PDF Attached

Source:

Reuters and FI

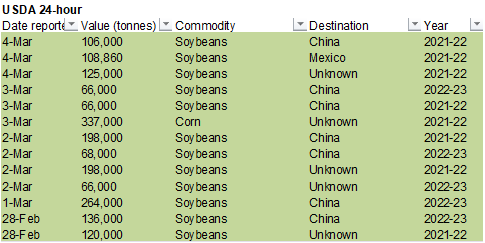

Private

exporters report the following activity:

-106,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

-108,860

metric tons of soybeans for delivery to Mexico during the 2021/2022 marketing year

-125,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

Day

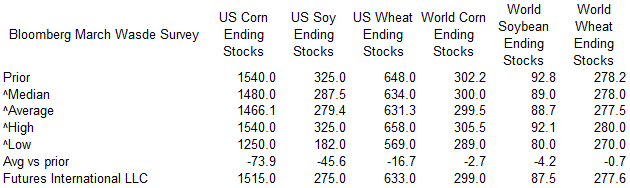

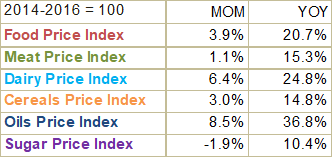

9 of the invasion. USD and WTI crude rallied. US equities were lower.

Demand for EU wheat is very strong with Black Sea ports closed. Today we saw profit taking in many markets. May Chicago wheat was up limit. The US is reviewing biofuel waivers. Malaysian palm

oil futures rolled over on profit taking Friday. Next week USDA will update their S&D’s.

75

cent Chicago and KC wheat limit for Monday https://www.cmegroup.com/trading/price-limits.html

WEATHER

EVENTS AND FEATURES TO WATCH

- Greater

rain is advertised for Spain and Portugal during the coming ten days - The

moisture will be well timed for spring planting and the resumption of winter crop development - Northwestern

Africa also gets some rain in the coming week to ten days improving topsoil moisture for better wheat and barley development - There

continues to be no threatening cold weather slated for Europe or Asia - Cold

weather will be returning to central North America next week - Stronger

energy demand may occur for little while in the U.S. Plains and western Midwest in the middle to latter part of next week and into the following weekend, but the cold never gets the eastern Midwest or Atlantic Coast states in a significant manner - No

risk of winterkill or wheat damage is perceived at this time - Storm

system in upper U.S. Midwest this weekend will produce rain, freezing rain, sleet and snow

- Travel

will be slowed - Additional

snow will add to the spring snow melt potential in Minnesota and the eastern Dakotas - A

narrow band of 4 to 10 inches of snow may occur from southeastern South Dakota to northeastern Minnesota and western Wisconsin - U.S.

hard red winter wheat areas will continue dry biased from West Texas and the Texas Panhandle to central and western Kansas - West

Texas cotton areas will continue missing significant precipitation events for a while - South

Texas and the Texas Coastal Bend will also be left with restricted amounts of precipitation for a while - California

will get some welcome mountain snow this weekend, but it will not be greater than usual, and the mountain snowpack deficits will remain - Canada’s

southern Prairies received some snow Thursday, and it will continue today which may improve topsoil moisture in the spring, but frost in the ground will limit the potential for moisture penetration into the soil

- U.S.

southeastern states will get some much needed moisture late next week and into the following weekend - The

region has been drying out recently and the moisture will be extremely well timed for winter crop development and the planting of spring crops - Corn

planting is already beginning in some areas - Concern

remains over the lower eastern U.S. Midwest soil moisture surplus and the same for the northern Delta and Tennessee River Basin areas - These

areas will see frequent precipitation events maintaining wet field conditions and possibly delaying early spring planting - South

America’s weather changed little overnight - Argentina

is still expecting moderate to heavy rainfall from central through north-central parts of the nation into early next week - Some

of that heavier rainfall already began overnight - Multiple

inches of rain will result causing some flooding - Chaco,

Santa Fe, Entre Rios and immediate surrounding areas will be wettest - Brazil’s

southern crop areas from Mato Grosso do Sul to Parana and southward to Rio Grande do Sul will get rain over the next week to ten days improving soil moisture for late season crop development - Safrinha

crop development will improve as rainfall increases - Mato

Grosso Brazil will continue plenty wet for Safrinha corn and cotton - Minas

Gerais will dry down in this coming week - Paraguay

will see some relief from dryness also in this next ten days - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Some

local flooding will be possible - Southern

Italy and the western and southern parts of the Balkans will be impacted with waves of rain in this coming week to ten days - The

moisture will be ideal for winter crop use in the spring - Romania

is still a little dry and would benefit from greater precipitation, but that may not occur for a while - Russia’s

Southern region and areas northeast into northern Kazakhstan and southern Russia’s New Lands will get snow and a little rain late this week through the weekend and into Monday - Accumulations

will vary from 4 to 10 inches and the moisture will be extremely welcome for the region’s low soil moisture that has prevailed since last summer - Some

frost in the ground may limit the moisture from snow melt from reaching very far into the ground, but the event will still be welcome - Temperatures

will turn colder behind the storm for a little while next week - Eastern

Australia is recovering from the weekend flood event that impacted areas near the lower Queensland coast and along the upper New South Wales coast - More

rain is expected late this week into next week aggravating the cleanup efforts - Rain

this weekend into next week will also impact eastern cotton and sorghum areas which may result in some concern over fiber quality in early maturing cotton - Sugarcane

will not bode well because of all the excessive moisture - A

tropical disturbance moving toward Sri Lanka and far southern India will become better organized today - Landfall

is possible in Tamil Nadu this weekend and the storm will produce some heavy rainfall and local flooding - The

system is advertised to be weaker in today’s forecasts relative to that of Thursday - Northeastern

parts Tamil Nadu will receive 3.00 to more than 8.00 inches of rain - Other

areas of India are not likely to get much precipitation in the next ten days except in the far Eastern States and in the extreme north where some significant moisture is possible - Southeast

Asia rainfall will occur frequently and abundantly this week - Flooding

may impact southern and east-central parts of the Philippines, northwestern Sumatra, parts of peninsula Malaysia and in a few western Java locations - Mainland

areas of Southeast Asia will see abundant showers and thunderstorms later this week and next week as pre-monsoonal moisture begins early and aggressively - The

moisture will be good for immature winter crops and for prepping the soil for spring planting of corn, rice and other crops - There

is going to be a rising risk of flooding rain during the next ten days - Ghana

and Ivory Coast will receive greater amounts of rain in the coming week easing recent dryness and improving the soil for coffee, and cocoa flowering - Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations - A

big part of Europe will not be bothered by significant precipitation this week - Rain

is expected from northern and eastern Spain through western and far southern France to the U.S. and in a few southern Balkan country locations - Central

and eastern Turkey will be wettest this week with additional rain and mountain snow expected

- Some

of the moisture will also impact northern Iraq and northern and western Iran wheat and cotton areas - Additional

rain in Turkey next week could raise the potential for flooding - Xinjiang,

China precipitation will continue restricted over the next ten days, although a few showers of rain and snow are expected - The

mountainous areas in the west will be wettest and a boost in snowpack is expected - China’s

most frequent and significant precipitation in the next ten days will be near and south of the Yangtze River where the ground will continue saturated or nearly saturated with moisture - Waves

of light snow will fall across China’s Northeast Provinces - Winter

wheat and rapeseed will remain dormant or semi-dormant and in mostly good condition - Additional

warming is needed in the south to improve planting conditions for rice and corn and to stimulate sugarcane development - Not

much moisture occurred during the weekend - Winter

crops are still dormant or semi-dormant and poised to perform well in the early spring - South

Africa will experience a good mix of rain and sunshine for late season crop development - Summer

crop conditions are still rated quite favorably. - Central

portions of the nation; including western and central summer crop areas will be wettest.

- East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Today’s

Southern Oscillation Index is +7.76 - The

index will slowly rise in this coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Monday,

March 7:

- China’s

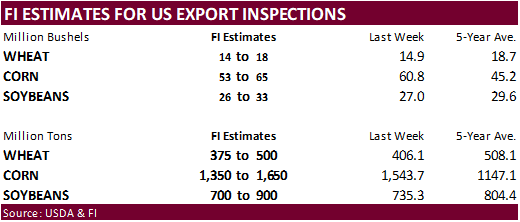

1st batch of Jan.-Feb. trade data, incl. soybean, edible oil, rubber and meat & offal imports - USDA

export inspections – corn, soybeans, wheat, 11am - Bursa

Malaysia Palm Oil Conference, day 1 - Vietnam’s

customs to publish Feb. coffee, rice and rubber export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Russia

Tuesday,

March 8:

- EU

weekly grain, oilseed import and export data - U.S.

National Coffee Association Virtual Convention, day 1 - Bursa

Malaysia Palm Oil Conference, day 2 - HOLIDAY:

Russia, Ukraine

Wednesday,

March 9:

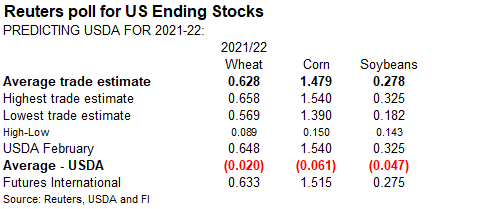

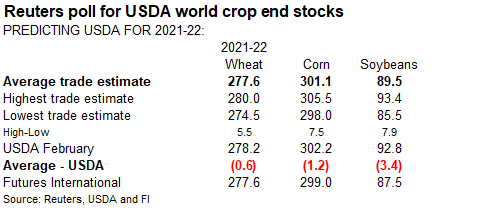

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - U.S.

National Coffee Association Virtual Convention, day 2 - FranceAgriMer

monthly French grains outlook - EIA

weekly U.S. ethanol inventories, production, 11am - Bursa

Malaysia Palm Oil Conference, day 3 - HOLIDAY:

South Korea

Thursday,

March 10:

- USDA

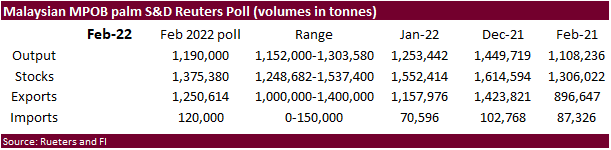

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysian

Palm Oil Board’s monthly data for output, exports and stockpiles - U.S.

National Coffee Association Virtual Convention, day 3 - Malaysia’s

March 1-10 palm oil export data - Brazil’s

Unica may release cane crush and sugar output data (tentative)

Friday,

March 11:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

Source:

Bloomberg and FI

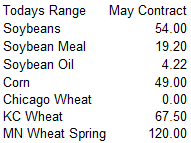

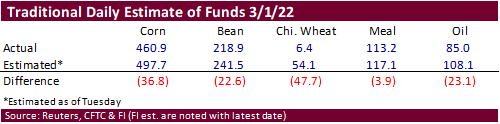

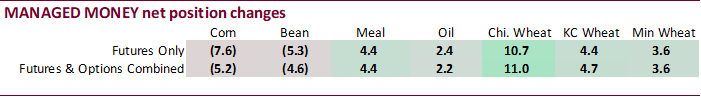

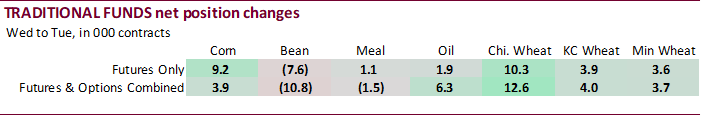

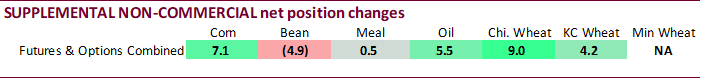

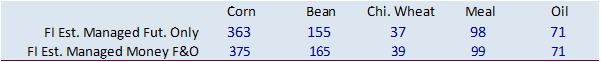

No

major records stand out this week. Note the positions below are from last Tuesday and don’t reflect the ongoing fireworks we saw over the past three trading days. However, as of March 1, the net fund positions were much less long than expected for all five

commodities we monitor on a daily basis, especially for Chicago wheat and soybean oil.

Estimates

Friday afternoon

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

293,763 7,070 444,009 -1,026 -715,256 -12,428

Soybeans

139,999 -4,863 189,461 -3,202 -297,577 8,831

Soyoil

46,586 5,541 125,138 1,780 -186,629 -7,777

CBOT

wheat -31,298 9,028 149,824 4,140 -111,237 -12,662

KCBT

wheat 21,161 4,164 57,669 -689 -80,028 -4,108

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

349,222 -5,213 301,888 4,507 -717,411 -14,783

Soybeans

175,721 -4,614 133,869 1,732 -305,293 9,861

Soymeal

94,829 4,412 94,834 130 -230,729 1,864

Soyoil

81,431 2,231 90,765 -469 -189,506 -6,329

CBOT

wheat -7,036 11,017 88,718 -3,245 -90,463 -8,838

KCBT

wheat 45,481 4,702 25,173 -372 -69,066 -4,296

MGEX

wheat 10,602 3,619 1,639 -833 -20,632 -1,795

———- ———- ———- ———- ———- ———-

Total

wheat 49,047 19,338 115,530 -4,450 -180,161 -14,929

Live

cattle 60,152 -25,281 81,898 -2,260 -145,363 23,322

Feeder

cattle -3,875 -6,542 6,994 151 3,124 4,010

Lean

hogs 74,506 -2,455 61,626 -2,377 -130,978 5,916

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

88,816 9,106 -22,515 6,383 1,977,728 30,408

Soybeans

27,585 -6,213 -31,882 -767 1,007,315 -29,625

Soymeal

12,278 -5,902 28,788 -504 452,265 -36,903

Soyoil

2,404 4,111 14,906 456 439,766 -17,674

CBOT

wheat 16,071 1,572 -7,289 -506 508,287 36,374

KCBT

wheat -2,786 -668 1,198 634 234,174 208

MGEX

wheat 4,961 100 3,430 -1,091 71,037 104

———- ———- ———- ———- ———- ———-

Total

wheat 18,246 1,004 -2,661 -963 813,498 36,686

Live

cattle 17,592 -3,438 -14,279 7,657 416,307 1,813

Feeder

cattle 649 -1,038 -6,892 3,419 63,109 5,681

Lean

hogs 5,897 -3,247 -11,051 2,164 356,855 -5,274

=================================================================================

Source:

Reuters via CFTC, and FI

US

Change In Nonfarm Payrolls Feb: 678K (est 423K; prev 467K; prevR 481K)

US

Unemployment Rate Feb: 3.8% (est 3.9%; prev 4.0%)

US

Average Hourly Earnings (Y/Y) Feb: 5.1% (est 5.8%; prev 5.7%; prevR 5.5%)

US

Average Hourly Earnings (M/M) Feb: 0.0% (est 0.5%; prev 0.7%; prevR 0.6%)

Canadian

Building Permits (M/M) Jan: -8.8% (est 1.2%; prev -1.9%; prevR -2.4%)

Canadian

Labour Productivity (Q/Q) Q4: -0.5% (est -0.2%; prev -1.5%)

Palladium

rose above $3,000 an ounce for the first time since May

78

Counterparties Take $1.483 Tln At Fed Reverse Repo Op (prev $1.534 Tln, 78 Bids)

·

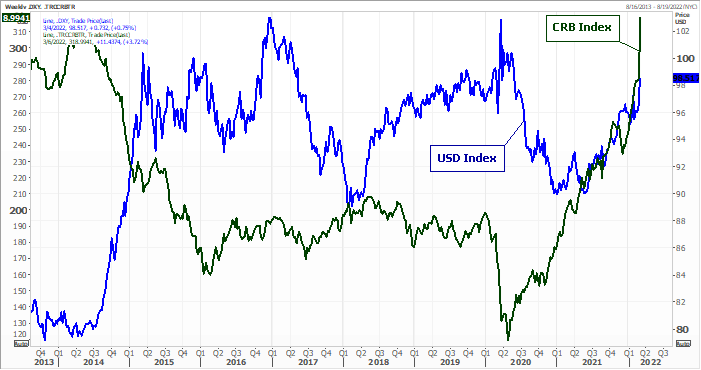

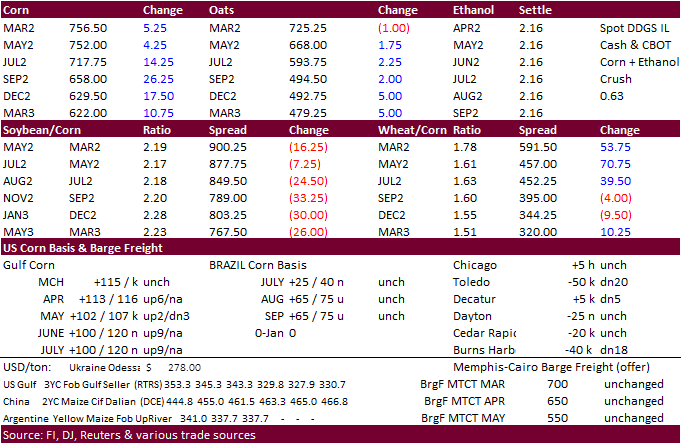

Earlier CBOT corn futures

traded sharply higher (2012 high) following limit up wheat futures and expectations for global trade flows to shift over the to the US, before pairing gains by mid-session. May ended 6.50 cents higher at $7.5425 and July up 17.75 cents at $7.2125.

·

Higher crude oil added to the firm undertone in corn before nearby corn futures sold off on profit taking. Nearby rolling WTI crude oil contract hit a September 2008 high.

·

Selected interior US corn and soybean basis location offers were sharply lower today.

Producers

were active sellers of corn and soybeans.

·

Gulf corn premiums were up on Thursday and Friday, an indication of possible corn sales. There were rumors China bought at least 15 US corn cargoes this week.

·

Unshipped Ukrainian corn to China could be as high as 4 million tons for this season. One rumor was up to 6 million tons but that seems high.

-

India

may see its ethanol blending rate reach 9.2% during first half 2022. -

USDA

reported a highly pathogenic bird flu outbreak in a flock of commercial broiler chickens in Stoddard County, Missouri.

https://www.aphis.usda.gov/aphis/ourfocus/animalhealth/animal-disease-information/avian/avian-influenza/2022-hpai -

Several

farm and biofuel organizations are petitioning the White House to allow for the year-round sale of gasoline blended with up to 15 percent ethanol (E15), that may help ease current gas prices.

-

February

average ethanol cash prices were near unchanged from January while RBOB rallied.

·

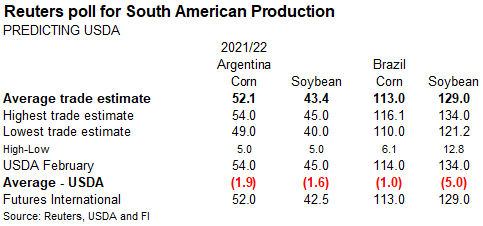

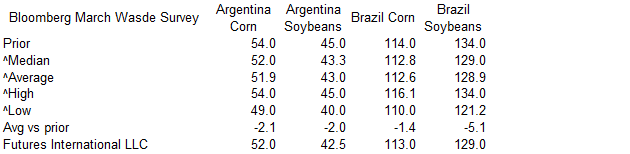

Rosario grains exchange: Argentina corn production less than 48 million tons. USDA @ 54

Export

developments.

- None

reported

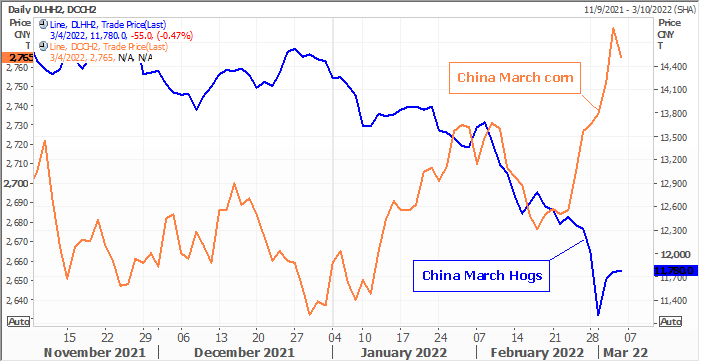

China

corn futures turned sharply lower late this week.

Updated

3/3/22

May

corn is seen in a $6.50 and $8.50 range

December

corn is seen in a wide $5.50-$7.50 range

·

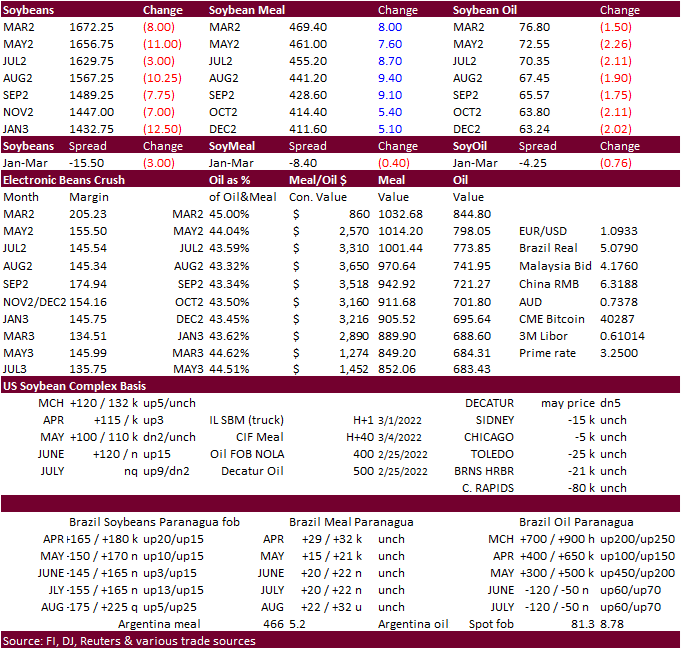

CBOT

soybean complex ended mixed with meal higher (Gulf basis $5.00 higher), soybeans lower (traded two-sided) and soybean oil sharply lower (some contracts traded tow-sided). Soybean oil saw pressure on concerns governments, including the US, will curtail biofuel

mandates to ensure food security. Meal was higher on thoughts of US Gulf export interest. Soybeans sold off on end of week profit taking despite additional 24-sale announcements. Producers were actively selling old and new crop soybeans.

·

US Gulf soybean meal basis was up $5/short ton from Thursday to $40 over the May, an indication someone could be buying US soybean meal.

·

Brazil soybean and soybean oil basis was up sharply from mid-week. March SBO was last 700/900 over the May.

·

Argentina will see rain of 0.50-3.50 inches through Thursday across at least three thirds of the growing regions and Brazil trace amounts to 0.75, locally more across central and southern areas.

·

Malaysian palm oil futures rolled over Friday on profit taking and demand destruction.

·

The Biden administration is studying whether waiving biofuel blending mandates could help cool corn and soybean oil prices that have surged since the Russian invasion of Ukraine. Waiving RFS requirements could pressure corn and

soybean oil futures. There are no details laid out or timing of a change, if any, planned.

·

The EU vegetable association Fediol warned the EU is facing a shortfall in sunflower oil and EU refiners are diverting limited volumes of sunflower oil destined for biodiesel fuel towards the food market. EU refineries source

35%-45% of their sunflower oil from Ukraine.

·

Southern Brazil, Paraguay and parts of Argentina saw improving rainfall this week that could stabilize crops.

·

Safras & Mercado: Brazil soybeans 125.08 vs. 127.17 previous. USDA @ 134

·

Rosario grains exchange: Argentina soybean production 40.5 million tons. USDA @ 45

·

Brazil’s agriculture research agency Embrapa warned producers may use 20 percent less fertilizer for the 2022-23 season. Fertilizer stocks are running at about 3 months of consumption, according to another agency.

- Under

the USDA 24-hour reporting system, private exporters reported:

-106,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

-108,860

metric tons of soybeans for delivery to Mexico during the 2021/2022 marketing year

-125,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

24-hour

soybean sales for week ending 3/3

2021-22

921,860

2022-23

600,000

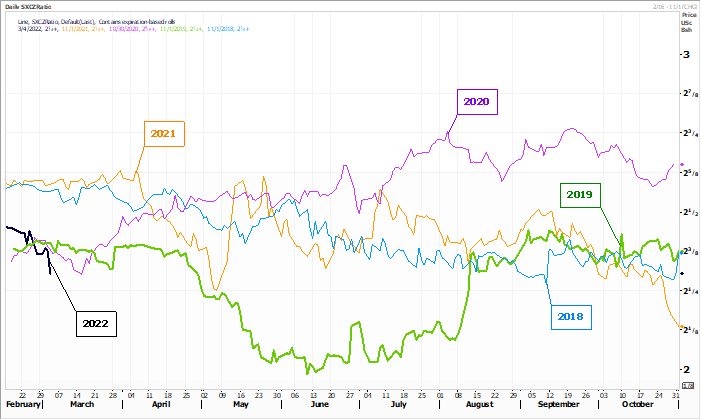

SX2/CZ2

ratio 2.30

There

is talk US corn acre estimates will increase and soybeans will be lower than previously projected.

Updated

3/1/22

Soybeans

– May $15.75-$18.25

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

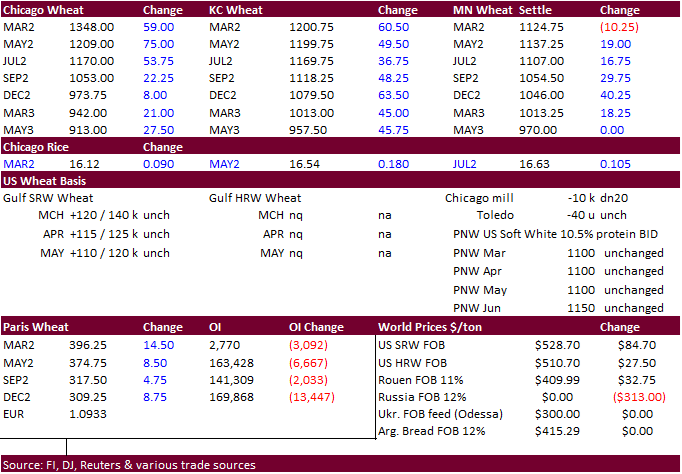

Another wild trade in US wheat futures with exception of May Chicago which stayed limit up. Follow through buying amid Black Sea shipping woes underpinned all three non-expiring contracts. Profit taking ahead of the weekend created

wide swings in many positions. Minneapolis lost ground to KC and Chicago by a large amount. Funds were thought to be the largest influence behind the large rally in US wheat futures this week.

·

Nearby expiring Chicago wheat took out its February 2008 high of $13.3450/bu.

·

May wheat ended 75 cents higher. Estimated synthetic @ close: WK 1282.25 / 1286.25 up 150.25

·

A major global agriculture shipping company shuttered operations in Russia after already closing Ukraine offices/port operations.

·

We heard Canadian (milling) wheat was sold to a large commercial in Toledo, OH. We are not sure why. Could be for blending with lower quality wheat or maybe destined for re-export out of the lakes.

·

May Paris wheat futures were up 8.50 euros at 371.75 euros, well off its absolute contract high of 406.75 euros.

·

French soft wheat crop in good or excellent condition by Feb. 28 was rated at 93%, unchanged from week earlier and above a year-ago rating of 88%. Spring barley sowing was 36% complete by Monday compared with 28% a week earlier

but lagging 47% progress seen a year ago. – FranceAgriMer

·

China May wheat futures increased to nearly 3,600 yuan per ton on Friday to a new contract high.

·

Argentina looks to control domestic wheat prices with global markets shaking up import prices.

·

Brazil’s wheat industry group Abitrigo noted Brazil is covered when it comes to upcoming wheat consumption as they contracts a more than needed amount of wheat imports from Argentina.

·

Iraq seeks two million tons of wheat to provide a strategic reserve. Iraq will accept offers from international companies for wheat from Sunday.

·

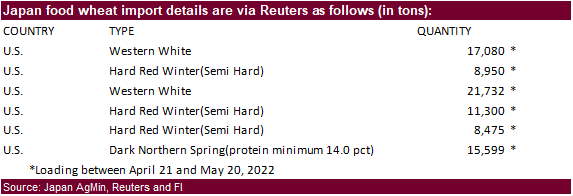

Japan bought 83,136 tons of food wheat from the US this week for loading between April 21 and May 20, 2022.

·

Jordan’s state grains buyer seeks 120,000 tons of milling wheat on March 9. Shipment is between LH May and LH July.

·

Jordan’s state grains buyer seeks 120,000 tons of feed barley on March 15. Shipment is between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing.

Rice/Other

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.37m bales, 127,000 bales below USDA’s previous est., according to the avg in a Bloomberg survey of seven analysts.

-Estimates range from 3.1m to 3.65m bales

-Global ending stocks seen unchanged at 84.31m bales

Updated

3/3/22

Chicago

May $8.50 to $13.50 range

KC

May $8.50 to $13.50 range

MN

May $9.25‐$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.