PDF Attached

Outside

markets largely influenced agriculture prices today, along with a large decline in some of the related overseas markets, such as Chinese soybean meal that fell 3.2% as SAF disease concerns rippled through the market. The China Ag Ministry issued a notice

that all localities must step up control of African Swine Fever. The USD rocketed higher. While there was not heavy volume Friday, we did see some key EIA data and CFTC updates that should be considered.

World

Weather Inc.

WORLD

WEATHER CHANGES AND AREAS OF INTEREST

- Argentina

is still looking dry biased for the next ten days with only a little rain in the west and north infrequently.

- The

dry bias will be most significant in the central and south - rain

is most likely in the west-central and northeast - Brazil

weather has not changed much overnight - Rain

will still fall in many areas at various times, but alternating periods of rain and sunshine are expected - Fieldwork

will advance around the precipitation, but some areas will be a little too wet for optimum conditions - Rain

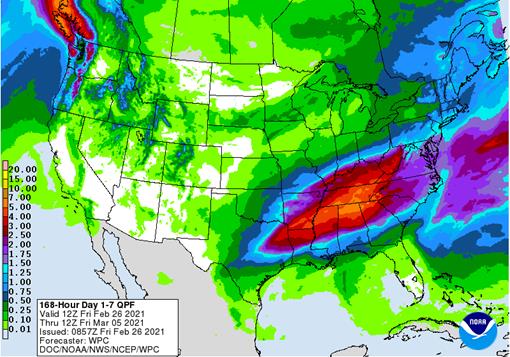

still falls in a part of U.S. hard red winter wheat country Wednesday into Thursday next week, but it is being down-played in the west-central and southwestern high Plains - Rainfall

will vary from 0.05 to 0.25 inch in the west and 0.30 to 1.00 inch in the east - Heavy

rain still occurs through the weekend and into Monday in the Delta and Tennessee River Basin with some flooding expected.

- Rain

totals of 2.50 to 6.00 inches are likely - Some

follow up rain is expected late next week that will push those totals even higher - 06z

GFS model run has increased snow and rain in the U.S. northern Plains, Upper Midwest and Canada’s eastern Prairies for March 6-8.

- This

feature is overdone. - One

more storm system occurs in the heart of the U.S. Midwest March 8-9, but is dependent upon the advancing colder air advertised into the north-central U.S. at that time.

- Unusually

warm air will be present in the U.S. Midwest March 2-9 and some of this will be in eastern Canada’s Prairies, too, but cooling occurred shortly thereafter – at least for a little while - River

ice on the Mississippi, Missouri and Illinois rivers will slowly decrease during the next week to ten days

- Southwestern

U.S. drought is not likely to change anytime soon - West

Texas dryness will prevail despite a few showers early next week and a few more late next week.

- Warming

temperatures will increase drying rates between precipitation events, although the region cooled Thursday - No

relief from long term dryness is expected through the next ten days - South

Texas crop areas are still too dry - 70-

and 80-degree Fahrenheit high temperatures in the coming week will accelerate the dryness while raising soil temperatures. Planting in irrigated areas will occur soon - Very

little change in Russia/Ukraine or the remainder of Europe was noted overnight - India

remains dry and warm for the next ten days - China

still sees precipitation in most of the nation with the Yangtze River Basin and areas into the interior south are still expected to get abundant rain - Yunnan

remains dry biased through the next ten days possibly delaying corn planting - Eastern

Australia rainfall is erratic and mostly light except in northeastern New South Wales where the greatest rain is expected - Interior

western Australia is wetter biased for a while next week following a tropical cyclone that dissipates in the northwest

- South

Africa precipitation will remain limited for the next ten days, although some showers will occur intermittently

- Net

drying is expected - Crop

and field conditions are still rated well for now - Portions

of North Africa are still too dry raising concern over spring crop development - Some

rain fell in Morocco Thursday and more showers are likely into Monday improving soil conditions in some areas - Northwestern

Algeria and southwestern Morocco are driest in North Africa, although Tunisia and northeastern Algeria have been drying down recently and may not get much moisture for a while. - Mexico

drought conditions are still prevailing, although the impact on winter crops is low due to irrigation - Water

supply is low in some areas and a notable improvement in rainfall is needed, but not very likely - Dryland

winter crops are stressed and will yield poorly - Freeze

damage is common in northern parts of the nation due to a couple of cold surges this winter - West

Africa rainfall will remain mostly confined to coastal areas for a while, but may drift to the north into some coffee and cocoa production areas early next week - East-central

Africa precipitation will be scattered over the coming week - The

lightest and most infrequent rain occurring in Ethiopia and parts of Uganda while the most significant rain occurs in Tanzania where all crop areas will get moisture - Southeast

Asia rainfall will occur relatively normally over the next two weeks - Mainland

areas will be mostly dry, although a few showers could pop up across the region next week - All

of the precipitation will be sporadic and light having little to no impact on crops or soil conditions - Philippines

rainfall will be scattered and light - Indonesia

and Malaysia weather during the next two weeks will bring rain to most crop areas maintaining a very good outlook for crop development - Sumatra,

Peninsular Malaysia and eastern Borneo have been drying out recently and greater rain is needed - New

Zealand weather over the next ten days will include erratic and often light rainfall and seasonable temperatures

- Mexico

precipitation in the coming ten days will be mostly confined to the east coast - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast is relatively dry - Southern

Oscillation Index is beginning to fall once again and was at +12.12 this morning. The index is expected to continue to fall notably over the next several days - Canada

Prairies will experience seasonable temperatures over the next ten days with precipitation mostly near to below average - Some

occasional precipitation will occur along the front range of mountains in Alberta and across the southwestern Prairies as well as in a few northeastern crop areas - Southeast

Canada will experience near to above normal amounts of precipitation in the coming week while temperatures are seasonable.

Source:

World Weather Inc. and FI

Friday,

Feb 26:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received, 3pm - Earnings:

Olam - HOLIDAY:

Thailand

Monday,

March 1:

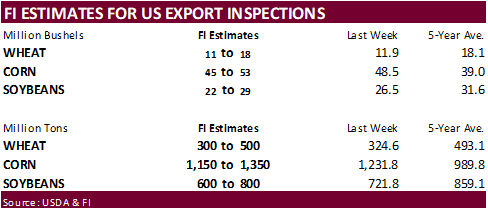

- USDA

Export Inspections – corn, soybeans, wheat, 11am - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia’s

February palm oil exports data - Australia

Commodity Index - U.S.

DDGS production, corn for ethanol, 3pm - USDA

soybean crush, 3pm - HOLIDAY:

South Korea

Tuesday,

March 2:

- Australia’s

Abares to release agricultural commodities report - Abares

to hold online Outlook 2021 conference, March 2-5 - New

Zealand global dairy trade auction - U.S.

Purdue Agriculture Sentiment, 9:30am - International

Sweetener Colloquium virtual event to cover sugar outlook, March 2-3

Wednesday,

March 3:

- EIA

weekly U.S. ethanol inventories, production - ANZ

Commodity Price - Brazil’s

Unica to release sugar production, cane crush data

Thursday,

March 4:

- FAO

World Food Price Index, grains supply and demand reports - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - U.S.

National Coffee Association hosts annual convention (virtual), March 4-5

Friday,

March 5:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia’s

March 1-5 palm oil export data - FranceAgriMer

weekly update on crop conditions - China’s

CNGOIC to publish supply and demand reports on commodities such as corn and soybeans

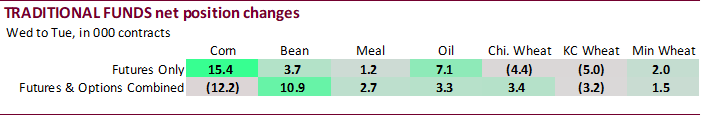

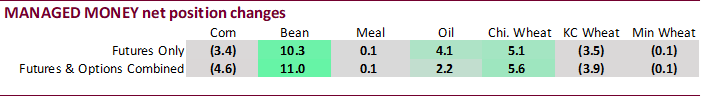

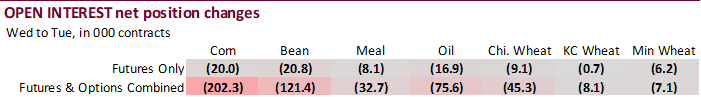

CFTC

Commitment of Traders

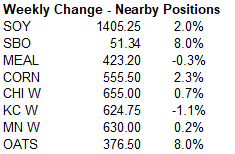

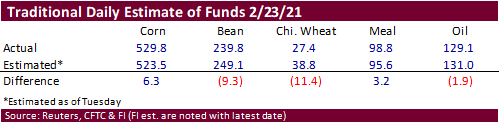

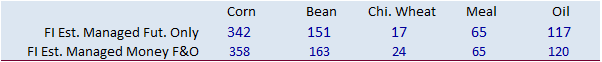

Not

too many surprises like last week when it came to actual readings for the CFTC Commitment of Traders report. Funds were less long for soybeans and wheat and more long for corn and soybean meal. Soybean oil was near expectations. What remains is that both

traditional funds and managed money are both very long. Changes in futures only versus futures and options combined did not line up for corn and soybeans, a hint option trading dominated some of the volume for the week ending February 23.

US

Personal Income Jan: 10.0% (est 9.5%; prev 0.6%)

US

Personal Spending Jan: 2.4% (est 2.5%; prev -0.2%)

US

PCE Core Deflator (M/M) Jan: 0.3% (est 0.1%; prev 0.3%)

US

PCE Core Deflator (Y/Y) Jan: 1.5% (est 1.4%; prev 1.5%)

US

PCE Deflator (M/M) Jan: 0.3% (est 0.3%; prev 0.4%)

US

PCE Deflator (Y/Y) Jan: 1.5% (est 1.4%; prev 1.3%)

US

Advance Goods Trade Balance (USD) Jan P: -83.7B (est -83.0B; prevR -83.2B; prev -82.5B)

US

Wholesale Inventories (M/M) Jan P: 1.3% (est 0.4%; prevR 0.5%; prev 0.3%)

US

Retail Inventories (M/M) Jan: 1.3% (est 0.5%; prev 1.0%)

Canadian

Industrial Product Price (M/M) Jan: 2.0% (est 1.9%; prev 1.5%)

Canadian

Raw Materials Price Index (M/M) Jan: 5.7% (prev 3.5%)

Corn.

-

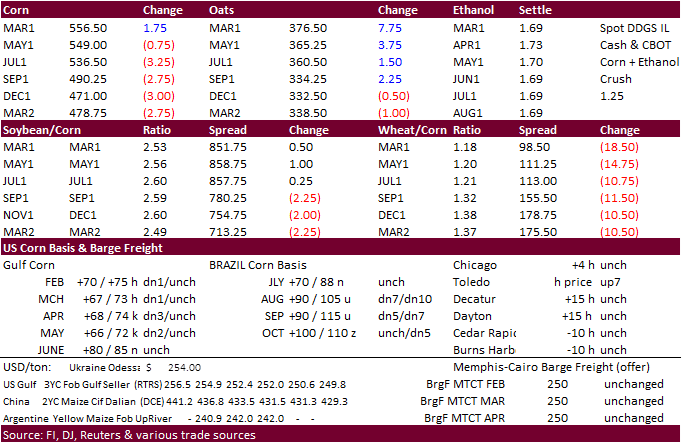

Corn

futures prices

were very choppy today, maybe not so much to SBO, but reflected conflicting opinion on whether to remain a bull to be a bear with extremely high prices. Lack of US export developments this week are concerning since the optimism of China buying post new year

holiday is starting to fade. Corn futures on Friday, last day of the trading month, ended mostly lower on follow through selling, end of month positioning, and a sharply higher USD (up 79.5 as of late Friday). Outside markets were also providing a bearish

sentiment, particularly a $1.87 lower trade in WTI crude. Meanwhile the March corn futures managed to close 0.75 higher, something we would not have seen this morning when most outside markets were setting a bearish undertone.

-

On

Friday funds sold an estimated 5,000 contracts after selling 11,000 on Thursday.

-

There

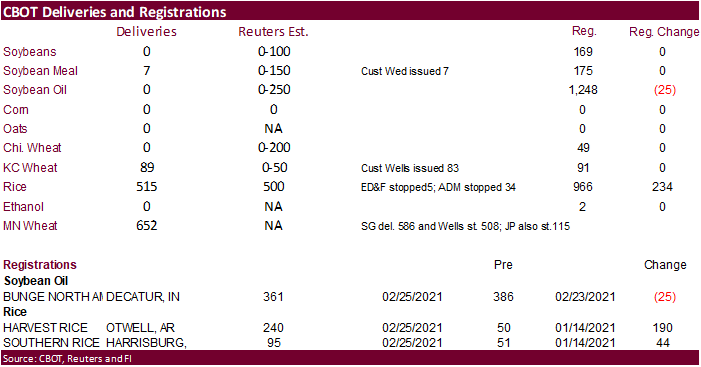

were no changes in CBOT corn or oats registrations.

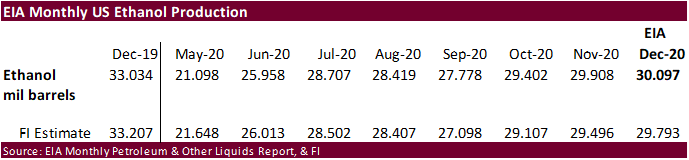

EIA:

Cold

weather results in near-record withdrawals from underground natural gas storage

https://www.eia.gov/todayinenergy/detail.php?id=46916&src=email

EIA

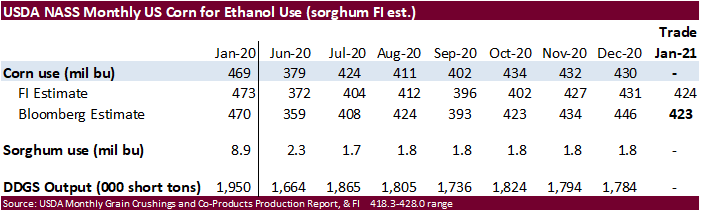

reported

December ethanol production at 30.097 million barrels, slightly higher than our expectation, above 29.908 million during November and well below 33.034 million during December 2019. We left our 2020-21 US corn for ethanol use projection unchanged at 4.560

billion bushels, 10 million above USDA and compares to 4.852 billion during 2019-20.

Corn

Export Developments

·

South Korea’s NOFI bought 137,000 tons of optional origin animal feed corn, for shipment in May and/or June, depending on origin. 68,000 tons was bought at an estimated $294.70 a toe c&f for arrival

in June. Another 69,000 tons was bought at an estimated $293.89 a ton c&f for arrival in July.

Updated

2/26/21

March

corn is seen trading in a $5.35 and $5.65range.

May

corn is seen in a $5.15 and $6.00 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.75-$6.00 range.