PDF Attached

WK

settles @ limit up, per the CME exec order, WK will see expanded limits tomorrow 130 cents. The usual rule of 2 months consecutive does not apply if WK settles limit up. Full CME notice:

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2022/03/SER-8946.pdf

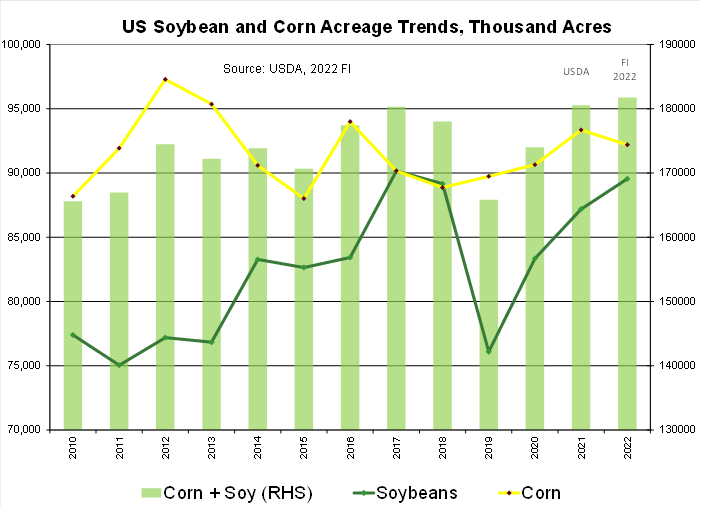

US

corn and soybean acreage is expected at be a combined record for 2022 by FI.

Day

12. Higher trade in most commodities. News was slow since this morning.

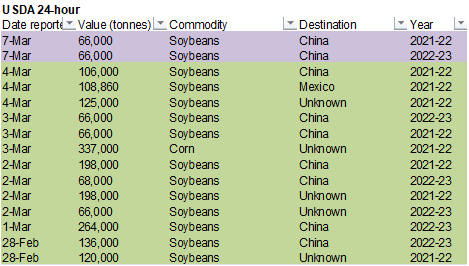

Private

exporters reported sales of 132,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons is for delivery during the 2022/2023 marketing year.

WORLD

WEATHER HIGHLIGHTS FOR MARCH 7, 2022

- North

Africa and Spain have reported some bouts of rain since late last week improving topsoil moisture in many winter and spring crop areas. - More

moisture is needed, and more is expected with the next greatest rain coming late this weekend into early next week.

- Central

and northeastern Europe will dry down for a while, but cool temperatures will prevent any area from becoming too dry.

- Cooling

in Russia will bring in some bitter cold temperatures during mid- to late-week this week, but snow cover should protect most winter crops.

- China

is warming up and a little rapeseed and southern wheat development is possible.

- Soil

moisture is favorable for crop development as well . - India’s

weather will be relatively tranquil for a while - South

Africa will see frequent bouts of rain over the next week to ten days. - Eastern

Australia rainfall will be greatest along the coast while only light precipitation occurs inland leaving cotton fiber quality unaffected. - Ivory

Coast, Ghana and other west-central Africa coffee and cocoa areas will continue to receive periodic rainfall over the next ten days

- Indonesia

and Malaysia get frequent rain of significance that may lead to some local flooding.

- The

same is true for the Philippines. - South

America weather will remain very good for late full season and Safrinha crops in Argentina and Brazil.

- In

the U.S., hard red winter wheat areas will get some rain and snow, but not enough moisture to change drought status.

- The

southeastern U.S. will get some needed moisture later this week - The

Delta will remain moist - Parts

of the lower eastern Midwest and Tennessee River Basin may continue too wet for a while - Minimal

precipitation is expected in West and South Texas and California – for at least a week.

Source:

World Weather Inc.

- China’s

1st batch of Jan.-Feb. trade data, incl. soybean, edible oil, rubber and meat & offal imports - USDA

export inspections – corn, soybeans, wheat, 11am - Bursa

Malaysia Palm Oil Conference, day 1 - Vietnam’s

customs to publish Feb. coffee, rice and rubber export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Russia

Tuesday,

March 8:

- EU

weekly grain, oilseed import and export data - U.S.

National Coffee Association Virtual Convention, day 1 - Bursa

Malaysia Palm Oil Conference, day 2 - HOLIDAY:

Russia, Ukraine

Wednesday,

March 9:

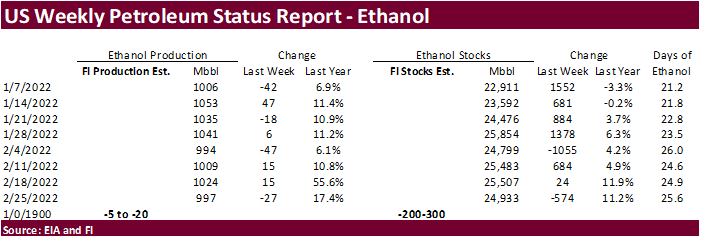

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - U.S.

National Coffee Association Virtual Convention, day 2 - FranceAgriMer

monthly French grains outlook - EIA

weekly U.S. ethanol inventories, production, 11am - Bursa

Malaysia Palm Oil Conference, day 3 - HOLIDAY:

South Korea

Thursday,

March 10:

- USDA

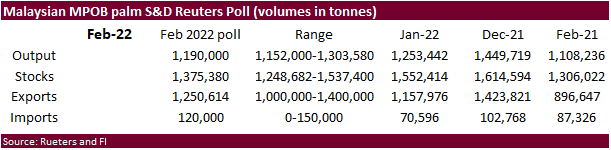

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysian

Palm Oil Board’s monthly data for output, exports and stockpiles - U.S.

National Coffee Association Virtual Convention, day 3 - Malaysia’s

March 1-10 palm oil export data - Brazil’s

Unica may release cane crush and sugar output data (tentative)

Friday,

March 11:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

Source:

Bloomberg and FI

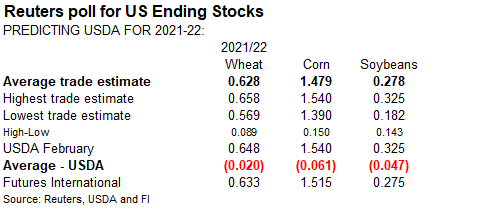

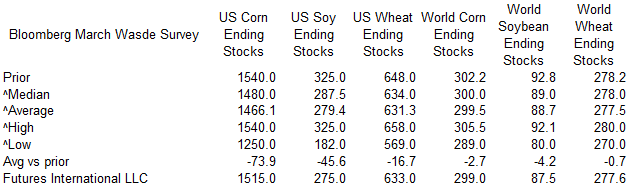

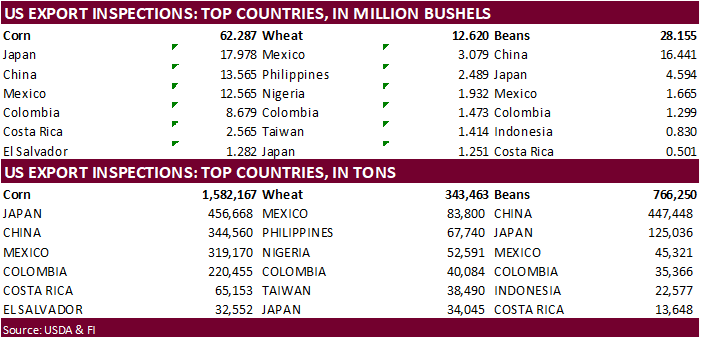

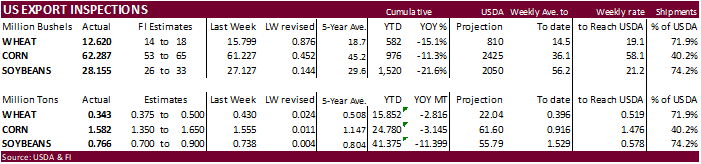

USDA

inspections versus Reuters trade range

Wheat

343,463 versus 300000-500000 range

Corn

1,582,167 versus 1000000-1650000 range

Soybeans

766,250 versus 400000-1475000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 03, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/03/2022 02/24/2022 03/04/2021 TO DATE TO DATE

BARLEY

0 0 0 10,010 31,023

CORN

1,582,167 1,555,227 1,682,172 24,780,431 27,925,277

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 600 400 3,617

RYE

0 0 0 0 0

SORGHUM

204,845 146,516 191,103 3,225,925 3,777,199

SOYBEANS

766,250 738,266 665,547 41,375,206 52,774,084

SUNFLOWER

0 0 0 432 0

WHEAT

343,463 429,984 523,205 15,852,189 18,667,969

Total

2,896,725 2,869,993 3,062,627 85,244,917 103,179,678

———————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Livesquawk

– Shell Is Limiting Supplies Of Heating Oil In Germany

Some

analysts are looking for a sharp increase in energy prices.

·

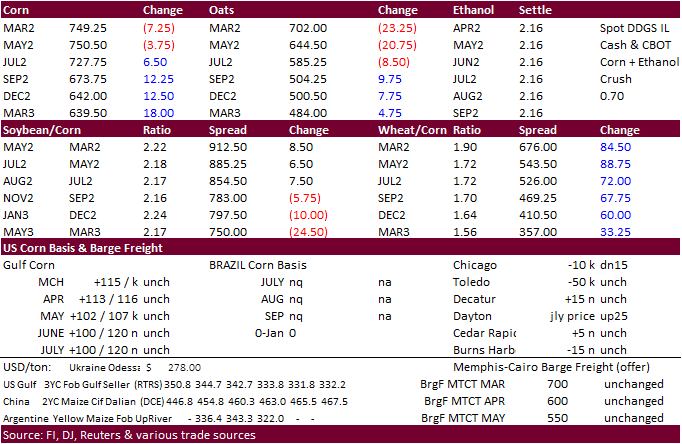

CBOT corn futures

ended higher led by old crop following the surge in wheat futures, which hit a record basis Chicago. News was light for corn.

·

China aims to expand summer grain plantings to ensure food security. If successful, we look for grain imports to decline from 2021. Soybean imports for the Jan-Feb period exceeded expectations.

·

China looks to buy 38,000 tons of frozen pork for state reserves on March 10. They bought pork last week, making the March 10 tender second for the crop year.

Export

developments.

- None

reported

USDA

Attaché : China Livestock and Products Semi-Annual

U

of I: International Benchmarks for Corn Production

Langemeier,

M. and L. Zhou. “International Benchmarks for Corn Production.” farmdoc daily (12):29, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 4, 2022.

https://farmdocdaily.illinois.edu/2022/03/international-benchmarks-for-corn-production-6.html

Updated

3/3/22

May

corn is seen in a $6.50 and $8.50 range

December

corn is seen in a wide $5.50-$7.50 range

·

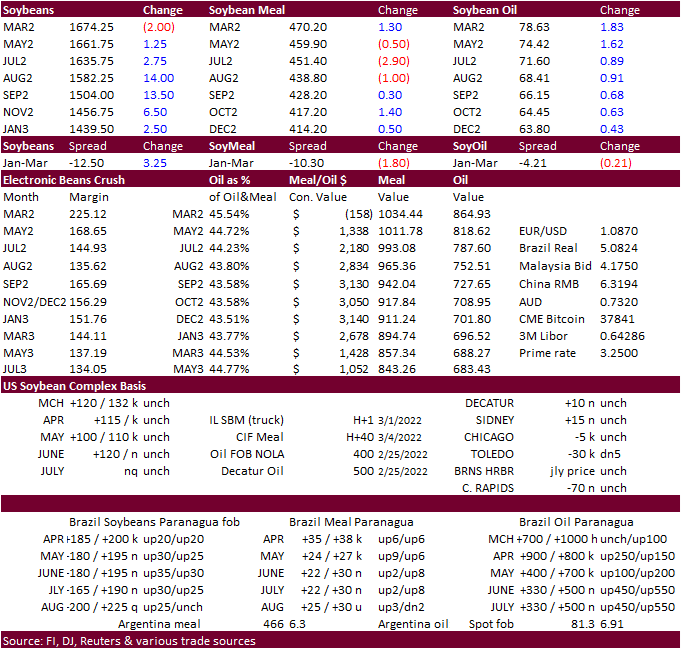

CBOT

soybeans, meal and soybean oil traded two-sided. Strength in wheat and higher energy prices limited losses.

·

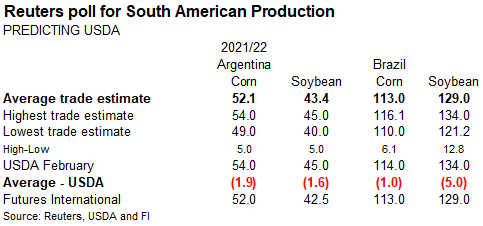

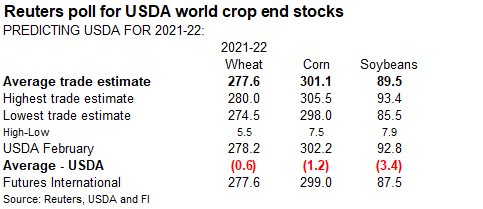

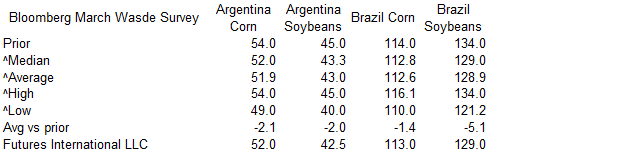

South American rains improved and that should limit additional downside risk for estimated 2022 Argentina and southern Brazil soybean crop estimates going forward. Latest estimates for Brazil and Argentina soybean production

suggest USDA is 6+ million tons too high, combined, and we could see a 50 million bushel cut to US ending stocks when updated this week (higher US exports). This could prompt a reversal in the SX2/CX2 ratio, currently favoring corn over soybean plantings

for the Northern Hemisphere.

·

AgRural – 122.8 MMT Brazil soybeans, down from 128.5 previous.

·

China: January – February soybean imports reached 13.94 million tons, above expectations and 4.1% above year earlier. Trade flows suggested 12.2 million tons, suggesting non-commercials were active in buying for domestic use.

March and April imports are expected to decline from the previous year.

USDA

Attaché : India Oilseed and Products Update

- South

Korea’s NOFI passed on 60,000 tons of soybean meal for June 30 arrival due to high prices. Lowest offer was a high $640/ton c&f, up from $548.50/ton paid by NOFI late January.

- Private

exporters reported sales of 132,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 66,000 metric tons is for delivery during the 2022/2023 marketing year.

Updated

3/1/22

Soybeans

– May $15.75-$18.25

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

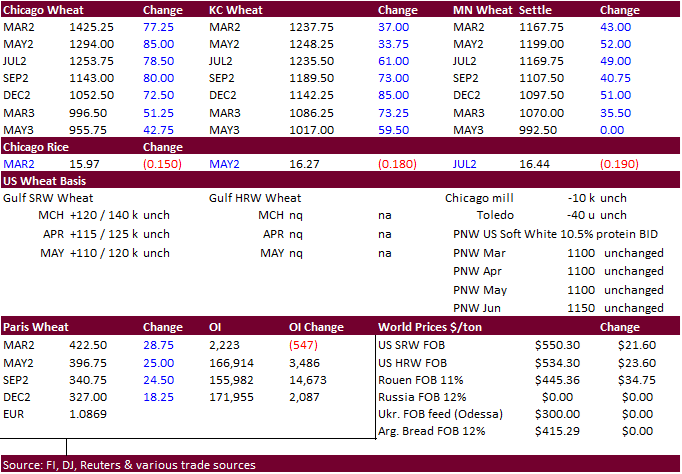

Record high was posted for Chicago wheat. Tuesday will be a 130 cent limit for Chicago and KC. We see a top in this market soon but will have to wait to see if funds cool down on buying. Note KC and MN didn’t follow Chicago

limit higher basis the May. Wheat cannot be replaced like other feedgrains, so traders are more than ever cautious when looking at global trade.

·

May Paris wheat futures were up 25 euros at 396.50 euros, a record high, but well off the session high of 424.

·

Iraq is looking to boost reserves of wheat by sourcing 3 million tons.

·

China warned that domestic winter wheat conditions could be “worst in history” but no figures were provided. Some plots could see a 20 percent loss. A bumper summer grain crop could offset such losses that would be used for feed

use.

·

There was rumor Mexico bought French wheat. Some question US completeness over French wheat but a reminder import interest has picked up. Taiwan seeks US PNW wheat.

·

Several countries announced they have enough grain reserves for domestic consumption.

·

India was in a good place to export wheat after the surge in global wheat prices and three consecutive years of a bumper crop. They may export more than 7 million tons, a large amount to help alleviate the Black Sea supply shortage.

They have already supplied over 6.6 million tons for export.

·

Algeria said they have enough wheat reserves to last until end of this year.

·

Romania said they have enough grain reserves to “weather” the Ukraine invasion. They will be exporting wheat in the meantime.

·

China last week, on March 2, sold 526,254 tons of wheat from state reserves at an average price of 3,054 yuan per ton ($483.32/ton), well above 2,753 average price recoded February 23.

·

Sudan received 20,000 tons of wheat (aid) on Sunday from Russia.

·

Tunisia seeks 125,000 tons of soft wheat and 100,000 tons of barley, optional origin, on Tuesday. Shipment is for March through May.

·

Taiwan seeks 50,000 tons of US PNW milling wheat on March 11 for April 23-May 7 shipment.

·

Algeria seeks 50,000 tons of soft milling wheat, optional origin, on March 8, opening until the 9th, for May shipment.

·

Iraq seeks two million tons of wheat to provide a strategic reserve. Iraq looked for offers from international companies over the weekend.

·

Jordan’s state grains buyer seeks 120,000 tons of milling wheat on March 9. Shipment is between LH May and LH July.

·

Jordan’s state grains buyer seeks 120,000 tons of feed barley on March 15. Shipment is between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing.

Rice/Other

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.37m bales, 127,000 bales below USDA’s previous est., according to the avg in a Bloomberg survey of seven analysts.

-Estimates range from 3.1m to 3.65m bales

-Global ending stocks seen unchanged at 84.31m bales

Updated

3/3/22

Chicago

May $8.50 to $13.50 range

KC

May $8.50 to $13.50 range

MN

May $9.25‐$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.