PDF attached

Day

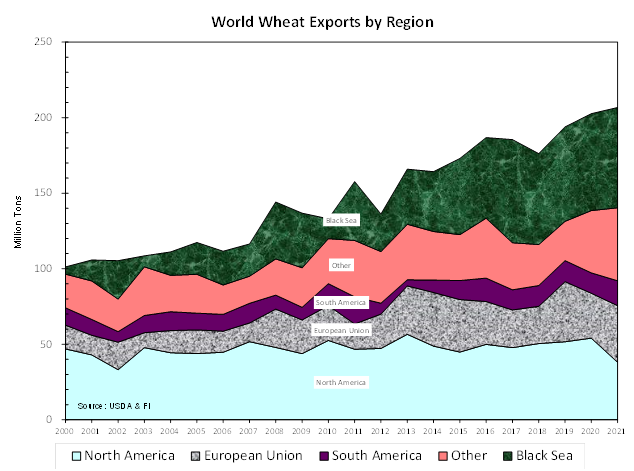

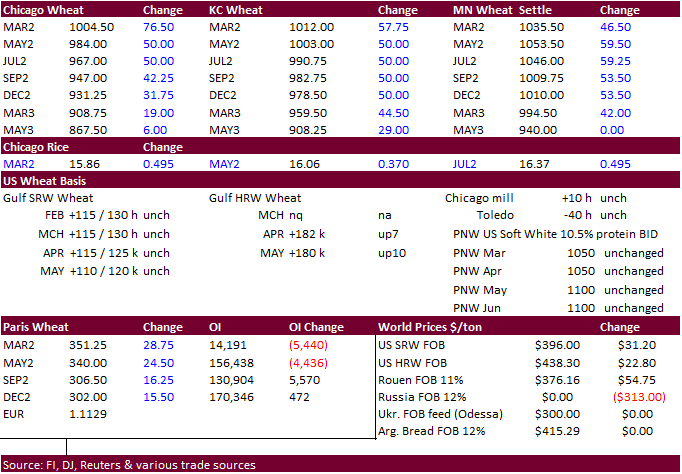

6 of the war. Another strong session in commodities (WTI oil up 8%) on follow through buying as tensions increase for Ukraine/Russia. WTI crude oil hit its highest level since June 2014. Corn, soft wheat, and hard wheat contracts reached limit higher. Front

month soybean oil gained on back months. With no end in sight for this invasion traders are worried it may take longer than originally thought to open Black Sea shipping terminals.

Some traders see little slowdown in the rally for the agriculture markets. We need to see the Black Sea region settle down and/or a massive shift in global trade flows before some of the commodities can see a correction, IMO.

We think its time major Black Sea importers will seek alternative supplies.

Wheat,

butter & milk limits expand

https://www.cmegroup.com/trading/price-limits.html

Weather

– rain

to develop back end of 7-day outlook

WEATHER

EVENTS AND FEATURES TO WATCH

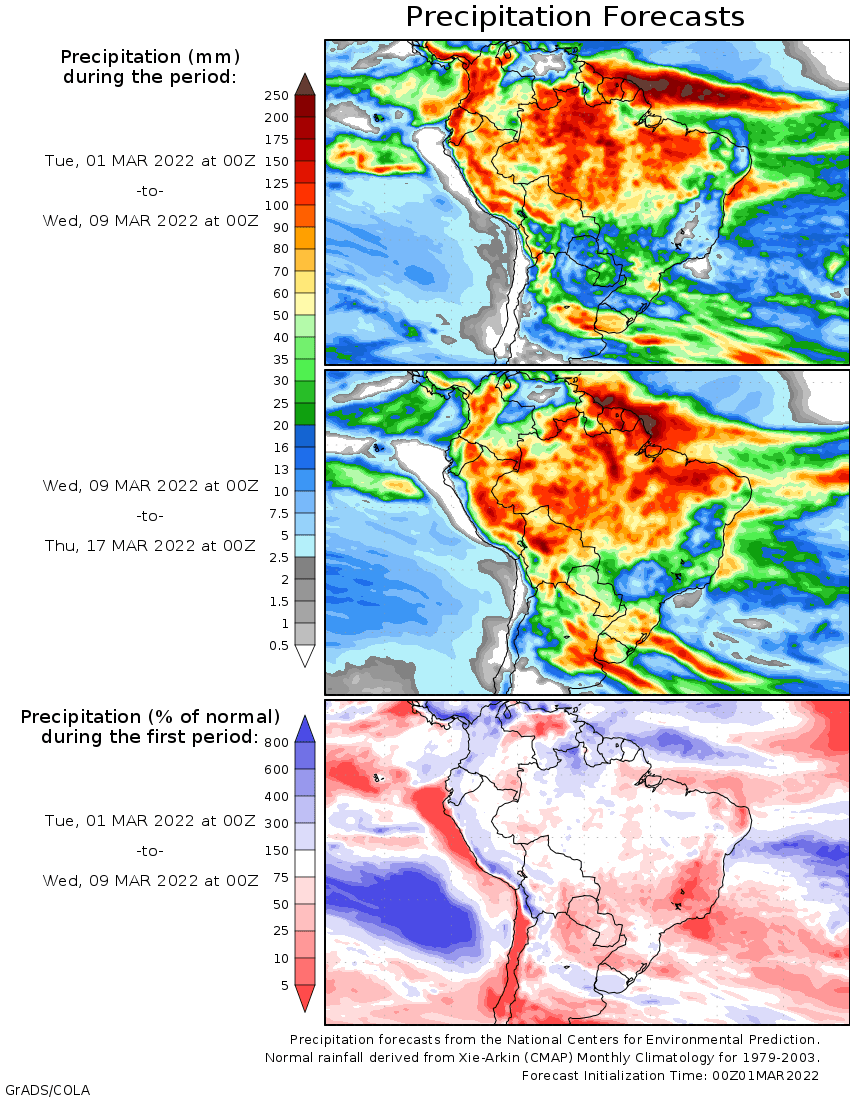

- No

change in the South America outlook was noted overnight - All

of Argentina, Uruguay, Paraguay and southern Brazil (i.e. Mato Grosso do Sul to Parana and southward to Rio Grande do Sul) will get rain at one time or another over the next ten days

- The

environment will be very good for late full season crops and for Safrinha crops especially those that have yet to receive a good soaking of rain - Crop

stress in the driest areas will be relieved as previously anticipated - Brazil’s

northern crop areas will see a good mix of rain and sunshine over the next ten days to two weeks resulting in favorable ongoing grain, oilseed, cotton, coffee and sugarcane production

- March

weather in Argentina is expected to be a little dry and warm in the far north and more favorably mild in the central and south where periodic rainfall is expected - March

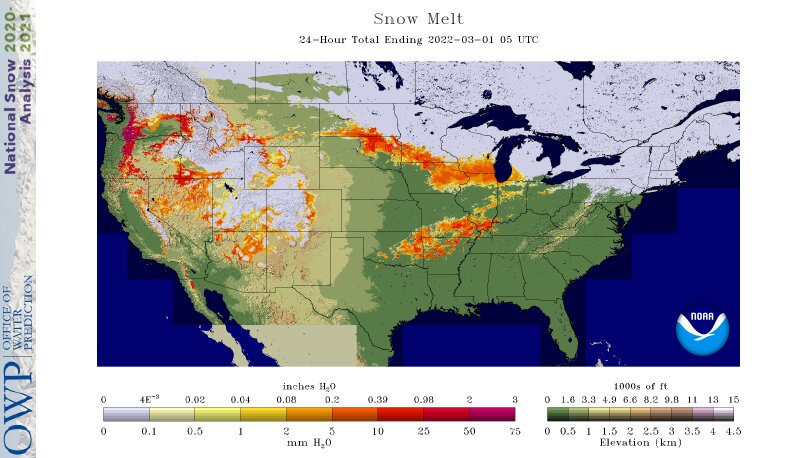

weather in Brazil is expected to be well mixed across much of the nation supporting late full season crops as well as Safrinha corn and cotton - U.S.

hard red winter wheat country is expected to turn quite warm to hot over the next few days - Highs

in the 70s Fahrenheit today, and 70s and 80s both Wednesday and Thursday before cooling from northwest to southeast Friday into the weekend - The

heat will reduce winter hardiness - Some

crops in the south will break dormancy - Accelerated

drying rates are likely further depleting soil moisture - Cooling

late this week and into the weekend will limit green up conditions in the northwestern part of the production region

- March

weather in U.S. hard red winter wheat areas will include a few brief bouts of moisture, but below average precipitation will continue and temperatures will be warmer than usual especially in the southern half of the region - Net

drying in the southeastern United States is expected to deplete soil moisture and raise concern over spring planting conditions - High

temperatures will be in the 70s and 80s Fahrenheit for several days with little to no rain, but some relief is expected briefly during the middle part of next week - March

weather is expected to include below average precipitation and above normal precipitation in Florida, southeastern Alabama, southern Georgia and South Carolina - Surrounding

areas will also experience less than usual rain and warm biased conditions at times, but they will be less persistent relative to the previously mentioned areas - West

Texas weather will continue drier than usual during much of the next ten days, although a few showers may occur briefly early next week

- None

of the moisture will be significant – especially not in the high Plains - California’s

Sierra Nevada will get some precipitation in the mountains late this week, but resulting amounts will be less than usual maintaining concern over long term runoff potential

- March

weather is expected to include less than usual precipitation in California with temperatures relatively closely to normal - U.S.

northwestern Plains and southwestern Canada’s Prairies may get some snow and rain in the next week to ten days, but with frost in the ground the moisture will not likely get very far into the soil - Greater

precipitation will be needed after frost has come out of the soil - A

new storm or two will impact the northeastern U.S. Plains and upper Midwest during the next ten days - The

first event will occur this weekend and a second system is expected near March 10 - The

weekend storm will bring snow and some rain to the region - Lower

eastern U.S. Midwest, the northern Delta and Tennessee River Basin will experience some drying conditions for several days, but more rain expected this weekend and especially next week

- The

wet bias will raise some concern over planting conditions this spring because the entire month of March should be wetter biased - Cold

air will be returning to Canada’s Prairies and could impact a part of the northern and central U.S. Plains and northwestern states next week - Temperatures

in the southeastern one-third of the United States will be warmer than usual at the same time - There

is still no threatening cold expected in any winter crop area in Europe or Asia through the next ten days to two weeks.

- Recent

rain in northern Algeria and some neighboring areas has been a Godsend for winter wheat and barley after being quite dry during the heart of winter - Follow

up rain is expected infrequently over the next ten days leaving some need for additional moisture later this month - Morocco

will continue drier than desired and production cuts are already expected because some of the crop was never planted due to drought - A

part of Spain and Portugal will get some needed rain in the next week to ten days offering some temporary relief to dryness that has been prevailing in the south

- Greater

rain may evolve near mid-month and if that occurs the situation will be almost ideal since spring planting and early season crop development will benefit greatly - Southern

Italy and the western and southern parts of the Balkans will be impacted with waves of rain in this coming week to ten days - The

moisture will ideal for winter crop use in the spring - Romania

is still a little dry and would benefit from greater precipitation, but that may not occur for a while - Russia’s

Southern region and areas northeast into northern Kazakhstan and southern Russia’s New Lands will get snow and a little rain late this week through the weekend into Monday - Accumulations

will vary from 4 to 10 inches and the moisture will be extremely welcome for the region’s low soil moisture that has prevailed since last summer - Some

frost in the ground may limit the moisture from snow melt from reaching very far into the ground, but the event will still be welcome - Temperatures

will turn colder behind the storm for a little while next week - Eastern

Australia is recovering from the weekend flood event that impacted areas near the lower Queensland coast and along the upper New South Wales coast - More

rain is expected late this week into next week aggravating the cleanup efforts - Rain

this weekend into next week will also impact eastern cotton and sorghum areas which may result in some concern over fiber quality in early maturing cotton - Sugarcane

will not bode well because of all the excessive moisture - A

tropical disturbance moving toward Sri Lanka and far southern India will become better organized in the next couple of days

- Landfall

is possible in Tamil Nadu late Thursday or Friday and the storm will produce some heavy rainfall and local flooding - Eastern

parts of Sri Lanka and Tamil Nadu will receive 3.00 to more than 8.00 inches of rain - Other

areas of India are not likely to get much precipitation in the next ten days except in the far Eastern States and in the extreme north where some significant moisture is possible - Southeast

Asia rainfall will occur frequently and abundantly this week - Flooding

may impact southern and east-central parts of the Philippines, northwestern Sumatra, parts of peninsula Malaysia and in a few western Java locations - Mainland

areas of Southeast Asia will see abundant showers and thunderstorms later this week and next week as pre-monsoonal moisture begins early and aggressively - The

moisture will be good for immature winter crops and for prepping the soil for spring planting of corn, rice and other crops - Ghana

and Ivory Coast will receive greater amounts of rain this week easing recent dryness and improving the soil for coffee, and cocoa flowering - Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations - A

big part of Europe will not be bothered by significant precipitation this week - Rain

is expected from northern and eastern Spain through western and far southern France to the U.S. and in a few southern Balkan country locations - Central

and eastern Turkey will be wettest this week with additional rain and mountain snow expected

- Some

of the moisture will also impact northern Iraq and northern and western Iran wheat and cotton areas - Xinjiang,

China precipitation will continue restricted over the next ten days, although a few showers of rain and snow are expected - The

mountainous areas in the west will be wettest and a boost in snowpack is expected - China’s

most frequent and significant precipitation in the next ten days will be near and south of the Yangtze River where the ground will continue saturated or nearly saturated with moisture - Waves

of light snow will fall across China’s Northeast Provinces - Winter

wheat and rapeseed will remain dormant or semi-dormant and in mostly good condition - Additional

warming is needed in the south to improve planting conditions for rice and corn and to stimulate sugarcane development - Not

much moisture occurred during the weekend - Winter

crops are still dormant or semi-dormant and poised to perform well in the early spring - South

Africa will experience a good mix of rain and sunshine for late season crop development - Summer

crop conditions are still rated quite favorably. - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Today’s

Southern Oscillation Index is +8.21 - The

index will move erratically this week - NOAA’s

ENSO model is still predicting La Nina through spring and possibly all summer in the Northern Hemisphere - Confidence

in the longer range outlook is low except in the statistical studies showing La Nina events in other 22-year solar cycle years like this persist longer than any other time

- Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

Bloomberg

Ag Calendar

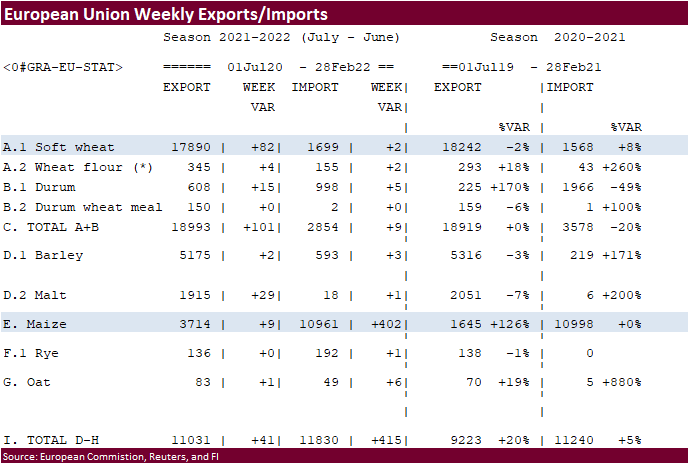

- EU

weekly grain, oilseed import and export data - USDA

soybean crush, corn for ethanol, DDGS output, 3pm - U.S.

Purdue Agriculture Sentiment - Australia

Commodity Index - New

Zealand dairy trade auction - EARNINGS:

Golden Agri Resources - HOLIDAY:

Brazil, Argentina, India, South Korea

Wednesday,

March 2:

- EIA

weekly U.S. ethanol inventories, production, 11am - Winter

Grain conference in Siberia

Thursday,

March 3:

- FAO

Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price - HOLIDAY:

Indonesia

Friday,

March 4:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

IEA

Will Deploy Emergency Oil Stockpiles to Ease Soaring Prices

WTI

Surges Above $105 A Barrel For First Time Since 2014

77

Counterparties Take $1.553 Tln At Fed Reverse Repo Op (prev $1.596 Tln, 82 Bids)

US

Crude Oil Futures Settle At $103.41/Bbl, Up $7.69, 8.03%

Corn

·

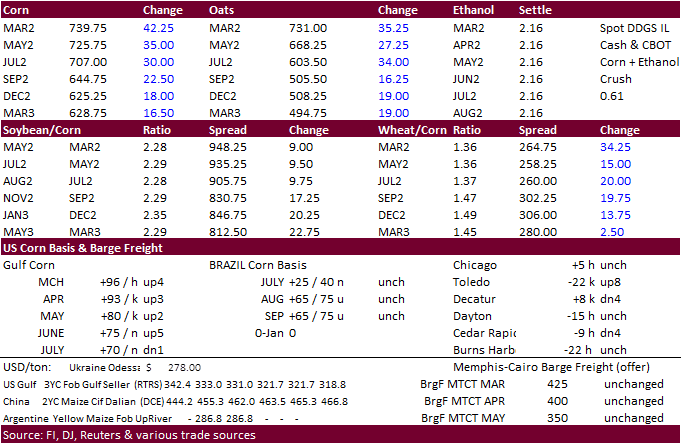

Fresh contract highs were achieved in corn futures. CBOT corn

futures

traded limit up this morning on follow through buying, but the back months were unable to sustain the higher move in turn weakening the front months. Limits will not expand in corn. May ended up 35 cents to $7.2575 and July was up 30.75 cents to $7.4250.

·

May corn synthetically settled at $7.29.

·

WTI futures were trading over $105/barrel earlier. July 2014 was the last time we saw WTI crude oil above $100/barrel. US crude oil futures settle at $103.41/Bbl, up $7.69, 8.03%

·

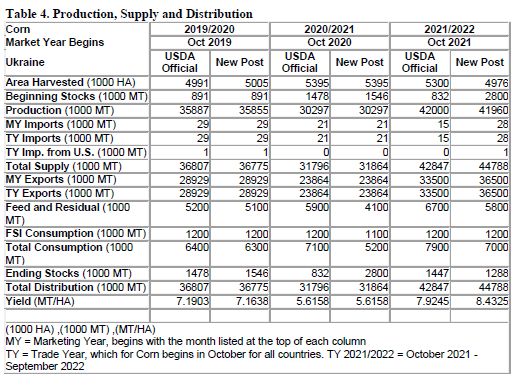

We heard China was looking around for US corn and wheat as Ukraine ports are shuttered. It will be important tom monitor daily sales. If a sale to China shows up, could provide another leg to the corn contracts. USDA attaché:

China remained the major consumer for MY2020/21, with 8.5 MMT of exports to this destination (around 36 percent of total exports from Ukraine), closely followed by the EU, buying 7.4 MMT (31 percent of total exports).

·

South Africa’s CEC estimated 11% less corn for the 2021-22 season at 14.528 million tons, down from 16.315 million tons last season. 2021-22 includes 7.535 million tons of white corn and 6.993 million tons of yellow.

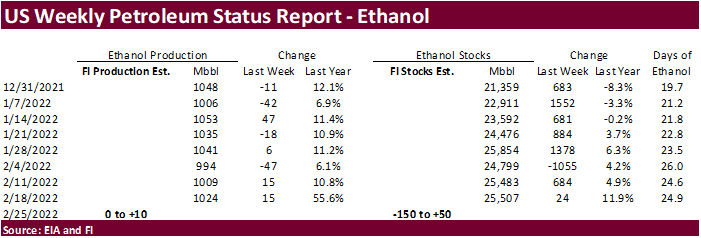

·

A Bloomberg poll looks for weekly US ethanol production to be up 18,000 barrels to 1.027 million (1010-1041 range) from the previous week and stocks up 61,000 barrels to 25.544 million.

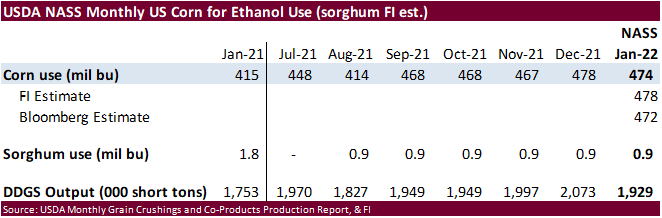

·

USDA NASS corn for ethanol use during the month of January was near expectations.

Export

developments.

- Taiwan

seeks 65,000 tons of corn, optional origin, on Thursday, for shipment around May.

USDA

Attaché latest Ukraine corn S&D

Updated

2/28/22

May

corn is seen in a $6.50 and $7.50 range

December

corn is seen in a wide $5.50-$7.25 range

·

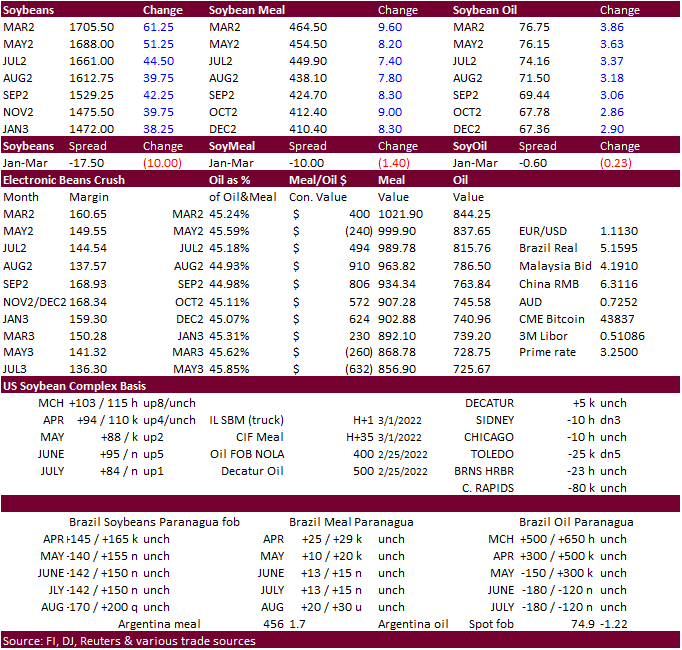

CBOT May soybeans traded

sharply higher in part to new highs in the May soybean oil market (palm was sharply higher Tuesday). Spreads further widened in soybean oil and we think the disconnect will eventually correct itself with increasing US domestic demand for vegetable oil/fats

as biofuel production ramps up later this year. Note EIA soybean oil, and other feedstocks, for biofuel use was very good for the month of December. Soybean meal traded higher as well. CBOT crush was up 6.75 cents for the May position to $1.4950, favoring

US domestic crush rates.

·

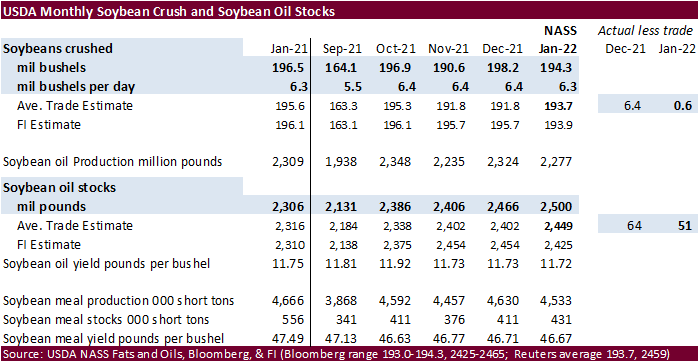

USDA NASS released their US January crush. Largest surprise was the higher than expected soybean oil stocks. See below.

·

Rain is still needed in northern Argentina and relief will occur this week. Brazil rainfall will be restricted this week in center south and northeastern parts of the nation of 0.20 to 0.75 inch. Brazil rain is expected in far

southern parts of the nation this week with 1.50 to more than 4.00 inches by Saturday.

·

Russia bumped up its export duty on sunflower oil to $260.10 per ton as of March 1 from $251.40 per ton in February. The export duty was $280.80 per ton in January 2022, $276.70 per ton in December 2021, $194.50 per ton in November,

$227.20 per ton in October, and $169.90 per ton in September.

·

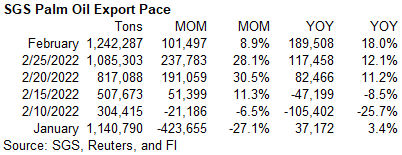

SGS Malaysian palm oil exports of palm oil and products for February rose 8.9 percent to 1,242,287 tons from 1,140,790 tons during January.

·

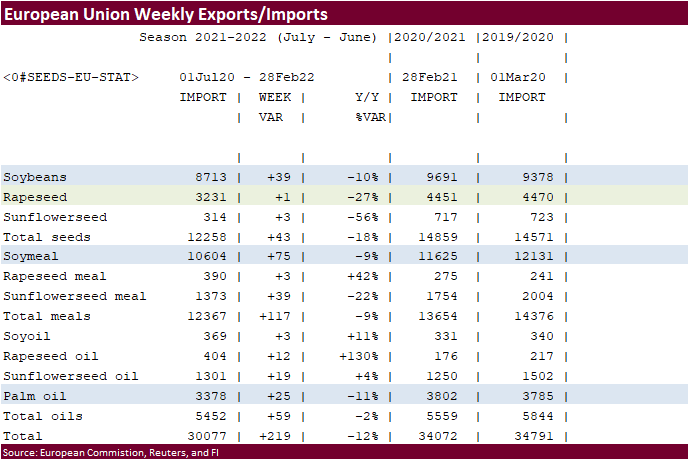

The European Union reported soybean import licenses since July 1 at 8.713 million tons, below 9.691 million tons a year ago. European Union soybean meal import licenses are running at 10.604 million tons so far for 2021-22, below

11.625 million tons a year ago. EU palm oil import licenses are running at 3.378 million tons, below 3.802 million tons a year ago, or down 11 percent.

·

USDA NASS reported the January US soybean crush at 194.3 million bushels, 0.6 above a Bloomberg trade guess and below 198.2 million for December. Soybean oil stocks came in at 2.500 billion pounds, 51 million pounds above a trade

guess and highest since April 20th.

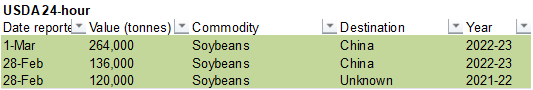

- Private

exporters reported the following activity:

-sales

of 264,000 metric tons of soybeans for delivery to China

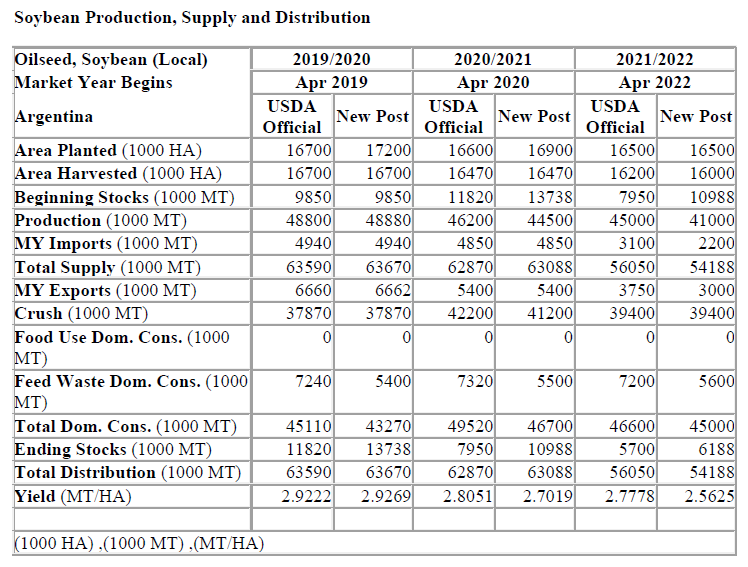

USDA

Attaché on Argentina soybeans

Production

3MMT below USDA official https://bit.ly/35Eulj1

Updated

3/1/22

Soybeans

– May $15.75-$18.25

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

US wheat futures were higher, up limit for KC and Chicago benchmark May (& July) contracts, on fund buying and concerns that the Black Sea wheat shipping ports will not open up anytime soon. Chicago SRW wheat is back near a 14-year

high.

·

Gapping higher, May EU wheat futures were up 24.50 euros at 340.25 euros, near its contract high established last Thursday.

·

Yesterday we read if Ukraine wheat producers are unable to apply fertilizer to fields that starts now, yields could decline by a third.

·

Ukraine and Russia combined make up nearly 30 percent of global wheat exports. We are concerned if ports are closed over a long period of time, bread price increases across the Middle East will yield to protests and/or unrest.

·

Russian Union of Grain Exporters proposed small changes to the formulas used to calculate its grain export taxes by setting the wheat export tax at $90 per ton if the indicative price is above $250 per ton. Russia’s wheat export

tax is set at $88.2 per ton for March 2-8 with the indicative price of $326.1.

·

US hard red winter wheat areas will turn warmer this week. Little precipitation will occur over the next week in the central or southwestern Plains.

·

Jordan passed on 120,000 tons of feed barley.

·

Tunisia seeks 75,000 tons of durum wheat today for April and/or March shipment.

·

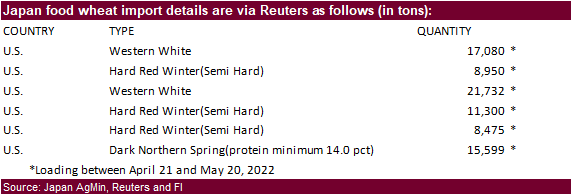

Japan seeks 83,136 tons of food wheat from the US this week for loading between April 21 and May 20, 2022.

·

Algeria seeks 50,000 tons of durum wheat on Wednesday, open until Thursday, for April shipment.

·

Turkey seeks 435,000 tons of milling wheat on March 2 for March-April shipment.

·

Jordan seeks 120,000 tons of wheat on March 2.

Rice/Other

·

Results awaited: South Korea seeks 72,200 tons rice from U.S. and Vietnam on Feb. 25.

Updated

2/24/22

Chicago

May $8.00 to $10.50 range

KC

May $8.25 to $10.75 range

MN

May $9.25‐$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.