domestic 2022 crop year soybeans on February 17.

Updated 02/17/23

Soybeans – March $15.00-$15.50, May $14.75-$16.00

Soybean meal – March $480-$510, May $425-$500

Soybean oil – March 60.00-63.00, May 58-70

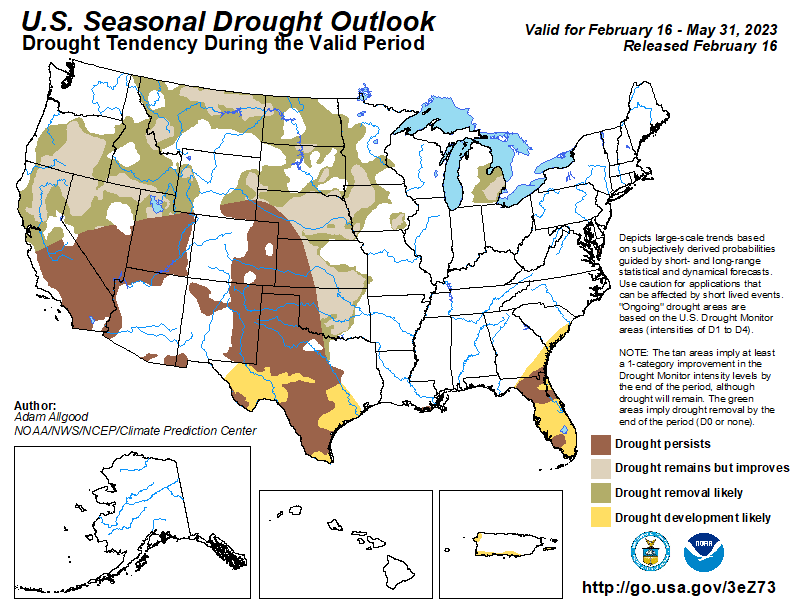

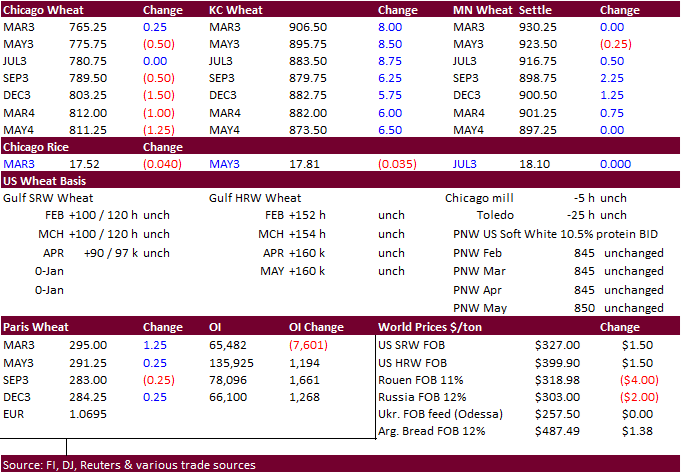

· US wheat futures traded two-sided, with Chicago and MN mixed and KC sharply higher. US subsoil and drought has not improved much for winter wheat areas since late last NA fall, and this is leading many to believe yields may come in well below trend when harvest in a few months arrive. But wheat is a weed, so look for a rebound in conditions if the US sees a good soakings from La Nina abating March forward. US CPC is not optimistic but does show improvement for central and eastern Great Plain areas.

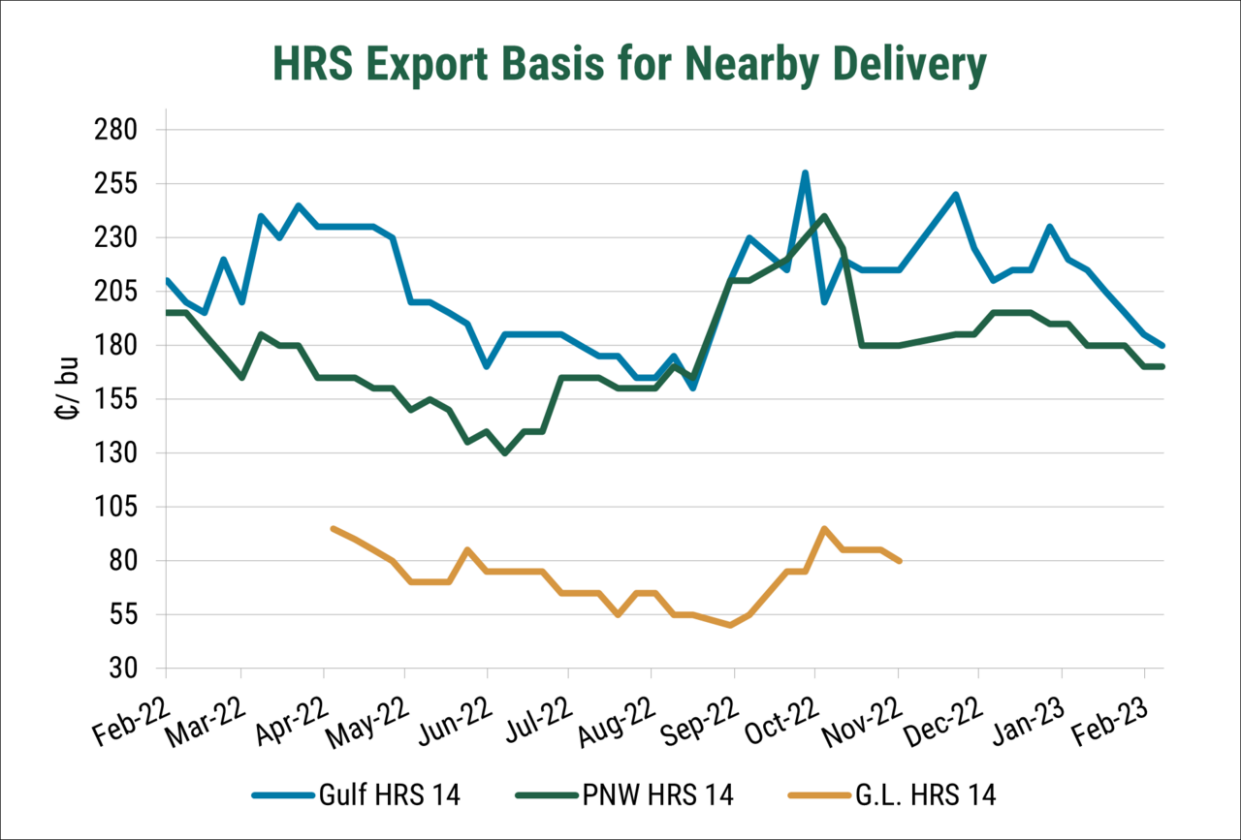

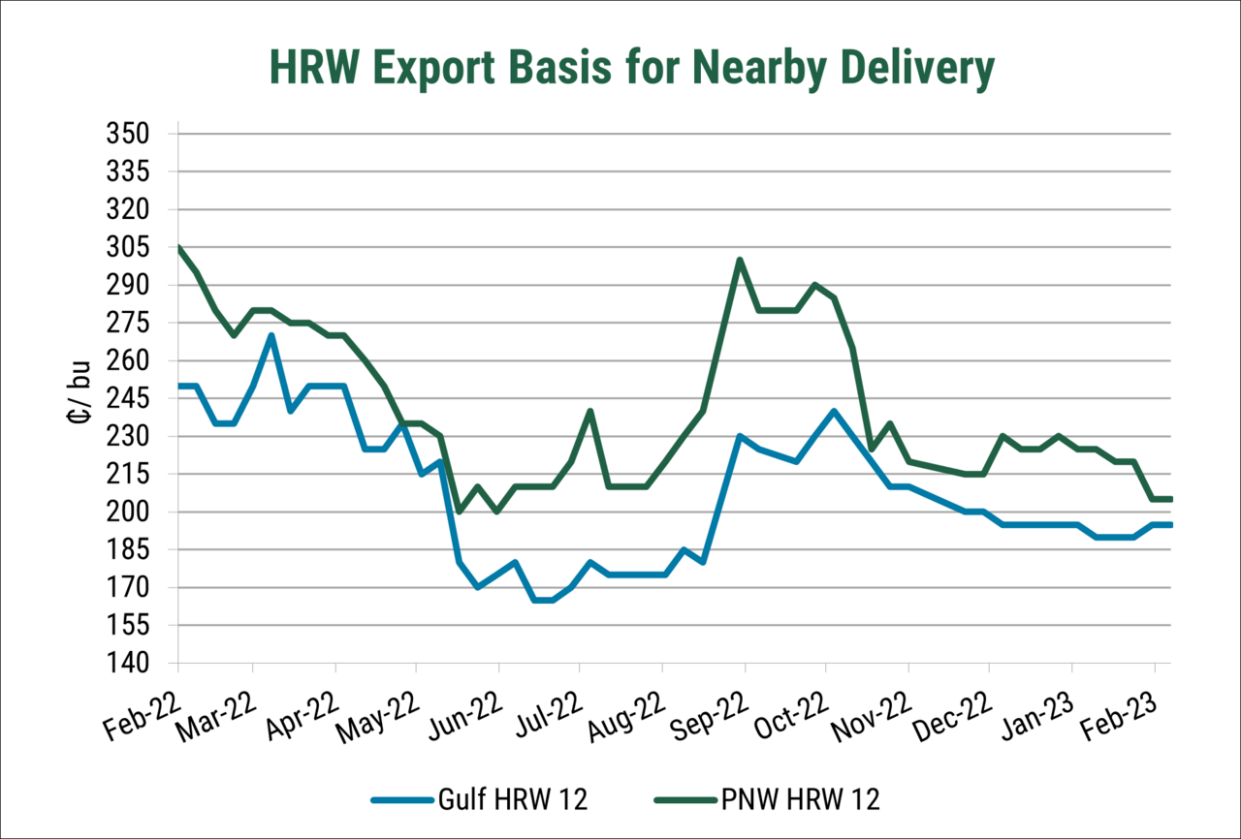

US Wheat Associates

· Ukraine’s UGA sees a lower 2023 grain and oilseed harvest of 64.8 million tons from 72.7 million in 2022. They pegged wheat at 17.4 million tons and corn at 21.1 million. Exports were seen at 14 million tons for wheat and 20 million tons for corn.

· China’s winter wheat crop is in good shape although some areas vary, according to a government official.

· French wheat crop ratings were 93% good/excellent for the week ending February 13, up from 92% previous week, down from 97% from early December and down from 95% year ago. Spring barley plantings were 58 percent, up from 26 percent previous week and compares to 26 percent year earlier.

· Paris May wheat was up 0.25 euro or 0.10% at 291.50 per ton.

Export Developments.

· Tunisia bought 100,000 tons of soft wheat (lowest offer earlier was $337.80/ton c&f) and 75,000 tons of feed barley (lowest offer earlier $298/ton), both optional origin, for March 1-30 shipment.

· Jordan’s state grain buyer seeks up to 120,000 tons of optional origin milling wheat on Feb. 21 for shipment between June 1-15, June 16-30, July 1-15 and July 16-31.

· Jordan’s state grain buyer seeks up to 120,000 tons of optional origin feed barley on Feb. 22 for shipment between June 1-15, June 16-30, July 1-15 and July 16-31.

Rice/Other

· None reported

Updated 02/17/23

Chicago – March $7.50 to $7.90, May $7.00-$8.25

KC – March $8.75-$9.25, $7.50-$9.25

MN – March $9.10 to $9.50, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |