PDF Attached

Russia

invaded Ukraine on three fronts, sending most global commodity and equity markets in a frenzy. Overnight into early morning many CBOT agriculture commodity markets traded limit higher, only to gyrate for the remainder of the day. One of the biggest concerns

amongst traders was that the Ukraine ports were shut down. Fundamental news outside the Ukraine situation was extremely light. Note with the selloff in soybeans, the trade has a long delta position in soybean calls. With today’s move, we did not see a massive

liquidation by option traders. It was mainly a futures price selloff.

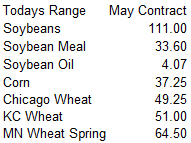

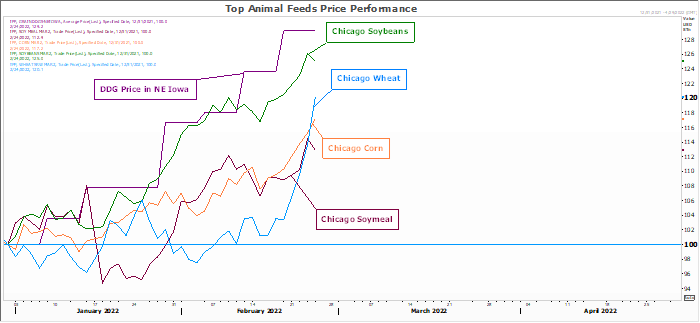

The

wide trading range in May agriculture futures is a good snapshot to visualize the volatility

CBOT

limits expand for Chicago and KC wheat https://www.cmegroup.com/trading/price-limits.html

![]()

The

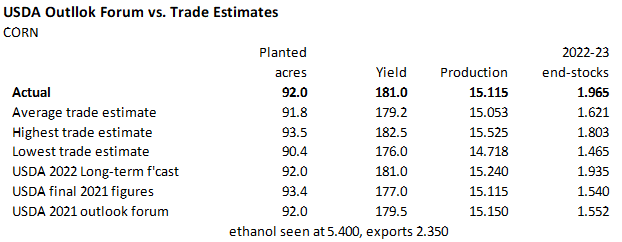

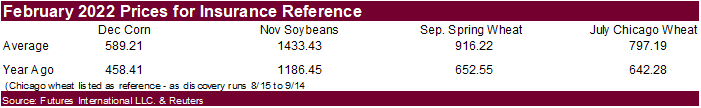

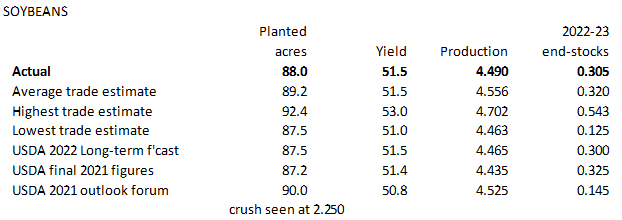

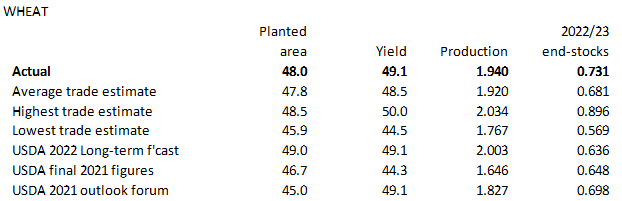

USDA Agriculture Forum kicked off. Based on the S&D’s USDA released, corn and wheat ending stocks and acreage were bearish, while soybeans were slightly bullish.

https://www.usda.gov/oce/ag-outlook-forum

Link

to commodity reports https://www.usda.gov/oce/ag-outlook-forum/2022-commodity-outlooks

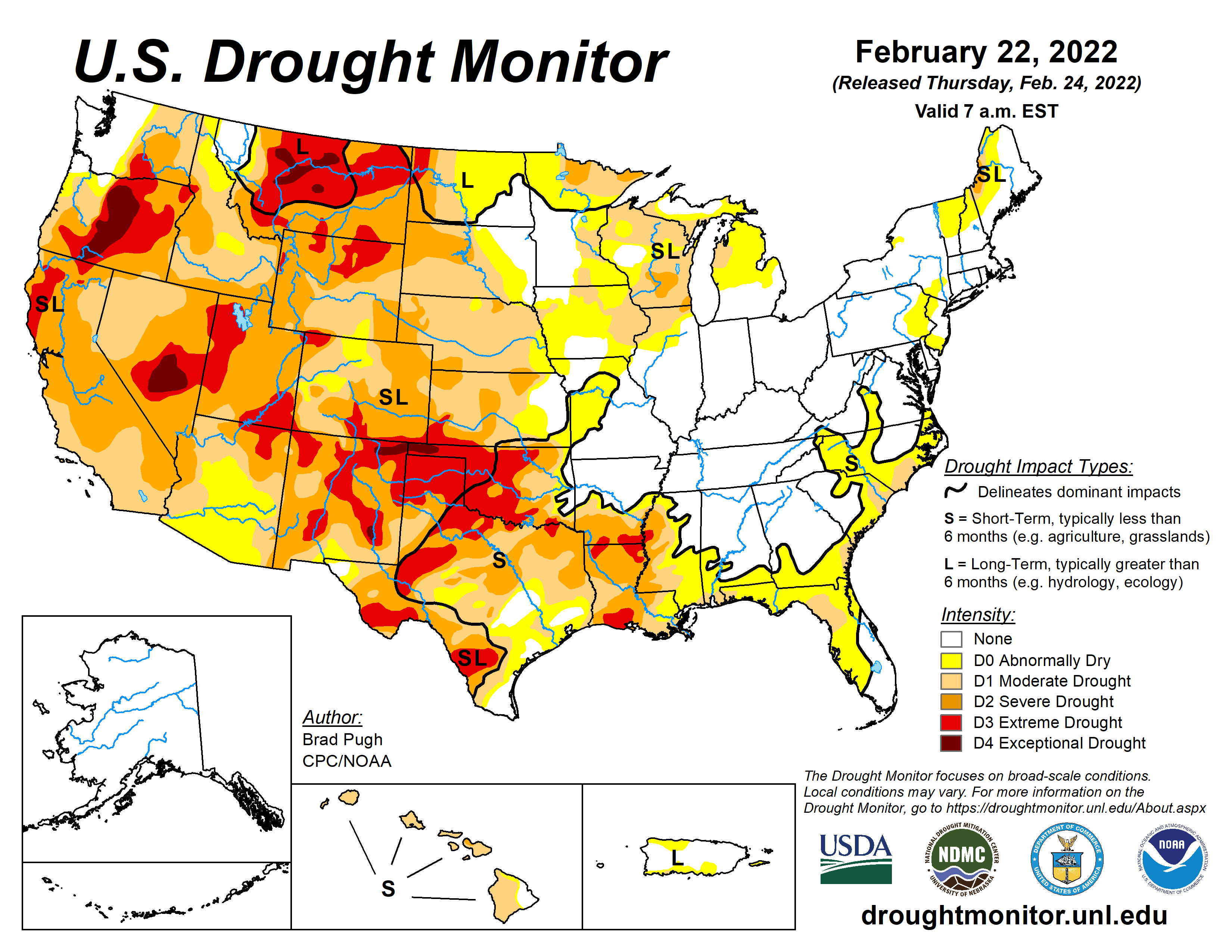

WEATHER

EVENTS AND FEATURES TO WATCH

- Rain

fell across much of central and southern Argentina Wednesday and overnight - The

precipitation maintained good soil moisture in southern Cordoba, northeastern La Pampa and Buenos Aires while bolstering topsoil moisture in central and southern Santa Fe and Entre Rios - Some

of the rain was light, but it was great enough to reduce stress - Follow

up rain in Argentina during the next week to ten days will eventually bring greater rainfall to the driest areas and that will make the improving environment more complete, but it will take multiple days of showers and thunderstorms - Rio

Grande do Sul, Brazil, like Argentina, will receive showers and thunderstorms this weekend into next week that will eventually offer a welcome reprieve form recent moisture and heat stress - Crop

conditions should improve, although a restoration in yield potentials for this summer’s crops is not likely - The

moisture will stop the decline in late fully season crop conditions - Interior

southern Brazil will continue dry biased through Monday and into Tuesday of next week - After

that showers and thunderstorms are expected for a little while and the moisture will bring relief to recent dryness, heat and plant moisture stress - Additional

rain will be needed, but the relief will be welcome - Safrinha

corn will benefit most from the rain next week - Some

fields in Mato Grosso do Sul and Parana are too dry to support good crop establishment and early development - The

rain next week should stimulate new crop development, although follow up rain will be very important - Northern

Brazil rainfall has already begun to diminish and the combination of warmer temperatures and greater sunshine is accelerating daily drying

- A

boost in late season soybean and other crop harvesting is expected - Safrinha

crops from Mato Grosso to Minas Gerais will improve and benefit most from this drier bias - Coffee,

citrus and sugarcane production areas in Brazil are still rated favorably with little change likely over the next ten days - Northwest

Africa and parts of Spain are advertised to be a little wetter next week than previously suggested - The

moisture boost is needed to restore favorable soil moisture for aggressive wheat and barley development - Dryness

in recent weeks and months has raised concern about small grain production in northwestern Africa, although northeastern Algeria and far northern Tunisia never became too dry - Morocco

crops cannot fully recover from this year’s dryness because much of the crop in the southwest is dry and water supply has been depleted so that no planting could occur this year - Irrigated

and rain-fed crops in the remainder of northwestern Africa will benefit from the moisture and crop development could improve greatly with routinely occurring rainfall - Confidence

is not high over the prospects for additional rain, but the most active time of the year for storm systems to impact northern Africa is now - Middle

East rainfall over the coming week will prove to be welcome and beneficial so that there is an opportunity for additional crop improvements after a dry autumn and early winter - U.S.

hard red winter wheat areas were bitterly cold again this morning with positive and negative single digit lows occurring in many areas especially in the high Plains region into Nebraska - The

cold might not have caused much winterkill, but some plant damage has occurred this winter through drought, heaving topsoil and other bouts of bitter cold without snow cover - The

region needs a wet and mild to cool spring to allow surviving plants a good opportunity for recovery - The

long range outlook does not provide a very good environment for crop recovery, but March and early April should provide some “temporary” relief - U.S.

southeastern states drying will be closely monitored over the next few weeks - Classic

La Nina will perpetuate the drier tendency in the region this spring which could impact corn and other early season crops - Too

much moisture is present across the northern U.S. Delta, parts of the Tennessee River Basin and lower and eastern Midwest - The

situation will improve this weekend and next week with a short term bout of drying, but more rain is expected in March to perpetuate the excessive moisture situation resulting in some potential for crop planting delays - West

Texas precipitation is expected to remain restricted over the next ten days, although it would not be surprising to see a little rain develop in early March - South

Texas precipitation is expected to be sporadic and mostly light over the next ten days leaving need for greater precipitation

- Corn,

sorghum and cotton will be planted in March with some fieldwork already under way

- Not

much relief from dryness is expected in the northwestern U.S. Plains or southwestern Canada’s Prairies for a while, although a little snowfall will come and go - California’s

precipitation potential will remain restricted and snow water equivalency in the Sierra Nevada will remain below average into April 1 which is the normal peak in the winter precipitation period.

- Ecuador,

Peru and Colombia crop areas will continue to see frequent rain over the next week maintaining moisture abundance for some areas and raising soil moisture in other areas - Southern

China is getting a break from recent wet weather this week with much less rain and less frequent precipitation.

- Temperatures

should trend a little warmer this week and remain that way next week - Most

other areas in China are experiencing mostly good crop and field conditions - Wheat

and rapeseed are mostly dormant or semi-dormant, but poised to perform well this spring if temperatures warm up normally in March and April - Some

rapeseed areas in the Yangtze River Basin have been too wet recently and this week’s drier weather will be welcome - Northern

Vietnam and northern Laos will continue to dry down following impressive weekend rainfall - The

precipitation was great enough to possibly induce some premature coffee flowering, although cool temperatures might have helped to curtail that event - Some

winter rice crop quality decline might have occurred - Drier

weather is expected over the next week to ten days - Indonesia,

Malaysia and Philippines weather will remain mixed over the next ten days with most crops staying in good condition. - Net

drying is expected in the Philippines during this first seven days of the outlook and then trend wetter in the following week - Most

of Europe outside of the Iberian Peninsula and parts of Romania are favorably moist with routinely occurring precipitation in the next ten days supporting status quo winter crop conditions.

- Greater

rain must occur soon for Spain and Portugal and at some time in the next few weeks in Romania to prevent dryness from threatening early season crop development - Weather

in the coming ten days will produce light and somewhat erratic precipitation, but soil moisture is good except as noted above leaving the outlook relatively benign on agriculture.

- Western

Russia, northwestern Ukraine, Belarus and Baltic States have abundant soil moisture and some areas in Russia are still buried beneath significant snow accumulations - Flood

potentials may be high for the spring this year in Russia if the region heats up too fast and all of the snow melts over a short period of time - There

is no threatening cold temperatures expected in Europe or any part of Europe during the next ten days to two weeks - Temperatures

will be above normal especially in Russia, Ukraine and eastern Europe - Kazakhstan

and southern Russia’s New Lands will receive only light amounts of precipitation in the next ten days, but any moisture would be welcome for improved topsoil conditions in the spring - Recent

snowfall has changed the early spring moisture outlook at least a little, but the region still has moisture deficits left over from drought last summer and greater precipitation will be needed in the spring.

- India

precipitation will be limited to a few sporadic very light showers during the next ten days except in the far north and extreme east where some moderate rain may impact a few areas - A

weak tropical disturbance may impact Sri Lanka and the far southern tip of India next week, but confidence is low.

- The

bulk of winter crops in the nation are poised to perform well barring no excessive heat in the next few weeks - At

least one more timely rain event would help push yields high than usual - Xinjiang,

China precipitation is expected to be restricted during the next week to ten days - The

province needs moisture to support spring planting in a few weeks - Eastern

Australia’s summer crop areas will receive additional scattered showers and thunderstorms today and Friday followed by drier weather - The

resulting precipitation will be ideal for reducing moisture stress in unirrigated crop areas, although greater volumes of rain will still be needed for the late maturing crop - The

precipitation might not be as well distributed as desired, but the majority of most important cotton and sorghum areas will get at least a little moisture - Irrigated

crops will remain in mostly favorable condition - South

Africa will experience a good mix of rain and sunshine for late season crop development - Summer

crop conditions are still rated quite favorably. - West-central

Africa coffee and cocoa production areas will experience additional showers in the coming week, but the precipitation will stay confined to coastal areas - There

is some potential for greater rain in Ivory Coast and Ghana next week - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Today’s

Southern Oscillation Index is +9.31 - The

index will move lower over the coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically - Tropical

Cyclone Emnati has left Madagascar after producing damaging wind and flooding rainfall to southeastern parts of the nation this week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

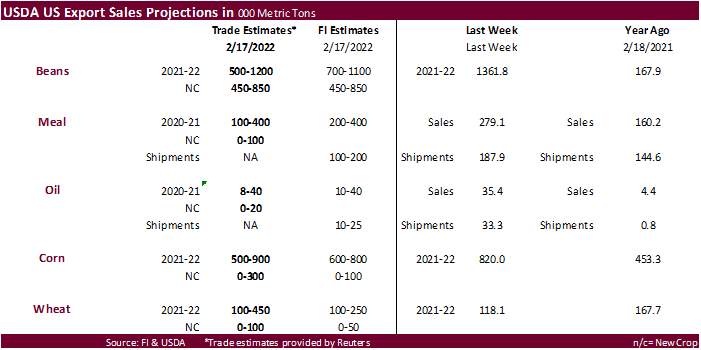

- USDA

corn, cotton, soybean and wheat acreage outlook, 8:30am - EIA

weekly U.S. ethanol inventories, production, 11am - U.S.

red meat production, 3pm

Friday,

Feb. 25:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Feb. 1-25 palm oil exports - U.S.

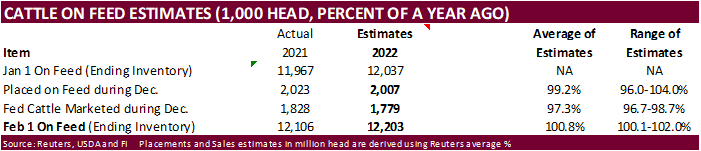

cattle on feed, 3pm

Source:

Bloomberg and FI

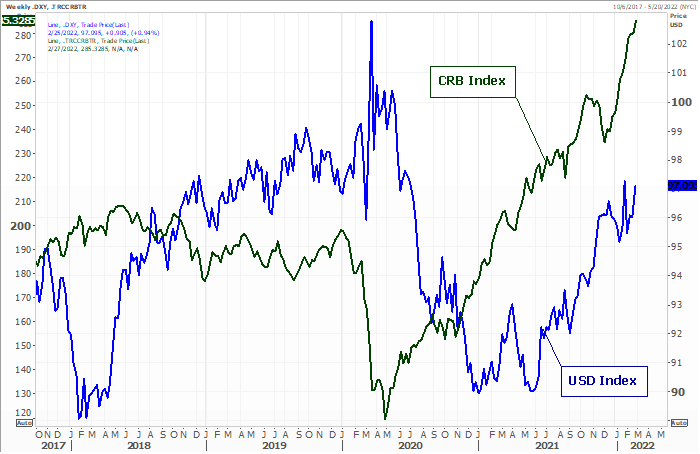

Macros

US

GDP Annualized Q4 S (Q/Q): 7.0% (est 7.0%; prev 6.9%)

US

Personal Consumption Q4 S: 3.1% (est 3.4%; prev 3.3%)

US

GDP Price Index Q4 S: 7.1% (est 6.9%; prev 6.9%)

US

Core PCE Q4 S (Q/Q): 5.0% (est 4.9%; prev 4.9%)

US

Initial Jobless Claims Feb 19: 232K (est 235K; prev 248K; prevR 249K)

US

Continuing Claims Feb 12: 1476K (est 1580K; prev 1593K; prevR 1588K)

Tensions

are now rising in other areas outside Ukraine.

TAIWAN

DEFENCE MINISTRY SAYS 9 CHINESE AIR FORCE PLANES ENTERED ITS AIR DEFENCE ZONE ON THURSDAY

US

New Home Sales Change Jan: 801K (est 802K; prev R 839K)

–

New Home Sales (M/M): -4.5% (est -1.2%; prev R 12.0%)

78

Counterparties Take $1.650 Tln At Fed Reverse Repo Op (prev $1.738 Tln, 77 Bids)

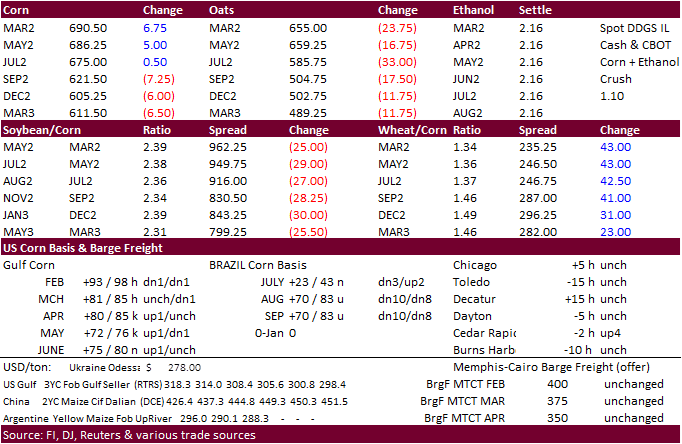

Corn

·

CBOT corn was up limit 35 cents earlier before prices backed off on profit taking.

·

Ukraine closed their ports.

·

Other news was extremely light as newswires focused on Ukraine.

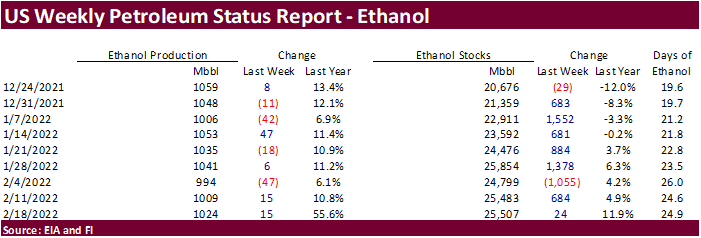

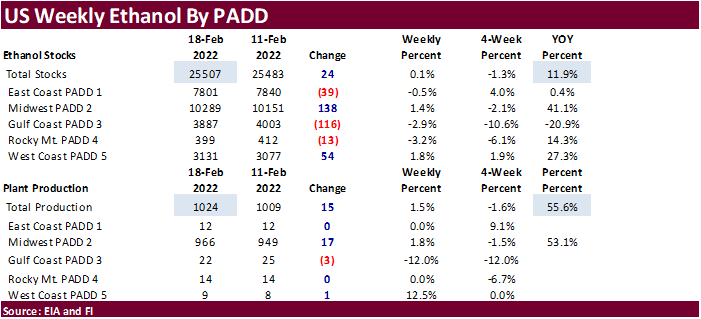

EIA

weekly ethanol update

·

The US weekly EIA ethanol data was viewed slightly bullish for US corn futures.

·

Weekly US ethanol production increased 15,000 barrels from the previous week to 1024 thousand barrels per day (bbl), second consecutive weekly increase. 1024 thousand is highest in a month.

·

Ethanol stocks increased 24,000 barrels to 25.507 million, also highest in a month.

·

For comparison, A Bloomberg poll looked for weekly US ethanol production to increase 1,000 barrels from the previous week and stocks to increase 135,000 barrels.

·

US ethanol production of 1024 thousand barrels per day is about 55% above from about the same time a year ago.

·

Over the past 4 weeks, production changes averaged down 3,000 and stock changes up 258,000.

·

Early September 2021 to date (25 weeks) US ethanol production is running 10.5% above the same period a year ago and 0.2% below same period for 2019-20.

·

Padd2 production was 966,000 barrels, up 17,000 from a week earlier. Padd1 was unchanged from the previous week.

·

There were no ethanol imports reported this week.

·

Ethanol stocks of 25.507 million barrels are up 11.9% from a year ago and 1.3% below the last previous 4-week average. The record for ethanol stocks was 27.689 million barrels set on 4/17/20, but today’s inventories are still

considered high.

·

Days of inventory of 24.9 compares to 22.8 a month ago and 36.9 during comparable period a year ago.

·

Weekly ending stocks of total gasoline were down 0.582 million barrels to 246.5 million barrels.

·

The net blender input of fuel ethanol was up 36,000 from the previous week at 871,000 bpd, above its 4-week average of 817,000 bpd.

·

Net production of finished reformulated and conventional motor gasoline with ethanol, increased 352,000 to 8.603 million barrels, or 81.4 percent of the net production of all finished motor gasoline (down from 92.7 percent for

the previous week).

·

For 2021-22, we are using 5.325 billion bushels, same as USDA. 2022-23 outlook forum looks for corn use to increase to 5.400 billion.

US

DoE Crude Oil Inventories (W/W) 18-Feb: 4514K (est 0K; prev -1332K)

–

Distillate Inventories: -584K (est -1700K; prev -1552K)

–

Cushing OK Crude Inventories: -2049K (prev -1900K)

–

Gasoline Inventories: -582K (est -1500K; prev -1332K)

–

Crude Refinery Utilization: 2.10% (est -0.4%; prev -2.9%)

Export

developments.

- Taiwan’s

MFIG seeks up to 65,000 tons of corn which from the United States, Brazil, Argentina or South Africa, on Friday, Feb. 25, for shipment between May 1 and early June shipment, depending on origin.

Updated

2/24/22

May

corn is seen in a $6.50 and $7.25 range

December

corn is seen in a wide $5.50-$7.25 range

·

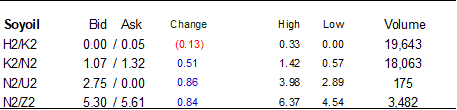

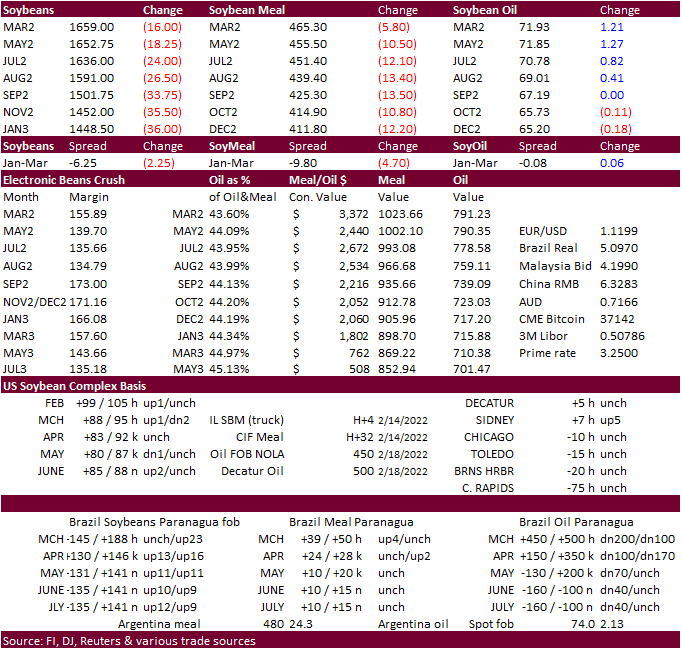

Sharply higher trade to start on geopolitical headlines. Nearby soybeans hit their highest level since 2012 before selling off.

·

CBOT May soybeans, meal and soybean oil traded in a wide trading range, with soybeans and meal ending sharply lower and soybean oil sharply higher in the front months. Soybeans were lower in part to heavy producer selling and

wheat/soybean spreading. Note Argentina saw good rain over the past 24-hours. BA Grains Exchange left their production estimates for soybean and corn unchanged. Soybean meal prices were on the defensive through much of the day session (product spreading).

·

The trade has a long delta position in soybean calls. With today’s move, we did not see a massive liquidation by option traders. It was mainly a futures price selloff.

·

Some major grain trading companies suspended operations in Ukraine.

·

Palm futures hit a record overnight. SBO reached limit higher 400 points during the session.

·

May soybean oil spreads against the back months made significant gains today, in part to the unavailability of spot cash Black Sea vegetable oils.

This

could be a selling opportunity for K/N soybean oil.

·

Correction from morning comment: Ukraine sunflower oil accounted for around 47 percent of global exports for 2020-21 and 49 percent of global exports for 2019-20.

- Iran’s

SLAL seeks up to 60,000 tons of soybean meal and 60,000 tons of feed barley on Feb. 23 for an unknow shipment period.

Updated

2/24/22

Soybeans

– May $15.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

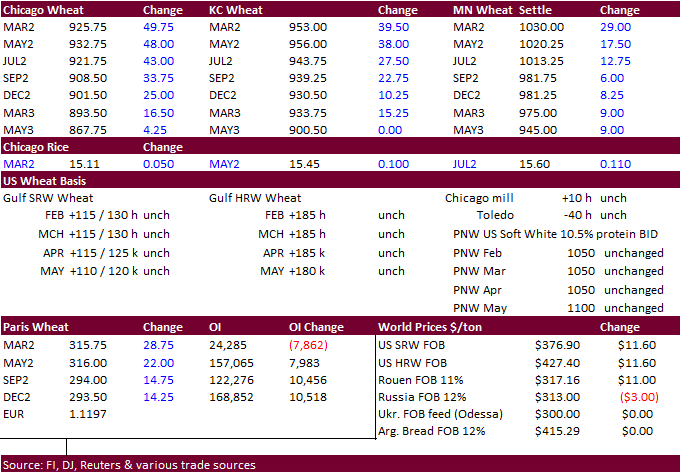

Wild trade today in US and Paris wheat futures as Ukraine ports were shuttered after Russia invaded on three fronts. Limits expand to 75 cents for Chicago and KC wheat. We don’t see the upside movement like we did today for Friday’s

trade.

·

Countries like Egypt, Turkey, and other major importers may have to scramble for wheat and corn supplies from other major exporters until the Black Sea region stabilizes, but timing is unknown when this will happen. Keep in mind

several countries have enough grain reserves for several months.

·

Germany saw inquiries for wheat today.

·

China already announced they will allow wheat imports from Russia.

·

May EU wheat futures gapped higher and rose as much as 16% at all-time high 341.75. It later settled at 315.00 euros, up 7.1%.

·

The European Commission on Thursday lowered its forecast of 2021/22 usable production of common wheat, or soft wheat, to 129.8 million tons from 130.5 million previously.

·

Tunisia said they have enough grain stocks to last through June.

Paris

May milling wheat

Source:

Reuters and FI

·

Jordan seeks 120,000 tons of wheat on March 2.

·

Turkey seeks 435,000 tons of milling wheat on March 2 for March-April shipment.

·

Jordan seeks 120,000 tons of feed barley on March 1.

Rice/Other

·

South Korea seeks 72,200 tons rice from U.S. and Vietnam on Feb. 25.

Updated

2/24/22

Chicago

May $8.00 to $10.50 range

KC

May $8.25 to $10.75 range

MN

May $9.25‐$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.