PDF Attached

Private

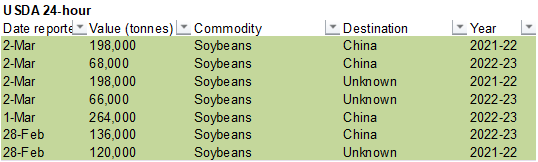

exporters reported the following activity:

-264,000

metric tons of soybeans for delivery to unknown destinations. Of the total, 198,000 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons is for delivery during the 2022/2023 marketing year

-266,000

metric tons of soybeans for delivery to China. Of the total, 198,000 metric tons is for delivery during the 2021/2022 marketing year and 68,000 metric tons is for delivery during the 2022/2023 marketing year

Attached

are updated US soybean complex S&D’s. Day 7 of conflict. Anther headline trading day. CBOT May soybeans traded lower in a risk off session. Products also fell. Corn was lower but bull spreading limited losses in the May position. Wheat saw considerable bull

spreading with May wheat up limit.

CBOT

limits – wheat stays at 75 cents

https://www.cmegroup.com/trading/price-limits.html

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

hard red winter wheat areas will continue to heat up for another couple of days - High

temperatures in the 70s and lower 80s Fahrenheit will accelerate drying across the region - Winter

wheat hardiness will be lost, although cooling this weekend into next week will slowly bring enough cool air back to restrict crop greening - Livestock

stress will rise because of the heat, although temperatures will only be warmest for a brief couple of hours and some wind is expected to keep animals cool - Very

little rain will occur in the central or southwestern U.S. hard red winter wheat areas for the coming week - Any

showers that occur will fail to change soil moisture or drought status - A

more generalized rain event is needed to bolster soil moisture and improve crop and field conditions - Damaged

crops from drought, extreme cold without snow cover and heaving topsoil will require a cool and wet spring for new tillers to be set and root system repair to take place

- Such

an event seem unlikely in the High Plains region - West

Texas cotton areas will continue dry biased for the next ten days, despite a few spits and spats of moisture - South

Texas and the Texas Coastal Bend will continue dry biased in this coming week and “may” receive some rain next week – mostly in the Coastal Bend region

- California

will get some rain and mountain snow briefly Thursday into Friday, but resulting precipitation will not fix the region’s moisture deficits and mountain snowpack will remain 53-58% of normal - Next

week will be dry again - South-central

and southwestern Canada’s Prairies will get some needed snowfall Thursday and Friday with 2 to 8 inches of snowfall and moisture totals to 0.40 inch resulting - Frost

in the ground will restrict the moisture from getting into the ground when the snow melts, but any moisture in the region will be good for add to on-farm water storage - U.S.

southeastern states will experience warm and dry biased weather for the coming week - Today’s

forecast models have suggested rain will fall in the second half of next week - Confidence

is low and future model runs may remove some of the advertised rainfall - U.S.

lower eastern Midwest, northern Delta and Tennessee River Basin are too wet today, but will dry down briefly before a new period of unsettled weather evolves this weekend and next week - Concern

will rise over planting delays this spring if the wet bias prevails too long - A

new storm or two will impact the northeastern U.S. Plains and upper Midwest during the next ten days - The

first event will occur this weekend and a second system is expected near March 10 - The

weekend storm will bring snow and some rain to the region - Argentina

is still expecting rain in most of its crop areas through the next ten days - Moderate

to heavy rain may impact a part of central and north-central Argentina where a minor amount of local flooding will be possible

- Saturday

into Monday will be wettest, but another round of rain is possible during mid-week next week - Rain

totals may range from 2.00 to 6.00 inches and locally more - The

rain will fall over the previously driest areas in the nation and should bring all concerns over dryness to an end – at least for a while

- The

moisture comes a little too late for bolstering late season crop production potentials very much, but some improvement is expected - Most

of Brazil will get rain over the next ten days, as well. - Sufficient

amounts will occur in the south to bolster topsoil moisture and improve late full season and Safrinha crop development potentials - Northern

Brazil will continue a little too wet – especially from northern Mato Grosso to Tocantins and Maranhao - Cold

air will be returning to Canada’s Prairies and could impact a part of the northern and central U.S. Plains and northwestern states next week - Temperatures

in the southeastern one-third of the United States will be warmer than usual at the same time - There

is still no threatening cold expected in any winter crop area in Europe or Asia through the next ten days to two weeks.

- Recent

rain in northern Algeria and some neighboring areas was good for winter wheat and barley after being quite dry during the heart of winter - Tuesday

was mostly dry - Follow

up rain is expected infrequently over the next ten days leaving some need for additional moisture later this month - Morocco

will continue drier than desired and production cuts are already expected because some of the crop was never planted due to drought - A

part of Spain and Portugal will get some needed rain Thursday into Friday and again during the middle part of next week offering some temporary relief to dryness that has been prevailing in the south

- Greater

rain may evolve near mid-month and if that occurs the situation will be almost ideal since spring planting and early season crop development will benefit greatly - Southern

Italy and the western and southern parts of the Balkans will be impacted with waves of rain in this coming week to ten days - The

moisture will ideal for winter crop use in the spring - Romania

is still a little dry and would benefit from greater precipitation, but that may not occur for a while - Russia’s

Southern region and areas northeast into northern Kazakhstan and southern Russia’s New Lands will get snow and a little rain late this week through the weekend and into Monday - Accumulations

will vary from 4 to 10 inches and the moisture will be extremely welcome for the region’s low soil moisture that has prevailed since last summer - Some

frost in the ground may limit the moisture from snow melt from reaching very far into the ground, but the event will still be welcome - Temperatures

will turn colder behind the storm for a little while next week - Eastern

Australia is recovering from the weekend flood event that impacted areas near the lower Queensland coast and along the upper New South Wales coast - More

rain is expected late this week into next week aggravating the cleanup efforts - Rain

this weekend into next week will also impact eastern cotton and sorghum areas which may result in some concern over fiber quality in early maturing cotton - Sugarcane

will not bode well because of all the excessive moisture - A

tropical disturbance moving toward Sri Lanka and far southern India will become better organized in the next couple of days

- Landfall

is possible in Tamil Nadu late Thursday or Friday and the storm will produce some heavy rainfall and local flooding - Eastern

parts of Sri Lanka and Tamil Nadu will receive 3.00 to more than 8.00 inches of rain - There

is some potential for 10-15 inches of rain in coastal Tamil Nadu - Other

areas of India are not likely to get much precipitation in the next ten days except in the far Eastern States and in the extreme north where some significant moisture is possible - Southeast

Asia rainfall will occur frequently and abundantly this week - Flooding

may impact southern and east-central parts of the Philippines, northwestern Sumatra, parts of peninsula Malaysia and in a few western Java locations - Mainland

areas of Southeast Asia will see abundant showers and thunderstorms later this week and next week as pre-monsoonal moisture begins early and aggressively - The

moisture will be good for immature winter crops and for prepping the soil for spring planting of corn, rice and other crops - There

is going to be a rising risk of flooding rain during the next ten days - Ghana

and Ivory Coast will receive greater amounts of rain this week easing recent dryness and improving the soil for coffee, and cocoa flowering - Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations - A

big part of Europe will not be bothered by significant precipitation this week - Rain

is expected from northern and eastern Spain through western and far southern France to the U.S. and in a few southern Balkan country locations - Central

and eastern Turkey will be wettest this week with additional rain and mountain snow expected

- Some

of the moisture will also impact northern Iraq and northern and western Iran wheat and cotton areas - Additional

rain in Turkey next week could raise the potential for flooding - Xinjiang,

China precipitation will continue restricted over the next ten days, although a few showers of rain and snow are expected - The

mountainous areas in the west will be wettest and a boost in snowpack is expected - China’s

most frequent and significant precipitation in the next ten days will be near and south of the Yangtze River where the ground will continue saturated or nearly saturated with moisture - Waves

of light snow will fall across China’s Northeast Provinces - Winter

wheat and rapeseed will remain dormant or semi-dormant and in mostly good condition - Additional

warming is needed in the south to improve planting conditions for rice and corn and to stimulate sugarcane development - Not

much moisture occurred during the weekend - Winter

crops are still dormant or semi-dormant and poised to perform well in the early spring - South

Africa will experience a good mix of rain and sunshine for late season crop development - Summer

crop conditions are still rated quite favorably. - Central

portions of the nation; including western and central summer crop areas will be wettest.

- East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Today’s

Southern Oscillation Index is +7.83 - The

index will move erratically this week for a little while longer and then move higher this weekend into next week - NOAA’s

ENSO model is still predicting La Nina through spring and possibly all summer in the Northern Hemisphere - Confidence

in the longer range outlook is low except in the statistical studies showing La Nina events in other 22-year solar cycle years like this persist longer than any other time

- Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- FAO

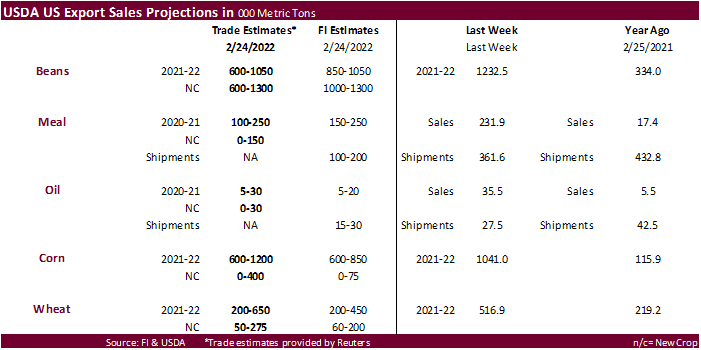

Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand Commodity Price - HOLIDAY:

Indonesia

Friday,

March 4:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macros

US

Department Of Energy: Announces An Emergency Sale Of 30Mln Barrels Of Crude Oil From Strategic Petroleum Reserve

US

ADP Employment Change Feb: 475K (est 375K; prev -301K; prevR 509K)

US

Industrial Production (Y/Y) Jan: 2.9% (prev -1.0%)

US

Industrial Production (M/M) Jan: -13.0% (prev 1.1%)

80

Counterparties Take $1.526 Tln At Fed Reverse Repo Op (prev $1.553 Tln, 77 Bids)

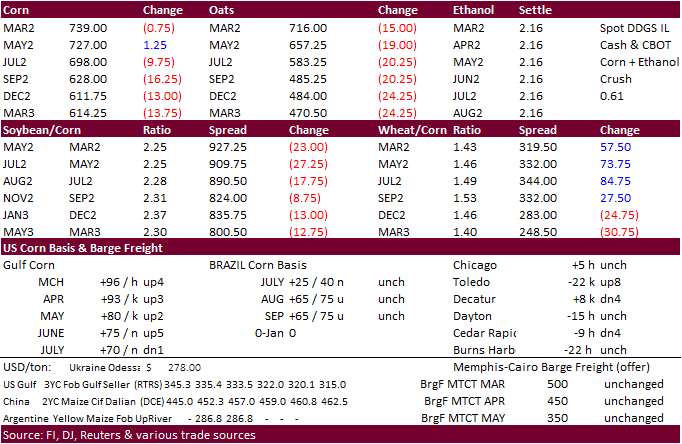

Corn

·

CBOT corn futures

were mixed to start and ended lower. May corn saw limited losses from a limit higher move in Chicago May wheat. May corn futures rallied above $7.45 overnight. Today it settled at $7.39/bu.

·

WTI was over $110/barrel by CBOT ag close. Three major oil companies ceased operations in Russia this week.

·

Traders will be watching out for China grain import announcements. China was rumored yesterday to be looking around for US corn. Bloomberg noted “China’s top government officials have issued orders to prioritize commodities

supply security, sparked by concerns over disruptions stemming from the Ukraine-Russia war.”

·

Russia and Ukraine provide about a fifth of the world’s corn supplies for the export market.

·

Earlier today we were asked what might be the US export capacity for combined corn and soybeans? Largest monthly combined corn and soybean exports recorded was during October 2020 when 572.6 million bushels were shipped, or 15.3

million tons, so it’s safe to say the US could manage 16-17 million tons if needed for a 31-day period.

·

Iowa reported a highly lethal form of bird flu in a backyard poultry flock in Pottawattamie County.

·

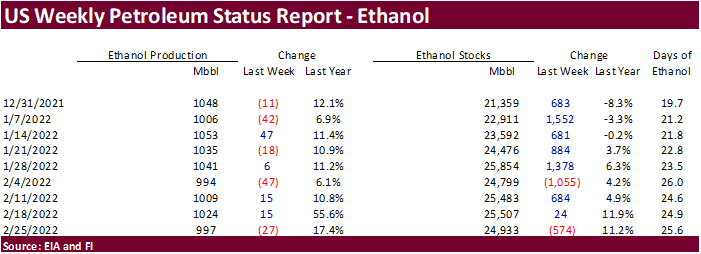

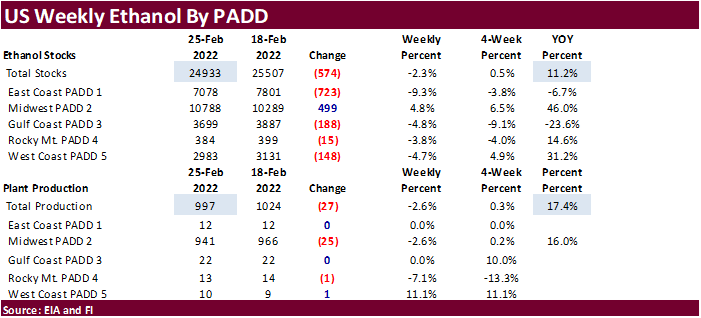

US ethanol production fell 27,000 barrels, opposite of what the trade expected, back below 1.0 million barrels to 997,000. Stocks declined a large 574,000 barrels to 24.933 million. A Bloomberg poll looked for weekly US ethanol

production to be up 3,000 barrels stocks up 37,000 barrels to 25.544 million.

Export

developments.

- South

Korea’s KFA bought around 134,000 tons of feed corn in two consignments. One was bought at an estimated $413.23 a ton c&f for arrival around May 5. The other was bought at an estimated premium of 294 cents a bushel c&f over the July, or about $408.34 a ton

c&f for arrival around round June 25. - Taiwan

seeks 65,000 tons of corn, optional origin, on Thursday, for shipment around May.

Updated

2/28/22

May

corn is seen in a $6.50 and $7.50 range

December

corn is seen in a wide $5.50-$7.25 range

·

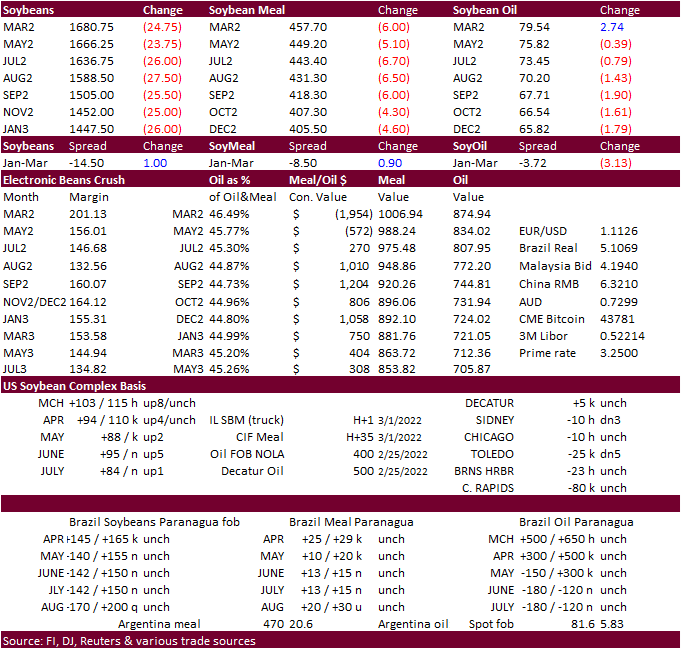

CBOT May soybeans ended

lower in a risk off session. Products also fell. While no Ukraine/Russia cease fire in sight, look for the soybean complex to see a choppy trade for the remainder of this week.

·

We are hearing China bought at least 5 US soybean cargoes this week for April-May shipment.

·

StoneX estimated Brazil 202122 soybean production at 121.17 million tons, down from 126.5 million previous.

·

(Reuters) – Brazil agriculture minister Tereza Cristina Dias said on Wednesday that the country will soon launch a national fertilizer plan to stimulate investments in potash and phosphorus mines. In an interview with CNN, Dias

said Brazil needs to have a bigger fertilizer production for a “national security matter”.

·

India asked Indonesia to boost palm oil shipments to make up for the loss of Black Sea sunflower oil supplies.

·

The landed cost for India imported crude palm oil is up 38% since Jan. 27, when Indonesia announced export curbs. Soybean oil landed price is up 29% this year. Sunflower oil landed price was not quoted.

- Private

exporters reported the following activity:

-264,000

metric tons of soybeans for delivery to unknown destinations. Of the total, 198,000 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons is for delivery during the 2022/2023 marketing year

-266,000

metric tons of soybeans for delivery to China. Of the total, 198,000 metric tons is for delivery during the 2021/2022 marketing year and 68,000 metric tons is for delivery during the 2022/2023 marketing year

Updated

3/1/22

Soybeans

– May $15.75-$18.25

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

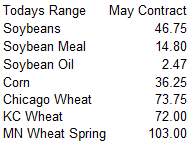

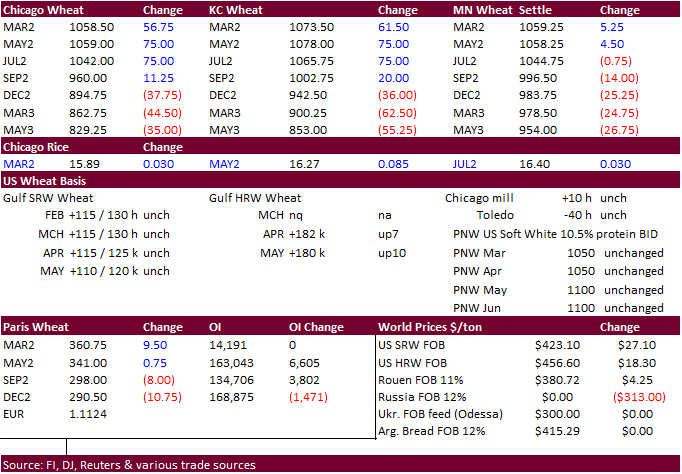

Chicago May wheat futures rose above $10.50 a bushel for the first time since March 2008, extending a rally as Russia’s invasion continues.

·

May wheat traded in a wide range.

·

Paris May wheat settled up 0.1% at 340.75 euros ($377.62) a ton, after earlier climbing to a new contract high 371.25 euros.

·

MGEX spring wheat stocks are down 10.4% from year ago.

·

US hard red winter wheat areas are seeing warm temperatures this week. Little precipitation will occur in the central or southwestern Plains.

·

More and more countries are taking steps to ensure food security.

·

(Bloomberg) — Turkey will apply measures to manage the possible reflection of developments between Russia and Ukraine and to ensure continuation of food and commodity supply. – Treasury and Finance Ministry

·

Jordan saw no offers for wheat on Wednesday. Their wheat reserves are large enough to last 15 months.

·

A trucker strike in Tunisia is disrupting grain unloading.

·

Algeria’s OAIC bought 250,000 tons of durum wheat, optional origin at around $625 a ton to $630 c&f for shipment between April 1-15 and April 16-30.

·

Tunisia bought about 100,000 tons of durum wheat (75k sought) at $634.89/ton c&f for April and/or March shipment.

·

Turkey started buying soft milling wheat out of the 435,000 tons sought for March-April shipment. About 370,000 tons traded.

·

Jordan passed on 120,000 tons of wheat today.

·

Jordan’s state grains buyer seeks 120,000 tons of feed barley on March 15. Shipment is between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

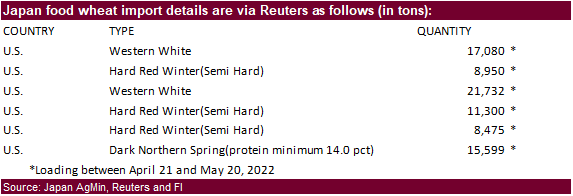

Japan started buying wheat from the US. Japan seeks 83,136 tons of food wheat from the US this week for loading between April 21 and May 20, 2022.

Rice/Other

·

Results awaited: South Korea seeks 72,200 tons rice from U.S. and Vietnam on Feb. 25.

Updated

3/2/22

Chicago

May $8.00 to $10.75 range

KC

May $8.25 to $11.25 range

MN

May $9.25‐$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.